- Greece Owes $1.2 Billion To Drugmakers As Government Can No Longer Afford Basic Medical Supplies

Talks between Greece and its creditors went full-retard on Wednesday when the following soundbite from Canada’s FinMin Joe Oliver hit the wires:

“No Greek payment to IMF would be default to IMF”

That seemed self-evident to us, but in a world governed by debt, we suppose everyone occasionally needs to remind themselves that failure to make good on one’s obligations constitutes default.

In any event, Greece apparently owes quite a bit of money to the world’s drug suppliers because, as we reported earlier this week, Athens is now running short on bed sheets and painkillers in its hospitals as the consequences of being completely beholden to the ”institutions” which control the printing of a fiat currency become increasingly clear.

Here’s what we said on Sunday:

The idea that a developed country cannot provide basic emergency medical care because it is in poor standing with the institutions that print a fiat currency is patently absurd and simply isn’t tenable meaning that one way or another, this ‘situation’ will resolve itself in the coming weeks, an event which will put Europe’s broken bond markets to a rather difficult test.

And now, we get this from Reuters:

Cash-strapped Greece has racked up mounting debts with international drugmakers and now owes the industry more than 1.1 billion euros ($1.2 billion), a leading industry official said on Wednesday.

The rising unpaid bill reflects the growing struggle by the nearly bankrupt country to muster cash, and creates a dilemma for companies under moral pressure not to cut off supplies of life-saving medicines.

Richard Bergstrom, director general of the European Federation of Pharmaceutical Industries and Associations, told Reuters his members had not been paid by Greece since December 2014. They are owed money by both hospitals and state-run health insurer EOPYY.

And in a further sign that, regardless of whatever outcome emerges from fraught talks between Syriza and group of creditors determined to use financial leverage as a means of subverting the democratic process in the EU, contingency plans are being discussed not only amongst ‘the institutions’ but amongst private sector firms as well:

Drugmakers and EU officials are now discussing options in the event Greece defaults on its debt or leaves the euro zone, disrupting imports of vital goods, including medicines.

“We have started a conversation in Brussels with the European Commission,” Bergstrom said. “We want the Commission to know that our companies are in this for the long run and are committed to Greece.”

There is a precedent for the pharmaceutical industry to agree exceptional supply measures during a financial crisis. It happened in Argentina in 2002, when some firms agreed to continue to supply drugs for a period without payment.

But the situation is complicated in Europe, given EU competition rules. They mean the Commission would need to take the initiative in approving any special scheme.

Drugmakers want any emergency program to include steps to mitigate spillover effects on other markets, including curbs on re-exports of drugs and a block on other governments referencing Greek prices when setting their own drug prices.

Simply turning off the supply is not an option for the industry, as Novo Nordisk discovered at the start of Greek debt crisis five years ago when it faced a storm of protest over plans to halt some insulin deliveries.

And while leaving Greeks with a shortage of “life-saving” drugs may “not be an option,” Greece has run out of options as well when it comes to coming up with the money to pay for basic medical supplies which means that without a deal, the world’s largest drugmakers could find themselves in the same financial place as the IMF and the ECB — that is, holding what amounts to IOUs from the Greek government.

The drugs industry has been here before. Greece also ran up large debts for its medicines in 2010-12, although they have since been repaid, with some companies receiving payment in government bonds that were subsequently written down in value.

Whether or not this is a precedent the industry will be willing to follow remains to be seen.

- Even If Patriot Act Expires, Government Will Keep Spying On All Americans

Mass surveillance under the Patriot Act is so awful that even its author says that the NSA has gone far beyond what the Act intended (and that the intelligence chiefs who said Americans aren’t being spied on should be prosecuted for perjury).

Specifically, the government is using a “secret interpretation” of the Patriot Act which allows the government to commit mass surveillance on every American.

So it’s a good thing that the Patriot Act may expire, but don’t get too excited …

Wikileaks’ Julian Assange said today:

Our sources say that the NSA is not too concerned, that it has secret interpretations of other authorities that give it much the same power that it would have had under the secret interpretation of 215 and other areas of the USA PATRIOT Act.

ZDNet agrees … and notes that Congress doesn’t even know about many of the government’s spying programs. And see this.

Indeed, the government now uses secret evidence, secret witnesses, secret interpretations, and even secret laws. See this and this.

High-level NSA whistleblower Thomas Drake told us:

It’s not rule of law. This secret law, secret rule, executive authoritarianism has saddled up again.

EFF notes:

Under international human rights law, secret “law” doesn’t even qualify as “law” at all.

***

This includes not just the law itself, but the judicial and executive interpretations of written laws because both of those are necessary to ensure that people have clear notice of what will trigger surveillance.

This is a basic and old legal requirement: it can be found in all of the founding human rights documents. It allows people the fundamental fairness of understanding when they can expect privacy from the government and when they cannot. It avoids the Kafkaesque situations in which people … cannot figure out what they did that resulted in government scrutiny, much less clear their names. And it ensures that government officials have actual limits to their discretion and that when those limits are crossed, redress is possible.

***

To bring the U.S. in line with international law, it must stop the process of developing secret law and ensure that all Americans, and indeed all people who may be subject to its surveillance have clear notice of when surveillance might occur.

Remember, the Nazis claimed – just like the NSA – that the truth was too complicated and dangerous to disclose to the public. That was B.S. then … and it's B.S. today.

Top NSA whistleblower Bill Binney told us that nothing will change unless we fire all of the corrupt officials within the NSA and other government agencies.

Constitutional and civil rights attorney John Whitehead agrees:

It doesn’t matter who occupies the White House: the secret government with its secret agencies, secret budgets and secret programs won’t change. It will simply continue to operate in secret until some whistleblower comes along to momentarily pull back the curtain and we dutifully—and fleetingly—play the part of the outraged public, demanding accountability and rattling our cages, all the while bringing about little real reform.

Thus, the lesson of the NSA and its vast network of domestic spy partners is simply this: once you allow the government to start breaking the law, no matter how seemingly justifiable the reason, you relinquish the contract between you and the government which establishes that the government works for and obeys you, the citizen—the employer—the master.

Once the government starts operating outside the law, answerable to no one but itself, there’s no way to rein it back in, short of … doing away with the entire structure, because the corruption and lawlessness have become that pervasive.

- Julian Assange On The TPP: "Deal Isn't About Trade, It's About Corporate Control"

Submitted by Mike Krieger via Liberty Blitzkrieg blog,

It’s mostly not about trade. Only 5 of the 29 chapters are about traditional trade.

– Julian Assange in a recent interview with Democracy Now

I’ve focused a little bit more of my attention on the Trans-Pacific Partnership lately, as the Obama Administration scrambles to attain “fast-track” authority from Congress.

The content of this unbelievably dangerous gift to multi-national corporations is being kept secret from the public, and for very good reason.

* * *

For some background on the TPP and where it stands, see:

As the Senate Prepares to Vote on “Fast Track,” Here’s a Quick Primer on the Dangers of the TPP

* * *

What little we know about the TPP has come from whistleblower site, Wikileaks. This is what Julian Assange thinks of this “trade” treaty in his own words.

- "Ms. Wantanabe" Bets On Resurgent Yen As PE Cashes Out

Make no mistake, we have had our fair share of laughs at the expense of China’s equity mania, with the millions of new trading accounts opened by semi-literate housewives and security guards-turned day traders serving as the anchor for many an amusing post.

But as it turns out, China isn’t the only place where housewives are keen to express their view on financial markets because as you can see from the below, ‘Ms. Watanabe’ is positioning for a stronger yen even as Mr. Kuroda plunges Japan further into the largest ponzi scheme in the history of mankind in an effort to stoke hyperinflation to ‘rescue’ the country from a decades-long battle with deflation.

Via Nikkei:

Japanese day traders, colloquially and collectively known as “Mrs Watanabe”, are buying the yen as it nears eight-year lows, suspecting that policymakers would be reluctant to let the currency fall further as it would provoke criticism at home and abroad.

Last week, net dollar buying positions on the Tokyo Financial Exchange, Japan’s largest margin trading platform, had fallen almost 60 percent from a high hit in January, to stand among the lowest levels seen in the past year.

At Gaitame.com, another platform popular among margin FX traders, traders have even gone long in yen for the first time since late 2012, when Prime Minister Shinzo Abe was voted into power promising to reflate the economy through massive monetary stimulus, said Takuya Kanda, senior researcher at Gaitame.com Research…

So far at least, it looks like Japanese housewives may be getting squeezed because the JPY just hit an eight-year low against the dollar…

…but ‘Ms. Watanabe’ is a contrarian soul and apparently won’t be deterred…

Last week, the dollar finally broke out of its long-held, tight range between 119 and 121, edging up near the eight-year high of 122.04 yen touched in March.

Given the breakout, the dollar/yen’s technical outlook is bullish, usually a good time for day traders to buy dollars.

Yet, Japanese day traders are selling the dollar instead.

Whether that’s a good idea ahead of a widely-anticipated Fed rate hike and expectations that the BoJ will ease further in the event wage growth continues to disappoint and disinflationary pressures persist is certainly debatable but one thing is for sure, private equity has benefited handsomely from stakes in publicy-listed Japanese companies as Kuroda’s multi-trillion yen plunge protection has done wonders to help the Nikkei levitate. Reuters has more:

U.S. buyout funds Bain Capital and Cerberus Capital Management sold big stakes in two Japanese companies as the stock market surges – taking profits and avoiding an expected bout of volatility if the U.S. Federal Reserve raises rate later in the year, investors said.

The buyout specialists’ sales came as the market capitalization of shares listed on the Tokyo Stock Exchange’s main board hit a record high last week, surpassing the previous peak hit in December 1989, as Prime Minister Shinzo Abe deployed pro-growth economic policies to boost investor sentiment.

U.S. buyout firm Bain Capital is selling down its 70 percent stake in Japanese restaurant chain Skylark Co to less than half.

Skylark shares closed at 1,685 yen on Tuesday, 40 percent above the 1,200 yen at which Bain sold the stock in an initial public offering last year.

U.S. fund Cerberus last week launched the sale of up to $878 million worth of its shares in rail operator Seibu Holdings

“Recent sell downs of shares held by those buyout funds is a reflection of the surge in Japan’s stock market,” said Soichi Takata, head of private equity at Tokio Marine Asset Management Co. “But buyout firms are also probably mindful of the possible increase in market volatility later this year when U.S. interest rates begin to rise.”

Incidentally, Paul Singer is also exiting “ripe” positions in Japan:

Real estate securities also continues to be an area of current deployment of capital in new situations, but the deployment is more than offset by liquidations of ripe positions in certain markets, especially Japan.

Should ‘lift-off’ in the US stoke volatility in Japanese equities you can certainly expect the BoJ to move in with still more ETF (and perhaps individual stock) purchases because after all, you can’t designate your $100 billion equity book as “held-to-maturity”, meaning Kuroda will be forced to keep up the 35 billion yen daily market interventions for as long as absolutely possible lest a sell-off should blow a massive hole in the central bank’s balance sheet and that means running the printing presses until they begin to smoke and short circuit. What that will mean for all of the ‘Ms. Watanabes’ betting on a resurgent yen remains to be seen, but it will likely be supportive for Japanese equity markets which will help PE giants like Carlye Group take portfolio companies like Tsubaki Nakashima Co public and reap hefty profits in the process:

While there are not many public company shares held by private equity firms in Japan, U.S. buyout fund Carlyle Group owns almost all the shares in ball bearing maker Tsubaki Nakashima Co and the buyout fund could list the shares in the near future after failing in 2012, calling off an initial public offering of the company citing market conditions.

For Carlyle in Japan then, it truly is “all ball bearings these days.”

- In Support of Ubers of the World

By Chris at www.CapitalistExploits.at

Recently I read how Uber is blitzing London’s black cabbies. God, it couldn’t have come sooner!

I spent my 20s living in London and whenever I landed up taking a black cab in London it was usually after I’d had too many drinks and my cognitive powers had gone kaput. I blame the fog of alcohol for that as there is simply no other explanation for being ripped off.

The shock when looking at my wallet the following morning came not from what had been spent on food and drink, but on what had been spent on a ride in a rattly old wagon of a vehicle that hasn’t had a design upgrade since Henry Ford decided horses were too slow.

In fact, I’d come to think that there were no homeless people on London’s streets, the “homeless” were merely office workers who’d missed the last tube home and couldn’t bear spending their weeks paycheck on a black cab.

Competition in the form of Uber is now providing a better, cheaper and more efficient service. It makes my heart leap for joy.

This is possibly the best thing to happen to the British way of life since the country was invaded by India and Pakistan, causing the widespread displacement of dingy eating houses smelling of grandmas’ curtains, hocking sausages and mash, with an incredible array of ethnic restaurants all selling delicious tasting cuisine.

Now, there was some truth to the value that a London cabbie could bring to the exchange. In order to get a license cab, drivers need to learn the streets of London like the back of their hand. No small task, I assure you. And as a passenger I would find that valuable if it weren’t for this piece of technology that made such knowledge largely obsolete – the GPS that sits on your smart phone.

Of course Londoners are not the only beneficiaries. The Americans have had it long before and it’s been working magic on their shores.

Driving a car is something that a teenager can and does do. It doesn’t require any particular level of skill. Recently NY medallions have been selling for over $1M. How on earth do we get to such an absurd situation where it costs over $1M in order to be “allowed” to drive a taxi in New York City?

Whenever we find absurdities where market forces are not left to solve problems, we find a market skewed by regulations where a tiny elite benefit while the majority suffer.

To understand why New York medallions sell for what seems to be an absurd price we need only look at the manipulation of the taxi market, namely a mandated limiting of supply of taxis. There are just over 13,000 medallions sold and they are strictly limited in supply.

This in itself is absurd. It’s the antithesis of a free market but nevertheless, the real reason that they are selling for ever increasing sums is due to the bond market.

Yup! The income stream from a medallion is pretty steady and as such the medallion is essentially a bond.

As we detail in our extensive report on global debt markets, interest rates have been butchered by successive central bankers so the hunt for yield has accelerated. If, for example, you can earn just $100,000 annually from your medallion, you’re looking at a 10% return. In today’s environment that looks pretty attractive. Even if you’re paying someone else to drive for you and that amounts to, say, $50,000 you’re still netting a real return of 5%. Again, not too bad in today’s yield starved world.

There are changes afoot in the bond market. Little do most purchasers of New York medallions realise that their actions are a result of central bank meddling.

I suspect that medallion purchasers are going to get hit from two sides. One from the repricing of risk in the global debt markets and two from disruptive technologies laying waste to archaic industries and practices.

There will always be those who mourn the loss of London’s black cabs and I say let them mourn. Not that long ago there was an outcry that we’d no longer have these things:

Remember them?

Now, I ask you to choose…

Yeah, I thought so. Me too!

I realise that many readers are reading this as it’s largely for financial and investment reasons.

I don’t have any particular thoughts on the current round of financing on Uber which values the company at $50 billion, other than to say that I’ve not quite figured out in all honesty why Uber is so special. There are no particular barriers to entry in this market, and it looks awfully like Uber is being valued like a monopoly.

Clearly they’ve shone the brightest thus far but this is a very short timeframe we’re talking about here. On the plus side, they actually have revenues, unlike Groupon who rose like a Phoenix only to collapse post IPO.

Certainly I think what Uber highlights more than anything is the very real fact that there are markets screaming out for disruption.

I’m in favour of Uber’s everywhere. I have written about disruptive industries and Uber is a great example of disruption to the taxi world. And it’s coming to the financial world too.

Some of the markets we’ve got our eye on in the venture capital space which are ripe for disruption are:

- healthcare;

- banking;

- finance;

- insurance;

- legal work;

- accounting;

- education;

- insurance;

- data of all kinds.

As I contemplate the list of private companies sitting in our due diligence pipeline, I’m terribly excited by the world that awaits. There are some truly enormous problems that the global economy faces, which we’ve detailed repeatedly on the blog.

One of those is a very real threat of capital moving rapidly out of current “safe” investments. At the same time, there are companies who are moving to take advantage of the current dysfunctional and broken system we have. This is one of the themes we’re actively investing in via Seraph. Sometimes it takes chaos to bring about change…

– Chris

“A free and open internet is a despot’s worst enemy.” – Jay Samit

- Crony Capitalism At Work – Boeing Threatens To Leave US If Ex-Im Subsidy Yanked

Submitted by Veronique De Rugy via The National Review,

When has crony capitalism really gotten out of control? How about when a major U.S. corporation (a huge defense contractor, no less) is publicly threatening government officials to leave the country if the federal government doesn’t continue to boost their profits through government handouts:

Boeing is stepping up pressure on opponents of the US Export-Import Bank with threats to shift manufacturing abroad if the agency that finances purchases by foreign customers is killed off next month.

The threats come as a new push is being made in Congress to find ways of wresting reauthorisation of the bank from a committee controlled by one of the agency’s fiercest opponents.

Scott Scherer, Boeing’s head of regulatory strategy at Boeing Capital, said the aerospace and defense group would “not sit idly by” if the ExIm Bank’s mandate was not renewed by the end of June. “Boeing is not going to let itself be hurt by the lack of an ExIm Bank,” he said in an interview with the Financial Times. “If it means sourcing … to other countries who will support us we may have to look at that. Other countries have more aggressive export policies. We will find an alternative.”

First, let me state the obvious: This basically sounds like blackmail to me, and I don’t think lawmakers should look at this kind of behavior favorably.

Second, it’s time for Boeing executives to understand that it’s not the role of the federal government to guarantee that they can sell as many planes as possible — they’ve benefited from the U.S.’s relatively free-market system; they should have to live with it.

And finally, I don’t think Boeing’s threat is very credible. Will Boeing really pick up its factories and move abroad if Ex-Im isn’t reauthorized? Is the possibility other governments might subsidize it really worth the transition costs and the risks of losing billions in defense contracts?

Thankfully, Jeb Hensarling, chairman of the House committee with jurisdiction over Ex-Im, called Boeing’s bluff:

The Republican chairman of the House Financial Services Committee rejected reports that Boeing Co. or other companies might move production overseas if Congress doesn’t reauthorize the U.S. Export-Import bank.

“I doubt I believe it,” Representative Jeb Hensarling of Texas said at a Washington press conference Tuesday about whether failing to extend the bank’s charter would drive major corporations out of the U.S. “I think it’s frankly a bit of bluster.”

Boeing, based in Chicago, might move some manufacturing overseas if Congress doesn’t extend the bank’s charter beyond June 30, the Financial Times reported May 17. It cited an interview with Scott Scherer, head of regulatory strategy at Boeing Capital.

Hensarling said he and others who oppose reauthorizing the Export-Import Bank are trying to “lead the party in a new direction” that will give priority to free enterprise over individual business interests.

Letting the Ex-Im Bank’s charter expire will go a long way to show that Republicans understand the difference between being pro-business and being pro-market — even if Boeing doesn’t.

- Artists's Impression Of This Week's US Foreign Policy Meeting

- Florida Man Arrested After Limping From Pawn Shop With AK-47s Stuffed Down His Pants

You know it's bad when…

Meet Marlon Paul Alvarez, 19, of Fort Lauderdale, Florida…

He faces grand theft charges after he was seen stuffing assault rifles down his pants at a pawn shop in Davie. As The Sun-Sentinel reports, made his first appearance in court Wednesday…

Broward Judge John Hurley expressed concern about Alvarez's behavior.

"You allegedly went into that pawn shop and removed an AK-47 rifle on display and stuck it down your pants," the judge read from the arrest report. "After a while, [you] pulled it out, put it back, then grabbed another assault rifle off another display [and] put that down your pants."

The owner of Public Pawn and Gun at 6798 Stirling Rd. noticed Alvarez limping out of the store with the assault rifle down his pant leg about 11:30 a.m. Tuesday, police said.

Owner Kevin Hughes confronted Alvarez outside and recovered the brand new $830 weapon before Alvarez ran off, the arrest report stated. Alvarez was seen on security video and the business owner was able to identify him when the suspect was arrested a short time later, police said.

Alvarez said in court he had moved to Florida from New York about one year ago and the judge noted there was a New York injunction ordering Alvarez to stay away from guns.

Assistant state attorney Eric Linder asked the judge to set a high bond. "It's one thing to try to steal a firearm, it's another thing trying to steal an AK47 and potentially trying to put a stolen firearm out on the street," Linder said. Hurley set bond at $25,000 for grand theft and the violation of a domestic violence injunction.

He revoked bond for a May 15 arrest on theft and drug possession charges in Pembroke Pines, Florida Department of Law Enforcement records showed.

"The court was just very concerned about your alleged behavior without even knowing your criminal background," Hurley said.

* * *

Finally after all that, according to the arrest report, Alvarez confessed to stealing the rifle.

- An Insane Financial World

Submitted by Gary Christenson via The Deviant Investor,

We know that most western governments are deficit spending, borrowing heavily, in debt beyond the point of no return and must increase taxes and appropriations from their citizens.

We know that politicians will take the politically expedient path instead of addressing financial problems. We know they will “extend and pretend,” delay, and distract the populace.

We know that war has been a nearly constant distraction since 9-11 and that a crisis is often used as a justification for economic insanity, such as borrowing more to address an excessive debt problem. It seems likely that weakening economies, deflationary forces, excessive debt, massive unemployment, riots, economic anxiety, consumer price inflation, and so much more, will require more distractions. We should “rig for stormy weather” and expect another crisis and more wars.

Bankers, politicians and military contractors will benefit. IN OUR INSANE WORLD WE MIGHT ASK:

- What happens to our financial system and the price of gold when western central banks are no longer willing or able to ship gold to Asia in exchange for fiat currencies held by Russia and China?

- What would happen if the Chinese government announced that it will buy gold at $2,000 per ounce to boost their stockpile? When gold is no longer available at $2,000 per ounce, might they offer $4,000 or $6,000?

- What would happen if the central banks of the world admitted that Quantitative Easing is primarily beneficial for banks and the wealthy, and that QE has been a failure at stimulating western economies?

- What would happen to global confidence if central banks admitted that consumer prices will rise substantially due to QE and inflation of the money supply?

- What would happen if commercial banks announced they will charge you for depositing your currency in their bank? (Oops, that has already happened.)

- What should we expect if banks penalize savers for depositing (loaning) currency to a bank? We should expect an increasing use of cash – actual paper notes. But there appears to be a “war on cash” in western countries. Discourage cash, force deposits into banks, charge for those deposits, squeeze savers as much as possible, increase controls, and boost financial system bonuses.

- What if bail-ins occur, and the banks take your deposited funds to pay off creditors, such as other banks who bought or sold derivative contracts? (If the bail-in is announced late on a Friday and the banks are closed the next week for “restructuring” you will have no opportunity to remove your currency from the bank. In Cyprus the insiders and politically connected escaped with their funds while many other individuals and businesses discovered their accounts had been “bailed-in.”)

- What happens if governments eventually announce that most retirement accounts and pension plans will be required to purchase continually devaluing government issued bonds?

- What happens if trust and confidence in the financial system are lost, banks no longer trust banks, businesses no longer trust they will be paid, and individuals no longer trust their governments or the pieces of paper we call money?

- The Fed has reduced interest rates so investors are chasing yield in all the wrong places, such as junk bonds. What happens when many of those junk bonds, which may have been stuffed into your bond mutual funds and pension plans, are priced at their true value – much less than face value?

What are the consequences?

A few words come to mind: anger, anguish, bankruptcy, betrayal, depression, recession, repression, riots, stagflation, and trauma.

In a saner world, we will depend far less on fiat currencies that are devalued easily and inevitably. Instead we will trust gold and silver more and paper much less.

My advice: Create your own financial sanity!

- The Global Economy As Seen From "The Man In The Moon"

Submitted by Paul Brodsky of Macro Allocation, Inc.

The Man in the Moon – Part 1 of 5

Summary: The Man in the Moon studies the pathology of Earth’s global economy and markets from a distance where there’s no gravitational pull towards empiricism or consensus. His findings: 1) the global economy is over-leveraged, fragile, stagnating, and increasingly centrally managed; 2) capital markets and asset performance have been captured by the perception of the ongoing value of money, and so; 3) unconventional investment analysis is prudent.

In Part 1, TMITM identifies the point of tension driving global output growth lower: ubiquitous leverage. Part 2 discusses “The Great Leveraging.” Part 3 explores the inevitable “Great Reconciliation”. Part 4 projects economy-saving exogenous influences one should expect. Part 5 builds a general investment framework for asset allocation.

Lunar View

The moon is about 239 thousand miles (384 thousand km) from Earth, many times more distant than the 30,000 foot level most investors think of as perspective-inducing. If an all-sentient Man in the Moon were to cast his eye upon Earth, interested only in building wealth for himself, where might his investment process begin? (With apogee-down analysis, no doubt.)To begin, he would surely grasp the gravity of disruptive innovations within telecommunications, logistics, robotics, transportation, farming, energy, payment services, and health care sectors. Breathtaking leaps forward have benefitted the global economy through creative destruction, a natural process pushing productivity gains.

When combined with an expanding global work force, innovation should have naturally driven the global economy to…well, economize, in turn driving consumer prices lower and affordability higher. Alas, deflation that benefits consumers would have been highly disruptive to entities that produce goods and services and to those that rely on inflation for sustainability, like banking systems.

Almost Copacetic

Entering 2015, the global economy seemed poised to expand. According to the World Bank:

”Global growth in 2014 was lower than initially expected, continuing a pattern of disappointing outturns over the past several years. Growth picked up only marginally in 2014, to 2.6 percent, from 2.5 percent in 2013. Beneath these headline numbers, increasingly divergent trends are at work in major economies…Overall, global growth is expected to rise moderately, to 3.0 percent in 2015, and average about 3.3 percent through 2017”

Despite such official optimism, the first quarter of 2015 is not providing hope that output is improving. Real GDP growth in the U.S. – among the growth leaders in developed economies last year – rose only 0.2 percent in the first quarter, significantly below expectations. The Atlanta Fed – the most accurate predictor of Q1 growth – further estimates Q2 output to be only 0.7 percent, implying weakness stretching beyond bad weather and port strikes. 2 And China, the world’s second largest economy and, with India, a reliable leader in output growth among emerging economies, reported Q1 nominal growth of 5.8 percent, a record low, and its Q2 trade figures show further deterioration.

To investors, future output growth seems to be just another input into asset allocation decisions, and not a very important one at that. Equity prices – corporate and property – are generally firm across domains. Bond prices remain well-bid; official funding and sovereign interest rates remain near record lows – in fact negative in some domains – implying either economic contraction is on the horizon or there’s a relative paucity of bonds (or both). And commodity prices (determined mostly by leveraged financial players trading leveraged derivative instruments rarely taking delivery) have dropped significantly, further implying lethargic global production.

Meanwhile, multinational businesses, each with an economy it calls home and a government to do its bidding, are aggressively allocating capital to boost short-term share values – abetted, it seems, by monetary authorities actively keeping economies and markets liquid. And although regional wars are taking human lives, confounding politicians, and adding volatility to the cost of energy, trade channels for resources remain mostly open. Lasting peace and prosperity? Hopefully…

The Dark Side

…but fundamental factors lie beneath the surface that pose significant threats to economies and investors. Balance sheets across the spectrum remain highly leveraged and continue to expand at a clip well beyond the rate of global output growth.

For median households, debt levels continue to rise more than wage growth; for governments, obligations are rising more than tax revenues; for publicly-owned businesses, debt is rising faster than revenues; and for investors, debt could easily grow more than income and asset appreciation, suddenly and without warning should markets stall or fall. (If only interest rates were high enough to support another refinancing wave then monetary policy makers would know what to do!)Growth and bull markets may come and go, but compounding debt is forever. There is not enough existing currency for debt extinguishment. This is why debt, per se, is not the fundamental problem – leverage is. Debt simply needs to be serviced, not necessarily repaid. Leverage ratios are most troubling however one chooses to calculate them: debt-to-GDP, debt-to-income, debt-to-base money, or, the most technically accurate (and the most telling indicator so far of central bank policy), bank assets-to-base money. (More on this in TMITM Part 3.)

Leverage reduction is generally discouraged by economic policy makers because it would create major structural problems. Indeed, in the U.S., even as bank balance sheets were de-leveraged from 2009 to 2014 through reserve-creating Quantitative Easing (QE), total credit market liabilities rose 17 percent.

Most economists today believe economies require constant credit growth for demand and output growth. As we are seeing, however, easy credit conditions do not necessarily lead to increasing production and capital formation, both of which would provide sustainable debt-servicing capabilities.

Increased savings rates would be just as bad to highly-leveraged economies, as it would decrease economic activity, in turn pressuring governments to invest money they don’t have and central banks to stimulate demand growth through even more credit creation, defeating the original purpose.

Global monetary authorities are boxed. Is it any wonder they fear deflation and see improving affordability as failing to create sufficient demand through credit growth? So much for economies economizing…

As it stands

The marginal buyers of sovereign debt today are:

- leveraged liquidity providers, such as private banks and hedge funds, that do not care about ROIs in real terms, preferring to use sovereign debt to fund themselves with zero risk-weighted assets and produce nominally-positive net interest margins;

- central banks with infinite, un-scrutinized balance sheets looking to keep their economies liquid and their private banks solvent;

- currency reserve holders, like China and Japan, that cannot easily spend their reserves to buy corporate equity, and;

- buy-side portfolios with relative return investment mandates forcing them to stay invested in assets guaranteeing losses in absolute terms.

While this line-up makes it easy to intellectualize low and negative interest rates, perhaps there is another, more fundamental driver: an underlying state of global economic dis-equilibrium in which:

- there is too much money and credit per unit of production, and therefore;

- real output is turning negative, and so;

- Equilibrium Real Interest Rates are also turning negative?

Are negative real rates implying that credit must contract so that real production, capital formation, and employment might grow? Perhaps nominal (non-inflation adjusted) risk-free rates actually deserve to be negative given such bleak prospects for real output growth? (What would this imply about interest rate “normalization” currently contemplated by the Fed – a rate hike or a rate cut?)

If this real-contraction premise has merit, then it might explain why interest rates are lowest (or negative) in domains most susceptible to output contraction, and why global equity markets are firm. Where else can one hope to generate risk-adjusted positive real rates of returns, especially given the likely antidote to nominal output contraction: inflation?

Whether or not fundamentals matter, global monetary authorities must now ensure liquidity remains sufficient so that asset prices – as the collateral for systemic credit – do not fall. This is something on which TMITM can reliably bet.

Goodnight Boom

The global economy seems to be suffering from a late-stage paradox in the financial leveraging cycle in which nominal output growth has become counter-cyclical to real output growth. The more commerce and trade rely on credit growth and asset appreciation, the more the ultimate benefit of growing economies is diminished.

Despite this paradox, the pursuit of demand growth and nominal GDP growth through credit growth has been immortalized into global monetary policy orthodoxy, and growth (not affordability) remains the primary metric scrutinized by most economists and investors. Such is Earth’s epic economic battle presently. In this corner, naturally occurring economic productivity gains and deflation. In that corner, policy-manufactured inflation to maintain asset values and liquidity. Ding! Ding!

The inescapable conclusion is that real output is quickly withering, whether we deflate nominal output for contemporaneous inflation (i.e., CPI, PCE, PPI), 2% inflation targets policy makers hope to produce (e.g., the Fed, BOJ and BOE), or far more significant future inflation (via currency purchasing power loss), the seeds of which are currently being planted, that would flare suddenly in the next leveraging cycle.

It seems clear that output growth in the future must be negative in real terms, and, ultimately, that there will have to be some kind of leverage reconciliation.

If weaker GDP growth currently in the U.S. China, and elsewhere (and deflation in the UK) is foreshadowing a secular global economic contraction, then perhaps the course of this reconciliation will present itself sooner than most think?

With apologies to Margaret Wise Brown:

In the great green room

There was a printing press

And a television

And a picture of –

Global growth in distress.And there were three central banks, shooting economic blanks

And global depositories

And political suppositories

Seventy years of coordination

Forty years of subordination

Thirty years of financializationGoodnight boom

Goodnight soon

Hello Man in the MoonTMITM – Part 2 will explore “The Great Leveraging”.

Paul Brodsky

Macro Allocation Inc.pbrodsky@macro-allocation.com

www.macro-allocation.com

- Guest Post: Cuba – Figuring Out Pieces Of The Puzzle

Submitted by Gail Tverberg via Our Finite World blog,

Cuba is an unusual country for quite a few reasons:

- The United States has had an embargo against Cuba since 1960, but there has recently been an announcement that the US will begin to normalize diplomatic relations.

- The leader of Cuba between 1959 and 2008 was Fidel Castro. Fidel Castro is a controversial figure, with some viewing him is a dictator who nationalized property of foreign citizens without compensation. Citizens of Cuba seem to view him as more of as a Robin Hood figure, who helped the poor by bringing healthcare and education to all, equalizing wages, and building many concrete block homes for people who had only lived in shacks previously.

- If we compare Cuba to its nearest neighbors Haiti and Dominican Republic (both of which were also former sugar growing colonies of European countries), we find that Cuba is doing substantially better than the other two. In per capita CPI in Purchasing Power Parity, in 2011, Cuba’s average was $18,796, while Haiti’s was $1,578, and the Dominican Republic was $11,263. In terms of the Human Development Index (which measures such things as life expectancy and literacy), in 2013, Cuba received a rating of .815, which is considered “very high”. Dominican Republic received a rating of .700, which is considered “High.” Haiti received a rating of .471, which is considered “Low.”

- Cuba is known for its permaculture programs (a form of organic gardening), which helped increase Cuba’s production of fruit and vegetables in the 1990s and early 2000s.

- In spite of all of these apparently good outcomes of Cuba’s experimentation with equal sharing of wealth, in recent years Cuba seems to be moving away from the planned economy model. Instead, it is moving to more of a “mixed economy,” with more entrepreneurship encouraged.

- Since 1993, Cuba has had a two currency system. The goods that the common people could buy were in one set of stores, and were traded in one currency. Other goods were internationally traded, or were available to foreigners visiting Cuba. They traded in another currency. This system is being phased out. Goods are now being marked in both currencies and limitations on where Cubans can shop are being removed.

I don’t have explanations for all of the things that are going on, but I have a few insights on what is happening, based on several sources:

- My recent visit to Cuba. This was a “people to people” educational program permitted by the US government;

- My previous work on resource depletion, and the impacts it is happening on economies elsewhere;

- Other published data about Cuba.

The following are a few of my observations.

1. Many island nations, including Cuba, are having financial problems related to dependence on oil.

Dependence on oil for electricity is one of the big issues affecting Cuba today. Island nations, including Cuba, very often use oil to produce much of their electricity supply, because it is easy to transport and can be used in relatively small installations. As long as the price of oil was low (under $20 barrel or so), the use of oil for electricity is not a problem.

Once the price of oil becomes high, the high cost of electricity makes it difficult to produce goods for export, because goods made with high-priced electricity tend not to be competitive with goods made where the cost of electricity is cheaper. Also, once the cost of oil rises, the price of imported food tends to rise, leading to a need for more foreign exchange fund for imports. In addition, the cost of vacation travel becomes more expensive, driving away potential vacationers. The combination of these effects tends to lead to financial problems for island nations.

If we look at current Standard and Poor’s credit ratings of island nations, we see a pattern of low credit ratings:

- Cuba – Caa2

- Dominican Republic – B1

- Haiti – Not Rated

- Jamaica – Caa3

- Puerto Rico – Caa1

None of these ratings is investment grade. Cuba’s rating is the same as Greece’s.

Cuba’s credit problem arises from that there is an imbalance between the goods and services which it is able to sell for export and the goods and services that it needs to import. As with most other island nations, this problem has gotten worse in recent years, because of high oil prices. Even with the recent drop in oil prices, the price of oil still isn’t really low, so there is still a problem.

2. Cuba has a low-cost arrangement for buying oil from Venezuela, but this can’t be depended on.

Venezuela is Cuba’s largest supplier of imported oil. The recent drop in oil prices creates a problem for Venezuela, because Venezuela needs high oil prices to profitably extract its oil and leave enough to fund its government programs. Because of these issues, Venezuela is having serious financial difficulties. Its financial rating is Caa3, which is even lower than Cuba’s rating. Cuba uses its excellent education system to provide physicians for Venezuela, and because of this gets a bargain price for oil. But it can’t count on this arrangement continuing, if Venezuela’s financial situation gets worse.

3. Neither high nor low oil prices are likely to solve Cuba’s financial problems; the real problem is diminishing returns (that is, rising cost of oil extraction).

Cuba finds itself in a dilemma similar to that that the rest of the world is experiencing–only worse because it is an island nation. The rising cost of oil extraction is pushing the world economy toward lower economic growth, because the higher cost of oil extraction is in effect making world’s production of goods and services less efficient (the opposite of growing efficiency, needed for economic growth). The extra effort needed to extract oil from deep beneath the sea, or used in fracking, makes it more expensive to produce a barrel of oil, and indirectly, the many things that a barrel of oil goes to produce, such as a bushel of wheat that Cuba must import.

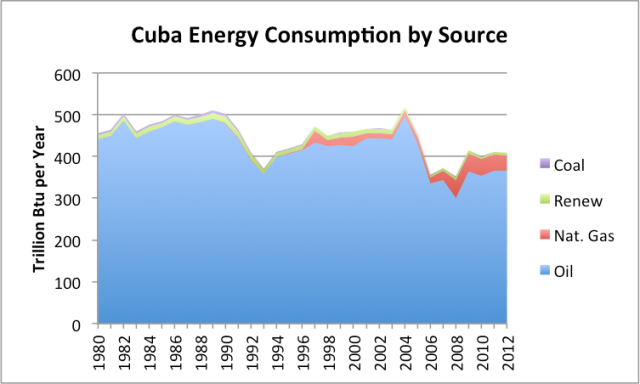

Figure 3. Cuba’s oil consumption, separated between oil produced by Cuba itself and imported oil, based on EIA data.

If the price of oil is low, Venezuela’s financial problems will become worse, increasing the likelihood that Venezuela will need to cut back on its low-priced oil exports to Cuba.

Also, if the price of oil remains low, it is unlikely that Cuba will be able to increase its own oil extraction (Figure 3). The recent decline in US oil rigs and production indicates that shale extraction in the US (requiring fracking) is not economic at current prices. Cuba’s onshore resources also seem to be of the type that requires fracking. Thus, the likelihood of extracting Cuba’s onshore oil seems low, unless prices are much higher. Offshore, none of the test wells to date have proven economic at today’s prices.

Conversely, if the price of oil is high enough to enable profitability of oil extraction in Venezuela and Cuba, say $150 barrel, then airline tickets will be very expensive, cutting back tourism greatly. The cost of imported food is likely to be very high as well.

4. One way Cuba’s problems are manifesting themselves is in cutbacks to entitlements.

Back in the early 1960s, Fidel Castro’s plan for the economy was one of perfect communism–the government would own all businesses; every worker would receive the same wages; a large share of what workers receive would come in the form of entitlements. What has been happening recently is that these entitlements are being cut back, without wages being raised.

Wages for all government workers are extremely low–the equivalent of $20 month in US currency. This was not a problem when workers received essentially everything they needed through a very low-priced ration program and other direct gifts, but they become a problem when entitlements are cut back.

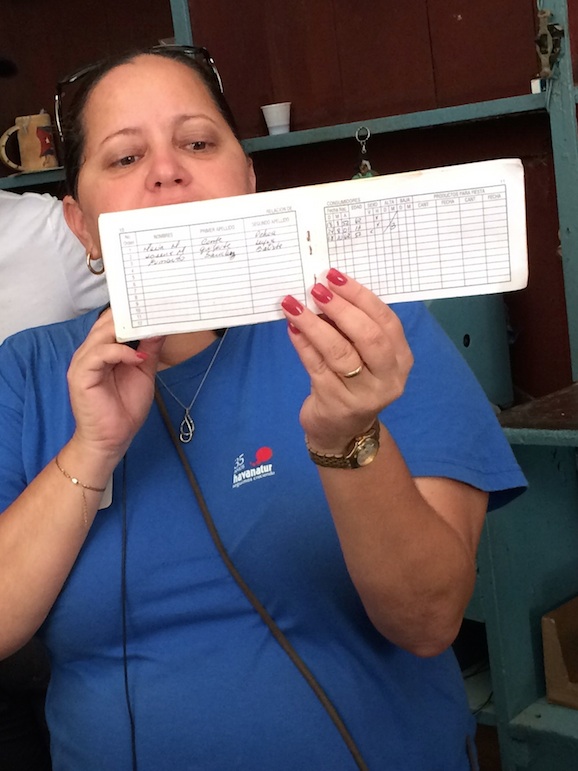

Each year, each Cuban family receives a ration booklet listing each member of the family, each person’s age, and the quantity of subsidized food of various types that that person is entitled to, based on the person’s age. Other items besides food, such as light bulbs, may be included as well.

The store providing the subsidized food keeps a list of foods available and prices on a blackboard.

One way that the standard of living of Cubans is being reduced because of Cuba’s financial problems is by cutbacks in the types of goods being subsidized. Also the quantities and prices are being affected, but the average wage of $20 month remains unchanged.

5. Another way Cuba’s financial problems are manifesting themselves is as higher prices charged to Cubans for goods not available through the ration program.

Since 1993, Cuba has had a two currency program. Cubans were able to purchase goods only in stores intended for Cuban residents using Cuban pesos. (This situation is similar to a company store program, in which a business issues pay in a currency which can only be used on goods available in the company story.) A second currency, Cuban Convertible Pesos (“CUC”), pegged 1:1 with the US dollar, has been used for the tourist trade, and for international purchases. Cubans were not allowed to purchase goods in businesses offering goods in CUCs.

Now the situation is changing. Goods in stores for Cubans marked in both currencies, and Cubans are permitted to purchase goods in more (or all?) types of businesses.

The change that seems to be occurring in the process of marking goods to both currencies is that goods as priced in Cuban pesos are becoming much more expensive for Cubans. Cubans are finding that their $20 per month paychecks are going less and less far. This is more or less equivalent to value of the Cuban peso falling relative to the US dollar. This decrease is difficult for international agencies to measure, because the prices Cubans were paying were not previously convertible to the US dollar. The big impact would occur in 2015, so is too recent to be included in most inflation data.

6. Another way Cuba’s problems are manifesting themselves is through low traffic on roads.

How much gasoline would you expect a person earning $20 month to buy, if gasoline costs about $5 gallon? Not a lot, I expect. Not surprisingly, we found traffic other than buses and taxis to be very low, especially outside Havana. Figure 6 shows one fairly extreme example. The three-wheeled bicycle in front is a popular form of taxi.

If a person travels away from the Havana area, transport by horse and buggy is fairly common.

7. As a workaround for Cuba’s for falling inflation-adjusted wages of government workers, Cuba is permitting more entrepreneurship.

Certain workers, such as musicians and artists, have always been able to earn more than the average wage, through programs that allowed these workers to sell their wares and keep the vast majority of the sales price.

Now, individuals are able to form businesses and hire workers. These businesses generally pay wages higher than those offered by the government. Many of these businesses are private restaurants and gift shops, serving the tourist trade.

In addition, many individual citizens try to figure out small things that they can do (such as sell peanuts, pose for photos, or sing songs) to earn tips from foreigners. The amounts they earn act to supplement the wages they earn working for the government.

Other new businesses are in the food production sector. We met one farmer who was growing rice, with the help of twenty workers he had hired. The farmer used land that he had leased for $0 per year from the government. He dried his rice on an underutilized two-lane public road. The rice covered one lane for many miles.

The farmer sold most of his rice to the government, at prices it had set in advance. The farmer was able to pay his workers $80 per month, which is equal to four times the average government wage.

8. Cuban citizens and its government are concerned about the country’s financial problems and are finding other solutions in addition to entrepreneurship.

Cuban citizens are concerned, because with only $20 month of spendable income and higher prices on almost everything, they are being “pushed into a corner.” The vast majority of jobs are still government jobs, paying only an average of $20 month. There aren’t very many ways out.

In order to make ends meet, it is very tempting to steal goods from employers, and resell them at below market prices to others. We were warned to be very careful about changing money, because it is very common to be shortchanged, or to receive Cuban pesos (which are worth about 1/24th of a CUC) in change for goods purchased in CUCs.

One legitimate way of increasing the wealth of Cuban citizens is to increase remittances from relatives living in the US. Legislation making this possible has already been implemented. Estimates of remittances from the US to Cuba range from $2 billion to $3.5 billion per year, prior to the change.

Another way of increasing Cuban revenue is to increase tourism. Selling services abroad, such as sending a Cuban choir to perform for US audiences, also acts to increase Cuba’s revenue. Getting rid of the US embargo would help expand both tourism and the sale of Cuban services abroad. This is no doubt part of the reason why Cuba, under the leadership of Raul Castro (Fidel’s brother), is interested in re-establishing relationships with the United States.

9. Most of Cuba’s accumulated wealth from the past is depleting wealth that requires continuing energy inputs to maintain.

Cuba has many fine old buildings that are a product past glory days (sugar exporter, tobacco sales, casino operator). These buildings need to be maintained, or they fall apart with age. In other words, they need the addition of new building materials (requiring energy products to create and transport), if they are to continue to be used for their intended purpose.

Cuba now has a severe problem with old buildings falling apart from decay. I was told that three buildings per day collapse in Havana. With a chronic shortage of energy supplies, Cuba has been able to use these buildings from past days to give themselves a higher standard of living than otherwise would be possible, but this dividend is slowly coming to an end.

Likewise, fields used for growing sugar or tobacco are assets requiring continued energy investment. If the Cuban government were to stop plowing fields and adding fertilizer to restore lost nutrients,1 nature would take care of the problem in its own way–acacia (a type of nitrogen-fixing shrub/tree) would overtake the land, making it difficult to replant. The fact that the Cuban government did not keep adding energy products to some of the fields is a major reason the Cuban government is now leasing land for $0 an acre. Quite a bit of the land formerly used for sugar cane needs to be cleared of acacia before crops can be grown on it.

Even Cuba’s famed 1950s vintage autos are a depleting asset. Replacement parts are needed frequently to keep them operating.

The illusion that Cuba could afford to pay owners for the value of property appropriated by the Cuban government in 1959 is just that–an illusion. The wealth that was available was temporary wealth that could not be packaged and sent elsewhere. Sugar cane and tobacco had been grown in ways that depleted the soil. Furthermore, most workers had been paid very low wages. The buyers of these products had reaped the benefits of these bad practices in the form of low prices for sugar and tobacco products. It is doubtful whether Cuba could ever have paid the former owners for the land and businesses it appropriated, except with debt payable by future generations. It certainly cannot now.

10. I wasn’t able to find out much about the permaculture situation in Cuba, but my impression is that the outcome is likely to be determined by financial considerations.

Subsidies can work reasonably well, as long as the economy as a whole is producing a surplus. Such a surplus tends to occur when the cost of energy production is low, because then it is easy for a growing supply of low-priced energy to boost human productivity.

Now that Cuba’s economy is not faring as well, the government is finding it necessary to start evaluating whether approaches they are taking are really cost effective. More emphasis is placed on entrepreneurs producing goods at prices that are affordable by customers. Thus, an entrepreneur might operate a permaculture garden. My impression is that permaculture will do well, if it can produce goods at prices that consumers can afford, but not otherwise. Consumers who are starved for money are likely to cut back to the very basics (rice and beans?), making this a difficult requirement to meet.

11. Cuba has done better on keeping population down than many other countries.

If we look at the population growth trends since 1970, Cuba has done better than its nearby neighbors in keeping population down.

Figure 8. Cuba population compared to 1970 estimates, along with those of selected other countries, based on USDA population estimates.

In fact, Cuba’s 2014 population per square kilometer is low compared to its neighbors, as well.

Figure 8. Population for Cuba and several nearby areas expressed in population per square kilometer.

One thing that many people would point to in the low population growth statistics is the high education of women in Cuba. This is definitely the result of Fidel Castro’s policies.

It seems to me that housing issues play a role as well. Cuba has added very little housing stock in recent years, even though the population has grown. This means that either multiple generations must live together, or new homes must be built. Cuba hasn’t provided a way for doing this (financing, etc). Under these circumstances, most families will keep the number of children low. There is simply no more room for another person in state-provided housing. No one would consider building a shack with local materials, without electricity and water supply, as a work around.

Also, US policies have allowed Cuban citizens who reach the United States to obtain citizenship more easily than say, residents of the Dominican Republic of Haiti. This has offered another work-around for growing population.

12. In many ways, Cuba is better prepared for a fall in standard of living than most countries, but a change in its standard of living is still likely to be problematic.

As we traveled through Cuba, we saw a huge amount of land that either was currently planted in crops, or that could fairly easily be planted as crops. We also saw many acres over-run by acacia, but that still could support some feeding by animals. Cuba is not very mountainous, and generally gets a reasonable amount of water for at least part of the year. These are factors that are helpful for supporting a fairly large population, if crops are chosen to match the available rainfall.

The Cuban population is also well educated and used to working together. Neighbors tend to know each other, and work to support each other through community associations called Committees for the Defense of the Revolution.

The problem, though, is that the changes needed to live sustainably, without huge annual balance of payment deficits, are likely to be quite large. Sugar production in Cuba began in the early 1800s. Since that time, Cuba’s economy has been organized as if it were part of a much larger system. Cuba has grown large amounts of certain products (sugar cane and tobacco), and much less of products that its population eats regularly (wheat, rice, beans, corn, and chicken). Residents have gotten used to eating imported foods, rather than foods that grow locally. According to this document, the government of Cuba reported importing 60% to 70% of its “food and agricultural products,” amounting to $2 billion dollars, in 2014. Regardless of whether or not this percentage is calculated correctly, there is at least a $2 billion per year gap in revenue caused by eating non-local foods that needs to be closed.

In theory, Cuba can produce enough food for all of its current population, even without fossil fuels. Doing so would require changes to what Cubans eat. The diet would need to be revised to include greater proportions of foods that can be grown easily in Cuba (plantain, yucca, bread plant, etc.) and fewer foods that can’t. Many people would likely need to move to locations where they can help in the growing and distribution of these foods. Given the current lack of funding, most of these new homes and businesses would likely need to be built by residents using local materials. Thus, they would likely need to look like the shacks (without electricity or running water) that Fidel Castro was able to do away with as a result of his 1959 Revolution.

There might also need to be a reduction to the amount of healthcare and education available to all. This would also be a big let down, because people have gotten used to the current plan of free education and free modern medical care for all. Education and health care no doubt account for a big share of Cuba’s high GDP today, but Cuba may also need to bring down these costs down to an affordable level, if it is to have a sustainable economy.

- Do Not Show This Chart To Bank Of Japan Governor Kuroda

As another example of “has the world gone mad?” – we present the following words of wisdom from BoJ Governor Kuroda-san:

- *KURODA DOESN’T SEE ANY ASSET BUBBLE OR STOCK MARKET BUBBLE, OR ANY ‘FINANCIAL EXCESS’ IN ECONOMY

And in the interests of sanity, we highly suggest he not look at the chart below…

And while on the topic of utter insanity, ask yourself – as you read his statements of perplexing blind ignorance – just what happens to BoJ capital when his $95 billion equity portfolio suffers a 2%, 10%, 50% sell-off?

We suspect he wouldn’t be laughing as much had he seen the Bank of Japan’s dreadful underperformance of the market in the last few years…

- Apple Co-founder: "Snowden Is A Hero To Me"

Hot on the heels of the apparent defeat of the extension of The Patriot Act, Apple co-founder Steve Wozniak reaffirmed his support for digital privacy in an interview over the weekend with Arabian Business.com.

When we start to talk about privacy and I ask him whether he thinks NSA whistleblower Edward Snowden is a hero or a villain his answer is prompt and unabashed.

"Total hero to me; total hero," he gushes. "Not necessarily [for] what he exposed, but the fact that he internally came from his own heart, his own belief in the United States Constitution, what democracy and freedom was about. And now a federal judge has said that NSA data collection was unconstitutional."

Snowden, who revealed classified NSA documents to reporters in 2013, is a fugitive from US prosecutors, living on a temporary visa in Russia, another nation he has criticised for its approach to privacy. The judgement Wozniak refers to is that of a federal court in New York, which earlier this month found Section 215 of the US Patriot Act, which authorised the mass surveillance programmes exposed by Snowden, to be insufficient grounds for justifying the NSA's collection of domestic communications data.

"So he's a hero to me, because he gave up his own life to do it," says Wozniak. "And he was a young person, to give up his life. But he did it for reasons of trying to help the rest of us and not just mess up a company he didn't like."

As stories emerge worldwide of implanted spyware in commercially available hard disks and in SIM cards sold to international telecoms companies, security specialists have incessantly offered solutions to the general public, as to how to shield private activities and data from prying eyes. Wozniak, however, is pessimistic about the prospects of protection, and believes the root cause of the problem extends back to the early years of OS development.

"It's almost impossible [to protect yourself] because today's operating systems generally get so huge that they can only come from a few sources, like Microsoft, Google and Apple," he says. "And those operating systems have so many millions of lines of code in them, built by tens of thousands of engineers over time, that it's so difficult to go back and detect anything in it that's spying on you. It's like having a house with 50,000 doors and windows and you have no idea where there might be a tiny little camera."

Woz is an ardent privacy advocate and bemoans the lost chances of computing's fledgling years, where he feels it may have been possible to block future attempts at monitoring.

"There is a type of technology that you can fairly securely today run on your computer and someone else's computer, [which allows you to] send them a message and it's private the way it should be," he says. "I believe that I should be allowed to send a message to my wife and nobody can know it unless they know our passwords.

In 1991, a system named PGP [Pretty Good Privacy] emerged for secure point-to-point data transfer. The data to be sent was encrypted on the machine that sent it and decrypted on the destination machine. Wozniak decries the technology as a lost opportunity for OS vendors.

"At that point in time, if Apple and Microsoft had built [PGP] into their operating system, it would have been a permanent part of email and all email would have been secure," he says. "Now we're talking about making laws that you cannot use encryption. It's almost like you can't have any secrets anymore. And the modern generation just accepts this as the status quo.

"Companies like Google and Facebook are trying to make money off knowing things about you; they're trying to funnel things to you and make money that way. Apple is only making good products that you can choose to buy if you want, so I look at Apple as being more the protector of privacy than anyone else."

* * *

Finally, Wozniak unleashes some other brutal truths…

"Everything is first-class [in Dubai]… The United States used to talk, when I was growing up, like that's what we were. The US would look like this if we didn't spend all our money on the military."

- "New Silk Road" Part 2: Cold War Or Competition?

Submitted by Robert Berke via OilPrice.com,

Part 2: Cold War or Competition on the New Silk Road.

Note:

In Part 1 of “The New Silk Road,” we examined the China’s plan for rebuilding the Silk Road, stretching from Europe to Asia.In Part 2, we look at currently proposed projects, and geopolitical rivalries that could stall and hamper progress.

Silk Road Projects:

It is important to understand that the new “Road’ is not a formal plan in any sense but merely a broad outline of goals, a work in progress, being filled in, opportunistically, with projects as they are developed, and as negotiations with target countries allow. The Road is also not a 'start-up' from scratch, but builds upon and extends a number of projects that have been ongoing with China's partners.

The Iran-Pakistan-China project (described in Part 1) is one of the few that provides more details, but it is still very much in the planning stage. The second proposed project, only recently made public, focuses on Russia. China is also proposing a partnership with India for its third project.

The Pakistan program is an important economic development project that ties in with the Road as one of the connecting dots along the way, while the proposed program for Russian could become the nexus for the entire Road project, and the proposed India project could become the crucial piece in tying it all together.

Russia and China, the Emerging Partnership:

What makes Russia important enough to include in the plan? A better question might be: how is it possible to leave out Russia, the largest country in Eurasia, from a plan to build across the entire region?

In a recent meeting in Moscow, celebrating the 70th anniversary of the allied victory in World War II – which saw Indian, Chinese, and Russia troops parading in Red Square – China and Russia signed multiple agreements to tie development of the Chinese sponsored Silk Road to the Russian sponsored Eurasian Economic Union (EAEU).

The EAEU plan is a Kremlin-sponsored trade union between Russian, Kazakhstan, Kyrgyzstan, Belarus and Armenia, that has been pilloried in the western press as part of Russia’s supposed underlying agenda to re-establish the Soviet Union. With Russia’s inclusion, the plan for the Silk Road will extend from Beijing to the border of Poland. The blossoming cooperation between Russia and China is not something to be ignored, according to former Indian diplomat M.K. Bhadrakumar:

“Clearly, the cold blast of western propaganda against the EAEU failed to impress China…China’s integration with the EAEU means in effect that a real engine of growth is being hooked to the Russian project. In reality, China is the key to the future of the EAEU. Significantly, Xi has combined his visit to Moscow with a tour of Belarus and Kazakhstan, the two other founder members of the EAEU….This is vital for the implementation of the Silk Routes via Russia and Central Asia.”

The Chinese/Russian agreements cover eight specific projects, starting with the development of a high speed railway that will connect Moscow and Kazan (Tatarstan Republic), and will be extended to China, connecting the two countries via Kazakhstan. China’s Railway Group has won a contract for $390 million to build the road, with China contributing an initial $5.8 billion toward total estimated costs of $21.4 billion. Eventually, the planners hope to link this project to Russia’s planned high speed railway to Europe.

Also, China's Jilii province has offered to build a cross-border high speed railway link between the two countries connecting with Russia's major Pacific port city, Vladivostok. In addition, the two nations are expanding their energy partnership through a variety of projects. As Oilprice reported in a May 12 article, “the Russian hydropower company RusHydro and China Three Gorges Corp. have signed a deal to cooperate on a 320-megawatt hydroelectric power project in Russia’s Far East…near the border between China and Russia.” As described, this is the largest dam project in China or Russia, already under construction, and is expected to generate 1.6 trillion watts of electrical energy per year, with an estimated cost of around $400 billion.

China has also proposed developing an economic corridor between Russia, Mongolia, and China, a plan likely to include the EAEU member states, the initial step in development of one of the major components of the Silk Road, the Eurasia Economic Corridor, a preferential trade zone stretching across the region.

Several smaller joint project deals were also signed, including establishing a $2 billion agriculture financing fund.

Geopolitics on the Silk Road:

Until very recently, it was widely assumed that the US would lead its western allies in a campaign against the Russian/Chinese deal to develop the Silk Road, but events have been reversing with remarkable speed.

With Obama desperately trying to keep the wars in Yemen, Syria, and Iraq from metastasizing across the region, Obama’s Middle East policy is at a crossroads, with none of the big issues likely to be resolved before his term ends. Clearly, the US President wants to concentrate on Asia and reduce the US presence in the Mid-East, a region that has bedeviled every President for more than a generation.

The Deal to Get Out:

In the midst of all this, and after more than a two year absence from Russia, Kerry and his entourage requested an immediate urgent meeting with Putin and Lavrov that was granted by the Kremlin.

There is widespread speculation over what might have taken place in the Kremlin meeting on May 8th. Yet, the fact that the meeting took place at all may be more important than any agreements reached, because it clearly shows some form of thaw in a relationship that’s in process.

The rumor out of Russia is that Kerry requested Putin’s help in resolving the ME conflicts and closing the nuclear deal with Iran, with the Russian President agreeing. The quid pro quo for Russia was the US lowering tensions in Ukraine. The issue of Crimea was apparently not even raised, while the visit ended with Kerry’s unprecedented warning to Kiev to abide by the Minsk 2 agreement for a truce in Ukraine’s eastern provinces.

Much of the news media is speculating that the US is starting to remove the ‘crime scene tape’ around the Kremlin. Whether this is really a US offer of an olive branch to Russia is still pretty much guesswork, and even if it were, how far the US is willing to go in accommodating the Kremlin is largely unknown. Stratfor, the popular internet intelligence newsletter, speculates that the US is willing to start easing sanctions on Russia.

Israel and the Gulf Kingdoms:

For the Israelis, any easing of tensions with Iran and Russia is very bad news. In the Middle East, Israel is the canary in the coal mine, and is always among the first to discern the faintest signs of political unrest in its region.

There's no denying the significance of Israel's reaction to the US/Iran nuclear deal and US coordination with Iran and Russia in Syria and Iraq. Israel placed all of its chips on its ability to stop the deals, and lost badly, while perhaps severely damaging its relationship with it largest ally, the US.

Now, the howls of protest and betrayal pour out of every media source in the country, and Israel is not the only one. Saudi Arabia also feels left out in the cold with the Iran deal.

Proposed Partnership with China and India:

If it were possible to put politics aside, there’s no question that China’s single best partner for the Road would be its giant neighbor India, bringing together the two most important markets for traders on the original ancient Silk Road. As the Associated Press reported on May 14, 2015:

“Both countries are members of the BRICS grouping of emerging economies, which is now establishing a formal lending arm, the New Development Bank, to be based in China's financial hub of Shanghai and headed by a senior Indian banker. India was also a founding member of the embryonic China-backed Asian Infrastructure Investment Bank.

The cooperation between China and India is only growing, and their needs appear to be compatible, as the AP goes on to note:

China is looking to India as a market for its increasingly high-tech goods, from high-speed trains to nuclear power plants, while India is keen to attract Chinese investment in manufacturing and infrastructure. With a slowing economy, excess production capacity and nearly $4 trillion in foreign currency reserves, China is ready to satisfy India's estimated $1 trillion in demand for infrastructure projects such as airports, roads, ports and railways.”

If India chooses to partner with China in the Silk Road, it could keep China building for the rest of the century, in a project that would combine the world’s most populous nations, with more than 2.6 billion people. With Russia already a partner, and Iran waiting in the wings to join, the project could add almost another quarter of a billion people, with a combined total of over one third the global population. A better fit would be hard to find.

But there is no shortage of historical baggage between China and India, ranging from a half century of unresolved border disputes; China’s growing relationship with Pakistan, India’s longtime adversary; and India’s close relationship with the US and Japan, both opposed to China’s claims in the South China Sea.

In a recent meeting in Beijing, China and India signed agreements for $22 billion in development projects, disappointing to many observers when compared to the $47 billion committed to the China/Pakistan deal. A former Indian diplomat, Bhadrakumar, argues, “that strategic distrust cannot be wished away,” and “…that India is not ready to replace the west as its development partner.”

It seems like the US influence with India has at least slowed prospects of recruiting India as a major Silk Road partner. Yet, the results are not so simple to predict since so many countries involved are dependent upon trade with China to the tune of hundreds of billions of dollars annually, and are also active trading partners with both Russia and Iran.

Even in the cold war, India became adept in its studied policy of co-existence with the Soviet Union and the US, which allowed India to play both sides. For pragmatic India, the choice of development partners may depend on the simple formula of 'following the money', given the fact that China is one of the few countries in the world with sufficient resources to finance the rebuilding of India's infrastructure.

The rush of western allies, including India, to join China's sponsored Asian Infrastructure Bank speaks clearly to the fact that western business is eager to take part in the Road projects. There are probably few banks in the world that would hesitate to finance major components of the project. However, whether the recent sea change in the US/Russian dynamic is a prelude for US support of the Silk Road project remains an open question.

Coming in June, Part 3: Prospects for Success and What it Means for Investors.

- Who Would Win A Conflict In The South China Sea: The Infographic