- Getting Paid for Doing the Obvious?

By Chris at www.CapitalistExploits.at

I’ve spent a good few hours running. Up hills, down hills, along flats… just running.

A not so startling realization is that running uphill burns more calories, is more taxing on your body, makes you breathe harder, and will make you tire faster than running on a flat or downhill. Running downhill is easier and less taxing on your body. Consequently only protein bar munching fitness nuts, and criminals escaping the scene of a crime, willingly and gleefully run uphill. The rest of us enjoy it when the decline hits.

I’ve also spent a good while trading currencies. Like running up and down hills, currency trading can be more or less taxing on your account, depending on the currency pair you’re trading. When trading currencies, it’s important to understand if you’re running up or downhill. I want to draw your attention to the costs associated with trading currency pairs.

When you trade a currency pair what you’re doing is borrowing one currency in order to buy another But as a trader you don’t care for taking settlement. What you’re concerned about is profiting from the change in exchange rates. Since you’re borrowing one currency it stands to reason that you’ll be paying interest on your borrowed currency (short position), and consequently, since you’re buying another, you’ll be receiving interest on the bought currency (long position).

This particular paying and receiving of interest is commonly referred to as rollover. At day’s end all accounts are settled and if you don’t wish to pay or receive interest then you need to close out your trade before day’s end. Here is the important bit to understand…

When you’re borrowing a currency which enjoys a lower yield than the currency which you’re buying then you get paid the difference at the end of every day. A good thing from a cashflow perspective.

If, on the other hand, you’re the other way around, you pay the difference. The problem, as with life in general, is that there is typically no free lunch. More often than not the best risk reward trade setups leave us paying, not receiving interest on a cross pair. You don’t want to be the guy who thought he was going for a nice gentle downhill run only to find you’re running up the steepest and longest hill you’ve ever come across, ensuring that you will absolutely puke along the way.

What is typical is that the currency which is weakening simultaneously enjoys a higher yield than the one which it is weakening against. This makes sense since the risk to holding the currency is higher and higher risk, ceteris paribus, should mean higher reward. For instance, long US dollar and short Chinese yuan means that the spread works against you. You’ll be paying the difference between yields not receiving it.

Below is a chart, taken from Interactive Brokers, with the rates. Bear in mind these change all the time and differ from broker to broker but the principle is important to understand.

Source: Interactive Brokers

The attentive amongst you will notice a wonderful anomaly.

Long USD/JPY pays you to hold this position while the yen is weakening. It’s the Holy Grail of cross pairs. The reason here is that the BoJ can hold the bond market together and keep yields very low and ironically massively devalue the yen at the same time. We’ve been in this trade for a long long time now and it’s paid us handsomely not only since the yen has lost so much value against the dollar but also because of the positive carry aspect.

The reason I talk about these little nuances is that it’s important for me to be positioned the best possible way at all times and if that’s true for me, it’s likely true for you too. This all becomes important as we stand today on the precipice of an emerging market liquidation – something I’ve written about here and here.

Remember the Asian crisis?

Just for some historical context consider Indonesia which went down 95% in dollar terms in a little over a year! Korea, hardly a basket case country itself, collapsed 90% in the same time frame. Liquidity just evaporated from the market. I’m not sure investors today get it.

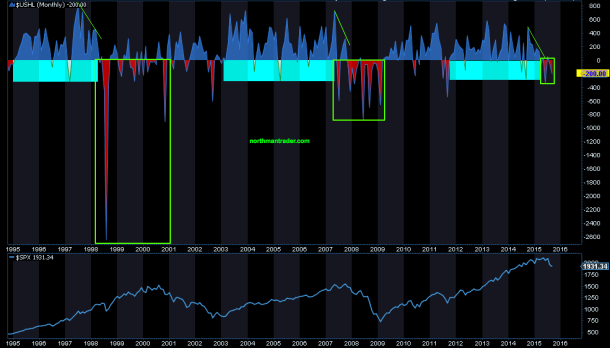

We’re there again.Liquidity is drying up and we think that we’re on the brink of liquidity collapsing, resulting in some gloriously curvy wavy charts like the one above. How long? I think we’ve already tipped over, we’re in it… just the very early stage. The next stage is the waterfall, the rapid“oh my God, how did that happen?” stage.

Where and What Blows Up?

Some great work done by CreditSights reveals where risk lies:

Brazil is already being punished, Chile has ways to go as does Colombia. Heck, put into context of how enormous this carry trade is, I think they’ve hardly moved yet.

I think we’ll also get trouble in energy. We’re already seeing it in shale and later this week I’ve got something special to share with you on that topic as it’s timely. I also think we’ll see it in emerging market equities in a big way. Emerging market corporate debt looks even worse.

Understanding the opportunity is one thing, though.

I know plenty very very smart PhDs but the one thing that no longer surprises me, but did for a long time, was how few of them were rich. They’re the equivalent of the geek in the bar who can identify the hottest girl because he has studied every possible feature of every single girl in the room but you know he’s still going home alone because he hasn’t gotten off his behind to talk to any of them and see how they actually work.

Understanding how to execute on an opportunity is a different mindset! It requires a tolerance for risk, a belief in your own analysis, a backing of yourself, and it requires action. We detailed in our complimentary USD Bull Report what was going to happen in this market. It’s happening now and the big move lies just over the horizon. Or we’re wrong. How about we let the market show us?

Next time I’ve got a treat for you regarding the energy sector that I think you’ll find fascinating.

– Chris

“Ideas are easy. It’s the execution of ideas that really separates the sheep from the goats.” – Sue Graft

- Of Greater Fools, Bigger Liars, & A Society In Decline

Submitted by Raul Ilargi Meijer via The Automatic Earth blog,

"Societies in decline have no use for visionaries"

– Anaïs Nin

The moment we heard that John Boehner would resign, the first thing that came to mind was: the next one will be a Greater Fool and a Bigger Liar. For all of his obvious faultlines, Boehner is human. As was evident for all to see Thursday when the Pope -Boehner’s as Catholic as JFK and Jesus Christ- came to see ‘him’ in ‘his’ Senate. Even smiled reading that the Pope had asked Boehner to pray for him.

But Boehner was really of course just a man who through time increasingly became a kind of barrier between a president and his party on the one hand, and Boehner’s own, increasingly ‘out there’, party on the other. He moved from far right to the right middle just to keep the country going. In essence, that’s little more than his job, but just doing your job can get you some nasty treatment these days in the land of the free.

So now we’ll get a refresher course in government shutdown, though there’s no guarantee that Boehner’s successor will be enough of a greater fool to cut his/her (make that his) new-found career short by actually letting it happen. At least not before December.

The government shutdown is a threat like Janet Yellen’s rate hike, one which always seems to disappear right around the next corner, a process that eats away at credibility much more than participants are willing and/or able to acknowledge. Until it’s too late.

Now that it’s clear they lost on Obamacare, Republicans demand that funding for Planned Parenthood must stop, as the women’s group is accused of ‘improperly selling tissue harvested from aborted fetuses’, something it vehemently denies. And there we’re right back to the shadow boxing multi-millionaire tragic comedy act the US Congress has been for years now.

So yeah, by all means let it shut down. Thing is, as much as Boehner was always already a walking safety hazard, there’s guys waiting in the wings who’d love to end Obama’s presidency any which way they can. The official GOP viewpoint may be that Da Donald is a greater fool, but that view isn’t shared by the entire caucus. Again, so yeah, bring it on, like the rate hike, let’s see you do it.

It’s not a little ironic that one day after the Pope holds his hand, Boehner leaves a squabble behind that involves aborted fetuses. Where I come from, no accusations of people either eating babies or selling their tissue is taken serious, ever. We call that folklore.

Meanwhile, Anarchy In The US is a distinct possibility. It’s probably a good thing all these guys still have paymasters, wouldn’t want to have them make their own decisions. More irony: Boehner brought more donations into the GOP caucus than anyone else. They’ll miss him yet.

Also meanwhile, European and US exchanges were up on Friday as if no investor ever saw a Volkswagen in their lives. Even as there’s no escaping the idea that VW’s illegal drummings go way beyond the 11 million vehicles they themselves fessed up to, and the millions more from other carmakers. Where I come from, we call this endemic fraud.

This little graphic from T&E seems to indicate that VW was the least worst of the offenders. And it will be very hard for politicians to find a carpet left big enough to sweep this under. Class action lawsuits are being prepared for investors and car owners, and politics doesn’t trump courts, at least not everywhere.

Merkel and Hollande and all of their lower level minions will have to cut their losses and offer their carmakers to the vultures, or risk getting severely burned in the process. Or is it already too late? The German Green Party claims Merkel knew of the rigged emissions tests. For now, the government is in steep denial:

German Greens Claim Merkel Government Knew Emissions Tests Were Rigged

The German Green party has claimed that the German Government, led by Chancellor Angela Merkel, knew about the software car manufacturers used to rig emissions tests in the US. The Green party has said it asked the German Transport Ministry in July about the devices used to deceive regulators and received a written response as follows, the FT reports: “The federal government is aware of [defeat devices], which have the goal of [test] cycle detection.”

The Transport Ministry denied knowing that the software was being used in new vehicles, however. The timing of the questions has raised concerns over whether the German government knew about the activities at Volkswagen stretching back to 2009. “The federal government admitted in July, to an inquiry from the Greens, that the [emissions] measurement practice had shortcomings. Nothing happened,” said Oliver Krischer, a German Green party lawmaker.

That written response the Financial Times reports on either exists or it does not. Let’s see it. Simple. If it does exist, Merkel’s in trouble. Then again, the EU knew about the defeat device at least two years ago. It’s starting to look as if everyone was involved. And you can’t fire everyone.

EU Warned On Devices At Centre Of VW Scandal Two Years Ago

EU officials had warned of the dangers of defeat devices two years before the Volkswagen emissions scandal broke, highlighting Europe’s failure to police the car industry. A 2013 report by the European Commission’s Joint Research Centre drew attention to the challenges posed by the devices, which are able to skew the results of exhaust readings. But regulators then failed to pursue the issue — despite the fact the technology had been illegal in Europe since 2007. EU officials said they had never specifically looked for such a device themselves and were not aware of any national authority that located one.

Matthias Müller was announced as VW’s new head honcho. Now there’s a greater fool if ever you saw one. Who can possibly want that gig? His predecessor Winterkorn left the top post, but to date not the one as head of Porsche. Ergo, he presides over those who lead the internal investigation at the company. And even if Winterkorn is bought off and out, VW is still as big of a hornet’s nest as you can find. The company’s corporate -and legal- structure, which includes unsavorily close ties to the governments of both Lower Saxony -which owns 20% of the company, in (highly) preferred stock- and federal Germany, virtually guarantees it.

Nor does it stop there. Both the German and British governments now stand accused of perverting EU law on emissions. The Wall Street Journal asks how much the EU itself knew. Easy answer: plenty. Inevitable. Key words: spin doctors, damage control.

This morning’s Bild am Sonntag, which claims to be in the possession of an ‘explosive document’, reports first that a October 7 deadline has been handed VW by Berlin to ‘fix’ its problems, and second that engineering giant Bosch, which provided the -initial?!- “defeat device” software, warned VW as long as 8 years ago, in 2007, that the software was for internal testing purposes only. VW‘s own technicians “warned about illegal emissions practices” in 2011, the Frankfurter Allgemeine Sonntagszeitung cites an internal report as saying.

And that’s just the beginning. Or rather, the beginning may have been much earlier. Bloomberg writes, in an article called “Forty Years Of Greenwashing” that “On 23 July 1973, the EPA accused [Volkswagen] of installing defeat devices in cars it wanted to sell in the 1974 model year.” Great, now we have to wonder what Gerald Ford knew? Dick Nixon?

In perhaps an ill-timed effort to divert attention away from her car industry, Merkel dreams of more global power:

Germany Battles Past Ghosts as Merkel Urges Greater Global Role

Europe’s dominant country is stepping out from its own shadow. Seventy years after Germany’s defeat at the end of World War II, Chancellor Angela Merkel’s government is signaling a willingness to assume a bigger role in tackling the world’s crises without fear of offending allies like the U.S. Spurred into more international action by the refugee crisis, Merkel on Wednesday prodded Europe to adopt a “more active foreign policy” with greater efforts to end the civil war in Syria, the source of millions fleeing to safety. As well as enlisting the help of Russia, Turkey and Iran, Merkel said that will mean dialogue with Bashar al-Assad, making her the first major western leader to urge talks with the Syrian president.

Germany’s position as Europe’s biggest economy allowed Merkel and her finance minister, Wolfgang Schaeuble, to assume a leading role during the euro-area debt crisis centered on Greece, but the change in focus to beyond Europe’s borders is very much political. After decades of relying on industrial prowess – now under international scrutiny as a result of the Volkswagen scandal – globalization and the necessity to keep Europe relevant are opening up options for Merkel to make Germany a less reluctant hegemon.

Syria has spurred “a rethink in German foreign policy,” Magdalena Kirchner at the German Council on Foreign Relations in Berlin, said. “As the refugee crisis developed, the view took hold that this conflict can no longer be fenced off or ignored. With her stance on the crisis, Merkel may be prodding other European leaders toward a bigger international engagement.”

And Angela’s Germany tells the ECB to take a hike and grow a pair while they’re at it. For a country that spent the best part of the year telling Greece to stick to the law and the plan or else, that’s quite something.

ECB Faces Defiance on Bank Oversight as Germany Hoards Power

The ECB faces increasing defiance from euro-area governments reluctant to cede control over their lenders, highlighted by a German bill that chips away at the ECB’s supervisory powers. The Bundestag, the lower house of parliament, votes Thursday on an amendment to Germany’s banking act that would allow the Finance Ministry in Berlin to issue rules on banks’ recovery plans, risk management and internal decisions under a bill implementing European Union rules for winding down failing banks. The ECB, which assumed supervisory powers over euro-area banks last November, is considering complaining at the European Commission, asking the EU’s executive arm to take Germany to court over the legislation.

As for Angela and the refugee issue, no changes any faster than a frozen molasses flow. Germany announced it will spend €4 billion on refugees already in the country, but votes to stop who’s still coming. As if that’s a serious option. They’re going to do it with gunboats, no less. Agianst overloaded dinghies.

EU To Use Warships To Curb Human Traffickers

The EU will use warships to catch and arrest human traffickers in international waters as part of a military operation aimed at curbing the flow of refugees into Europe, the bloc’s foreign affairs chief has said. “The political decision has been taken, the assets are ready,” Federica Mogherini said on Thursday at the headquarters of the EU’s military operation in Rome. The first phase of the EU operation was launched in late June. It included reconnaissance, surveillance and intelligence gathering, and involved speaking to refugees rescued at sea and compiling data on trafficker networks. The operation currently involves four ships – including an Italian aircraft carrier – and four planes, as well as 1,318 staff from 22 European countries.

Beginning on October 7, the new phase will allow for the seizure of vessels and arrests of traffickers in international waters, as well as the deployment of European warships on the condition that they do not enter Libyan waters. “We will be able to board, search, seize vessels in international waters, [and] suspected smugglers and traffickers apprehended will be transferred to the Italian judicial authorities,” Mogherini said. “We have now a complete picture of how, when and where the smugglers’ organisations and networks are operating so we are ready to actively dismantle them,” she said.

Those 1,318 staff could be used to help and rescue refugees, who will keep coming. Another 17 drowned in the Aegean Sea this Sunday morning. That should be the no. 1 priority. Instead, Europe’s policy of death continues unabated. France started bombing Syria -again- and Putin can and will no longer be ignored when it comes to his sole Middle East stronghold. We’ve created a god-awful mess, and not even god’s alleged man-on-the-earth, the underwhelming Pope Francis, does more than stammer a few hardly audible scripted lines about it.

It’s all about power and money, and none of it is about people. In other ‘news’, China securitizes its markets in a pretty standard desperate greater fools’ last move. As I said earlier, Beijing’s Rocking the Ponzi.

China Becomes Asia’s Biggest Securitization Market

China’s fledging securitization market is soaring, as Beijing looks for new ways to ease lending to firms amid the country’s slowest period of economic growth in more than two decades. In the past few months, Chinese officials have laid out new rules to expand and quicken the process for car makers and other lenders to issue debt by bundling together pools of underlying loans. Issuance of asset-backed securities in the world’s second largest economy rose by a quarter in the first eight months of 2015—to $26.3 billion from $20.8 billion in the same period last year, according to data publisher Dealogic. Though the Chinese securitization market took flight just last year, it has already become Asia’s biggest, outpacing other, more developed markets like South Korea and Japan.

China’s new economic reality, no matter what Xi tells Obama, was revealed by China Daily. Imagine a company in the US, or an EU country, announcing 100,000 lay-offs in one go. For China, it’s the first of many, though not all may be publicly announced.

Chinese Mining Group Longmay To Cut 100,000 Coal Jobs (China Daily)

The largest coal mining group in Northeast China is cutting 100,000 jobs within the next three months to reduce its losses – one of the biggest mass layoffs in recent years. Heilongjiang Longmay Mining Holding Group Co Ltd, which has a 240,000 workforce, said a special center would be created to help those losing their jobs to either relocate or start their own businesses. Chairman of the group Wang Zhikui said the job losses were a way of helping the company “stop bleeding”. It also plans to sell its non-coal related businesses to help pay off its debts, said Wang.

In Japan, desperate fool Shinzo Abe moves on to Abenomics 2.0 with three entirely fresh but as yet unnamed new “arrows”. Here’s thinking Japan doesn’t need Abenomics 2.0, it needs Abe 2.0. Or tomorrow will be even worse than today.

Japan’s Abe Airs Abenomics 2.0 Plan For $5 Trillion Economy

Japan’s prime minister Shinzo Abe, fresh from a bruising battle over unpopular military legislation, announced Thursday an updated plan for reviving the world’s third-largest economy, setting a GDP target of 600 trillion yen ($5 trillion). Abe took office in late 2012 promising to end deflation and rev up growth through strong public spending, lavish monetary easing and sweeping reforms to help make the economy more productive and competitive.

So far, those “three arrows” of his “Abenomics” plan have fallen short of their targets though share prices and corporate profits have soared. “Tomorrow will definitely be better than today!” Abe declared in a news conference on national television. “From today Abenomics is entering a new stage. Japan will become a society in which all can participate actively.”

Participate actively in the downfall of both Abe and the nation, that is.

As for you yourself, unless you stop clinging to the silly notion of an economic recovery -let alone perpetual growth-, you too are a greater fool, the quintessential one. And until you do, you’re a bigger liar too. You lie to yourself. Just so others can lie to you too.

What is happening in today’s world is a total downfall, both economic and moral, and the two are closely intertwined. What’s more, though we’re blind to it, as Anaïs Nin said, “Societies in decline have no use for visionaries.” Our societies therefore end up with liars only. Nobody else gets a shot at the title. There’s no use for anything but lies.

All leaders, as we can see these days wherever we look, talk the talk but don’t walk the walk. Every single one of them schemes and lies and hides their acts from public scrutiny. Political leaders, corporate leaders, the lot. This behavior is so ubiquitous we’ve come to see it as inevitable, even normal.

Whether it’s the economy, climate, the planet, warfare, your future obligations, your pensions, the future of your children, nobody in power tells you the truth. Human life is fast losing the value we would like to tell ourselves we assign to it. We don’t, do we? Children drown in the Mediterranean every day, and we let them drown, it’s not just our leaders who do.

Children also get shot to bits in various theaters of war (or rather, invasion) in faraway countries that our leaders involve us in, our tax dollars pay for, and our media don’t show. What the European refugee crisis shows us is that there are no faraway countries anymore, or theaters of war. Our own technological advances have taken care of that. They’re on our doorstep. And sending in the military is only going to make it worse.

Our technological advances haven’t come with moral advances, quite the contrary, our morals turn out to be a thin layer of mere cheap veneer. What advances we’re making are the last death rattle of a society in decline, and a dying civilization. All we have left to look forward to from here on in is cats in a sack. And we owe that to ourselves.

- GaZiNG INTo THe ABYSS…

- What Recovery? 9.4 Million More Americans Below Poverty Line Than Pre-Crisis

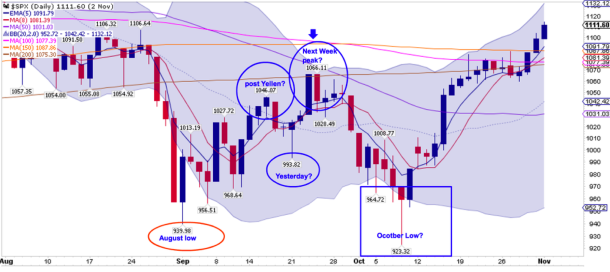

According to Janet Yellen, we are still on pace to raise rates in 2015. While the rate hike was supposed to happen this month, it got derailed by the August market selloff, volatility in China, lackluster work force numbers, and a variety of other factors.

Despite the Fed continuing to kick this down the road, they continue to claim that we are in the middle of an ongoing recovery. There’s just one problem with that: things are getting worse than pre-crisis levels for millions of the poorest Americans.

It’s true that the wealthiest 10% of Americans have finally seen their household incomes rise above the levels last seen in 2007. It’s also true that median incomes have “recovered” from the worst of the 2008 disaster. Median earners were -8.1% worse off in 2011, and now they are only -6.5% worse off according to most recent data for 2014 released by the U.S. Census Bureau last week.

However, when we look at the lowest 10% of income earners, the situation is much more precarious. In 2011, the bottom 10% of households were -9.0% worse off in terms of income than they were pre-crisis. Since then, it hasn’t gotten any better: they now are making -11.6% less income than they were in 2007.

Possibly even more concerning is the fact that the amount of Americans living below the poverty line has soared since 2007. There are now 9.4 million more people that can claim to be a part of this unfortunate group, and the total contingent living below the poverty line now makes up 14.8% of all Americans. This is also an increase from the 12.5% figure from before the Great Recession.

What’s the difference between 2007 and today? One stark contrast is the fact that the Fed’s balance sheet has exploded by adding $3.5 trillion of phony money to its balance sheet (that’s about the size of Germany’s economy) with its Quantitative Easing (QE) program. As part of the same experiment, it kept rates artificially low at near 0% for a record amount of time to encourage both lending and economic growth.

However, it is seven years later, and we are starting to see the fruits of this experiment especially in terms of wealth inequality. Studies and economists are starting to sound off, noting that QE and ZIRP have been a failure for America’s poorest. We explained the basics in a previous chart, but here’s some other articles worth reading from Forbes, WSJ, andSCMP that help show the effect of these policies.

By the way, the St. Louis Fed has essentially admitted QE was a mistake, while the Philadelphia Fed also admitted that these policies likely helped cause income inequality. Even fragilista economist Joseph Stiglitz has said this summer thatZIRP has helped increase income inequality.

- Western Propaganda Machine Kicks Into Overdrive As UK Brands Assad "A Butcher", France Bombs Syria In "Self Defense"

On Sunday, France proudly announced that it had launched its first strikes against ISIS targets in Syria. Here’s The New York Times:

In France’s first airstrikes against Islamic State militants in Syria, warplanes destroyed a training camp, President François Hollande announced on Sunday.

At a news conference in New York, where he had arrived for the United Nations General Assembly, Mr. Hollande said that the warplanes had attacked the training camp in eastern Syria after it had been identified by French air surveillance with help from the coalition of Western and Middle Eastern states conducting the air campaign against the Islamic State, also known as ISIS, ISIL or Daesh.

“Our forces reached their objectives: the camp was completely destroyed,” Mr. Hollande said. “Six jets were used, including five Rafales, and they were able to ensure that our operation did not have

He added that France might launch other strikes in the coming weeks if necessary, with the goal of “identifying targets that are training camps or places where we know that the Daesh terrorist group can threaten the security of our country.”

Prime Minister Manuel Valls also confirmed to reporters in southeastern France on Sunday that the airstrikes had taken place.

“We are striking Daesh in Syria because this terrorist organization prepares and organizes attacks in France from Syria, from these sanctuaries,” Mr. Valls said. “We are therefore acting in self-defense, which Article 51 of the United Nations Charter permits us to do.”

Got that? Paris needs to bomb Syria in “self defense” because clearly, a ragtag group of militants who only exist because they’re still a useful tool in Washington’s geopolitical calculus, pose a very real threat to the territorial integrity of France, one of the most influential nations on the face of the earth.

Obviously, that is absurd to the point that it’s almost not worth mentioning were it not for the fact that France’s involvement comes as Britain is also set to step up its own “anti-ISIS” air raids in Syria.

In short, both France and Britain are ramping up their involvement in Syria’s civil war just as Russia, Iran, and China are set to bolster the Assad regime. As we’ve detailed exhaustively, the West is now finding it almost impossible to maintain the narrative. Russia and Iran both have an interest in ensuring that Assad does not fall which means that by default, they also have an interest in eradicating the Sunni extremists operating in Syria. That’s extremely inconvenient for Washington and its allies given that the US has gone out of its way to portray ISIS as the greatest threat to human decency since the Third Reich. Now, Moscow, Tehran, and Damascus have effectively said the following: “Yes, you’re right, so why won’t you join us in defeating them?”

So far, the West’s response has been to suggest that somehow, Russia’s efforts to defeat anti-regime forces in Syria will serve to embolden terrorists. For instance, here’s what British think tank Royal United Services Institute has to say:

The deployment of Russian troops in Syria could end up helping Islamic State as they have been sent to areas where they are most likely to fight other groups opposed to Isis, according to a new report.

Essentially, the contention there is that Russia should not attempt to eradicate one group of extremists because in doing so, they might inadvertenlty help other extremists. If you applied that logic to sports, it would be the equivalent of saying no one should ever try to win, because by defeating one opposing team, you might indirectly improve the position of another opposing team.

As ridiculous as that is, the one thing you can say about the West and foreign policy is that things can always get more ridiculous and with that in mind, we bring you the following from U.K. Prime Minister David Cameron (via Bloomberg):

Bashar al-Assad should face a criminal trial, U.K. Prime Minister David Cameron said, while keeping open the possibility the Syrian president could temporarily remain in power to oversee a transition to a more inclusive government.

Cameron made the comments on Sunday as he flew to New York for the United Nations General Assembly, where he’ll meet with other leaders to discuss possible solutions to the 4 1/2-year conflict that has seen Islamic State take control of parts of the Middle Eastern country and led to an exodus of millions of refugees.

“People who break international law should be subject to international law,” the prime minister told reporters traveling with him. “He’s butchered his own people, he’s helped create this conflict and this migration crisis, he’s one of the great recruiting sergeants for ISIL.”

As we’ve said on a number of occasions, no one is arguing that Bashar al-Assad is the most benevolent leader in the history of statecraft, but when Western propaganda reaches the point where Syria’s President is accused of being a “butcher” and, going still further, of facilitating the recruitment of the very people who are trying to oust him, the world should start asking questions.

At this point, if you’re buying the Western narrative with regard to Syria, we suggest you refer to the clip shown below…

- Chinese GDP Propaganda Full Frontal: Plunge In Key Data Points Pitched As Bullish

The fact that China habitually overstates its GDP growth is probably the worst kept secret in the world next to Russia’s support for the Ukrainian separatists at Donetsk.

In short, the idea that China’s economy is growing at a 7% clip is so laughable that at this juncture, even the very “serious” people are openly challenging it. To be sure, it’s not entirely clear what part of the fabricated numbers represent willful deception and what part simply derive from an inability to accurately assess the situation. For instance, the deflator tracks producer prices more closely than it probably should, meaning GDP is overstated in times of plunging commodity prices but that might well stem more from a lack of robust statistical systems than it does from a desire to mislead the market.

In any event, getting an accurate read on Chinese economic growth has become something of a contest. It’s almost as if the market thinks that one day, the truth will come out and everyone wants to be able to say “my estimate was the closest.” What’s particularly interesting about the whole thing is that a quick look at the variables that Premier Li Keqiang himself has said are a better proxy for economic growth in the country (electricity usage, rail freight volume, and credit growth) suggest GDP growth in China may actually be running below 4%. SocGen’s Albert Edwards and any number of other analysts have noted this as well.

Of course Beijing has never seen a problem that a good dose of propaganda can’t fix which presumably explains the following bit from the Global Times (a paper owned by the ruling Communist Party’s official newspaper, the People’s Daily) which attempts to portray the weakness in electricity usage and freight volumes as a positive in light of the country’s transition towards an economic model driven by consumption and services:

China’s industrial restructuring has helped cut electricity consumption and freight transportation, while the economy has maintained a medium-to-high growth rate in the first six months, said Zhang Xiaoqiang, executive deputy director of China Center for International Economic Exchanges.

Zhang admitted that there were some doubts about China’s economic growth rate in the first half (H1), as two key indicators of economic growth, namely power consumption and freight volume, dropped remarkably.

China’s GDP expanded 7 percent in the first six months this year from the same period last year, slightly down from 7.4 percent in 2014.

Power consumption, however, only expanded 1.3 percent in the first six months, sharply lower than 5.3 percent posted last year. Freight volume expanded 4.2 percent, down from 7.5 percent last year.

The industrial sector grew at a slower pace in H1, while the service sector has become a major engine for the economic growth, said Zhang, adding that the industrial sector consumes more energy per unit of GDP than the service sector.

In freight transportation, China’s coal, steel and cement industries have been subject to restructuring and, thus, their output has dropped, leading to slowdown in growth, he said.

The discrepancy between economic growth and the two key indicators’ growth in the first six months did not fit with previous patterns, but industrial restructuring is a new factor, and should be taken into account when analyzing the new situation, he said.

Consider that, along with the following chart, and draw your own conclusions…

- The New World Financial Disorder

Submitted by Doug Noland via Credit Bubble Bulletin,

The Federal Reserve is flailing and global currency markets are in disarray. Notably, the Brazilian real dropped more than 10% in five sessions, before Thursday’s sharp recovery reversed much of the week’s loss. This week the Colombian peso dropped 3.0%, and the Chilean peso fell 3.1%. The Mexican peso dropped 1.9%. The Malaysian ringgit sank 4.5% for the week, with the South Korean won down 2.7% and the Indonesia rupiah losing 2.2%. The Singapore dollar fell 1.8%. The South African rand sank 4.4% and the Turkish lira fell 1.4%. Notably, market dislocation was not limited to EM. The Norwegian krone was hit for 4.4%, and the Swedish krona lost 2.0%. The British pound declined 2.3%. The Australian dollar also lost 2.3%.

Apparently alarmed by the market’s poor reaction to last week’s no hike decision, the Ultra-Dovish Fed this week attempted to slip on a little hawk attire. It’s looking really awkward. On Thursday evening, chair Yellen did her best to backtrack from last week’s FOMC statement with its focus on global issues. The markets are doing their best not to panic.

Securities markets have over the years grown too accustomed to knowing almost precisely what the Fed’s (and global central bankers) next move would be and what indicators were driving the decision-making (and timing) process. Transparency and clarity are hallmarks of New Age central banking. But chairman Bernanke back in 2013 significantly muddied the waters with his comments that the Fed was ready to push back against a “tightening of financial conditions.” Markets celebrated short-term ramifications: the Fed was overtly signaling it would react to “risk off” speculative dynamics.

And for more than two years, global market Bubble vulnerabilities ensured the Fed stayed firmly planted at zero. Meanwhile, the U.S. unemployment rate dropped to 5.1%. Stock prices shot to record highs, with conspicuous signs of speculative excess (biotech and tech!) The U.S. recovery soldiered on, Bubble excesses and imbalances on clear display.

At least to the adults on the FOMC, crisis-period zero rates some time ago became inappropriate. So it’s time to at least attempt a semblance of responsible central banking. There is, however, no thought of really tightening policy. Just a baby-step – or perhaps two – so history won’t look back and say the Fed sat back, watched the Bubble inflate and did absolutely nothing. The problem today is that even 25 bps will upset the fragile apple cart.

The global Bubble is bursting – hence financial conditions are tightening. Bubbles never provide a convenient time to tighten monetary policy. Best practices would require central bankers to tighten early before Bubble Dynamics take firm hold. Central bankers instead nurture and accommodate Bubble excess. It ensures a policy dead end.

As the unfolding EM crisis gathered further momentum this week, the transmission mechanism to the U.S. has begun to clearly show itself. While “full retreat” may be a little too strong at this point, the global leveraged speculating community is backpedaling. Biotech stocks suffered double-digit losses this week, as a significant Bubble deflates in earnest. It’s also worth noting that the broader market underperformed. The speculator Crowd hiding out in the small caps on the thesis that these companies were largely immune to global maladies must be feeling uncomfortable. The small cap universe is a dangerous place in the midst of de-leveraging/de-risking.

There was a new Z.1 “flow of funds” report released from the Fed last week. The “flow of funds” always turns fascinating at inflection points.

…

Ultra-loose financial conditions spurred resurgent system debt growth. Federal borrowings dominated Credit creation from 2008 through 2012, in the process bolstering household incomes, spending and corporate profits. Of late, corporate debt growth – notably to finance stock buybacks and M&A – has been instrumental in sustaining system reflation. It's central to my analysis that the corporate debt market is increasingly vulnerable to the faltering global Bubble.

“Flow of funds” analysis will now take special interest in the Rest of World (ROW) sector. ROW holdings of U.S. Financial Assets ended Q2 at a record $23.402 TN. For perspective, ROW holdings began the 1990s at $1.74 TN before ending the decade at $5.62 TN. ROW holdings surpassed $10.0 TN for the first time in 2005, before concluding 2007 at $14.56 TN. Since ending 2008 at $13.70 TN, massive post-Bubble U.S. fiscal and monetary inflation (inundating the world with dollar balances) has seen ROW U.S. Financial Asset holdings surge 71%.

Not surprisingly (from the perspective of a faltering global Bubble), Q2 ROW activity was notable. Rest of World holdings of U.S. Financial Assets increased SAAR $1.145 TN. Curiously, ROW Securities Repo holdings contracted SAAR $245 billion, Net Inter-Bank Assets contracted SAAR $115 billion, and Time & Checkable Deposits contracted SAAR $92 billion. Meanwhile, during the quarter holdings of Treasuries surged SAAR $565 billion, Agency Securities increased SAAR $128 billion and holdings of Corporate bonds jumped an eye-catching SAAR $705 billion. It's worth noting that ROW holdings of Corporate debt increased an unprecedented $266 billion over the past year. This data confirm highly unstable global financial flows.

Current dynamics in the corporate debt market recall the pivotal 2007 to 2008 inflection point period in the mortgage finance Bubble. Recall how the initial crack in subprime (spring 2007) actually spurred a loosening of conditions in prime (GSE) mortgage Credit and the corporate debt market. This worked to extend “Terminal Phase” excesses and vulnerabilities that would come home to roost later in 2008.

I do not know the sources of extraordinary Rest of World demand for U.S. corporate bonds and other securities. I suspect there is a speculative component – “carry trades,” and other “hot money” flows seeking refuge in the perceived safety of U.S. securities markets. I would also posit that, similar to late-2008 dynamics, there is now potential for an abrupt reversal of speculative flows as the faltering Bubble takes increasing aim at The Core.

Looking back to Q4 2007, even in the midst of a faltering Bubble, Non-Financial Debt (NFD) growth remained at an elevated SAAR $2.50 TN pace. Importantly, system Credit expansion (and fragilities) was being dominated by late-cycle excesses throughout mortgage and corporate finance. And by Q2 2008, NFD had sunk to SAAR $1.13 TN. Mortgage borrowings had collapsed and Corporate borrowings had fallen by more than half.

The U.S. corporate debt market is increasingly impinged by the forces of a faltering global Bubble and a resulting “risk off” speculative dynamic. Financial conditions have tightened meaningfully in the energy and commodities sectors. More generally, the market is now looking at leveraged balance sheets with rising trepidation. And as financial conditions tighten more generally and equities succumb to harsh new realities, I would expect corporate Treasurers to approach borrowing for stock buybacks with newfound caution. Heightened global economic and market risk should also prick the M&A Bubble. Heightened risk aversion, slowing stock buybacks and less M&A combine for a much less hospitable backdrop for equities. Faltering equities will further weigh on fragile sentiment in corporate debt markets. And faltering markets will hit Household wealth and spending.

Anticipating Fed policy moves has become tricky business. A faltering global Bubble will surely at some point pressure the Fed into additional QE. After all, who will be on the other side of a major cycle of speculative deleveraging? By default, it will be our and global central banks. Meanwhile, the Fed currently believes the market prefers a Fed rate increase. I suspect this preference will prove transitory.

Markets have been fearing a disorderly unwind of global leveraged “carry trades.” In particular, bouts of dollar weakness were pressuring short positions in the yen and euro (used to finance speculative bets in higher-yielding currencies). The Ultra-Dovish Fed statement pressured the dollar along with de-risking/deleveraging. And while Fed backtracking this past week did bolster the dollar, it came at the expense of increasingly disorderly EM and currency markets more generally.

I actually believe the faltering global Bubble has progressed beyond the point where Fed rate policy has much impact. Yet the Fed is determined to “push back against a tightening of financial conditions.” But are so-called “financial conditions” being tightened by happenings in China? Or is the culprit pressure on yen and euro short positions? Could it be because of a panicked “hot money” exit from EM – exposing Trillions of problematic dollar-denominated debt? How about an unwind of “risk parity” and other leveraged strategies that will not perform well in the New World Disorder of liquidity-challenged and unstable currency and financial markets? What about the possibility that the global leveraged speculating community is in increasing disarray? How about fears of potential counter-party issues in the convoluted world of derivatives trading? Could it be because of mounting fears of a crisis of confidence in Chinese and EM banking systems? Analysts and the media always like to pick a culprit du jour.

Perhaps chair Yellen and the FOMC is beginning to appreciate that it is not in control of the markets – and is certainly not in control of the faltering global Bubble. And Chinese officials are not in control – nor the BOJ nor ECB. EM central bankers, facing a currency crisis, have certainly lost control. And with European and U.S. equities Bubbles succumbing, the unfolding global crisis has penetrated The Core. Things turn even more serious when contagion begins impinging liquidity in the U.S. corporate debt market.

- "Nothing's Safe" Passport's Burbank Warns "The Liquidity Of Everything Is Being Taken Down"

Having warned that "we are on the precipice of a liquidation in emerging markets like the fourth quarter of 1997," Passport Capital's John Burbank sits down with RealVisionTV to discuss why "the Fed would eventually be forced into a fourth round of quantitative easing to shore up the economy." Being among 2015's best performing hedge funds, successfully navigating this turmoiling unwind of the Fed's efforts to "mean-revert" the world's assets back to normal, Burbank concludes, "nothing's safe," no matter what The Fed does, "the liquidity of everything is being taken down."

"The market is now going to discover just how much liquidity [or lack of it] is actually in the market."

"QE in Europe is not the same as QE in The US"

"There's just not enough dollars out there… everything will be liquidated"

Click image below for link to brief RealVisionTV interview:

"What we learned after the financial crisis was that The Fed is able to reflate assets in The US and The World… for a time.

What The Fed learned was that their models don't work – they didn't have the GDP/Economic effect – and to interpret what they are doing,

I think they realize the more they do this, the more they can't get out of it, and the more they pervert markets… and I believe they want to get out of it."

* * *

- 71-Year-Old Arrested For Widespread "Hitlerization" Of Shinzo Abe Posters

Having achieved his militarist goals, amid massive protests and plunging popularity, it appears Shinzo Abe is rapidly taking gaining on Vladimir Putin's spot atop the tyrannical-dicators-of-the-world-meme. By pushing through this change to Japan’s pacifist constitution, Japan’s nationalists have gotten their foot in the door, so to speak; and as Pater Tenebrarum notes, once a long-held principle is abandoned, further steps to alter the legal framework are usually not long in coming, prompting, as TokyoReporter.com reports, a 71-year-old man to allegedly deface roughly 30 political posters – drawing a hitler-esque moustache on Abe posters.

As Acting-Man.com's Pater Tenebrarum explains, Abe Has reached His Militarist Goals

Japan’s House of Councilors Briefly Transforms into Rada Outpost

Pictures such as those below used to primarily reach us from Ukraine’s Rada, back before Poroshenko’s “lustration law” banned about four million Ukrainian citizens from the political process forever. In Ukraine, brawls regularly broke out between Western Ukrainian nationalists and representatives of Eastern Ukrainian ethnic Russians.

Last week we received similar imagery from the upper house of Japan’s Diet, a.k.a. the House of Councilors.

A brawl breaks out in the usually quite reserved upper house of Japan’s Diet

A few close-ups:

Alain Delonakawa dishes out an an uppercut

Take that you bastard! Lawmakers are piling on in scrum-fashion

So what has happened? Why are Japan’s notoriously consensus-prone and bushido-inhibited lawmakers suddenly trading fisticuffs and one presumes, matching verbal insults?

Dulce et Decorum est pro Patria Mori?

As our long-time readers know, we have posted a portrait of Japan’s nationalist-socialist prime minister Shinzo Abe a while back, entitled “Shinzo Abe’s True Agenda”. In brief: “fixing” Japan’s economy with even more inflation and deficit spending is only a side-show for Abe. He is convinced that he has a quasi-divine mission to bring Japan back to its glorious militaristic past. In this, he appears to be influenced by the philosophy of his grandfather Nobusuke Kichi, who actually served as a minister in Japan’s war cabinet during WW2 and became prime minister in the late 1950s.

Nationalist Shinzo Abe has succeeded in altering Japan’s pacifist constitution to allow its armed forces to take part in overseas missions

Photo credit: Koji Sasahara / AP

As a first step in this process, Abe has pursued a change of Japan’s pacifist post WW2 constitution, so as to allow Japan’s military forces to operate abroad again (as opposed to fulfilling a purely defensive function). In other words, similar to numerous European US vassals, he wants Japan also to take part when the Empire decides to bomb some defenseless little country usually inhabited by brown-skinned people back into the stone age.

Not surprisingly, emotions have been flaring in Japan as a result. Especially the older generation that still has lots of painful memories of the war is strongly opposed to abandoning Japan’s post WW2 pacifism – regardless of the “reasoning” forwarded as to why it should be ditched. They don’t seem to agree that dying for the fatherland is sweet and honorable when it involves venturing abroad instead of just defending one’s home.

Demonstrators in Tokyo in a vain attempt to stop Abe’s plans. It is noteworthy that as a rule, a great many senior citizens have taken part in these demonstrations. Usually the elderly are not known for thronging the streets to make political demands.

If only Abe showed similar enthusiasm in delivering his “third arrow” of economic reform. What he has delivered in terms of economic policy so far – a repeat of the same hoary Keynesian recipe, only on an even grander scale – actually fits well with his militaristic agenda. Militarism is an inherently statist endeavor. It is always connected with government grabbing more power for itself and expanding its role in all walks of life. As an aside to this, we never cease to be astonished that allegedly small government and free market supporting conservatives seem utterly blind to this fact.

As the Telegraph reports, most Japanese citizens vehemently oppose the initiative, but representatives of the Empire are declaring themselves satisfied, emitting Orwellian language in the process (“war is peace”):

Japan made a controversial change to its constitution on Friday night, loosening restrictions on its armed forces that have applied since the Second World War. The reform will allow Japan to use force to defend a foreign ally, not simply its own territory. As such, Japan’s formidable armed services will weigh more heavily in the Pacific balance of power.

[…]

America supports Mr Abe’s reform, which will help to tip the regional balance of military power against China. Philip Hammond, the Foreign Secretary, welcomed the passage of the law, saying: “We look forward to Japan taking an increasingly active part in peacekeeping operations and supporting international efforts to secure peace and prosperity.”

However, opinion polls suggest that most Japanese oppose the change. Shortly before the law was approved, Akira Gunji, from the opposition Democratic party, said: “We should not allow such a dangerous government to continue like this.”

(emphasis added)

Who cares about what the citizens want? It is yet another demonstration that modern-day democracies are in many ways really a kind of updated feudalism. If the power elites want something, it matters not one whit what the electorate wants.

But protests continue… even among the 71 year olds… (as TokyoReporter.com reports)

Tokyo Metropolitan Police on Friday announced the arrest of a 71-year-old man after he allegedly defaced political posters featuring Prime Minister Shinzo Abe, reports Fuji News Network (Sep. 25).

On September 18, Takeshi Muto is alleged to have used an oil-based pen to draw a narrow moustache, very similar to that made famous by Adolf Hitler, on an image of Abe appearing on a poster hanging on a fence inside a parking lot in the Kanamorihigashi area of Machida City.

Muto, who has been charged with destruction of property, admits to the allegations. “In considering the current government, it was unavoidable,” the suspect is quoted by police.

According to police, Muto is believed to have been behind roughly 30 other similar incidents since July. In some cases, the posters were cut with a knife.

The posters are in support of the Liberal Democratic Party, for which Abe serves as president. “You play a leading role in the growth of the nation,” the poster’s slogan reads.

* * *

By pushing through this change to Japan’s pacifist constitution, Japan’s nationalists have gotten their foot in the door, so to speak. Once a long-held principle is abandoned, further steps to alter the legal framework are usually not long in coming. There are many historical examples for this. Just think about the US income tax, introduced in 1912 at a “barely noticeable” single digit rate, which required the adoption of the 16th amendment to the constitution. We have little doubt that Abe and his friends would love to introduce even more radical changes and plan to employ Salami tactics to this end going forward.

We certainly don’t believe that the decision has made the world any “safer”. It has simply made war more likely. Just consider e.g. the pointless disputes between Japan and China over a few small rocks (we’re not sure if they really deserve to be called islands) in the South China Sea, which could easily become a future flashpoint leading to a military confrontation.

What was wrong with Japan’s formidable military having no other purpose than the defense of Japan?

- Wholesale Money Markets Are Broken: Ignore "Perverted" Swap Spreads At Your Own Peril

At the height of the financial crisis, the unprecedented decline in swap rates below Treasury yields was seen as an anomaly. The phenomenon is now widespread, as Bloomberg notes, what Fabozzi's bible of swap-pricing calls a "perversion" is now the rule all the way from 30Y to 2Y maturities. As one analyst notes, historical interpretations of this have been destroyed and if the flip to negative spreads persists, it would signal that its roots are in a combination of regulators’ efforts to head off another financial crisis, China selling pressure (and its impact on repo markets) and "broken" wholesale money-markets.

US Swap Spreads have collapsed rapidly in recent weeks across the entire curve…

There appears to be 5 main reasons being cited for this "perversion"… (as Bloomberg explains)

1. Central Bank un-cooperation…

“There is a rebalancing of holdings by central banks and there is still a massive supply of Treasuries that has no end in sight,” said Ralph Axel, an analyst in New York at Bank of America Corp. “We see recent signs that China is selling and overall all central banks, including the Fed, are no longer the big supporters of Treasuries as they had been in recent years. This is narrowing spreads as it cheapens Treasuries.”

Some strategists are pegging the narrowing of the two-year swap spread in recent weeks to selling of Treasuries by China as that nation’s central bank moves to stabilize its currency following the surprise yuan devaluation in August.

As speculation has swirled that China is selling shorter-maturity Treasuries while other investors dumped the securities before this month’s Federal Reserve meeting, dealer holdings of U.S. government debt climbed.

That drives repo rates higher because dealers need more cash to finance those positions.

2. Unintended Consequences from Regulatory Actions (fixing the last crisis)…

Regulatory moves such as higher capital requirements have led banks to curtail market-making, crimping liquidity and driving repurchase agreement rates above bank funding benchmarks. Repo rates factor into Treasuries pricing because they’re considered the cost of financing positions in government debt.

3. Companies are piling into the debt market to lock in low borrowing costs. They frequently swap the issuance from fixed to floating payments, which causes swap spreads to tighten.

4. Wrong-footed bets have also exacerbated the slide in spreads.

“Most people on the hedge-fund side had been long swaps spreads,” said David Keeble, New York-based head of fixed-income strategy at Credit Agricole SA.

“But the rising repo rates and heavy corporate issuance really convinced a lot of people to capitulate and kill off the long-swap spread trades.”

and Finally 5. Wholesale Funding markets are broken… (as Alhambra's Jeffrey Snyder explains)…

First, some relevant history. The interest rate swap rate is quoted as the counterparty paying fixed to receive some floating (usually tied to LIBOR, which is why eurodollar futures are entangled). Since there is credit risk involved in counterparties, it had always been assumed that the swap rate would have to trade above the relevant UST rate since the US government is assumed to be without it. That all changed during panic in 2008:

October 23, 2008, was an unusual day in credit markets even within a vast sea of unusual days. Credit and “exotics” desks at banks were left scrambling to figure out how it was possible that the 30-year swap rate could trade less than the 30-year treasury. It was thought one of those immutable laws of finance that no such might occur, to the point there were stories (apocryphal or not, the tale is about the scale of disbelief) that some trading machines were never programmed to accept a negative swap spread input. The surface tension about such things was decoded under the typical generalities that stand for analysis; if the 30-year swap spread was negative that might suggest the “market” thinking about a bankrupt US government.

A negative swap spread on its surface seems to indicate that the “market” views counterparty risk as less than risk of investing in the same maturity UST. That was never the case, however, as bank balance sheet capacity was simply collapsing leading to all sorts of irregularities; thus the problem of mainstream interpretations that stay close to the surface rather than recognize the wholesale origin (chaos and disorder) beneath. On the basis a comprehensive view of the 30-year swap spread, the sea of illiquidity is brightly and fully illuminated as once more “dollar waves” crashing the global financial system – the second much more devastating than the first.

Worse, as you can see plainly above, there was a third “dollar” wave that started in early to mid-January 2009 well after TARP, ZIRP and even QE1 (once more dispelling any heroics on the part of economists at the Fed who still had no idea what to do), accounting for the final crash to the March lows.

So you can begin to fill out the broad picture as October 2008 wore on, even though the worst of the broader market panic seemed to have been left behind. The demand for fixed side hedging was only increasing as the money dealers were both withdrawing and being unwritten in their assumed steadiness (not just ratings downgrades but very visible capital deficiencies and worse in terms of extrapolations at that moment). It was in every sense a rerun of the credit default swap reversal that had nearly brought it all down in March 2008 and then again with Lehman, Wachovia and, of course, AIG that September. In short, the “buy side” was in desperation for more hedging lest their portfolios and leverage employments tend too far uncovered while the dealers were in no position to supply it; desperate demand and no supply means prices adjust quite severely, which in this case pushed the swap rate, the quoted fixed part, below the UST rate for the first time ever (not that the swap rate history was all that long by then).

One main point of emphasis for that column was that every time this occurred thereafter there was a mainstream attempt to dismiss it while simply assuming some benign explanation dutifully quoting the usual “fixed income trader.” When swap spreads turned negative again in early 2010, for example, media stories of corporate fixed income volume filled the space to assure that all was still quite well; obviously it wasn’t given what happened not long after. Loyally replaying that very same tendency, earlier this year we received the same bland message, “ignore the turn in swaps because it’s just fixed income being more normal.”

Any actual catalog of swap spreads, especially since the “dollar” began “rising”, shows that to be utterly false. There is nothing at all benign about negative spreads, especially now, after August 24, where they are still sinking in every maturity.

It isn’t just the 30s, again, as this sinking has infected even the benchmark 10s and further up into the short end maturities (while the spread of spreads, 10s minus 5s, continues to expand).

In what might be the most conclusive indication of illiquidity in the entire spectrum of them, and the most troubling, the compression in swap spreads could not be more clear in terms of interpretation at the 2s:

Either corporate issuers suddenly decided that the week after August 19 was the perfect time to issue at maximum (because companies always float more debt during global liquidations?), or dealer capacity was so strained that it broke open all the way down to the 2-year maturity in swaps. And the truly disturbing part, again, where all the very dark interpretations lie, is what has occurred thereafter, namely that spreads are still decompressing everywhere more than a month afterward. Either companies are going nuts at worse spreads and prices (think leveraged loan prices and even AAA-spreads) or dealer-driven liquidity is seriously and durably impaired.

In that view, the eurodollar curve is confirmed as are junk bubble prices and even stocks that can’t seem to gain any footing in the aftermath (though, we are told repeatedly, they “should” have). You can only claim this is “normalizing” behavior if you accept that “normal” is the eurodollar decay and that illiquidity is the actual base condition; which it is proving to be as QE fantasy is the aberration.

Heading toward the quarter end, this should be quite concerning rather than, like LIBOR, ignored or rationalized yet again as if it were welcome and expected.

* * *

As Jeffrey concludes, ignore swap spreads at your own peril.

- Did The PBOC Covertly Buy 1,747 Tonnes Of Gold In London?

Submitted by Koos Jansen via BullionStar.com,

The London Float And PBOC Gold Purchases

This BullionStar blogpost is part of a chronological storyline. Please make sure you’ve read The Mechanics Of The Chinese Domestic Gold Market, PBOC Gold Purchases: Separating Facts from Speculation and The London Bullion Market And International Gold Trade, or it will be difficult to understand the finesses.

This week I listened to an interview with a Swiss refiner which promptly reminded me of an interview I conducted with Alex Stanczyk (currently Managing Director of Physical Gold Fund SP) on 9 September 2013 about what he was hearing from industry insiders on Chinese gold demand. Back then we knew very little about the Chinese gold market and how physical gold across the globe was flowing towards China. This started to change on 18 September 2013 when I published my first analysis on the structure of the Chinese gold market with the Shanghai Gold Exchange (SGE) at its core; a topic that since then has been discussed by researchers at investment banks, in the blogosphere and in the mainstream media. The Western gold space has learned a great deal about the Chinese gold market and global gold flows, though we’re always left with loose ends. For example, the issue regarding PBOC gold purchases; how much gold do they truly have and where was it bought? Does the PBOC buy 400-ounce Good Delivery (GD) bars in London and covertly transports these gold bars to its gold vaults in China mainland, or are the Good Delivery gold bars shipped to Switzerland, refined into 1 Kg 9999 gold bars, sent forward to the Chinese mainland where they’re required to be sold through the SGE gold exchange and from where they can be bought (in clear sight) by the PBOC. The latter would imply that the full gold flow would be visible for anyone with an Internet connection.

Yesterday I re-read my interview with Alex from September 2013 in which he shared information from industry insiders. From Alex (September 2013):

One of our partners had lunch in the recent past with the head of the largest global operations company in security transport. He said there is a lot of gold that they’re moving into China that’s not going through exchanges. If the gold is for the government they don’t have to declare where it’s going. They don’t have to declare where it’s going in, or where it’s heading. If you look at the way the Chinese do things, why would they tell?

With the knowledge we have now, this quote from 2013 is even more interesting, as it describes what has come together in the past years through several analysis. Consider the following:

- Good Delivery gold bars can be monetized – in countries like the UK, Hong Kong, Switzerland and Singapore – from where they can be shipped into China while circumventing global trade statistics. This is because monetary Good Delivery gold bars are exempt from global trade statistics (UN, IMTS 2010). Needless to say monetary imports into China are conducted by the PBOC.

- Non-monetary Good Delivery gold bars (declared at international customs departments) imported into the Chinese domestic gold market are required to be sold through the SGE. However, trading volume at the SGE in GD bars has been a mere 3 tonnes in all of history.

We can thus conclude that if any Good Delivery gold bars have entered China these did not go through the SGE system where Chinese citizens, banks and institutions buy gold. Instead, it’s likely that the Good Delivery gold bars that crossed the Chinese border went directly to the PBOC vaults.

More from Alex (September 2013):

…We talked to the head of the largest refinery in Switzerland and he told us directly that all that metal that’s coming out of London is being refined into kilo bars and sent to China, as well as metal that’s coming in from other areas in the world, that’s all going to China. It’s way more than is being reported or moved through the exchanges. All the kilo bars go to the Chinese people but the PBOC is likely only buying good delivery [GD].

There you have it. More clues the PBOC does not buy gold through the SGE (where only gold bars smaller than GD are traded). But there is more.

Although, it’s virtually impossible to track monetary gold flows, the least we can do is try. In recent weeks Ronan Manly, Bron Suchecki, Nick Laird and I conducted a small investigation with respect to how much monetary and non-monetary gold is left in the UK. Luckily for us, the London Bullion Market Association (LBMA) has published a few estimates in recent years about the total amount of physical gold in London (monetary and non-monetary). In 2011, it was 9,000 tonnes. In 2015, it had dropped to 6,256 tonnes – likely all in GD bars. These estimates from the LBMA combined with our investigation have resulted in the next charts (conceived by Nick Laird, Sharelynx):

For a better understanding of physical gold located in London you can read this post by Ronan, this post by Nick or have a look at the next diagram conceived by Jesse (Cafe Americain):

According to gold trade data from HMRC, the UK saw a net (non-monetary) gold outflow from 1 January 2011 to 30 June 2015 of 997 tonnes. Have a look at the chart below. The UK net exported 1,425 tonnes in 2013. In 2014 net export fell to 448 tonnes. Add to that the UK net imported 904 tonnes in 2012.

We don’t know exactly when in 2011 the LBMA measured there were 9,000 tonnes of gold in London, but it doesn’t really matter. In the chart above we can see that the most significant movements since 2011 have taken place in 2012 and 2013. If we measure the flow of gold from the UK between 2012 and 2014, the net outflow is 970 tonnes. So it’s not that important when in 2011 the 9,000 tonnes were counted by the LBMA. What is important is that since 2011 not more than 997 tonnes of non-monetary gold has left the UK, according to official trade statistics.

Nick Laird and I noticed that although the total amount of physical gold in London fell roughly 2,744 tonnes (9,000 – 6,256) over four years (graph 1), only 997 tonnes were net exported as non-monetary gold (graph 4). This makes me wonder where the residual 1,747 tonnes (2,744 – 997) went. Possibly, this gold has been monetized in the UK and covertly shipped to a central bank in Asia, for example China. I don’t have rock hard evidence, but it fits right into the wider analyses.

Furthermore, from 2006 to 2011, the UK was a net importer every year. If the 9,000 tonnes estimate by the LBMA was hopelessly outdated, say, it was from 2008, this would increase the “missing gold” even more (as net export over the years would have been smaller than 997 tonnes).

What stands out for now is, (i) the LBMA has stated there were 9,000 tonnes of physical gold in London in 2011 and (ii) gold trade provided by HMRC reflects all physical movement of non-monetary gold in and out of the UK. Both these handles have nothing to do with complicated rules on changes in ownership of gold in London (that I’m aware of). Therefor we must conclude 2,744 tonnes left the UK since 2011, but only 997 tonnes was seen leaving as non-monetary gold. Where did the residual 1,747 tonnes go?

This investigation is far from finished, next I will research historic UK gold tarde – as far back as possible. Hopefully we can find another piece of the puzzle.

- American "Capitalism"

- The Fed's Troubling Clarity Of Confusion

Over the past few years no institution has had more consequences beholden to their words than the Federal Reserve. So much so one could reasonably argue in response to prevailing circumstances their communiques overshadowed most others; including presidents and other leaders.

The problem today is; in their effort to bring more clarity via press-ers, and more as to what might be transpiring behind the doors at the Eccles building, they’ve now communicated more confusion in the last two weeks nullifying all previous efforts. As of now they’ve not only hindered, they’ve made their communiques outright suspect for the foreseeable future. Quite literally – at the exact worst of times.

When the Fed. held back and decided to postpone raising rates by a measly 25 basis points it shocked many. The underlying (as well as whispered) issue that still dominates the reasoning is: What does the Fed. know which they aren’t telling?

One could argue this was in direct response to China’s ongoing stock debacle. Yet, the issue here was: and this is the Fed’s concern? For China itself is still standing pat on the premise they were in control and were dealing with its gyrations directly. While concurrently their GDP growth (as implied by the politburo) is still on track to be more than double the GDP of the U.S. Which begged the question: So what’s the big deal with raising rates here since it’s been the most publicized and anticipated by an amount so small (25 basis points) many see it be more of a symbolic gesture rather than anything else, if things are supposedly doing better here?

The Fed’s insertion of the words “international developments” added confusion not clarity. So now, one has to wonder what data point is now relevant for a Fed. decision? i.e., U.S. unemployment data? Or, does Brazil’s free-fall and rising inflation combined with a Petrobas™ calamity now preempt or overrule? Can (or will) other “international developments” now overshadow a U.S. economy concern? The answer to these types of questions are now totally up in the air; for the Fed. made that perfectly clear with its latest decision. Remember; the reason given for inaction over action was “international developments.” Not U.S. developments.

One can’t help but contemplate: Will access to the bond markets or bank loans for say a troubled company in Peoria, Detroit, the Dakotas et al or even a State itself be equal or given more weight if a future decision if buttressed with a concerning factor as say Brazil might be for access to Dollar swaps from the Fed.? If both are being hindered at the same time which one tips the scale? U.S. interest or development? Or, does the “international development” side take the favor? It’s now an open question based purely on the empirical evidence. Not speculation.

Again: Does a company in the U.S. with global reach draw the same, less, or more concern as to access the capital markets than say another nation does that may be in need of access to Dollar swaps or other necessaries provided via the Fed.? What “international development” will now trump a domestic one? Do interest rates (whether higher, lower, or remaining fast) borne to U.S. entities take a back seat to “international developments?” Once again, with the latest “clarity” statements emanating from the Fed. – these are open questions. For they just proved by their own votes “international” concerns trumped domestic. i.e., U.S. savers and more took a back seat to share holders in China.

These questions at first sound vague or even preposterous. However, I must implore it’s by the Fed’s own actions and reasons why per their latest decision – they are anything but “unimaginable.”

Imagine you’re a company trying to deciding on whether you should now make any large capital expenditures based on Fed. policy for interest rates. With what you just witnessed over the last two weeks – do you have more clarity as to “pen a deal?” Absolutely not. If anything, you’re going to sit back and wait, (and quite possibly just buy back more shares) which is exactly the opposite of what the Fed. is trying to push forward. i.e., cap-ex spending. This problem, again, has been exacerbated by their own hands. For they just pushed most considerations not only back into the neutral position, but quite possible park with the emergency brake securely applied.

Many think the decision to not move forward at this last meeting was its own version of a “one and done.” In other words, just an obvious blunder not to move when clearly they should have and will be long forgotten in the coming weeks. However, I believe there was far more to this latest policy error than what was taken at first blush.

What transpired both during as well as right after Ms. Yellen’s FOMC presser was anything but a clarification of where the Fed. as a whole thinks, or believes is happening not only in the U.S. – but globally. And it was in this clarity for the observer, not the Fed., where the realization of troubling issues were on display for anyone caring to look with a concerning eye; rather than the usual sycophantic ear displayed by most of the financial media.

Here are a few things where I was left dumbfounded as to not be pursued or pressed with vigor by any of the financial media during that conference. For the implications are far from minuscule:

Why did “international” eclipse domestic concerns? If China is stating publicly they have things under control, why is the Fed. basing its decision to avoid “normalization” for domestic monetary policy? And if “international” was not a code word for China, then what other global development was the decision based on?

How is it during the weeks and months of this most telegraphed “intent” to raise where Fed. officials have been more vocal about the need, as well as the ability, to move off of the zero bound since the economy has improved via the Fed’s own talking points. Yet – did not? Were officials just talking up the economy? Or, are we in worse straights than we’re being told from official channels?

Is the Fed. underestimating the potential backlash for second guessing future decisions as this one inherently clouds certainty rather than clarifies? The exact opposite of what the Fed. has tried to dispel.

Last but not least: How is it for the first time in Fed. history a member openly stated (via the Dot Plot) the forethought or desire that Fed. interest rate policy would not only remain low but in fact cross the Rubicon into a negative rate policy when clearly the Fed. itself is signaling an improving economy? The two not only don’t fit, but the timing of such a declaration is counter-intuitive.

And that last one is the very question that has changed everything in ways I truly believe the Fed. itself (and most of the financial media) doesn’t understand. Which in and of itself – is another very troubling matter from my viewpoint.

During her presser Ms. Yellen gave what many take as the typical “Fed. speak” responses to questions such as (I’m paraphrasing) “Not something we seriously considered.” Or: “We would look at all available tools and evaluate it under ….” And so forth. However, the issue here is while everybody wants to think of it as a parting members final statement. No one can be sure if it wasn’t Ms. Yellen herself. Because, after all – they are made and publicized in anonymity. It could be any member.

Speculation has now become a clarifying qualifier. And that’s a very new, very troublesome epiphany I would imagine the Fed. has yet to fully comprehend.