- Yesterday's Dystopian Fiction Is Today's New World Order

Submitted by 'Jeremiah Johnson', retired Green Beret, via SHTFPlan.com,

Many of the things that are happening this very moment have direct parallels in literature of the past. Whether it is an account such as the “Gulag Archipelago” by Solzhenitsyn or a work of “fiction” such as “1984” by George Orwell is irrelevant. Elements of the history or the storyline (regarding the former and the latter works) are now becoming thoroughly inculcated into the fabric of modern reality.

All of the measures taken by the Soviet Union to crush and control its population are beginning to manifest themselves today in the United States. The courts are “stacked” to reflect the decision of the regime and not to rule by law. The Military Industrial Complex contracts are still being shuffled, along with government policies that just happen to substantiate those business interests with kickbacks for all. Laws serve political and corporate interests, and the lawmakers themselves do not represent any of their constituents: they are self-serving thieves, selling out their country and its populace for money and power.

The police departments have (for all intents and purposes) been “federalized,” with budgets and marching orders becoming increasingly dependent upon federal and not local or state policies. Sheriffs who follow their appointed roles as duly-elected law enforcement officials upholding Constitutional guidelines are being “phased out” of existence. The changed demographics of “forced” insertions of illegal aliens and “refugees” into populations are rapidly negating the remainder of the two-party system to ensure that the Democratic party takes control ad infinitum.

Orwell envisioned it. His work is labeled a work of fiction, although all of the measures Oceania pursued are either currently in place in the United States or they’re being developed. There is mass surveillance, increasing by the day. The “internet of things,” as coined by former General David Petraeus, is almost primed to allow “telescreens” to watch our every movement, and a camera on every corner to back them up. Orwell hated totalitarianism, having been exposed to it in his short but accomplished lifetime, and he knew man’s propensity was to move toward the enslavement of his fellow man.

The development of new weapons by DARPA and the MIC are not toward a foreign enemy so much as the purpose of using them against the citizenry. Drones, robots, nanotechnology, and every other “gizmo” able to be employed are all being drawn from behind the black curtain to unleash upon the citizens. Also, the world’s situation is directly paralleling “1984” as three great spheres of influence…Europe, Asia, and North America…are being created by the powers that be. Global governance in “thirds” is probably the NWO end state, as outlined by Orwell for a very significant reason: control with as much ethnic and cultural homogeneity as possible.

It stands to reason that an Oriental (“Eastasia,” in “1984”) empire/totalitarian state would control the Oriental nations, rather than split it up between populations that are not as closely related linguistically and culturally. We are seeing those shifts of influence into the divisions outlined by Orwell now, as the nations jockey for position and power. Just as in “1984,” where it stated that even two of the super-states in alignment and concerted efforts could not together topple the third, perhaps the same is with our world.

The shift is toward totalitarianism, and the populations have been (and are being) conditioned to accept, if not embrace, collectivist thought and socialism. A good example was a film called “the Mutant Chronicles,” in which there were four great super-states that were organized not as nations but as corporations, that made war with one another over resources. We see the blending of government and corporation today in virtually every facet of life, with the illusion of elections and the illusion of choice upheld to keep the population around the dullard state of consciousness.

What will save us from this? Will we be able to save ourselves from it? The more and more one watches freedoms disappearing by the day, the more one must wonder if there is a way to stem the tide. Orwell and Solzhenitsyn…visionary and historian…gave us blueprints to follow…checklists with which to use as frameworks of reference for what is befalling us daily. Someday it may be that the brief period of freedom enjoyed by the American people may be categorized as a “work of fiction” in a future that may not even allow anyone to read it.

- (Poor) Judgment Matters – Hillary's "Inconsequential" Emails

Indications are that the federal probe investigating the possible mishandling of classified materials on Hillary Clinton’s private email server while she served as Secretary of State is winding down. And so far, neither the FBI nor the prosecutorial staff at the Justice Department has come up with information that point to Hillary or her aides knowingly, or negligently, discussing classified secrets over her non-secure email system… contrary to the hopes and “political prayers” of every soul in the Republican Party.

Truth be said with logic and candor, Hillary faces little risk, if at all, of being prosecuted for using her private email system to conduct official business; and chances of her being found criminally liable approach the totally-unlikely. To deny Hillary the brains to handle appropriately classified, or sensitive information that could be “classifiable,” borders on the absurd; accusations of this sort solely sprouting from the usual stinging sources of ultra-right talk radio… the likes of Russ Limbaugh, Glenn Beck et al.

The lack of an indictment by the Justice Department, or even the lack of a more venial sin – the improper handling of some materials, will surely exonerate Hillary Clinton and put an end to the political controversy; but it does not clear her from a most important indictment of all: one where we, the governed citizens, accuse her of poor judgment; not just Republicans, but Democrats and Independents as well.

Hillary’s glass of very questionable judgment seems to have filled to the rim with bad political decisions going back to her support of Husband Bill’s poor decisions on international trade and criminal justice, cupped by her military hawkishness and consent to invade Iraq. And, as US Secretary of State, a far-from-bright decision to use her private server to conduct government business. Many would say that her allowable glass of bad judgment has spilled over; and with it, her qualifications to take the helm from Barack Obama.

As inconsequential as the email issue might seem to most of us, judgment matters!

And if judgment matters, the text of Hillary Clinton’s speeches should be critical to the Democratic Party faithful when making up their minds whether they would want her to be the party’s nominee. The DNC’s complicity in failing to denounce the speeches’ secrecy is an affront to the truth, showing the machinations of dirty politics.

Damn, Hillary! Just tell us what you said in those pearly speeches that you gave folks at Goldman Sachs. Are you afraid that the text in such pricey speeches might give telltales of deceit? Could the transcripts be so damaging as to throw your campaign in disarray, and give Bernie the upper hand? And perhaps, just perhaps, deny you and Bill a second tenancy at the White House?

We might suspect that the speeches only provided soothing assurances that Hillary’s future candidacy to the presidency, or her election, would not be detrimental to Wall Street’s interests, particularly those of Goldman Sachs. What else can we deduce from the near $700,000 in emoluments given by a savvy investment firm! It’s no secret to most that the Clintons, both Bill and Hillary, fit center-right in the political spectrum; that’s where they are, and that’s where they have been throughout their political careers. Bernie Sanders pushing Hillary a short distance to the left, during the pre-nomination period, will not create a problem for her, or concern for Goldman Sachs.

Ah! But have Hillary and the establishment in the Democratic Party considered the possible future danger in keeping the text of these speeches hidden? Wouldn’t it be a total catastrophe if Donald Trump was her Republican match in the general election? Rest assured that all confidentiality in those speeches would cease, and he would make hay of her deceit; claiming her to be just another politician bought by money.

Meantime Gentleman Bernie keeps giving Hillary Clinton a pass; first by declaring the email issue as inconsequential; now by not forcefully, yes forcefully, demanding full disclosure of her speeches to the audiences at Goldman Sachs.

As much as we like to claim democracy in the US, we constantly find ways to circumvent it. Take the superdelegate issue in the Democratic Party: In Washington, my home state, where we just had caucuses on Saturday with an overwhelming victory by Bernie Sanders over Hillary Clinton (73 percent to 27 percent), none of the 17 superdelegates are pledged to Bernie, while two key ones, Sen. Patty Murray and Sen. Maria Cantwell, continue pledged to Hillary Clinton. Shouldn’t they be pledged to Bernie or at the very least stay uncommitted until the party’s convention? A funny democracy, ours!

- This (Crashing) Trend Is Not Your Friend

Despite Yellen's best efforts today to basically dismiss any and all data as irrelevant going forward in The Fed's decision-making process, we suspect all eyes (and algos) will be firmly glued to this week's payrolls' data. Will it be another record month for Obama to crow about? Will Mark Zandi do the "told you so dance" to all the trump supporters who seem less exuberant about the recovery? One look at this chart – and the disastrous trend – and we suspect, sooner-rather-than-later, the fecal matter will be striking the rotating object in America…

As Bloomberg notes, a growing gap is developing between corporate profits and job growth in the U.S.

Company earnings, a key driver of business spending and employment, tumbled in the fourth quarter and history shows that when they retreat, the economy often follows.

So we wonder just what kind of seasonal-adjustments are being used to ensure this gap remains. Notice the "gap" in 1999… that did not end well.

BofAML's Michael Contopoulos adds that it is no surprise that falling corporate earnings is a leading indicator for economic recessions – when corporates struggle to grow their bottom lines, they are forced to source liquidity through either the capital markets or cost cutting methods. And when funding either becomes unavailable or too expensive, companies must scale back through capex and/or personnel reductions.

Although a US recession is not a necessary precondition for a turn in the credit cycle, but matters only so much as its influence on the shape of the next wave of defaults, we still look closely at how macroeconomic factors could affect corporate health. And it becomes concerning to us that after a 2nd consecutive decline in year over year corporate earnings, coupled with a lack of worker productivity and higher wages, that soon the very rosy jobs numbers may begin to disappoint.

With personal spending increasing by a paltry 0.1% for each of the past 3 months, we believe consumer spending habits are already more conservative than they should be given low gasoline prices and currently favorable employment statistics. Should jobs numbers begin to disappoint, in our opinion consumers would be quick to pull back and save more of their income.

Even a marginally weaker spender could have a substantial impact on the most vulnerable companies, forcing these weakest links to liquidate, fire and default. The potential for this added labor slack could lead to a further pullback in consumer spending and produce stress within the next weakest links in the chain. This self-perpetuating cycle, should it continue, could create a rolling blackout as defaults migrate from one sector to the next. And while Energy and Materials are currently in the crosshairs, we could envision a number of sectors that could come into focus and prove unable to withstand the added stress of a weaker consumer.

To this end, we believe more attention should be paid to the current fundamentals of US corporates and the vulnerability of what are now considered ‘healthy’ high yield sectors to a wave of defaults that has the potential to spread into all industries. Although technicals are currently keeping the market afloat, we are not buyers of the market at current levels and believe fundamentals will ultimately force spreads wider.

- Price Controls May Be On the Way

Submitted by Paul-Martin Foss via The Mises Institute,

If you thought negative interest rates were as bad as it could get with central banks, you might be in for a surprise. Central banks have been so spectacularly unsuccessful with their accommodative monetary policies that they are discussing pulling out all the stops to get the results they want. They fail to realize that the reason prices aren’t rising is because they really want and need to fall. Bad debts weren’t liquidated during the last financial crisis, the debtors were merely bailed out. Overpriced assets weren’t allowed to be reduced in price. Central banks pumped trillions of dollars into the economy to attempt to paper over the recession. Market forces want to drive prices down, while central banks attempt to prop them up. So what to do when central banks aren’t getting their way?

Central bankers may very well recommend price controls in an attempt to “jolt the economy out of its doldrums.” Of course, economies don’t go into doldrums and they can’t be jolted out of them. Recessions are not something endemic to the economy but are rather the result of central bank monetary intervention. Because central banks refuse to acknowledge their culpability for causing recessions, their methods for responding to recessions end up being more of the same thing that caused them in the first place: monetary easing. And now that those methods are proving ineffective, more drastic measures might be on the way. Remember that the last time all-out wage and price controls were implemented in the United States was in the early 1970s, also a time of great monetary turmoil. In fact, the price controls were instituted by President Nixon at the same time as he closed the gold window in 1971.

As Ludwig von Mises pointed out many decades ago, once you begin to institute price controls, you inevitably lead to socialism.

It must add to the first decree concerning only the price of milk a second decree fixing the prices of the factors of production necessary for the production of milk at such a low rate that the marginal producers of milk will no longer suffer losses and will therefore abstain from restricting output. But then the same story repeats itself on a remoter plane. The supply of the factors of production required for the production of milk drops, and again the government is back where it started. If it does not want to admit defeat and to abstain from any meddling with prices, it must push further and fix the prices of those factors of production which are needed for the production of the factors necessary for the production of milk. Thus the government is forced to go further and further, fixing step by step the prices of all consumers’ goods and of all factors of production — both human, i.e., labor, and material — and to order every entrepreneur and every worker to continue work at these prices and wages.

That is why no one should be surprised that the governments of Japan, Europe, and the United States might resort to price controls to try to achieve what monetary policy could not. It follows logically, after all, since central bankers are in the price-setting and price control game to begin with. The interest rates that central bankers target or set are themselves prices, prices of money being loaned overnight or of money being deposited with the central bank. The aim of targeting or setting those interest rates is to influence interest rates and prices in the broader economy. So if that limited price-fixing doesn’t work, governments will expand their efforts to fix even more prices. It may not come directly, at least at first, but rather through some sort of incentivization. Pressure may be brought to bear to raise wages, using tax policy as either a carrot or a stick. The aim and the effect, though, will be to move prices to where the government thinks they ought to be, not what the market can actually bear.

If price controls are in fact enacted, it will make it all the more obvious that economic planning on the parts of central banks and governments must be firmly opposed. It will separate the wheat from the chaff, those who actually support economic freedom from those who are willing to rationalize central planning. Anyone who claims to stand for free markets, free trade, and limited government but who attempts to defend the existence or importance of the Federal Reserve or central banking is a liar. Either you support free markets and freedom of pricing or you support central bank price-fixing and creeping socialism. There is no third way or middle road — socialism and the free market are mutually incompatible. A little bit of socialism in the form of price-fixing is like a little bit of gangrene, if left unchecked it will eventually infect and kill the whole. Now that governments and central banks may endorse further price controls as a remedy, the monetary policy facade has been torn away to reveal the reality that it is just another tool that leads to intensified central planning. Will enough people rise to the occasion to oppose further transgressions against monetary and economic freedom, or will they shrug their shoulders as our society continues to slouch toward socialism?

- The Difference Between Capitalism & Communism (Explained To President Obama)

As President Obama explained in his Townhall in Cuba…

To make a broader point, so often in the past there’s been a sharp division between left and right, between capitalist and communist or socialist. And especially in the Americas, that’s been a big debate, right? Oh, you know, you’re a capitalist Yankee dog, and oh, you know, you’re some crazy communist that’s going to take away everybody’s property. And I mean, those are interesting intellectual arguments, but I think for your generation, you should be practical and just choose from what works. You don’t have to worry about whether it neatly fits into socialist theory or capitalist theory — you should just decide what works.

And I said this to President Castro in Cuba. I said, look, you’ve made great progress in educating young people. Every child in Cuba gets a basic education — that’s a huge improvement from where it was. Medical care — the life expectancy of Cubans is equivalent to the United States, despite it being a very poor country, because they have access to health care. That’s a huge achievement. They should be congratulated. But you drive around Havana and you say this economy is not working. It looks like it did in the 1950s. And so you have to be practical in asking yourself how can you achieve the goals of equality and inclusion, but also recognize that the market system produces a lot of wealth and goods and services and innovation. And it also gives individuals freedom because they have initiative.

And so you don’t have to be rigid in saying it’s either this or that, you can say — depending on the problem you’re trying to solve, depending on the social issues that you’re trying to address what works. And I think that what you’ll find is that the most successful societies, the most successful economies are ones that are rooted in a market-based system, but also recognize that a market does not work by itself. It has to have a social and moral and ethical and community basis, and there has to be inclusion. Otherwise it’s not stable.

And it’s up to you — whether you’re in business or in academia or the nonprofit sector, whatever you’re doing — to create new forms that are adapted to the new conditions that we live in today.

Investors.com's Michael Ramirez succinctly explains the difference…

And we leave it to RedState.com to rage…

When I first started listening I was appalled. Communism and capitalism are much more than “interesting intellectual arguments.” They are one facet of how a society views its people, subject versus citizen, and the role of the government, master of the people or servant of the people. Then I thought, maybe I’m being too critical. But as he finished I was truly horrified at what I’d heard.

First, we need to knock away the undergrowth. Let’s ignore the idea that there is a “sharp division” between left and right. That isn’t true and I’m not sure who, other than Obama, believes that. Certainly no one who lived in Latin America in the 1950s and 60s would. And no, Cuba does not have life expectancy comparable to the United States. Infants who die of birth defects and suicides do not count in Cuban statistics. And, ultimately, no one really knows what Cuban life expectancy is because it is not transparent of outside observation.

The real point here would be that fundamentally, Obama is a Marxist. As far as he is concerned the conflict between East and West from the end of World War II until the collapse of the Soviet empire was between competing economic arrangements. That was not the case. It was the conflict between the autonomy of the person and the autonomy of the state. No where is his argument more obviously fallacious than in Argentina which has suffered under differing varieties of Peronism, an amalgamation of socialist and capitalist impulses under the banner of Argentine superiority.

Doing “what works,” absent any guiding principles is dangerous. As far as Obama is concerned, letting Mexican drug cartels buy weapons in the United States is okay because his objective was creating a set of facts that justified more restrictive gun laws. One could actually argue that he was using “capitalism”, that is the sale of firearms, to achieve a “socialist” aim, disarming the American people. This is the same logic that led to the involuntary sterilization of undesirable people in the United States (three generations of imbeciles is enough, after all) and the extermination of undesirables in Nazi Germany. The only difference between the two is the grandiosity of scale and concept. Both are based on “what works.” “What works” is a subsidiary question that government should look at. The primary questions are “what is right” and “what is least intrusive upon the rights of the citizens.”

The scary idea that “inclusion and equality” are core govermental goals is evident in ObamaCare forcing nuns to be provided with contraceptive coverage and in the way the beliefs of religious people are not allowed to be taken outside the church.

Obama is profoundly un-American. Not from the standpoint that he is not an American per se, but because he has consciously rejected the very founding principles of the nation. Life, liberty, and the pursuit of happiness have been sent to the ashcan and we are left with “what works.”

- MSNBC Host Admits Democratic Primary Rigged, While Station Simultaneously Rigs Coverage

Submitted byMike Krieger via Liberty Blitzkrieg blog,

While it might sound strange, a coronation of Hillary Clinton in the Democratic primary will mark the end of the party as we know it. There’s been a lot written about the “Sanders surge,” with much of it revolving around Hillary Clinton’s extreme personal weakness as a candidate. While this is indisputable, it’s also a convenient way for the status quo to exempt itself from fault and discount genuine grassroots anger. I’m of the view that Sanders’ support is more about people liking him than them disliking Hillary, particularly when it comes to registered Democrats. He’s not merely seen as the “least bad choice.” People really do like him.

The Sanders appeal is twofold. He is seen as unusually honest and consistent for someone who’s held elected office for much of his life, plus he advocates a refreshingly anti-establishment view on core issues that matter to an increasing number of Americans. These include militarism, Wall Street bailouts, a two-tiered justice system, the prohibitive cost of college education, healthcare insecurity and a “rigged economy.” While Hillary is being forced to pay lip service to these issues, everybody knows she doesn’t mean a word of it. She means it less than Obama meant it in 2008, and Obama really didn’t mean it.

– From the post: It’s Not Just the GOP – The Democratic Party is Also Imploding

I just finished watching a surprisingly good and honest 14 minute segment on MSNBC’s Morning Joe which covered how the Democratic National Committee has been rigging the primary in favor of Hillary Clinton. Host Joe Scarborough even went so far as to admit the media’s complicity in the process with regard to superdelegates. He notes:

“And I know the Republican party wishes they rigged the process as well as the Democratic party did right now, because they could rig it against Trump — but the Democratic party rigs their process so that these superdelegates, which by the way can move any direction they want, actually skew the process and the reporting so badly that the voters actually don’t have their say when it comes to voting.”

This is a key issue that has been driving me up a wall lately. It is journalistic malpractice for media outlets to include superdelegates in the total tally when these Democratic operatives can switch their support at any point between now and the convention. As we learned in the post Did Hillary Clinton Really Win More New Hampshire Delegates Than Sanders Despite a Landslide Loss?:

Q: From everything you’ve told me so far, I can’t understand why you’re calling Superdelegate votes “irrelevant.” It seems to me like they have the same voting power as a normal delegate, and this puts Sanders in a tremendous hole from the word “go.”

A: Here’s why it doesn’t matter: Superdelegates have never decided a Democratic nomination. It would be insane, even by the corrupt standards of the Democratic National Committee, if a small group of party elites went against the will of the people to choose the presidential nominee.

This has already been an incredibly tense election, and Sanders voters are already expressing their unwillingness to vote for Clinton in the general election. When you look at the astounding numbers from Iowa and New Hampshire, where more than 80 percent of young voters have chosen Sanders over Clinton, regardless of gender, it’s clear that Clinton already finds herself in a very tenuous position for the general election. It will be tough to motivate young supporters, but any hint that Bernie was screwed by the establishment will result in total abandonment.

Democrats win when turnout is high, and if the DNC decides to go against the will of the people and force Clinton down the electorate’s throat, they’d be committing political suicide.

The important thing to know here is that Superdelegates are merely pledged to a candidate. We know who they support because they’ve stated it publicly, or been asked by journalists. They are not committed, and can change at any time. If Bernie Sanders wins the popular vote, he will be the nominee. End of story.

I completely agree with this assessment, which is why the media plays the key role in rigging this thing for Hillary Clinton. For example, consider the following “political reporting” published by Bloomberg yesterday:

Though Sanders picked up 55 delegates Saturday to Clinton’s 20, she still holds a commanding lead with 1,712 delegates of the 2,383 needed for a first-ballot nomination at the party’s national convention at Philadelphia in July. That includes 469 superdelegates—Democratic office-holders and party officials who aren’t bound by results from primaries and caucuses. Sanders has 1,004 total delegates.

The truth is she doesn’t actually “have” those superdelegates, and if Sanders wins the delegates people actually vote for, he’ll probably get the nomination. As such, the media invents a number that isn’t actually real, and definitely not set in stone, to demoralize Sanders supporters and make them think the gap is too large to overcome. It’s absolutely disgusting.

So given that Joe Scarborough alluded to this trick during his segment, you’d think the person in charge of graphics at MSNBC wouldn’t be so shameless. But you’d be wrong. This is how the station portrayed the race on several occasions during the segment:

Here’s another example:

Incredibly, the only graphic shown during the segment that even alluded to the fact that these numbers are inflated by superdelegates is the following:

While better, the above still represents a completely dishonest portrayal of the race. This is the right way to do it, from the New York Times:

If anything, superdelegates should be mentioned as a footnote only. Anything else represents a total lack of ethics, integrity and highlights why the public has nothing but derision for the American mainstream media.

The clip is still worth watching.

- Japanese Industrial Production Crashes Most Since 2011 Tsunami

While we are sure this will not deter Japanese officialdom from declaring that QQE and NIRP is working and that the deflation-mindset is being beaten, the fact is that when February’s 6.2% collapse in Japanese industrial production is compared to the devastatingly poor plunge aftwer March 2011’s quake, tsusnami, and nuclear ‘event’, something has gone disastrously wrong in Japan.

Across every sub-sector, it was a total disaster…

Find the silver-lining in that – we dare you!

- Fitch Downgrades Chicago After "Worst Possible Outcome" In State Supreme Court Pension Reform Bid

Last week, Rahm Emanuel got some bad news. The Illinois Supreme Court agreed with Cook County judge Rita Novak’s ruling that the Chicago mayor’s scheme to put worker pension plans on a sustainable path was unconstitutional.

“These modifications to pension benefits unquestionably diminish the value of the retirement annuities the members of (the city workers and laborers funds) were promised when they joined the pension system,” the high court wrote in its opinion. “Accordingly, based on the plain language of the act, these annuity reducing provisions contravene the pension protection clause’s absolute prohibition against diminishment of pension benefits, and exceed the General Assembly’s authority.”

To be sure, the ruling didn’t come as a surprise. Indeed, it would have been next to impossible for the court to decide otherwise, given that the justices had effectively ruled on the exact same set of issues last May. As judge Novak put it in her opinion (delivered last summer), “the principle [that public pensions shall not be diminished or impaired] is particularly compelling where the Supreme Court’s decision is so recent, deals with such closely parallel issues and provides crystal-clear direction on the proper interpretation of the law.”

That “crystal-clear direction” makes it all but impossible for officials to implement reform measures that will help ensure the city’s pension system doesn’t go belly up in the short span of 10 years. As we noted last week, the good news for taxpayers is that they’ll be off the hook in the short-term as money earmarked to sweeten the deal for pensions that went along with the reform plan will no longer be needed. “The city faces a short-term benefit of about $89 million that’s currently in escrow that can be used to help other areas of the budget,” Civic Federation President Laurence Msall said, before warning that “it will be a very hollow victory for the beneficiaries.” That’s because over the long haul, this is a disaster. “The ruling eases some immediate demands as the overturned law had stepped up the city’s required contributions,” Bloomberg wrote on Monday afternoon. “Without the restructuring, the unfunded liabilities of the municipal and laborers funds will climb by $900 million a year, making them insolvent by 2026 and 2029.”

Right. Which means that unless city officials can come up with alternative ways to fill the holes, pensions will be more than “diminished and impaired” – they’ll disappear altogether like a Chinese short seller after a market rout.

But the inviolable nature of pension benefits means that no matter how certain insolvency is, the court will never sanction a plan that seeks to alter the “implicit contract” between public sector employees and state and local governments.

Needless to say, none of the above bodes well for the city’s credit rating.

Moody’s decided to get out ahead of things last year when, on the heels of the Illinois Supreme Court’s ruling regarding a reform bid for state pensions, the ratings agency cut Chicago to junk. On Monday, Fitch cut the city by two notches to BBB- the lowest investment grade rating. “Last week’s Illinois Supreme Court ruling striking down pension reform legislation for two of the city of Chicago’s four pension plans was among the worst of the possible outcomes for the city’s credit quality,” Fitch said. “Not only did it strike down the pension reform legislation in its entirety, but it made clear that the city bears responsibility to fund the promised pension benefits, even if the pension funds become insolvent.” And make no mistake, they will become insolvent.

Fitch’s decision affects nearly $10 billion in GO debt and nearly a half billion in sales tax revenue obligations.

For their part, Moody’s calls the ruling “a credit negative setback.”

“The ruling significantly limits the city’s ability to curb its $20 billion pension shortfall by restructuring benefits,” Moody’s said on Tuesday, before noting that it “expects Chicago to find an alternate plan to address unfunded liabilities” and any delay in doing so will “likely weaken” the city’s credit profile.

In other words, Emanuel needs to figure out a way to address the underfunded liabilities and he needs to do it fast.

The problem: there are no good options. Emanuel just raised property taxes (by a record amount no less) and the city has already borrowed $220 million this year.

It may be about time to get on the phone with Detroit and ask for pointers on how to efficiently navigate the bankruptcy process.

* * *

From Fitch

Fitch Ratings has downgraded to ‘BBB-‘ from ‘BBB+’ the ratings on the following Chicago, Illinois obligations:

–$9.8 billion unlimited tax general obligation (ULTGO) bonds;

–$486 million sales tax revenue bonds.

The Rating Outlook is Negative.

SECURITY

The ULTGO bonds are payable from the city’s full faith and credit and its ad valorem tax, without limitation as to rate or amount.

The sales tax bonds have a first lien on the city’s 1.25% home rule sales and use tax and the city’s local share of state-distributed 6.25% sales and use tax. Additionally, there is a springing debt service reserve, funded over a 12-month period that would be triggered if coverage fell below 2.5x.

KEY RATING DRIVERS

PENSION RULING HEIGHTENS PRESSURE: Fitch believes last week’s Illinois Supreme Court ruling striking down pension reform legislation for two of the city of Chicago’s four pension plans was among the worst of the possible outcomes for the city’s credit quality. Not only did it strike down the pension reform legislation in its entirety, but it made clear that the city bears responsibility to fund the promised pension benefits, even if the pension funds become insolvent.

CITY STRATEGY ANTICIPATED: The city expects to present a strategy to address the increased burden resulting from the ruling in the next several weeks. Given the lack of flexibility to alter the liability, Fitch believes the plan must rely on meaningful use of revenue and expenditure controls to meet much higher annual payments.

UNDERLYING FUNDAMENTALS REMAIN SOUND: The ‘BBB-‘ rating recognizes the city’s role as an economic hub for the Midwestern region of the United States with a highly educated workforce and improving employment trends. Aside from its pension funding issues, Chicago’s financial profile has markedly improved in recent years, although full structural balance remains a challenge. The city’s independent legal authority to raise revenues remains a key credit strength.

RATING SENSITIVITIES

PATH TO PLAN SOLVENCY: The rating could stabilize at ‘BBB-‘ if the city presents a realistic plan that puts the pension funds on an affordable path toward solvency. The lack of such a plan would likely result in a downgrade as it would raise the risk that plan assets will be depleted and pension benefit payments would be made on a paygo basis, severely impairing financial flexibility.

RATING CAPS: The ULTGO rating serves as a ceiling to the sales tax rating. A change of the ULTGO rating, therefore, would result in a change to the sales tax rating.

CREDIT PROFILE

LONGER-TERM LIABILITIES A CHIEF CONCERN

The city continues to face credit challenges related to critically-underfunded pension obligations and rising associated costs. The Outlook for the city’s credit quality cannot be considered stable until such challenges are met in a sustainable fashion. Since last week’s ruling appears to eliminate the option of reducing the liability, the city will need to rely on its ability to increase revenues and control spending. Fitch will evaluate the direction of the rating and Outlook as their level of ability to do so becomes more apparent.

The weight of the city’s extremely large unfunded pension liability is compounded by the high (8.7% of market value) debt burden, which is the product of substantial borrowing by the city as well as overlapping jurisdictions. Many of these overlapping governments also maintain underfunded pensions, and Fitch remains concerned that the funding requirements for all of these long-term liabilities will pressure the resource base in the coming years.

The city maintains four single-employer defined benefit pension plans, all of which are poorly funded due to a statutory funding formula which has fallen far short of actuarial requirements. In fiscal 2014, the combined actual pension contribution amounted to just a quarter of the actuarially determined requirement. The combined unfunded liability for all four plans is reported at approximately $20 billion, yielding a very low funded ratio of 34% or an even lower estimated 32% when adjusted by Fitch to reflect a 7% rate of return assumption.

PENSION REFORM CHALLENGE DECISION

Last week’s court ruling struck down pension reform legislation covering two of the city’s four pension plans (Municipal and Laborers). The legislation included some changes to the benefit structure that reduce the liability, as well as a multi-year ramp up in contributions.

The city contended its reform would preserve and protect benefits, rather than diminishing or impairing them. The basis for this contention was that prior to the pension reform legislation, under Illinois statute the city was not legally responsible for the unfunded liability of the Municipal and Laborers’ pension funds.

The ruling struck down the benefit changes and confirmed the city’s responsibility for providing promised benefits. If the city does not implement a plan to increase funding, those funds face depletion in 10-13 years. The Municipal plan is the largest of the city’s four pension plans.

POLICE AND FIRE PLANS REQUIRE INCREASED PAYMENTS

The Police and Fire pension plans also faced increased funding requirements. The existing formula requires a contribution that would be sufficient to bring both systems to a 90% funding level by 2040. The state legislature passed a bill that would change the amortization period to 40 years and allow for a ramp up period to the 90% actuarially based funding level in 2020.

Those two changes are estimated to lessen the increase in the first year’s (2016) payment from $550 million to $330 million. The legislature has not sent the bill to the governor for his signature. Once the legislature sends the bill to the governor, if not signed, it would become law 60 days. The city has arranged to fund the full, higher contribution for 2016, using short-term borrowing proceeds to fund the difference.

PENSION CHALLENGES OVERSHADOW IMPROVED FINANCIAL PERFORMANCE

Management has made significant progress toward matching ongoing revenues with non-pension annual expenditures. Fitch will not consider the city’s financial operations to be structurally balanced in the absence of a sustainable, actuarially-based pension funding structure. Successful execution of the city’s plan toward financially sustainable practices would be considered a positive rating factor. Remaining plan elements include the elimination of scoop-and-toss refundings by 2019, the use of current funds to pay legal settlements or judgments, and growth of the ‘rainy day fund.’

The city ended the practice of appropriating reserves beginning with fiscal 2015. The $3.5 billion fiscal 2015 general fund budget was balanced with a reduced but still significant amount of one-time measures, including scoop-and-toss refunding. The city expects to end fiscal 2015 on budget, with no use of fund balance anticipated.

The $3.6 billion fiscal 2016 general fund budget closed the previously identified budget gap of $232.6 million through a variety of recurring and one-time measures and no appropriation of general fund balance. Fitch believes the budget target is achievable given the city’s recent history of budgetary adherence. Despite the progress made, the city’s budget still requires some non-recurring measures for balance, which is concerning several years into an economic recovery.

REVENUE CONTROL AND RESERVES KEY

Fitch views the city’s home rule status as a credit strength, fostering revenue independence and flexibility. The general fund derives support from utility taxes, state sales taxes, transaction taxes, and recreation taxes among others. The general fund does not rely upon property taxes for operations, as they are earmarked for pensions, library expenses and debt service.

The audited fiscal 2014 unrestricted general fund balance dropped to 3.6% from 4.6% of spending a year prior. Fitch views the approximately $626 million, equivalent to 19.4% of fiscal 2014 general fund spending, in the service concession and reserve fund as an important element of financial flexibility. A draw on reserves would signal an increasing reliance on non-recurring measures and could trigger a rating downgrade.

- You Probably Want To Go Long Oil Tomorrow (Video)

By EconMatters

Strong API Report for this time of year, and Equities about to break out means short covering ahead for oil bears. Remember this is quarter end window dressing week as well! Expect some short covering in Oil ahead of the EIA Report on Wednesday.

© EconMatters All Rights Reserved | Facebook | Twitter | YouTube | Email Digest | Kindle

- Why We Have A Wage-Inequality Problem

Submitted by Gail Tverberg via Our Finite World blog,

Wage inequality is a topic in elections around the world. What can be done to provide more income for those without jobs, and those with low wages?

Wage inequality is really a sign of a deeper problem; basically it reflects an economic system that is not growing rapidly enough to satisfy everyone. In a finite world, it is easy for an economy to grow rapidly at first. In the early days, there are enough resources, such as land, fresh water, and metals, for each person to get a reasonable-sized amount. Each would-be farmer can obtain as much land as he thinks he can work with; fresh water is readily available virtually for free; and goods made with metals, such as cars, are not expensive. There are many jobs available, and wages for most people are fairly similar.

As population grows, and as resources degrade, the situation changes. It is still possible to grow enough food, but it takes large farms, with expensive equipment (but very few actual workers) to produce that food. It is possible to produce enough water, but it takes high-tech equipment and a handful of workers who know how to use the high-tech equipment. Metals suddenly need to be lighter and stronger and have other characteristics for the high tech industry, thus requiring more advanced products. International trade becomes more important to be able to get the correct mix of materials for the advanced products needed to operate the high-tech economy.

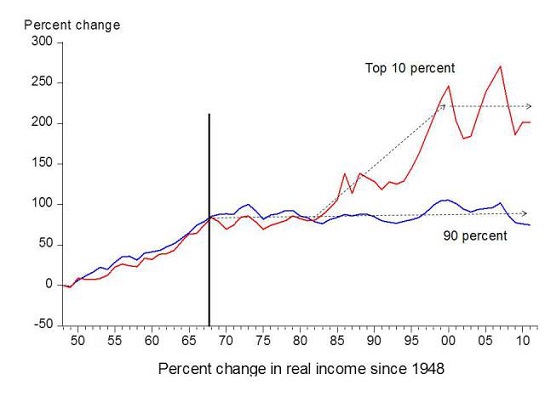

With these changes, the economic system that previously provided many jobs for those with limited training (often providing on-the-job training, if necessary) gradually became a system that provides a relatively small number of high-paying jobs, together with many low-paying jobs. In the United States, the change started happening in 1981, and has gotten worse recently.

Figure 1. Chart comparing income gains by the top 10% to those of the bottom 90%, by economist Emmanuel Saez. Based on an analysis IRS data; published in Forbes.

What Happens When An Economy Doesn’t Grow Rapidly Enough?

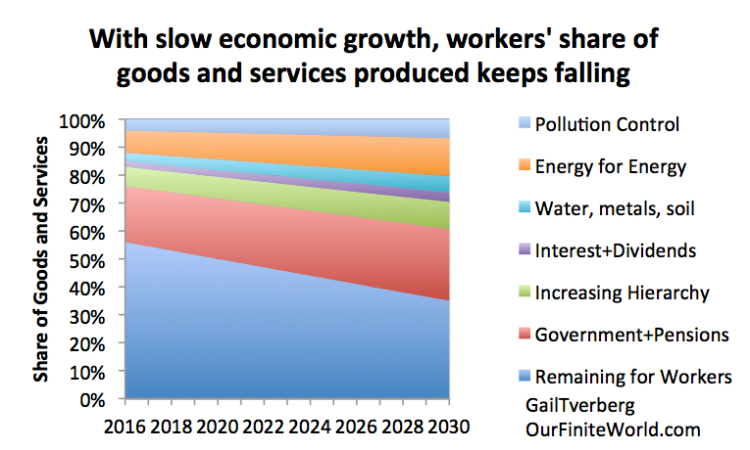

If an economy is growing rapidly enough, it is easy for everyone to get close to an adequate amount. The way I think of the problem is that as economic growth slows, the “overhead” grows disproportionately, taking an ever-larger share of the goods and services the economy produces. The ordinary worker (non-supervisory worker, without advanced degrees) tends to get left out. Figure 2 is my representation of the problem, if the current pattern continues into the future.

Figure 2. Author’s depiction of changes to workers share of output of economy, if costs keep rising for other portions of the economy. (Chart is only intended to illustrate the problem; it is not based on a study of the relative amounts involved.)

The reason for the workers’ declining share of the total is that we live in a finite world. We are using renewable resources faster than they replenish and continue to use non-renewable resources. The workarounds to fix these problems take an increasing share of the total output of the economy, leaving less for what I have called “ordinary workers.” The problems we encounter include the following:

- Pollution control. Pollution sinks are already full. Continuing to use non-renewable resources (including burning fossil fuels) adds increased pollution. Workarounds have costs, and these take an increasing share of the output of the economy.

- Energy used in energy production. When we started extracting energy products, the cheapest, easiest-to-extract energy products were chosen first. The energy products that are left are higher-cost to extract, and thus require a larger share of the goods the economy produces for extraction.

- Water, metals, and soil workarounds. These suffer from deteriorating quantity and quality, leading to the need for workarounds such as desalination plants, deeper mines, and more irrigated land. All of these take an increasingly large share of the output of the economy.

- Interest and dividends. Capital goods tend to be purchased through debt or sales of stock. Either way, interest payments and dividends must be made, leaving less for workers.

- Increasing hierarchy. Companies need to be larger in size to purchase and manage all of the capital goods needed to work around shortages. High pay for supervisors reduces funds available to pay lower-ranking employees.

- Government funding and pensions. Government programs grow in size in good times, but are hard to cut back in hard times. Pensions, both government and private, are a particular problem because the number of elderly people tends to grow.

It should be no surprise that this type of continuing pattern of eroding wages for ordinary workers leads to great instability. If nothing else, workers become increasingly disillusioned and want to change or overthrow the government.

It might be noted that globalization also plays a role in this shift toward lower wages for ordinary workers. Part of the reason for globalization is simply to work around the problems listed above. For example, if pollution becomes more of a problem, globalization allows pollution to be shifted to countries that do not try to mitigate the problem. Globalization also allows businesses to work around rising the rising cost of oil production; production can be shifted to countries that instead emphasized coal in their energy mix, with much lower energy used in energy production. With increased globalization, people who are primarily selling the value of their own labor find that wages do not keep up with the rising cost of living.

Studies of Previous Economies that Experienced Declining Wages of Ordinary Workers

Researchers Peter Turchin and Surgey Nefedov analyzed eight civilizations that collapsed in detail, and recorded their findings in the book Secular Cycles. According to them, the typical economic growth pattern of civilizations that collapsed was similar to Figure 3, below. Before the civilizations began to collapse (Crisis Stage), they hit a period of Stagflation. During that period of Stagflation, wages of ordinary workers tended to fall. Eventually these lower wages led to the downfall of the system.

Figure 3. Shape of typical Secular Cycle, based on work of Peter Turchin and Sergey Nefedov in Secular Cycles. Chart by Gail Tverberg.

In many instances, a growth cycle started when a group of individuals discovered a way that they could grow more food for their group. Perhaps they cleared trees from a large plot of land so that they could grow more food, or they found a way to irrigate an area that was dry, again leading to sufficient food for more people. A modern analogy would be discovering how to use fossil fuels to grow more food, thus allowing population to rise.

At first, population grew rapidly, and incomes tended to grow as well, as the size of the group expanded to the carrying capacity of the improved land. Once the economy got close to the carrying capacity of the land, a period of Stagflation took place. There no longer was room for more farmers, unless plots of land were subdivided. Would-be farmers were forced to take lower-paying service jobs, or to become farmers’ helpers. In this changing world, debt levels rose, and food prices spiked.

To try to solve the many issues that arose, there was a need for more elite workers–what we today would call managers and high-level government officials. In some cases, a decision would be made to expand the army, in order to try to invade other countries to obtain more land to solve the problem of inadequate resources for a growing population. All of these changes led to a higher needed tax level and more high-level managers.

What tended to bring the system down was the growing wage inequality and the resulting low wages for ordinary workers. Governments needed ever-higher taxes to pay for their expanding services, but they had difficulty collecting sufficient tax revenue. If they raised taxes to an adequate level, workers found themselves without sufficient money for food. In their weakened state, workers became subject to epidemics. Governments with inadequate tax revenue tended to collapse.

Sometimes, rather than collapse, wars were fought. If the wars were successful, the resource shortage that ultimately led to low wages of workers could be addressed. If not, the end of the group might come through military defeat.

Today’s Fundamental Problem: The World Economy Can No Longer Grow Quickly

Because of our depleted resources and because of the world’s growing population, the only the way the world economy can now grow is in a strange way that assigns more and more output to various parts of “overhead” (Figure 2), leaving less for workers and for unemployed individuals who want to be workers.

Automation looks like it would be a solution since it can produce a large amount of goods, cheaply. It doesn’t really work, however, because it doesn’t provide enough employees who can purchase the output of the manufacturing system, so that demand and supply can stay in balance. In theory, companies that automate their operations could be taxed at a very high rate, so that governments could pay would-be workers, but this doesn’t work either. Companies have a choice regarding which country they operate in. If a tax is added, companies can simply move to a lower-tax rate jurisdiction, where no tax is required for automation.

The world is, in effect, reaching the end of the Stagflation period on Figure 3, and approaching the Crisis period on Figure 3. The catch is that the Crisis period is likely to be shorter and steeper than illustrated on Figure 3, because we live in a much more interconnected world, with more dependence on debt and world trade than in the past. Once the interconnected world economic system starts to fail, we are likely to see a rapid drop in the total amount of goods and services produced, worldwide. This will produce an even worse distribution problem–how does everyone get enough?

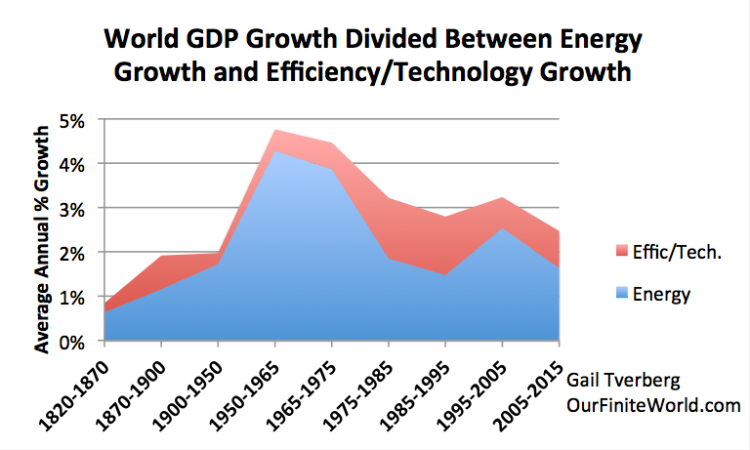

The low oil, natural gas, and coal prices we are now seeing may very well be the catalyst that brings the economy to the “Crisis Period” or collapse. Unless there is a rapid increase in prices, companies will cut back on fossil fuel production, as soon as 2016. With less fossil fuel production, the total quantity of goods and services (in other words, GDP) will drop. Most economists do not understand that there is a physics reason for this problem. The quantity of energy consumed needs to keep rising, or world GDP will decline. Technology gains and energy efficiency improvements provide some uplift to GDP growth, but this generally averages less than 1% per year.

Figure 4. World GDP growth compared to world energy consumption growth for selected time periods since 1820. World real GDP trends for 1975 to present are based on USDA real GDP data in 2010$ for 1975 and subsequent. (Estimated by author for 2015.) GDP estimates for prior to 1975 are based on Maddison project updates as of 2013. Growth in the use of energy products is based on a combination of data from Appendix A data from Vaclav Smil’s Energy Transitions: History, Requirements and Prospects together with BP Statistical Review of World Energy 2015 for 1965 and subsequent.

Are There Political Strategies to Solve Today’s Wage Inequality Problem?

Unfortunately, the answer is probably, “No.” While some strategies look like they might have promise, they risk the possibility of pushing the economy further toward financial collapse, or toward war, or toward a major reduction in international trade. Any of these outcomes could eventually bring down the system. There also doesn’t seem to be much time left.

Our basic problem is that the world economy is growing so slowly that the ordinary workers at the bottom of Figure 2 find themselves with less than an adequate quantity of goods and services. This problem seems to be getting worse rather than better, over time, making the problem a political issue.

These are a few strategies that have been mentioned for fixing the problem:

- Provide a basic income to all citizens. The intent of this strategy is to try to capture a larger share of the world’s goods and services by printing money (or borrowing money), This money would hopefully allow citizens to purchase a larger share of the goods and services available on the world market. If the pool of goods and services is pretty much fixed in total, more goods and services purchased by one country would mean fewer goods and services purchased by other citizens of other countries. I would expect that this strategy would not really work, because of changing currency relativities: the level of the currency of the country issuing the checks would tend to fall relative to the currencies of other countries. The basic problem is that it is possible to print currency, but not goods and services. There is also a possibility that printing checks for everyone will encourage less work on the part of citizens. If citizens do less work, the country as a whole will produce less. Such a change would leave the country worse off than before.

- Lower interest rates, even negative interest rates. With lower interest rates, the interest portion of the Interest and Dividend sector shown on Figure 2 can theoretically mostly disappear, leaving more money for wages on Figure 2 and thus tending to “fix” the wage problem this way. Low interest rates also tend to reduce dividends, because companies will choose to buy back part of their stock and issue very low interest rate debt instead. If interest rates become negative, the sector can completely disappear. The ultra-low interest rates will have negative ramifications elsewhere. Banks are likely to have a hard time earning an adequate income. Pension funds will find it impossible to pay people the pensions they have been promised, creating a different problem.

- Get jobs back from foreign countries through the use of tariffs. Some jobs might be easier to get back from foreign countries than others. For example, programming, call center operations, and computer tech support are all “service type” jobs that can be done from anywhere, and thus could be transferred back easily. In situations where new factories need to be built, and materials sourced from around the world, the transfer would be more difficult. Businesses will tend to automate operations, rather than hire locally. The countries that we try to get the business from may retaliate by refusing to sell needed devices (for example, computers) and needed raw materials (such as rare earth minerals). Or a collapse may occur in a country we try to get jobs back from, so fewer goods and services are produced worldwide.

- Keep out immigrants. The theory is, “If there aren’t enough jobs to go around, why give them to immigrants?” In a world with sagging GDP, job growth will be slow or may not occur at all. There may be a particular point in keeping out well-educated immigrants, if there aren’t enough jobs for college-educated people who already live in a country. Of course, Europe has been doing the opposite–taking in more immigrants, in the hope that they will provide young workers for countries that are rapidly aging. (Another approach to finding more workers would be to raise the retirement age–but such an approach is not politically popular.)

- Medicare for all. Medicare is the US healthcare plan for those over 65 or having a disability. It pays a substantial share of healthcare costs. The concern I have with “Medicare for all” is that because of the way the economy now functions, the total amount of goods and services that we can choose to purchase, for all kinds of goods and services in total, is almost a fixed sum. (Some people might say we are dealing with a zero-sum game.) If we make a choice to spend more on medical treatment, we are simultaneously making a choice that citizens will be less able to afford other things that might be worthwhile, such as apartments and transportation. The US healthcare system is already the most expensive in the world, as a percentage of GDP. We need to fix the overall system, not simply add more people to a system that is incredibly expensive.

- Free college education for all. As the situation stands today, 45% of recent college graduates are in jobs that do not require a college degree. This suggests that we are already producing far more college graduates than there are jobs for college graduates. If we provide “free college education for all,” this offer needs to be made in the context of entrance exams for a limited number of spaces available (reduced from current enrollment). Otherwise, we sink a huge share of our resources into our education system, to no great benefit for either the students or the overall system. We are back to the zero-sum game problem. If we spend a large share of our resources on college educations that don’t really lead to jobs that pay well, more people of all ages will find themselves unable to afford apartments and cars because of the higher tax levels required to fund the program.

- Renewables to replace fossil fuels. Despite the popularity of the idea, I don’t think that adding renewables provides any significant benefit, given the scenario we are facing. Renewables are made using fossil fuels, and they tend to have pollution problems of their own. They don’t extend the life of the electric grid, if we are facing collapse. At most, they might be helpful for a few people living off grid, if the electrical grid is no longer operating. If the economic system is on the edge of collapse already, fossil fuel use will drop quickly, with or without the use of renewables.

Conclusion

It would be really nice to “roll back” the world economy to a date back before population rose to its current high level, resources became as depleted as they are, and pollution became as big a problem as it is. Unfortunately, we can’t really do this.

We are now faced with the question of whether we can do anything to mitigate what may be a near-term crisis. At this point, it may be too late to make any changes at all, before the downward slide into collapse begins. The current low prices of fossil fuels make the current situation particularly worrisome, because the low prices could lead to lower fossil fuel production, and hence reduce world GDP because of the connection between energy consumption and GDP growth. Low oil prices could also push the world economy downward, due to increasing defaults on energy sector loans and adverse impacts on economies of oil exporters.

In my view, a major reason why fossil fuel prices are now low is because of the low wages of “ordinary workers.” If these wages were higher, workers around the globe could be buying more houses and cars, and indirectly raising demand for fossil fuels. Thus, low fossil fuel prices may be a sign that collapse is near.

One policy that might be helpful at this late date is increased focus on contraception. In fact, an argument could be made for more permissive abortion policies. Our problem is too little resources per capita–keeping the population count in the denominator as low as possible would be helpful.

On a temporary basis, it is also possible that new programs that lead to rising debt–whether or not these programs buy anything worthwhile–may be helpful in keeping the world economy from collapsing. This occurs because the economy is funded by a combination of wages and by growing debt. A shortfall in wages can be hidden by more debt, at least for a short time. Of course, this is not a long-term solution. It simply leads to a larger amount of debt that cannot be repaid when collapse does occur.

- Rail Traffic Volumes Tumble As Coal Stockpiles Soar At Record Rate

For the first two months of 2016, it seemed as if a modest, if stable, rebound was finally taking place among one of the hardest hit transportation sectors of 2015, rails. Alas, like virtually everything else, this too has proven to be nothing more than a dead cat coming back to life and getting run over by a train.

As RBC writes in a recent notes, rail traffic volume declines have again intensified. “On a Y/Y basis, traffic slowed by -14% Y/Y for week 11 as all rails posted stiff volume declines and on a segment basis only Motor Vehicles carloads were higher (+7% Y/Y). Since week 7 when volumes grew by +4% Y/Y, the sharpest traffic decline has come in Intermodal carloads (from growth of +17% Y/Y for week 7 to a -12% Y/Y decline last week). Coal headwinds have also intensified in recent weeks and the segment remains the major laggard so far this quarter (-30% Y/Y QTD).”

Visually:

And while we have touched on some of the primary catalysts for the ongoing decline in railroad traffic, chief among which the drop off in global trade and the plunge in oil transportation, a third – just as important factor – has been the situation involving US coal power plants, where as the EIA writes, “coal stockpiles at electric generating facilities totaled 197 million tons at the end of 2015, the highest level since June 2012 and the highest year-end inventories in at least 25 years.”

The full details from EIA’s Today in Energy, by Tim Shear:

As coal stockpiles at power plants rise, shippers are reducing coal railcar loadings

Source: U.S. Energy Information Administration, Electric Power Monthly and Association of American Railroads

Coal stockpiles at electric generating facilities totaled 197 million tons at the end of 2015, the highest level since June 2012 and the highest year-end inventories in at least 25 years. More than 40 million tons of coal were added to stockpiles at electric generating facilities from September through December, the largest build during that timespan in at least 15 years. In addition to relatively low overall electricity generation, largely attributable to the warmest winter on record, coal-fired electricity has recently been losing market share to electricity produced using natural gas and renewable resources.

Source: U.S. Energy Information Administration, Electric Power Monthly

Coal stockpiles typically follow a seasonal pattern in which stocks build during the lower electricity demand periods of the spring and fall and then get drawn down during periods of higher electricity demand in the summer and winter. In 2015, the stockpile build from August to December was 40 million tons, far higher than the 11 million ton average stockpile build for these months over 2001-14. Coal stockpiles typically decrease in December, averaging a roughly 3 million ton decline for the month over 2001-14. However, stockpiles this December increased by more than 8 million tons.

As stockpiles grew toward the end of 2015, shipments of coal by rail fell. Weekly coal railcar loadings averaged nearly 94,000 carloads per week from September through December 2015, 22% below average loadings for that time of year over the previous five years. Railcar loadings were even lower in the first months of 2016. Through February, weekly coal railcar loadings averaged slightly more than 75,000 carloads, 35% below the previous five-year average.

Source: U.S. Energy Information Administration, Electric Power Monthly

* * *

What is most surprising is that the near record high coal stockpile levels at the end of 2015 come despite a reduction in coal-fired generation capacity. From 2010 to 2015, total U.S. coal generating capacity declined 10%, falling by nearly 33 gigawatts (GW) to 285 GW. One way of measuring coal stockpiles while accounting for the overall change in generating capacity is to calculate days of burn. This calculation considers the current stockpile level at each generator and its estimated consumption (burn) rates in coming months, based on the average consumption rates for those months over the past three years. This measure approximates how many days the generator could run at historical levels before depleting its existing stockpile.

This means that just as oil inventories hit all time highs at the end of 2015 and into 2016, the same was taking place at US power plant coal stockpiles; worse, since much electricity production has been shifted to other, cleaner forms of electric generation, the excess coal capacity in the market is so vast, that it will take pervasive, acute bankruptcies to reset some semblance of equilibrium. It also means that the Peabody bankruptcy will be only the start, and that tens of thousands more hard-working Americans will soon lose their jobs.

- "It's Worse Than 2008": Toronto's "Condo King" Weighs In On The Death Of Alberta's Housing Market

Last week, National Bank’s Peter Routledge did some “back of the envelope” calculations and determined that Chinese buyers might well have accounted for one-third of all real estate purchased in Vancouver during 2015. Here’s how he came to that rather startling conclusion:

“The NAR estimates that buyers from China invested US$28.6 billion in U.S.-domiciled residential real estate properties over the 12 months ending March 31, 2015. The results of a multiple choice survey the Financial Times solicited from 77 high net worth and affluent individuals from China (admittedly not a statistically significant sample size) [show that] of those who had purchased residential real estate outside China, 33.5% had done so in the United States, 11.7% in Vancouver, and 8.3% in Toronto. From this survey data, one could hypothesize that for every three high net worth investors from China who purchase a U.S. residence, one purchases a residence in Vancouver. One can then apply these ratios to the NAR’s estimate of US$28.6 billion in U.S. residential real estate investment made by buyers from China. From this, we hypothesize that, in 2015, homebuyers from China invested ~US$9.9 billion / Cdn$12.7 billion in Vancouver residential real estate; this amounts to 33% of total purchase volume.

If that’s even close to accurate, it would confirm what we and others have been saying for quite a while: namely that capital flight from China is driving the explosion of housing prices in red hot markets like London, Hong Kong, and yes, Vancouver.

Persistent CAD weakness made Canadian homes look particularly attractive to Chinese buyers who had traded in their RMB for USD. The same dynamic – combined with the allure of a burgeoning tech industry – also drove outsized gains in Toronto, Waterloo, and other markets across the country.

But Alberta wasn’t so lucky. Situated at the heart of Canada’s dying oil patch, the province was the only territory where real GDP contracted in 2015. While manufacturing sales across Canada rose 2.3% in January, Y/Y sales plunged 13.2% in Alberta, the sixth decline in seven months and a sure sign that the oil slump has spilled over into the rest of the economy. Provincial manufacturing sales dropped 16% last year.

The dire outlook for the provincial economy has weighed on the housing market in places like Calgary. Have a look, for instance, at the following chart which we’re fond of presenting.

As you can see, one of those three markets is not like the others.

Underscoring just how bad things truly are in Alberta, Toronto’s “condo king” Brad Lamb is putting the brakes on two condo projects planned for Alberta. “The 36-storey Jasper House and 45- storey North will be delayed at least a year,” The Calgary Herald reports. Here’s more:

“The situation in Alberta is worse than 2008,” said Brad Lamb, known as Toronto’s condo king and for his humorous billboard ads depicting his face on a sheep’s body. “This is a unique event that is annihilating anywhere in the world that produces oil.” Executives at Fortress Real Developments Inc., which partnered with Lamb on the projects, declined to comment.

Lamb is pulling back as condo sales in Calgary and Edmonton posted the steepest decline in 2015 since the financial crisis. Sales of condos fell 38 percent in Calgary, Alberta’s biggest city, and declined 56 percent in Edmonton, according to Altus Group Ltd.

Prices for Calgary apartments have been among the hardest hit in the housing market, sliding 8.7 percent to $279,697 in January, while the average Edmonton condo declined 10 percent to $227,052 over the same period, according to the real estate boards for those cities.

Yes, “it’s worse than 2008,” and any locale where the economy depends at least partly on crude has been “annihilated.”

Lamb insists that the two postponed projects will eventually be completed. Construction on Jasper House, for instance, will begin in 2017. In the meantime, if you should happen to own a Toronto condo and want to take advantage of the soaring prices made possible by the billions upon billions fleeing China…

…don’t hesitate to give Brad a call…

- Trump Explains His "Women Problems": "I Never Knew I Was Going To Run For President"

To let CNN tell it, Donald Trump has women problems.

And we don’t mean in the sense that he has trouble finding an attractive dinner date:

Following a patently absurd spat with Ted Cruz that began when a supposedly unaffiliated anti-Trump group ran an ad featuring a GQ spread of Melania Trump and promptly ended when Trump publicly “schlonged” Cruz by re-tweeting a head-to-head beauty comparison between Melania and Heidi Cruz, some in the media are looking to rekindle the fire Megyn Kelly started last year when, at the first GOP debate, the Fox anchor asked the Republican frontrunner if he thought it was befitting of a presidential candidate to call women “disgusting animals.”

“Trump’s negatives among female voters are climbing,” Kellyanne Conway, a Republican pollster who runs the pro-Cruz super-PAC “Keep the Promise” says.

Conway is referring to a CNN poll from last week that shows 73% of women hold an unfavorable view of the billionaire. “The attrition is most striking among married and suburban female Republicans,” she remarked, adding that “They [women] can tolerate a snide remark or witty snark here or there, but draw the line at personal insults in place of policy prescriptions.”

Yes, “they draw the line at personal insults.” “Insults” like these (note the finale at 0:41):

That’s an ad bought and paid for by Our Principles PAC, a group run by staffers from Jeb Bush’s miserable failure of a campaign.

While Trump has thus far shaken off suggestions that comments he’s made in the past are alarmingly misogynistic, he seems to be making an attempt to mend some fences ahead of the Wisconsin primary. “After a week that found Trump launching attacks on Texas Senator Ted Cruz’s wife, Heidi Cruz, and tossing barbs at Fox News anchor Megyn Kelly, the billionaire front-runner on Monday attempted to play down his degrading comments about women, saying they were made in jest,” Bloomberg writes.

“I never knew I was going to be running for office. And you joke, and you kid and say things, but you’re not a politician so you never think anybody cares,” Trump told Wisconsin’s FOX 11 in a phone interview.

Needless to say, Trump’s detractors don’t think “I never thought I would be running for President” is a good excuse for disparaging women.

“[You have problems with] conservative women who are repelled by your attitude and your treatment of females,” Wisconsin-based conservative radio host Charlie Sykes told the frontrunner yesterday. “[I’ve] hired tremendous numbers of women,” Trump responded. “I have been better to women than any of these candidates, frankly.” Here’s what Trump had to say on Twitter:

The media is so after me on women Wow, this is a tough business. Nobody has more respect for women than Donald Trump!

— Donald J. Trump (@realDonaldTrump) March 26, 2016

“@pattiandsammi: @gullakhta99 @realDonaldTrump @Tytan01 @CNN WOMEN LOVE TRUMP. TRUMP’S EXECS PREDOMINANTLY FEMALE. #WOMEN4TRUMP“

— Donald J. Trump (@realDonaldTrump) March 26, 2016

Be that as it may, it’s not just CNN whose polls show that Trump may have trouble with women voters – especially if he ends up squaring off against Hillary Clinton in the national election. A recent NBC/WSJ poll shows some 70% of women give Trump a negative rating while a Reuters poll conducted March 1-15 showed half of American women view the billionaire in a “very unfavorable” light (up 10 points from last autumn). In case that’s in any way unclear, NBC made a giant red graphic with a long line of womens’ restroom symbols on the bottom to illustrate the point:

“Some GOP strategists fear Trump would alienate women voters in historic numbers as the nominee, particularly if he faces Democratic front-runner Hillary Clinton, who hopes to become the first female president and hasn’t been shy to call out sexism in her primary battle against Bernie Sanders,” Bloomberg continues.

“In 2012 Mitt Romney won white women by 14 points according to exit polls – 56% to 42% for President Barack Obama,” NBC goes on to say, reinforcing the supposed threat to the GOP’s chances in the national election. “But in the latest NBC/WSJ poll white women go to Hillary Clinton in a hypothetical general election matchup by 10 points, 48% to 38% [which would be] an enormous 24-point swing in the white women vote between 2012 and 2016.”

Of course if all of this is completely accurate, one wonders how it is that Trump holds such a commanding lead over the rest of the GOP field. Were there no female Republican voters in Florida? Or in Arizona? Or in New Hampshire?

In any event, Trump was apparently surprised to learn that anyone still cares about this. “I thought this was actually a dead issue until I just spoke to you,” he told Sykes.

And it probably was. But the establishment has to do something (anything) to derail this freight train, lest Trump should get to 1,237 before July and dash any hope Republicans had of denying him the nomination. And if you thought Megyn Kelly had “blood coming out of her eyes” at the debate in September, just wait until you see the establishment if Trump becomes the nominee.

* * *

Bonus: Apparently not all women have an unfavorable view of the billionaire

- Caption Contest: Obama Game Face Edition

- Is Trump Right About NATO?

Submitted by Patrick Buchanan via Buchanan.org,

I am “not isolationist, but I am ‘America First,'” Donald Trump told The New York times last weekend. “I like the expression.”

Of NATO, where the U.S. underwrites three-fourths of the cost of defending Europe, Trump calls this arrangement “unfair, economically, to us,” and adds, “We will not be ripped off anymore.”

Beltway media may be transfixed with Twitter wars over wives and alleged infidelities. But the ideas Trump aired should ignite a national debate over U.S. overseas commitments — especially NATO.

For the Donald’s ideas are not lacking for authoritative support.

The first NATO supreme commander, Gen. Eisenhower, said in February 1951 of the alliance: “If in 10 years, all American troops stationed in Europe for national defense purposes have not been returned to the United States, then this whole project will have failed.”

As JFK biographer Richard Reeves relates, President Eisenhower, a decade later, admonished the president-elect on NATO.