- Facebook and Exxon Mobil are both Overvalued Stocks for Different Reasons (Video)

By EconMatters

XOM is trading as a Bond in this yield chasing QE inspired Central Bank World, and FB is your classic momentum stock. The first lesson of modern investing is that everything is a trade in financial markets. Avoid being the bag holder in either of these two stocks. The day of their demise is merely a calendar event on the investing time clock horizon.

© EconMatters All Rights Reserved | Facebook | Twitter | YouTube | Email Digest | Kindle

- Why Were Texas Game Wardens Just Issued Nuclear Radiation Detectors?

Submitted by Mac Slavo via SHTFPlan.com,

After countless reports about the potential for nuclear or radioactive weapons of mass destruction being smuggled into the United States, the State of Texas is has begun to take the threat seriously.

Via Houston Public Media:

Up and down the Texas Gulf Coast, the state’s game wardens are on the water, looking for people fishing or hunting illegally. But as we’ve reported, they sometimes come across things like illegal chemical dumpsites and more says Texas Parks and Wildlife’s Tom Harvey.

“Game wardens encounter all kinds of things on their patrols, including a lot of illegal fishing, and this is a new threat we’re gearing up to be able to address,“ Harvey told News 88.7.

That new threat is terrorism. One fear is that terrorists could try to smuggle radioactive material into the country by boat. The Port of Houston has for years had radiation detectors to scan cargo.

So now, besides guns and handcuffs, game wardens will have one more tool.

“We’ve acquired about a hundred devices that allow game wardens to detect radiological or nuclear emissions. These are little devices that can be worn on someone’s belt,” Harvey said.

They’re about the size of a cellphone and can help a warden determine if something suspicious is radioactive. It wouldn’t necessarily have to be connected to terrorism: radioactive materials used in the energy and medical industries can be illegally dumped.

Game wardens began training with the radiation detectors in January and completed a mock exercise to find radioactive packages along the coast.

In March the Obama administration warned that there were four ways a large-scale nuclear attack on U.S. soil could happen,

The havoc such an attack could wreak in an urban area such as New York or London is concerning enough that leaders scheduled a special session on the threat during the two-day summit. U.S. officials said the leaders would discuss a hypothetical scenario about a chain of events that could lead to nuclear terrorism.

And just last month we learned that ISIS-linked terrorists have targeted at least two nuclear power plants in Europe – one in Belgium in the lead up to the terror attacks in Brussels, as well as a cyber attack on a German plant that made it possible for hackers to take control of highly radioactive cooling rods at the facility. Moreover, as far as Europe is concerned, officials report that CBRN weapons (Chemical, Biological, Radiological, and Nuclear) have already been smuggled into Europe, suggesting that mass-casualty attacks are in the planning stages.

The threats to America is equally serious, as officials have reported that terrorists have already been captured attempting to cross into the United States through our southern border. Moreover, in recent years there have been numerous cases of nuclear material capable of being used in dirty bombs being stolen from facilities in Mexico.

The issue was so serious that the Texas Rangers were dispatched to secure the southern border amid the threat.

Though ignored by most Americans as an implausible scenario, the fact that DHS recently announced they will be holding a mock poison gas attack in New York suggests that officials are growing more concerned with the potential for a serious attack on key U.S. cities.

Should a chemical, biological, radiological or nuclear attack become reality, the panic would be unprecedented. Large scale evacuations of entire cities or regions would be likely, and thousands could die or be sickened because of a lack of protective equipment against CBRN attacks.

That terrorists are actively targeting nuclear power plants is a warning sign that should not be taken lightly. The goal is mass casualties, and CBRN devices would be the optimal weapons used.

- Incompetence Personified: Illinois Has Devolved To One-Off Funding Bills As It Still Can't Pass A Budget

As Illinois struggles to get its fiscal house in order (good luck with that), it has devolved into funding key programs with one-off stopgap measures rather than approving an overall comprehensive budget. The state remains the only remaining state without a 2016 plan.

Most recently, lawmakers overwhelmingly approved $700 million to fund social service programs, however, as the Chicago Sun Times reports, the bill is likely to sit on Governor Bruce Rauner’s desk as he tries to push lawmakers to come to an agreement on a balanced budget instead of one-off solutions.

“The administration remains focused on enacting a truly balanced budget alongside meaningful reforms, and the Governor will continue negotiating in good faith toward a bipartisan agreement” said Rauner spokeswoman Catherine Kelly.

The bill included enough money to provide about 46% of what social service providers and programs such as Catholic Charities received from the state last year, and lawmakers such as Democrat Greg Harris are pushing to have the money released immediately.

“This is a $700 million piece of legislation that would help the neediest at the time when they need help the most. This is money that is available to be dispersed immediately.”

Legislators are haggling over a budget that under its current proposal would increase tax revenues by $5.4 billion by raising personal income tax rates from 3.75% to as much as 4.85%, cut spending by $2.5 billion, and borrow $5 billion in order to pay an expected $10 billion deficit by the time the fiscal year ends July 1.

All of this is just another example of the state of complete disarray that municipalities, cities, and states are in all across the U.S. Between pension funds going insolvent, states missing budget projections by a billion dollars, and in Illinois’ case, flat out inability to even know where to begin to solve the massive amount of accumulated debt, the pressure is building on Congress to start talking up bailout programs – because right now, helicopter money is literally the only thing that can save everyone from defaulting all at once.

- Did The Clinton Foundation Give $2 Million To Bill's "Energizer" Mistress?

At Bill Clinton's behest, a $2 million commitment for Energy Pioneer Solutions was placed on the agenda during a September 2010 conference of the Clinton Global Initiative. As it turns out, the commitment is a bit of an issue…

At the heart of the issue is the foundation sent funding to a company that had significant ties to the Clinton family according to the WSJ. The IRS website states that any 501(c)(3) should not be operated for the benefit of private interests.

The WSJ explains the connections

Energy Pioneer Solutions was founded in 2009 by Scott Kleeb, a Democrat who twice ran for Congress from Nebraska. An internal document from that year showed it as owned 29% by Mr. Kleeb; 29% by Jane Eckert, the owner of an art gallery in Pine Plains, N.Y.; and 29% by Julie Tauber McMahon of Chappaqua, N.Y., a close friend of Mr. Clinton, who also lives in Chappaqua.

Owning 5% each were Democratic National Committee treasurer Andrew Tobias and Mark Weiner, a supplier to political campaigns and former Rhode Island Democratic chairman, both longtime friends of the Clintons.

The Clinton Global Initiative holds an annual conference at which it announces monetary commitments from corporations, individuals or nonprofit organizations to address global challenges—commitments on which it has acted in a matchmaking role. Typically, the commitments go to charities and nongovernmental organizations. The commitment to Energy Pioneer Solutions was atypical because it originated from a private individual who was making a personal financial investment in a for-profit company.

Not only did the Clinton's oversee $2 million being sent to friends at Energy Pioneer Solutions via the foundation, according to the WSJ, Bill also personally endorsed the company to then-Energy Secretary Steven Chu for a federal grant, ultimately leading to a grant in the amount of $812,000. Of course, Chu now says he doesn't remember the conversation.

As it is no stranger to having to scramble and do damage control, the foundation has come out with the following narrative:

Asked about the commitment, foundation officials said, “President Clinton has forged an amazing universe of relationships and friendships throughout his life that endure to this day, and many of those individuals and friends are involved in CGI Commitments because they share a passion for making a positive impact in the world. As opposed to a conflict of interest, they share a common interest.”

A spokesman for Mr. Clinton, Angel Urena, said, “President Clinton counts many CGI participants as friends.” Mrs. Clinton’s campaign didn’t respond to a request for comment.

A Clinton Foundation spokesman, Craig Minassian, called the commitment an instance of “mission-driven investing…in and by for-profit companies,” which he said “is a common practice in the broader philanthropic space, as well as among CGI commitments.” Of thousands of CGI commitments, Mr. Minassian cited three other examples of what he described as mission-driven investing involving a private party and a for-profit company such as Energy Pioneer Solutions.

Energy Pioneer Solutions has struggled to operate profitably, and an audit found deficiencies in how the company accounted for expenses paid with federal grant money – surprise, surprise, another government funded (and Clinton funded) enterprise that can't make a profit and has lost taxpayer money.

Energy Pioneer Solutions has struggled to operate profitably. It lost more than $300,000 in 2010 and another $300,000 in the first half of 2011, said records submitted for an Energy Department audit. Mr. Kleeb noted that losses are common at startups.

The audit found deficiencies in how the company accounted for expenses paid with federal grant money, Energy Department records show. The company addressed the deficiencies, and a revised cost proposal was approved in 2011, said an Energy Department spokeswoman, Joshunda Sanders.

Recently, Mr. Kleeb laid off most of his staff, closed his offices, sold a fleet of trucks and changed his business strategy, promising to launch a national effort instead. “We are right now gearing up to start under this new model,” he said.

Asked if Energy Pioneer Solutions has ever broken even, Mr. Kleeb said, “We’re at that stage…We are expanding and doing well. We have partnerships, and it’s good.”

Partnerships indeed. Speaking of partnerships, there is a connection that is noteworthy in this tangled web of cronyism…

One of the owners of Energy Pioneer Solutions was Julie Tauber McMahon. She described Bill as a "close family friend" in an interview, but perhaps there is a bit more to that story.

As the NY Post reports

The fit, blond mother of three, who lives just minutes from Bill and Hillary Clinton’s home in Chappaqua, Westchester, is the daughter of Joel Tauber, a millionaire donor to the Democratic Party.

McMahon, 54, is rumored to be the woman dubbed “Energizer” by the Secret Service at the Clinton home because of her frequent visits, according to RadarOnline.

Secret Service agents were even given special instructions to abandon usual protocol when the woman came by, according to journalist Ronald Kessler’s tell-all book, “The First Family Detail.”

“You don’t stop her, you don’t approach her, you just let her go in,” says the book, based on agents’ accounts.

“Energizer” is described in the book as a charming visitor who sometimes brought cookies to the agents.

The book describes one sun-drenched afternoon when agents took notice of the woman’s revealing attire.

“It was a warm day, and she was wearing a low-cut tank top, and as she leaned over, her breasts were very exposed,” an agent is quoted in the book.

“They appeared to be very perky and very new and full . . . There was no doubt in my mind they were enhanced.”

“Energizer” reportedly timed her arrivals and departures around Hillary Clinton’s schedule.

McMahon has denied in reports having an intimate relationship with Bill Clinton.

* * *

While nobody knows for certain if Bill was funding a mistress (which really wouldn't surprise anyone), the fact remains that this is yet another stunning example that cronyism is alive and well.

- Chomsky: Europe Bows To Its "Washington Masters" On Everything From Snowden To Iran

Submitted by Claire Bernish via TheAntiMedia.org,

United States exceptionalism has created a preternaturally excessive number of military installments, deployments, and bases around the world. In point of fact, as David Vine described for the Nation in September 2015:

“While there are no freestanding foreign bases permanently located in the United States, there are now around 800 US bases in foreign countries. Seventy years after World War II and 62 years after the Korean War, there are still 174 US ‘base sites’ in Germany, 113 in Japan, and 83 in South Korea, according to the Pentagon. Hundreds more dot the planet in around 80 countries, including Aruba and Australia, Bahrain and Bulgaria, Colombia, Kenya, and Qatar, among many other places. Although few Americans realize it, the United States likely has bases in more foreign lands than any other people, nation, or empire in history.”

It’s commonly accepted that, in terms of economic and political policy, as Germany goes so goes Europe — and as the United States goes, so goes Germany. Essentially, European nations’ historical fealty to whims of the U.S. has created a juggernaut of obligatory policies with other countries, whether or not such dealings ultimately prove to be in Europe’s best interests. According to a U.S. Department of Defense report dated June 2015, over 80,000 troops were stationed in various locations in Europe — including 44,660 in Germany, alone — and those numbers will be bolstered by 3,000 to 5,000 in 2017, “to help countries harden themselves against Russian influence,” as Secretary of Defense Ashton Carter stated in February.

But as Professor Noam Chomsky explained in an exclusive interview with AcTVism Munich, as the American empire gasps its last breaths, that tide appears to be turning — and Europe, with Germany unofficially stationed at the helm, stands before an open window to escape overbearing U.S. influence.

“If you go back to the early 50s,” Chomsky explained, “there was always concern that Europe might move in a direction independent of U.S. power. It might become what was called at the time a ‘third force’ in international affairs. The dominant force was the United States, the second force was the junior superpower … the Soviet Union, and there was concern that Europe was, of course, a rich, developed, advanced area that might just move in an independent direction […] In fact, one of the functions of NATO, as is generally understood, was to ensure that Europe would remain under the U.S. aegis, but not move towards an independent direction.”

One current example of the friction between European countries’ continued capitulation to U.S. interests concerns the vast disparity in perceptions over the Iran nuclear deal, Chomsky noted. While enthusiastic “European ministers of government [and] corporation executives are flocking to Tehran to try to set up deals and arrangements,” Republican presidential candidates, including presumptive nominee Donald Trump, have said they would not follow through on the deal.

U.S. dominance over policy has even influenced Europe’s response to the controversy over Edward Snowden. As Chomsky explained, a plane transporting Bolivian president Evo Morales was denied passage through European airspace en route to Bolivia — despite the aircraft’s diplomatic immunity — during the time period when Snowden’s whereabouts remained unknown to the U.S. This unprecedented shirking of diplomatic immunity occurred at the behest of the U.S. government, though the plane eventually landed in Austria where it was raided by police — just to find out if the rogue whistleblower happened to be aboard.

“All of this is kind of pitiful,” Chomsky said. “It’s a revelation of real cowardice in the face of power that the European elites are unwilling to confront — a sign of subordination and a real lack of dignity and integrity, in my view […]

“There are, I think, by now four Latin American countries that offer asylum to Snowden – not one European country. In fact, they won’t even let him cross their borders. Why? Because the master in Washington tells them, ‘we don’t want him to.’ And Snowden, it’s important to recall, performed an enormous service, a patriotic service in fact, to the people of the United States and the world.”

Snowden revealed to the planet the nefarious extent of the U.S. surveillance state — and its true reach both domestically and around the world.

“That’s what he should have done,” added Chomsky. “That’s the responsibility of a decent citizen.”

- Canaccord Founder Sells $31 Million Vancouver Mansion To Chinese Student

Everybody loves a good Vancouver real estate horror story. Here is a great one.

In the endless series of reports about wealthy Chinese oligarchs, billionaires, money launderers, or mere criminals, never have we encountered anything quite like this yet, because according to The Province, the majority owner of this Point Grey mansion located at 4833 Belmont Avenue and which was recently ranked 16th among the most expensive homes in Vancouver, was sold earlier this year by Canaccord founder Peter Brown for a record $31.1 million is a “student,” property records show. A Chinese “student”… of course.

Land title documents list Tian Yu Zhou as having a 99-per-cent interest in the five-bedroom, eight-bathroom, 14,600 square-foot mansion on a 1.7-acre lot at 4833 Belmont Ave. Zhou’s occupation is listed as a “student.”

The other owner of the property, which boasts sweeping views of the North Shore mountains and Vancouver, is listed as Cuie Feng, a “businesswoman.” Feng has a one-per-cent interest in the property, which was assessed this year as having a total value of about $25.6 million, records show.

Efforts to reach Zhou and Feng through the lawyer listed on the land title documents were not successful, and realtor Cherry Xu, who reportedly served as the buyer’s agent, did not want to comment on the sale, citing privacy considerations.

As the Province amusingly puts it, NDP housing critic David Eby said the fact that a student was able to buy one of the most expensive homes in the city contradicts the government’s messaging that “everything is under control in the Vancouver real estate market.”

Eby said it also links to a theme uncovered in a 2015 study by Andy Yan, an adjunct professor at the University of B.C., which found homemakers and, to a lesser extent, students, are often the listed occupations of the owners of many newly purchased multi-million dollar Vancouver properties.

“It’s incredibly strange that a student would be able to afford such a luxurious and multi-million-dollar property,” said Eby. “This is part of a trend of homemakers and students mass-buying property. I don’t know how that can be possible with the income of homemakers and students typically have, which is close to zero.”

We can only hope he was being serious: that would make his statement all the more fun.

Mortgage documents attached to the land title papers show that a mortgage of $9.9 million was taken out by Zhou and Feng from the Canadian Imperial Bank of Commerce on April 28. The bi-weekly payments are listed as $17,079.41.

Now this may be a first: traditionally Chinese kleptocrats pay all cash – what is the point of taking out a mortgage when the whole purpose of buying ridiculously overpriced real estate is to park hot or stolen cash. We will have to mull this one over.

Where The Province article gets interesting is where Eby suggests that the government’s messaging and slow response to the housing crisis in Metro Vancouver could be because party donors, like Brown, are directly benefiting from the red-hot market.

According to financial records, Brown has donated $62,500 to the B.C. Liberal Party in the past two years, and Eby further noted that Brown is a longtime Liberal fundraiser.

“I think we shouldn’t underestimate the connection between the government saying there is no issue with the real estate market in Vancouver at the same time one of their major fundraisers is selling his home to a student for $31 million and significantly over the assessed value,” said Eby. “The government’s donors are directly profiting from this crazy real estate market while a lot of hard-working families are suffering.”

While the government has been cautious in its approach to tackling the housing issue in Metro Vancouver, saying more data needs to be compiled, some action has been taken.

“I always think more information is better in helping us understand that nature of what’s happening out there, rather than less,” Premier Christy Clark said Wednesday.

“Let’s find out how many homes are being purchased in the market by people who aren’t residents of Canada, whoever they may be in the world. I think that information will help us come up with the right solutions.”

Earlier this week, the government introduced regulations to clamp down on unethical real estate practices, including the legal use of assignment clauses to crank up the final sale price of a property, a practice known as shadow flipping.

The government also said it will introduce amendments to the property transfer tax forms that will require, as of June 10, buyers of B.C. real estate to include their principal address and whether they are Canadian citizens or permanent residents.

We are confident absolutely nothing will change and as more Chinese are desperate to park their cash in Canada, soon stories such as this one will become an (even more) everyday occurence.

- Minimum-Wage Blowback – Wendy's To Employ Self-Service Kiosks At 6,000 Locations

Submitted by Mike Shedlock via MishTalk.com,

In direct response to higher wage prices and the firming of commodity prices, Wendy’s is going to install self-service ordering kiosks at 6,000 locations. McDonald’s is expected to follow at a slower pace.

Investors Business Daily reports Wendy’s Serves Up Big Kiosk Expansion As Wage Hikes Hit Fast Food.

Wendy’s (WEN) said that self-service ordering kiosks will be made available across its 6,000-plus restaurants in the second half of the year as minimum wage hikes and a tight labor market push up wages.

It will be up to franchisees whether to deploy the labor-saving technology, but Wendy’s President Todd Penegor did note that some franchise locations have been raising prices to offset wage hikes.

McDonald’s (MCD) has been testing self-service kiosks. But Wendy’s, which has been vocal about embracing labor-saving technology, is launching the biggest potential expansion.

All 258 Wendy’s restaurants in California, where the minimum wage rose to $10 an hour this year and will gradually rise to $15, are franchise-operated. Likewise, about 75% of 200-plus restaurants in New York are run by franchisees.

“We are seeing a bit of a softer overall category in April” relative to the past two quarters, Penegor said on an earnings call, implying more of an industrywide trend than an issue specific to Wendy’s.

Penegor said the reason for softer growth was hard to pinpoint, but he listed a cautious consumer, tougher spring weather in the Northeast, and a wider gap between the cost of food at home vs. food away from home as possible contributors.

In addition to self-order kiosks, the company is also getting ready to move beyond the testing phase with labor-saving mobile ordering and mobile payment available systemwide by the end of the year. Yum Brands and McDonald’s already have mobile ordering apps.

Carl’s Jr. Investing in Machines

Business Insider reports Fast-food CEO says he’s investing in machines because the government is making it difficult to afford employees.

The 100% automated restaurant, Eatsa, has inspired the CEO of Carl’s Jr.

The CEO of Carl’s Jr. and Hardee’s has visited the fully automated restaurant Eatsa — and it’s given him some ideas on how to deal with rising minimum wages.

“I want to try it,” CEO Andy Puzder told Business Insider of his automated restaurant plans. “We could have a restaurant that’s focused on all-natural products and is much like an Eatsa, where you order on a kiosk, you pay with a credit or debit card, your order pops up, and you never see a person.”

“This is the problem with Bernie Sanders, and Hillary Clinton, and progressives who push very hard to raise the minimum wage,” says Puzder. “Does it really help if Sally makes $3 more an hour if Suzie has no job?”

Zero Human Interaction Eatsa

Also consider This is the first fast-food chain in America that requires zero human interaction.

A new restaurant chain called Eatsa is unlike any fast-food chain we’ve seen before.

The restaurant is almost fully automated, functioning like a vending machine that spits out freshly-prepared quinoa bowls.

When customers enter Eatsa, they order their food at an iPad kiosk.

Then they wait in front of a wall of glass cubbies, where their food will be appear when it’s ready.

Hidden behind the wall of cubbies, kitchen staff prepare the food.

Positions Open!

State of Affairs

Fast food is not cheap. $15 minimum wages do not help.

It’s easy to dismiss Eatsa. It has 10 stores. But it’s the idea that’s important.

Wendy’s is adopting a similar model as best it can, en masse.

Department stores that have massively over-expanded will follow suit.

None of these trends bode well for store expansion or hiring. Layoffs are on the horizon.

- China Warns US: "Don't Disturb" Hong Kong Social Order; Threatens "Bad Reaction"

Over the past few months, tensions have been high between the U.S. and China. Events such as China denying USS John C. Stennis and its escort ships access to a Hong Kong port showed just how strained relations have become between the two countries, and with China's recent comments saying that U.S. activity near the Fiery Cross Reef "threatened China's sovereignty and security interests", one would assume that things couldn't get much worse.

Alas, that assumption would be wrong. As Reuters reports, China is now accusing the U.S. of trying to "disturb" social order in Hong Kong, something that Foreign Ministry spokesman Lu Kang said will "cause Chinese people to go on alert and have a bad reaction."

Channel NewsAsia has more…

BEIJING: China's Foreign Ministry on Friday accused unidentified people in the United States of trying to "disturb" social order in Hong Kong, after the U.S. State Department expressed further concern the territory's autonomy was being eroded.

The State Department made the comments in its latest report on the former British colony, released on Wednesday. Chinese Foreign Ministry spokesman Lu Kang said that as Hong Kong was a part of China, no other country had a right to interfere in its internal affairs.

"We also remind the United States that certain people on the U.S. side have always wanted to disturb Hong Kong, disturb its socio-economic development, disturb the normal order of its residents' lives, and even use the Hong Kong issue to interfere in China's internal affairs," he told a daily news briefing.

"This can only be futile. The only effect it will have is to cause Chinese people to go on alert and have a bad reaction."

Britain handed Hong Kong back to China in 1997 under agreements that its broad freedoms, way of life and legal system would remain unchanged for 50 years.

Beijing's refusal to grant the former British colony full democracy has embittered a younger generation of activists who launched big protests in 2014.

Political tension has simmered amid occasional incidents of unrest. A riot erupted in the city in February after a dispute between authorities and street vendors.

The United States has repeatedly expressed concern about developments in Hong Kong, including freedom of the press and human rights issues.

* * *

So to summarize, the United States is antagonizing Russia, antagonizing China, and doing its very best to generate even further conflict in the Middle East. Perhaps the best indicator of how the economy is doing is not reading FOMC minutes, rather, just pay attention to how much war mongering the U.S. is doing around the world. After all, nothing solves a bad economy like a massive war – right?

- The Real Oil Limits Story – What Other Researchers Missed

Submitted by Gail Tverberg via Our Finite World blog,

For a long time, a common assumption has been that the world will eventually “run out” of oil and other non-renewable resources. Instead, we seem to be running into surpluses and low prices. What is going on that was missed by M. King Hubbert, Harold Hotelling, and by the popular understanding of supply and demand?

The underlying assumption in these models is that scarcity would appear before the final cutoff of consumption. Hubbert looked at the situation from a geologist’s point of view in the 1950s to 1980s, without an understanding of the extent to which geological availability could change with higher price and improved technology. Harold Hotelling’s work came out of the conservationist movement of 1890 to 1920, which was concerned about running out of non-renewable resources. Those using supply and demand models have equivalent concerns–too little fossil fuel supply relative to demand, especially when environmental considerations are included.

Virtually no one realizes that the economy is a self-organized networked system. There are many interconnections within the system. The real situation is that as prices rise, supply tends to rise as well, because new sources of production become available at the higher price. At the same time, demand tends to fall for a variety of reasons:

- Lower affordability

- Lower productivity growth

- Falling relative wages of non-elite workers

The potential mismatch between amount of supply and demand is exacerbated by the oversized role that debt plays in determining the level of commodity prices. Because the oil problem is one of diminishing returns, adding debt becomes less and less profitable over time. There is a potential for a sharp decrease in debt from a combination of defaults and planned debt reductions, leading to very much lower oil prices, and severe problems for oil producers. Financial institutions tend to be badly affected as well. If a person looks at only past history, the situation looks secure, but it really is not.

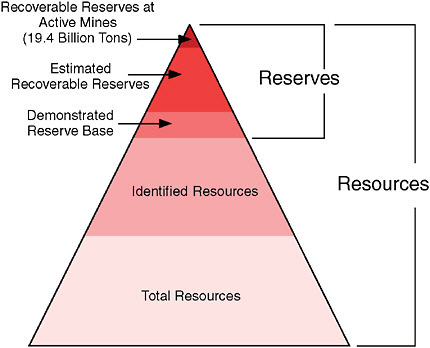

Figure 1. By Merzperson at English Wikipedia – Transferred from en.wikipedia to Commons, Public Domain, https://commons.wikimedia.org/w/index.php?curid=2570936

Substitutes aren’t really helpful; they tend to be high-priced and dependent on the use of fossil fuels, including oil. They cannot possibly operate on their own. They add to the “oversupply at high prices” problem, but don’t really fix the need for low-priced supply.

Why supply tends to rise as prices rise

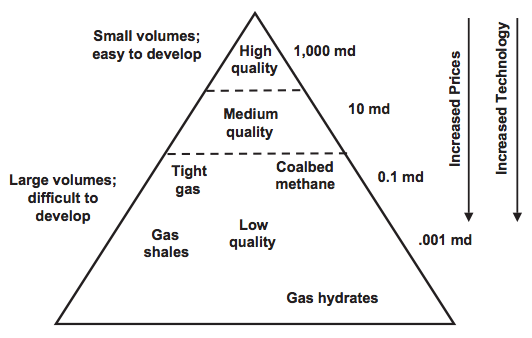

For any non-renewable commodity, there are a wide variety of resources that will “sort of” work as substitutes, if the price is high enough. If the price can be raised to a very high level, the funds available will encourage the development of more advanced (and expensive) technology.

If it is possible to raise the price to a very high level, it is likely that a very large quantity of oil will be available. Figure 1 shows some of the types of oil available:

I got my idea for Figure 2 from a natural gas resource triangle by Stephen Holditch.

A similar resource triangle is available for coal (from National Academies Press; Coal Resource, Reserve, and Quality Assessments):

Figure 4. Coal resources in 1997, based on EIA data. Image from National Academies Press.

Because of the availability of an increasing amount of resources, we are likely to get more oil, natural gas, and coal, if prices rise. We associate high prices with scarcity; instead, high prices tend to make a larger quantity of energy product available.

The International Energy Agency (IEA) has a different way of illustrating the likelihood of huge future oil supply, if prices can only rise high enough.

The implication of this chart is that the IEA believes that oil prices can rise to $300 per barrel, giving the world plenty of oil to extract for many years ahead.

Can consumers really afford very high-priced energy products?

In my view, the answer is “No!” If oil is high priced, then the many things made with oil will tend to be high priced as well. Wages don’t rise with oil prices; most of us remember this from the oil price run-up of 2003 to 2008.

Because of this affordability issue, the limit to oil production is really an invisible price limit, represented as a dotted line. We can’t know in advance where this is, so it is easy to assume that it doesn’t exist.

The higher cost of extraction is equivalent to diminishing returns.

As we are forced to seek out ever more expensive to extract resources, the economy is in some sense becoming less and less efficient. We are devoting more of our human labor and other resources to extracting fossil fuels, and to extracting minerals from ever-lower-quality ores. In some sense, we could just as well be putting these resources into a pit and burying them–they no longer help us grow the rest of the economy. Using resources in this way leaves fewer resources to “grow” the rest of the economy. As a result, we should expect economic contraction when the cost of oil extraction rises.

In fact, economic contraction seems to happen when oil prices rise, at least for oil importing countries. Economist James Hamilton has shown that 10 out of 11 post-World War II recessions were associated with oil price spikes. A 2004 IEA report says, “. . . a sustained $10 per barrel increase in oil prices from $25 to $35 would result in the OECD as a whole losing 0.4% of GDP in the first and second years of higher prices. Inflation would rise by half a percentage point and unemployment would also increase.”

Energy products play a critical role in the economy.

Economic activity is based on many kinds of physical changes. For example:

- Using heat to transform materials from one form to another;

- Using energy products to help move goods from one place to another;

- Moving electrons in such a way that light is provided

- Moving electrons in such a way that Internet transmission can be provided.

A human being, by himself, exerts only about 100 watts of power. A human being is also quite limited in what he can do; he can provide a little heat, but no light, for example. Energy products are very helpful for making capital goods such as buildings, machines, roads, electricity transmission lines, cars and trucks.

We can think of energy products, and capital goods made using energy products, as ways of leveraging human energy. If per capita energy consumption increases over time, leveraging of human labor can grow. As a result, humans can become ever more productive–think of new and better machines to help humans do their work. Dips in this leveraging tend to correspond to economic contraction (Figure 7).

Figure 7. World energy consumption per capita, based on BP Statistical Review of World Energy 2105 data. Year 2015 estimate and notes by G. Tverberg.

To have a growing economy, wages of non-elite workers need to be growing.

Our economy is in a sense a “circular economy,” in which non-elite workers (less educated, non-managerial workers) play a pivotal role because they are both producers of goods and potential consumers of the output of the economy. Because there are so many non-elite workers, their demand for homes, cars, and electronic goods plays a critical role in maintaining the total demand of the economy.

If the wages of these non-elite workers are growing, thanks to increased productivity, the economy as a whole can grow. If the wages of these workers are shrinking or are flat (in inflation-adjusted terms), the economy is in trouble. The recycling process cannot work very well.

If there is not enough economic growth–often caused by not enough growth in energy consumption to leverage human labor–then we tend to get a growing imbalance between the sector on the left with businesses, governments, and elite workers, and the sector on the right, with non-elite workers. Part of this wage imbalance comes from sending jobs to low-wage countries. As jobs are shifted to low-wage countries, the workers of the world increasingly cannot afford the goods that they and other workers are producing.

If the wages of non-elite workers are not rising sufficiently, rising debt can be used to hide this problem for a while. The way this is done is by allowing workers to buy goods at ever-lower interest rates, over ever-longer time periods. This strategy has an endpoint, which we seem to be close to reaching.

Debt is a key factor in creating an economy that operates using energy.

A generally overlooked problem of our current system is the fact that we do not receive the benefit of energy products until well after they are used. This is especially the case for energy used to make capital investments, such as buildings, roads, machines, and vehicles. Even education and health care represent energy investments that have benefits long after the investment is made.

The reason debt (and close substitutes) are needed is because it is necessary to bring forward hoped-for future benefits of energy products to the current period if workers are to be paid. In addition, the use of debt makes it possible to pay for consumer products such as automobiles and houses over a period of years. It also allows factories and other capital goods to be financed over the period they provide their benefits. (See my post Debt: The Key Factor Connecting Energy and the Economy.)

When debt is used to move forward hoped-for future benefits to the present, oil prices can be higher, as can be the prices of other commodities. In fact, the price of assets in general can be higher. With the higher price of oil, it is possible for businesses to use the hoped-for future benefits of oil to pay current workers. This system works, as long as the price set by this system doesn’t exceed the actual benefit to the economy of the added energy.

The amount of benefits that oil products provide to the economy is determined by their physical characteristics–for example, how far oil can make a truck move. These benefits can increase a bit over time, with rising efficiency, but in general, physics sets an upper bound to this increase. Thus, the value of oil and other energy products cannot rise without limit.

Using hoped-for benefits to set oil prices is likely to lead to oil prices that overshoot their maximum sustainable level, and then fall back.

A debt-based system of setting oil prices is different from what most of us would have considered possible. If wages of non-elite workers had been growing fast enough (Figure 9), increasing debt would not even be needed, because the whole system could grow thanks to the increased buying power of the many non-elite workers. These workers could buy new houses and cars, have more meat in their diet, and travel on international vacations, adding to demand for oil and other energy products, thereby keeping prices up.

As wages of non-elite workers fall behind, an increasing amount of debt is needed. For the US, the ratio of the increase in debt to the increase in GDP (including the rise in inflation) is as shown in Figure 10:

Figure 10. United States increase in debt over five-year period, divided by increase in GDP (with inflation!) in that five-year period. GDP from Bureau of Economic Analysis; debt is non-financial debt, from BIS compilation for all countries.

Thus, the increase in debt has never been less than the corresponding increase in GDP over five-year periods, even when oil prices were low prior to 1970. In general, the pattern would suggest that the higher the oil price, the higher the increase in debt needs to be to generate one dollar of GDP. This is to be expected, if economic growth depends on Btus of energy, and higher prices lead to the need for more debt to cover the purchase of necessary Btus of energy.

We are reaching a head-on collision between (1) the rising cost of energy production and (2) the falling ability of non-elite workers to pay for this high-priced energy.

The head-on collision we are reaching is what causes the potential instability referred to at the beginning of this article, as illustrated in Figure 1. Of course, such a collision has the potential to cause debt defaults, as it becomes impossible to repay debt with interest.

Figure 11. Repaying loans is easy in a growing economy, but much more difficult in a shrinking economy.

Turchin and Nefedov in the academic book Secular Cycles analyzed eight agricultural economies that eventually collapsed. The problem that these economies encountered was exactly the same one we are now encountering: falling wages of non-elite workers at the same time that the cost of producing energy products (food, at that time) was rising. Rising costs were often an end result of too many people for the arable land. A workaround could be found, such as building irrigation or adding a larger army to conquer a neighboring land, but it would add costs.

As the problems of these economies progressed, debt defaults became more of a problem. Governments found it hard to collect enough taxes, because so many of the workers were increasingly impoverished. Often, workers became sufficiently weakened by an inadequate diet that they became vulnerable to epidemics. Governments often collapsed.

In the economies analyzed by Turchin and Nefedov, food prices temporarily spiked, but it is not clear that this was the final outcome, given the inability of workers to pay the high prices. Debt defaults would tend to further reduce ability to pay. Thus, it would not be surprising if prices ended up low (from lack of demand), rather than high. We know that ancient Babylon is an example of one economy that collapsed. Revelation 18:11-13 seems to describe the situation after Babylon’s collapse as one of lack of demand.

11 “The merchants of the earth will weep and mourn over her because no one buys their cargoes anymore— 12 cargoes of gold, silver, precious stones and pearls; fine linen, purple, silk and scarlet cloth; every sort of citron wood, and articles of every kind made of ivory, costly wood, bronze, iron and marble; 13 cargoes of cinnamon and spice, of incense, myrrh and frankincense, of wine and olive oil, of fine flour and wheat; cattle and sheep; horses and carriages; and human beings sold as slaves.

Other parts of the oil limits story that researchers have missed

As I have previously mentioned, most researchers begin with the view that soon there will be a problem with energy scarcity. The real issue that tends to bring the system down is related, but it is fairly different. It is the fact that as we use energy, the system necessarily generates entropy. This entropy takes the form of rising debt and increased pollution. It is these entropy-related issues, rather than a shortage of energy products per se, that tends to bring the system down. See my post, Our economic growth system is reaching limits in a strange way.

We could, in theory, fix our problems by adding infinite debt at the same time that wages of non-elite workers tend toward zero. We could then use this additional debt to fight pollution problems and pay all of the workers. All of us know that this solution would not work in the real world, however.

The two-sided economy I have described in Figures 8 and 9 is one part of our problem. There is a popular saying, “We pay each other’s wages.” Unfortunately, paying each other’s wages does not work well, if the wage level of elite workers differs too much from the wage level of the non-elite workers. A worker making $7.50 per hour in a part-time job is not going to be able to pay the wages of a surgeon making $300,000 per year, no matter how an insurance policy is designed to spread costs evenly. A worker in India or Africa will not be able to afford goods made by human workers in the United States, because of wage differences.

Governments can try to fix the problem of non-elite workers getting too small a share of the output of the system, but this is not easy to do. The real problem is that the system as a whole is not producing enough goods and services. This happens because the high cost of energy extraction (plus related issues–pollution control; need for more education for workers; need for ever-larger government and more elite workers) is removing too many resources from the system. The result is that the economy as a whole tends to grow ever more slowly. The quantity of goods and services produced by the economy does not rise very rapidly. When there are not enough goods produced in total, non-elite workers tend to find that their allocation has been reduced.

If governments attempt to add debt to fix the problems with the system, the addition of debt tends to raise asset prices on the left side of Figures 8 and 9. Unfortunately, the additional debt usually has little impact on the wages of non-elite workers (that is, the right hand part of the system).

Governments have talked about minimum income programs to raise incomes of those who are not elite workers. Whether or not this approach can work depends on many things–how much additional debt can be added to the system; whether this debt will actually raise the total amount of goods and services produced; how tolerant those in the left-hand side of Figures 8 and 9 are of losing their share of goods and services; the impact on relative currency levels.

Research involving Energy Returned on Energy Investment (EROEI) ratios for fossil fuels is a frequently used approach for evaluating prospective energy substitutes, such as wind turbines and solar panels. Unfortunately, this ratio only tells part of the story. The real problem is declining return on human labor for the system as a whole–that is, falling inflation adjusted wages of non-elite workers. This could also be described as falling EROEI–falling return on human labor. Declining human labor EROEI represents the same problem that fish swimming upstream have, when pursuit of food starts requiring so much energy that further upstream trips are no longer worthwhile.

Falling fossil fuel EROEI is a contributor to falling EROEI with respect to human labor, but there are other contributors as well (Figure 12). (My list is probably not exhaustive.)

Figure 12. Author’s depiction of changes to workers’ share of output of economy, as costs keep rising for other portions of the economy.

If our problem is a shortage of fossil fuels, fossil fuel EROEI analysis is ideal for determining how to best leverage our small remaining fossil fuel supply. For each type of fossil fuel evaluated, the fossil fuel EROEI calculation determines the amount of energy output from a given quantity of fossil fuel inputs. If a decision is made to focus primarily on the energy products with the highest EROEI ratios, then our existing fossil fuel supply can be used as sparingly as possible.

If our problem isn’t really a shortage of fossil fuels, EROEI is much less helpful. In fact, the EROEI calculation strips out the timing over which the energy return is made, even though this may vary greatly. The delay (and thus needed amount of debt) is likely to be greatest for those energy products where large front-end capital expenditures are required. Nuclear would tend to be a problem in this regard; so would wind and solar.

To evaluate the extent to which a given energy product tends to raise debt levels, a better approach might be to look at debt levels directly. Another measure might be to compare the required system-wide capital expenditures for a particular purpose, for example, to provide sufficient non-intermittent electricity for the state of California over a period of say, 50 years, using different electricity generation scenarios.

Our academic system of inquiry, with its peer reviewed literature system, has let us down.

Our peer reviewed academic system is not telling this story. Part of the problem is that this is a difficult story. It has taken me most of the last ten years to figure it out.

Part of the problem with our academic system seems to be excessive reliance on past analyses. Once one direction has been set, it is hard to change. Another part of the problem is that the focus of each researcher tends to be quite narrow. The result can be that it is hard to “see the forest for the trees.”

Furthermore, politicians and academic publishers tend to “push” results in the direction of a desired outcome. Grant money goes to researchers who follow the government-preferred fields of inquiry; publishers prefer books that are not too alarming to students.

I am coming at this issue from “out in left field.” I don’t have a Ph.D., although I am a Fellow of the Casualty Actuarial Society, which many would consider similar. I also have an M. S. in Mathematics. I do not work in a university setting. I do not have a strong background in subjects a person might expect, such as geology, economic theory, or physics. I do have a fair amount of practical experience with financial modeling from my actuarial background, however.

My approach is very different from that of most researchers. I come to the problem from the point of view of how a finite world might be expected to operate. I write most of my articles on the Internet, where I get the benefit of comments from readers. Many of these commenters point me in the direction of articles or books I should read, or raise additional issues I should consider.

Over the years, I have become acquainted with many researchers in related fields. These people have generally reached out to me–invited me to speak at their conferences, or corresponded with me about issues they considered important. As a result of this collaboration, I have been able to put together a more complete story than others.

I have stayed away from publishers and funding sources that might try to influence what I say. I have not been taking donations, and do not run ads on my website. The story is one that needs to be told, but it easily gets distorted if the person telling the story is influenced by what will generate the largest donations, or the most grant money.

Digest powered by RSS Digest

Saving...

Saving...