- Capitalism Requires World War

Authored by Cathal Haughian via TheSaker.ie,

It has been our undertaking, since 2010, to chronicle our understanding of capitalism via our book The Philosophy of Capitalism. We were curious as to the underlying nature of the system which endows us, the owners of capital, with so many favours. The Saker has asked me to explain our somewhat crude statement ‘Capitalism Requires World War’.

The present showdown between West, Russia and China is the culmination of a long running saga that began with World War One. Prior to which, Capitalism was governed by the gold standard system which was international, very solid, with clear rules and had brought great prosperity: for banking Capital was scarce and so allocated carefully. World War One required debt-capitalism of the FIAT kind, a bankrupt Britain began to pass the Imperial baton to the US, which had profited by financing the war and selling munitions.

The Weimar Republic, suffering a continuation of hostilities via economic means, tried to inflate away its debts in 1919-1923 with disastrous results—hyperinflation. Then, the reintroduction of the gold standard into a world poisoned by war, reparation and debt was fated to fail and ended with a deflationary bust in the early 1930’s and WW2.

The US government gained a lot of credibility after WW2 by outlawing offensive war and funding many construction projects that helped transfer private debt to the public book. The US government’s debt exploded during the war, but it also shifted the power game away from creditors to a big debtor that had a lot of political capital. The US used her power to define the new rules of the monetary system at Bretton Woods in 1944 and to keep physical hold of gold owned by other nations.

The US jacked up tax rates on the wealthy and had a period of elevated inflation in the late 40s and into the 1950s – all of which wiped out creditors, but also ushered in a unique middle class era in the West. The US also reformed extraction centric institutions in Europe and Japan to make sure an extractive-creditor class did not hobble growth, which was easy to do because the war had wiped them out (same as in Korea).

Capital destruction in WW2 reversed the Marxist rule that the rate of profit always falls. Take any given market – say jeans. At first, all the companies make these jeans using a great deal of human labour so all the jeans are priced around the average of total social labour time required for production (some companies will charge more, some companies less).

One company then introduces a machine (costed at $n) that makes jeans using a lot less labour time. Each of these robot assisted workers is paid the same hourly rate but the production process is now far more productive. This company, ignoring the capital outlay in the machinery, will now have a much higher profit rate than the others. This will attract capital, as capital is always on the lookout for higher rates of profit. The result will be a generalisation of this new mode of production. The robot or machine will be adopted by all the other companies, as it is a more efficient way of producing jeans.

As a consequence the price of the jeans will fall, as there is an increased margin within which each market actor can undercut his fellows. One company will lower prices so as to increase market share. This new price-point will become generalised as competing companies cut their prices to defend their market share. A further n$ was invested but per unit profit margin is put under constant downward pressure, so the rate of return in productive assets tends to fall over time in a competitive market place.

Interest rates have been falling for decades in the West because interest rates must always be below the rate of return on productive investments. If interest rates are higher than the risk adjusted rate of return then the capitalist might as well keep his money in a savings account. If there is real deflation his purchasing power increases for free and if there is inflation he will park his money (plus debt) in an unproductive asset that’s price inflating, E.G. Housing. Sound familiar? Sure, there has been plenty of profit generated since 2008 but it has not been recovered from productive investments in a competitive free market place. All that profit came from bubbles in asset classes and financial schemes abetted by money printing and zero interest rates.

Thus, we know that the underlying rate of return is near zero in the West. The rate of return falls naturally, due to capital accumulation and market competition. The system is called capitalism because capital accumulates: high income economies are those with the greatest accumulation of capital per worker. The robot assisted worker enjoys a higher income as he is highly productive, partly because the robotics made some of the workers redundant and there are fewer workers to share the profit. All the high income economies have had near zero interest rates for seven years. Interest rates in Europe are even negative. How has the system remained stable for so long?

All economic growth depends on energy gain. It takes energy (drilling the oil well) to gain energy. Unlike our everyday experience whereby energy acquisition and energy expenditure can be balanced, capitalism requires an absolute net energy gain. That gain, by way of energy exchange, takes the form of tools and machines that permit an increase in productivity per work hour. Thus GDP increases, living standards improve and the debts can be repaid. Thus, oil is a strategic capitalistic resource.

US net energy gain production peaked in 1974, to be replaced by production from Saudi Arabia, which made the USA a net importer of oil for the first time. US dependence on foreign oil rose from 26% to 47% between 1985 and 1989 to hit a peak of 60% in 2006. And, tellingly, real wages peaked in 1974, levelled-off and then began to fall for most US workers. Wages have never recovered. (The decline is more severe if you don’t believe government reported inflation figures that don’t count the costof housing.)

What was the economic and political result of this decline? During the 20 years 1965-85, there were 4 recessions, 2 energy crises and wage and price controls. These were unprecedented in peacetime and The Gulf of Tonkin event led to the Vietnam War which finally required Nixon to move away from the Gold-Exchange Standard in 1971, opening the next degenerate chapter of FIAT finance up until 2008. Cutting this link to gold was cutting the external anchor impeding war and deficit spending. The promise of gold for dollars was revoked.

GDP in the US increased after 1974 but a portion of end use buying power was transferred to Saudi Arabia. They were supplying the net energy gain that was powering the US GDP increase. The working class in the US began to experience a slow real decline in living standards, as ‘their share’ of the economic pie was squeezed by the ever increasing transfer of buying power to Saudi Arabia.

The US banking and government elite responded by creating and cutting back legal and behavioral rules of a fiat based monetary system. The Chinese appreciated the long term opportunity that this presented and agreed to play ball. The USA over-produced credit money and China over-produced manufactured goods which cushioned the real decline in the buying power of America’s working class. Power relations between China and the US began to change: The Communist Party transferred value to the American consumer whilst Wall Street transferred most of the US industrial base to China. They didn’t ship the military industrial complex.

Large scale leverage meant that US consumers and businesses had the means to purchase increasingly with debt so the class war was deferred. This is how over production occurs: more is produced that is paid for not with money that represents actual realized labour time, but from future wealth, to be realised from future labour time. The Chinese labour force was producing more than it consumed.

The system has never differed from the limits laid down by the Laws of Thermodynamics. The Real economy system can never over-produce per se. The limit of production is absolute net energy gain. What is produced can be consumed. How did the Chinese produce such a super massive excess and for so long? Economic slavery can achieve radical improvements in living standards for those that benefit from ownership. Slaves don’t depreciate as they are rented and are not repaired for they replicate for free. Hundreds of millions of Chinese peasants limited their way of life and controlled their consumption in order to benefit their children. And their exploited life raised the rate of profit!

They began their long march to modern prosperity making toys, shoes, and textiles cheaper than poor women could in South Carolina or Honduras. Such factories are cheap to build and deferential, obedient and industrious peasant staff were a perfect match for work that was not dissimilar to tossing fruit into a bucket. Their legacy is the initial capital formation of modern China and one of the greatest accomplishments in human history. The Chinese didn’t use net energy gain from oil to power their super massive and sustained increase in production. They used economic slavery powered by caloric energy, exchanged from solar energy. The Chinese labour force picked the World’s low hanging fruit that didn’t need many tools or machines. Slaves don’t need tools for they are the tool.

Without a gold standard and capital ratios our form of over-production has grown enormously. The dotcom bubble was reflated through a housing bubble, which has been pumped up again by sovereign debt, printing press (QE) and central bank insolvency. The US working and middle classes have over-consumed relative to their share of the global economic pie for decades. The correction to prices (the destruction of credit money & accumulated capital) is still yet to happen. This is what has been happening since 1971 because of the growth of financialisation or monetisation.

The application of all these economic methods was justified by the political ideology of neo-Liberalism. Neo-Liberalism entails no or few capital controls, the destruction of trade unions, plundering state and public assets, importing peasants as domesticated help, and entrusting society’s value added production to The Communist Party of The People’s Republic of China.

The Chinese have many motives but their first motivation is power. Power is more important than money. If you’re rich and weak you get robbed. Russia provides illustrating stories of such: Gorbachev had received a promise from George HW Bush that the US would pay Russia approximately $400 billion over10 years as a “peace dividend” and as a tool to be utilized in the conversion of their state run to a market based economic system. The Russians believe the head of the CIA at the time, George Tenet, essentially killed the deal based on the idea that “letting the country fall apart will destroy Russia as a future military threat”. The country fell apart in 1992. Its natural assets were plundered which raised the rate of profit in the 90’s until President Putin put a stop to the robbery.

In the last analysis, the current framework of Capitalism results in labour redundancy, a falling rate of profit and ingrained trading imbalances caused by excess capacity. Under our current monopoly state capitalism a number of temporary preventive measures have evolved, including the expansion of university, military, and prison systems to warehouse new generations of labour.

Our problem is how to retain the “expected return rate” for us, the dominant class. Ultimately, there are only two large-scale solutions, which are intertwined.

One is expansion of state debt to keep “the markets” moving and transfer wealth from future generations of labour to the present dominant class.

The other is war, the consumer of last resort. Wars can burn up excess capacity, shift global markets, generate monopoly rents, and return future labour to a state of helplessness and reduced expectations. The Spanish flu killed 50-100 million people in 1918. As if this was not enough, it also took two World Wars across the 20th century and some 96 million dead to reduce unemployment and stabilize the “labour problem.”

Capitalism requires World War because Capitalism requires profit and cannot afford the unemployed. The point is capitalism could afford social democracy after the rate of profit was restored thanks to the depression of the 1930’s and the physical destruction of capital during WW2. Capitalism only produces for profit and social democracy was funded by taxing profits after WW2.

Post WW2 growth in labour productivity, due to automation, itself due to oil & gas replacing coal, meant workers could be better off. As the economic pie was growing, workers could receive the same %, and still receive a bigger slice. Wages as a % of US GDP actually increased in the period, 1945-1970. There was an increase in government spending which was being redirected in the form of redistributed incomes. Inequality will only worsen, because to make profits now we have to continually cut the cost of inputs, i.e. wages & benefits. Have we not already reached the point where large numbers of the working class can neither feed themselves nor afford a roof over their heads?13% of the UK working age population is out of work and receiving out of work benefits. A huge fraction is receiving in work benefits because low skill work now pays so little.

The underlying nature of Capitalism is cyclical. Here is how the political aspect of the cycle ends:

- 1920s/2000s – High inequality, high banker pay, low regulation, low taxes for the wealthy, robber barons (CEOs), reckless bankers, globalisation phase

- 1929/2008 – Wall Street crash

- 1930s/2010s – Global recession, currency wars, trade wars, rising unemployment, nationalism and extremism

- What comes next? – World War.

If Capitalism could speak, she would ask her older brother, Imperialism, this: “Can you solve the problem?” We are not reliving the 1930’s, the economy is now an integrated whole that encompasses the entire World. Capital has been accumulating since 1945, so under- and unemployment is a plague everywhere. How big is the problem? Official data tells us nothing, but the 47 million Americans on food aid are suggestive. That’s 1 in 7 Americans and total World population is 7 billion.

The scale of the solution is dangerous. Our probing for weakness in the South China Sea, Ukraine and Syria has awakened them to their danger.The Chinese and Russian leadershave reacted by integrating their payment systems and real economies, trading energy for manufactured goods for advanced weapon systems. As they are central players in the Shanghai Group we can assume their aim is the monetary system which is the bedrock of our Imperial power. What’s worse, they can avoid overt enemy action and simply choose to undermine “confidence” in the FIAT.

Though given the calibre of their nuclear arsenal, how can they be fought let alone defeated? Appetite preceded Reason, so Lust is hard to Reason with. But beware brother. Your Lust for Power began this saga, perhaps it’s time to Reason.

- EIA Weekly Summary Report Analysis 3 2 2016 (Video)

By EconMatters

An Analysis of the EIA Weekly Summary Report regarding the Oil Industry. Increasing Oil Imports right now are outpacing U.S. Production cuts, but the market is looking past this data metric, and focusing on increased gasoline demand numbers on a year over year basis.

© EconMatters All Rights Reserved | Facebook | Twitter | YouTube | Email Digest | Kindle

- Global Central Banks Continue Longest Gold-Buying-Spree Since Vietnam War

While “greed was good” in the ’80s, it appears “gold is good” in the new normal. As much as the barbarous relic is despised by all the mainstream money-peddlers in public (aside from those who have left the familia like Alan Greenspan), it seems to be loved in private. Central banks have been net buyers of gold for eight straight years, according to IMF estimates, the longest streak since the first troops were deployed in The Vietnam War.

Chart: Bloomberg

As Bloomberg notes, Russia, China and Kazakhstan among the biggest hoarders, International Monetary Fund data show.

Countries purchased almost 590 metric tons last year, accounting for 14 percent of annual global bullion demand, the World Gold Council estimates. Central bankers are using the metal to diversify from currencies, particularly the dollar, said Stefan Wieler, a Toronto-based vice president at GoldMoney Inc., a financial bullion services firm.

While physical demand has been consistently strong, paper prices have roller-coastered over the same period. However, gold’s recent “golden cross” as the world goes NIRP (and protectionist), just as The Fed unleashes tightening hell, suggests something is different this time…

- America's Ruling Classes: No Fear, No Caution, No Prudence

Submitted by Charles Hugh-Smith of OfTwoMinds blog,

Could it be that America's ruling classes, its Imperial state and the Federal Reserve, no longer rule their own destiny?

America's smug ruling classes are supremely confident: they feel no fear, no caution, and exhibit no prudence.

I outlined the five ruling classes in America's Nine Classes: The New Class Hierarchy.

The Deep State is confident that its Imperial toady Hillary Clinton will win the election, beating the Upstart Crow, paving a smooth path to unhindered Imperial entanglements around the world. Hillary never saw an Imperial entanglement she didn't like, and her track record of abysmal failure doesn't phase her.

The Obama Administration, from the president on down, are confident their thin legacy will remain untarnished, and will provide them a cash-out in the tens of millions in book advances, speaking fees, and all the other rewards that flow to those who served the Financial Oligarchy and the Deep State.

The Financial Oligarchy is also supremely confident. Obama's complete surrender to the Oligarchy in 2009 enabled a vast expansion of their wealth and power, and Goldman Sachs Hillary stands ready to do her masters' bidding.

The New Nobility (everyone between the .001% and the .05%) is also confident that the Federal Reserve will continue inflating their private wealth by whatever means are necessary–up to and including expropriation of middle class savings via zero interest rate policy and other financial tyranny.

The Upper Caste of technocrats that have skimmed billions in government contracts and stock options in Silicon Valley's Unicorn era are also supremely confident: thanks to the Federal Reserve, they can borrow money for essentially zero interest and use the free money to buy back millions of shares, boosting their own private wealth immensely.

The flim-flam of "innovation" will continue to sell their shares and their gadgets, and their dominance of New Media guarantees they have a lock on the devilishly effective soma of distraction, social media, mindless mobile gaming, etc. that persuades the debt-serf masses that they love their servitude.

The State Nomenklatura is also smugly confident that their privileged spot at the bloated Federal trough of trillions is guaranteed: wealthy lobbyists are buying multi-million dollar McMansions in the cultural wastelands of Northern Virginia (the gaudy ugliness of the homes matching the pretensions of the Nomenklatura), contractors are billing taxpayers billions for questionable services to the National Security State, and public union employees are confident that the Federal government will bail out their unaffordable pension and benefits plans once their local Democratic machines have stripmined the taxpayers and bankrupted what's left of the local government.

This is hubris on an unimaginable scale. If there was any karmic justice in this Universe, all these classes would be ground into the dust of an era that they thought would last forever–an era doomed by their smug confidence that nothing could ever threaten their privileges, wealth and power.

Here's an interesting chart (courtesy of mdbriefing.com) of financial profits as a percentage of GDP and the ratio of debt to GDP. In the virtuous cycle of rapidly expanding financialization/credit, expanding debt pushes growth as measured by GDP (a misleading measure, but that's another story).

The cycle has reversed and is now unvirtuous: more debt is not pushing GDP higher, hence the declining ratio. Adding debt is not generating growth. Diminishing returns have grabbed the parasitic, predatory monster of financialization by its surprisingly vulnerable neck.

Meanwhile, financial profits are cratering. Wait, how could this be happening? Where's the Federal Reserve? Wave your wands, do some more magic!

Could it be that America's ruling classes, its Imperial state and the Federal Reserve, no longer rule their own destiny? Could their smug confidence be their undoing?

Only two things could upset the ruling class apple cart: a financial crash that the Fed can't stop, much less reverse, and Donald Trump winning the presidency.

- Striking Admission By Former Bank Of England Head: The European Depression Was A "Deliberate" Act

Once again we find that it is only after they leave their official posts that central bankers finally tell the truth.

Last night, it was Alan Greenspan who blasted the state of the economy, saying that “we’re in trouble basically because productivity is dead in the water” and when asked if he is optimistic going forward, Greenspan replied “no, I haven’t been for quite a while.”

Then on Sunday, the former head of the BOE, Mervyn King, warned that another aspect of the global economy, namely the financial system whose structural problems remain untouched since the financial crisis have been untouched, is “certain to have another crisis.”

To be sure, warnings by former central bankers who are more responsible about the current global mess sound as nothing but revisionist bullshit. And yet, it was what King said today at the launch of his new book that left us surprised.

As the Telegraph reports today, according to the former head of the Bank of England Europe’s economic depression “is the result of “deliberate” policy choices made by EU elites. Mervyn King continued his scathing assault on Europe’s economic and monetary union, having predicted the beleaguered currency zone will need to be dismantled to free its weakest members from unremitting austerity and record levels of unemployment.

King also said he could never have envisaged an economic collapse of the depths of the 1930s returning to Europe’s shores in the modern age. But, he added, the fate of Greece since 2009 – which has suffered a contraction eclipsing the US depression in the inter-war years – was an “appalling” example of economic policy failure, he told an audience at the London School of Economics.

“I never imagined that we would ever again in an industrialised country have a depression deeper than the United States experienced in the 1930s and that’s what’s happened in Greece.

Lord King – who spent a decade fighting the worst financial crisis in history at the Bank of England – has said the weakest eurozone members face little choice but to return to their national currencies as “the only way to plot a route back to economic growth and full employment”.

But the biggest question about Europe’s depression has always been whether it was the result of sheer stupidity and poor economic decisions or deliberate. King’s answer was stunning: “it is appalling and it has happened almost as a deliberate act of policy which makes it even worse”.

The reason this statement is profound, is because it validates what “that” 2008 AIG report predicted long ago, and certainly years before the European crisis was unleashed, namely that Europe would specifically create a financial crisis (as well as an environmental crisis, as well as terrorism) in order to fortify “Empire Europe.”

Recall what then-AIG Banque’s strategist Bernard Connolly said in response to the rhetorical question of “What Europe wants“

To use global issues as excuses to extend its power:

- environmental issues: increase control over member countries; advance idea of global governance

- terrorism: use excuse for greater control over police and judicial issues; increase extent of surveillance

- global financial crisis: kill two birds (free market; Anglo-Saxon economies) with one stone (Europe-wide regulator; attempts at global financial governance)

- EMU: create a crisis to force introduction of “European economic government”

The tragedy for Europe is that it has all panned out just as Europe’s unelected, ruling oligarchy as expected, and while we should congratulate Brussels which has managed to not only preserve but solidify its power, it now rules over a decaying, economically insolvent continent, with an entire generation left unemployed, with millions of refugees scrambling to get in, and with Europe’s cultural “integration” back to levels not seen in decades.

And whereas before we could speculate that all of this had been at most a chance occurrence, we now know better: it was premeditated from day one.

- British Pension Provider Warns Of "Death Of Retirement"

British workers will have to work until they are 81 if they want to build up savings that guarantee their parents’ standard of retirement, according to a new study by pension provider Royal London. Without significantly higher levels of engagement in pensions, the report concludes rather ominously, “we may be witnessing the death of retirement.”

As AP reports,

The research released Wednesday comes as the British government embarks on a review of pensions that has prompted speculation it will raise the retirement age to compensate for a burgeoning older population. The retirement age for men and women is already set to rise to 66 between December 2018 and October 2020.

Royal London says changes in workplace pensions mean workers aren’t saving enough to ensure they have the same kind of retirement their parents expected.

Royal London notes that changes in workplace pension provision mean that coming generations of retirees could have a radically different experience of retirement from their parents. Unless today’s workers begin to save significantly more for their later life, many will find that the quality of later life enjoyed by their parents will be unattainable unless they work well beyond traditional retirement ages.

For many people, continuing to work to these much higher ages may simply be beyond their physical capability. Without significantly higher levels of engagement in pensions, we may be witnessing the ‘death of retirement’.

Full Royal London Report below:

- Why Globalization Reaches Limits

Submitted by Gail Tverberg via Our Finite World blog,

We have been living in a world of rapid globalization, but this is not a condition that we can expect to continue indefinitely.

Each time imported goods and services start to surge as a percentage of GDP, these imports seem to be cut back, generally in a recession. The rising cost of the imports seems to have an adverse impact on the economy. (The imports I am showing are gross imports, rather than imports net of exports. I am using gross imports, because US exports tend to be of a different nature than US imports. US imports include many labor-intensive products, while exports tend to be goods such as agricultural goods and movie films that do not require much US labor.)

Recently, US imports seem to be down. Part of this reflects the impact of surging US oil production, and because of this, a declining need for oil imports. Figure 2 shows the impact of removing oil imports from the amounts shown on Figure 1.

Figure 2. Total US Imports of Goods and Services, and this total excluding crude oil imports, both as a ratio to GDP. Crude oil imports from https://www.census.gov/foreign-trade/statistics/historical/petr.pdf

If we look at the years from 2008 to the present, there was clearly a big dip in imports at the time of the Great Recession. Apart from that dip, US imports have barely kept up with GDP growth since 2008.

Let’s think about the situation from the point of view of developing nations, wanting to increase the amount of goods they sell to the US. As long as US imports were growing rapidly, then the demand for the goods and services these developing nations were trying to sell would be growing rapidly. But once US imports flattened out as a percentage of GDP, then it became much harder for developing nations to “grow” their exports to the US.

I have not done an extensive analysis outside the US, but based on the recent slow economic growth patterns for Japan and Europe, I would expect that import growth for these areas to be slowing as well. In fact, data from the World Trade Organization for Japan, France, Italy, Sweden, Spain, and the United Kingdom seem to show a recent slowdown in imported goods for these countries as well.

If this lack of demand growth by a number of industrialized countries continues, it will tend to seriously slow export growth for developing countries.

Where Does Demand For Imports Come From?

Many of the goods and services we import have an adverse impact on US wages. For example, if we import clothing, toys, and furniture, these imports directly remove US jobs making similar goods here. Similarly, programming jobs and call center jobs outsourced to lower cost nations reduce the number of jobs available in the US. When US oil prices rose in the 1970s, we started importing compact cars from Japan. Substituting Japanese-made cars for American-made cars also led to a loss of US jobs.

Even if a job isn’t directly lost, the competition with low wage nations tends to hold down wages. Over time, US wages have tended to fall as a percentage of GDP.

Figure 3. Ratio of US Wages and Salaries to GDP, based on information of the US Bureau of Economic Analysis.

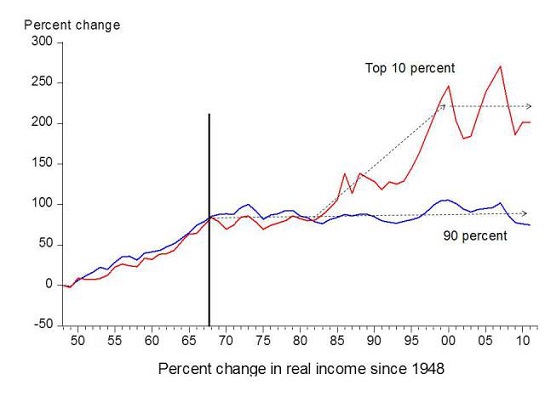

Another phenomenon that has tended to occur is greater disparity of wages. Partly this disparity represents wage pressure on individuals doing jobs that could easily be outsourced to a lower-wage country. Also, executive salaries tend to rise, as companies become more international in scope. As a result, earnings for the top 10% have tended to increase since 1981, while wages for the bottom 90% have stagnated.

Figure 4. Chart by economist Emmanuel Saez based on an analysis IRS data, published in Forbes. “Real income” is inflation-adjusted income.

If wages of most workers are lagging behind, how is it possible to afford increased imports? I would argue that what has happened in practice is greater and greater use of debt. If wages of American workers had been rising rapidly, perhaps these higher wages could have enabled workers to afford the increased quantity of imported goods. With wages lagging behind, growing debt has been used as a way of affording imported goods and services.

Inasmuch as the US dollar was the world’s reserve currency, this increase in debt did not have a seriously adverse impact on the economy. In fact, back when oil prices were higher than they are today, petrodollar recycling helped maintain demand for US Treasuries as the US borrowed increasing amounts of money to purchase oil and other goods. This process helped keep borrowing costs low for the US.

Figure 5. US Increase in Debt as Ratio to GDP and US imports as Ratio to GDP. Both from FRED data: TSMDO and IMPGS.

The problem, however, is that at some point it becomes impossible to raise the debt level further. The ratio of debt to GDP becomes unmanageable. Consumers, because their wages have been held down by competition with wages around the world, cannot afford to keep adding more debt. Businesses find that slow wage growth in the US holds down demand. Because of this slow growth in the demand, businesses don’t need much additional debt to expand their businesses either.

Commodity Prices Are Extremely Sensitive to Lack of Demand

Commodities, by their nature, are things we use a lot of. It is usually difficult to store very much of these commodities. As a result, it is easy for supply and demand to get out of balance. Because of this, prices swing widely.

Demand is really a measure of affordability. If wages are lagging behind, then an increase in debt (for example, to buy a new house or a new car) can substitute for a lack of savings from wages. Unfortunately, such increases in debt have not been happening recently. We saw in Figure 5, above, that recent growth in US debt is lagging behind. If very many countries find themselves with wages rising slowly, and debt is not rising much either, then it is easy for commodity demand to fall behind supply. In such a case, prices of commodities will tend to fall behind the cost of production–exactly the problem the world has been experiencing recently. The problem started as early as 2012, but has been especially bad in the past year.

The way the governments of several countries have tried to fix stagnating economic growth is through a program called Quantitative Easing (QE). This program produces very low interest rates. Unfortunately, QE doesn’t really work as intended for commodities. QE tends to increase the supply of commodities, but it does not increase the demand for commodities.

The reason QE increases the supply of commodities is because yield-starved investors are willing to pour large amounts of capital into projects, in the hope that commodity prices will rise high enough that investments will be profitable–in other words, that investments in shares of stock will be profitable and also that debt can be repaid with interest. A major example of this push for production after QE started in 2008 is the rapid growth in US “liquids” production, thanks in large part to extraction from shale formations.

Figure 6. US oil and other liquids production, based on EIA data. Available data is through November, but amount shown is estimate of full year.

As we saw in Figure 5, the ultra-low interest rates have not been successful in encouraging new debt in general. These low rates also haven’t been successful in increasing US capital expenditures (Figure 7). In fact, even with all of the recent shale investment, capital investment remains low relative to what we would expect based on past investment patterns.

Figure 7. US Fixed Investment (Factories, Equipment, Schools, Roads) Excluding Consumer Durables as Ratio to GDP, based in US Bureau of Economic Analysis data.

Instead, the low wages that result from globalization, without huge increases in debt, make it difficult to keep commodity prices up high enough. Workers, with low wages, delay starting their own households, so have no need for a separate apartment or house. They may also be able to share a vehicle with other family members. Because of the mismatch between supply and demand, commodity prices of many kinds have been falling. Oil prices, shown on Figure 9, have been down, but prices for coal, natural gas, and LNG are also down. Oil supply is up a little on a world basis, but not by an amount that would have been difficult to absorb in the 1960s and 1970s, when prices were much lower.

Figure 9. World oil production and price. Production is based on BP, plus author’s estimate for 2016. Historical oil prices are calculated based on a higher than usual recent inflation rate, assuming Shadowstats’ view of inflation is correct.

Developing Countries are Often Commodity Exporters

Developing countries can be greatly affected if commodity prices are low, because they are often commodity exporters. One problem is obviously the cutback in wages, if it becomes necessary to reduce commodity production. A second problem relates to the tax revenue that these exports generate. Without this revenue, it is often necessary to cut back funding for programs such as building roads and schools. This leads to even more job loss elsewhere in the economy. The combination of wage loss and tax loss may make it difficult to repay loans.

Obviously, if low commodity prices persist, this is another limit to globalization.

Conclusion

We have identified two different limits to globalization. One of them has to do with limits on the amount of goods and services that developed countries can absorb before those imports unduly disrupt local economies, either through job loss, or through more need for debt than the developed economies can handle. The other occurs because of the sensitivity of many developing nations have to low commodity prices, because they are exporters of these commodities.

Of course, there are other issues as well. China has discovered that if its coal is burned in great quantity, it is very polluting and a problem for this reason. China has begun to reduce its coal consumption, partly because of pollution issues.

Figure 10. China’s energy consumption by fuel, based on data of BP Statistical Review of World Energy 2015.

There are many other limiting factors. Fresh water is a major problem, throughout much of the developing world. Adding more people and more industry makes the situation worse.

One problem with globalization is a long-term tendency to move manufacturing production to countries with ever-lower standards in many ways: ever-lower pollution controls, ever-lower safety standards for workers, and ever-lower wages and benefits for workers. This means that the world becomes an ever-worse place to work and live, and the workers in the system become less and less able to afford the output of the system. The lack of buyers for the output of the system makes it increasingly difficult to keep prices of commodities high enough to support their continued production.

The logical end point, even beyond globalization, is for automation and robots to perform nearly all production. Of course, if that happens, there will be no one to buy the output of the system. Won’t that be a problem?

Adequate wages are critical to making any system work. As the system has tended increasingly toward globalization, politicians have tended to focus more and more on the needs of businesses and governments, and less on the needs of workers. At some point, the lack of buyers for the output of the system will tend to bring the whole system down.

Thus, at some point, the trend toward globalization and automation must stop. We need buyers for the output from the system, and this is precisely the opposite of the direction in which the system is trending. If a way is not found to fix the system, it will ultimately collapse. At a minimum, the trend toward increasing imports will end–if it hasn’t already.

- How Wall Street Is Preparing For "President Trump"

While the market has had its share of bogeymen to worry about so far in 2016, mostly along the lines of the "Four Cs", namely China, Crude, Credit and Currencies, it has so far largely ignored one letter: the Big D, for Donald, as in how would a Trump presidency affect the market. And, as Reuters writes, it is time for Wall Street to add "the juggernaut that is Donald J. Trump to the list of what-ifs that is worrying Wall Street."

The kneejerk, conventional wisdom reaction is that the non-establishment outsider would be a big risk for stocks: "a growing realization that the unpredictable New York real estate developer is in a position to win the Republican nomination and then battle Hillary Clinton for the White House in November's election has caused some investors to sell U.S. stocks. They fear having such a wild-card president could trigger trade wars, hurt the economy and add a lot of market volatility."

AS Doug Kass notes, "as the market rarely feasts on lack of predictability – Trump represents a nightmare for investors this year." Kass said last week that he was adding to his existing short bet on the U.S. stock market in part because of Trump's increasingly strong position in the race.

The problem is that it is difficult to pigeonhole Trump's market policies: according to Reuters, "his statements on business and Wall Street don't neatly fit into one ideological worldview, but if anything, they are seen as isolationist in a globally connected world. He can also suddenly pick on businesses over various issues, such as his call for a boycott of Apple’s products after the tech giant refused to help the FBI unlock the iPhone used by one of the San Bernardino shooters."

It's not just the usual "year eight" of the presidential cycle jitters when the market tends to underperform: "The election this year is the height of uncertainty," said Phil Orlando, a senior portfolio manager and chief equity strategist at Federated Investors in New York, which manages $351 billion. He said political concerns – personified by Trump's emergence as a frontrunner – are one of the main reasons why he began reducing equity exposure in mid-January.

Others are concerned about Trump's "lack of substance" such as Dave Lafferty, chief market strategist at Natixis Global Asset Management who said that "Trump has been light on policy substance so it’s very difficult for the markets to handicap." He expects market volatility to rise if Trump extends his lead in Tuesday’s elections.

Then there are fears about Trump's domestic policies. Some investors are particularly concerned about Trump's nationalist rhetoric, saying it is potentially destructive to a global economy that is already struggling. If it reduces trade flows then it could also hamper U.S. and global growth and hurt U.S. company profits.

As Trump has noted several times during recent speeches, he proposes labeling China a currency manipulator and ending what he calls China's illegal export subsidies and theft of U.S. intellectual property. He also wants to penalize companies who move jobs from the U.S. to Mexico by hitting them with high tariffs if they want to export back to the U.S., as well as build a wall at the Mexican border to prevent the flow of illegal immigrants. Then again considering the US just announced a 266% duty on Chinese steel imports, it may be that Obama is merely frontrunning Trump's policies.

In response, Trump’s spokeswoman Hope Hicks said in an email to Reuters that the same crowd criticizing the Republican Party's top candidate had been responsible for causing the last worldwide recession and economic meltdown in 2007-2008.

"They have zero credibility," said Hicks. "Mr. Trump will restore confidence to the global markets by ending runaway spending and borrowing, restoring trade balance and fairness, and bringing wealth to America's middle class."

One can't say that he is wrong.

What is surprising, is that among his other proposals, Trump would bring forth some very market-friendly policies: plans include ideas that traditionally come from Republican candidates, such as lowering the corporate tax rate, simplifying the tax code, and as his web site puts it, cutting the deficit through "eliminating waste, fraud and abuse" and "growing the economy to increase tax revenues.”

"I think markets will like Trump on the taxes issue since he favors lower rates and a permanent change in repatriation rules," said David Kotok, chairman and chief investment officer at Cumberland Advisors.

On the other hand, some on Wall Street are worried that Trump's plans to do away with the so-called carried interest tax loophole – which gives hedge fund and private equity managers preferential tax treatment on much of their income – would prompt more selling if he begins to climb in national polls against Clinton.

Then there are questions about Trump's fiscal policies. David Ader, chief government bond strategist at CRT Capital Group in Stamford, Connecticut, said Trump's history raises questions about his ability to run an organization as unwieldy and complex as the government. The businessman has in the past filed for Chapter 11 bankruptcy protection for the Trump Taj Mahal casino and Trump Plaza Hotel. Ader says the uncertainty would cause investors to flock to safe-haven U.S. Treasuries should Trump take office. "It's one thing to run casinos that have gone bankrupt, it's another to run a country and its foreign policy," he said.

To this one can respond that if the Fed is unsuccessful at inflating away the debt, default would be the next option (if not very likely), and someone who is familiar with balance sheet restructurings, such as Trump, is precisely what America needs.

However, that may not be enough for Todd Morgan, senior managing partner at wealth management firm Bel Air Investments Advisors in Los Angeles, who is already taking action: he said that the increasing likelihood that Trump will be the Republican nominee is one reason why he has raised cash in some client portfolios over the past four months. He would likely sell more if it looks like Trump will win the general election, he said.

"It's like a scale and you keep dropping more weights on the balance everyday, and the political uncertainty is becoming a bigger and bigger weight," he said.

Some are far more optimistic, and as Carl Icahn told Neil Cavuto last night, "I do believe Donald Trump is what this country needs right now."

Watch the latest video at video.foxbusiness.com

But the best and most pragmatic response came from DoubleLine's Jeffrey Gundlach, who said that Trump has a history of being ”comfortable with a lot of debt and leverage," and that won't impede him from spending heavily. He said he believes Trump’s pledge to spend heavily on the military makes defense stocks a good investment play.

In other words, for all the rhetoric and all the bluster, at the end of the day, America under president Trump will be… very much the same.

- Can Americans Handle Four More Years Of This?

- How The U.S. Government And HSBC Teamed Up To Hide The Truth From A Pennsylvania Couple

Submitted by Mike Krieger via Liberty Blitzkrieg blog,

The reason both the Democratic and Republican establishments are in full on panic mode about the rise of Donald Trump and Bernie Sanders is a deep seated fear that the plebs have finally woken up.

Democrats rail against big corporations, while Republicans rail against big government. This scheme has been used to successfully divide and conquer the public for decades while big government and big business successfully schemed to divert all wealth and power to an ever smaller minuscule segment of the population — themselves.

It took awhile, but the people are finally starting getting it and they are royally pissed off. One of the primary mechanisms for this historic elite theft has been the creation of a two-tiered justice system in which the rich, powerful and connected are never prosecuted for their criminality. Instead, the government actively protects them by pretending corporate entities commit crimes as opposed to individuals. Of course, this is impossible, but yet it’s how the government handles white collar crime. The Orwellian named “Justice Department” casually utilizes deferred prosecution agreements (DPAs), in which companies pay a little fine and the criminals themselves walk away with not just their freedom, but ill gotten monetary gains as well.

Nowhere is this most apparent than when it comes to the big banks. The individuals who work at these criminal cartels can literally do anything they want with total impunity. One of the most egregious examples of this was the $1.9 billion settlement arranged with HSBC for laundering Mexican drug cartel money and dealing with sanctioned countries. If you or I did this we’d be sitting in a concrete box eating porridge through a straw for the rest of our lives, but when “masters of the world” at big banks do it, the parent company just pays a slap on the wrist fine and life goes on. That’s how oligarch justice works.

Although the Department of Justice and HSBC thought the money laundering case was settled ancient history, a determined chemist from Pennsylvania is throwing a wrench into their plans and it could have major implications.

The Wall Street Journal reports:

WEST CHESTER, Pa.—When Dean Moore ran into roadblocks with a request for mortgage relief, he did what many people do: He sat down at his kitchen table to bang out an angry letter.

The letter has thrust Mr. Moore, a chemist, and his wife, Ann Marie Fletcher-Moore, a part-time bookstore manager, into a high-stakes battle over whether HSBC Holdings PLC must release a secret report on its compliance with a $1.9 billion money-laundering settlement.

A “secret” report. You’ve got to be kidding me.

The disclosure would be the first ever for this type of case and would shine a light on an increasingly common practice for banks accused of breaking the law. Instead of being prosecuted, banks typically enter into settlements under which they often agree to be overseen by monitors whose detailed judgments are kept secret. Judge Gleeson’s order has the potential to dial back that confidentiality, opening a new channel of information that prosecutors say could threaten the viability of such settlements in future cases.

If you don’t get by now that America is a banana republic, there’s little hope for you.

HSBC and Justice Department prosecutors have opposed the release, saying it wouldn’t do much to help Mr. Moore with his mortgage predicament. Judge Gleeson, in his order to unseal the report, said that was irrelevant.

Big banks and the U.S. government are simply 100% in bed together. Constantly scheming to prevent citizens from learning the truth.

The bank is appealing the ruling, but already it may be having an impact. HSBC disclosed last week that the January report by independent monitor Michael Cherkasky found instances of potential financial crime and had “significant concerns” about the bank’s pace of progress in complying with the money-laundering settlement.

A legitimate government that cared about the people would want the public to know this, but not the U.S. government.

The Moores say the experience has been surreal. The couple lives in this Philadelphia suburb with their four children, two dogs and a 15-year-old rabbit and had never spent much time in court other than for jury duty. They have nevertheless held their own against a phalanx of lawyers from the British bank and the Justice Department. A recent hearing in a Brooklyn federal court “was like ‘Law and Order,’” said Mrs. Fletcher-Moore, who is 50 years old.

HSBC admitted in its 2012 settlement that it failed to catch at least $881 million in drug-trafficking proceeds laundered through its U.S. bank and that its staff stripped data from transactions with Iran, Libya and Sudan to evade U.S. sanctions.

The mortgage was administered by HSBC, and the Moores say they wrote to the bank starting in 2008 asking it to temporarily lower the 7% interest rate. They said the lender appeared receptive, only for its representatives to misplace documents needed to complete their application for a loan modification several times.

Frustrated, the Moores researched the bank online last year and stumbled upon news of the money-laundering settlement and the monitor’s secret report. The Moores say they believe the report details faulty internal controls like those they encountered when trying to modify their loan.

If his ruling stands, it would be “the first time we get to see what happens after a bank settles a prosecution,” said Brandon Garrett, a professor at University of Virginia’s law school who has studied the monitor system.

Which is exactly what the U.S. government doesn’t want people to see.

HSBC and the Justice Department are still fighting to keep the report private and have appealed Judge Gleeson’s ruling to the Second Circuit Court of Appeals. An appeals court ruling could be months away. “I feel like a very small boat in a very large ocean,” Mr. Moore wrote at one point, in a letter responding to some of their arguments.

For more on the corrupt U.S. justice system, see:

How the Department of Justice is Actively Trying to Prevent Civil Asset Forfeiture Reform

Is the Justice Department Finally Ready to Jail Corporate Criminals?

Florida Man Sentenced to 2.5 Years in Jail for Having Sex on the Beach

Some Money Launderers are “More Equal” than Others

Some Money Launderers are More Equal than Others Part 2 – CEO of BitInstant is Arrested

Just another day in the…

- What Percent Are You?

Are you the 1% or the 99%? How about among millennials? Or high-school dropouts? The Wall Street Journal shows how your income compares with your fellow Americans.

Earning $25,780 would put you below 50% of Americans reporting individual income in 2014. What percent are you?

Click image below for interactive version

- "How To Move To Canada" Searches Spike 1,000% After Trump Super Tuesday Rout

Super Tuesday sure was “super” for Donald Trump.

The billionaire – who has gone from “joke” to “frontrunner” in the span of just 9 months – is now the presumed pick for the GOP nomination.

That’s rattled the Republican establishment and sent shockwaves through Washington where no one – and we mean on one – can figure out how this happened.

And while citizens clearly believe Trump is preferable to America’s entrenched political aristocracy, there are quite a few people who have very real reservations about the prospects of a Trump presidency. As we noted earlier this week, readers will likely disagree with a number of Larry Summers’ points, but the bottom line is that some Americans are concerned about the direction the coutnry will take under a Trump presidency.

As The Telegraph notes, searches by Americans for “how can I move to Canada” were up more than 1,000% at their peak after Trump’s Super Tuesday victory.

@smfrogers @jtuohey21 this shows 1500%? pic.twitter.com/T9ftRHSrsG

— Brian Ries (@moneyries) March 2, 2016

And so, while this would seem to indicate a bit of national disaffection for the Trump bid, it’s worth noting that the billionaire’s supoort base is unwavering. In fact, the GOP frontrunner’s dominating performance on Tuesday evening indicates that for every American who wants to move to Canada should in the event he wins the presidency, there are just as many (or many more) Americans who think Trump is just what the country needs.

“While analysts were already aware of Trump’s popularity among less-educated workers, his landslide win in Massachusetts with 49 per cent of the vote was particularly surprising, since the state has the most educated population in the U.S,” The Telegraph goes on to note.

At his victory speech in Florida, he said: “I’m going to get along very well with the world. You’re going to be very proud of me as president.”

Well, unless you move to Canada. In which case you’ll have to be “very proud” of Justin Trudeau.

- Billionaire Koch Brothers Won't Attack Trump In Primaries After Murdoch Calls For Party Unity

It appears it is not just the bookies that see Trump’s nomination as a done deal. Even the money behind the establishment is folding now as Reuters reports the mega-donor billionaire Koch brothers have said they have “no plans to get involved in the primary.” This follows another mega-donor, Rupert Murdoch’s call to “unify the party” as Trump tries to make peace with the “establishment.”

Before Super Tuesday – as the rhetoric reached 1st grade – Murdoch (cum peacekeeper) tweeted…

Both “establishment” Republicans and Trump need to cool it and close ranks to fight real enemy. Trump, Rubio, Kasich could all win general.

— Rupert Murdoch (@rupertmurdoch) February 28, 2016

And then earlier this evening, following Trump’s success, he followed up with…

As predicted, Trump reaching out to make peace with Republican “establishment”. If he becomes inevitable party would be mad not to unify.

— Rupert Murdoch (@rupertmurdoch) March 2, 2016

Which, as Reuters reports, appears to have forced some to stop the denial and move forward…

The billionaire industrialist Koch brothers, the most powerful conservative mega donors in the United States, will not deploy their $400 million political arsenal to attack Republican front-runner Donald Trump in the U.S. presidential primary election, according to an official from the brother’s political umbrella group.

“We have no plans to get involved in the primary,” said James Davis, spokesman for Freedom Partners, the Koch brothers’ political umbrella group.

Donors and media reports have speculated since a Koch summit in January that the brothers would launch a “Trump Intervention,” a strategy that would involve deploying the Koch’s vast political network to target the billionaire reality TV star in hopes of removing him from the race.

It is hardly surprising as throwing good money after bad (ask Jeb) just isn’t going to change the minds of an angry electorate…

- Are You A 'Religious Extremist'?

Submitted by Michael Snyder via The End of The American Dream blog,

Are you a religious extremist? For years, world leaders have been endlessly proclaiming that we need to eradicate “extremism”, but what actually is “extremism”? Many would point to the ISIS jihadists over in the Middle East that are beheading people that don’t agree with them as examples of religious extremists, and I think that very few people would argue with that. But our politicians (especially the liberal ones) rarely use the term “Islamic terrorists” anymore. Instead, they tend to use the term “religious extremists”, and that has a much, much broader connotation. In fact, if you are a Bible-believing Christian, you are probably included in that category.

Most Bible-believing Christians would never think of themselves as being similar to radical jihadists in the Middle East, but that is precisely how many of their fellow Americans very them. The Barna Group has just released a shocking new study which found that 45 percent of all “non-religious” Americans believe that “Christianity is extremist”…

The perception that the Christian faith is extreme is now firmly entrenched among the nation’s non-Christians. A full forty-five percent of atheists, agnostics, and religiously unaffiliated in America agree with the statement “Christianity is extremist.” Almost as troubling is the fact that only 14 percent of atheists and agnostics strongly disagree that Christianity is extremist. The remaining four in ten (41%) disagree only somewhat. So even non-Christians who are reluctant to fully label Christianity as extremist, still harbor some hesitations and negative perceptions toward the religion.

Even more troubling is what the study discovered about how the general population views specific religious activities. There has been a tremendous shift in society, and behaviors that were considered to be completely mainstream a few decades ago are now considered to be “extremism”.

Are you ready to take a test? Look over the Barna infographic that I have shared below very carefully. Have you ever participated in any of these “extremist activities”?…

If you have ever participated in any of the activities listed in category 1 or category 2, you are a “religious extremist” according to most Americans.

Of course every single one of the behaviors in category 2 would potentially apply to me, so I guess that would make me an “extremist” according to this definition.

This is where our society is heading. Of course “Christian extremists” are not normally put into prison in the United States quite yet, but hatred toward our faith in rapidly rising in society. Church attendance is dropping like a rock, the Christian faith is relentlessly mocked in movies and on television, and incidents of hostility toward Christians have doubled over the past three years.

And the truth is that even the federal government and the military are rapidly turning against Bible-believing Christians. For example, the slide that I have posted below comes from a U.S. Army Reserve Equal Opportunity training brief that described “Evangelical Christianity” and “Catholicism” as examples of “religious extremism”…

Once this came out, there was a huge uproar and some people got into trouble over this. But it should be exceedingly alarming to people of faith that U.S. military personnel were being trained that evangelical Christians are on the same level as the Ku Klux Klan.

And of course this is far from the only example of this phenomenon. In fact, Christians have regularly been described as “extremists” and “potential terrorists” in official U.S. government documents since the day that Barack Obama first stepped into the White House.

The following is an extended excerpt from my previous article entitled “72 Types Of Americans That Are Considered ‘Potential Terrorists’ In Official Government Documents“…

*****

Below is a list of 72 types of Americans that are considered to be “extremists” and “potential terrorists” in official U.S. government documents. To see the original source document for each point, just click on the link. As you can see, this list covers most of the country…

1. Those that talk about “individual liberties”

2. Those that advocate for states’ rights

3. Those that want “to make the world a better place”

4. “The colonists who sought to free themselves from British rule”

5. Those that are interested in “defeating the Communists”

8. Anyone that possesses an “intolerance toward other religions”

9. Those that “take action to fight against the exploitation of the environment and/or animals”

10. “Anti-Gay”

11. “Anti-Immigrant”

12. “Anti-Muslim”

14. “Opposition to equal rights for gays and lesbians”

15. Members of the Family Research Council

16. Members of the American Family Association

18. Members of the American Border Patrol/American Patrol

19. Members of the Federation for American Immigration Reform

20. Members of the Tennessee Freedom Coalition

21. Members of the Christian Action Network

22. Anyone that is “opposed to the New World Order”

23. Anyone that is engaged in “conspiracy theorizing”

24. Anyone that is opposed to Agenda 21

25. Anyone that is concerned about FEMA camps

26. Anyone that “fears impending gun control or weapons confiscations”

28. The sovereign citizen movement

29. Those that “don’t think they should have to pay taxes”

30. Anyone that “complains about bias”

31. Anyone that “believes in government conspiracies to the point of paranoia”

32. Anyone that “is frustrated with mainstream ideologies”

33. Anyone that “visits extremist websites/blogs”

34. Anyone that “establishes website/blog to display extremist views”

35. Anyone that “attends rallies for extremist causes”

36. Anyone that “exhibits extreme religious intolerance”

37. Anyone that “is personally connected with a grievance”

38. Anyone that “suddenly acquires weapons”

39. Anyone that “organizes protests inspired by extremist ideology”

40. “Militia or unorganized militia”

41. “General right-wing extremist”

42. Citizens that have “bumper stickers” that are patriotic or anti-U.N.

43. Those that refer to an “Army of God”

44. Those that are “fiercely nationalistic (as opposed to universal and international in orientation)”

45. Those that are “anti-global”

46. Those that are “suspicious of centralized federal authority”

47. Those that are “reverent of individual liberty”

48. Those that “believe in conspiracy theories”

49. Those that have “a belief that one’s personal and/or national ‘way of life’ is under attack”

51. Those that would “impose strict religious tenets or laws on society (fundamentalists)”

52. Those that would “insert religion into the political sphere”

53. Anyone that would “seek to politicize religion”

54. Those that have “supported political movements for autonomy”

55. Anyone that is “anti-abortion”

56. Anyone that is “anti-Catholic”

57. Anyone that is “anti-nuclear”

60. Those concerned about “illegal immigration”

61. Those that “believe in the right to bear arms”

62. Anyone that is engaged in “ammunition stockpiling”

63. Anyone that exhibits “fear of Communist regimes”

65. Those that are against illegal immigration

66. Those that talk about “the New World Order” in a “derogatory” manner

67. Those that have a negative view of the United Nations

68. Those that are opposed “to the collection of federal income taxes”

69. Those that supported former presidential candidates Ron Paul, Chuck Baldwin and Bob Barr

70. Those that display the Gadsden Flag (“Don’t Tread On Me”)

71. Those that believe in “end times” prophecies

*****

Are you starting to get the picture?

- The Copper Market Breakout 3 2 2016 (Video)

By EconMatters

We broke out in the copper market today. We look at what resistance levels are in play going forward in the market.

© EconMatters All Rights Reserved | Facebook | Twitter | YouTube | Email Digest | Kindle

- The Next Cockroach Emerges: Including Undrawn Loans, Canadian Banks Exposure To Oil Doubles

One month ago, when we looked at the (very opaque) European banking sector and the pains it was undergoing as a result of its China and commodity exposure, we asked whether Canadian banks are next, focusing on the uncharacteristically low reserves local banks have to the loans in the oil and gas sector.

As we summarized, using an RBC report, if using the same average reserve level as that applied by US banks, Canadian banks’ current loss allowance excluding RBC would surge from $170MM to over $2.5 billion, resulting in a substantial hit to earnings, and potentially impairing the banks’ ability to service dividends and future cash distributions.

We also wondered what other cockroaches may be hiding inside the uncharacteristically optimistic Canadian banks’ balance sheets.

One answer was revealed today when Bloomberg reported that if one includes untapped loans in the form of undrawn revolvers and other committed but unused credit facilities, Canadian banks’ exposure to the struggling oil-and-gas industry more than doubles from the current C$50 billion in outstanding loans generally highlighted by Royal Bank of Canada, Toronto-Dominion Bank and the country’s four other large lenders in quarterly earnings calls and presentations, to C$107 billion ($80 billion).

As Bloomberg explains for those unfamiliar with how gross exposure works, in addition to existing loans and drawn credit facilities, banks also have exposure in the form of commitments, such as credit lines. They can potentially increase a bank’s risk, because the weakest borrowers often tap their entire credit line when nearing default. The banks’ exposure to oil-and-gas companies from outstanding loans and commitments range from about C$5 billion for National Bank of Canada to C$32 billion for Bank of Nova Scotia.

And when a liquidity shortage arrives as it most certainly will should oil continue to trade at current prices, distressed energy companies will promptly fully draw the last dollar available under untapped credit lines.

Borrowing the full amount before the credit line is cut helps companies preserve liquidity to keep paying their bills, and gives them leverage to negotiate with their creditors. For example, Royal Bank is among the lead lenders to SandRidge Energy Inc., which drew its entire $500 million credit line in January. The Oklahoma City-based company then missed a bond interest payment on Feb. 16, starting a 30-day countdown to default unless the coupon is paid or an agreement is reached with its lenders.

Remember when in late 2013 this website was warning about the unprecedented surge in issuance of covenant-lite loans? This is the reason.

Barring breaching contracts, “the banks really don’t have a lot of recourse to prevent you from drawing the credit line,” said Jason Wangler, an energy analyst at Wunderlich Securities in Houston. “They were really lax last year on covenants and it’s starting to cost them.”

Putting Canada’s energy loans in context, European banks disclosed during the most recent earnings season that they have almost $200 billion in oil-and-gas loans, while U.S. banks have an estimated $123 billion of outstanding loans and commitments to the industry. In other words when adding the committed but undrawn exposure, total Canadian bank exposure of $80 billion is fast approaching that of the entire US banking sector.

Not surprisingly, it was bank analysts who promptly tried to put liptsick on this pig:

Including oil-and-gas lending commitments overstates the banks’ risks, since the borrowers may not fully draw down those credit lines in times of trouble, said Peter Routledge, an analyst with National Bank Financial.

“The banks will lower the undrawn commitments before the borrowers go bankrupt,” Routledge said in an interview. “There will be some lines cut so it’s not going to be as big.”

Incidentally, this is precisely what US banks are quietly doing right now as we also reported two months ago, when we first explained that U.S. banks have been quietly shrinking the credit facilities of numerous oil and gas companies.

However, the banks better hurry: with every passing day energy company liquidity is getting increasingly more dire, to the point where they will soon scramble to take out as much cash as they possibly can before the banks perform their periodic redeterimation, and cut the borrowing bases based on new strip assumptions.

Who is most exposed?

According to Bloomberg, Scotiabank, Canada’s third-largest lender, has the highest credit exposure to oil-and-gas, including C$17.9 billion in outstanding loans and C$14.1 billion of commitments, according to March 1 disclosures. About 60 percent of the drawn exposure is investment grade, compared with about 75 percent for the undrawn commitments, the bank said.

“When you back out the investment grade, what’s left is a very small portion that is an area of focus, but we’re very comfortable,” Chief Financial Officer Sean McGuckin said Tuesday in telephone interview from Toronto. “We do a name-by-name analysis on a regular basis and we’ve got a good handle on this portfolio.”

Royal Bank, Canada’s largest lender, had the second-highest exposure. Chief Risk Officer Mark Hughes said on a Feb. 24 call that the bank’s drawn wholesale loan book to the oil-and-gas industry represented about 1.6 percent of its total, with an accompanying presentation showing the amount was C$8.4 billion. Gross exposure to oil-and-gas firms was C$22.1 billion, including C$13.7 billion of undrawn commitments, according to a report to shareholders.

Some banks, such as RBC are hoping their covenants will provide sufficient protection. Royal Bank’s Chief Risk Officer Mark Hughes said that “The vast majority of our clients’ credit profiles are strong and have remained stable over the past year,” Hughes said in an e-mailed statement. “We have covenants in place as safeguards, such as liquidity and coverage requirements, which serve to restrict drawings in times of stress. If the company can demonstrate their compliance with these requirements, they can continue to draw on their facilities.”

“We do remain very comfortable because our oil and gas exposure is below our peers,” CFO Riaz Ahmed said in a Feb. 25 phone interview.

The other Canadian banks are just as optimistic that these credit facilities, most of which were drafted when oil was at $100, will prevent capital losses.

Oil-and-gas loans at Bank of Montreal were C$7.4 billion in the first quarter, representing about 2 percent of its portfolio, the Toronto-based firm said in a Feb. 23 disclosure. The undrawn exposure shows that the lender had an additional C$8.24 billion of undrawn commitments, raising its exposure to C$16.3 billion.

“We evaluate the risk on both drawn and undrawn basis,” Chief Executive Officer Bill Downe said in a Feb. 29 interview in Florida. “We assume that lines will be drawn under periods of stress. I think our disclosure is fair.”

National Bank reported C$3.2 billion of outstanding oil-and-gas loans in the first quarter, a “low and manageable” exposure representing about 2.7 percent of its loan book, Chief Risk Officer William Bonnell said during a Feb. 23 earnings call.

Unless oil rebounds, the entire world will find out very soon just how contained this particular “cockroach” is, even as we look forward to discovering the next one.

- Hacking Democracy – Welcome To The Jungle Of Non-Cooperative Nations

Submitted by Ben Hunt via Salient Partners' Epsilon Theory blog,