- Onshore Yuan Has Been In Freefall Since The IMF Added China To The SDR Basket

For the 5th day in a row, Onshore Yuan has tumbled against the USDollar. Absent the violent devaluation in August, this is the largest drop since March 2014, leaving the Chinese currency at its weakest level against the USD since August 2011. It appears that after showing some signs of 'stability' to appease The IMF's political decision, and following the weak trade data this week, China has decided to escalate the currency wars, perhaps in anticipation of (or in an attempt to stall) any market turbulence when The Fed hikes rates next week and withdraws up to $800bn in liquidity from global markets.

Onshore Yuan is now at its weakest since August 2011…

As it seems, with the blessing of The IMF, China has begun its competitive devaluation efforts…slowly and under the cover of darkness from America's mainstream media…

Put simply, something is going on as the world's money markets prepare for what lies ahead next week and the asset classes with the most risk (see CCC US Corps, EM FX, Oil) are the first to suffer before the effects of shortened collateral chains ripple up into mom-and-pop's 401k.

Charts: Bloomberg

- The Global Economic Reset Has Begun

Submitted by Brandon Smith via Alt-Market.com,

In my last article, I outlined the deliberately engineered trend toward the forced “harmonization” of national economies and monetary policies, as well as the ultimate end goal of globalists: a single world currency system controlled by the International Monetary Fund and, by extension, global governance, which internationalists sometimes refer to in their more honest public moments as the “new world order.”

The schematic for the new world order, according to the admissions of the internationalists, cannot possibly include the continued existence of U.S. geopolitical and economic dominance. The plan, in fact, requires the destabilization and reformation of America into a shell of its former glory. The most important element of this plan demands the removal of the U.S. dollar as the de facto world reserve currency, a change that would devastate our current financial structure.

I outlined with undeniable evidence the reality that major governments, including the BRICS governments of the East, are fully on board with the globalist agenda. There is no way around it; the BRICS, including Russia and China, have openly called for a global monetary system centralized and dictated by the IMF using the SDR basket. This same plan was outlined decades ago in the Rothschild-owned magazine The Economist. We are witnessing that plan being implemented in front of our very eyes today.

For the past couple of years, the current head of the IMF, Christine Lagarde, has used the phrase “global economic reset” often in her speeches and interviews. There is some (deliberate) ambiguity to this notion, but after sitting through hours upon hours of her most boring and repetitive discussions in globalist think tanks such as the Council On Foreign Relations, the consistent message is pretty straightforward. If anyone can stand to listen to this woman's carefully crafted prattle and well-vetted half-truths for more than five minutes, I suggest they watch this particular speech given in January at the CFR:

Her message on the global economic reset is essentially this: “Collective” cooperation will not just be encouraged in the new order, it will be required — meaning, the collective cooperation of all nations toward the same geopolitical and economic framework. If this is not accomplished, great fiscal pain will be felt and “spillover” will result. Translation: Due to the forced interdependency of globalism, crisis in one country could cause a domino effect of crisis in other countries; therefore, all countries and their economic behavior must be managed by a central authority to prevent blundering governments or "rogue central banks" from upsetting the balance.

It’s interesting how the IMF’s answer to the failings of globalization is MORE globalization. In other words, Lagarde would argue that while we are in the midst of an international system, we are not centralized enough for such a system to succeed.

The IMF points out correctly that the economic situation around the world is not stable and could revert once again to the chaos of the initial 2008 crash. The Bank for International Settlements, the primary hub of central bank control, has also given numerous warnings this year on the potential for disaster, including in its latest quarterly report.

The warnings of the BIS in particular should not be taken lightly (some analysts are indeed taking them lightly). The BIS knows exactly when financial disasters will erupt because it wrote the central bank policies that created those same events. For example, in 2007, the BIS released a warning that perfectly predicted the elements of the derivatives and credit crisis in 2008.

What these globalist institutions will not tell you in a direct manner are the real causes and motivations behind the inevitable next stage in the ongoing destruction of the current economic system

The global reset is not a “response” to the process of collapse we are trapped in today. No, the global reset as implemented by central banks and the BIS/IMF are the CAUSE of the collapse. The collapse is a tool, a flamethrower burning a great hole in the forest to make way for the foundations of the globalist Ziggurat to be built. As outlined in my last article, economic disaster serves the interests of elitists.

When you look at these actions by the Federal Reserve and the U.S. government in particular, questions arise. Is it “stupidity” that is causing them to sabotage the golden goose? Is it hubris and greed? Their actions are clearly facilitating a program of incremental implosion, yet they continue to ignore the obvious. Why?

The people who ask these questions are operating on a false assumption; they have assumed that the international bankers and the puppet politicians they control have any interest in protecting the longevity of the U.S. The fact is they do not. They have no loyalty whatsoever to the U.S. system, nor do they see the U.S. as “too big to fail.” This is utter nonsense to globalists. Rather, they see each nation and central bank as a piece in a game, much like chess. Some pieces have to be sacrificed in order to gain a better position on the board. This is all that the U.S., the Federal Reserve and even the dollar are to them: expendable pieces in a larger game.

The U.S. is now experiencing the next stage of the great reset. Two pillars were put in place on top of an already existing pillar by the central banks in order to maintain a semblance of stability after the 2008 crash. This faux stability appears to have been necessary in order to allow time for the conditioning of the masses towards greater acceptance of globalist initiatives, to ensure the debt slavery of future generations through the taxation of government generated long term debts, and to allow for internationalists to safely position their own assets. The three pillars are now being systematically removed by the same central bankers. Why? I believe that they are simply ready to carry on with the next stage of the controlled demolition of the American structure as we know it.

Bailouts And QE: The First Pillar Removed

The bailout bonanza was in part a direct intervention in the deflationary avalanche of the derivatives bubble, but also an indirect intervention in that it changed the psychological dynamics of the markets. As former Fed chairmans Alan Greenspan and Ben Bernanke have both hinted at in interviews and op-eds, one of the primary concerns of the central bank was the psychology behind higher stock prices.

Stock prices could be propped up by the Fed itself through proxy buyers using the printing press. Or the Fed could inject billions, if not trillions, of dollars into banks and allow them to run wild, artificially boosting investment while doing nothing to solve the existing dilemma of negative fundamentals. Beyond this, the markets began to move on the mere words or edicts of Fed officials as algo-computers and the general investment world placed bets on rhetoric rather than reality; a dynamic which is now ending.

The bailouts also reanimated the cadavers of large corporations and banks, not just in the U.S. but in Europe, giving the illusion of life to the financial system while leaving Main Street to rot. In the meantime, quantitative easing measures provided a way to continue financing U.S. government debt at the expense of generations of taxpayers as numerous primary lenders began to abandon typical long-term bond purchases.

Furthermore, oil markets appear to have been directly inflated by QE intervention. It is important to take note that oil prices remained extraordinarily high despite the continuous fall in global demand UNTIL the moment the Federal Reserve instituted the taper of QE3. Then, prices began to plunge.

In a September 2013 article, I predicted that the Fed, despite all common sense and the claims of banks like Goldman Sachs, would indeed follow through with the taper: a removal of the first pillar levitating the U.S. system.

I was, of course, called crazy at the time for this prediction by some people within the alternative economic community.

“Why in the world” they asked, “would the Fed taper QE when they can simply print to infinity and kick the can down the road perpetually?” Again, these people do not understand that America is under scheduled demolition by the international banks; it is not being protected by them.

The taper occurred in December of that year.

Near Zero Interest Rates: The Second Pillar Nearly Removed

After the taper of QE, volatility not seen since 2008/2009 returned to the markets. And the public once again was reminded in sporadic moments that the recovery might not be real after all. Europe and Japan quickly stepped in with their own renewed stimulus measures, and Fed officials began using strategic media interviews to “hint” falsely that QE might return. Markets rallied, then fell dramatically, then rallied again, then fell again in a shocking manner. And this volatility has been the trend up until recently, when the question of the end of zero interest rate policy arose.

Again, very few people have ever asked or demanded the Fed end QE or ZIRP. There was never any legitimate public pressure on the fed to remove these pillars. The investment world has been essentially addicted like heroin junkies to assured gains for three years. The war cry of the investment world has been BTFD! (Buy the f'ing dip) for quite some time; investors have come to expect and demand inevitable central bank intervention and fiat driven stock market rallies. Yet, the Fed is ending the party anyway.

ZIRP is the only pillar left holding stocks in place. Without zero interest rates, and with even the most minor of .25 basis points added, cost-free overnight lending to banks and corporations will end. They will not be able to afford continued lending on the massive scale seen since 2009/2010. This means no more stock buybacks for dying companies like IBM or General Motors, among others. This means a considerable decline in the markets, declines which we have had a taste of in recent plunges in equities at the mere mention of interest rate increases.

In August in an article entitled 'Economic Crisis Goes Mainstream: What Happen's Next?', I wrote:

"The Federal Reserve push for a rate hike will likely be determined before 2015 is over. Talk of a September increase in interest rates may be a ploy, and a last-minute decision to delay could be on the table. This tactic of edge-of-the-seat meetings and surprise delays was used during the QE taper scenario, which threw a lot of analysts off their guard and caused many to believe that a taper would never happen. Well, it did happen, just as a rate hike will happen, only slightly later than mainstream analysts expect.

If a delay occurs, it will be short-lived, triggering a dead cat bounce in stocks, with rates increasing by December as dismal retail sales become undeniable leading into the Christmas season."

You can also read my analysis on the motivations behind a Fed rate hike as well as the theater surrounding their policies.

The cat seems to have finished its bounce and stocks are returning to volatility. Retail sales so far for Black Friday weekend (including Thanksgiving) have posted a staggering 10% drop with online sales below expectations. Chain Store sales have recently crashed 6.3% week over week. Plunging freight rates and global shipping indicate a severe lack of global demand and a terrible sales season ahead. Janet Yellen, ignoring all negative economic signals as predicted, has all but declared a rate hike a given by Dec. 16.

I was, yet again, called crazy for this assertion by some at the time; and to be clear, I could still be wrong. The Fed could pull a fast one and not raise rates, though the rhetoric coming from the fed today almost guarantees they will take action. Not raising rates doesn’t match with their past habits; they seem to be following the timing of the taper model perfectly. The point is, despite common assumptions within the alternative media, the Fed is not “trapped” and can do whatever it wants, including killing the markets if it benefits the greater goal of a global economic authority. With the ZIRP pillar gone, expect even more violent swings in stocks and general uncertainty and panic among day-traders and the public.

U.S. Dollar's World Reserve Status: The Third Pillar In Progress Of Removal

I’ve been writing about the loss of the dollar’s reserve status since 2008. And as I have always said, the removal of this final pillar is a process, not an overnight affair. The BRICS nations have been positioning themselves for years — China since 2005, the rest of the BRICS since at least 2010.

The delusion that some economic analysts have been under is that the BRICS were strategically vying for power by building their own unified banking institution in “opposition” to the IMF and the West. As I presented in my last article, this has proven to be completely false. They were in fact positioning to take their place as puppets within the new global paradigm taking shape. China has now joined the IMF’s SDR basket (as predicted); and Russia, along with the other BRICS, has openly called for the IMF to take control of the global monetary system.

China’s inclusion, I believe, will hasten the loss of the dollar’s market share of reserve status over the next year, along with other factors. Saudi Arabia has also brought the idea of a depeg from the U.S. dollar into the mainstream discussion. This action, which mainstream economists are calling a possible Black Swan, would end the dollar’s petro-status and result in catastrophe for the U.S. economy. The removal of the final pillar is well underway.

As I have stated in the past, the U.S. system as it stands does not necessarily deserve to survive, but then again, this does not mean that it should be sacrificed in order to breathe life into the monstrosity of global economic governance. Such a trade-off only serves the interests of a select group of elites, with the global reset ending in the mechanized multicultural suicide of sovereignty, leeching prosperity from the rest of us in the name of “collective progress.” Globalists want us to believe there is no other option but their leadership, and they will create any measure of chaos in order to convince us of their necessity.

- In Lehman Rerun, Banks Are Buying Protection Against Their Own Systemic Demise Again

At the peak of the craziness of the last cycle, banks took to protecting themselves by buying (credit) protection on other banks as a 'hedge' for systemic risk (which instead exacerbated contagion concerns, seemingly missing the facts that their bids drove risk wider, increaing counterparty risks, and that the inevitable collapse required to trigger these trades would also mean the payoffs to the 'hedges' would never be realized). Fast forward 8 years and it appears once again, as Bloomberg reports, that banks are buying (equity) protection in order to hedge the stress-test downside scenarios enforced by The Fed.

For more than a year, dealers in the U.S. equity derivatives market have noted a widening gap in the price of certain options. (chart below shows the absolute premium for downside protection over upside protection)

If you want to buy a put to protect against losses in the Standard & Poor’s 500 Index, often you’ll pay twice as much as you would for a bullish call betting on gains. (chart below shows the relative premium for downside protection over upside protection)

New research suggests the divergence is a consequence of financial institutions hoarding insurance against declines in stocks. As Bloomberg details,

While various explanations exist including simply nervousness following a six-year bull market, Deutsche Bank AG says in a Dec. 6 research report that the likeliest explanation may be that demand is being created for downside protection among banks that are subject to stress test evaluations by federal regulators. In short, financial institutions are either hoarding puts or leaving places for them in their models should markets turn turbulent.

“Since so many banking institutions are facing these stress tests, the types of protection that help banks do well in these scenarios obtain extra value,” said Rocky Fishman, an equity derivatives strategist at Deutsche Bank.

“The way the marketplace has compensated for that is by driving up S&P skew.”

The Federal Reserve’s Comprehensive Capital Analysis & Review, or CCAR, has become one of the most important annual events for the largest banks. It determines whether trading units, including equity derivatives, can handle a market shock and pay out capital to shareholders. In the test, banks must demonstrate that they can weather a crisis and stay above minimum capital ratios even as their amount of equity is reduced by losses and the planned dividends and buybacks.

One aspect of the stress test is gauging how banks respond to what’s the Fed describes as a “severely adverse” scenario. It’s the most extreme of three situations laid out by the central bank during the annual CCAR.

“One of the reasons S&P puts have been so expensive relative to at-the-money options this year is that the severely adverse scenario prescribed by CCAR program implies a very negative shock to the S&P,” said Fishman. “It creates value for the downside options.”

Of course, we have seen this kind of systemic hedging by banks before. When banks bought credit protection against other banks during the last crisis. Still, the Fed stress tests remain the cornerstone of the U.S. central bank’s efforts to prevent a repeat of the 2008 financial crisis and to gauge the ability of banks to withstand economic turmoil. To Dan Deming of KKM Financial LLC, their presence will have a lasting effect on risk tolerance.

“Risk requirements have ramped up to a point where market participants are forced to buy downside puts as an insurance policy against open option positions,” said Deming. “What was perceived as reasonable risk five years ago is no longer seen as reasonable amid all the new requirements.”

But what regulators (since we are sure the banks know) miss in their math is that these so-called hedges only payoff when a systemic collapse happens and, in the case of the last crisis, the actual assumed payoff disappears as counterparty collateral chains dry up, banks implode, and just when you needed the hedge the most… there is no one left to pay you.

Charts: Bloomberg

- Does Fear Lead To Fascism?

Submitted by John Whitehead via The Rutherford Institute,

“No one can terrorize a whole nation, unless we are all his accomplices.”—Edward R. Murrow, broadcast journalist

America is in the midst of an epidemic of historic proportions.

The contagion being spread like wildfire is turning communities into battlegrounds and setting Americans one against the other.

Normally mild-mannered individuals caught up in the throes of this disease have been transformed into belligerent zealots, while others inclined to pacifism have taken to stockpiling weapons and practicing defensive drills.

This plague on our nation—one that has been spreading like wildfire—is a potent mix of fear coupled with unhealthy doses of paranoia and intolerance, tragic hallmarks of the post-9/11 America in which we live.

Everywhere you turn, those on both the left- and right-wing are fomenting distrust and division. You can’t escape it.

We’re being fed a constant diet of fear: fear of terrorists, fear of illegal immigrants, fear of people who are too religious, fear of people who are not religious enough, fear of Muslims, fear of extremists, fear of the government, fear of those who fear the government. The list goes on and on.

The strategy is simple yet effective: the best way to control a populace is through fear and discord.

Fear makes people stupid.

Confound them, distract them with mindless news chatter and entertainment, pit them against one another by turning minor disagreements into major skirmishes, and tie them up in knots over matters lacking in national significance.

Most importantly, divide the people into factions, persuade them to see each other as the enemy and keep them screaming at each other so that they drown out all other sounds. In this way, they will never reach consensus about anything and will be too distracted to notice the police state closing in on them until the final crushing curtain falls.

This is how free people enslave themselves and allow tyrants to prevail.

This Machiavellian scheme has so ensnared the nation that few Americans even realize they are being manipulated into adopting an “us” against “them” mindset. Instead, fueled with fear and loathing for phantom opponents, they agree to pour millions of dollars and resources into political elections, militarized police, spy technology and endless wars, hoping for a guarantee of safety that never comes.

All the while, those in power—bought and paid for by lobbyists and corporations—move their costly agendas forward, and “we the suckers” get saddled with the tax bills and subjected to pat downs, police raids and round-the-clock surveillance.

Turn on the TV or flip open the newspaper on any given day, and you will find yourself accosted by reports of government corruption, corporate malfeasance, militarized police and marauding SWAT teams.

America has already entered a new phase, one in which children are arrested in schools, military veterans are forcibly detained by government agents because of the content of their Facebook posts, and law-abiding Americans are having their movements tracked, their financial transactions documented and their communications monitored

These threats are not to be underestimated.

Yet even more dangerous than these violations of our basic rights is the language in which they are couched: the language of fear. It is a language spoken effectively by politicians on both sides of the aisle, shouted by media pundits from their cable TV pulpits, marketed by corporations, and codified into bureaucratic laws that do little to make our lives safer or more secure.

Fear, as history shows, is the method most often used by politicians to increase the power of government. Even while President Obama insists that “freedom is more powerful than fear,” the tactics of his administration continue to rely on fear of another terrorist attack in order to further advance the agenda of the military/security industrial complex.

An atmosphere of fear permeates modern America. However, with crime at a 40-year low, is such fear of terrorism rational?

Even in the wake of the shootings in San Bernardino and Paris, statistics show that you are 17,600 times more likely to die from heart disease than from a terrorist attack. You are 11,000 times more likely to die from an airplane accident than from a terrorist plot involving an airplane. You are 1,048 times more likely to die from a car accident than a terrorist attack. You are 404 times more likely to die in a fall than from a terrorist attack. You are 12 times more likely to die from accidental suffocating in bed than from a terrorist attack. And you are 9 more times likely to choke to death in your own vomit than die in a terrorist attack.

Indeed, those living in the American police state are 8 times more likely to be killed by a police officer than by a terrorist. Thus, the government’s endless jabbering about terrorism amounts to little more than propaganda—the propaganda of fear—a tactic used to terrorize, cower and control the population.

So far, these tactics are working.

The 9/11 attacks, the Paris attacks, and now the San Bernardino shooting have succeeded in reducing the American people to what commentator Dan Sanchez refers to as “herd-minded hundreds of millions [who] will stampede to the State for security, bleating to please, please be shorn of their remaining liberties.”

Sanchez continues:

I am not terrified of the terrorists; i.e., I am not, myself, terrorized. Rather, I am terrified of the terrorized; terrified of the bovine masses who are so easily manipulated by terrorists, governments, and the terror-amplifying media into allowing our country to slip toward totalitarianism and total war…

I do not irrationally and disproportionately fear Muslim bomb-wielding jihadists or white, gun-toting nutcases. But I rationally and proportionately fear those who do, and the regimes such terror empowers. History demonstrates that governments are capable of mass murder and enslavement far beyond what rogue militants can muster. Industrial-scale terrorists are the ones who wear ties, chevrons, and badges. But such terrorists are a powerless few without the supine acquiescence of the terrorized many. There is nothing to fear but the fearful themselves…

Stop swallowing the overblown scaremongering of the government and its corporate media cronies. Stop letting them use hysteria over small menaces to drive you into the arms of tyranny, which is the greatest menace of all.

As history makes clear, fear leads to fascistic, totalitarian regimes.

It’s a simple enough formula. National crises, reported terrorist attacks, and sporadic shootings leave us in a constant state of fear. Fear prevents us from thinking. The emotional panic that accompanies fear actually shuts down the prefrontal cortex or the rational thinking part of our brains. In other words, when we are consumed by fear, we stop thinking.

A populace that stops thinking for themselves is a populace that is easily led, easily manipulated and easily controlled.

As I document in my book Battlefield America: The War on the American People, the following are a few of the necessary ingredients for a fascist state:

- The government is managed by a powerful leader (even if he or she assumes office by way of the electoral process). This is the fascistic leadership principle (or father figure).

- The government assumes it is not restrained in its power. This is authoritarianism, which eventually evolves into totalitarianism.

- The government ostensibly operates under a capitalist system while being undergirded by an immense bureaucracy.

- The government through its politicians emits powerful and continuing expressions of nationalism.

- The government has an obsession with national security while constantly invoking terrifying internal and external enemies.

- The government establishes a domestic and invasive surveillance system and develops a paramilitary force that is not answerable to the citizenry.

- The government and its various agencies (federal, state, and local) develop an obsession with crime and punishment. This is overcriminalization.

- The government becomes increasingly centralized while aligning closely with corporate powers to control all aspects of the country’s social, economic, military, and governmental structures.

- The government uses militarism as a center point of its economic and taxing structure.

- The government is increasingly imperialistic in order to maintain the military-industrial corporate forces.

The parallels to modern America are impossible to ignore.

“Every industry is regulated. Every profession is classified and organized,” writes Jeffrey Tucker. “Every good or service is taxed. Endless debt accumulation is preserved. Immense doesn’t begin to describe the bureaucracy. Military preparedness never stops, and war with some evil foreign foe, remains a daily prospect.”

For the final hammer of fascism to fall, it will require the most crucial ingredient: the majority of the people will have to agree that it’s not only expedient but necessary. In times of “crisis,” expediency is upheld as the central principle—that is, in order to keep us safe and secure, the government must militarize the police, strip us of basic constitutional rights and criminalize virtually every form of behavior.

Not only does fear grease the wheels of the transition to fascism by cultivating fearful, controlled, pacified, cowed citizens, but it also embeds itself in our very DNA so that we pass on our fear and compliance to our offspring.

It’s called epigenetic inheritance, the transmission through DNA of traumatic experiences.

For example, neuroscientists observed how quickly fear can travel through generations of mice DNA. As The Washington Post reports:

In the experiment, researchers taught male mice to fear the smell of cherry blossoms by associating the scent with mild foot shocks. Two weeks later, they bred with females. The resulting pups were raised to adulthood having never been exposed to the smell. Yet when the critters caught a whiff of it for the first time, they suddenly became anxious and fearful. They were even born with more cherry-blossom-detecting neurons in their noses and more brain space devoted to cherry-blossom-smelling.

The conclusion? “A newborn mouse pup, seemingly innocent to the workings of the world, may actually harbor generations’ worth of information passed down by its ancestors.”

Now consider the ramifications of inherited generations of fears and experiences on human beings. As the Post reports, “Studies on humans suggest that children and grandchildren may have felt the epigenetic impact of such traumatic events such as famine, the Holocaust and the Sept. 11, 2001, terrorist attacks.”

In other words, fear, trauma and compliance can be passed down through the generations.

Fear has been a critical tool in past fascistic regimes, and it now operates in our contemporary world—all of which raises fundamental questions about us as human beings and what we will give up in order to perpetuate the illusions of safety and security.

In the words of psychologist Erich Fromm:

[C]an human nature be changed in such a way that man will forget his longing for freedom, for dignity, for integrity, for love—that is to say, can man forget he is human? Or does human nature have a dynamism which will react to the violation of these basic human needs by attempting to change an inhuman society into a human one?

We are at a critical crossroads in American history, and we have a choice: freedom or fascism.

Let’s hope the American people make the right choice while we still have the freedom to choose.

- Guest Post: Could Trump Become One Of America's Greatest Presidents?

Submitted by Bill Bonner of Bonner & Partners (annotated by Acting-Man.com's Pater Tenebrarum),

Ganging up on the Donald

Poor Donald Trump. Everybody’s against him.

Jeb Bush says he’s “unhinged”…

…Chris Christie says he has “no idea what [he’s] talking about”…

…John Kasich accuses him of “outrageous divisiveness”…

The Donald – in reality, they love him…

…and Marco Rubio describes him as “offensive and outlandish.”

And those are just his fellow Republicans!

“Reprehensible… prejudiced…” adds Hillary Clinton.

Piling on, Martin O’Malley says Trump is a “fascist demagogue.”

Can a man with enemies like these really be bad?

Looney Leanings

Donald Trump brought the wrath, ire, and contempt of the mainstream political establishment down on his head yesterday. He called for a “total and complete shutdown on Muslims entering the United States.”

Most commentators quickly condemned him, pointing out that such a ban would be unconstitutional and completely against the principles on which the nation was founded.

Alien anchor hair discovered…

But in a spirit of pure mischief (a blustery billionaire hardly qualifies for our customary support for die-hards, lost causes, and underdogs), we rush to the defense of “The Donald.”

Yes, his proposal is reckless, stupid, unworkable, unfair, and un-American. But it might not be unpopular. Give the man credit. He’s running for president. To win, he needs the votes of people who are at least as block-headed as he is.

In that respect (perhaps the only respect) his latest proposal may not be a bad idea. Also, making preposterous and outrageous proposals hardly disqualifies you for the White House.

Some of our “best” presidents – at least, according to historians and the public – were those who did the looniest things… things that were completely at odds with the Constitution, the spirit of liberty, and their own policy goals.

President Lincoln told the crowd at Gettysburg that his war against the South was in line with the Declaration of Independence, which clearly asserted the right of a people to choose their own government.

The war would determine, he said, whether “that nation, or any nation so conceived and so dedicated, can long endure.” The answer was “no.” And he made sure of it.

Contemporary cartoon of Lincoln attack him over the human toll of the Union war effort. Columbia, wearing a liberty cap and a shirt made of an American flag, demands, “Mr. Lincoln, give me back my 500,000 sons!” At the right, Lincoln, unfazed, sits at a writing desk, his leg thrown over the chair back. A proclamation calling for “500 Thous. More Troops,” signed by him, lies at his feet – click to enlarge.

President Wilson did the same thing for foreigners – invading more countries than any other president… while proclaiming the right to self-determination. Elections were fine, said Wilson, as long as they chose “good men.” If he didn’t like the men chosen… he sent in the troops.

By the standards set by Lincoln and Wilson, Donald Trump has the capacity to be one of our greatest leaders.

Vote for Woodrow Wilson “who kept you out of war” (and didn’t saddle you with a Federal Reserve…)

Image credit: Punch

PS:

It doesn’t really matter who wins the race for the White House, because the Deep State already controls just about every aspect of American life. From health care, to education, to the food on our tables, to the never-ending war on terror, the Deep State is pulling the strings.

- America Crosses The Tipping Point: The Middle Class Is Now A Minority

Americans have long lived in a nation made up primarily of middle-class families, neither rich nor poor, but comfortable enough, notes NPR's Marilyn Geewax, but this year – for the first time in US history, that changed. A new analysis of government data shows that as of 2015, middle-income households have become the minority, extending a multi-decade decline that confirms the hollowing out of society as 49% of all Americans now live in a home that receives money from the government each month. Sadly, the trends that are destroying the middle class in America just continue to accelerate.

Back in 1971, about 2 out of 3 Americans lived in middle-income households. Since then, the middle has been steadily shrinking.

Today, just a shade under half of all households (about 49.9 percent) have middle incomes. Slightly more than half of Americans (about 50.1 percent) either live in a lower-class household (roughly 29 percent) or an upper-class household (about 21 percent).

As NPR explains, thanks to factory closings and other economic factors, the country now has 120.8 million adults living in middle-income households, the study found. That compares with the 121.3 million who are living in either upper- or lower-income households.

"The hollowing of the middle has proceeded steadily for the past four decades," Pew concluded.

And middle-income Americans not only have shrunk as a share of the population but have fallen further behind financially, with their median income down 4 percent compared with the year 2000, Pew said.

Since 1970, the U.S. economy has been growing, and we all have been getting wealthier. But people who have the biggest incomes have been pulling away from the pack in a trend that shows no sign of slowing… as middle-income jobs are still 900,000 short of pre-recession employment levels…

And if you’re a millennial, you’d be forgiven for being disillusioned with the American dream. As we recently noted, compared to young Americans in 1986, you’re three times as likely to think the American dream is dead and buried. As WaPo notes, "young workers today are significantly more pessimistic about the possibility of success in America than their counterparts were in 1986, according to a new Fusion 2016 Issues poll – a shift that appears to reflect lingering damage from the Great Recession and more than a decade of wage stagnation for typical workers.”

While there are numerous reasons for the collapse of the American Middle Class (most appear driven by political 'fairness' or monetary policy intended consequences), though we suspect politicians learned long ago that it's easier to just import non-Americanized voters to vote for you, than, as FutureMoneyTrends notes, to get naturalized citizens who still cherish the idea of America to vote for things like national healthcare systems, higher taxes on business owners, and the catering to every little tribal group that declares themselves a minority.

It is only a matter of time before the middle class is wiped out and America begins to resemble the poverty, violence and tyranny so often associated with the countries from which many illegal migrants originate.

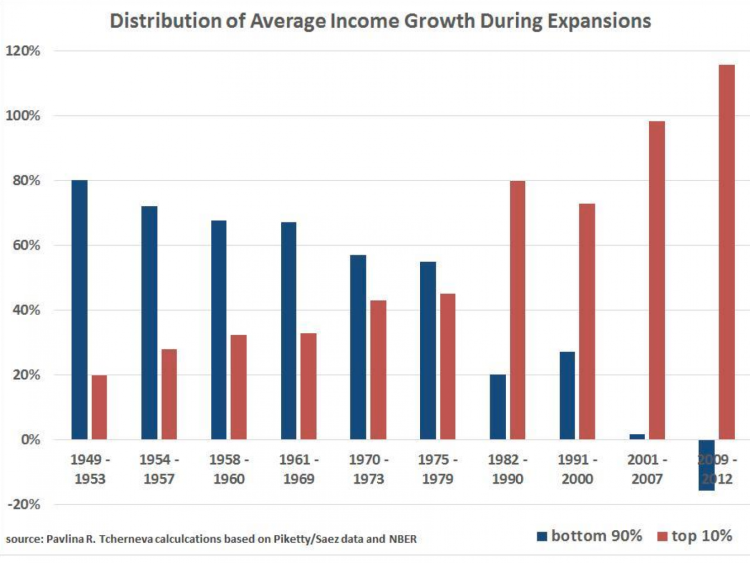

It appears that time is drawing near as Charles Hugh-Smith recently noted, the mainstream is finally waking up to the future of the American Dream: downward mobility for all but the top 10% of households.

Downward mobility and social defeat lead to social depression. Here are the conditions that characterize social depression:

1. High expectations of endless rising prosperity have been instilled in generations of citizens as a birthright.

2. Part-time and unemployed people are marginalized, not just financially but socially.

3. Widening income/wealth disparity as those in the top 10% pull away from the shrinking middle class.

4. A systemic decline in social/economic mobility as it becomes increasingly difficult to move from dependence on the state (welfare) or one's parents to financial independence.

5. A widening disconnect between higher education and employment: a college/university degree no longer guarantees a stable, good-paying job.

6. A failure in the Status Quo institutions and mainstream media to recognize social recession as a reality.

7. A systemic failure of imagination within state and private-sector institutions on how to address social recession issues.

8. The abandonment of middle class aspirations by the generations ensnared by the social recession: young people no longer aspire to (or cannot afford) consumerist status symbols such as luxury autos or homeownership.

9. A generational abandonment of marriage, families and independent households as these are no longer affordable to those with part-time or unstable employment, i.e. what I have termed (following Jeremy Rifkin) the end of work.

10. A loss of hope in the young generations as a result of the above conditions.

If you don't think these apply, please check back in a year. We'll have a firmer grasp of social depression in December 2016.

- China Says Turkey Needs To Respect Iraq's Sovereignty, Territorial Integrity

“Turkey is acting recklessly and inexplicably,” Vitaly Churkin, Russia’s ambassador to the UN told the Security Council at a closed-door meeting on Tuesday.

Churkin was not, as you might have guessed, referring to Ankara’s brazen move to shoot down a Russian warplane near the Syrian border late last month (although we’re quite sure that Moscow would classify that as “reckless and inexplicable” as well).

Churkin was referencing Erdogan’s decision to send between 150 and 300 Turkish troops along with around two dozen tanks to Bashiqa, just northeast of the ISIS stronghold in Mosul.

The Russian ambassador is correct to characterize the deployment as “inexplicable” – at least in terms of Ankara being able to offer an explanation that makes sense to the general public. The official line is that it’s part of an ongoing “training mission” that Iraqi officials agreed to at some point in the past. Baghdad denies this.

Masoud Barzani supports the Turkish effort (and how could he not, given the fact that without Turkey, the Kurds wouldn’t be able to transport crude independently of Baghdad) which serves to provide a kind of quasi-legitimacy to the Turkish presence. But as we outlined last weekend, this may simply be an attempt to secure oil smuggling routes and ensure that Turkey’s interests in Islamic State-held territory are preserved.

The latest from Iraq – as we outlined earlier today – is that some lawmakers are now looking to annul the country’ security agreement with the US on the way to inviting the Russians in to help fight ISIS. As for the “situation” with Turkey, Iraq’s UN ambassador Mohamed Ali Alhakim told reporters after Russia raised the issue that Baghdad and Ankara “are solving it bilaterally.”

“We have not yet escalated it to the Security Council or to the United Nations,” he added.

Yes, “not yet,” but it’s difficult to see how “bilateral” talks are going to solve this given the fact that Erdogan clearly had some idea of what he wanted to accomplish by sending troops and tanks to Mosul. He had to have known going in that the whole “we’re just replacing 90 troops that had been there for the better part of two years” excuse wasn’t going to fly with Shiite politicians and the various Iran-backed militias who are all hyper-sensitive now that the The Pentagon has suggested the US is set to insert ground troops to assist the Peshmerga in their efforts against ISIS.

Well, when you start to discuss the Security Council in the context of the conflicts raging in Syria and Iraq, it’s important to remember that Russia isn’t the lone voice of dissent among the five permanent members. Recall that back in May of 2014 Beijing voted with Moscow to veto a Security Council resolution that would have seen the conflict in Syria referred to the Hague. Here’s what China had to say at the time:

For some time now, the Security Council has maintained unity and coordination on the question of Syria, thanks to efforts by Council members, including China, to accommodate the major concerns of all parties. At a time when seriously diverging views exist among the parties concerning the draft resolution, we believe that the Council should continue holding consultations, rather than forcing a vote on the draft resolution, in order to avoid undermining Council unity or obstructing coordination and cooperation on questions such as Syria and other major serious issues. Regrettably, China’s approach has not been taken on board; China therefore voted against the draft resolution.

Thus far, China hasn’t involved itself directly in the latest round of Mid-East conflicts, but if Xi were to step in, it’s clear that he would side with the Russians and the Iranians which means that when it comes to Turkey and the US putting boots on the ground in Iraq against Baghdad’s wishes, Beijing would almost surely fall on the side of the Iraqis.

Sure enough, on Wednesday, the Chinese Foreign Ministry weighed in for the first time. Here’s an excerpt from the statement by spokesperson Hua Chunying:

“The Chinese side believes that we should deal with state-to-state relationship in accordance with purposes and principles of the UN Charter as well as other widely-recognized basic norms governing international relations, and that Iraq’s sovereignty and territorial integrity shall be respected.”

That may sound like a rather generic statement, but in fact it sends a very clear message. The implication is that Turkey has violated Iraq’s sovereignty and territorial integrity and that is not something the Security Council should condone.

The question becomes this: what happens when Baghdad annuls its agreement with Washington and the US troop presence ends up representing a similar violation of Iraq’s sovereignty?

If Baghdad were to go to the Security Council and claim that The Pentagon’s deployment of SpecOps to northern Iraq constitutes an illegal act, how would the five permanent members resolve an intractable dispute between the US and France on one side (don’t forget, the French are bombing Iraq as well) and Russia and China on the other?

In short: how long until Xi decides it’s time to awaken the sleeping dragon and enter the Mid-East fray?

For now, Chunying says Beijing will “closely follow the development of the incident.”

- Amid Commodity Collapse, World's Most Resource-Driven Economy Posts Greatest Jobs Gain In 15 Years

When Australia released its October jobs data a month ago (printing an astonishing 58k increase – almost 6 times expectations of a 10k increase), the media threw up all over the farce of the best jobs gain in 3 years (amid commodity price collapses, mining industry bankruptcy fears, and China trade implosions) saying simply "don't believe the jobs figure for October." So we cannot wait to see what the men from downunder make of November's print. With expectations of a 10k drop, Australia added a mind-numbing 71,400 jobs – the most in 15 years!! This is equivalent to the US adding almost 1.75 million jobs in 2 months… They just don't care anymore!

Best Jobs print in 15 months…

November was an 8 standard deviation beat… which followed a 6 standard deviation beat in October…

The big surge in jobs last month, which was the largest gain since July 2000, raised renewed skepticism about the accuracy of the data, which the Australian Bureau of Statistics has acknowledged in the past.

This is the biggest 2-month increase in jobs since January 1988…

Does this look like companies that are hiring at the fastest pace in 27 years!!!

“It’s hard to believe that employment has grown 130,000 over two months in the context of everything else,” said Michael Turner, fixed-income and currency strategist at Royal Bank of Canada in Sydney. “But there’s got to be some signal in this, not just noise.”

No – there really doesn't. It seems Australia has figured out how to create jobs when its biggest trading partner is hemorrhaging them…

And it appears the hiring has been going on "stealthily" as businesses are not reporting any improvment at all…

The economic propaganda was slammed last month:

The ABS is itself cautions against placing too much credence on the monthly figures, which are based on a changing sample, particularly the seasonally adjusted data. The statistician encourages people to focus on the trend estimate (which had the unemployment rate unchanged).

And, after a series of stuff ups, revisions and methodological changes over the past year, there is even more room for caution.

Last year, the ABS was forced to abandon seasonally adjusted labour force numbers for a period after conceding they were unreliable. The former chief statistician recently said the data was not worth the paper it was written on.

Wait, what: confidence boosting data is unreliable? Surely you jest.

And here is the ABC's conclusion confirming at least one "developed" country still have a thinking media: "don't be surprised if the October labour market data is revised."

Nope, no revision – just an even more ridiculous "injection" of confidence.

* * *

If only we could say the same about propaganda rags in the United States

- "We Are Living Amid An Islamic Threat", French Mayor Says: "Our Country Is At War Inside Our Borders"

Whatever one’s opinion of the Muslim attacks and the perpetrators behind them, one thing is without dispute – the French response, which has been to quickly impose unlimited emergency laws, is nothing short of the second coming of “Operation Gladio.”

In addition to warrantless searches and raids, France’s state of emergency laws allow the government to put people under house arrest, seal the country’s borders and ban demonstrations. The laws were created during the Algerian war in 1955.

France is currently aiming to change its constitution to allow a state of emergency to last for six months, according to government sources. The proposal, which has been slammed by many who say the government is abusing its powers, will be put to ministers on December 23, according to AFP.

As a result of this unprecedented expansion of the French police state and the emergency legislation enacted after last month’s Paris attacks, there has been a fierce crackdown on not only France’s Islamic population but also on various tangential hotspots such as the arrest of 24 climate activists before the culmination of start of the COP21 climate change summit in Paris at the end of November courtesy of the recently introduced “pre-crime” laws.

As the local press notes, warrantless searches and raids have become commonplace, a move which many say violates the civil liberties of all citizens, not just Muslims.

But Muslims definitely are getting the short end of the stick.

Case in point, Daniel Bushell, the manager of the Pepper Grill restaurant on the outskirts of Paris, who recalled a police raid at his restaurant on Saturday night.

As the restaurant manager recounted to RT, “They blocked the roads with trucks, and up to 40 armed men stormed our restaurant…Saturday night’s the busiest time. Children were eating. The cops had shotguns, black masks, and shields, making the women tremble with fear. Several officers rushed downstairs, then suddenly…they began breaking the doors with battering rams. The door wasn’t even locked.”

Elsewhere, the emergency laws, implemented after last month’s terror attacks which killed 130 people and left 352 others injured, have led to thousands of warrantless searches and raids.

It it’s not just private property that is being targeted – Muslims are also being singled out on the street.

“Police tried to pull the hood off the head of an Arab friend eating with my little brother. Then they detained him, saying it’s a state of emergency so they have the right,” a local told RT on condition of anonymity, fearing police reprisals. He added that the community is “sick of being targeted.”

Such targeting is reportedly worse for young people, many of whom said they pull hoods over their faces as soon as they see a police car, so officers can’t see the color of their skin.

The result: even more antagonism, even more retaliations by both sides, until an intifada-like atmosphere settles, with the two groups determined to hurt and kill each other at every opportunity, for reasons lost in the sands of time (for a historical precedent, look no further than the middle east where virtually every ethnic and religious group has been in a two thousand-year long vendetta with every other group).

Ultimately, there is just one winner – the Police State, which gets more powerful with every passing day as people have no choice but to abdicate even more civil liberties in order to preserve the illusion of “government security.”

And just to make sure this continues, one French mayor is willing to go the distance and is not backing down, believing that extra security is necessary because France is “living amid an Islamic threat.”

This is what Robert Menard, mayor of the French town of Beziers, told RT:

“I’ve already doubled the number of city policemen, but I went even further. I asked all the former policemen, firefighters and servicemen to come and help to protect our citizens. If my initiative goes against the law, we should change the law. We are living amid an Islamic threat and we should be aware of the consequences. Our country, as well as other European countries, is at war – both outside our borders, in Syria for instance, and inside our borders, because our enemies live in our own country,”

Robert Menard used to be a journalist, a socialist and the outspoken founder of an international press group, Reporters Without Borders. But 18 months ago he caused shockwaves by winning the town hall of Beziers, a city of more than 71,000, on a far-right ticket.

In the US, this man’s comments would lead to an unprecedented media scandal; in France they have barely registered.

As a reminder, all of this was predicted with uncanny precision by AIG in a presentation from May 2008, in which the author answered the question “What Europe Wants“. His answer:

To use global issues as excuses to extend its power:

- environmental issues: increase control over member countries; advance idea of global governance

- terrorism: use excuse for greater control over police and judicial issues; increase extent of surveillance

- global financial crisis: kill two birds (free market; Anglo-Saxon economies) with one stone (Europe-wide regulator; attempts at global financial governance)

- EMU: create a crisis to force introduction of “European economic government”

The US police state wants exactly the same things, and it is coming to get them.

- "Most Hated Man In America" Martin Shkreli Spends $2 Million On Wu-Tang Clan Album

Back in September, Martin Shkreli became “the most hated man in America” when the Turing Pharma CEO moved to boost the price of a toxoplasmosis drug by 5000%.

That rather egregious example of unbridled greed immediately caused the American public as well as lawmakers in Washington to begin taking a closer look at a practice that actually happens all the time in Big Pharma even if the industry’s larger players are careful to be a bit less audacious about it than Shkreli.

Following the Turing price hike, Democrats on the House oversight committee sent a letter demanding that serial biotech rollup Valeant Pharmaceuticals provide documents explaining hefty price increases for two heart drugs. Around two months later, Senators Susan Collins (R-Maine) and Claire McCaskill (D-Mo.), who together lead the Senate Special Committee on Aging, opened a bipartisan investigation into pharmaceutical drug pricing.

At that point, we thought Shkreli’s fifteen minutes of fame might have been up – we were wrong.

Exactly two weeks after the launch of the Senate investigation, Shkreli swooped in and bought over half of the outstanding shares of KaloBios, which at the time was was trading between $1-2/share, representing a market cap between $5 and $10 million. What happened next was the stuff of market tragicomedy legend as the E-trading Joe Campbells of the world lost a small fortune after Shkreli’s purchase sparked a relentless rally that would have been impressive enough on its own had he stopped there. But he didn’t. He then pulled the borrow and “Volkswagen-ed” some folks as we documented in a series of hilarious pieces posted late last month (see here, here, and here). Summing up:

Ok. Now, prepare yourself for something that will briefly seem like a complete non sequitur – bear with us.

Sometime in 2011, or 2012, or 2013, the Wu-Tang Clan began to record a double disc entitled “Once Upon A Time In Shaolin.”

For those unfamiliar, the Wu-Tang Clan are, well, legends in the rap industry. The group features some of the most famous names to ever touch a mic including Method Man, Raekwon, and Ghostface, all three of which are institutions to hip hop heads the world over. As a team, Wu-Tang has released multiple long plays considered classics among rap aficionados and when you count the various solo offerings from the group’s 10 members, their catalogue is unparalleled in rap’s short history.

In March of 2014, Forbes reported that “Once Upon A Time In Shaolin” would be a different type of album. The group would mint only a single copy. It would be sold for at least $1 million and would come in a series of handcrafted boxes by British-Moroccan artist Yahya, whose works have been commissioned by royal families and business leaders around the world.”

Last month, Forbes reported that the album had been sold in May to an American collector for a price tag “in the millions” which made it at least four times more expensive than “Jack White’s $300,000 purchase of a rare acetate recording of Elvis Presley’s first song.”

Now you’re probably starting to see where this is going.

According to RZA (who has always been the group’s frontman if never the Clan’s most famous member), the album attracted many bidders: “Private collectors, trophy hunters, millionaires, billionaires, unknown folks, publicly known folks, businesses, companies with commercial intent, young, old,” he told Bloomberg. “It varied.” Serious bidders got to hear the 13-minute highlights in private listening sessions arranged by Paddle8 (an upstart, angel investor-backed auction house) in New York.

Enter America’s most hated man (via Bloomberg):

One of [the bidders] was a pharmaceutical company executive named Martin Shkreli. He’s 32 years old but seems much younger, with a tendency to fiddle with his hair and squirm in his seat like an adolescent. The son of Albanian immigrants, Shkreli grew up in what he describes as a tough part of Brooklyn’s Sheepshead Bay neighborhood. He skipped grades in school because he was so bright. Shkreli idolized scientists, but he was also a music fan. Primarily interested in rock as a teenager, he didn’t understand rap, but that changed when he read Shakespeare in high school. “You would get these rhyming couplets and soliloquies and stuff like that, but the couplets would really kind of jar you,” he says. “They would be really these big, soul-crushing moments that Shakespeare intended to stir your spirit. And in many ways, music does that.”

Shkreli was taken by the Wu-Tang song C.R.E.A.M., which stands for “Cash Rules Everything Around Me.” It includes the often-repeated phrase “Dolla dolla bill, y’all!” Shkreli turned out to be good at making dollars himself. He founded two hedge funds that shorted pharmaceutical stocks and then started his own drug company, Retrophin, earning a reputation on Wall Street as something of a boy genius. In September 2014, however, he says he was “asked to leave” by the company’s board. Retrophin later alleged after an internal investigation that he’d abused his position and misused assets. Shkreli says that he didn’t do anything without the company’s approval. Retrophin and its former CEO are now facing off in court. “I was pretty pissed,” Shkreli says. “But I realized that it actually would be better for me, maybe not ego-wise, but financially. I could just sell my stock and build my own next company.”

Now that Shkreli had more money, he started collecting music-related items. He once joked on Twitter about trying to buy Katy Perry’s guitar so he could get a date with her. He purchased Kurt Cobain’s Visa card in a Paddle8 auction and occasionally produces it to get a rise out of people when it’s time to pay a check.

Shkreli heard about Once Upon a Time in Shaolin and thought it would be nice to own, too. He attended a private listening session at the Standard Hotel hosted by Paddle8 co-founder Alexander Gilkes. Shkreli, who describes himself as a bit of a recluse, recalls Gilkes telling him that if he bought the record, he would have the opportunity to rub shoulders with celebrities and rappers who would want to hear it. “Then I really became convinced that I should be the buyer,” Shkreli says. (Paddle8 declined to comment, citing their policy of client confidentiality.)

He also got to have lunch with RZA. “We didn’t have a ton in common,” Shkreli says. “I can’t say I got to know him that well, but I obviously like him.”

Yes, “obviously,” but what also seems obvious is that RZA doesn’t like Shkreli: “The sale of Once Upon a Time in Shaolin was agreed upon in May, well before Martin Skhreli’s [sic] business practices came to light. We decided to give a significant portion of the proceeds to charity,” he told Bloomberg, in a statement.

Needless to say, Congress is not amused. “My biggest challenge today is to not lose my temper. The facts underlying this hearing are so egregious but it’s hard not to get emotional about it,” Sen. Claire McCaskill (D-Mo.) said on Wednesday. “This is the same guy who thought it was a great idea to pay millions of dollars for the only existing album of the Wu Tang Clan,” she added, incredulous.

Now, Claire, that’s not true. It’s not “the only existing Wu-Tang album.” In fact, the Clan has sold many millions in their day:

What he bought was the only existing copy of “Once Upon A Time In Shaolin.” We’re sure that once the Congresswoman understands the distinction, she’ll feel a lot better about the situation.

So coming full circle, we can now see why the Martin Shkrelis of the world need to raise prices by thousands of percent (in the process raising healthcare premiums for all Americans as insurers pass along the soaring cost of specialty drugs, which as we reported a few weeks back, has now surpassed the median US household income). If they didn’t, how would they afford one-of-a-kind Wu-Tang albums?

But before you’re too hard on Shkreli, ask yourself this: how different is this from the big pharma CEO who buys a Rolls Royce and a couple of $50 million Picassos after hiking drug prices? Why is one a titan of industry lauded by the mainstream financial news media and the other a pariah? Both are skewering Americans and getting rich at the expense of the sick. The fact that the public thinks one has better taste than the other is meaningless.

* * *

Bonus: Bloomberg’s not-so-subtle tribute to deceased Wu-Tang member Ol’ Dirty Bastard…

Bonus, Bonus: “Once Upon A Time In Shaolin” documentary from Forbes…

- Economic Growth: How It Works, How It Fails, & Why Wealth Disparity Occurs

Submitted by Gail Tverberg via Our Finite World,

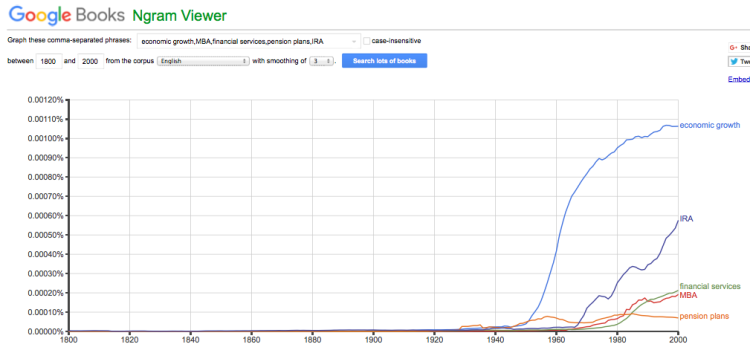

Economists have put together models of how an economy works, but these models were developed years ago, when the world economy was far from limits. These models may have been reasonably adequate when they were developed, but there is increasing evidence that they don’t work in an economy that is reaching limits. For example, my most recent post, “Why ‘supply and demand’ doesn’t work for oil,” showed that when the world is facing the rising cost of oil extraction, “supply and demand” doesn’t work in the expected way.

In order to figure out what really does happen, we need to consider findings from a variety of different fields, including biology, physics, systems analysis, finance, and the study of past economic collapses. Since I started studying the situation in 2005, I have had the privilege of meeting many people who work in areas related to this problem.

My own background is in mathematics and actuarial science. Actuarial projections, such as those that underlie pensions and long term care policies, are one place where historical assumptions are not likely to be accurate, if an economy is reaching limits. Because of this connection to actuarial work, I have a particular interest in the problem.

How Other Species Grow

We know that other species don’t amass wealth in the way humans do. However, the number of plants or animals of a given type can grow, at least within a range. Techniques that seem to be helpful for increasing the number of a given species include:

- Natural selection. With natural selection, all species have more offspring than needed to reproduce the parent. A species is able to continuously adapt to the changing environment because the best-adapted offspring tend to live.

- Cooperation. Individual cells within an organism cooperate in terms of the functions they perform. Cooperation also occurs among members of the same species, and among different species (symbiosis, parasites, hosts). In some cases, division of labor may occur (for example, bees, other social insects).

- Use of tools. Animals frequently use tools. Sometimes items such as rocks or logs are used directly. At other times, animals craft tools with their forepaws or beaks.

All species have specific needs of various kinds, including energy needs, water needs, mineral needs, and lack of pollution. They are in constant competition with both other members of the same species and with members of other species to meet these needs. It is individuals who can out-compete others in the resource battle that survive. In some cases, animals find hierarchical behavior helpful in the competition for resources.

There are various feedbacks that regulate the growth of a biological system. For example, a person or animal eats, and later becomes hungry. Likewise, an animal drinks, and later becomes thirsty. Over the longer term, animals have a reserve of fat for times when food is scarce, and a small reserve of water. If they are not able to eat and drink within the required timeframe, they will die. Another feedback within the system regulates overuse of resources: if any kind of animal eats all of a type of plant or animal that it requires for food, it will not have food in the future.

Energy needs are one of the limiting factors, both for individual biological members of an ecosystem, and for the overall ecosystem. Energy systems need greater power (energy use per period of time) to out-compete one another. The Maximum Power Principle by Howard Odum says that biological systems will organize to increase power whenever system constraints allow.

Another way of viewing energy needs comes from the work of Ilya Prigogine, who studied how ordered structures, such as biological systems, can develop from disorder in a thermodynamically open system. Prigogine has called these ordered structures dissipative systems. These systems can temporarily exist as long as the system is held far from equilibrium by a continual flow of energy through the system. If the flow energy disappears, the biological system will die.

Using either Odum’s or Prigogine’s view, energy of the right type is essential for the growth of an overall ecosystem as well as for the continued health of its individual members.

How Humans Separated Themselves from Other Animals

Animals generally get energy from food. It stands to reason that if an animal has a unique way of obtaining additional energy to supplement the energy it gets from food, it will have an advantage over other animals. In fact, this approach seems to have been the secret to the growth of human populations.

Human population, plus the domesticated plants and animals of humans, now dominate the globe. Humans’ path toward population growth seems to have started when early members of the species learned how to burn biomass in a controlled way. The burning of biomass had many benefits, including being able to keep warm, cook food and ward off predators. Cooking food was especially beneficial, because it allowed humans to use a wider range of foodstuffs. It also allowed bodies of humans to more easily get nutrition from food that was eaten. As a result, stomachs, jaws, and teeth could become smaller, and brains could become bigger, enabling more intelligence. The use of cooked food began long enough ago that our bodies are now adapted to the use of some cooked food.

With the use of fire to burn biomass, humans could better “win” in the competition against other species, allowing the number of humans to increase. In this way, humans could, to some extent, circumvent natural selection. From the point of the individual who could live longer, or whose children could live to maturity, this was a benefit. Unfortunately, it had at least two drawbacks:

- While animal populations tended to become increasingly adapted to a changing environment through natural selection, humans tend not to become better adapted, because of the high survival rate that results from more adequate food supplies and better healthcare. Humans might eventually find themselves becoming less well adapted: more overweight, or having more physical disabilities, or having more of a tendency toward diabetes.

- Without a natural limit to population, the quantity of resources per person tends to decline over time. For example, such a tendency tends to lead to less farmland per person. This would be a problem if techniques remained the same. Thus, rising population tends to lead to constant pressure to raise output (more food per arable acre or technological advancements that allow the economy to “do more with less”).

How Humans Have Been Able to Meet the Challenge of Rising Population Relative to Resources

Humans were able to meet the challenge of rising population by taking the techniques many animals use, as described above, and raising them to new levels. The fact that humans figured out how to burn biomass, and later would learn to harness other kinds of energy, gave humans many capabilities that other animals did not have.

- Co-operation with other humans became possible, through a variety of mechanisms (learning of language with our bigger brains, development of financial systems to facilitate trade). Even as hunter-gatherers, researchers have found that economies of scale (enabled by co-operation) allowed greater food gathering per hectare. Division of labor allowed some specialization, even in very early days (gathering, fishing, hunting).

- Humans have been able to domesticate many kinds of plants and animals. Generally, the relationship with other species is a symbiotic relationship–the animals gain the benefit of a steady food supply and protection from predators, so their population can increase. Chosen plants have little competition from “weeds,” thanks to the protection humans provide. As a result, they can flourish whether or not they would be competitive with other plants and predators in the wild.

- Humans have been able to take the idea of making and using tools to an extreme level. Humans first started by using fire to sharpen rocks. With the sharpened rocks, they could make new devices such as boats, and they could make spears to help kill animals for food. Tools could be used for planting the seeds they wanted to grow, so they did not have to live with the mixture of plants nature provided. We don’t think of roads, pipelines, and lines for transmitting electricity as tools, but as a practical matter, they also provide functions similar to those of tools. The many chemicals humans use, such as herbicides, insecticides, and antibiotics, also act in way similar to tools. The many objects that humans create to make life “better” (houses, cars, dishwashers, prepared foods, cosmetics) might in some very broad sense be considered tools as well. Some tools might be considered “capital,” when used to create additional goods and services.

- Humans created businesses and governments to enable better organization, including division of labor and hierarchical behavior. A single person can create a simple tool, just as an animal can. But there are economies of scale, such as when many devices of a particular kind can be made, or when some individuals learn specialized skills that enable them to perform particular tasks better. As mentioned previously, even in the days of hunter-gatherers, there were economies of scale, if a larger group of workers could be organized so that specialization could take place.

- Financial systems and changing systems of laws and regulations provide additional structure to the system, telling businesses and customers how much of a given product is required at a given time, and at what prices. In animals, appetite and thirst determine how important obtaining food and water are at a given point in time. Financial systems provide a somewhat similar role for an economy, but the financial system doesn’t operate within as constrained a system as hunger and thirst. As a result, the financial system can give strange signals, including prices that at times fall below the cost of extraction.

- Humans have tended to put resources of many kinds (arable land, land for homes and businesses, fresh water, mineral resources) under the control of governments. Governments then authorize particular individuals and business to use this land, under various arrangements (“ownership,” leases, or authorized temporary usage). Governments often collect taxes for use of the resources. The practice is in some ways similar to the use of territoriality by animals, but it can have the opposite result. With animals, territoriality is used to prevent crowding, and can act to prevent overuse of shared resources. With human economies, ownership or temporary use permits can lead to a government sanctioned way of depleting resources, and thus, over time, can lead to a higher cost of resource extraction.

Physicist François Roddier has described individual human economies as another type of dissipative structure, not too different from biological systems, such as plants, animals, and ecosystems. If this is true, an adequate supply of energy is absolutely essential for the growth of the world economy.

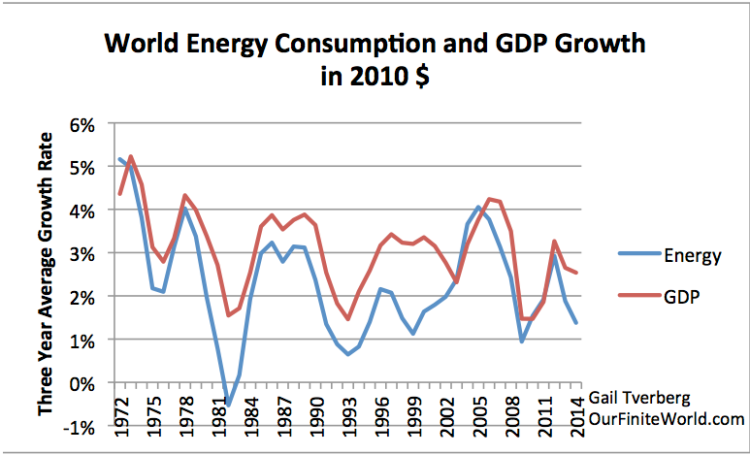

We know that there is a very close tie between energy use and the growth of the world economy. Energy consumption has recently been dropping (Figure 1), suggesting that the world is heading into recession again. The Wall Street Journal indicates that a junk bond selloff also points in the direction of a likely recession in the not-too-distant future.

Figure 1. Three year average growth rate in world energy consumption and in GDP. World energy consumption based on BP Review of World Energy, 2015 data; real GDP from USDA in 2010$.

What Goes Wrong as Economic Growth Approaches Limits?

We know that in the past, many economies have collapsed. In fact, if Roddier is correct about economies being dissipative structures, then we know that economies cannot be expected to last forever. Economies will tend to run into energy limits, and these energy limits will ultimately bring them down.

The symptoms that occur when economies run into energy limits are not intuitively obvious. The following are some of the things that generally go wrong:

Item 1. A slowdown in economic growth.

Research by Turchin and Nefedov regarding historical collapses shows that growth tended to start in an economy when a group of people discovered a new energy-related resource. For example, a piece of land might be cleared to allow more arable land, or existing arable land might be irrigated. At first, these new resources allowed economies to grow rapidly for many years. Once the population grew to match the new carrying capacity of the land, economies tended to hit a period of “stagflation” for another period, say 50 or 60 years. Eventually “collapse” occurred, typically over a period of 20 or more years.

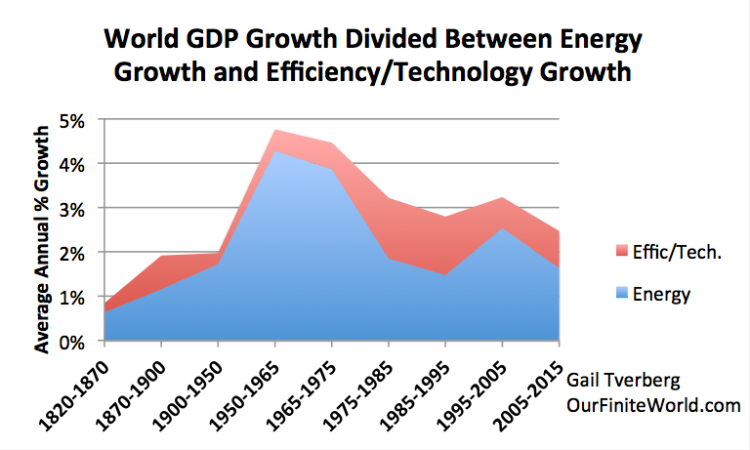

Today’s world economy seems to be following a similar pattern. The world started using coal in quantity in the early 1800s. This helped ramp up economic growth above a baseline of less than 1% per year. A second larger ramp up in economic growth occurred about the time of World War II, as oil began to be put to greater use (Figure 2).

Figure 2. World GDP growth compared to world energy consumption growth for selected time periods since 1820. World real GDP trends for 1975 to present are based on USDA real GDP data in 2010$ for 1975 and subsequent. (Estimated by author for 2015.) GDP estimates for prior to 1975 are based on Maddison project updates as of 2013. Growth in the use of energy products is based on a combination of data from Appendix A data from Vaclav Smil’s Energy Transitions: History, Requirements and Prospects together with BP Statistical Review of World Energy 2015 for 1965 and subsequent.

Worldwide, the economic growth rate hit a high point in the 1950 to 1965 period, and since then has trended downward. Figure 2 indicates that in all periods analyzed, the increase in energy consumption accounts for the majority of economic growth.

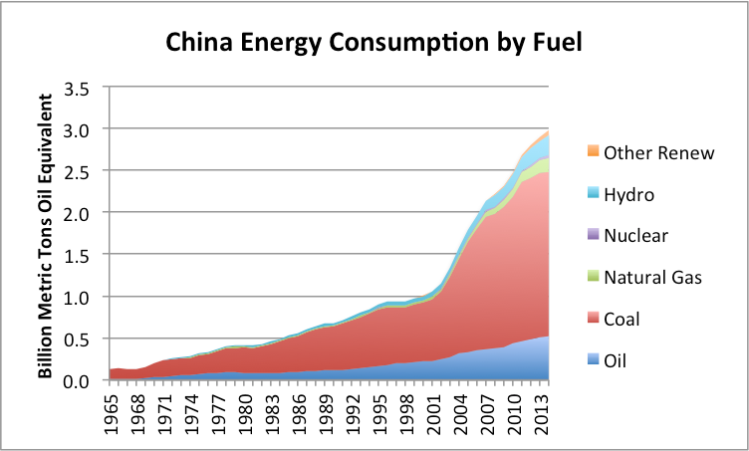

Since 2001, when China joined the World Trade Organization, world economic growth has been supported by economic growth in China. This growth was made possible by China’s rapid growth in coal consumption (Figure 3).

Figure 3. China’s energy consumption by fuel, based on data of BP Statistical Review of World Energy 2015.

China’s growth in energy consumption, particularly coal consumption, is now slowing. Its economy is slowing at the same time, so its leadership in world economic growth is now being lost. There is no new major source of cheap energy coming online. This is a major reason why world economic growth is slowing.

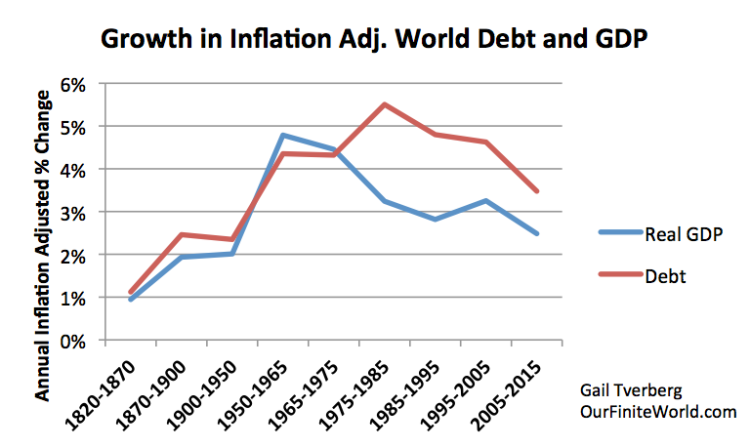

Item 2. Increased use of debt, with less and less productivity of that debt in terms of increased goods and services produced.

Another finding of Turchin and Nefedov is that the use of debt tended to increase in the stagflation period. Since growth was lower in this period, it is clear that the use of debt was becoming less productive.

If we look at the world situation today, we find a similar situation. More and more debt is being used, but that debt is becoming less productive in terms of the amount of GDP being provided. In fact, this pattern of falling productivity of debt seems to have been taking place since the early 1970s, when the price of oil rose above $20 per barrel (in 2014$). It is doubtful that that economic growth can occur if the price of oil is above $20 per barrel, without debt spiraling ever upward as a percentage of GDP. It is supplemental energy that allows the economy to function. If the price of energy is too high, it becomes unaffordable, and economic growth slows.