- ISIS: The 'Enemy' The US Created, Armed, & Funded

Submitted by Robert Fantina via TheAntiMedia.org,

Out of nowhere, it seems, Daesh, also commonly referred to as ISIL or ISIS, spontaneously formed, a group that perverts aspects of Islam for its own violent ends, and threatens, we are told, all that the civilized world holds dear.

The “war on terror,” governments inform their citizens, has a new front. And that front is Daesh.

Let us not be too hasty. Things are not always what they appear. Daesh is well-financed, and that money must be coming from somewhere other than a ragtag band of malcontents. Daesh soldiers have advanced weaponry and sophisticated communications methods. They have tanks and Humvees. None of these can be obtained without significant funding. Though the source is quite illusive, there is some evidence that will lead to a trail.

First, we must look at Daesh’s origins, and even that is not easily discernible. Writing for The Guardian in August 2014, Ali Khedery suggests:

“Principally, Isis is the product of a genocide that continued unabated as the world stood back and watched. It is the illegitimate child born of pure hate and pure fear – the result of 200,000 murdered Syrians and of millions more displaced and divorced from their hopes and dreams. Isis’s rise is also a reminder of how Bashar al-Assad’s Machiavellian embrace of al-Qaida would come back to haunt him.

Facing Assad’s army and intelligence services, Lebanon’s Hezbollah, Iraq’s Shia Islamist militias and their grand patron, Iran’s Revolutionary Guards, Syria’s initially peaceful protesters quickly became disenchanted, disillusioned and disenfranchised – and then radicalised and violently militant.”

It is interesting that Mr. Khedery says that Assad’s “embrace of al-Qaida” came back to haunt him. It brings to mind a parallel situation in the United States. (Actually, there are many, but we will look at only one.)

Examining the theories of the origins of Daesh

In the early 1960s, when the U.S.-supported leadership of Iraq was becoming just a bit too big for its britches — at least in the United States’ view — in wanting to challenge Israel as a major player in the Middle East, the U.S. decided that its leader, Abdel Karim Kassem, had to go. Selecting a virulent anti-communist party to throw its support to, the U.S. worked closely with a young man named Saddam Hussein. We all know how well that ultimately worked out. The source of much, but not all, of the unrest in the Middle East today can be traced back to that U.S. decision.

Other theories on the formation of Daesh are also worth considering. Yasmina Haifi, a senior employee of the Dutch Justice Ministry’s National Cyber Security Center, asserted that Daesh was created by Zionists seeking to give Islam a bad reputation. “ISIS has nothing to do with Islam. It’s part of a plan by Zionists who are deliberately trying to blacken Islam’s name,” she wrote on Twitter in August 2014.

And finally, it has been more than suggested that Daesh “is made-in-the-USA, an instrument of terror designed to divide and conquer the oil-rich Middle East and to counter Iran’s growing influence in the region,” as Garikai Chengu, a research scholar at Harvard University, put it in September 2014.

Yet if the United States’ role wasn’t that blatant, it certainly existed, according to Seumas Milne, a columnist and associate editor at The Guardian. He argued in a June opinion piece:

“[T]he U.S. and its allies weren’t only supporting and arming an opposition they knew to be dominated by extreme sectarian groups; they were prepared to countenance the creation of some sort of ‘Islamic state’ – despite the ‘grave danger’ to Iraq’s unity – as a Sunni buffer to weaken Syria.”

No matter how one looks at it, there are many possible causes that spawned Daesh. As we look at its funding sources, it may all become clearer.

Funding and materiel, courtesy of Uncle Sam and his friends

In Daesh’s role as opposing Syria (just one of its many roles) the terrorist outfit is believed to have received funding from Saudi Arabia, Kuwait, Qatar and the United Arab Emirates, as part of their opposition to the Assad regime.

But it also generates its own income, having taken control of local businesses, taxing others, and selling oil. Among its customers, incredibly, is Syria. Since Daesh controls much of the oil-production infrastructure in the country, Syria has little choice but to purchase oil from the very group that seeks to overthrow its government.

Reports also indicate that Israel is a main buyer of Daesh oil. The sale is not direct; oil is smuggled by Kurdish and Turkish smugglers, and then Turkish and Israeli negotiators determine the price. As a result of these oil sales, Daesh has annual revenues estimated at $500 million, according to data compiled by the U.S. Treasury.

In November of this year, Russian President Vladimir Putin claimed that Daesh is being financed by at least 40 countries — including G20 members. With such widespread financing, it will be difficult to defeat Deash.

The U.S., in its misguided and destructive foreign policy toward the Middle East (its misguided and destructive foreign policies toward the rest of the world are topics for a separate discussion), also provided Daesh with a vast arsenal.

Last year, the Department of Defense, bragging about advances against this new “enemy” in Iraq, issued a press release: “The three strikes destroyed three ISIL armed vehicles, and ISIL vehicle-mounted anti-aircraft artillery gun, an ISIL checkpoint and an IED emplacement.” Commenting on that statement in Alternet, Alex Kane wrote:

“What went unmentioned by the Pentagon is that those armed vehicles and artillery guns they bombed were likely paid for with American tax dollars. The arms ISIS possesses are another grim form of blowback from the American invasion of the country (Iraq) in 2003. It’s similar to how U.S. intervention in Libya, which overthrew the dictator Muammar Gaddafi but also destabilized the country, let to a flood of arms to militants in Mali, where France and the U.S. waged war in 2013.”

The U.S. left untold amounts of weaponry in Iraq, and as that country descended into civil war following the United States’ odd salvation of it, that weaponry was free for the taking.

So even if, as suggested above, the U.S. didn’t give birth to Daesh, it has certainly nourished it.

A merry-go-round that never stops spinning

It is interesting to note that U.S. taxpayers are spending $615,482 every hour to fight a “war” in which the “enemy” is being well-financed by countries with whom the U.S. has full diplomatic relations. Does this not make it appear that “victory” over this enemy is not the goal? With many countries financing and supplying Daesh, might the world’s largest supplier of weaponry, the U.S., not be too interested in losing such a lucrative market? It’s worth noting that the United States’ “foreign military sales rose to a record high of $46.6 billion for fiscal 2015.” With such a healthy cash cow, would the country’s power-brokers really want to end war? Why kill the goose that is laying such pretty golden eggs?

As the U.S. and its hapless allies continue this “war on terror,” an ill-defined and nebulous “enemy” if ever there was one, Syria and Yemen seem to be bearing the brunt of the violence. As in every modern war at least since World War I, innocent men, women and children are the most frequent victims, suffering unspeakably and dying horrible deaths. And, somehow, the world’s most powerful military machine, owned and operated by the U.S., is unable to defeat Daesh. It must, therefore, continue to arm its allies, which are arming Daesh. So the U.S. provides funding to countries to fight Deash; some of those countries transfer money and armaments to Daesh, who the U.S. is bombing. And it seems that this deadly merry-go-round will continue its endless spinning.

And why shouldn’t it? The U.S. can, with ever-decreasing credibility, pretend to stand as a beacon of freedom and liberty, arming revolutionaries and destabilizing governments that displease it, while arming allies of the country in revolution, which in turn assist that country. So this “war on terror” never ends, and neither do the abundant profits from war-making.

And when possession of the moral high ground is just an illusion, when rhetoric spewed from the mouths of hypocritical politicians to get the citizenry to wrap themselves in the flag and shed a tear for apple pie, motherhood and Old Glory, and when the almighty dollar is always the bottom line, nothing is going to change.

- The Incredible Shrinking Benefits Of Massive Japanese Money Printing

Excerpted from JPMorgan CIO Michael Cembalest 2016 Outlook,

Something is wrong with this picture. In the US and Japan, corporate profits sank during the global financial crisis. In the US, the profit recovery was accompanied by a recovery in household income. In Japan, however, corporate profits and household income moved in opposite directions, as dynamics that helped profits recover did not help consumers.

How can we explain the outcome in Japan? The benefits of a weak Yen are mostly concentrated among large corporations, given translation gains on offshore non-Yen income relative to Yen-denominated costs. For smaller companies and households, a weaker Yen simply resulted in imported inflation. While consumer spending has stabilized after a decline caused by the imposition of a Value Added Tax in 2014, there are few signs of a rebound to pre-VAT levels. Japanese GDP growth has been volatile and averaged 1.5% in 2015; we’re expecting a similar outcome in 2016.

In October 2015, the Bank of Japan did not take further steps which markets were anticipating (e.g., an increase in equity ETF purchases from ¥3tn per year, an increase in REIT purchases from ¥90bn per year or an increase in government bond purchases from ¥80tn per year). Perhaps concerns about the negative domestic impacts from a weaker Yen are affecting BoJ policy.

Our contacts in Japan believe that the BoJ is no longer being pre-emptive, and will wait until November 2016 to act.

The Japanese experiment.

There are few precedents for the kind of experiment Japan is conducting. At the current pace of BoJ purchases, private sector banks might actually run out of JGBs by the end of 2016, at which point the BoJ would have to buy them directly from the non-bank private sector; I think it’s fair to say that no one really knows what would happen then.

One thing is certain: like riding a tiger the BoJ can’t stop now, and has little choice but to continue with debt monetization as Japan’s Federal debt grows higher, and as it veers further and further into the economic unknown.

- Google Is Collecting Information On Public School Students – Here's How

Submitted by Mike Krieger via Liberty Blitzkrieg blog,

As a new parent, the idea of sending my children to public school is a frightening thought. The more you read, the more you realize the importance of extreme vigilance when it comes to what’s happening at whatever place you send your kids to for majority of their day. Quite often, parents are simply left completely in the dark about some very important matters.

One such example relates to Google’s penetration of the U.S. public school system, and how the company employs a loophole in order to collect data on children. Google achieves this by referring to itself as a “school official” under the law. I truly wish I was making this up.

From the Washington Post:

Google is a major player in U.S. education. In fact, in many public schools around the country, it’s technically a “school official.” And that designation means parents may not get a chance to opt out of having information about their children shared with the online advertising giant.

The combined allure of Google’s free suite of productivity tools and cheap laptops that use the company’s Web-based ChromeOS operating system have made Google’s products a popular choice at schools around the country. And the company’s growing dominance is raising concern from some privacy advocates who allege it is using some student data for its own benefit.

Google’s standard agreement for providing its education suite defines the company as a “school official” for the purpose of that student privacy law. In Google’s case, the company is providing software that districts might otherwise have to develop or support themselves, such as email services or tools that help students digitally collaborate on assignments.

But schools are supposed to have “direct control” of how a company or individual uses and maintains education records to deem them a “school official,” according to the department’s regulation. Khaliah Barnes, an associate director at the Electronic Privacy Information Center or EPIC, argues that isn’t happening with many ed tech providers, including Google.

“The schools don’t have access to Google’s servers or a lot of the way that it uses the information because it is proprietary,” she said. In 2012, EPIC brought a lawsuit against the Education Department in an attempt to stop the government from interpreting the law in ways it argued could allow schools to share more data about students with less explicit consent, but the case was later dismissed on standing grounds.

Why am I not surprised in the least.

Today, Google and many other tech companies are increasingly part of students’ daily classroom lives under the “school official” designation. And that leaves parents in the dark about who has access to an increasingly large cache of information about their children and may compromise their privacy down the line, experts say. But as previously reported, Google said it has “always been firmly committed to keeping student information private and secure.”

Private and secure, ok, but they are still collecting this data aren’t they? They are still essentially tracking the activity of little children without their consent or parental consent, are they not?

Even 20 years ago, parents really didn’t expect schools to track more than basic information about their children’s school performance — things like attendance and test scores. But the latest generation of educational tech products are cataloging a nearly limitless amount of data on what students do everyday — from emails and chats, to metadata, such as location history, that educators may not even realize is being collected, Barnes said.

“The companies themselves aren’t transparent, and often times schools even aren’t aware of the extent of data collection,” Barnes said.

“School districts are just generally not providing notice to parents,” said Reidenberg.

You’ve been warned.

- What Does The Future Hold For Negative Rates In Europe? Goldman Answers

A week before Mario Draghi disappointed a thoroughly spoiled market by “only” cutting the depo rate by 10 bps, “merely” extending QE by six months, and failing to boost the monthly rate of asset purchases under PSPP, we explained why the ECB is effectively chasing its own tail.

The argument goes something like this: as the market continues to price in further rate cuts, extensions of QE, and increases in the pace of PSPP bond buying, yields on core paper will be driven inexorably lower, quickly negating any benefit the ECB would have gotten vis-a-vis the expansion of the purchase-eligible universe of bonds.The only alternative is to do away with the depo rate floor altogether and thus lock in even greater losses for the central bank on its trillion euro, “held to maturity”, pile of EGBs. Absent that, the ECB is effectively forced to delay the expansion of PSPP. In short: Draghi, like Kuroda, is running out of bonds to buy and the ECB’s situation is complicated by the depo rate constraint. Each incremental purchase takes Draghi closer to the QE endgame at which point the bank will either be forced to buy riskier assets (like IG corporates or, gasp, stocks) or else concede defeat on the inflation target.

While the market might have been disappointed by the ECB’s “underdelivery”, it came as a relief for the Riksbank, the SNB, the Norges Bank, and the Nationalbank who are effectively forced to cut each time the ECB eases or risk seeing upward pressure on their respective currencies. That dynamic has led to a veritable race to the Keynesian bottom with Norway as the last man standing in terms of conducting monetary policy with rates above zero.

As we head into 2016, a number of questions remain. Is Draghi done or will sluggish inflation “force” the former Goldmanite – gun to his head – to expand PSPP and/or take the depo rate to -0.40% (or lower)? If the ECB does cut further but doesn’t adopt a two-tiered approach to the application of NIRP, will the SNB be forced to go “nuclear” and apply negative rates to depositors in order to mitigate excess pressure on the EURCHF cross (remember, because the SNB has different rules for the application of NIRP, ECB cuts tend to impact the franc more than other currencies)? Will low inflation force Sweden to cut further despite a frightening housing bubble? Can the Norges Bank afford to keep rates in positive territory given the continued plunge in crude prices? And on and on.

For those who enjoy pondering such things, we present the following excerpts and graphics from Goldman’s Allison Nathan who looks at where we stand now, and where we’re going in the year ahead.

* * *

From Goldman

Where we stand

Official interest rates have fallen further in the Euro area and Sweden. The European Central Bank (ECB) lowered its deposit facility rate 10bp to -0.30% on December 3, pushing beyond levels previously described by Mario Draghi as the bank’s lower bound. The latest ECB measures fell short of market expectations, likely reducing the pressure for neighboring central banks to add stimulus; the Swiss National Bank (SNB) and Riksbank have subsequently been on hold.

Sweden’s Riksbank has been the only other central bank to push rates further into negative territory since we published in February, with cuts of 15bp in March and 10bp in July motivated by appreciation pressures on the krona. All the while, inflation—the Riksbank’s original reason for introducing negative rates—has been rising.

Government bond yields remain in negative territory. As of December 14, over 50% of European government bonds maturing in less than five years had a negative yield, roughly the same as in the run-up to the launch of ECB QE in March. Two-year government bond yields were generally lower on the year, despite some rebound after aggressively pricing further ECB easing ahead of the December meeting. (The German two-year yield, for example, bottomed out at -0.44% on December 2.) Looking beyond Europe, roughly half of two-year government bonds in the developed world trades at a negative yield.

Sovereigns have issued debt at record-low—or altogether negative—yields. In April, Switzerland became the first country to issue 10-year government bonds at a negative yield; other governments did the same at shorter maturities.

By contrast, companies with large pension deficits have struggled and continued to underperform, as the present value of their future liabilities continues to rise. Alongside mixed asset returns, pension funding ratios have continued to deteriorate. Similarly, insurance companies have struggled with falling reinvestment yields and solvency ratios.

Where we’re going

Risks that could push the ECB’s lower bound. While our base case is for the ECB to stay on hold, low inflation or a stronger euro could open the door for further monetary easing. We see the ECB’s effective lower bound in the ballpark of -0.50%. Should the ECB cut rates further, it would likely pressure neighboring economies in Europe to do the same or to implement other easing measures, particularly in cases where the local currency is pegged to the euro.

- 2015 Year In Review: "Terminal Phase" Excess & Peak Cognitive Dissonance

Excerpted from Doug Noland's Credit Bubble Bulletin,

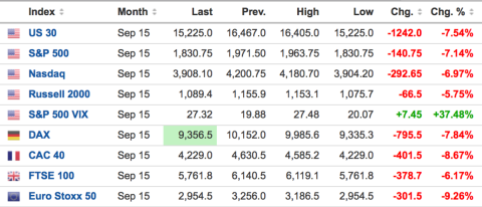

The year 2015 was extraordinary. Incredibly, despite powerful confirmation of the bursting global Bubble thesis, market optimism remained deeply entrenched. All leading strategists surveyed in December by Barron’s remained bullish – some were borderline crazy optimistic.

Optimism withstood a commodity price collapse. Crude, the world’s most important commodity, crashed almost 35% to an eleven-year low, much to the peril of scores of highly leveraged companies and countries. The Bloomberg Commodities Index dropped 25%, its fifth straight year of declines. Copper fell 24%, with platinum and palladium down about 30%. In agriculture commodities, wheat fell 20%, with soybeans and corn down about 10%. Coffee sank 25%.

Bullishness persevered through deepening EM turmoil and a crisis of confidence. The Brazilian real dropped about a third (worst year since 2002), and Brazil’s sovereign debt suffered major losses. Brazil’s corporate debt market was pummeled (Petrobras, Vale, BTG, Samarco, etc.) while confidence in the nation’s major banks and government waned. Russia and Turkey showed further deterioration. Fragility surfaced in EM linchpin Mexico. Currencies suffered generally throughout EM – Latin America, Asia, the Middle East, Eastern Europe, etc. Collapsing currency peg regimes saw almost 50% devaluations for the Azerbaijani manat and Kazakh tenge. Argentina devalued the peso 30% versus the dollar. Throughout EM, dollar-denominated debt became a market concern.

Optimism survived the major financial tumult that unfolded in China. Early 2015 stimulus efforts stoked “Terminal Phase” excess in Chinese equities, a Bubble that came crashing down in a 40% summer drubbing. An August yuan devaluation destabilized markets across the globe. Aggressive (invasive) monetary, fiscal and regulatory measures somewhat stabilized equities and the yuan, at the heavy cost of extending “Terminal Phase” excess throughout the Credit system (i.e. corporate debt and “shadow banking”). The yuan posted a 4.5% 2015 decline against the dollar, the worst performance since 1994. The “offshore yuan” trading in Hong Kong dropped 5.3%.

Bullishness endured despite the August global market “flash crash.” And while the summer market dislocation provided important confirmation of mounting fragilities throughout the markets on a global basis, the bulls interpreted the event as further validating their view of unwavering central bank support and liquidity backstops. The Fed’s September flip-flop emboldened speculative excess, with U.S. equities back within striking distance of record highs by early-November.

From the perspective of my analytical framework, 2015 was momentous; not necessarily because of the year’s occurrences as much as for the far-reaching dynamics set in motion. The “Core and Periphery” analytical framework is an especially valuable tool in our efforts to decipher an easily perplexing 2015. Instability afflicting the EM “Periphery” in 2014 gravitated to the EM's “Core.” In particular, and central to the “momentous 2015” view, faltering Bubbles in commodities and China were transmitted to the “developed” world’s markets and economies (at least at the “Periphery of the Core”).

Troubled energy and commodities companies led a surge in U.S. corporate debt troubles, with the U.S. actually accounting for 60% of global defaults (from S&P). U.S. junk bonds posted negative returns for the year. Junk bond sales slowed sharply after the August “flash crash,” with 2015 issuance down about 16% from the previous year (2014 $348bn). Leveraged loan issuance was down about 20% (from S&P Capital IQ). Confidence was further shaken by a public mutual fund (Third Avenue) barring redemptions. ETF outflows became a serious market concern.

The year ended with heavy outflows from bond funds – junk as well as, notably, investment-grade. Beyond devastating consequences for highly leveraged energy and commodities players, the tightening of financial conditions was transmitted to “Core” equities market. The volume of U.S. IPO deals fell more than 40% in 2015, with money raised sinking 65% to $30 billion (from Renaissance Capital). Global IPO volumes were down 35% from 2014 to $156 billion.

In the face of a wrenching commodities collapse, a slowing global economy, heightened risk aversion and prospects for Fed rate increases, Wall Street remained undaunted. A December 28 Bloomberg headline: “Wall Street Predicts Corporate America's Bond Binge Will Go on – Wall Street’s biggest dealers are forecasting that blue chip U.S. companies will sell more than $1 trillion of bonds for a fifth straight year in 2016 as corporate America’s borrowing binge endures…” In equities, investors gravitated away from the deteriorating broader market in favor of crowding securely in “FANG” (Facebook, Amazon, Netflix and Google).

For much of 2015, deterioration at the “Periphery” worked to bolster flows to “Core” markets. Investment-grade issuance jumped to a record $1.31 TN, up about 17% from 2014’s record $1.168 TN. Record low corporate yields and the Fed-induced insatiable demand for investment-grade debt sustained the historic M&A boom. For the year, global M&A reached a record $5.04 TN (from Dealogic), surpassing 2007’s record. U.S. M&A surged 56% to $2.43 TN. Despite rapidly slowing earnings growth, corporate America repurchased stock and paid dividends at record levels.

The U.S. economy likely grew about 2% in 2015, below earlier expectations and a dismal performance considering the prolonged ultra-loose monetary backdrop. Most notably, the U.S. economy turned only more unbalanced. The bust in energy and commodities gathered momentum, while Bubbles in tech and biotech inflated precariously. In general, housing markets slowed meaningfully into year-end. Yet aggregate data mask downturns in some markets and runaway booms in others. The commercial real estate Bubble inflated further. The unemployment rate dropped to 5%, yet income and wealth inequality had Americans feeling increasingly uneasy with the economic backdrop, the Fed, government and Wall Street.

Importantly, Credit growth slowed markedly in 2015, with implications for income growth, corporate profits and the asset markets more generally. Through three-quarters of 2015, Non-Financial Credit growth slowed markedly to an annualized pace of about $1.32 TN. Assuming weak Q4 growth, 2015 will see the slowest Credit expansion since 2009 ($1.204 TN). For perspective, Credit expanded $1.843 TN in 2014, $1.608 TN in 2013 and $1.923 TN in 2012. And after three-years of major stock market-induced gains in Household Assets, 2015 will see the smallest rise in Household Net Worth since 2011.

The year was notable for the increasingly problematic central bank-induced divergence between inflating securities markets and deflating real economy prospects. Bursting commodities and EM Bubbles weighed on global growth, while QE and ultra-dovish monetary policies spurred ongoing speculative excess. As the global economy deflated (in the face of aggressive monetary stimulus), over-abundant liquidity was further enticed into the inflating global financial asset Bubble. And as speculators rushed to exit faltering markets, asset classes and individual stocks, the Crowded Trade phenomenon turned only more destabilizing. The huge bets on central bank policies left markets at high risk for abrupt reversals and trade unwinds – 2015 The Year of the Erratic Crowded Trade.

The Swiss National Bank’s surprising January decision to break the swissy’s cap with the euro proved a precursor of 2015’s disorderly Crowded Trades – and the general inhospitable backdrop for leveraged speculation. Recall how the swissy moved a massive 30% as the news broke, the type of market discontinuity that blows out both leveraged trades and dynamic-trading hedging strategies. While not as dramatic, currency markets again dislocated during the August “flash crash.” Later, the euro moved an immediate 4% in early-December when Mario Draghi was unable to deliver on his vow to “do what we must to raise inflation as quickly as possible.” The year saw the risk vs. reward calculus deteriorate significantly for leveraged speculation, especially in currency trading.

January 1 – Wall Street Journal (Rob Copeland): “Hedge funds start the New Year with something to prove—again. The money managers who charge some of the highest fees on Wall Street had a chance in 2015 to outperform a flat stock market and end years of subpar performance. Instead, hedge funds lost more than 3%, on average, according to early estimates from hedge-fund-research firm HFR Inc., while the S&P 500 returned 1.4%, including dividends. Managers stumbled for myriad factors, including bad wagers on energy and currencies and an overreliance on certain stocks. ‘Everything went wrong,’ said Alexander Roepers, founder of $1.5 billion hedge-fund firm Atlantic Investment Management. ‘There were very few places to hide.’”

Hedge fund travails have been well publicized. The industry overall lost money in 2015, following several unimpressive years. Some major funds suffered their worst year since the financial crisis. Many funds closed and/or returned money to outside investors. Still, investor confidence for the most part held up. The industry overall did not suffer major outflows. Yet it wasn’t only hedge funds that struggled in 2015’s unsettled market backdrop.

December 31 – Wall Street Journal (Sarah Krouse): “It is getting a lot harder to sell hedge-fund-style investing to the masses. More ‘liquid alternative’ mutual funds closed in 2015 than in any year on record, according to… Morningstar Inc., as inflows dwindled and performance weakened. The results show that enthusiasm is fading for what had emerged in recent years as one of the hottest products in asset management—funds that combine hedge-fund strategies like shorting stock with the daily liquidity of mutual funds. In all, 31 liquid-alternative funds have been closed this year, up from 22 a year earlier… ‘You had so many funds that were launched in the last couple of years and hadn’t really been tested by market volatility and you’re starting to see the cracks in them,’ said Jason Kephart, an analyst at Morningstar… Fund companies aggressively pitched liquid-alternative products, saying they could help protect investors from volatility and offer better returns. Assets in liquid-alternative funds grew to $310.33 billion at the end of 2014 from $124.44 billion at the end of 2010.”

It was certainly not the year of the “non-correlated” fund or asset class. Overall, most funds and strategies that were expected to perform well in the event of market instability failed to live up to expectations. Symptomatic of the general backdrop, too much “money” has flooded into various “liquid alternative,” “risk parity,” and sophisticated hedging strategies. Instead of providing investor protection, the proliferation of variations of model-directed, trend-following strategies only exacerbated market instability.

An overarching theme from 2015 was that the market turned increasingly unstable, while the vast majority of strategies used for market risk mitigation performed disappointingly. This is closely related to another critical market development illuminated in 2015: rapidly waning benefits to diversification. The halcyon post-crisis backdrop of holding (leveraging?) a portfolio of U.S. equities, fixed-income and global stocks & bonds – all generating positive returns – ended with a vengeance. Commodities were a disaster and EM was a minefield. Moreover, bonds were no longer providing a reliable hedge against “risk off” market turbulence. Perhaps not obviously, but the game turned much more difficult in 2015. Bloomberg: “The Year Nothing Worked: Stocks, Bonds, Cash Go Nowhere”

I didn’t adopt the terminology, but “quantitative tightening” was used (initially by Deutsche Bank) starting in August to describe the dynamic whereby EM outflows forced EM central bankers to liquidate Treasuries and “developed” sovereign debt securities. A key “virtuous cycle” dynamic from the global government finance Bubble period had been the large flow of finance into EM that was then easily/predictably recycled back into “developed” markets through the purchase of sovereign debt.

2015 marked a key inflection point for EM international reserved holdings, with important implications for EM and global market stability. The potential for big EM central bank liquidations became a significant market uncertainty. Moreover, the prevailing dynamic where “risk off” instability led predictably (great for hedging!) to aggressive buying of Treasuries (and “developed” sovereigns) was supplanted by fear that global tumult would spur EM outflows, Treasury sales and a destabilizing pop in global yields. Importantly, Treasuries lost the attribute of providing a cheap and reliable hedge against faltering global risk markets. This greatly compromised popular diversification and hedging strategies.

China’s international reserve position ended November at $3.4 TN, declining from the 2014 high of $4.0 TN. Reserves were down $405bn through November. Estimates had outflows from China surging to $200 billion monthly during the summer, and perhaps remaining near $100 billion per month through year-end China imposed onerous measures throughout the summer and fall that amounted to capital controls. These, along with the late-summer market crackdown on selling, short-selling and derivatives trading, ensured an international investor crisis of confidence in the course of Chinese policymaking. Crackdowns on the securities firms and what has evolved into "wildcat banking" significantly complicates the already fragile Chinese Credit backdrop.

Fundamental to “momentous 2015” is the thesis that the year marks a pivotal year in confidence in global policymaking generally. Clearly, the unfolding bust saw a dramatic change in perceptions with respect to the aptitude of Chinese officials. In general, confidence in the effectiveness of QE waned throughout the year. A global commodities collapse in the face of ongoing QE was unnerving.

As the year progressed, it seemed only central bankers remained confident that QE could reverse the downward trajectory of global CPI. Within individual central banks, skepticism mounted as to both the effectiveness of QE and the associated risks to financial stability. The Bank of Japan hesitated to increase QE, while market darling Draghi couldn’t deliver on what the market had believed was promised more aggressive QE. Market perceptions shifted from “whatever it takes” QE on demand to fears that current QE, while not all that effective, could be as good as it gets.

2015 developments also support the view that the bursting of the global Bubble portends serious geopolitical risk and instability. Geopolitical tensions were on the rise virtually everywhere. Strongman Putin took his show to the Middle East, a region increasingly a volatile cauldron of mayhem. Strongman Erdogan’s Turkey shot down a Russian fighter jet. Millions of refugees to Europe, further destabilizing the political backdrop. Multiple terrorist attacks. ISIS. The U.S. challenged China in the South China Sea. Strongman Xi Jinping took further measures to centralize authority and solidify power. Japan’s Shinzo Abe pushed forcefully ahead with reform and militarization. 2015 was the year of the authoritative leader – on a seemingly global basis. With pundits and traditional analysts in disbelief, Bernie Sander catches fire with an anti-capitalism and anti-Wall Street message, while the Donald Trump phenomenon takes the Republican primary season by storm. And few see the association to Credit Bubbles, unsound “money” and Credit, inflationism and resulting central bank-induced monetary disorder.

Important pillars of the bull case evaporated throughout 2015. Global price pressures weakened, the global Credit backdrop deteriorated and the global economy decelerated. Indeed, a global bear market commenced yet most remain bullish. Serious and objective analysts would view this ominously.

- From $500,000 To $170 Million In A Few Months: The Next "Subprime Trade" Emerges

Ever since a few far-sighted, contrarian traders made a killing by betting on the collapse of subprime in 2005 and 2006 – and by implication on the implosion of the capital markets – a trade famously resurrected in the latest Wall Street movie The Big Short (whose Michael Burry recently warned that “The Little Guy Will Pay” For The Next Crisis, again) everyone has been dreaming to uncover the next “subprime” – a trade that has a 20-to-1 upside to downside ratio, which can be put on in massive size, and which would lead to a quick and lucrative retirement.

So far the next “subprime trade” remains elusive, with global capital markets continuing to grind ever higher thanks to constant central bank manipulation, as first called out on this website many years ago, and as admitted recently even by such “serious” legacy institutions banks as Bank of America which in an attempt to explain market instability

Central bank’s risk manipulation well explains local tails

A good way to explain why we have seen local tail risks arise so frequently since central banks began to heavily manipulate asset prices is with the following analogy, illustrated in Exhibit 1. Essentially central banks, by unfairly inflating asset prices have compressed risk like a spring to unfairly tight levels. Unfortunately, the market is aware the price of risk is not correct, but they can’t fight it, and everyone is forced to crowd into the same trade. By manipulating markets they have also reduced investors’ inherent conviction by rendering fundamentals less relevant.

This then creates a highly unstable (fragile) situation that breaks violently when a sufficient catalyst causes risk to rise – overly crowded positioning meets a market with little conviction.

The above explanation leads to a critical line of thought: perhaps the next “subprime” trade is not shorting a mispriced asset at all?

After all, all assets are mispriced as a result of central bank intervention.

As BofA admits “the market is aware the price of risk is not correct, but they can’t fight it, and everyone is forced to crowd into the same trade“, which is logical: after all why should one fight the Fed when any time there is even a 5% drop in the S&P500, the Fed can and will either jawbone and threaten to cut rates or launch QE4 or NIRP, or just do it? In doing so, of course, the Fed merely “kicks the can” and with every failed attempt at reprice risk and bring back some trace of price discovery, guarantees that the next market crash will be the most epic ever, one which will wipe out not only the Fed’s credibility but the bedrock of the modern financial and economic system, a monetarist system based on neo-Keynesian rules. Frankly, the devastation can not come fast enough.

But first, why not make some money?

And if one is limited from generating 20-1 returns in a market of suppressed volatility due to a global central bank puts, perhaps the next “subprime” trade has to do with the process of actually putting the trade on.

A process which involves ETFs.

To be sure, we – and many others – had issued many warnings about the very nature of ETFs in recent years, especially during 2015. Here is a brief chronology of the countless warnings we have issued on this topic in the past year alone:

- March 2015: What Would Happen If ETF Holders Sold All At Once? Howard Marks Explains

- May 2015: ETF Issuers Quietly Prepare For “Market Meltdown” With Billions In Emergency Liquidity

- June 2015: How Fund Managers Use ETF Phantom Liquidity To Avert A Meltdown

- July 2015: The Complete Guide To ETF Phantom Liquidity

All of these warnings became realized on August 24, the day of the infamous ETFlash Crash which even the SEC remarked on in the last week of December with an 88-page note on “Equity Market Volatility on August 24, 2015.” What the SEC essentially said is that it is generally concerned with plumbing and exchange regulation, with an emphasis on ETFs.

To be sure the story of broken markets as a result of the epic proliferation of Exchange Traded Funds continued after August, with stories such as:

- August 2015: Was Monday’s ETF Collapse Just A Warmup?

- September 2015: Mom And Pop “Will Probably Get Trampled”: Alliance Bernstein Warns On Bond ETF Armageddon

- October 2015: How The Entire Short Volatility ETF Complex Could Be Wiped Out Overnight

- November 2015: How Illiquid Are Bond ETFs, Really? (Spoiler Alert: Very!)

Is it possible that “the next subprime trade” was so obvious that it was staring everyone in the face for the past year?

A trade which involved betting on the collapse not of the central-bank supported market, but the death of the instrument which allows this unprecedented global central bank “put” to prop up markets, and which like the infamous coiled spring in the Bank of America “revelation” is just waiting for a catalyst to snap: in other words, betting against ETFs?

Actually the answer is yes, and for some, the “next subprime trade” is already happening.

Meet David Miller and his Catalyst Macro Strategist Fund (ticker: MCXCX). The introduction, provided by WaPo reads like something straight out of a Michael Lewis book:

The Michigan-native is betting against one of the most popular investment vehicles for mom-and-pop investors: exchange-traded funds. The bets have paid off, turning Miller’s little known Catalyst Mutual Funds into one of Wall Street’s most successful players in 2015.

It sure sounds like a story about one of the lucky few who correctly predicted in 2006 what would happen to not just subprime, but the overall market just a few years later… and would retired filthy rich.

The comparisons between Miller’s story and the “Michael Burry’s” of the subprime era don’t end there, because the young asset manager has not only figured out what to bet against, but how to make a lot of money in the process: ever since it started making complicated bets against some leveraged ETFs, Miller’s Catalyst Macro Strategies Funds has since grown from $500,000 in assets at the start of the year to about $170 million. It achieved a more than 50 percent return this year, placing it far ahead of its competitors.

In a year in which virtually not one hedge fund generated notable returns, and most were an embarrassment, it is surprising that not all financial media outlets are talking about Catalyst’s performance, which as shown below, is quite impressive. Behold the 2015 performance of the Catalyst Macro Strategy Fund, which according to Morningstar held a total of $169.5 million in assets most recently.

Miller’s initial target in the broken sector: leveraged ETFs: “Our goal is to identify poorly designed financial vehicles,” said Miller, Catalyst’s senior portfolio manager. “The strategy has certainly worked out well for us.”

While still a tiny part of the market, the growth of leveraged ETFs has been explosive. Nearly nonexistent in 2005, the market has grown to more than $20 billion this year, according to data from Lipper. The market has doubled since 2011.

The regulators have, as usual, been asleep at the wheel, making such debacles as August 24 a recurring reality, and allowing people like Miller to make outrageous profits by betting against the broken market:

[A]s the industry has grown, so have concerns around whether investors understand the risks. The Securities and Exchange Commission proposed rules in December to rein in these type of funds. And the Financial Industry Regulatory Authority, also known as FINRA, has cracked down on brokers who have sold complicated ETFs they didn’t understand.

“The SEC and FINRA have been coming down on them, and they still have not gone away,” Miller said. “Money keeps coming into them despite their poor performance.”

But if leveraged ETFs are the “BBB” CDO tranches in the subprime analogy, then regular, and just as broken ETFs, will be the A, AAs and higher which will be the next to flame out: “Even traditional ETFs aren’t immune from market volatility. Over the summer, the price of some ETFs dropped off a cliff, then bounced back within minutes. Investors who automatically sold as their value plunged, faced heavy losses.”

Catalyst may have been the first, but many more are coming, looking to profit from problematic ETFs. New York hedge fund Hilltop Park has employed complicated trades to bet against some ETFs, according to The Wall Street Journal.

Perhaps the final analogy to the subprime crisis is the infamous straw that broke the camel’s back: back then, just like now, the fulcrum security was safe… until enough bets had been made against it (infamously by such as Goldman itself, which via Abacus and others, was selling exposure to CDOs only to short them at the same time), at which point the bubble bursts.

And while 10 years ago it was the subprime bubble, this time it will be the ETFs that go first as more and more bets against them proliferate, and when they do, it will be all up to the central banks to preserve the last artificial asset prices in “markets” which over the past eight years forgot how to discount reality, and merely reflect the intentions of a few clueless economist hacks.

To help accelerate this process, we present Catalyst Macro Strategy’s latest prospectus, with hopes more modern “Michael Burrys” emerge and take on what the fulcrum security of today’s broken markets.

- Earnings Revisions Tumble To Weakest In 9 Months, BofAML Warns "More To Come"

Until recently healthcare had been the only sector offering any optimism from an earnings perspective but even that has collapsed now. The three-month earnings revision ratio (ERR) fell for the fifth month in a row to 0.53 from 0.55 – its lowest level in nine months, indicating twice as many cuts as increases. As BofAML notes, this is well below the long-term average of 0.84, and given S&P 500 sales revisions have collapsed to April 2009 lows, they forecast more cuts are likely to come… and a muted January effect looms.

S&P 500 Sales Forecast Revisions are the worst since April 2009…

And Earnings Revisions have re-plunged to nine-month lows (as mid-year hope collapses)

The ratio suggests nearly twice as many downgrades as upgrades to earnings. The ratio remains below the long-term average of 0.84, suggesting more muted near-term market returns. The more volatile one-month ratio fell to 0.54 from 0.59.

Which implies a drastically weaker January effect…

As all 10 Sectors have seen more downward than upward revisions to earnings over the past three months.

Previously, Health Care had been the only sector with positive revisions, but the ERR has fallen below one in this sector as well, to its lowest level in 2½ years. Materials continues to have the worst three-month ratio, with 5x as many cuts vs. increases to estimates — but an improvement from the prior month’s post-crisis low. Also of note: Industrials’ 3-month ERR is the lowest in three years (and still falling).

But, it's not just US corporates, Global earnings revision trends also remain weak…

Based on our global quantitative strategy team’s last update, the 3-month global earnings revision ratio fell in November to 0.59 from 0.68, as analysts accelerated their pace of downgrades. All regions saw the three-month ERR deteriorate, led by the US and Europe. Japan and the US continue to have the highest ratios, while Asia ex-Japan has the lowest, but all regions are now seeing more downgrades than upgrades.

The one-month ratio fell to 0.56 from 0.59 – the lowest in nearly four years. Global equity returns tend to be muted when the Global ERR is near current levels.

Source: BofAML

- "Tread Lightly" – 2016 Technical Outlook

If there was one key trading lesson to draw from 2015 it is this: Ignore the noise and focus on the technicals. Hence in today’s article I’m outlining what I’m seeing from a technical perspective across multiple time frames and asset classes. Note I’m not trying to convince you of any particular view here, but my aim is to share, what I consider to be, fascinating data sets that hopefully offer some insights worth considering.

But before I go into the technicals I want to provide some context on the noise factor. What is noise? Well mostly it’s the myriad of opinions, forecasts, predictions and news flashes that come our screens every day and they can be of detriment to traders and investors alike. Now I’m not saying not to seek out information and other perspectives, but I am saying to not take anything as gospel especially when it comes to consensus.

Consider the following:

Wall Street forecasts for 2015 were largely wrong across the board. Now I have no problem with anybody being wrong. I’m wrong all the time and my wife is sure to let me know when I am. But what I do take issue with is that Wall Street largely insisted on staying wrong even though the facts were changing in 2015. The main factor changing: Earnings forecasts were coming down. Hard. And yet price targets stayed higher. The only thing that really changed was the narrative, i.e. “well if earnings are down so what then markets go up because fund managers have to chase performance”. And hence you end up with overly optimistic forecasts not based on reality. But Wall Street is in the business of selling supply to the public.

And nothing has changed on this front. For 2016 Wall Street appears to see little risk in markets and the same forecasts for 2015 have been moved into 2016. Not a single analyst sees the $SPX moving below 2000 or even 2,100 for that matter. No downside. None. And none was projected in 2015.

Yet Hedge funds got hammered in 2015 resulting in hundreds of closings and many well known funds and hedge fund managers are down severely. Heck even Warren Buffet had a lousy year being down 11%.

Economists also have widely missed the boat on economic growth projections. It’s been a year of slowing growth globally and yet forecasts kept pointing to more optimistic outlooks. For along time markets have been either ignoring or outright celebrating any bad news as it suggested more central bank easing to come. And to be fair this has worked for years. After all central banks have cut rates over 650 times since 2008 and even in the 2015 the ECB and BOJ added $1.2 trillion in assets to their balance sheets.

But the scale and scope of forecast misses is eye opening. Just this last week the Chicago PMI figure came in so mismatched in both direction and magnitude versus economists’ forecasts one has to wonder what they are actually looking at: “The index fell to 42.9 from 48.7 in November. Economists had expected it to rise 1.3 points to 50 in the December reading. The index has spent much of the year below the 50 mark that separates expansion from contraction”.

What’s the standard excuse for the missed forecasts? The weather of course which prompted this sarcastic tweet from me:

Lessons for 2016: Never trust an economist without a degree in meteorology

— Northy (@NorthmanTrader) December 31, 2015

Which brings me to my beloved Fed. After months and months and months of talking, tinkering, and handwringing they finally hiked rates while insisting it meant nothing. Janet Yellen keeps claiming the Fed is data dependent. Yet their own forecasts continued to be wrong and GDP growth figures continued to be revised downward throughout the year. So why did they hike rates? To maintain credibility?

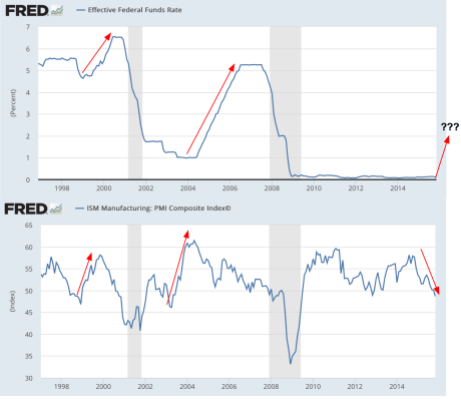

Certainly not because of the mentioned PMI figures. In fact, during the last two rate hike cycles (who can even remember those) PMI was leading by expanding not contracting as it does now. So I have to ask: They want to hike rates into a declining PMI trend into the lows 40s?

So one has to really wonder if the Fed really knows what they are doing here. I have my well founded doubts.

And finally: 2015 put to shame statistical folklore. “Stocks go up in December” “Years ending in a 5 are always positive”, etc. All these historical notions were really off base. Yes historical stats can be interesting to look at, but perhaps the breaking of many historical precedents raises a key question:

If all forecasts and predictions and conventional wisdoms are wrong perhaps nobody really knows what kind of market we are dealing with here?

After all, never before has the world seen such a combination of massive expansion in debt, central bank intervention and low to negative interest rates for such an extended period of time.

Do the technicals provide clarity? Let me walk you through the charts and I’ll outline both bearish and bullish considerations. Note my aim is to be as clinical as possible in my review here.

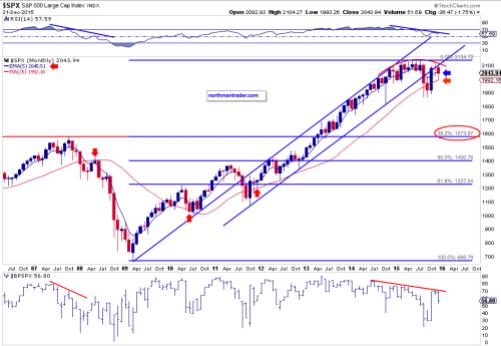

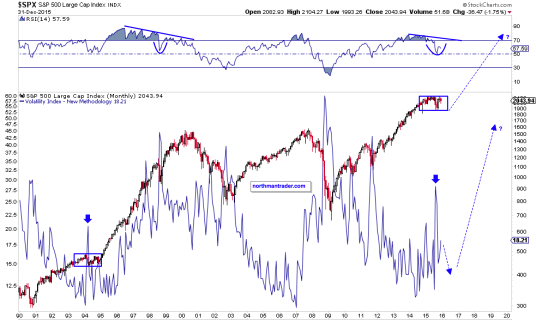

First off, please note that during this past year the $SPX has moved from a series of higher highs to a series of lower highs. Until proven otherwise this could be regarded as a rounding top:

The $SPX finished the year just below its 50 and 200 day moving averages. These are still on a so called golden cross and could easily be recaptured unless further selling commences in early January. Also note that since September 2014 we have seen 2 larger corrective events. Both recovered quickly in price and in the process produced a very well defined supporting trend line connecting these lows (see above).

Yet a very clear message comes across here: Months of price discovery can disappear in an instant. Who can forget this morning in August?

Anybody remember what stopped this? Circuit breakers. Trading was stopped and for many it was a travesty. Why? Because many trading platforms only reopened AFTER markets already bounced higher. Many people simply couldn’t enter or re-enter if they had been stopped out on the way down.

The seeming good news for investors: Every time markets break down a magic hand appears and markets bounce back. I have to admit I do worry about this repetitive market expectation as it breeds a certain level of complacency: Nothing bad can ever happen right? Markets always come back. Buy the dip. And technically one has to respect the results. And we did ourselves as we bought long on the technical signals.

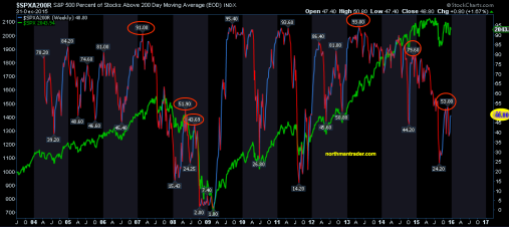

But the subsequent recovery produced lower highs. And we can’t ignore this. Nor can we ignore that internals have been horrid and this is where the bearish evidence comes in.

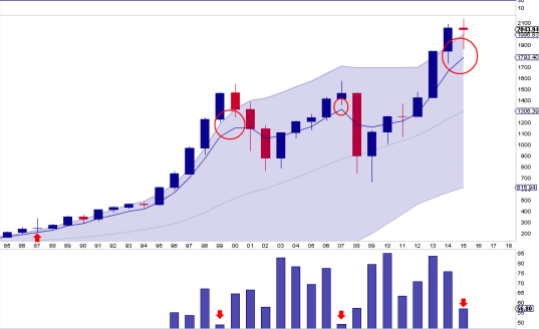

Purely technically speaking we are observing a very similar pattern for previous major tops.

Consider the equal weight charts:

While the value line geometric index temporarily broke above its 1998 and 2007 highs it has since literally fallen off the cliff and is sporting a potential bear flag similar to the one in 2007/2008.

This similarity is supported by the Guggenheim equal weight index and it raises the question of a repeat to come:

Equal weight of course is reflective of a harsh reality: Most stocks are underperforming the indices greatly. Here too we see similar behavior to the 2007/2008 top, specifically stocks above their 200 day moving averages are showing a seeming repetitive pattern of lower highs:

If the pattern is to repeat new lows could well be in this market’s future.

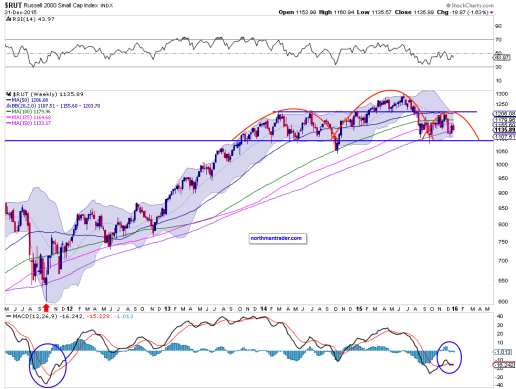

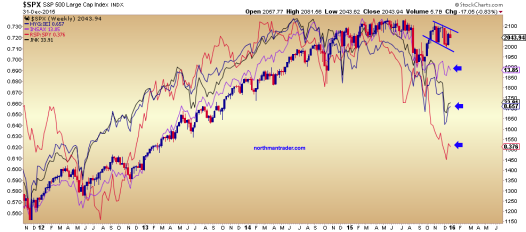

And there are many bearish patterns to support this notion. Consider several large heads and shoulders patterns on indices and key individual stocks:

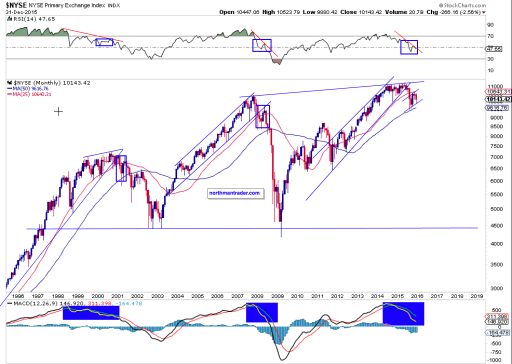

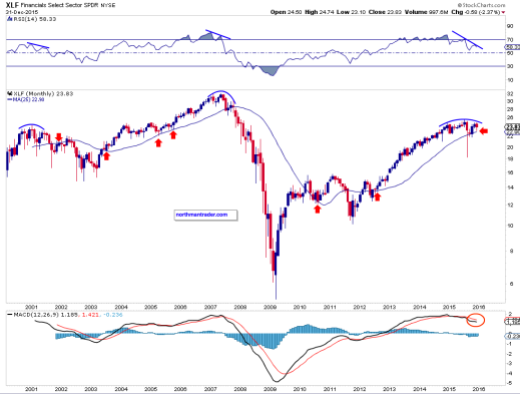

MACD patterns are well below the center lines on all of them. And the larger monthly charts highlight the technical bearish picture with negative RSI divergences, negative MACD patterns and broken trend lines in many cases:

Even the best performing index in 2015 the $NDX is showing negative divergences and the broken trend line is yet to be recaptured:

But, and I need to stress this here as well: Nothing has really broken yet. None of the patterns above really mean anything until they show a confirmed break. In the case of the heads and shoulders patterns they won’t confirm until they break their necklines.

Will we see a similar corrective move in the months to come? That is the key question isn’t it as it has potentially significant ramifications. Consider the potential target of such a corrective move. If the rounding top indeed plays out and price were to break below the established lower trend line there is an obvious target: The .382 fib off the 2009 lows as it also coincides with the 2007 highs or 1574 on the $SPX:

This would constitute a 26.2% correction off the highs. After years of a steady uptrend such a price event seems unfathomable for most investors these days.

What could cause such a break of the various necklines?

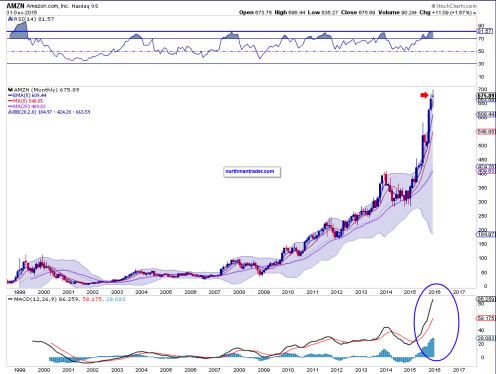

Perhaps the very same reason that has prevented markets from breaking down so far: The winners. Much like society the stock market has morphed into a basket of haves and have nots. And while internals are horrid 2015 has seen incredible market cap expansion in several high cap stocks leading them to historically overbought levels with negative divergences on top of it.

Some familiar examples:

Note all of them are widely disconnected from their monthly 5 EMAs. If market history teaches us anything it is that these disconnects do not last. A simple reconnect would not be a bearish event in itself, but standard market practice, yet as you can see in many cases a simple reconnect could invite a 7-10% correction in just these stocks. How would the market handle such a correction in its leaders?

And if you think I’m perhaps overstating the historic nature of some of these disconnects perhaps a little broader perspective may help.

I won’t mention the names not to cloud your view, but here are the quarterly charts of two major companies with a combined market cap of over $400B. But here’s a hint: One distributes stuff and one sells burgers:

See any corrective potential here? Any excess?

One additional technical perspective: Despite closing slightly down on the year the $SPX is still vastly disconnected from its annual 5 EMA (12.2%) and has not touched it in 2 years now. History suggests it doesn’t like extended disconnects especially on weakening internals:

So admittedly this is all looking rather gloomy and suggests markets are at major risk of a very sizable correction in 2016.

One could argue that the combination of these technical facts support Mella’s $VIX chart she posted a couple of weeks ago:

$VIX monthly. Happy New Year lol pic.twitter.com/5tKch8qzJ9

— Mella (@Mella_TA) December 21, 2015

Wowser.

But as Mella also says: “Generally a bull market just doesn’t roll over and die.” And that’s a fair comment. Where’s the euphoria? Where’s the blow off top?

While one may argue we may see it in some of the individual stocks the vast majority of stocks have corrected and are down. And the very technical issues outlined above may also serve as the foundation for a vastly different technical outlook.

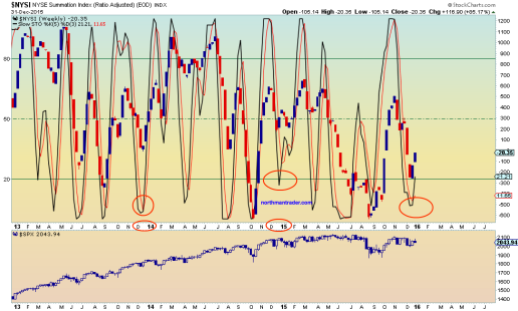

Consider that for the past year the $SPX has really not gone anywhere. Yes we have lower highs for now, but in terms of price we remain stuck in a range, and as pointed out above nothing has really broken yet. This type of consolidation is not unprecedented. In fact, the notion of an aggressively rising $VIX is also not incompatible with rising prices. See what happened in the mid 90s after a lengthy consolidation with a low $VIX: Both rose.

What could prompt a break higher? Consider some of key culprits for the negative divergences in 2015: Energy and high yield. These divergences have been in place for months now. The obvious question: What happens if these things were to improve?

Note, one could view the recent weekly price consolidation to be in context of a bull flag. Should price break above the pattern and make a high above recent highs the technical picture could change rather dramatically and quickly so.

One of the worst performers in 2015: Oil. What does the chart suggest? A descending wedge with a positive RSI, an intrinsically bullish pattern:

A break higher in oil prices may certainly invite a rally in energy stocks and with it an improvement in high yield and junk. In short, internals could improve quickly and what was a bearish scenario could turn bullish:

After all markets are generally still oversold:

And such an improvement would bring back the bullish case we recently discussed. Here are the updated charts:

As regular readers know the above pitchfork has been a key technical indicator we’ve been watching since the summer lows. The middle line is clearly now resistance. If markets can break above it then indeed we may see a blow off top along with a rising $VIX.

Last but not least: Global central banks remain highly active and despite its difficulties since the spring highs the DAX, for example, as retained its trend line. So far anyways:

Confused yet? It’s actually not confusing. What we are seeing is a market in a consolidation phase and it still is in range and it has to still make its case: To break up or down.

One could even make a case that new highs could be bearish. What would constitute such a scenario? Simply a move to tag along the rising trend line without recapturing it. This scenario may perhaps be the most deceptive as it could capitulate sellers and turn participants bullish, yet be technically very suspect as it could produce new highs on even greater negative divergences:

So which way will this play? The technicals suggest that a break in either direction will produce an outsized move providing significant swing and day trade opportunities in 2016. The $VIX chart suggests that volatility will likely rise either way.

But until we know specifically with what kind of market we are really dealing with perhaps traders and investors may want to heed the words of Walter White:

Tread lightly indeed. Which is exactly what the technicals are telling me until this market reveals its true character.

Good luck in 2016. It’s shaping up to be a wild one.

- Protesters Storm, Set Fire To Saudi Embassy In Iran

Earlier today, Saudi Arabia announced it had staged its largest mass execution in 25 years.

43 al-Qaeda conspirators were killed along with 4 Shiites accused of shooting policemen in the anti-government protests which broke out during the Arab Spring. Among the Shiites killed: prominent cleric Nimr al-Nimr.

His death drew sharp criticism from Iran and Hezbollah with the latter calling the execution a “grave mistake.” Here’s WSJ:

Lebanese militant group Hezbollah called Mr. al-Nemer’s execution a “stain that would haunt this regime,” while former Iraqi Prime Minister Nouri al-Malki, another ally of Iran, said the execution “will topple the Saudi regime.”

Arab Gulf allies of the kingdom such as Bahrain and the United Arab Emirates said they supported steps taken by Saudi Arabia to “confront terrorism.”

Mr. al-Nemer was sentenced to death in October 2014 and charged with crimes including disobeying the ruler, inciting sectarian strife and bearing arms against security forces.

Mr. al-Nemer wasn’t widely known outside Qatif before 2011, when he emerged as a leading voice behind Shiite protests that rocked the oil-rich eastern part of Saudi Arabia for two years.

He was arrested after a car chase near his family’s farm in their hometown of Awwamiya in July 2012. Authorities said he opened fire at security forces. His family has denied this and said he was unarmed.

“We condemn a deplore this unjust killing and consider it an example of killing wisdom and moderation,” Mr. al-Nemer’s family said in a statement.

“The Saudi government supports terrorists and takfiri [heretic] extremists, while executing and suppressing critics inside the country,” Iran’s Foreign Ministry declared. These are “hostile statements,” Riyadh responded, adding that Iran’s comments constitute “a blatant intervention in the kingdom’s affairs.”

Protests erupted in the Qatif district of Saudi Arabia’s Eastern Province as well as in Bahrain, where hundreds took to the streets, burning tires and braving tear gas fired by police. As we reported earlier today, protesters had also converged on the Saudi embassy in Iran.

Now, in what looks like a repeat of the Iran Hostage Crisis, the protesters in Tehran have reportedly broken into the Saudi embassy and set it ablaze with Molotov cocktails.

“Images shared on social media early on Sunday morning appeared to show Iranian protesters breaking into Saudi Arabia’s embassy in Tehran and starting fires, after gathering there to denounce the kingdom’s execution of a Shi’ite cleric,” Reuters reports. “One photograph, posted on Twitter, showed protesters outside the embassy building with small fires burning inside, while another showed a room with smashed furniture purportedly inside the building.”

Video shows protesters inside Saudi embassy in Tehran pic.twitter.com/DEmsNLI6ZG

— Sobhan Hassanvand (@Hassanvand) January 2, 2016

It’s 23:50 here in Tehran, seems protest agnst Nimr execution continues outside Saudi embassy in Tehran right now pic.twitter.com/5LLj89FhYn

— Sobhan Hassanvand (@Hassanvand) January 2, 2016

#BREAKING: Angry protesters storm Saudi embassy in Tehran

pic.twitter.com/xOX5n6QtsR— Sobhan Hassanvand (@Hassanvand) January 2, 2016

Protesters break into Saudi embassy building in Tehran pic.twitter.com/7wtBGpZuco

— Sobhan Hassanvand (@Hassanvand) January 2, 2016

Police disperse protesters at Saudi embassy in Tehran

Firefighters are trying to put off fire at embassy pic.twitter.com/WWb1QCURQG— Sobhan Hassanvand (@Hassanvand) January 2, 2016

Saudi Arabia flag brought down at embassy in Tehran pic.twitter.com/7ptL0gV0ZF

— Sobhan Hassanvand (@Hassanvand) January 2, 2016

Protesters in Mashhad bring down Saudi flag at consulate following al-Nimr execution pic.twitter.com/2abn4V2KgW

— Sobhan Hassanvand (@Hassanvand) January 2, 2016

VIDEO: Footage from earlier tonight of protesters throwing Molotov cocktails at Saudi embassy in Tehran – @hamid3663

pic.twitter.com/j6ATZDYEzZ— Conflict News (@Conflicts) January 2, 2016

As a reminder, the Sheikh was a prominent voice in the anti-government movement in Saudi Arabia. Riyadh effectively killed (literally) two birds with one stone with his execution: 1) a dissident voice was forever silenced, 2) a message was sent to Tehran, whose regional influence is expanding in Iraq and Yemen and whose forces have served to shore up the Assad government in its fight against Sunni extremists in Syria.

Now, the Iranians look set to send a message back to Riyadh as the sectarian divide once again rears its ugly head.

Meanwhile, Iran’s foreign ministry is calling for “calm.” Here’s Reuters:

Iran’s Foreign Ministry called for calm in the early hours of Sunday after police dispersed angry protesters who had stormed Saudi Arabia’s embassy in Tehran.

Demonstrators broke into the embassy and started fires before being cleared away by the police, Iran’s ISNA news agency reported, after gathering there to denounce the kingdom for executing a prominent Shi’ite cleric on Saturday.

The ministry issued a statement calling on protesters to respect the diplomatic premises, according to the Entekhab news website.

If this situation escalates, clearly crude oil will be well bid on Sunday afternoon.

- Trump Muslim Ban Comments Featured In Al-Qaeda Propaganda Video

Early last month, Donald Trump shocked the American electorate by “calling for a total and complete shutdown of Muslims entering the United States until [the] country’s representatives can figure out what is going on.”

While it wasn’t entirely clear what Trump meant by “until lawmakers can figure out what is going on,” the message was unequivocal: the GOP frontrunner was calling for the nation to filter those entering the country based on religion.

In the wake of Trump’s declaration, many analysts, commentators, and pundits assumed the brazen billionaire had finally crossed the line. That is, up to that point, Trump had proven to be largely “gaffe proof,” so to speak. Nothing he said – from calling illegal immigrants “rapists” to suggesting Fox anchor Megyn Kelly was “bleeding out of her wherever” – seemed to dent his run for the White House and in fact, his poll numbers seemed to rise with each passing insult.

The Muslim ban however, would be another story. Or so many people thought.

As it turns out, Trump’s lead over the rest of the field only widened as his message with regard to combating radical Islam resonated with many Americans who are struggling to discern how best to ensure what happened in Paris doesn’t happen in New York or Washington DC.

Irrespective of one’s take on Trump’s Muslim diktat, it was fairly obvious from the beginning that extremists around the world would use it to recruit. Here’s what Hillary Clinton said during the third Democratic primary debate: “He is becoming ISIS’s best recruiter. They are going to people, showing videos of Donald Trump insulting Islam and Muslims in order to recruit more radical jihadists.”

That’s not so much a politically-motivated attack on Trump from an entrenched member of America’s political aristocracy as it is an objective assessment of reality. That is, if you were a member of an extremist group and you were in charge of recruiting, you’d be remiss not to mention Trump.

For his part, Trump denies the allegations. Here’s what he said in the wake of Clinton’s comments:

“Nobody has been able to back that up. It’s nonsense. It’s just another Hillary lie. She lies like crazy about everything, whether it’s trips where she was being gunned down in a helicopter or an airplane. She’s a liar, and everybody knows that. But she just made this up in thin air. No fact-checker has been able to back up her claim on that.”

Well, no fact checkers are needed now because al-Shabaab (al-Qaeda’s Somali arm) has released the following video featuring Trump:

Besides Trump, the video stars Anwar al-Awlaki, the top al-Qaeda recruiter who was killed in a US drone strike in 2011. “There are ominous clouds gathering in your horizon,” al-Awlaki says. “Yesterday, America was a land of slavery, segregation, lynching, and Ku Klux Klan. And tomorrow it will be a land of religious discrimination and concentration camps,” he continues.

Will Trump shake this off with the ease he’s shed each and every controversy surrounding his campaign thus far? Probably.

However, it’s worth noting that al-Awlaki gives Muslims living in the West “two choices”: “Either you leave, or you fight,” he says. How would voters respond if this particular video were to serve as the inspiration for an attack on American soil by a US citizen? Would it cause the portion of the electorate who supports the notion of a Muslim ban to reconsier their position or, would such a tragedy only strengthen Trump’s hand by reinforcing the link between Islam and violence?

We’ll leave it to readers to decide.

- On The Trail Of Dubai's Stolen Gold: A Robbed Client Breaks The Silence, And A Fascinating Detail Emerges

On Christmas Day, 2015, we told our readers the fascinating tale about the Turkish-Iranian gold smuggling ring – perhaps the biggest and most brazen in history, one which lasted for years, which saw billions in gold transported out of Turkey and into Iran to allow Tehran to circumvent the western financial sanctions using gold as a medium for bater, and which was all made possible thanks to the tiny Emirate of Dubai.

What made this particular instance of gold smuggling especially memorable is that it reached to the very political top in both Turkey, and Iran, and Dubai.

However, while the broad framework of Turkey’s exporting of gold to Iran, initially directly and then via Dubai, had been already in the public domain, Zero Hedge first revealed the man, or rather people, who made it all possible: the Dubai gold “trading” company of Gold.A.E. – is a subsidiary of Gold Holdings Ltd, a company which is owned by SBK Business Holdings and Abu Dhabi’s second in command, the son and avisor to the ruler of Abu Dhabi, Sheik Sultan bin khalifah Al Nahyan.

The reason why Gold.A.E. suddenly, and very dramatically, emerged on the global arena is because as we first reported a week ago, the company’s “new” management team admitted that after many months of “inquiries”, it had discovered that not only had the “old” management, led by the now former CEO of Gold A.E., Mohammad Abu Alhaj disappeared, but that all the money – and gold – held at Gold.A.E. which once again was primarily a “trading” front for the Turkish-Dubai-Iran gold smuggling triangle, had been stolen.

Here, for those who missed it the first time, is the letter that Gold.A.E.’s stunned clients received in late December:

Dear Client

A group of minority shareholders of GOLD HOLDING suspected that there were questionable financial transactions being undertaken in Gold AE DMCC (“the Company”). Acting on these suspicions they initiated internal investigations. During the course of the investigations the entire then management team abruptly resigned with no notice. Since the majority shareholders also seemed to be unavailable, the minority shareholders did not accept this resignation. However, these persons went to DMCC, submitted their resignations and managed to get their visas cancelled.

Following this, in august 2015, Mr. Andre Gauthier has been appointed as the manager of the Company so that investigations continued and once completed necessary action can be taken to secure the interests of the clients and shareholders of the company. His appointment took effect from August 9 ,2015 . When he took over, new management realized that he now had access to more information concerning the activities of the previous management and, he realized that there had been substantial withdrawals from the company’s account to the personal accounts of some of the management and the majority shareholders.

Management has also uncovered information with respect to the existence of a bank account with Arab Bank (Switzerland) Ltd in Switzerland in the name of the Company. An attempt has been made to approach this bank but, since none of the current management or minority shareholders are signatories to the account and, due to the stringent Swiss banking laws and regulations regarding confidentiality, no additional information or access has been provided by the bank.

In order to try and secure/recover monies that had been taken out of the accounts of the company, Mr. Gauthier in his capacity as manager has filed various cases as against the recipients of the funds from the Company (Dubai Police ( Bur Dubai Police Station), Case No: 24378). The minority shareholders are doing everything within their powers to support him in his efforts to recover these monies that were withdrawn from Gold AE in questionable circumstances.

DMCC has alleged that some of these activities undertaken by the previous management are in breach of DMCC’s rules and as such they have taken the decision to terminate the license of the Company. We are working closely with DMCC to find a solution and in the meanwhile, we request that you bear with us. In the meanwhile, as a statutory consequence of the license being terminated, the trading platform of the Company has to shut down as of the date of termination of the license which is 24th November 2015.

We trust the forgoing is of assistance.

Sincerely,

On behalf of GOLD AE MANAGEMENT

Or, as we said a week ago, one can summarize the letter above by loosely paraphrasing South Park‘s infamous episode: “aaaannd it’s gone. The gold is all gone.“

In a follow up article, “The Mystery Of Dubai’s Vaporized Gold: The Plot Thickens“, we presented readers with the version of events as laid out by the local press, in this case Arabian Business, which tried to assign responsibility for the theft, while in the process exonerating SBK Holdings and its billionaire owner – one of the most important people in the United Arab Amirates – and “washing” their hands of any accountability.

Recall, “the rush to make sure any link between the criminal Gold.AE and its parent, SBK Holdings-owned Gold Holding is immediately severed. A spokesperson for the DIFC said: “We wish to make it clear that although Gold AE is a subsidiary of M/s Gold Holding, which is a DIFC-based holding company, Gold AE and M/s Gold Holding Ltd are two separate entities.”

“We wish also to clarify that M/s Gold Holding Ltd is, to our knowledge, not involved in any trading operations, client-facing business affecting clients of Gold AE or the provision of any financial services. Accordingly, it is not regulated by the Dubai Financial Services Authority.”

But was Gold Holding involved in the smuggling of billions in gold out of Turkey and into Iran? And then, back to Mohamed Abu Alhaj, who just a year ago was the widely respected CEO of Gold AE.

When Arabian Business emailed the public inquiries email address for Gold Holding, info@goldholding.com, it received a reply from Mohammad Abdel Khaleq Abu Al Haj, who is a member of Gold AE’s previous management team facing allegations of fraud.

Al Haj insisted in his email that Gold AE’s existing management team were responsible for the alleged fraudulent activity. He also claimed that requests by him for meetings with shareholders to discuss management issues had been refused.

In short: one side saying the other is guilty, the other side responding identically, blaming the first side. Meanwhile the money – and gold – of the clients of this company, perhaps the most important gold holding company in the Persian Gulf, has been stolen.

* * *

So while we continue to dig into the mystery of Dubai’s stolen gold, one which has received absolutely no mention in the western press – in fact the only reason anyone mentioned Dubai in recent months was the dramatic burning of The Address hotel on New Year’s Eve (as covered here), we got the following curious email from a former client of the company; a client whose gold is now all gone.