- Russia Offers Help To Greece In German War Reparations Investigation

Just a day after German President Joachim Gauck shocked his government by remarking in an interview that Germany should at least “consider” demands by Prime Minister Alexis Tsipras that the nation pay billions of euros in reparations for the Nazi occupation of Greece, ekathimerini reports that none other than ‘helpful’ Russians are willing to provide assistance in the World War II claims investigation.

Following recent comments by German President Joachim Gauck that,

“We are not only people who are living in this day and age but we’re also the descendants of those who left behind a trail of destruction in Europe during World War Two — in Greece, among other places, where we shamefully knew little about it for so long,” Gauck said in an interview with German newspaper Sueddeutsche Zeitung.

“It’s the right thing to do for a history-conscious country like ours to consider what possibilities there might be for reparations.”

While he only went as far as to suggest “consideration” of the demand, this is further than the direct rejections other high-ranking German officials have issued. As Reuters recalls, the last time a German official mentioned the reparations demand, it was economic minister Sigmar Gabriel, who proclaimed them “stupid.”

And now, as ekathimerini reports, it appears the Greeks are getting some assistance…

Moscow is helping Greece in its investigation into possible Second World War reparations from Germany by providing access to previously unused archives.

Following a request by Alternate Defense Minister Costas Isichos, the Russian Embassy in Athens has provided Greek authorities with a list of the relevant archives, including documents, photographs and documentary footage.

Moscow’s move comes as the National Council for WWII Reparations from Germany has stepped up efforts to inform Greeks about its work. The group has put on display videos and posters explaining its work at 100 locations in Athens metro stations.

* * *

Perhaps Putin is working on commission? 20% finders fee of the €278.7 billion that Greece believes it is owed for helping to gather the money from the Germans?

- In A Cop Culture, The Bill Of Rights Doesn't Amount To Much

Submitted by John Whitehead via The Rutherford Institute,

Police officers are more likely to be struck by lightning than be held financially accountable for their actions.—Law professor Joanna C. Schwartz (paraphrased)

“In a democratic society,” observed Oakland police chief Sean Whent, “people have a say in how they are policed.”

Unfortunately, if you can be kicked, punched, tasered, shot, intimidated, harassed, stripped, searched, brutalized, terrorized, wrongfully arrested, and even killed by a police officer, and that officer is never held accountable for violating your rights and his oath of office to serve and protect, never forced to make amends, never told that what he did was wrong, and never made to change his modus operandi, then you don’t live in a constitutional republic.

You live in a police state.

It doesn’t even matter that “crime is at historic lows and most cities are safer than they have been in generations, for residents and officers alike,” as the New York Times reports.

What matters is whether you’re going to make it through a police confrontation alive and with your health and freedoms intact. For a growing number of Americans, those confrontations do not end well.

As David O. Brown, the Dallas chief of police, noted: “Sometimes it seems like our young officers want to get into an athletic event with people they want to arrest. They have a ‘don’t retreat’ mentality. They feel like they’re warriors and they can’t back down when someone is running from them, no matter how minor the underlying crime is.”

Making matters worse, in the cop culture that is America today, the Bill of Rights doesn’t amount to much. Unless, that is, it’s the Law Enforcement Officers’ Bill of Rights (LEOBoR), which protects police officers from being subjected to the kinds of debilitating indignities heaped upon the average citizen.

Most Americans, oblivious about their own rights, aren’t even aware that police officers have their own Bill of Rights. Yet at the same time that our own protections against government abuses have been reduced to little more than historic window dressing, 14 states have already adopted LEOBoRs—written by police unions and being considered by many more states and Congress—which provides police officers accused of a crime with special due process rights and privileges not afforded to the average citizen.

In other words, the LEOBoR protects police officers from being treated as we are treated during criminal investigations: questioned unmercifully for hours on end, harassed, harangued, browbeaten, denied food, water and bathroom breaks, subjected to hostile interrogations, and left in the dark about our accusers and any charges and evidence against us.

Not only are officers given a 10-day “cooling-off period” during which they cannot be forced to make any statements about the incident, but when they are questioned, it must be “for a reasonable length of time, at a reasonable hour, by only one or two investigators (who must be fellow policemen), and with plenty of breaks for food and water.”

According to investigative journalist Eli Hager, the most common rights afforded police officers accused of wrongdoing are as follows:

- If a department decides to pursue a complaint against an officer, the department must notify the officer and his union.

- The officer must be informed of the complainants, and their testimony against him, before he is questioned.

- During questioning, investigators may not harass, threaten, or promise rewards to the officer, as interrogators not infrequently do to civilian suspects.

- Bathroom breaks are assured during questioning.

- In Maryland, the officer may appeal his case to a “hearing board,” whose decision is binding, before a final decision has been made by his superiors about his discipline. The hearing board consists of three of the suspected offender’s fellow officers.

- In some jurisdictions, the officer may not be disciplined if more than a certain number of days (often 100) have passed since his alleged misconduct, which limits the time for investigation.

- Even if the officer is suspended, the department must continue to pay salary and benefits, as well as the cost of the officer’s attorney.

It’s a pretty sweet deal if you can get it, I suppose: protection from the courts, immunity from wrongdoing, paid leave while you’re under investigation, and the assurance that you won’t have to spend a dime of your own money in your defense. And yet these LEOBoR epitomize everything that is wrong with America today.

Once in a while, the system appears to work on the side of justice, and police officers engaged in wrongdoing are actually charged for abusing their authority and using excessive force against American citizens.

Yet even in these instances, it’s still the American taxpayer who foots the bill.

For example, Baltimore taxpayers have paid roughly $5.7 million since 2011 over lawsuits stemming from police abuses, with an additional $5.8 million going towards legal fees. If the six Baltimore police officers charged with the death of Freddie Gray are convicted, you can rest assured it will be the Baltimore taxpayers who feel the pinch.

New York taxpayers have shelled out almost $1,130 per year per police officer (there are 34,500 officers in the NYPD) to address charges of misconduct. That translates to $38 million every year just to clean up after these so-called public servants.

Over a 10-year-period, Oakland, Calif., taxpayers were made to cough up more than $57 million (curiously enough, the same amount as the city’s deficit back in 2011) in order to settle accounts with alleged victims of police abuse.

Chicago taxpayers were asked to pay out nearly $33 million on one day alone to victims of police misconduct, with one person slated to receive $22.5 million, potentially the largest single amount settled on any one victim. The City has paid more than half a billion dollars to victims over the course of a decade. The Chicago City Council actually had to borrow $100 million just to pay off lawsuits arising over police misconduct in 2013. The city’s payout for 2014 was estimated to be in the same ballpark, especially with cases pending such as the one involving the man who was reportedly sodomized by a police officer’s gun in order to force him to “cooperate.”

Over 78% of the funds paid out by Denver taxpayers over the course of a decade arose as a result of alleged abuse or excessive use of force by the Denver police and sheriff departments. Meanwhile, taxpayers in Ferguson, Missouri, are being asked to pay $40 million in compensation—more than the city’s entire budget—for police officers treating them “‘as if they were war combatants,’ using tactics like beating, rubber bullets, pepper spray, and stun grenades, while the plaintiffs were peacefully protesting, sitting in a McDonalds, and in one case walking down the street to visit relatives.”

That’s just a small sampling of the most egregious payouts, but just about every community—large and small—feels the pinch when it comes to compensating victims who have been subjected to deadly or excessive force by police.

The ones who rarely ever feel the pinch are the officers accused or convicted of wrongdoing, “even if they are disciplined or terminated by their department, criminally prosecuted, or even imprisoned.” Indeed, a study published in the NYU Law Review reveals that 99.8% of the monies paid in settlements and judgments in police misconduct cases never come out of the officers’ own pockets, even when state laws require them to be held liable. Moreover, these officers rarely ever have to pay for their own legal defense.

For instance, law professor Joanna C. Schwartz references a case in which three Denver police officers chased and then beat a 16-year-old boy, stomping “on the boy’s back while using a fence for leverage, breaking his ribs and causing him to suffer kidney damage and a lacerated liver.” The cost to Denver taxpayers to settle the lawsuit: $885,000. The amount the officers contributed: 0.

Kathryn Johnston, 92 years old, was shot and killed during a SWAT team raid that went awry. Attempting to cover their backs, the officers falsely claimed Johnston’s home was the site of a cocaine sale and went so far as to plant marijuana in the house to support their claim. The cost to Atlanta taxpayers to settle the lawsuit: $4.9 million. The amount the officers contributed: 0.

Meanwhile, in Albuquerque, a police officer was convicted of raping a woman in his police car, in addition to sexually assaulting four other women and girls, physically abusing two additional women, and kidnapping or falsely imprisoning five men and boys. The cost to the Albuquerque taxpayers to settle the lawsuit: $1,000,000. The amount the officer contributed: 0.

Human Rights Watch notes that taxpayers actually pay three times for officers who repeatedly commit abuses: “once to cover their salaries while they commit abuses; next to pay settlements or civil jury awards against officers; and a third time through payments into police ‘defense’ funds provided by the cities.”

Still, the number of times a police officer is actually held accountable for wrongdoing while on the job is miniscule compared to the number of times cops are allowed to walk away with little more than a slap on the wrist.

A large part of the problem can be chalked up to influential police unions and laws providing for qualified immunity, not to mention these Law Enforcement Officers’ Bill of Rights laws, which allow officers to walk away without paying a dime for their wrongdoing.

Another part of the problem is rampant cronyism among government bureaucrats: those deciding whether a police officer should be immune from having to personally pay for misbehavior on the job all belong to the same system, all with a vested interest in protecting the police and their infamous code of silence: city and county attorneys, police commissioners, city councils and judges.

Most of all, what we’re dealing with is systemic corruption that protects wrongdoing and recasts it in a noble light. However, there is nothing noble about government agents who kick, punch, shoot and kill defenseless individuals. There is nothing just about police officers rendered largely immune from prosecution for wrongdoing. There is nothing democratic about the word of a government agent being given greater weight in court than that of the average citizen. And no good can come about when the average citizen has no real means of defense against a system that is weighted in favor of government bureaucrats.

So if you want a recipe for disaster, this is it: Take police cadets, train them in the ways of war, dress and equip them for battle, teach them to see the people they serve not as human beings but as suspects and enemies, and then indoctrinate them into believing that their main priority is to make it home alive at any cost. While you’re at it, spend more time drilling them on how to use a gun (58 hours) and employ defensive tactics (49 hours) than on how to calm a situation before resorting to force (8 hours).

Then, once they’re hyped up on their own authority and the power of the badge and their gun, throw in a few court rulings suggesting that security takes precedence over individual rights, set it against a backdrop of endless wars and militarized law enforcement, and then add to the mix a populace distracted by entertainment, out of touch with the workings of their government, and more inclined to let a few sorry souls suffer injustice than challenge the status quo or appear unpatriotic.

That’s not to discount the many honorable police officers working thankless jobs across the country in order to serve and protect their fellow citizens, but there can be no denying that, as journalist Michael Daly acknowledges, there is a troublesome “cop culture that tends to dehumanize or at least objectify suspected lawbreakers of whatever race. The instant you are deemed a candidate for arrest, you become not so much a person as a ‘perp.’”

Older cops are equally troubled by this shift in how police are being trained to view Americans—as things, not people. Daly had a veteran police officer join him to review the video footage of 43-year-old Eric Garner crying out and struggling to breathe as cops held him in a chokehold. (In yet another example of how the legal system and the police protect their own, no police officers were charged for Garner’s death.) Daly describes the veteran officer’s reaction to the footage, which as Daly points out, “constitutes a moral indictment not so much of what the police did but of what the police did not do”:

“I don’t see anyone in that video saying, ‘Look, we got to ease up,’” says the veteran officer. “Where’s the human side of you in that you’ve got a guy saying, ‘I can’t breathe?’” The veteran officer goes on, “Somebody needs to say, ‘Stop it!’ That’s what’s missing here was a voice of reason. The only voice we’re hearing is of Eric Garner.” The veteran officer believes Garner might have survived had anybody heeded his pleas. “He could have had a chance,” says the officer, who is black. “But you got to believe he’s a human being first. A human being saying, ‘I can’t breathe.’”

As I point out in my new book Battlefield America: The War on the American People, when all is said and done, the various problems we’re facing today—militarized police, police shootings of unarmed people, the electronic concentration camp being erected around us, SWAT team raids, etc.—can be attributed to the fact that our government and its agents have ceased to see us as humans first.

Then again, perhaps we are just as much to blame for this sorry state of affairs. After all, if we want to be treated like human beings—with dignity and worth—then we need to start treating those around us in the same manner. As Martin Luther King Jr. warned in a speech given exactly one year to the day before he was killed: “We must rapidly begin the shift from a ‘thing-oriented’ society to a ‘person-oriented’ society. When machines and computers, profit motives and property rights are considered more important than people, the giant triplets of racism, materialism, and militarism are incapable of being conquered.”

- On This Day In 1945: Reporter Fired For Biggest Scoop In History

In World War II's final moments in Europe, Associated Press correspondent Edward Kennedy gave his news agency perhaps the biggest scoop in its history.

He reported, a full day ahead of the competition, that the Germans had surrendered unconditionally at a former schoolhouse in Reims, France.

For this, he was publicly rebuked by the AP, and then quietly fired.

The reason: The veteran reporter was accused of breaking a pledge that he and 16 other correspondents had made to keep the surrender secret for a time, as a condition of being allowed to witness it. This was done so Russian dictator Josef Stalin could formally announce the defeat in Berlin.

Kennedy viewed the embargo as a political security issue, rather than a military one, and felt compelled to report the surrender, especially after learning that German radio had already broadcast the news.

In 2012, almost 50 years after Kennedy's death, then-AP President and CEO Tom Curley apologized for the way the company had treated the journalist.

Ed Kennedy, pictured below, was one of 17 reporters taken to witness the ceremony.

He and the others were hastily assembled by military commanders, then pledged to secrecy by a U.S. general while the group flew over France. As a condition of being allowed to see the surrender in person, the correspondents were barred from reporting what they had witnessed until authorized by Allied headquarters.

Initially, the journalists were told the news would be held up for only a few hours. But after the surrender was complete, the embargo was extended for 36 hours—until 3 p.m. the following day.

Kennedy was astounded.

"The absurdity of attempting to bottle up news of such magnitude was too apparent," he would later write.

Nevertheless, he initially stayed quiet. Then, at 2:03 p.m., the surrender was announced by German officials, via a radio broadcast from Flensburg, a city already in Allied hands. That meant, Kennedy knew, that the transmission had been authorized by the same military censors gagging the press.

Furious, Kennedy went to see the chief American censor and told him there was no way he could continue to hold the story. Word was out. The military had broken its side of the pact by allowing the Germans to announce the surrender. And there were no military secrets at stake.

The censor waved him off. Kennedy thought about it for 15 minutes, and then acted.

Seventy years after the scoop, the AP is making Kennedy's original story and photographs available…

Germany surrendered unconditionally to the Western allies and the Soviet Union at 2:41 a.m. French time today. (This was at 8:41 p.m. Eastern war time Sunday, May 6, 1945.)

The surrender took place at a little red school house that is the headquarters of Gen. Dwight D. Eisenhower.

The surrender was signed for the Supreme Allied Command by Lt. Gen. Walter Bedell Smith, chief of staff for Gen. Eisenhower.

It was also signed by Gen. Ivan Susloparov of the Soviet Union and by Gen. Francois Sevez for France.

Gen. Eisenhower was not present at the signing, but immediately afterward Gen. Alfred Jodl and his fellow delegate, Gen. Admiral Hans Georg von Friedeburg, were received by the supreme commander.

They were asked sternly if they understood the surrender terms imposed upon Germany and if they would be carried out by Germany.

They answered yes.

Germany, which began the war with a ruthless attack upon Poland, followed by successive aggressions and brutality in concentration camps, surrendered with an appeal to the victors for mercy toward the German people and armed forces.

After signing the full surrender, Gen. Jodl said he wanted to speak and received leave to do so.

"With this signature," he said in soft-spoken German, "the German people and armed forces are for better or worse delivered into the victor's hands.

"In this war, which has lasted more than five years, both have achieved and suffered more than perhaps any other people in the world."

* * *

After being fired by the AP, Kennedy took a job as managing editor of the Santa Barbara News-Press in California, and then went on to become publisher of the Monterey Peninsula Herald. He died at age 58 after being struck by an automobile.

Kennedy's family had held on to the manuscript for decades before his daughter, Cochran, began looking for a publisher.

She said that even though she was only 16 when her father died, she got the impression he still took great joy in his career, despite the episode.

Curley said Kennedy's daughter approached him around the same time he had become interested in the matter while helping with work on the book "Breaking News: How The Associated Press Has Covered War, Peace, and Everything Else." The publication of Kennedy's memoir prompted the AP's apology, Curley said.

He called Kennedy's dismissal "a great, great tragedy" and hailed him and the desk editors who put the surrender story on the wire for upholding the highest principles of journalism.

- In Most Countries, 40 Hours + Minimum Wage = Poverty

Last week, we noted that Democratic lawmakers in the US are pushing for what they call “$12 by ’20” which, as the name implies, is an effort to raise the minimum wage to $12/hour over the course of the next five years. Republicans argue that if Democrats got their wish and the pay floor were increased by nearly 70%, it would do more harm than good for low-income Americans as the number of jobs that would be lost as a result of employers cutting back in the face of dramatically higher labor costs would offset the benefit that accrues to the workers who are lucky enough to keep their jobs.

Regardless of who is right or wrong when it comes to projecting what would happen to low-wage jobs in the face of a steep hike in the minimum wage, one thing is certain: many working families depend on government assistance to make ends meet, suggesting it’s tough to persist on minimum wage in today’s economy and indeed, a new study by the OECD shows that in 21 out of the 26 member countries that have a minimum wage, working 40 hours per week at the pay floor would not be sufficient to keep one’s family out of poverty.

Here’s more from Bloomberg:

A global ranking out Wednesday by the Paris-based Organization for Economic Cooperation and Development painted a grim picture of the situation in member countries straddling continents. The 34-member organization found that a legal minimum wage existed in 26 countries and crunched the numbers to see how they compared.

Forget taking a siesta in Spain. There, you’d have to work more than 72 hours a week to escape the trappings of poverty. Turns out that is the norm, not the exception. In the 21 countries highlighted with blue bars in the chart below, a full 40-hour work week still won’t lift families out of relative poverty. This list includes France, home to the 35-hour work week, which almost met the threshold. Minimum wage workers there who are supporting a spouse and two children need to work 40.2 hours to get their families out of poverty. (The poverty line is defined as 50 percent of the median wage in any nation.)

- US Approves Saudi Use Of Banned Cluster Bombs (But Only If They're Extra Careful)

Following a report on Sunday, where Human Rights Watch said video and photographic evidence showed that Saudi Arabia used cluster bombs near villages in Yemen’s Saada Province at least two separate times, the US State Department said it is "looking into" the allegations but, as Foreign Policy reports, said the notoriously imprecise weapon — banned by much of the world — could still have an appropriate role to play in Riyadh’s U.S.-backed offensive (as long as it was used carefully).

Human Rights Watch details credible evidence indicates that the Saudi-led coalition used banned cluster munitions supplied by the United States in airstrikes against Houthi forces in Yemen, Human Rights Watch said today.

Cluster munitions pose long-term dangers to civilians and are prohibited by a 2008 treaty adopted by 116 countries, though not Saudi Arabia, Yemen, or the United States.

Photographs, video, and other evidence have emerged since mid-April 2015 indicating that cluster munitions have been used during recent weeks in coalition airstrikes in Yemen’s northern Saada governorate, the traditional Houthi stronghold bordering Saudi Arabia.

“Saudi-led cluster munition airstrikes have been hitting areas near villages, putting local people in danger,” said Steve Goose, arms director at Human Rights Watch. “These weapons should never be used under any circumstances. Saudi Arabia and other coalition members – and the supplier, the US – are flouting the global standard that rejects cluster munitions because of their long-term threat to civilians.”

However, as Foreign Policy reports, the State Department said it is "looking into" the allegations…

“We’re looking into those details carefully. I don’t have an outcome of that to report,” State Department spokesman Jeff Rathke said in answer to questions about the HRW report. “We take all accounts of civilian deaths in the ongoing hostilities in Yemen very seriously.”

…

On Monday, Rathke noted that U.S. law and policy dictates that the United States may only export cluster munitions to foreign buyers if the weapon’s unexploded ordnance rate does not exceed one percent. The U.S. also requires that the governments buying U.S. cluster bombs “must commit that cluster munitions will only be used against clearly defined military targets and will not be used where civilians are known to be present or in areas normally inhabited by civilians,” said Rathke.

When Foreign Policy asked if cluster bombs were “appropriate” to use in the U.S.-backed air campaign in Yemen, Rathke said they were so long as they’re used “against clearly defined military targets.”

“That’s our policy on those,” he said.

…

On the humanitarian front, U.S. officials have privately noted concerns about civilian casualties and fears that Riyadh is failing to properly vet the local fighters it’s arming in Yemen. But publicly, the White House fully backs the operation.

Rathke said “we share the concerns regarding unintended harm to civilians caused by the use of cluster munitions.”

“The United States remains the single largest financial supporter of addressing the explosive remnants of war,” he added.

* * *

And single largest supplier of explosives and creator of the need for them…

- Guest Post: The Big Business Of Cancer – 100 Billion Dollars Was Spent On Cancer Drugs Last Year Alone

Submitted by Michael Snyder via The End of The American Dream blog,

If you are an American, there is a 1 in 3 chance that you will get cancer during your lifetime. If you are a man, the odds are closer to 1 in 2. And almost everyone in America either knows someone who currently has cancer or who has already died from cancer. But it wasn’t always this way. Back in the 1940s, only one out of every sixteen Americans would develop cancer. Something has happened that has caused the cancer rate in this nation to absolutely explode, and it is being projected that cancer will soon surpass heart disease and become the leading cause of death in the United States. Overall, the World Health Organization says that approximately 14 million new cases of cancer are diagnosed around the globe each year, and the number of new cases is expected to increase by about 70 percent over the next 2 decades.

There are very few words in the English language that cause more fear than the word “cancer”, but despite billions spent on research and all of the technological progress we have made over the years this plague just continues to spiral wildly out of control. Why is that?

In America today, more money is spent to treat cancer than to treat any other disease by far. In fact, according to NBC News, 100 BILLION dollars was spent on cancer drugs just last year alone…

As drug prices continue to fall under ever-increasing scrutiny, spending on cancer medicines has hit a new milestone: $100 billion in 2014.

That’s up more than 10 percent from 2013, and up from $75 billion five years earlier, according to a report published Tuesday from the IMS Institute for Healthcare Informatics.

100 million dollars would be an astounding amount of money to spend on these drugs. But 100 billion dollars is 1,000 times as much money as 100 million dollars. And the IMS Institute for Healthcare Informatics is projecting that the amount of money spent on cancer drugs will continue to grow at a rate of 6 to 8 percent a year.

Needless to say, there are a lot of people out there that are becoming exceedingly wealthy treating this disease.

And the cost of some these drugs is absolutely absurd. According to NBC News, two of the latest cancer drugs to be developed “are priced at $12,500 a month“…

Forty-five new drugs for cancer hit the market between 2010 and 2014, including 10 last year alone, IMS said. Two of those are so-called immunotherapies, a hot new class that harnesses the immune system to fight cancer. They are Opdivo from Bristol-Myers Squibb and Keytruda from Merck. Both are priced at $12,500 a month.

Yes, I understand that drug companies are in business to make a profit.

But how can anyone possibly justify charging cancer patients that much for their medicine?

If you are diagnosed with cancer in America today and you choose to trust the medical system with your treatment, you can say goodbye to your financial future. Even if you have health insurance, you will probably end up flat broke one way or the other. Either you will survive and be flat broke, or you will die flat broke.

And despite all of our ultra-expensive treatments, the survival rate for cancer is still not very good. At this point, the five year survival rate for those diagnosed with cancer is just 65 percent. That means that 35 percent of those diagnosed with cancer are going to end up dead within five years, and for certain forms of cancer that percentage is much, much higher.

Sadly, as I mentioned at the top of this article, the percentage of the population getting cancer just continues to go up…

We have lost the war on cancer. At the beginning of the last century, one person in twenty would get cancer. In the 1940s it was one out of every sixteen people. In the 1970s it was one person out of ten. Today one person out of three gets cancer in the course of their life.We live in a society that is highly toxic, and it is getting worse with each passing day.

And once you do develop cancer, doctors are not allowed to prescribe any “alternative treatments” for you. They are only permitted to offer you the treatments that the system tells them that they must offer.

One of these is chemotherapy. It is an absolutely nightmarish treatment that often kills the patient before it kills the cancer. The following is how one woman described her experience with chemo…

This highly toxic fluid was being injected into my veins. The nurse administering it was wearing protective gloves because it would burn her skin if just a tiny drip came into contact with it. I couldn’t help asking myself “If such precautions are needed to be taken on the outside, what is it doing to me on the inside?” From 7 pm that evening, I vomited solidly for two and a half days. During my treatment, I lost my hair by the handful, I lost my appetite, my skin colour, my zest for life. I was death on legs.

Many patients go through round after hellish round, hoping that it will do something about their cancer. Have you ever known someone who has gone through this ordeal? It can be absolutely heartbreaking.

But in the end, there is a tremendous amount of doubt regarding whether chemo does much good at all. Just consider the words of Dr. Ralph Moss, the author of a book entitled “The Cancer Industry“…

In the end, there is no proof that chemotherapy actually extends life in the vast majority of cases, and this is the great lie about chemotherapy, that somehow there is a correlation between shrinking a tumour and extending the life of a patient.

So why do oncologists push chemo so hard?

Well, it is because they make a tremendous amount of money doing it…

According to the research of Steven Levitt and Stephen Dubner of Freakonomics

fame, “Oncologists are some of the highest paid doctors, their average income is increasing faster than any other specialist in the medical field, and more than half their income comes from selling and administering chemotherapy.”

Yes you read that right. Oncologists make a huge profit, as much as two-thirds of their income in some cases, from chemotherapy drugs.

Their business model is very different from other doctors because you can’t buy chemotherapy drugs at your local pharmacy.

Oncologists buy these drugs direct at wholesale prices, then they mark them up and bill the insurance companies. This legal profiting on drugs by doctors is unique to the cancer treatment world. They’re making money off the drugs that they insist you take to save your life. That’s a HUGE conflict of interest. They’re selling you the drugs, and charging you for the privilege of putting them in your body. No other doctor can do that.

Our system is deeply corrupt and deeply broken.

But nothing is going to change any time soon because hundreds of billions of dollars are being made.

- America’s Main Problem: Corruption

Preface: Sadly, in the month since we last posted on this topic, many new examples of corruption have arisen.

The Cop Is On the Take

Government corruption has become rampant:

- Senior SEC employees spent up to 8 hours a day surfing porn sites instead of cracking down on financial crimes

- Nuclear Regulatory Commission workers watch porn instead of cracking down on unsafe conditions at nuclear plants

- An EPA employee who downloaded 7,000 porn files, then spent 2-6 hours each workday watching porn. He's been doing it for years … but the EPA never fired him. Another EPA employee harassed 16 women co-workers … and then was promoted to a higher-paying job with more responsibility, where he harassed more women

- NSA spies pass around homemade sexual videos and pictures they've collected from spying on the American people

- NSA employees have also been caught using their mass surveillance powers to spy on love interests, such as girlfriends, obsessions or former wives … and to eavesdrop on American soldiers’ intimate conversations with their wives back home. And see this (“routinely shared salacious or tantalizing phone calls that had been intercepted” … “‘Hey, check this out … there’s good phone sex'”)

- An employee of the Transportation Security Administration admitted that TSA agents share – and laugh at – nude scans of passengers. Another TSA employee says that screeners make excuses so they can grope and fondle travelers that they're attracted to

- Investigators from the Treasury’s Office of the Inspector General found that some of the regulator’s employees surfed erotic websites, hired prostitutes and accepted gifts from bank executives … instead of actually working to help the economy

- The Minerals Management Service – the regulator charged with overseeing BP and other oil companies to ensure that oil spills don’t occur – was riddled with “a culture of substance abuse and promiscuity”, which included “sex with industry contacts”

- Agents for the Drug Enforcement Agency had dozens of sex parties with prostitutes hired by the drug cartels they were supposed to stop (they also received money, gifts and weapons from drug cartel members)

- Pentagon employees used government credit cards to pay for adult "escorts" (i.e. prostitutes) and to gamble

- Federal agents with the Drug Enforcement Administration and Secret Service investigating Bitcoin money laundering extorted and stole over $1 million in Bitcoin

- The Commodity Futures Trading Commission has conspired with big banks to manipulate commodities prices for decades

- The government-sponsored rating agencies committed massive fraud (and see this)

- The Treasury department allowed banks to “cook their books”

- Regulators knew of and allowed the use of debt-hiding accounting tricks by the big banks

- The Secretary of Treasury (Tim Geithner) was complicit in Lehman’s accounting fraud, (and see this)

- The former chief accountant for the SEC says that Bernanke and Paulson broke the law and should be prosecuted

- The government knew about mortgage fraud a long time ago. For example, the FBI warned of an “epidemic” of mortgage fraud in 2004. However, the FBI, DOJ and other government agencies then stood down and did nothing. See this and this. For example, the Federal Reserve turned its cheek and allowed massive fraud, and the SEC has repeatedly ignored accounting fraud. Indeed, Alan Greenspan took the position that fraud could never happen

- Paulson and Bernanke falsely stated that the big banks receiving Tarp money were healthy, when they were not. The Treasury Secretary also falsely told Congress that the bailouts would be used to dispose of toxic assets … but then used the money for something else entirely

- A high-level Federal Reserve official says quantitative easing is “the greatest backdoor Wall Street bailout of all time”

- The SEC has been shredding Wall Street documents for decades to help the big banks cover up their fraud

- The non-partisan Government Accountability Office calls the Fed corrupt and riddled with conflicts of interest. Nobel prize-winning economist Joe Stiglitz says the World Bank would view any country which had a banking structure like the Fed as being corrupt and untrustworthy. The former vice president at the Federal Reserve Bank of Dallas said said he worried that the failure of the government to provide more information about its rescue spending could signal corruption. “Nontransparency in government programs is always associated with corruption in other countries, so I don’t see why it wouldn’t be here,” he said

- Arguably, both the Bush and Obama administrations broke the law by refusing to close insolvent banks

- Congress may have covered up illegal tax breaks for the big banks

- Police have been busted framing innocent people

- Warmongerers in the U.S. government knowingly and intentionally lied us into a war of aggression in Iraq. The former head of the Joint Chiefs of Staff – the highest ranking military officer in the United States – said that the Iraq war was “based on a series of lies”. The same is true in Libya and other wars

- $8.5 TRILLION dollars in taxpayer money doled out by Congress to the Pentagon since 1996 has NEVER been accounted for. The military wastes and "loses" trillions of dollars. And Congress pushes expensive boondoggles that our generals say are unnecessary and unhelpful … because it's pork for their district

- The government lied when it said it doesn't conduct mass surveillance on Americans, and then lied again when it said that spying was aimed at protecting America against terrorists

- The government also lied when it said American doesn't torture (and see this), and then lied once again when it said torture was aimed at protecting America against terrorists

- The government made sure that false claims were made about the amount of oil spilled by BP in the Gulf

- The government has framed whistleblowers with false evidence

- The Pentagon falsely smeared USA Today reporters because they investigated illegal Pentagon propaganda

- When one of the most respected radiologists in America – the former head of the radiology department at Yale University – attempted to blow the whistle on the fact that the FDA had approved a medical device manufactured by General Electric because it put out massive amounts of radiation, the FDA installed spyware to record his private emails and surfing activities (including installing cameras to snap pictures of his screen), and then used the information to smear him and other whistleblowers

- In an effort to protect Bank of America from the threatened Wikileaks expose of wrongdoing – the Department of Justice told Bank of America to a hire a specific hardball-playing law firm to assemble a team to take down WikiLeaks (and see this)

- The Bush White House worked hard to smear CIA officers, bloggers and anyone else who criticized the Iraq war

- Corruption at the FBI lab led to the execution of scores of innocent people

- The FBI smeared top scientists who pointed out the numerous holes in its anthrax case. Indeed, the head of the FBI's investigation agrees that corruption was rampant

- Terror attacks such as 9/11, the Boston Marathon bombing and the Texas shooting all happened because of pervasive corruption in our intelligence agencies

The biggest companies own the D.C. politicians. Indeed, the head of the economics department at George Mason University has pointed out that it is unfair to call politicians “prostitutes”. They are in fact pimps … selling out the American people for a price.

Government regulators have become so corrupted and “captured” by those they regulate that Americans know that the cop is on the take. Institutional corruption is killing people’s trust in our government and our institutions.

Indeed, America is no longer a democracy or republic … it's officially an oligarchy.

The allowance of unlimited campaign spending allows the oligarchs to purchase politicians more directly than ever. Moreover, there are two systems of justice in America … one for the big banks and other fatcats, and one for everyone else.

Big Corporations Are Also Thoroughly Corrupt

But the private sector is no better … for example, the big banks have literally turned into criminal syndicates.

Wall Street and giant corporations are literally manipulating every single market.

And the big corporations are cutting corners to make an extra penny … wrecking havoc with their carelessness. For example:

- Fracking companies dumped 3 billion gallons of highly-toxic waste into California's drinking water supply. Fracking is polluting water all over the country. A study published in the journal Ground Water predicts that the highly-toxic fluids used in fracking can migrate to aquifers within a few short years. In addition, it is now official that fracking can cause earthquakes. Yet fracking companies are using military psychological operations techniques to discredit opponents (and see this)

- U.S. military contractors have pocketed huge sums of money earmarked for humanitarian and reconstruction aid

- Monsanto has claimed for decades that Roundup is safe, but the World Health Organization just said that it probably causes cancer. Monsanto forbids independent scientists from testing its GMO crops for safety, attacks the computers of people who oppose GMO foods and sue small farmers when Monsanto GMO crops drift onto their fields

- Big farmers are drenching their crops with Roundup right before harvest … to save a buck

- Big food companies work hand-in-glove with the government to dish up unhealthy food

- BP's criminal negligence led to the giant Gulf oil spill

(Further examples here, here, here, here and here.)

We've Forgotten the Lessons of History

The real problem is that we need to learn a little history:

- We’ve known for thousands of years that – when criminals are not punished – crime spreads

- We’ve known for hundreds of years that the failure to punish financial fraud destroys economies, as it destroys all trust in the financial system

- We’ve known for centuries that powerful people – unless held to account – will get together and steal from everyone else

Beyond Partisan Politics

Liberals and conservatives tend to blame our country's problems on different factors … but they are all connected.

The real problem is the malignant, symbiotic relationship between big corporations and big government.

- Introducing Hotel ISIS: Have Fun, But Don't 'Lose Your Head'

Over the past year, the world has learned quite a bit about ISIS, the once obscure band of CIA-trained, Qatar-funded, marauding Muslim militants whose Cinderella story saw the group transform themselves from Syrian proxy war puppets to barbarous pseudo-state conquerors in the space of nine short months. We’ve learned, for instance, that the group are avid Twitter users, which is why they felt especially betrayed when the social network began suspending members’ accounts, prompting the group to warn co-founder Jack Dorsey that ISIS “lions” would be arriving in short order to “take his breath.” We’ve also learned that despite proving themselves extraordinarily capable when it comes to producing near Hollywood-quality videos, the group struggles when it comes to creating a social network from scratch. Finally, we’ve come to understand that despite the group’s tough guy posturing, most members have a soft spot for kittens and enjoy a spoonful of Nutella now and again.

And so, as the CIA prepares to train the next group of “moderate” Syrian rebels who may or may not become the successor to ISIS much as ISIS did to al-Qaeda, and as Texans ponder “lone wolves” and false flags, we present ISIS first-ever venture into the hospitality industry. Behold! Hotel ISIS…

This was once the 262-room, five-star Ninawa International Hotel in Mosul, Iraq:

It is now being reopened under new ownership…

…who are working diligently to give the hotel a fresh new look…

…while tending to the grounds…

…trimming the hedges…

…and waxing the floors…

As you can see, the group expended quite a bit of effort to get the building ready for opening night which was reportedly on May 1. All Muslims were told they could attend the event free of charge and as The Independent reports, ISIS even put on a fireworks show at the end of the night:

Pictures circulated by Isis-affiliated social media accounts show members tending to a well-maintained garden, polishing floors and cleaning windows, expansive swimming pools and two black Isis flags flying at the front of the multi-storey building.

The hotel is believed to be the Ninawa International Hotel, which received a number of positive reviews on TripAdvisor before being overtaken by militants and stripped of its branding. It has 262 rooms, two restaurants, two ballrooms and a gymnasium, among other facilities.

Images from the event show dozens gathered around pools during the day, followed by a firework display in the evening.

So while there’s plenty of fun to be had at this former five-star establishment, you’d be wise not to go overboard or otherwise ‘lose your head’ because well… you might lose your head. Here’s SputnikNews:

Alas, the jihadists have prohibited their guests from dancing, smoking, gambling and other “sins”; women, visiting the hotel, should be dressed in accordance with strict Sharia laws – head-to-toe in black.

Those who violate the Islamic rules are at risk of being decapitated, while ISIL’s infamous female police al-Khansaa will keep an eye on guests to ensure observance of Islamic values and practices.

For those interested in making the trip to Mosul, we have not yet been apprised of the best way to make reservations, but we’ll be sure to keep an eye on Expedia for the best deals.

- Why We Have An Oversupply Of Almost Everything

Submitted by Gail Tverberg via Our Finite World blog,

The Wall Street Journal recently ran an article called, Glut of Capital and Labor Challenge Policy Makers: Global oversupply extends beyond commodities, elevating deflation risk. To me, this is a very serious issue, quite likely signaling that we are reaching what has been called Limits to Growth, a situation modeled in 1972 in a book by that name.

What happens is that economic growth eventually runs into limits. Many people have assumed that these limits would be marked by high prices and excessive demand for goods. In my view, the issue is precisely the opposite one: Limits to growth are instead marked by low prices and inadequate demand. Common workers can no longer afford to buy the goods and services that the economy produces, because of inadequate wage growth. The price of all commodities drops, because of lower demand by workers. Furthermore, investors can no longer find investments that provide an adequate return on capital, because prices for finished goods are pulled down by the low demand of workers with inadequate wages.

Evidence Regarding the Connection Between Energy Consumption and GDP Growth

We can see the close connection between world energy consumption and world GDP using historical data.

Figure 1. World GDP in 2010$ compared (from USDA) compared to World Consumption of Energy (from BP Statistical Review of World Energy 2014).

This chart gives a clue regarding what is wrong with the economy. The slope of the line implies that adding one percentage point of growth in energy usage tends to add less and less GDP growth over time, as I have shown in Figure 2. This means that if we want to have, for example, a constant 4% growth in world GDP for the period 1969 to 2013, we would need to gradually increase the rate of growth in energy consumption from about 1.8% = (4.0% – 2.2%) growth in energy consumption in 1969 to 2.8% = (4.0% – 1.2%) growth in energy consumption in 2013. This need for more and more growth in energy use to produce the same amount of economic growth is taking place despite all of our efforts toward efficiency, and despite all of our efforts toward becoming more of a “service” economy, using less energy products!

Figure 2. Expected change in GDP growth corresponding to 1% growth in total energy, based on Figure 1 fitted line.

To make matters worse, growth in world energy supply is generally trending downward as well. (This is not just oil supply whose growth is trending downward; this is oil plus everything else, including “renewables”.)

Figure 3. Three-year average percent change in world energy consumption, based on BP Statistical Review of World Energy 2014 data.

There would be no problem, if economic growth were something that we could simply walk away from with no harmful consequences. Unfortunately, we live in a world where there are only two options–win or lose. We can win in our contest against other species (especially microbes), or we can lose. Winning looks like economic growth; losing looks like financial collapse with huge loss of human population, perhaps to epidemics, because we cannot maintain our current economic system.

The symptoms of losing the game are the symptoms we are seeing today–low commodity prices (temporarily higher, but nowhere nearly high enough to maintain production), not enough good paying jobs for common workers, and lack of investment opportunities, because workers cannot afford the high prices of goods that would be required to provide adequate return on investment.

How We Have Won in Our Contest with Other Species–Early Efforts

The “secret formula” humans have had for winning in our competition against other species has been the use of supplemental energy, adding to the energy we get from food. There is a physics reason why this approach works: total population by all species is limited by available energy supply. Providing our own external energy supply was (and still is) a great work-around for this limitation. Even in the days of hunter-gatherers, humans used three times as much energy as could be obtained through food alone (Figure 1).

Earliest supplementation of food energy came by burning sticks and other biomass, starting one million years ago. Using this approach, humans were able to gain an advantage over other species in several ways:

- We were able to cook some of our food. This made a wider range of plants and animals suitable for food and made the nutrients from these foods more easily available to our bodies.

- Because less energy was needed for chewing and digesting, our bodies could put energy into growing a larger brain, thus giving us an advantage over other animals.

- The use of cooked food freed up time for such activities as hunting and making clothes, because less time was needed for chewing.

- Heat from burning plant material could be used to keep warm in cold areas, thereby extending our range and increasing total human population that could be supported.

- Fire could be used to chase off predatory animals and hunt prey animals.

Our bodies are now adapted to the need for supplemental energy. Our teeth our smaller, and our jaws and digestive apparatus have shrunk in size, as our brain has grown. The large population of humans that are alive today could not survive without supplemental energy for many purposes, such as cooking food, heating homes, and fighting illnesses that spread when humans are in as close proximity as they are today.

Our Modern Formula For Winning the Battle Against Other Species

In my view, the formula that has allowed humans to keep winning the battle against other species is the following:

- Use increasing amounts of inexpensive supplemental energy to leverage human energy so that finished goods and services produced per worker rises each year.

- Pay for this system with debt, because (if supplemental energy costs are cheap enough), it is possible to repay the debt, plus the interest on the debt, with the additional goods and services made possible by the cheap additional energy.

- This system gradually becomes more complex to deal with problems that come with rising population and growing use of resources. However, if the output of goods per worker is growing rapidly enough, it should be possible to pay for the costs associated with this increased complexity, in addition to interest costs.

- The whole system “works” as long as the total quantity of finished goods and services rises rapidly enough that it can fund all of the following: (a) a rising standard of living for common workers so that they can afford increasing amounts of debt to buy more goods, (b) debt repayment, and interest on the debt of the system, and (c) and an increasing amount of “overhead” in the form of government services, medical care, educational services, and salaries of high paid officials (in business as well as government). This overhead is needed to deal with the increasing complexity that comes with growth.

The formula for a growing economy is now failing. The rate of economic growth is falling, partly because energy supply is slowing (Figure 3), and partly because we need more and more growth of energy supply to produce a given amount of economic growth (Figure 2). With this lowered world economic growth, the amount of goods and services being produced is not rising fast enough to support all of the functions that it needs to cover: interest payments, growing wages of common workers, and growing “overhead” of a more complex society.

* * *

Some Reasons the Economic Growth Cycle is Now Failing

Let’s look at a few areas where we are reaching obstacles to this continued growth in final goods and services. An overarching problem is diminishing returns, which is reflected in increasingly higher prices of production.

1. Energy supplies are becoming more expensive to extract.

We extract the easiest to extract energy supplies first, and as these deplete, need to use the more expensive to extract energy supplies. We hear much about “growing efficiency” but, in fact, we are becoming less efficient in the production of energy supplies.

In the US, EIA data shows that we are becoming less efficient at coal production, in terms of coal production per worker hour (Figure 5).

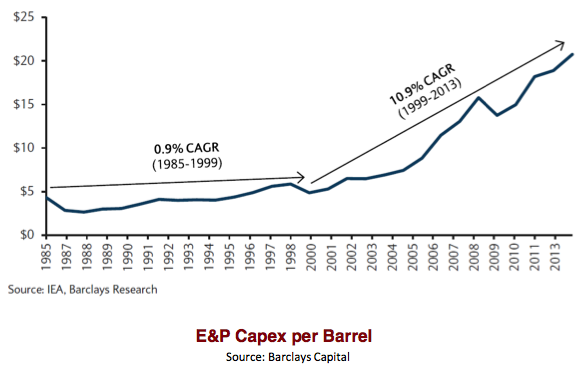

With oil, growing inefficiency is shown by the steeply rising cost of oil exploration and production since 1999 (Figure 6).

Figure 6. Figure by Steve Kopits of Douglas-Westwood showing trends in world oil exploration and production costs per barrel.

Thus, it is for a fairly recent period, namely the period since about 2000, that we have been encountering rising costs both for US coal and for worldwide oil extraction.

The extra workers and extra costs required for producing the same amount of energy counteract the tendency toward growth in the rest of the economy. This occurs because the rest of the economy must produce finished products with fewer workers and less resources as a result of the extra demands on these resources by the energy sector.

2. Other materials, besides energy products, are experiencing diminishing returns.

Other resources, such as metals and other minerals and fresh water, are also becoming increasingly expensive to extract. The issue with mineral ores is similar to that with fossil fuels. We start with a fixed amount of ores in good locations and with high mineral percentages. As we move to less desirable ores, both human labor and more energy products are required, making the extraction process less efficient.

With fresh water, the issue is likely to be a need for desalination or long distance transport, to satisfy the needs of a growing population. Workarounds again involve more human labor and more resource use, making the production of fresh water less efficient.

In both of these cases, growing inefficiency leaves the rest of the economy with less human energy and less energy products to produce the finished goods and services that the economy needs.

3. Growing pollution is taking its toll.

Instead of just producing end products, we are increasingly finding ourselves fighting pollution. While this is a benefit to society, it really is only offsetting what would otherwise be a negative. Thus, it acts like overhead, rather than producing economic growth.

From the point of view of workers having to pay for higher cost energy in order to fight pollution (say, substitution of a higher cost energy source, or paying for more pollution controls), the additional cost acts like a tax. Workers need to cut back on other expenditures to afford the pollution control workarounds. The effect is thus recessionary.

4. The amount of “overhead” to the world economy has been growing rapidly in recent years, for a number of reasons:

- The amount of overhead is growing because we are reaching natural barriers. For example, population per acre of arable land is growing, so we need more intensity of development to produce food for a rising population.

- With greater population density and increased bacterial antibiotic resistance, disease transmission becomes a more of a problem.

- Increasing education is being encouraged, whether or not there are jobs available that will make use of that education. Education that cannot be used in a productive way to produce more goods and services can be considered overhead for the economy. Educational expenses are frequently financed by debt. Repayment of this debt leads to a decrease in demand for other goods, such as new homes and vehicles.

- We have more elderly to whom we have promised benefits, because with the benefit of better nutrition and medical care, more people are living longer.

5. We are reaching debt limits.

As economic growth has slowed, we have been adding more and more debt, to try to mitigate the problem. This additional debt becomes a problem in many ways: (a) without cheap energy to leverage human labor, there are not many productive investments that can be made; (b) the addition of more debt leads to a need for more interest payments; and (c) at some point debt ratios become overwhelmingly high.

At least part of the slowdown in economic growth that we are seeing today is coming from a slowdown in the growth of debt. Without debt growth, it is hard to keep commodity prices high enough. Investment in new manufacturing plants is also affected by low growth in debt.

* * *

Reasons for Confusion in Understanding Our Current Predicament

1. Not understanding that all of the symptoms we are seeing today are manifestations of the same underlying “illness”.

Most analysts think that the economy has stubbed its toe and has a headache, rather than recognizing that it has a serious underlying illness.

2. Academia is focused way too narrowly, and tied too closely to what has been written before.

Academics, because of their need to write papers, focus on what previous papers have said. Unfortunately, previous papers have not understood the nature of our problem. Academics have developed models based on our situation when we were away from limits. The issues we are facing cover such diverse subjects as physics, geology, and finance. It is hard for academics to become knowledgeable in many areas at once.

3. Models that seemed to work before are no longer appropriate.

We take models like the familiar supply and demand model of economists and assume that they represent everlasting truths.

Figure 7. (Source Wikipedia). The price P of a product is determined by a balance between production at each price (supply S) and the desires of those with purchasing power at each price (demand D). The diagram shows a positive shift in demand from D1 to D2, resulting in an increase in price (P) and quantity sold (Q) of the product.

Unfortunately, as we get close to limits, things change. Both wage levels and debt levels have an impact on demand; the quantity goods available is also affected by diminishing returns. The model that worked in the past may be totally inappropriate now.

Even a complex model like the climate change model being used by the IPCC is likely to be affected by financial limits. If near-term financial limits are to be expected, IPCC’s estimate of future carbon from fuels is likely to be too high. At a minimum, the findings of the IPCC need to be framed differently: climate change may be one of a number of problems facing those people who manage to survive a financial crash.

4. Too much wishful thinking.

Everyone would like to present a positive result, especially when grants are being given for academic research will support some favorable finding.

A favorite form of wishful thinking is believing that higher costs of energy products will not be a problem. Higher cost energy products, whether they are renewable or not, are a problem for many reasons:

- They represent growing inefficiency in the economy. With growing inefficiency, we produce fewer finished goods and services per worker, not more.

- Countries using more of the higher cost types of energy become less competitive in the world market, and because of this, may develop financial problems. The countries most affected by the Great Recession were countries using a high percentage of oil in their energy mix.

- The amount workers have available to spend is limited. If a worker has $100 to spend on energy supply, he can buy 100 times as much in energy supplies priced at $1 as he can energy supplies priced at $100. This same principle works even if the cost difference is much lower–say $3.50 gallon vs. $3.00 gallon.

5. Too much faith in, “We pay each other’s wages.”

There is a common belief that growing inefficiency is OK; the wages we pay for unneeded education will work its way through the system as more wages for other workers.

Unfortunately, the real secret to economic growth is not paying each other’s wages; it is growing output of finished products per worker through increased use of cheap energy (and perhaps technology, to make this cheap energy useful).

Increased overhead for the system is not helpful.

6. An “upside down” peak oil story.

Most people in the peak oil community believe what economists say about supply and demand–namely, that oil prices will rise if there is a supply problem. They have not realized that in a networked economy, wages and prices are tightly linked. The way limits apply is not necessarily the way we expect. Limits may come through a lack of good paying jobs, and because of this lack of jobs, inability to purchase products containing oil.

The connection between energy and jobs is clear. Good jobs require the use of energy, such as electricity and oil; lack of good-paying jobs is likely to be a manifestation of an inadequate supply of cheap energy. Also, high paying jobs are what allow rising buying power, and thus keep demand high. Thus, oil limits may appear as a demand problem, with low oil prices, rather than as a high oil price problem.

In my opinion, what we are seeing now is a manifestation of peak oil. It is just happening in an upside down way relative to what most were expecting.

* * *

Conclusion

One way of viewing our problem today is as a crisis of affordability. Young people cannot afford to start families or buy new homes because of a combination of the high cost of higher education (leading to debt), the high cost of fuel-efficient new cars (again leading to debt), the high cost of resale homes, and the relatively low wages paid to young workers. Even older workers often have an affordability problem. Many have found their wages stagnating or falling at the same time that the cost of healthcare, cars, electricity, and (until recently) oil rises. A recent Gallop Survey showed an increasing share of workers categorize themselves as “working class” rather than “middle class.”

It is this affordability crisis that is bringing the system down. Without adequate wages, the amount of debt that can be added to the system lags as well. It becomes impossible to keep prices of commodities up at a high enough level to encourage production of these commodities. Return on investment tends to be low for the same reason. Most researchers have not recognized these problems, because they are narrowly focused and assume that models that worked in the past will continue to work today.

- Slavery In America

- What The US Government Spends Its Money On, Besides Hookers And Gambling

While there are those who, oblivious of the fastest collapse in US economic data on record, have pointed out that government tax receipts are rising with the implication being that the US consumer is doing quite fine thank you (and they are absolutely correct if by “consumer” they mean about 1% of the US population), what is rarely if ever discussed is that government expenditures are rising just as fast.

In fact as the following chart from the latest Treasury refunding presentation shows, the cumulative deficit through December in 2015 is just a fraction greater than last year, when government tax revenues were substantially lower.

So to understand where Uncle Sam spent all that extra cash it collected through various rising tax increases on the rich here is the full breakdown of the largest outlay categories for the US government in the first fiscal quarter of 2015 and 2014.

It will hardly come as a surprise that after being neck and neck a year ago with Social Security outlays, the spending on Medicare and Medicaid (HHS) has jumped substantially, and at over $250 billion in the quarter, is now the most cash demanding category courtesy of a demographically deteriorating America that is just a little bit older and whole lot fatter.

The bulk of the other spending categories were largely in line with the prior year, and the one outlier was interest on the debt (Treasury), which jumped to just around $125 billion for the quarter an increase of about 25% from a year ago, which is somewhat unexpected considering the average cost of debt continues to decline even if the total notional amount of US Federal Debt is now in the mid-$18 trillion range.

The one most interesting category was defense spending: a category despised by progressives even though at this rate spending on interest for the progressives’ beloved government debt will soon eclipse defense. It is here that outlays actually dropped from a year ago, declining to just over $150 billion for the quarter. Which is surprising, because as Politico wrote overnight, among the items funded by general taxpayer revenue were such discretionary expenses as hookers and blackjack, after a defense department audit founds that Pentagon employees used their government credit cards to gamble and pay for “adult entertainment.”

From Politico:

The audit of “Government Travel Charge Transactions” by the Department of Defense Office of Inspector General, which is to be made public in coming weeks, found that both civilian and military employees used the credit cards at casinos and for escort services and other adult activities — in Las Vegas and Atlantic City.

The audit forgot to add that the employees were either ridiculously brave or dumb as a bag of hammers to assume that charging a hooker on your taxpayer credit card would pass unnoticed.

Actually make that dumb as a bag of hammers, because the expenditures did not just involve swiping you card (in the prostitute’s magnetic card reader), but actually submitting the expense for reimbursement. And for the supervisors to figure out that the funds were spent on hookers, it means that the Pentagon lackeys wrote down just that.

A Pentagon official briefed on some of the findings stressed that the federal government did not necessarily pay the charges; holders of the cards pay their own bills and then submit receipts to be reimbursed for expenses related to their government business.

Actually make that really, really dumb, because “the official said that the employees may have used the government cards for gambling and escort services in order to shield the charges from spouses.” In other words, if you got caught not only would you get fired, but you would lose half your assets following a very messy divorce.

Those taxpaying Americans wondering if this was a one-off event, will be delighted to know that their taxes are abused pretty much on a constant basis by the government’s employees: “the Department of Labor’s Inspector General recently found that Job Corps employees charged nearly $100,000 to the government for hair cuts, clothing, and personal cell phone service. The Department of Homeland Security found that Coast Guard employees charged more than $12,000 at a one California coffee shop alone. Three employees were fired and two resigned last year at the Bureau of Land Management after they charged $800,000 worth of gift cards on their government credit cards.”

On the other hand, the Keynesians among us will protest that this is perfectly normal and even legitimate theft: after all, how is the economy expected to grow if corrupt criminals don’t spend, spend, spend. Especially if the money isn’t theirs to begin with. Those same Keynesians will demand that instead of collecting taxes, the government should merely issue a quadrillion dollars in debt which will be promptly monetized by the Fed, with the proceeds used by every government criminal to hire hookers, do blow, gamble 24/7 and otherwise “boost” the economy.

In fact, that may well describe the Keynesian nirvana: surely it would explain why the real US economy is fast approaching a state of terminal collapse. Which is why expect the trend in declining defense spending not to persist.

As for that last question, whether anyone will be fired, here is the simple answer: of course not,

Because the review was an audit of the credit card system and not an investigation of particular individuals, the official said the likely result will be that the agencies and military branches most affected will be compelled to remind employees that the practice violates policy — and possibly the law. [T]he findings are expected to lead department officials to issue stern new warnings.

Because if criminal banks get away with a wrist slap and a harsh warning by their “regulators”, why not criminal government workers?

- New Russian High-Tech Tank Suffers BSOD Moment During Army Parade

Russia unveiled its new main battle tank as part of practices for Saturday’s Victory Day parade (commemorating the end of WWII). According to RT, the Armata “is a cutting-edge vehicle with an unmanned turret armed with a brand new 125 mm smoothbore cannon, which is the most powerful gun of its kind to date in terms of muzzle energy.” You decide…

Of course, the painful 40 seconds could be seen as an anology for The Fed’s effort to revive The US Economy.

- Global Trade To Remain Subdued Until At Least 2020, Goldman Says

In early March, Maersk chief executive Søren Skou delivered a stinging blow to those who claim the epic decline in the Baltic Dry Index is representative not of sagging worldwide demand, but rather of severe oversupply, and is thus no longer a reliable indicator when it comes to assessing the state of the global economy. Skou told FT he sees container demand “towards the low end” of the 3-5% growth range the company forecasts for 2015. If Skou is correct, it would mark a Y/Y decline in growth for the company, which handles around 15% of all seaborne freight. Skou also flagged the generally sluggish pace of global economic growth, noting that “the economies in Europe are still very sluggish. Brazil, Russia and China: those three economies used to drive a lot of growth, and right now we are not really seeing that to the same extent. The only real bright spot is the US, and even the US is good but not great.” This led us to remark that “yes supply isn’t helping, but it is the lack of global demand that is pushing equilibrium levels lower, aka global deflation.” Later in the month, we flagged further declines in shipping rates as evidence that global trade was grinding to a crawl.

Meanwhile, we’ve exhaustively documented the laundry list of signs that point to dramtically decelerating economic growth in China, including falling metals demand, collapsing rail freight volume, slumping exports, a war on pollution that may cost the country 40% in industrial production terms, and, most recently, a demographic shift that’s set to trigger a wholesale reversal of the factors which contributed to the country’s meteoric rise. All of this means that the world’s once-reliable engine of demand is set to stall in the years ahead.

Finally, we’ve been keen to note that CB policy has had the effect of allowing otherwise insolvent companies to stay solvent by tapping investors at record low borrowing costs contributing to a supply glut and, ultimately, to deflation.

Consider the above and then consider the following, from Goldman, who now predicts the intersection between soft commodity markets and the Chinese transition from investment to consumption will weigh on dry bulk trade — and by extension, on shipping rates — until at least 2020.

Via Goldman:

The transition from investment to consumption in the Chinese economy, together with a shift towards cleaner energy sources, has caused a sharp deceleration in dry bulk trade. After expanding at an average annual rate of 7% over the period 2005-14, seaborne demand in iron ore, thermal and metallurgical coal is set to increase by only 2% in 2015 to 2.5 billion tonnes as these trends persist. In the steel sector, domestic consumption growth ground to a halt in 2014 and the prospect of peak iron ore demand is nigh. In the power sector, demand for coal-fired generation is suffering from a combination of weaker economic growth, rising energy efficiency and a diversification in the fuel mix towards renewable energy, natural gas and nuclear. There are no other markets large and/or dynamic enough to offset a slowdown in China in the foreseeable future, and we forecast trade volumes to stabilize in the period to 2018.

Meanwhile, shipyards churning out large dry bulk carriers in expectation of a sustained period of strong demand for commodities now find themselves adding unwanted capacity into an oversupplied freight market. The two largest dry bulk vessel types, panamax (c.75,000 DWT2) and capesize (c.180,000 DWT), benefited the most from the bull market in iron ore and coal. The size of the fleet doubled between 2008 and 2015, and current order books will ensure that shipping capacity continues to grow until 2017, when vessel retirements will finally outweigh new deliveries.

The divergence between demand for freight and the capacity of the vessel fleet reflects the time lag between the mining and shipping sectors. In both industries, supply responds to price: rising commodity prices in a tight market leads to investment in new mining capacity in the same way that rising freight rates encourages greater activity in shipyards. On that basis, the mining sector moves first by ramping up export volumes and the shipping sector moves next, responding to rising trade volumes by investing in new vessels. Conversely, mining companies will be the first to respond in a bear market by curtailing investment, while the delayed response from ship builders will result in overinvestment and excess capacity.

The daily charter rate for a capesize vessel has declined from a peak in excess of US$100,000 in 2008 down to its current level below US$10,000. Faced with the risk of leaving vessels idle over long periods, we believe that ship owners will charge charter rates that are range bound between the cash cost of operating the vessel and the accounting break-even rate. This compounds the impact of lower fuel prices, resulting in a period of cheap freight that should last until older vessels have been scrapped in sufficient numbers to balance the market, most likely beyond 2020.