- Western Democracy Is An Endangered Species On Its Way To Extinction

Submitted by Paul Craig Roberts,

The British Labour Party no longer represents the working class. Under UK prime minister Tony Blair, the Labour Party became a vassal of the One Percent. The result has been a rebellion in the ranks and the rise of Jeremy Corbyn, a principled Labourite intent on representing the people, a no-no in Western “democracies.”

Corbyn is too real for the Labour Party Blairites, who hope to be rewarded with similar nest eggs as Blair for representing the capitalist One Percent. So what is the corrupted Labour Party doing to prevent Corbyn’s election?

The answer is that it is denying the vote to Corbyn supporters. You can read the story here:

http://www.globalresearch.ca/britains-labour-party-purge-is-underway-preventing-supporters-from-voting-for-jeremy-corbyn/5471194The illegal Egyptian military dictatorship that overthrew on Washington’s orders the first democratically elected government in Egyptian history has issued an edict prohibiting journalists from contradicting the military dictatorship. In brief, the dictatorship installed by Washington has outlawed facts.

Washington rejected the government that the Egyptian people elected, because it appeared that the democratically elected government would have a foreign policy that was at least partially independent of Washington’s. Remember, according to the neocons who, together with Israel, control US foreign policy, countries with independent foreign policies, such as Iran, Russia, and China, are America’s “greatest threats.”

The Egyptian military thugs, following Washington’s orders, have more or less eliminated all of the leadership of the political party that was democratically elected. The party was called the Muslim Brotherhood. In the presstitute Western media, the political party was described more or less as al Qaeda, and how are the ignorant, brainwashed, and propagandized Americans to know any difference? Certainly neither “their” government nor the presstitute media will ever tell them.

With the military dictatorship’s edict, independent news reporting no longer exists in Egypt. Washington is pleased and rewards the dictatorship with bags full of money paid by the hapless and helpless American taxpayers.

Americans should keep in mind that most of the dollars that they pay in income tax are spent either spying upon themselves and the world or killing people in many countries. Without resources taken from American taxpayers millions of women, children, and village elders would still be alive in Afghanistan, Iraq, Libya, Syria, Somalia, Yemen, Pakistan, Ukraine, South Ossetia, and other countries. America is the greatest exporter of violence the world has ever known. So wear your patriotism on your sleeve and be proud. You are a depraved citizen of the world’s worst killer nation. Compared to the USA, Rome was a piker.

France herself seems to be collapsing as a democracy and no longer respects her own laws. According to this report from Kumaran Ira on World Socialist Website https://www.wsws.org/en/articles/2015/08/19/fkil-a19.html ,

“In the name of the “war on terror,” the French state is dramatically accelerating its use of clandestine operations to extra-judicially murder targeted individuals. French President François Hollande reportedly possesses a “kill list” of potential targets and constantly reviews the assassination program with high-ranking military and intelligence officers.

“This program of state murder, violating basic constitutional rights in a country where the death penalty is illegal, underscores the profound decay of French bourgeois democracy. Amid escalating imperialist wars in France’s former colonial empire and deepening political crisis at home, the state is moving towards levels of criminality associated with the war against Algerian independence and the Vichy regime of Occupied France.”

Where do you suppose the socialist president of France got his idea of an illegal and unconstitutional “kill list”? If you answer from “America’s First Black President,” you are correct.

The French people should be outraged that “their” president is nothing more than a murderer and an agent of Washington. But they aren’t. False flag operations have made them fearful. The French like other Western peoples, have ceased to think.

* * *

Every western democracy is gone with the wind. Washed up, Finished. Every value that defined Western civilization and made it great has been flushed by power and greed and arrogance.

Proconsuls have replaced democracy.

I certainly do not believe that Western civilization was ever pure as snow and devoid of sins and crimes against humanity. But it is a fact that in Western civilization, despite the numerous injustices, reforms were possible that improved life for the lower classes. Reforms were possible that restricted the rapaciousness of the rich and powerful. In the US reforms made the impossible come true: ladders of upward mobility made it possible for members of the lowest economic class to become multimillionaires. And this actually happened.

The governments in Washington committed many crimes, but on occasion Washington prevented crimes. Remember President Eisenhower’s ultimatum to Washington’s British, French, and Israeli allies to remove themselves from the Suez Canal in Egypt or else.

Today Washington pushes its allies to commit crimes against humanity. That is what NATO and the National Endowment for Democracy are for.

In my lifetime Americans have always had a good opinion of themselves. But in the 21st century this good opinion has hyper-jumped into hubris and arrogance. If you haven’t been around very long in terms of a human life, you don’t see this. But older people do.

Just as the Roman Empire ended in the destruction of the Roman people, the American Empire will end in the destruction of the American people. Judging from histories, Roman citizens were superior to American citizens; yet, Rome failed.

Americans shouldn’t expect any other outcome. The price to be paid for insouciance, self-satisfaction, and complicity is high.

- Japan's Kuroda Denies Existence Of Currency War As China Devalues Yuan To Fresh 4 Year Lows, Injects CNY150bn Liquidity

The night began much like any other morning in Asia – with pure comedy gold from Japanese leadership with BOJ's Kuroda saying he is "not concerned about currency wars, there is no currency war," adding that he has "no plans for further easing." That coincided with a drift lower in Japanese stocks from the US close – but mots of Asian stock markets were green buoyed by America's victory against malicious sellers for the first time in a week. Meanwhile, in China, margin debt drops to a 7-month lows (but is still up 133% YoY). But as rumor-mongers face death squads and any broker caught not buying with both hands and feet faces prison, it is no surprise that Chinese stocks are higher in the pre-open (A50 +5%, CSI +2.7%) but large corporate bond issues are being canceled willy nilly even as China devalues Yuan to fresh 4-year lows (6.4085) and adds CNY150bn liquidity.

First we turn to Japan…

Some comedy genius from Japan's central banker

- *KURODA: NOT CONCERNED ABOUT CURRENCY WAR, IS NO CURRENCY WAR

- *KURODA: CENTRAL BANKS NOT TARGETING EXCHANGE RATES

- *KURODA: SOME IN MARKET TOO PESSIMISTIC ABOUT CHINA ECONOMY

- *KURODA: FX POLICY IN JAPAN IS UP TO FINANCE MINISTRY

Well yeah apart from China (directly intervening to devalue), Japan (printing $80bn a month doesn't count), Kazakhstan (devalue 25% or die)…

but none of the EMs should worry…

- *KURODA: UNDERSTANDS CONCERNS EXPRESSED BY EMERGING ECONOMIES

And then he dropped this little gem…

- *KURODA: NO PLANS FOR FURTHER EASING

Which sparked a little run…

Don't worry, we got this (just like the PBOC)..

- *KURODA: CAN AVOID ANY SERIOUS FINANCIAL INSTABILITY DURING QQE

What a farce – and these are the people "in charge!!"

* * *

Having got that off our chest, we pivot to China…

Some more good news… the deleveraging continues…

- *SHANGHAI MARGIN DEBT BALANCE FALLS TO LOWEST IN SEVEN MONTHS

But its still up a stunning 133% YoY…

But with witch hunts growing, is it any wonder today's US rally is being escalated in China…

- *FTSE CHINA A50 SEPT. FUTURES RALLY 5.5%

But not everything is awesome…

- *CHINA CSI 300 STOCK-INDEX FUTURES EXTEND GAINS TO 2.7%

But let's get some context for this bounce in light of the last 3 days' utter collapse…

- *CHINA SHANGHAI COMPOSITE SET TO OPEN UP 1.7% TO 2,978.03

But everything is not awesome in bond land…

- *XIAMEN HAICANG INVESTMENT CANCELS BOND SALE ON MKT VOLATILITY

- *XIAMEN HAICANG INVESTMENT CANCELS 1B YUAN BOND SALE

And even with everything awesome in stocks, it appears The PBOC still needed to devalue to frsh 4 year lows,…

- *CHINA SETS YUAN REFERENCE RATE AT 6.4085 AGAINST U.S. DOLLAR

and inject more liquidity…

- *PBOC TO INJECT 150B YUAN WITH 7-DAY REVERSE REPOS: TRADERS

The biggest injection since Nov 2012…

But they have other problems for now…

- *SHANGHAI WARNS CHILDREN, ELDERLY STAY INDOORS ON POLLUTION

- *SHANGHAI AIR `HEAVILY POLLUTED' AS OF 9 A.M.: MONITORING CENTER

And finally another probe…

- *TIANJIN PORT SAYS CHAIRMAN UNDER PROBE

- *TIANJIN PORT SAYS CO. KNOWS ABOUT CHAIRMAN PROBE FROM XINHUA

- *TIANJIN PORT SUSPENDS TRADING IN HONG KONG: 3382 HK

Chinese police have arrested 12 people suspected of involvement in this month's massive explosions in the city of Tianjin that killed 139 people and devastated the port area, the state-run Xinhua news agency said on Thursday.

Among those arrested were the chairman, vice-chairman and three deputy general managers of the logistics company that had been storing the chemicals that blew up, the agency said, quoting police. It did not say who the rest were.

The news comes a day after China sacked the head of its work safety regulator for suspected corruption.

The witch-hunting, blame-mongering, and scape-goating will go on until morale improves.

Charts: Bloomberg

- North Dakota Becomes First State To Legalize Drones Weaponized With Tasers, Tear Gas, Rubber Bullets & Sound Cannons

Submitted by Mike Krieger via Liberty Blitzkrieg blog,

It is now legal for law enforcement in North Dakota to fly drones armed with everything from Tasers to tear gas thanks to a last-minute push by a pro-police lobbyist.

With all the concern over the militarization of police in the past year, no one noticed that the state became the first in the union to allow police to equip drones with “less than lethal” weapons. House Bill 1328 wasn’t drafted that way, but then a lobbyist representing law enforcement—tight with a booming drone industry—got his hands on it.

– From the Daily Beast article: First State Legalizes Taser Drones for Cops, Thanks to a Lobbyist

You could see the writing on the walls years ago. In an increasingly authoritarian, lawless, surveillance state like America, it was always inevitable that drones would be weaponized. In North Dakota, this is now a reality.

Although I haven’t written much about domestic drones as of late, I published many articles on the topic several years ago. In the 2012 piece, Drones in America? They are Already Here…I warned:

Like with any new technology, drones can be put to good use or to evil use. Just like nuclear power can harness energy or destroy humanity altogether, drones could do a lot of good, but the problem is that the government is clearly moving more and more towards a surveillance state so we must be extra careful. Stay vigilant.

Apparently, North Dakotans weren’t particularly vigilant, and now the state has become the first in the nation to legalize weaponized drones; not a distinction they should be proud of. What started out as a bill to require police using drones for surveillance obtain warrants, turned into a law that puts tasers and tear gas on them. Go ‘Merica.

The Daily Beast reports:

It is now legal for law enforcement in North Dakota to fly drones armed with everything from Tasers to tear gas thanks to a last-minute push by a pro-police lobbyist.

With all the concern over the militarization of police in the past year, no one noticed that the state became the first in the union to allow police to equip drones with “less than lethal” weapons. House Bill 1328 wasn’t drafted that way, but then a lobbyist representing law enforcement—tight with a booming drone industry—got his hands on it.

The bill’s stated intent was to require police to obtain a search warrant from a judge in order to use a drone to search for criminal evidence. In fact, the original draft of Rep. Rick Becker’s bill would have banned all weapons on police drones.

Then Bruce Burkett of North Dakota Peace Officer’s Association was allowed by the state house committee to amend HB 1328 and limit the prohibition only to lethal weapons. “Less than lethal” weapons like rubber bullets, pepper spray, tear gas, sound cannons, and Tasers are therefore permitted on police drones.

Even “less than lethal” weapons can kill though. At least 39 people have been killed by police Tasers in 2015 so far, according to The Guardian.

And just in case you’re wondering why North Dakota rolled over so easily. The state is desperate for “economic growth,” even if that growth expands GDP via fascist panopticon surveillance.

Drones in North Dakota are a profitable enterprise in a state hit hard by the oil bust. Companies that market machines for agricultural and commercial use have been popping up in industrial parks on the outskirts of Grand Forks for the better part of the last three years. The university, one of the city’s largest employers, even offers a four-year degree in drones. The Air Force has partnered with the private sector to create a drone research and development park, too.

Drones are overwhelmingly seen as a good thing in North Dakota, which is perhaps why few noticed when HB 1328 passed with a clause allowing them to be armed with non-lethal weapons.

Because it’s imperative to national security that we make this, so much easier…

Great work North Dakota. Let’s hope the rest of us aren’t so hopelessly stupid.

- China's Great Wall Of Worry – Goldman Warns China Options Signal Caution Ahead

Via Goldman Sachs,

China has been the epicenter of recent market concerns as global markets focus on China's growth trajectory. Equity markets have been hit hard. The Shanghai Composite is down -43% since its peak on June 12th; with -21% of that down-move coming over the last five trading days. HSCEI is down -32% since June 12th, -12% over the past week. On August 25th the PBOC announced a series of moves including lowering the benchmark lending and deposit rate by 25 bps and the reserve requirement ratio by 50 bps.

What is the options market telling us? HSCEI implied volatility > 40, term structure inversion and high skew, all signal caution.

HSCEI: 1m implieds 43, term structure sharply inverted. HSCEI 1m implied volatility jumped 16 points over the last week and as of Tuesday August 25 market close stood at 43, its highest level since Aug-11. A similar story for FXI, where 1m implieds were up 21 points in a week, peaked at 49, and then dropped to 45 after the PBOC announcement and subsequent FXI rally. The HSCEI and FXI term structures are both sharply inverted, continuing to signal caution.

Skew spiked: Earlier in the year, as the rally in Chinese equities was in full force, higher demand for upside calls rather than downside put hedges led to a rarity in the options market. HSCEI, HSI, and FXI were the only major global indices with negative skew. Since mid-April, skew on these indices has done a 180 degree turn, and after a sharp spike, is now positive and fast approaching highs last seen in 2011-2012.

* * *

Trade accordingly…

- Deflationary Collapse Ahead?

Submitted by Gail Tverberg via OurFiniteWorld.com,

Both the stock market and oil prices have been plunging. Is this “just another cycle,” or is it something much worse? I think it is something much worse.

Back in January, I wrote a post called Oil and the Economy: Where are We Headed in 2015-16? In it, I said that persistent very low prices could be a sign that we are reaching limits of a finite world. In fact, the scenario that is playing out matches up with what I expected to happen in my January post. In that post, I said

Needless to say, stagnating wages together with rapidly rising costs of oil production leads to a mismatch between:

- The amount consumers can afford for oil

- The cost of oil, if oil price matches the cost of production

This mismatch between rising costs of oil production and stagnating wages is what has been happening. The unaffordability problem can be hidden by a rising amount of debt for a while (since adding cheap debt helps make unaffordable big items seem affordable), but this scheme cannot go on forever.

Eventually, even at near zero interest rates, the amount of debt becomes too high, relative to income. Governments become afraid of adding more debt. Young people find student loans so burdensome that they put off buying homes and cars. The economic “pump” that used to result from rising wages and rising debt slows, slowing the growth of the world economy. With slow economic growth comes low demand for commodities that are used to make homes, cars, factories, and other goods. This slow economic growth is what brings the persistent trend toward low commodity prices experienced in recent years.

A chart I showed in my January post was this one:

Figure 1. World Oil Supply (production including biofuels, natural gas liquids) and Brent monthly average spot prices, based on EIA data.

The price of oil dropped dramatically in the latter half of 2008, partly because of the adverse impact high oil prices had on the economy, and partly because of a contraction in debt amounts at that time. It was only when banks were bailed out and the United States began its first round of Quantitative Easing (QE) to get longer term interest rates down even further that energy prices began to rise. Furthermore, China ramped up its debt in this time period, using its additional debt to build new homes, roads, and factories. This also helped pump energy prices back up again.

The price of oil was trending slightly downward between 2011 and 2014, suggesting that even then, prices were subject to an underlying downward trend. In mid-2014, there was a big downdraft in prices, which coincided with the end of US QE3 and with slower growth in debt in China. Prices rose for a time, but have recently dropped again, related to slowing Chinese, and thus world, economic growth. In part, China’s slowdown is occurring because it has reached limits regarding how many homes, roads and factories it needs.

I gave a list of likely changes to expect in my January post. These haven’t changed. I won’t repeat them all here. Instead, I will give an overview of what is going wrong and offer some thoughts regarding why others are not pointing out this same problem.

Overview of What is Going Wrong

- The big thing that is happening is that the world financial system is likely to collapse. Back in 2008, the world financial system almost collapsed. This time, our chances of avoiding collapse are very slim.

- Without the financial system, pretty much nothing else works: the oil extraction system, the electricity delivery system, the pension system, the ability of the stock market to hold its value. The change we are encountering is similar to losing the operating system on a computer, or unplugging a refrigerator from the wall.

- We don’t know how fast things will unravel, but things are likely to be quite different in as short a time as a year. World financial leaders are likely to “pull out the stops,” trying to keep things together. A big part of our problem is too much debt. This is hard to fix, because reducing debt reduces demand and makes commodity prices fall further. With low prices, production of commodities is likely to fall. For example, food production using fossil fuel inputs is likely to greatly decline over time, as is oil, gas, and coal production.

- The electricity system, as delivered by the grid, is likely to fail in approximately the same timeframe as our oil-based system. Nothing will fail overnight, but it seems highly unlikely that electricity will outlast oil by more than a year or two. All systems are dependent on the financial system. If the oil system cannot pay its workers and get replacement parts because of a collapse in the financial system, the same is likely to be true of the electrical grid system.

- Our economy is a self-organized networked system that continuously dissipates energy, known in physics as a dissipative structure. Other examples of dissipative structures include all plants and animals (including humans) and hurricanes. All of these grow from small beginnings, gradually plateau in size, and eventually collapse and die. We know of a huge number of prior civilizations that have collapsed. This appears to have happened when the return on human labor has fallen too low. This is much like the after-tax wages of non-elite workers falling too low. Wages reflect not only the workers’ own energy (gained from eating food), but any supplemental energy used, such as from draft animals, wind-powered boats, or electricity. Falling median wages, especially of young people, are one of the indications that our economy is headed toward collapse, just like the other economies.

- The reason that collapse happens quickly has to do with debt and derivatives. Our networked economy requires debt in order to extract fossil fuels from the ground and to create renewable energy sources, for several reasons: (a) Producers don’t have to save up as much money in advance, (b) Middle-men making products that use energy products (such cars and refrigerators) can “finance” their factories, so they don’t have to save up as much, (c) Consumers can afford to buy “big-ticket” items like homes and cars, with the use of plans that allow monthly payments, so they don’t have to save up as much, and (d) Most importantly, debt helps raise the price of commodities of all sorts (including oil and electricity), because it allows more customers to afford products that use them. The problem as the economy slows, and as we add more and more debt, is that eventually debt collapses. This happens because the economy fails to grow enough to allow the economy to generate sufficient goods and services to keep the system going–that is, pay adequate wages, even to non-elite workers; pay growing government and corporate overhead; and repay debt with interest, all at the same time. Figure 2 is an illustration of the problem with the debt component.

Where Did Modeling of Energy and the Economy Go Wrong?

- Today’s general level of understanding about how the economy works, and energy’s relationship to the economy, is dismally low. Economics has generally denied that energy has more than a very indirect relationship to the economy. Since 1800, world population has grown from 1 billion to more than 7 billion, thanks to the use of fossil fuels for increased food production and medicines, among other things. Yet environmentalists often believe that the world economy can somehow continue as today, without fossil fuels. There is a possibility that with a financial crash, we will need to start over, with new local economies based on the use of local resources. In such a scenario, it is doubtful that we can maintain a world population of even 1 billion.

- Economics modeling is based on observations of how the economy worked when we were far from limits of a finite world. The indications from this modeling are not at all generalizable to the situation when we are reaching limits of a finite world. The expectation of economists, based on past situations, is that prices will rise when there is scarcity. This expectation is completely wrong when the basic problem is lack of adequate wages for non-elite workers. When the problem is a lack of wages, workers find it impossible to purchase high-priced goods like homes, cars, and refrigerators. All of these products are created using commodities, so a lack of adequate wages tends to “feed back” through the system as low commodity prices. This is exactly the opposite of what standard economic models predict.

- M. King Hubbert’s “peak oil” analysis provided a best-case scenario that was clearly unrealistic, but it was taken literally by his followers. One of Hubbert’s sources of optimism was to assume that another energy product, such as nuclear, would arise in huge quantity, prior to the time when a decline in fossil fuels would become a problem.

Figure 3. Figure from Hubbert’s 1956 paper, Nuclear Energy and the Fossil Fuels.

The way nuclear energy operates in Figure 2 seems to me to be pretty much equivalent to the output of a perpetual motion machine, adding an endless amount of cheap energy that can be substituted for fossil fuels. A related source of optimism has to do with the shape of a curve that is created by the sum of curves of a given type. There is no reason to expect that the “total” curve will be of the same shape as the underlying curves, unless a perfect substitute (that is, having low price, unlimited quantity, and the ability to work directly in current devices) is available for what is being modeled–here fossil fuels. When the amount of extraction is determined by price, and price can quickly swing from high to low, there is good reason to believe that the shape of the sum curve will be quite pointed, rather than rounded. For example we know that a square wave can be approximated using the sum of sine functions, using Fourier Series (Figure 4).

Figure 4. Sum of sine waves converging to a square wave. Source: Wolfram Mathworld.

- The world economy operates on energy flows in a given year, even though most analysts today are accustomed to thinking on a discounted cash flow basis. You and I eat food that was grown very recently. A model of food potentially available in the future is interesting, but it doesn’t satisfy our need for food when we are hungry. Similarly, our vehicles run on oil that has recently been extracted; our electrical system operates on electricity that has been produced, essentially simultaneously. The very close relationship in time between production and consumption of energy products is in sharp contrast to the way the financial system works. It makes promises, such as the availability of bank deposits, the amounts of pension payments, and the continuing value of corporate stocks, far out into the future. When these promises are made, there is no check made that goods and services will actually be available to repay these promises. We end up with a system that has promised very many more goods and services in the future than the real world will actually be able to produce. A break is inevitable; it looks like the break will be happening in the near future.

- Changes in the financial system have huge potential to disrupt the operation of the energy flow system. Demand in a given year comes from a combination of (wages and other income streams in a given year) plus the (change in debt in a given year). Historically, the (change in debt) has been positive. This has helped raise commodity prices. As soon as we start getting large defaults on debt, the (change in debt) component turns negative, and tends to bring down the price of commodities. (Note Point 6 in the previous section.) Once this happens, it is virtually impossible to keep prices up high enough to extract oil, coal and natural gas. This is a major reason why the system tends to crash.

- Researchers are expected to follow in the steps of researchers before them, rather than starting from a basic understudying of the whole problem. Trying to understand the whole problem, rather than simply trying to look at a small segment of a problem is difficult, especially if a researcher is expected to churn out a large number of peer reviewed academic articles each year. Unfortunately, there is a huge amount of research that might have seemed correct when it was written, but which is really wrong, if viewed through a broader lens. Churning out a high volume of articles based on past research tends to simply repeat past errors. This problem is hard to correct, because the field of energy and the economy cuts across many areas of study. It is hard for anyone to understand the full picture.

- In the area of energy and the economy, it is very tempting to tell people what they want to hear. If a researcher doesn’t understand how the system of energy and the economy works, and needs to guess, the guesses that are most likely to be favorably received when it comes time for publication are the ones that say, “All is well. Innovation will save the day.” Or, “Substitution will save the day.” This tends to bias research toward saying, “All is well.” The availability of financial grants on topics that appear hopeful adds to this effect.

- Energy Returned on Energy Investment (EROEI) analysis doesn’t really get to the point of today’s problems. Many people have high hopes for EROEI analysis, and indeed, it does make some progress in figuring out what is happening. But it misses many important points. One of them is that there are many different kinds of EROEI. The kind that matters, in terms of keeping the economy from collapsing, is the return on human labor. This type of EROEI is equivalent to after-tax wages of non-elite workers. This kind of return tends to drop too low if the total quantity of energy being used to leverage human labor is too low. We would expect a drop to occur in the quantity of energy used, if energy prices are too high, or if the quantity of energy products available is restricted.

- Instead of looking at wages of workers, most EROEI analyses consider returns on fossil fuel energy–something that is at least part of the puzzle, but is far from the whole picture. Returns on fossil fuel energy can be done either on a cash flow (energy flow) basis or on a “model” basis, similar to discounted cash flow. The two are not at all equivalent. What the economy needs is cash flow energy now, not modeled energy production in the future. Cash flow analyses probably need to be performed on an industry-wide basis; direct and indirect inputs in a given calendar year would be compared with energy outputs in the same calendar year. Man-made renewables will tend to do badly in such analyses, because considerable energy is used in making them, but the energy provided is primarily modeled future energy production, assuming that the current economy can continue to operate as today–something that seems increasingly unlikely.

- If we are headed for a near term sharp break in the economy, there is no point in trying to add man-made renewables to the electric grid. The whole point of adding man-made renewables is to try to keep what we have today longer. But if the system is collapsing, the whole plan is futile. We end up extracting more coal and oil today, in order to add wind or solar PV to what will soon become a useless grid electric system. The grid system will not last long, because we cannot pay workers and we cannot maintain the grid without a financial system. So if we add man-made renewables, most of what we get is their short-term disadvantages, with few of their hoped-for long-term advantages.

Conclusion

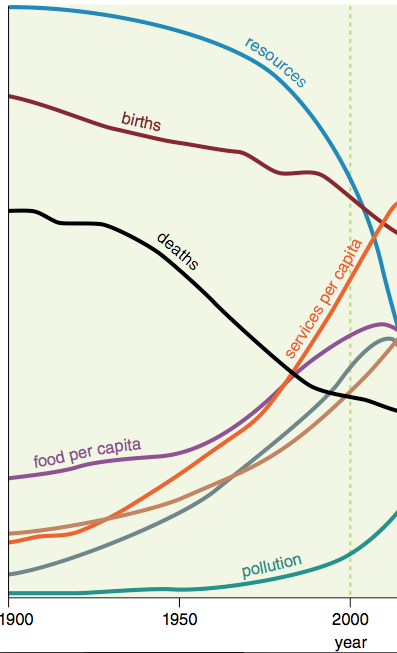

The analysis that comes closest to the situation we are reaching today is the 1972 analysis of limits of a finite world, published in the book “The Limits to Growth” by Donella Meadows and others. It models what can be expected to happen, if population and resource extraction grow as expected, gradually tapering off as diminishing returns are encountered. The base model seems to indicate that a collapse will happen about now.

Figure 5. Base scenario from 1972 Limits to Growth, printed using today’s graphics by Charles Hall and John Day in “Revisiting Limits to Growth After Peak Oil” http://www.esf.edu/efb/hall/2009-05Hall0327.pdf

The shape of the downturn is not likely to be correct in Figure 5. One reason is that the model was put together based on physical quantities of goods and people, without considering the role the financial system, particularly debt, plays. I expect that debt would tend to make collapse quicker. Also, the modelers had no experience with interactions in a contracting world economy, so had no idea regarding what adjustments to make. The authors have even said that the shapes of the curves, after the initial downturn, cannot be relied on. So we end up with something like Figure 6, as about all that we can rely on.

Figure 6. Figure 5, truncated shortly after industrial output per capita (grey) and food per capita turns down, since modeled amounts are unreliable after that date.

If we are indeed facing the downturn forecast by Limits to Growth modeling, we are facing a predicament that doesn’t have a real solution. We can make the best of what we have today, and we can try to strengthen bonds with family and friends. We can try to diversify our financial resources, so if one bank encounters problems early on, it won’t be a huge problem. We can perhaps keep a little food and water on hand, to tide us over a temporary shortage. We can study our religious beliefs for guidance.

Some people believe that it is possible for groups of survivalists to continue, given adequate preparation. This may or may not be true. The only kind of renewables that we can truly count on for the long term are those used by our forefathers, such as wood, draft animals, and wind-driven boats. Anyone who decides to use today’s technology, such as solar panels and a pump adapted for use with solar panels, needs to plan for the day when that technology fails. At that point, hard decisions will need to be made regarding how the group will live without the technology.

We can’t say that no one warned us about the predicament we are facing. Instead, we chose not to listen. Public officials gave a further push in this direction, by channeling research funds toward distant theoretically solvable problems, instead of understanding the true nature of what we are up against. Too many people took what Hubbert said literally, without understanding that what he offered was a best-case scenario, if we could find something equivalent to a perpetual motion machine to help us out of our predicament.

- Dow Follows Biggest Crash Since Lehman With Third Biggest One Day Surge Ever As China Dumps Treasurys

Another dead cat bounce… but this one didn't completely collapse… which means…

S&P kisses goodbye to #correction. #Adios!

— Amanda Drury (@MandyCNBC) August 26, 2015

Log in to Etrade like pic.twitter.com/FhjdbiBWf5

— 3:30 Ramp Capital™ (@RampCapitalLLC) August 26, 2015

Victory!!!

As Nasdaq gets back into the green for the week!! Mission Accomplished…

As post-European close panic-buying hit US Stocks…

And Bonds were brutalized today as the realization that China is selling spreads… This is the worst 2-day percentage yield rise for 30Y bonds since Oct 2011.

And bond liquidity was absymal….

10Y Futures Volume 8/19: 1,342,746 8/20: 1,144,180 8/21: 1,378,470 8/24: 2,922,005 8/25: 3,111,586 Today: 1,349,883

— Stalingrad & Poorski (@Stalingrad_Poor) August 26, 2015

Another day, another overnight ramp on vapor-thin volume to maintain the illusion into the US open…

And then the panic-buying ensued.

CNBC cheerleaders out en masse today once again… which made one tweeter think…

if as cnbc says this is a healthy correction – why are they running "Markets In Turmoil" every night?

— Tim Backshall (@credittrader) August 26, 2015

But thanks to USDJPY, eveything was awesome…

Volume was weaker than it has been in the flush…

NOTE – today saw another lower high!! Be Careful

Today was the biggest short squeeze since mid Dec 2014…

Perhaps a little context is required for this 'healthy correction'… Todsay is The Dow's biggest point gain since Oct 2008 (and biggest percentage gain since Nov 2011)

AAPL's best day since April 2014…

And VIX saw its signal early on and pushed down to meet it… VIX crashes below 30 once again…

Meanwhile – have no fear, The VIX Term Structure is 'normal'….

looks totally safe pic.twitter.com/6B7iV6RQMA

— HedgedIn (@noalpha_allbeta) August 26, 2015

Chatter that credit risk has turned are overstated… as counterparty risk seems notably bid still…

But the S&P has caught down to the weakness in the credit cycle…

EUR weakness and Cable hammered drove the USD Index higher on the day and back into the green for the week…

Commodities were all sold with silver and gold worst hit. The PMs did stabilize a little after Europe closed as copper & crude kept sliding…

WTI ended at the lows of the day with a $38 handle once again (despite weak production and a big draw)…

We leave you with this comment from one bruight CNBC anchor, smiling gormelssly at thblionkg green lights…

"Concfidence In The Market Has Been Restored"

So no need for 'Markets In Turmoil" shows anymore then?

Charts: Bloomberg

Bonus Chart: A Change In Trend Is Coming…

The one Sentiment Survey that's NOT contrarian signaling potential change in trend pic.twitter.com/tM2fK8DogK

— Not Jim Cramer (@Not_Jim_Cramer) August 26, 2015

- "Would You Finance Your Kicks?": Shoe-Backed Securities Are On The Way

Meet “Affirm“, a startup from PayPal co-founder Max Levchin whose mission is, according to the “company” section of their website, “[to use] modern technology to re-imagine and re-build core components of financial infrastructure from the ground up… focusing on improving the lives of everyday consumers with less expensive, more transparent financial products.”

Can’t decipher that? That’s ok, neither can we.

Fortunately, Affirm sums it up more succinctly in the “buy with Affirm” section: “pay over time for your most important purchases.”

Now we understand. Essentially, what Affirm does is “connect directly with online stores” and then loans you money to buy things from said stores.

But not just any things.

“Important things.”

Like $1,000 Air Jordans.

Here’s Hypebeast:

Longing for that rare pair of kicks that you need to have but can’t cough up the money? That doesn’t have to be a problem anymore, because Flight Club is now offering financing options for up to a year. Leaders in the consignment game, paying for these pricey kicks has always been an issue especially with younger consumers as prices can go up into the thousands. Much like buying other pricey items such as cars, houses or jewelry, you’re now able to finance goods (borrow money) from a credit company as long as you agree to pay it all back, with interest. Partnering with AFFIRM, Flight Club kicks such as the ”Fragment” Air Jordan 1 is at $123.01 USD a month, while the Nike Air MAG is at $702.90 USD a month. This seems much better than coughing up the total amount at check. The process seems simple enough:

Enjoy your purchase immediately, with no hidden fees. Provide some basic information and get instant approval to split your purchase (up to $10,000) into 3, 6, or 12 monthly payments with rates from 10-30% APR. Just select Pay with AFFIRM at checkout.

Hypebeast then asks: “would you finance your kicks?”

And while we’ll plead the fifth on that question, it’s only natural for us to speculate that given the success of recent ABS offerings from Springleaf and OneMain, and given the fact that “other” consumer loan-backed ABS supply is expected to come in at around $30 billion this year, it may be only a matter of time before pools of loans for shoes are run through the Street’s securitization machine and sold to investors as a tradable security and on that note, we’ll leave you with the following original schematic for tranching loans-for-kicks:

(Note: this assumes that the more expensive the financed pair of kicks, the more creditworthy the borrower)

- China & The Return Of The "Yellow Peril" – The Muddled Economics Of Scapegoating

Submitted by Justin Raimondo via AntiWar.com,

As the US stock market was dropping 1,000 points on Monday morning, US commentators were pinning the blame on China. The Chinese economy, they said, was slowing down: what had been the “engine” of worldwide economic expansion was running out of fuel. The clear implication was that China’s rulers were somehow responsible for the sudden evaporation of over $2 trillion in assets over three days of the market plunge.

This focus on China as the foreign culprit behind America’s economic woes is being broadcast far and wide by Donald Trump, the mercurial demagogue who has put foreigner-bashing at the center of the political discourse. China’s rulers are “smart,” he says, while ours are “dumb.” Chinese leader Xi Jinping is slated to visit the United States and The Donald doesn’t want him to be feted at a fancy White House dinner: instead, he wants to feed him a Big Mac from McDonald’s because China has “sucked all of our jobs.”

Our jobs. Our inflated stock market prices. An American politician can’t lose by appealing to our sense of entitlement, and Trump certainly knows how to play that tune. Americans are never to blame for the consequences of their own folly: it’s always somebody else’s fault. That’s why the need for a scapegoat is a staple of American politics: today it’s the Mexicans and the Chinese, during the cold war era it was the Russians and the Japanese. Remember when it was cheap Japanese goods that were “stealing” our markets?

The portrayal of China as this sleeping giant that is now awakening to take over the world – and take our jobs – is, like most such conceptions, a total delusion. The Peoples Republic of China is weak in almost every sense: politically, economically, and militarily, the PRC is a paper tiger – as Mao Tse-tung liked to characterize the US – and its rulers are sitting atop a volcano.

Yes, China has made great strides since the dark days of the Cultural Revolution and the Mao era: having abandoned communism and gone in for a form of state capitalism, the leaders of the no-longer-Communist Party of China have unleashed the natural entrepreneurial spirit of their people. In doing so, however, they have also unleashed the “creative destruction” that comes with capitalism – and, perhaps, they have also ensured their own destruction.

Of course the Chinese commies haven’t instituted laissez-faire: their “capitalism” resembles our own times ten, i.e., it is what we call crony-capitalism. It is driven, in short, by politics, not by the spontaneous order of the market: it is monopolistic, not competitive. The big industries are controlled by China’s version of the One Percent: the “princelings,” the children of the Communist Party elite who are flaunting their wealth and privileges in a society still officially committed to the egalitarianism of the Mao era. This is a surefire recipe for social unrest, and in spite of the Communist Party’s tight rein on the media we are beginning to see evidence of social turmoil boiling up to the surface. Although China is regularly characterized as a “totalitarian” state by human rights activists, there are an estimated 90,000 “mass incidents” – raucous protests that often turn into riots – each year.

The reasons for this are as multitudinous as the local issues that have been vexing China’s lower and middle classes – housing, land issues, official corruption, rising crime rates – but all are related to the system China’s rulers have constructed in the years after the fall of the “Gang of Four” and the discrediting of Maoist ultra-leftism. It is the same system that exists in our own country magnified a hundred times: state-privileged politically-driven capitalism.

Under this system, the Communist Party elite has “privatized” a large percentage of the means of production and turned it over to … themselves. Utilizing the Party’s control of the economy, these state-controlled (and some ostensibly “private”) companies dominate the commanding heights of the Chinese economy. As a corollary development, economic liberalization has created burgeoning upper and middle class sectors with buying power far beyond the reach of China’s rural peasant masses.

In short, economic inequality has skyrocketed, and, in the context of China’s history, this represents a dire threat to the political class: after all, Maoism is still the official ideology of the Chinese Communist Party, albeit greatly modified in the years since Mao’s death. The distance between official ideals and everyday reality grows ever greater, and this is a major problem for China’s rulers as protests become more frequent and more violent.

While China’s ruling elite presents a unified face to the world, the Communist Party – like all parties everywhere – is rife with factionalism, and the effects of behind-the-scenes maneuvering is exacerbated by the country’s legendary opacity. One never knows who or what is on top in the upper reaches of the Chinese elite, and the result is uncertainty and instability.

This inherent instability is enhanced by a systemic problem. In imitating Western-style capitalism, the Chinese have combined Keynesian pump-priming – flooding the country with freshly-printed money – with Maoist-style central planning. It is Krugmanism combined with the old Soviet-type Five Year Plan. Certain favored industries are targeted for growth, with quotas set and inevitably fulfilled, and this has resulted in the creation of a series of bubbles – in real estate, investment, and credit – that are fated to pop.

The portrayal of China as a giant – either as a benign one, in the form of an economic powerhouse that will provide a ready market for Western exports, or as an economic and military threat that is taking “our jobs” and potentially replacing the US as the dominant military power – is in itself a bubble, a myth on the brink of exploding. In reality, the Peoples Republic is a makeshift construction with a very fragile foundation, one that could give way at any time. And there is plenty of seismic movement beneath the surface of Chinese society: a rising middle class whose expectations cannot be met, a volatile peasant mass, corruption on such a scale that it has become the norm, and a rising nationalism that the Communist Party elite fears even as it tries to manipulate it for its own purposes.

Too big to control, too volatile to be predictable, and too full of contradictions to achieve stability, China is a society that is on the edge of coming completely unglued. So the Donald Trumps of this world are wrong, as usual, in conjuring a vision of the Yellow Peril. China isn’t eating our lunch: indeed, their own “iron rice bowl” – the old Maoist guarantee of full employment and state support for the masses – is in the process of being melted down. Which means we might expect a demagogue to arise out of the ensuing chaos, one who attacks “foreign devils,” appeals to populist prejudices, and aspires to “Make China Great Again” – a Chinese version of Donald Trump.

Trump’s bombastic anti-Chinese rhetoric – China “will bring us down,” be bloviates – is ironic to the nth degree. Appealing to the typical American conceit that nothing that ever happens to us is our own fault, Trump’s scapegoating is a reflection of widespread economic ignorance. For the reality is that the policies of our own rulers limn those of the Chinese: pump-priming the currency, flooding the US economy with money, and creating massive bubbles is something they learned from us. And those policies are having the same effect here as they are having in China.

This piles irony on top of irony, for it provides more grist for the Trumpian mill of scapegoating, economic protectionism, and nonsensical denunciations of the “Yellow Peril.” Yes, the wheel turns around and around, a veritable perpetual motion machine of prejudice, ignorance, and malice.

The program of Trumpismo – trade barriers, foreigner-bashing, and the myth of a Lost Greatness – is a recipe for war. If goods – and people – don’t cross borders, then armies soon will. If “foreigners” are blamed for America’s problems, then it won’t be long before we’re taking up arms against them. As the “Make America Great Again” crowd grows in strength, a country that measures “greatness” in terms of military strength is bound to turn to war as a panacea for all its ills.

- Americans Are "Fired Up" About First Commercially Available Flamethrowers

On the heels of the shooting at Sandy Hook back in 2012, the gun control debate in America reached a fever pitch. Of course all of the attention and subsequent lawmaker scrutiny had the predictable effect of boosting demand for firearms, as many feared their Second Amendment rights were soon to be curtailed.

Gun control was back in the national spotlight last month, after the tragic massacre at an African American church in Charleston, and no sooner had that begun to fade from America’s collective memory than we witnessed yet another shooting, this time in a movie theatre in Louisiana.

Then, on Wednesday morning, a “disgruntled” newsman filmed himself shooting and killing a cameraman and another reporter then posted the shocking video on both Twitter and Facebook. The shooter was African American and cited the Charleston shootings as a motive. Obviously, this means it’s only a matter of days (or hours) before the gun control debate kicks into hyperdrive, sparking further fears of federal firearm confiscation.

And while it’s semi automatic handguns and assault rifles that have been at the center of the debate thus far, there’s another type of weapon that, although currently legal, may come under scrutiny soon, which is leaving some enthusiasts “fired up” so to speak, about getting in before regulations close the market: flamethrowers.

Here’s more from arstechnica:

In the wake of two companies now selling the first commercially available flamethrowers in the United States, at least one mayor has called for increased restrictions on their use. And to no one’s surprise, the prospect of prohibition has now driven more sales.

“Business is skyrocketing higher than ever due to the discussion on prohibition,” Chris Byars, the CEO of the Ion Productions Team based in Troy, Michigan, told Ars by e-mail.

“I’m a huge supporter of personal freedom and personal responsibility. Own whatever you like, unless you use it in a manner that is harmful to another or other’s property. We’ve received a large amount of support from police, fire, our customers, and interested parties regarding keeping them legal.”

Yes, support from “police” and “fire,” which is both disturbing and odd all at once given that, respectively i) no one wants to confront a trigger happy police officer wielding a flamethrower and, ii) traditionally, firemen are in the business of extinguising fires, not starting them.

In any event, back to arstechnica:

Byars added that the company has sold 350 units at $900 each, including shipping, in recent weeks. That’s in addition to the $150,000 the company raised on IndieGoGo.

The Ion product, known as the XM42, can shoot fire over 25 feet and has more than 35 seconds of burn time per tank of fuel. With a full tank of fuel, it weighs just 10 pounds.

Another company—XMatter, based in Cleveland, Ohio—sells a similar device for $1,600 each, but it weighs 50 pounds. However, this device has approximately double the range of the XM42. Quinn Whitehead, the company’s co-founder, did not immediately respond to Ars’ request for comment.

Why does one need a handheld flamethrower, you ask? Here are some “ideas” from the Ion Productions’ official XM42 website:

- start your bonfire from across the yard

- kill the weeds between your cracks in style

- clearing snow/ice

- controlled burns/ground-clearing of foliage/agricultural

- insect control

As Ion goes on to point out (correctly, we might add), there are “endless possibilities for entertainment and utility.”

And don’t worry all you lefties out there, in the FAQ section the answer to the question “Is there a left handed model?” is emphatically “yes.”

Amusingly, flamethrowers – which, on a literal interpretation, would seem to be the very definition of the term “fire-arm” – are not actually counted as such by the ATF:

“These devices are not regulated as they do not qualify as firearms under the National Firearms Act,” Corey Ray, a spokesman with the Bureau of Alcohol, Tobacco, and Firearms, told Ars by e-mail.

Asked what the point of building and selling flamethrowers is, Byars said simply: “It’s awesome.”

Meanwhile, Warren, Michigan Mayor Jim Fouts isn’t so sure and because we like to encourage people to decide for themselves on the merits of contentious issues, we’ll close with the following rather amusingly deadpan bit from Fouts, explaining his position, and leave it to readers to discuss:

“My concern is that flamethrowers in the wrong hands could cause catastrophic damage either to the person who is using it or more likely to the person who is being targeted. This is a pretty dangerous mix because it’s a combination of butane and gasoline which is highly flammable. Anybody who aims this at someone else or something happens and it happens close to them is going to be close to be incinerated.”

* * *

- What An Actual Leader Might Say

Submitted by Paul Rosenberg via Free-Man's Perspective,

In the current deluge of wannabe leaders clamoring for attention and trying to convince us that they are the boss who should be applying rules to us, it strikes me that all of them are looking backward and none are looking forward. (I do not consider “My administration will give you more bennies” to be seriously forward-looking.)

So, since none of this crowd is going to venture anywhere outside of their hermetically sealed status quo, I’d like to give you an example of something a real leader might say.

Late summer 2015, Anytown, USA: A small platform stands at the edge of a cornfield. A very average-looking person steps up to a microphone and speaks:

Friends,

I stand here, not to praise you, but to acquaint you with reality, at least as well as I am able. Perhaps that means I should be killed or at least run out of town. But if that’s so, then so be it. I am tired of living a life other than my own – the pre-scripted, advertiser-generated life that is shoved before my eyes day by day. And I suspect that some of you are tired of it as well.

Please allow me to begin by pointing out that all the fights from all the platforms this election cycle will concern trivialities – Team Red versus Team Blue – and competing varieties of fears – terrorists versus outlawed unions versus less free stuff versus whatever works in your little corner of the world. At most, these are fights over personalities – He’s an arrogant ass, she’s a conniving witch, and so on – all of which really come down to, “My opponent is scarier than I am.”

None of these bobbleheads will ask the questions that matter: Who are we? What do we want? Where should we be headed?

You see, once we get past all the publicized fears – some real, but most imaginary – the dialog we’re having, if we care to admit it, is mostly self-praise. We laud our great “democracy,” even though not one in a thousand can define it. Or we brag about our wonderful “freedom” but avoid defining it, knowing that our definition wouldn’t stand up to the test. Freedom is “what we have,” and further questions are evidence of stupidity, bordering on treason.

The truth is that we’ve trained ourselves to evade reality. Praising ourselves is so much easier: Team America!

By doing this, my friends, we’ve been blind to the greatest opportunity that has ever stood before a human generation: If we wanted to, we could quickly and easily step into a golden age. In fact, we’ve been doing just that, half by accident, for a long time. If we bothered to work at it, even halfheartedly, we’d go down in history as the generation that transformed humanity forever.

But perhaps most of us wouldn’t like that. And if so, that’s our choice to make. My objection is that no one bothers to talk about it.

I’d like for you, for just a few seconds, to take a look at two graphs, which I pulled out of Julian Simon’s The State of Humanity. The first graph shows how much wheat is not grown, because our production capacity is so much greater than our demand for wheat.

This second one shows the price of wheat measured in wages.

And I have others like this, for other commodities.

There is one message that comes screaming through here, and it’s one that I know can be deeply troubling. Nonetheless, that message is true: Scarcity on planet Earth is dying.

I’ll pause to allow you a small freakout over that, to let all those prerecorded messages run screaming through your mind.

You see, our ruling systems have been built on the assumption of scarcity, and the idea that scarcity may be failing throws us into crisis.

Isn’t it odd that good news should upset us?

Scarcity, sadly, became more than a sad fact to us; it became a psychological necessity. But what if we no longer need to fight over resources? Is that a concept that we should rush to eliminate?

And in actual fact, there are fewer and fewer starving people all the time, and most of those are starving because of political distortions, not because of insufficient production technology.

All of this reminds me of a comment from Buckminster Fuller that I like to condense:

I decided man was operating on a fundamental fallacy: that he was destined to be a failure. I decided that man was, in fact, designed to be an extraordinary success. His characteristics were magnificent; what he needed was to discover the comprehensive patterns operating in the universe.

So, what if humanity is designed to be an extraordinary success? Why should this thought repel us, even before we honestly consider it?

You see, these are things we need to discuss.

We are, whether we like it or not, stepping out of scarcity, and it seems to me that we should decide whether or not that’s a good thing.

Our problem – our real problem, if we can muster the courage to admit it – is that we’re living with space-age technology and bronze-age rulership. But we can get past this problem if we wish, and we can easily meet all of humanity’s basic needs… if we wish.

But perhaps we don’t want to. Maybe it’s more important to us that we should be the biggest dog in town and that everyone else should be a little yap-yap dog.

And if that’s the case, we need to admit it to ourselves. Perhaps we’ll decide that what we really need is to be the dominant dog, and that all the morality stuff we talk about – golden rules and loving our neighbors – was all juvenile blather; that what we really want is to dominate everyone else.

And if that’s the case, we should get busy rebuilding our civilization in the form of the Roman Empire. We should get serious about beating the hell out of everyone else… at least until a new Christ comes along (or perhaps just people who remember the old one) and convinces our subjects that there’s a better way to live.

But in the meantime, we could kick the crap out of a billion brown people for a century or two, minimum. That’s our choice to make, of course, I’m only suggesting that we be forthright about it.

So, my friends, let me conclude by saying this:

If what we really want is to be the big dog, to feast on the fact that we’re able to kick all the smaller dogs around, then let’s do it. Let’s go full-Caesar on ’em. Let’s conquer everything, steal what we like, and live it up.

Or, if that’s not what we really want, then let’s get the golden age started; let’s dump the hierarchies that steal half our earnings and labor to keep fear alive. Let’s build and plant and thrive; and let’s welcome others to thrive with us.

Thank you for not shooting me.

- What Would Happen If Everyone Joins China In Dumping Treasurys?

On Tuesday evening in “Devaluation Stunner: China Has Dumped $100 Billion In Treasurys In The Past Two Weeks,” we quantified the cost of China’s near daily open FX operations in support of the yuan.

As BNP’s Mole Hau put it on Monday, “whereas the daily fix was previously used to fix the spot rate, the PBoC now seemingly fixes the spot rate to determine the daily fix, [thus] the role of the market in determining the exchange rate has, if anything, been reduced in the short term.” And a reduced role for the market means a larger role for the PBoC and that, in turn, means burning through more FX reserves to steady the yuan.

Translation and quantification (with the latter coming courtesy of SocGen): as part of China’s devaluation and subsequent attempts to contain said devaluation, China has sold a gargantuan $106 (or more) billion in US paper just as a result of the change in the currency regime.

Notably, that means China has sold as much in Treasurys in the past 2 weeks – over $100 billion – as it has sold in the entire first half of the year. Today, we got what looks like confirmation late in the session when Bloomberg, citing fixed income desks, reported “substantial selling pressure in long end Treasuries coming from Far East.”

The question or rather, the series of questions, that need to be considered going forward are:

“What happens when China liquidates all of its Treasury holdings is anyone’s guess, and an even better question is will anyone else decide to join China as its sells US Treasurys at a never before seen pace, and best of all: will the Fed just sit there and watch as the biggest offshore holder of US Treasurys liquidates its entire inventory…”

And make no mistake, these are timely questions, because the combination of collapsing commodity prices, China’s devaluation, and the threat of a Fed hike have put enormous pressure on EM currencies the world over and that, in turn, means a drawdown of EM FX reserves and pressure on DM bonds. As JP Morgan put it last month, “the sharp reversal in EM FX reserve accumulation between Q1 and Q2 is consistent with the sharp reversal in DM core bond markets. Core bond market yields collapsed in Q1 but saw a big rise in Q2. This is a good reminder of how important FX reserve managers remain in driving core bond markets.”

Indeed. And just how important, you ask, is that for US Treasurys and, in turn, for Fed policy going forward? For the answer, we go to Citi:

Taken in isolation, a reserves drop of 1% of USD GDP (=$178bn) would infer a rise in 10y UST yields by 15-35bp based on a range of academic studies.

And more to the point:

Suppose EM and developing countries, which hold $5491 bn in reserves, reduce holdings by 10% over one year. This amounts to 3.07% of US GDP and means 10yr Treasury yields rates rise by a mammoth 108bp (35bp*3.07).

In other words, if EM currencies remain under pressure – and there is every reason to believe that they well – the reserve drawdown necessary to stabilize currencies and maintain unsustainable pegs means more Treasury liquidation and massive upward pressure on yields. Here’s a look at EM reserve accumlation vs. the yield on the 10Y (inverted):

As for what this means in the US, we go to Citi one more time:

These moves are unlikely to happen in a vacuum. For instance, any move by these magnitudes would choke off the US housing market and see the Fed stand still or ease.

Of course one of the catalysts for the EM outflows is the looming Fed hike which, when taken together with the above, means that if the FOMC raises rates, they will almost surely accelerate the pressure on EM, triggering further FX reserve drawdowns (i.e. UST dumping), resulting in substantial upward pressure on yields and prompting an immediate policy reversal and perhaps even QE4.

And as we never, ever tire of reminding readers, it all harkens back to last November…

- Jim Grant Warns "The Fed Turned The Stock Market Into A 'Hall Of Mirrors'"

The question we appear to be getting answered this week is, as Grant's Interest Rate Observer's Jim Grant so poetically explains, "how much of this paper moon market is real, and how much is governmental whipped cream?" In this brief but, as usual, perfectly to the point interview with Reason.com's Matt Welch, Grant asks (and answers), "are prices meant to be imposed from on high, or discovered by individuals acting spontaneously in markets?" noting that, while many readers here may know the answer, "they’re regrettably in the minority." The always entertaining Grant then goes on to discuss the underlying causes of the recent market turbulence, why we don’t really "have interest rates anymore."

"One thing to recall is that markets are meant to be two-way propositions – they go up, they go down – but it has been almost four years since we have seen a 10% correction… what's unusual is not the occasional down day but The Great Sedation that preceded."

"Confoundingly to me, people have come to be quite accepting of the value attached by fiat to these pieces of paper we call currency."

Well worth the price of admission during a week when financial markets start to show their true colors…

- "I Fear For The Chinese Citizen"

Submitted by Raul Ilargi Meijer via The Automatic Earth blog,

Look, it’s very clear where I stand on China; I’ve written a lot about it. And not just recently. Nicole Foss, who fully shares my views on the topic, reminded me the other day of a piece I wrote in July 2012, named Meet China’s New Leader : Pon Zi. China has been a giant lying debt bubble for years. Much if not most of its growth ‘miracle’ was nothing but a huge credit expansion, with an outsize role for the shadow banking system.

A lot of this has remained underreported in western media, probably because its reporters were afraid, for one reason or another, to shatter the global illusion that the western financial fiasco could be saved from utter mayhem by a country producing largely trinkets. Even today I read a Bloomberg article that claims China’s Q1 GDP growth was 7%. You’re not helping, boys, other than to keep a dream alive that has long been exposed as false.

China’s stock markets have a long way to fall further yet. This little graph from the FT shows why. The Shanghai Composite closed down another 1.27% today at 2,927.29 points. If it ‘only’ returns to its -early- 2014 levels, it has another 30% or so to go to the downside. If inflation correction is applied, it may fall to 1,000 points, for a 60% or so ‘correction’. If we move back 10 or 20 years, well, you get the picture.

That is a bursting bubble. Not terribly unique or mind-blowing, bubbles always burst. However, in this instance, the entire world will be swept out to sea with it. More money-printing, even if Beijing would attempt it, no longer does any good, because the Politburo and central bank aura’s of infallibility and omnipotence have been pierced and debunked. Yesterday’s cuts in interest rates and reserve requirement ratios (RRR) are equally useless, if not worse, if only because while they may provide a short term additional illusion, they also spell loud and clear that the leadership admits its previous measures have been failures. Emperor perhaps, but no clothes.

Every additional measure after this, and there will be many, will take off more of the power veneer Xi and Li have been ‘decorated’ with. Zero Hedge last night quoted SocGen on the precisely this topic: how Beijing painted itself into a corner on the RRR issue, while simultaneously spending fortunes in foreign reserves.

The Most Surprising Thing About China’s RRR Cut

[..] how does one reconcile China’s reported detachment from manipulating the stock market having failed to prop it up with the interest rate cut announcement this morning. The missing piece to the puzzle came from a report by SocGen’s Wai Yao, who first summarized the total liquidity addition impact from today’s rate hike as follows “the total amount of liquidity injected will be close to CNY700bn, or $106bn based on today’s onshore exchange rate.” And then she explained just why the PBOC was desperate to unlock this amount of liquidity: it had nothing to do with either the stock market, nor the economy, and everything to do with the PBOC’s decision from two weeks ago to devalue the Yuan. To wit:

In perspective, the PBoC may have sold more official FX reserves than this amount since the currency regime change on 11 August.

Said otherwise, SocGen is suggesting that China has sold $106 billion in Treasurys in the past 2 weeks! And there is the punchline. It explains why the PBOC did not cut rates over the weekend as everyone expected, which resulted in a combined 16% market rout on Monday and Tuesday – after all, the PBOC understands very well what the trade off to waiting was, and it still delayed until today by which point the carnage in local stocks was too much. Great enough in fact for China to not have eased if stabilizing the market was not a key consideration.

In other words, today’s RRR cut has little to do with net easing considerations, with the market, or the economy, and everything to do with a China which is suddenly dumping a record amount of reserves as it scrambles to stabilize the Yuan, only this time in the open market!

The battle to stabilise the currency has had a significant tightening effect on domestic liquidity conditions. If the PBoC wants to stabilise currency expectations for good, there are only two ways to achieve this: complete FX flexibility or zero FX flexibility. At present, the latter is also increasingly unviable, since the capital account is much more open. Therefore, the PBoC has merely to keep selling FX reserves until it lets go.

And since it can’t let go now that it has started off on this path, or rather it can but only if it pulls a Swiss National Bank and admit FX intervention defeat, the one place where the PBOC can find the required funding to continue the FX war is via such moves as RRR cuts.

Ambrose Evans-Pritchard, too, touches on the subject of China’s free-falling foreign reserves.

China Cuts Rates To Stem Crisis, But Doubts Grow On Foreign Reserve Buffer

The great unknown is exactly how much money has been leaving the country since the PBOC stunned markets by ditching its dollar exchange peg on August 11, and in doing so set off a global crash. Some reports suggest that the PBOC has already burned through $200bn in reserves since then. If so, this would require a much bigger cut in the RRR just to maintain a neutral setting. Wei Yao said the strategy of the Chinese authorities is unworkable in the long run.

If they keep trying to defend the exchange rate, they will continue to bleed reserves and will have to keep cutting the RRR in lockstep just to prevent further tightening. They may let the currency go, but that too is potentially dangerous. She said China can use up another $900bn before hitting safe limits under the IMF’s standard metric for developing states.

“The PBOC’s war chest is sizeable, but not unlimited. It is not a good idea to keep at this battle of currency stabilisation for too long,” she said. Citigroup has also warned that China’s reserves – still the world’s largest at $3.65 trillion but falling fast – are not as overwhelming as they appear, given the levels of short-term external debt. The border line would be $2.6 trillion. “There are reasons to question the robustness of China’s reserves adequacy. By emerging market standards China’s reserves adequacy is low: only South Africa, Czech Republic and Turkey have lower scores in the group of countries we examined,” it said.

It is a dangerous game they play, that much should be clear. And you know what China bought those foreign reserves with in the first place? With freshly printed monopoly money. Which is the same source from which the Vinny the Kneecapper shadow loans originated that every second grandma signed up to in order to purchase ghost apartments and shares of unproductive companies.

And that leads to another issue I’ve touched upon countless times: I can’t see how China can NOT descend into severe civil unrest. The government at present attempts to hide its impotence and failures behind the arrest of all sorts of scapegoats, but Xi and Li themselves should, and probably will, be accused at some point. They’ve gambled away a lot of what made their country function, albeit not at American or European wealth levels.

If the Communist Party had opted for what is sometimes labeled ‘organic’ growth (I’m not a big afficionado of the term), instead of ‘miracle’ Ponzi ‘growth’, if they had not to such a huge extent relied on Vinny the Kneecapper to provide the credit that made everything ‘grow’ so miraculously, their country would not be in such a bind. It would not have to deleverage at the same blinding speed it ostensibly grew at since 2008 (at the latest).

There are still voices talking about the ‘logical’ aim of Beijing to switch its economy from one that is export driven to one in which the Chinese consumer herself is the engine of growth. Well, that dream, too, has now been found out to be made of shards of shattered glass. The idea of a change towards a domestic consumption-driven economy is being revealed as a woeful disaster.

And that has always been predictable; you can’t magically turn into a consumer-based economy by blowing bubbles first in property and then in stocks, and hope people’s profits in both will make them spend. Because the whole endeavor was based from the get-go on huge increases in debt, the just as predictable outcome is, and will be even much more, that people count their losses and spend much less in the local economy. While those with remaining spending power purchase property in the US, Britain, Australia. And go live there too, where they feel safe(r).

I fear for the Chinese citizen. Not so much for Xi and Li. They will get what they deserve.

- Fed Dudley: We Are A Long Way From More QE

EMOTION MOVING MARKETS NOW: 5/100 EXTREME FEAR

PREVIOUS CLOSE: 3/100 EXTREME FEAR

ONE WEEK AGO: 11/100 EXTREME FEAR

ONE MONTH AGO: 7/100 EXTREME FEAR

ONE YEAR AGO: 36/100 FEAR

Put and Call Options: EXTREME FEAR During the last five trading days, volume in put options has lagged volume in call options by 10.90% as investors make bullish bets in their portfolios. However, this is still among the highest levels of put buying seen during the last two years, indicating extreme fear on the part of investors.

Market Volatility: EXTREME FEAR The CBOE Volatility Index (VIX) is at 30.32 and indicates that investors remain concerned about declines in the stock market.

Stock Price Strength: EXTREME FEAR The number of stocks hitting 52-week lows is slightly greater than the number hitting highs and is at the lower end of its range, indicating extreme fear.

PIVOT POINTS

EURUSD | GBPUSD | USDJPY | USDCAD | AUDUSD | EURJPY | EURCHF | EURGBP| GBPJPY | NZDUSD | USDCHF | EURAUD | AUDJPY

S&P 500 (ES) | NASDAQ 100 (NQ) | DOW 30 (YM) | RUSSELL 2000 (TF) | Euro (6E) |Pound (6B)

EUROSTOXX 50 (FESX) | DAX 30 (FDAX) | BOBL (FGBM) | SCHATZ (FGBS) | BUND (FGBL)

MEME OF THE DAY – IT’S THE JERKS

UNUSUAL ACTIVITY

LVS SEP 40 PUT ACTIVITY on offer @$.80 4500+ Contracts

GPRO OCT 48 PUT ACTIVITY @$5.00 right by offer 1944 Contracts

HZNP SEP 30 CALLS block @$1.45 on offer 3900 Contracts

CBS OCT 47.5 CALL Activity @$1.20 on offer 3700+ Contracts

ABT SEP 44 CALL ACTIVITY ON THE OFFER @$1.05-1.06 5100+ Contracts

RYAM Director Purchase 5,000 @$6.9

TEP Director Purchase 9,000 @$44.5

ABUS Director Purchase 1,000 @$6.95

CVX Executive Vice President Purchase 2,000 @$ 73.529 Purchase 500 @$72.37

HEADLINES

Fed Dudley: September rate rise less compelling

Fed Dudley: We are a long way from more QE

US July Building permits revised up to -15.5% at 1.130 units

OIS price 30% chance of Sept hike (26% yesterday)

OIS price 62% chance of Dec hike (54% yesterday)

NY Fed Economists say 89% of slack has been wrung out of US economy

Fed increasing Scrutiny of bank payment systems

ECB Praet: Downside risks to inflation path, ECB ready to act

ECB Hansson: Greek outlook brightening

Tsy yields rise after lacklustre 2y FRN and 5y auctions

Monsanto drops $46bn takeover bid for Syngenta

Schlumberger to buy Cameron International in $14.8bn deal

GOVERNMENTS/CENTRAL BANKS

Fed Dudley: September rate rise less compelling –FT

Fed Dudley: We are a long way from more QE –ForexLive

Fed interest rate hike falls rapidly down the probability scale –FT

NY Fed Economists say 89% of slack has been wrung out of US economy –Liberty Street

Federal Reserve Increasing Scrutiny of Bank Payment Systems –WSJ

BOC COMMENT: Global Fin Mkt Woes Shldn’t Drive A Sept BOC Rate Cut –MNI

ECB Praet: Downside Risks To Infl Path, ECB Ready To Act –MNI

ECB Hansson: Greek outlook brightening –BS

Greece raisis E22.3bn in state revenues (Jan-Jul) vs exp of E25.772bn –KTG

EU’s Dombrovskis expects Greek progress regardless of government –Kathimerini

French FinMin Sapin: Tax Cuts Possible But Lower Deficit A Priority –MNI

GEOPOLITICS

US Pres Obama on cusp of winning Iran nuclear vote –FT

FIXED INCOME

Treasury yields rise as auction gets lukewarm response –CNBC

2Y FRN auction sees small tail as dealer takedown highest since Dec 2014 –Livesquawk

German Yield Falls From 3-Week High as Selloff Seen Excessive –BBG

Abengoa bonds and CDS jump on rights talk –IFR

Philippines mulls project bonds –IFR

FX

USD: Dollar retreats as Fed’s Dudley cautions on rates –FT

JPY: Yen stronger vs dollar on dovish Dudley comments –FXstreet

GBP: Sterling lower after inflation expectations decline –FXstreet

AUD: AUD/USD oscillates above 0.7100 –FXstreet

AUD COMMENT: Westpac: Australian Dollar’s Recent Support is Superficial –Westpac

ZAR: SARB chief rules out defence of rand –FT