- Paul Craig Roberts: Obama Deifies American Hegemony

Authored by Paul Craig Roberts,

Today is the 70th anniversary of the UN. It is not clear how much good the UN has done. Some UN Blue Hemet peacekeeping operations had limited success. But mainly Washington has used the UN for war, such as the Korean War and Washington’s Cold War against the Soviet Union. In our time Washington had UN tanks sent in against Bosnian Serbs during the period that Washington was dismantling Yugoslavia and Serbia and accusing Serbian leaders, who tried to defend the integrity of their country against Washington’s aggression, of “war crimes.”

The UN supported Washington’s sanctions against Iraq that resulted in the deaths of 500,000 Iraqi children. When asked about it, Clinton’s Secretary of State said, with typical American heartlessness, that the deaths of the children were worth it.

In 2006 the UN voted sanctions against Iran for exercising its right as a signatory of the non-proliferation treaty to develop atomic energy. Washington claimed without any evidence that Iran was building a nuclear weapon in violation of the non-proliferation treaty, and this lie was accepted by the UN. Washington’s false claim was repudiated by all 16 US intelligence agencies and by the International Atomic Energy Agency inspectors on the ground in Iran, but in the face of the factual evidence the US government and its presstitute media pressed the claim to the point that Russia had to intervene and take the matter out of Washington’s warmonger hands. Russia’s intervention to prevent US military attacks on Iran and Syria resulted in the demonization of Russia and its president, Vladimir Putin. “Facts?!, Washington don’t need no stinkin’ facts! We got power!” Today at the UN Obama asserted America’s over-riding power many times: the strongest military in the world, the strongest economy in the world.

The UN has done nothing to stop Washington’s invasions and bombings, illegal under international law, of seven countries or Obama’s overthrow by coup of democratic governments in Honduras and Ukraine, with more in the works.

The UN does provide a forum for countries and populations within countries that are suffering oppression to post complaints—except, of course, for the Palestinians, who, despite the boundaries shown on maps and centuries of habitation by Palestinians, are not even recognized by the UN as a state.

On this 70th anniversary of the UN, I have spent much of the day listening to the various speeches. The most truthful ones were delivered by the presidents of Russia and Iran. The presidents of Russia and Iran refused to accept the Washington-serving reality or Matrix that Obama sought to impose on the world with his speech. Both presidents forcefully challenged the false reality that the propagandistic Western media and its government masters seek to create in order to continue to exercise their hegemony over everyone else.

What about China? China’s president left the fireworks to Putin, but set the stage for Putin by rejecting US claims of hegemony: “The future of the world must be shaped by all countries.” China’s president spoke in veiled terms against Western neoliberal economics and declared that “China’s vote in the UN will always belong to the developing countries.”

In the masterly way of Chinese diplomacy, the President of China spoke in a non-threatening, non-provocative way. His criticisms of the West were indirect. He gave a short speech and was much applauded.

Obama followed second to the President of Brazil, who used her opportunity for PR for Brazil, at least for the most part. Obama gave us the traditional Washington spiel:

The US has worked to prevent a third world war, to promote democracy by overthrowing governments with violence, to respect the dignity and equal worth of all peoples except for the Russians in Ukraine and Muslims in Somalia, Libya, Iraq, Afghanistan, Syria, Yemen, and Pakistan.

Obama declared Washington’s purpose to “prevent bigger countries from imposing their will on smaller ones.” Imposing its will is what Washington has been doing throughout its history and especially under Obama’s regime.

All those refugees overrunning Europe? Washington has nothing to do with it. The refugees are the fault of Assad who drops bombs on people. When Assad drops bombs it oppresses people, but when Washington drops bombs it liberates them. Obama justified Washington’s violence as liberation from “dictators,” such as Assad in Syria, who garnered 80% of the vote in the last election, a vote of confidence that Obama never received and never will.

Obama said that it wasn’t Washington that violated Ukraine’s sovereignty with a coup that overthrew a democratically elected government. It was Russia, whose president invaded Ukraine and annexed Crimera and is trying to annex the other breakaway republics, Russian populations who object to the Russophobia of Washington’s puppet government in Ukraine.

Obama said with a straight face that sending 60 percent of the US fleet to bottle up China in the South China Sea was not an act of American aggression but the protection of the free flow of commerce. Obama implied that China was a threat to the free flow of commerce, but, of course, Washington’s real concern is that China is expanding its influence by expanding the free flow of commerce.

Obama denied that the US and Israel employ violence. This is what Russia and Syria do, asserted Obama with no evidence. Obama said that he had Libya attacked in order to “prevent a massacre,” but, of course, the NATO attack on Libya perpetrated a massacre, an ongoing one. But it was all Gaddafi’s fault. He was going to massacre his own people, so Washington did it for him.

Obama justified all of Washington’s violence against millions of peoples on the grounds that Washington is well-meaning and saving the world from dictators. Obama attempted to cover up Washington’s massive war crimes, crimes that have killed and displaced millions of peoples in seven countries, with feel good rhetoric about standing up to dictators.

Did the UN General Assembly buy it? Probably the only one present sufficiently stupid to buy it was the UK’s Cameron. The rest of Washington’s vassals went through the motion of supporting Obama’s propaganda, but there was no conviction in their voices.

Vladimir Putin would have none of it. He said that the UN works, if it works, by compromise and not by the imposition of one country’s will, but after the end of the Cold War “a single center of domination arose in the world”—the “exceptional” country. This country, Putin said, seeks its own course which is not one of compromise or attention to the interests of others.

In response to Obama’s speech that Russia and its ally Syria wear the black hats, Putin said in reference to Obama’s speech that “one should not manipulate words.”

Putin said that Washington repeats its mistakes by relying on violence which results in poverty and social destruction. He asked Obama: “Do you realize what you have done?”

Yes, Washington realizes it, but Washington will not admit it.

Putin said that “ambitious America accuses Russia of ambitions” while Washington’s ambitions run wild, and that the West cloaks its aggression as fighting terrorism while Washington finances and encourages terrorism.

The President of Iran said that terrorism was created by the US invasion of Afghanistan and Iraq and by US support for the Zionist destruction of Palestine.

Obama’s speech made clear that Washington accepts no responsibility for the destruction of the lives and prospects of millions of Muslims. The refugees from Washington’s wars who are overflowing Europe are the fault of Assad, Obama declared.

Obama’s claim to represent “international norms” was an assertion of US hegemony, and was recognized as such by the General Assembly.

What the world is faced with is two rogue anti-democratic governments—the US and Israel—that believe that their “exceptionalism” makes them above the law. International norms mean Washington’s and Israel’s norms. Countries that do not comply with international norms are countries that do not comply with Washington and Israel’s dictates.

The presidents of Russia, China, and Iran did not accept Washington’s definition of “international norms.”

The lines are drawn. Unless the American people come to their senses and expel the Washington warmongers, war is our future.

- Global 'Wealth' Destruction – World Market Cap Plunges $13 Trillion To 2 Year Lows

Since the start of June, global equity markets have lost over $13 trillion.

(The last time global market dropped this much – Bernanke unleashed QE2)

World market capitalization has fallen back below $60 trillion for the first time since February 2014 as it appears the world's central planners' print-or-die policy to create wealth (and in some magical thinking – economic growth) has failed – and failed dramatically.

To rub more salt in the wounds of monetray policy mumbo-jumbo, despite endless rate cuts and balance sheet expansion around the world, the last 4 months have seen an 18% collapse – the largest since Lehman.

It appears "Wealth" creation is just as transitory as The Fed thinks every other outlier is.

Charts: Bloomberg

- China's Leadership: Brilliant Or Clueless?

Submitted by Charles Hugh-Smith of OfTwoMinds blog,

What worked in the post-global financial meltdown era of 2008-2014 will not work the same magic in the next seven years.

I am often amused by the Western media's readiness to attribute godlike powers of long-term planning and Sun-Tzu-like strategic brilliance to China's leadership. A well-known anecdote illustrates the point.

Zhou Enlai, Premier of China in the Mao era, who when asked by Henry Kissinger about the French Revolution, is reputed to have replied, "It's too early to say."

This is generally taken to express the Chinese Long View, i.e. that the events of 1789 are still playing out.

But accounts of those present discount this interpretation. Zhou understood Kissinger's query as being about the 1968 general strike in France. That social revolution was still actively in play in the early 1970s when Zhou and Kissinger were meeting, so the time frame was definitely present-day, not the 18th century.

China's dramatic rise since the early 1980s, when Deng Xiaoping's reforms occurred, has been nothing short of phenomenal. This remarkable success has to be attributed in some measure to the leadership's policies and decisions of the past three decades.

This economic success is the foundation of those who see China's leadership as brilliant.

But the policies and decisions that worked so well in the boost phase of growth–what we might call the era of low-hanging fruit–do not necessarily work in the next phase, where growth has matured and all the costs that were ignored in the boost phase must now be addressed and paid.

If we look at the problems in China's economy, environment and foreign policy, it seems the leadership is making it up as they go along, with the one overriding goal being to maintain the domestic political control of the Communist Party.

On the economic front, China's leadership has actively pursued policies that expanded the shadow banking system and conventional banking system into a $28 trillion debt bubble. This explosive expansion of credit has fueled a real estate bubble of monumental proportions, and a $10 trillion stock market bubble that is now bursting (as all bubbles eventually do, despite claims that "this time it's different").

Rather than being brilliant, this is a disaster, as bubbles don't dissipate without profound systemic consequences.

rather than deal with the crumbling of the real estate bubble, China's leaders have inflated a stock bubble that promises to bankrupt the tens of millions of households that placed bets in the casino with borrowed money (margin accounts).

On the foreign policy front, China has accomplished the near-impossible, i.e. driving all its neighbors into a united front, as Vietnam, the Philippines, Korea and Japan are all being forced by Chinese belligerence and over-reaching territorial claims to set aside their differences and strengthen ties with the U.S.

Were someone to craft a foreign policy designed to unite all of China's potential enemies into a powerful alliance, this would be the top choice.

The Chinese leadership is acting for all the world as if it moves from strength to strength, when the reality is the opposite: the leadership moves from one catastrophically ill-planned misadventure to the next.

It is easy to predict the unraveling of the real estate and stock market bubbles and the subsequent collapse of China's multi-trillion dollar shadow banking system. Having united all its potential enemies into one camp, China has undone decades of careful diplomacy and boxed itself into a diplomatic corner. Now that it has publicly issued extravagant territorial claims, China cannot back down without losing face; but if it continues to push its claims, it further alienates potential allies and pushes them to strengthen ties with the U.S. and other nations threatened by China's bellicose claims.

In the Great Game, one should never risk one's position before one has the means to defend that position. China is aggressively pursuing territorial claims that is cannot defend without isolating itself–a policy that would doom its export-and-resource dependent economy.

There are few if any historical precedents for China's leaders to follow. the boost phase of plucking low-hanging fruit is the easy part, the fun part, the exciting part.

Dealing with the aftermath of burst credit/asset bubbles, environmental destruction, corruption, wealth inequality, global recession and China's aggressive claim to territory in the South China Sea is the hard part, the not-fun part, the part rife with the potential for catastrophic errors in policy and judgment.

What worked in the post-global financial meltdown era of 2008-2014 (i.e. inflating a $15 trillion credit bubble) will not work the same magic in the next seven years, but there is little evidence that China's leadership (or indeed, the leadership of the U.S. Japan and the European Union) have a Plan B that will replace strategies that are yielding diminishing returns and raising the risks of a systemic failure.

Brilliant or clueless? As Zhou observed, it's too early to tell.

- Peak Japaganda: Advisers Call For More QE (But Admit Failure Of QE); China's Yuan Hits 3-Week High

Asian markets are bouncing modestly off a weak US session, buoyed by more unbelievable propaganda from Japan. Abe's proclamations that "deflationary mindset" has been shrugged off was met with calls for more stimulus, more debt monetization, and an admission by Etsuro Honda (Abe's closest adviser) that Japan "is not growing positively" and more QE is required despite trillions of Yen in money-printing having failed miserably, warning that raising taxes to pay for extra budget "would be suicidal." Japanese data was a disaster with factory output unexpectedly dropping 0.5% and retail trade missing. Markets are relatively stable at the open as China margin debt drop sto a 9-month low. PBOC strengthened the Yuan fix for the 3rd day in a row to its strongest in 3 weeks.

We begin the evening in Asia with some exceptional double-talk from who else but the Japanese leadership.

First Abe:

- *ABE: WILL RESHUFFLE CABINET ON OCT. 7 (should fix everything)

- *ABE: WOMEN AND ELDERLY SHOULD BE TAPPED BEFORE IMMIGRANTS (not quite sure what he means there)

- *ABE: CLOSE TO ESCAPING DEFLATION (nope!)

- *JAPAN HAS SHRUGGED OFF `DEFLATIONARY MINDSET,' ABE SAYS (nope!)

- *JAPAN'S CPI HAS `MADE A TURNAROUND,' PRIME MINISTER ABE SAYS (nope!)

Japan just dipped back into deflation…

Then came Former Economy Minister Takenaka:

- *TAKENAKA: JAPAN SHOULD COMPILE 5T YEN EXTRA BUDGET IN AUTUMN (fiscal stimulus, ok)

- *TAKENAKA: FOLLOWED BY MORE BOJ EASING (well who else is going to monetize that debt?)

- *TAKENAKA: YEN IN 'COMFORTABLE RANGE' OF 115-120 VS DOLLAR

Then one of Abe's closest advisers accidentally spilled some truthiness (as The FT reports):

Japan needs more economic stimulus to stave off a serious shock from China, according to one of Prime Minister Shinzo Abe’s closest advisers.

Etsuro Honda, an architect of Abenomics in his role as special adviser to Mr Abe, said passing a supplementary budget to boost the stagnant economy was an “urgent task”.

“I don’t think we should call it a technical recession yet, but generally speaking, the Japanese economy is in a static situation,” Mr Honda said in an interview with the Financial Times. “It is not growing positively.”

And he is right – as Japan heads for Quintuple Dip recession…

and it appears, despite China's reassurance, all is not well…

“I’m sure that something serious is happening in China,” he said, arguing that a shift towards the service industry in China could not explain how far its imports have fallen, or other measures such as electricity consumption.

And do not even think about raising taxes to cover this additional budget…

Mr Honda said: “Definitely if something serious happens outside of Japan, like the Lehman shock, we cannot raise consumption tax. It would be suicidal.

“At this moment, all that I can say is ‘I don’t know’.”

And then Japanese data hit – and it was a disaster…

- Japan Aug. Industrial Production Falls 0.5% M/m; Est. +1% (oops!)

- *JAPAN AUG. RETAIL SALES UNCHANGED M/M (Exp. +0.5%)

* * *

Following Daiichi Chuo's bankruptcy:

- *DAIICHI CHUO SAYS FILED FOR BANKRUPTCY AFTER OVER INVESTING

- *DAIICHI CHUO TRADES IN TOKYO, FALLS TO AS LOW AS 1 YEN

Other shipbuilders are under pressure:

- *DAEWOO SHIPBUILDING FALLS 8% IN SEOUL TRADING

And today's bounce in Glencore has the rest of the commodity/miner sector in confidence-boostingh mode…

- *FORTESCUE CEO SAYS CO. CAN WEATHER VOLATILITY IN MARKETS

- *FORTESCUE IN 'FANTASTIC POSITION' AFTER CUTTING COSTS: CEO

- *FORTESCUE COULD BRING IN INVESTOR TO SPEED DEBT PAYMENT: CEO

And Aussie miners are bouncing modestly (apart from South32)

* * *

China opened with more de-dollarization…

- *PBOC TO PROMOTE CURRENCY SWAP COOPRATION W/ KYRGYZSTAN C. BANK

- Central banks of two countries agree to promote cooperation in currency swap and local currency settlement, according to a statement posted on People’s Bank of China website.

And some good news on deleveraging…

- *SHANGHAI MARGIN DEBT BALANCE FALLS TO NINE-MONTH LOW

- Outstanding balance of Shanghai margin lending dropped for fifth day, falling 0.8%, or 4.7b yuan, to 573.4b yuan on Tuesday, lowest level since Dec. 4.

The PBOC fixed The Yuan stronger for the 3rd day in a row (under pressure from offshore Yuan) to its strongest in 3 weeks

- *CHINA SETS YUAN REFERENCE RATE AT 6.3613 AGAINST U.S. DOLLAR

But offshore Yuan remains notably stronger than onshore still…

Chinese stocks are modestly higher pre-market…

- *FTSE CHINA A50 OCTOBER FUTURES RISE 0.6% IN SINGAPORE

- *CHINA'S CSI 300 STOCK-INDEX FUTURES RISE 0.8% TO 3,103.4

And Interbank lending markets remain entirely suppressed…

Here's why you may want to care about that…

Simply put – as the mainland squeeze bleeds out to Hong Kong, it creates a liquidity suck out from the rest of the world, reducing carry trade 'power' and thus derisking any and every leveraged portfolio's exposure to US equities. When (or if) SHIBOR finally snaps then we will see the real impact (just as we saw shockwaves after CNY devalued unexpectedly).

* * *

Crude has faded as Asia opens after the bigger than expected API inventory build…

Charts: Bloomberg

- Forget Glencore: This Is The Real "Systemic Risk" Among The Commodity Traders

Back in July, long before anyone was looking at Glencore (or Asia’s largest commodity trader, Noble Group which we also warned last month was due for a major crash, precisely as happened overnight) which everyone is looking at now that its CDS is trading points upfront and anyone who followed our suggestion last March to go long its then super-cheap CDS can take a few years off, we had a rhetorical question:

Which will be first: Trafigura, Mercuria or Glencore

— zerohedge (@zerohedge) July 22, 2015

Judging by what happened less than two months later, it appears that we have our answer: for now at least, Glencore, which is now flailing and which Bloomberg reported moments ago is set to meet with its bond investors tomorrow (supposedly to allay their fears of an imminent insolvency), is firmly the “answer” to our rhetorical question.

And yet, something stinks.

First, a quick look at Trafigura bonds reveals that the contagion from the Glencore commodity-trader collapse, which “nobody could possibly predict” two months ago and which has rapidly become the market’s biggest black swan, has spread and we now have a new contender. And while Trafigura’s equity is privately held, it does have publicly-traded bonds. They just cratered:

… sending the yield soaring to junk-bond levels.

As discussed below, this may just be the beginning for the company which, because it does not have publicly traded equity – but has publicly traded debt – has so far managed to slip under the radar.

But who is Trafigura? Only the world’s third largest private commodity trader after Vitol and Glencore.

From the company’s own description:

Trafigura is one of the world’s leading independent commodity trading and logistics houses. We’re at the heart of the global economy. Every day and around the world, we are advancing trade – reliably, efficiently and responsibly. We see global trade as a positive force and we go further to make trade work better.

More important than some pitchbook boilerplate, is the company’s history: Trafigura was formed in 1993 by Claude Dauphin and Eric de Turckheim when It split off from a group of companies managed by Marc Rich, aka “the king of oil” in 1993.

Who is March Rich? Why the founder of Glencore of course who as a reminder, was indicted in 1983 on 65 criminal counts including income tax evasion, wire fraud, racketeering, and trading with Iran during the oil embargo. Upon learning his prison sentence may be as long as 300 years, Rich promptly fled to Switzerland; he was so afraid of US authorities, he even skipped his daughter’s funeral in 1996.

Marc Rich got a presidential pardon from Bill Clinton in a decision which was blessed by the kingpin of corruption, former DOJ head Eric Holder. Clinton himself later expressed regret for issuing the pardon, saying that “it wasn’t worth the damage to my reputation.“

But back to Trafigura, whose summary financials reveal that the company – with $127.6 billion in revenues in 2014 and $39 billion in assets – is absolutely massive. In fact, in terms of turnover, it is virtually the same size as Glencore.

But the most important and relevant numbers are on neither of the pretty annual report grabs above. They are highlighted in red in the excerpt from the company’s interim report: the $6.2 billion in non-current debt and $15.6 billion in current debt for a grand total of 21.9 billion in debt!

Now, this is less than Glencore’s $31 billion (the implication being that Trafigura has a solid $6 billion equity cushion although judging by the bond plunge the market is starting to seriously doubt this) but the problem is that Trafigura’s EBITDA is lower. Much lower.

According to CapIq, Trafigura had $1.8 billion in LTM EBITDA, suggesting a debt/EBITDA leverage ratio of a whopping 12x. If one wants to be generous and annualizes the company’s disclosed 6-month EBITDA (for the period ended 3/31/2015) of $1.1 billion, the EBITDA grows to $2.2 billion. This lowers the debt/EBITDA for Trafigura to “only” 10x.

Indicatively, Glencore’s own debt/EBITDA, and the reason for so much conerns about the company’s solvency, is about half of Trafigura’s.

At least on the surface, it appears that Trafigura, which is as reliant on the ups and down of commodity trading as Glencore, is far more levered, and exposed, to any commodity crush than the Swiss giant.

But what really set off our alarm bells, is that a quick skim through the company’s annual report reveals something disturbing: a commissioned report titled “Too Big To Fail: Commodity Trading Firms and Systemic Risk” whose purpose was to explain why, as the title implies, commodity trading firms are not systemically important. The timing, just months before a historic rout for commodity traders, is odd to say the least.

As a general take, any time someone first brings up, and then tries to talk down the impact of something as being “Too Big To Fail”, run.

More seriously, there are two problems with this analysis: as events in the past week have shown, commodity trading firms clearly carry a systemic risk: after all, one after another news outlet rushed to explain why yesterday’s market plunge was the result of Glencore fears. It would have been the same with Trafigura’s equity plunge… if the company had publicly-traded equity instead of just debt.

The second problem is the subheader to the paper:

Trafigura commissioned a white paper this year on commodity trading firms and systemic risk. Its author, Craig Pirrong, explains why he believes these firms are unlikely to have a destabilising effect on the global economy.

The paper’s conclusion: “Commodity trading firms are not a source of systemic risk.“

Oops.

Who is Craig Pirrong? As the NYT explained in a 2013 article titled “Academics Who Defend Wall St. Reap Reward“, Pirrong, a University of Houston professor, is just a member of that all too pervasive “paid expert for hire” group, academics without actual credibility inside their own circles, and who as a result will “opine” on anything and everything – usually involving Wall Street regulatory and “risk” matters, just to get paid.

This is precisely what Trafigura did when it commissioned him to “explain” why Trafigura is not systemic. Ironically it did so in August, just as all hell was about to break loose for the commodity traders, especially the most systemic ones.

And while the market has shown how the paid opinions of such “experts for hire” should be completely ignored, the question remains: just what was Trafigura so concerned about when it commissioned a well-compensated study meant to goal-seek the company’s explicit conclusion: that it is not systemic, when it obviously is.

Opinions aside, at the end of the the market will decide just who is systemic and who isn’t. One look at the price of Trafigura’s bonds above has given us the answer: it is a move comparable to what happened to Lehman bonds – if not equity – the day after the bankruptcy filing.

Clearly the Lehman bonds could not believe what just happened until it was too late. For Glencore, and increasingly Trafigura, the bond price is finally signalling the realization that “this is indeed happening.”

* * *

We’ll save our discussion of Mercuria for another day.

- Gold: "The More Ridiculous The System Gets, The More Valuable It Becomes"

Submitted by Simon Black via SovereignMan.com,

Nearly four months ago on June 2nd, something very unusual happened in Edmonton, Alberta, Canada.

The price of propane actually became negative, hitting an unbelievable -0.625 cents per gallon.

It’s hard to believe that the price of a productive commodity could become so beat down by the market that producers would practically have to pay you to take it off their hands.

Now that’s cheap. And completely nuts.

This actually happens from time to time with certain commodities. And there are a number of reasons for it.

A negative price might imply a dramatic oversupply where the cost of storing the commodity exceeds the benefit from owning it.

Sometimes even something like real estate can have a negative value—perhaps when a building is in such decrepit condition that the cost of tearing down the structure exceeds the land value.

But sometimes a negative price simply means that markets are completely broken.

The primary function of a marketplace is what’s called ‘price discovery’. This is an incredibly important role where buyers and sellers collectively determine the true value of a product, service, or asset.

Think of it like an auction: if you really want to know what that old baseball card is worth, put it on eBay and let the market tell you.

The problem is that, these days, markets are so heavily manipulated that the price discovery mechanism has been broken.

Consider that the most important ‘price’ in the world is the price of money, i.e. interest rates.

The price of money dictates, or at least heavily influences, the price of so many other major assets and commodities. Stocks. Bonds. Oil. Home prices.

And yet, rather than leave this all-important price to be set by the market, the price of money is established by an unelected committee of central bankers.

So by setting the price of money, they are effectively influencing the price of just about EVERYTHING. Including propane in Alberta.

Then of course there’s the more nefarious price manipulation, much of which is coming to light now.

There was the appalling LIBOR scandal back in 2012 when multiple banks confessed to criminal charges of conspiring to fix interest rates.

Investors in the United States have filed a number of lawsuits alleging that banks and brokers have rigged the market for US Treasury bonds.

The US Federal Energy Regulatory Commission has recently accused French oil company Total and British firm BP of manipulating natural gas prices.

And both the US Department of Justice and the Swiss Competition Commission are investigating several banks for colluding to manipulate gold and silver prices.

So in addition to markets being broken, there’s also an extraordinary amount of manipulation going on… which means that, quite often, prices mean absolutely nothing.

Consider gold and silver, two obvious long-term stores of value whose prices have been in decline.

Bear in mind these are paper prices, i.e. prices set in broken commodities markets, heavily influenced by central banks, and criminally manipulated by investment banks.

So is this price really a valid indicator of their worth? Not by a long shot.

Think about the ever-widening gulf between the ‘paper’ price of silver and the ‘physical’ price of silver… evidenced by the massive shortage in real, physical silver right now.

The paper prices of gold and silver are set (and manipulated) in financial markets through commodities exchanges.

It’s not like traders are huddled around bags of coins bidding on which one of them will haul it away.

Instead they’re dealing with contracts… pieces of paper (or electrons) passed around by traders and bankers.

In fact, the gold and silver contracts traded in commodities exchanges are designed especially for people who have no intention of ever taking physical possession of the metal.

Case in point: the paper price for silver traded in Chicago is based on a contract that is supposed to end with physical silver being delivered to the buyer.

But the contract specifications set by the exchange allow up to 10% FEWER ounces of silver to be delivered than what was specified in the contract.

And in London, the London Bullion Market Association’s “Good Delivery” rules allow silver bars to be up to 25% less than what was specified in the contract.

Amazing.

And it certainly raises the question– who would possibly purchase 1,000 ounces of silver if the exchange was only required to deliver 750?

Anyone who actually wants to own real gold and silver would rather buy from a local coin dealer.

Futures contracts are for bankers and traders. Paper prices are for economists and reporters.

The current shortage of silver, particularly in North America, is a much better reflection of its value than heavily manipulated commodities markets.

All these contracts and prices truly reflect is how broken the financial system really is… which is actually precisely why you would want to own more gold and silver.

Seriously, how messed up is our financial system when asset prices across the world can be so easily rigged by the very institutions that demand our trust?

* * *

This system is pure insanity, as are its prices.

As such, I don’t let their prices guide my life. It wouldn’t bother me if the price of gold went negative, just like propane in Alberta.

After all, I’m not trading paper currency for gold, just to trade it back for more paper currency if the ‘price’ goes up.

The idea behind buying gold is to swap paper money for something real.

Banks can rig its price all they want; gold’s true value comes from its function as a long-term form of savings and a hedge against a broken financial system.

And the more ridiculous the system gets, the more valuable it becomes.

- Saudi Prince Calls For Royal Coup

In the wake of the petrodollar’s dramatic collapse late last year, we’ve been keen to document the projected effect on global liquidity of net petrodollar exports turning negative for the first time in decades. We also moved to explain how this dynamic relates to the FX reserve liquidation we’re now seeing across EM.

Of course we’ve also endeavored to explain that while grasping the big picture is certainly critical (and even more so now that China’s efforts to support the yuan in the wake of the August 11 deval have thrust FX reserve liquidation into the spotlight), understanding what “lower for longer” means specifically for Riyadh is important as well.

To recap, the necessity of preserving the status quo for everyday Saudis combined with funding two regional proxy wars while simultaneously defending the riyal peg isn’t exactly compatible with intentionally suppressing crude prices in an effort to outlast ZIRP and bankrupt the US shale complex. The difficulty of balancing all of this has created a current account/fiscal account outcome that makes Brazil look quite favorable by comparison and it has also forced the Saudis into the debt markets, suggesting that the kingdom’s debt-to-GDP ratio is set to rise sharply by the end of 2016 (although it would of course still look favorable by comparison in even the worst case scenarios).

Thrown in a catastrophic crane collapse at Mecca and an incredibly horrific hajj stampede (followed by some epic trolling out of Tehran) and you have a recipe for social upheaval.

It’s against this backdrop that we present the following from The Guardian followed by extensive commentary from Nafeez Ahmed.

From The Guardian:

A senior Saudi prince has launched an unprecedented call for change in the country’s leadership, as it faces its biggest challenge in years in the form of war, plummeting oil prices and criticism of its management of Mecca, scene of last week’s hajj tragedy.

The prince, one of the grandsons of the state’s founder, Abdulaziz Ibn Saud, has told the Guardian that there is disquiet among the royal family – and among the wider public – at the leadership of King Salman, who acceded the throne in January.

The prince, who is not named for security reasons, wrote two letters earlier this month calling for the king to be removed.

“The king is not in a stable condition and in reality the son of the king [Mohammed bin Salman] is ruling the kingdom,” the prince said. “So four or possibly five of my uncles will meet soon to discuss the letters. They are making a plan with a lot of nephews and that will open the door. A lot of the second generation is very anxious.”

“The public are also pushing this very hard, all kinds of people, tribal leaders,” the prince added. “They say you have to do this or the country will go to disaster.”

A clutch of factors are buffeting King Salman, his crown prince, Mohammed bin Nayef, and the deputy crown prince, Mohammed bin Salman.

A double tragedy in Mecca – the collapse of a crane that killed more than 100, followed by a stampede last week that killed 700 – has raised questions not just about social issues, but also about royal stewardship of the holiest site in Islam.

As usual, the Saudi authorities have consistently shrugged off any suggestion that a senior member of the government may be responsible for anything that has gone wrong.

Local people, however, have made clear on social media and elsewhere that they no longer believe such claims.

“The people inside [the kingdom] know what’s going on but they can’t say. The problem is the corruption in using the resources of the country for building things in the right form,” said an activist who lives in Mecca but did not want to be named for fear of repercussions.

“Unfortunately the government points the finger against the lower levels, saying for example: ‘Where are the ambulances? Where are the healthcare workers?’ They try to escape the real reason of such disaster,” he added.

* * *

Submitted by Nafeez Ahmed via Middle East Eye

On Tuesday 22 September, Middle East Eye broke the story of a senior member of the Saudi royal family calling for a “change” in leadership to fend off the kingdom’s collapse.

In a letter circulated among Saudi princes, its author, a grandson of the late King Abdulaziz Ibn Saud, blamed incumbent King Salman for creating unprecedented problems that endangered the monarchy’s continued survival.

“We will not be able to stop the draining of money, the political adolescence, and the military risks unless we change the methods of decision making, even if that implied changing the king himself,” warned the letter.

Whether or not an internal royal coup is round the corner – and informed observers think such a prospect “fanciful” – the letter’s analysis of Saudi Arabia’s dire predicament is startlingly accurate.

Like many countries in the region before it, Saudi Arabia is on the brink of a perfect storm of interconnected challenges that, if history is anything to judge by, will be the monarchy’s undoing well within the next decade.

Black gold hemorrhage

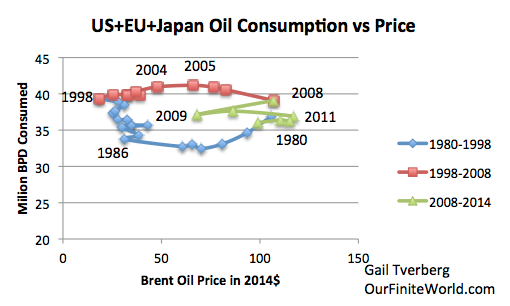

The biggest elephant in the room is oil. Saudi Arabia’s primary source of revenues, of course, is oil exports. For the last few years, the kingdom has pumped at record levels to sustain production, keeping oil prices low, undermining competing oil producers around the world who cannot afford to stay in business at such tiny profit margins, and paving the way for Saudi petro-dominance.

But Saudi Arabia’s spare capacity to pump like crazy can only last so long. A new peer-reviewed study in the Journal of Petroleum Science and Engineering anticipates that Saudi Arabia will experience a peak in its oil production, followed by inexorable decline, in 2028 – that’s just 13 years away.

This could well underestimate the extent of the problem. According to the Export Land Model (ELM) created by Texas petroleum geologist Jeffrey J Brown and Dr Sam Foucher, the key issue is not oil production alone, but the capacity to translate production into exports against rising rates of domestic consumption.

Brown and Foucher showed that the inflection point to watch out for is when an oil producer can no longer increase the quantity of oil sales abroad because of the need to meet rising domestic energy demand.

In 2008, they found that Saudi net oil exports had already begun declining as of 2006. They forecast that this trend would continue.

They were right. From 2005 to 2015, Saudi net exports have experienced an annual decline rate of 1.4 percent, within the range predicted by Brown and Foucher. A report by Citigroup recently predicted that net exports would plummet to zero in the next 15 years.

From riches to rags

This means that Saudi state revenues, 80 percent of which come from oil sales, are heading downwards, terminally.

Saudi Arabia is the region’s biggest energy consumer, domestic demand having increased by 7.5 percent over the last five years – driven largely by population growth.

The total Saudi population is estimated to grow from 29 million people today to 37 million by 2030. As demographic expansion absorbs Saudi Arabia’s energy production, the next decade is therefore likely to see the country’s oil exporting capacity ever more constrained.

Renewable energy is one avenue which Saudi Arabia has tried to invest in to wean domestic demand off oil dependence, hoping to free up capacity for oil sales abroad, thus maintaining revenues.

But earlier this year, the strain on the kingdom’s finances began to show when it announced an eight-year delay to its $109 billion solar programme, which was supposed to produce a third of the nation’s electricity by 2032.

State revenues also have been hit through blowback from the kingdom’s own short-sighted strategy to undermine competing oil producers. As I previously reported, Saudi Arabia has maintained high production levels precisely to keep global oil prices low, making new ventures unprofitable for rivals such as the US shale gas industry and other OPEC producers.

The Saudi treasury has not escaped the fall-out from the resulting oil profit squeeze – but the idea was that the kingdom’s significant financial reserves would allow it to weather the storm until its rivals are forced out of the market, unable to cope with the chronic lack of profitability.

That hasn’t quite happened yet. In the meantime, Saudi Arabia’s considerable reserves are being depleted at unprecedented levels, dropping from their August 2014 peak of $737 billion to $672bn in May – falling by about $12bn a month.

At this rate, by late 2018, the kingdom’s reserves could deplete as low as $200bn, an eventuality that would likely be anticipated by markets much earlier, triggering capital flight.

To make up for this prospect, King Salman’s approach has been to accelerate borrowing. What happens when over the next few years reserves deplete, debt increases, while oil revenues remain strained?

As with autocratic regimes like Egypt, Syria and Yemen – all of which are facing various degrees of domestic unrest – one of the first expenditures to slash in hard times will be lavish domestic subsidies. In the former countries, successive subsidy reductions responding to the impacts of rocketing food and oil prices fed directly into the grievances that generated the “Arab Spring” uprisings.

Saudi Arabia’s oil wealth, and its unique ability to maintain generous subsidies for oil, housing, food and other consumer items, plays a major role in fending off that risk of civil unrest. Energy subsidies alone make up about a fifth of Saudi’s gross domestic product.

Pressure points

As revenues are increasingly strained, the kingdom’s capacity to keep a lid on rising domestic dissent will falter, as has already happened in countries across the region.

About a quarter of the Saudi population lives in poverty. Unemployment is at about 12 percent, and affects mostly young people – 30 percent of whom are unemployed.

Climate change is pitched to heighten the country’s economic problems, especially in relation to food and water.

Like many countries in the region, Saudi Arabia is already experiencing the effects of climate change in the form of stronger warming temperatures in the interior, and vast areas of rainfall deficits in the north. By 2040, average temperatures are expected to be higher than the global average, and could increase by as much as 4 degrees Celsius, while rain reductions could worsen.

This would be accompanied by more extreme weather events, like the 2010 Jeddah flooding caused by a year’s worth of rain occurring within the course of just four hours. The combination could dramatically impact agricultural productivity, which is already facing challenges from overgrazing and unsustainable industrial agricultural practices leading to accelerated desertification.

In any case, 80 percent of Saudi Arabia’s food requirements are purchased through heavily subsidised imports, meaning that without the protection of those subsidies, the country would be heavily impacted by fluctuations in global food prices.

“Saudi Arabia is particularly vulnerable to climate change as most of its ecosystems are sensitive, its renewable water resources are limited and its economy remains highly dependent on fossil fuel exports, while significant demographic pressures continue to affect the government’s ability to provide for the needs of its population,” concluded a UN Food & Agricultural Organisation (FAO) report in 2010.

The kingdom is one of the most water scarce in the world, at 98 cubic metres per inhabitant per year. Most water withdrawal is from groundwater, 57 percent of which is non-renewable, and 88 percent of which goes to agriculture. In addition, desalination plants meet about 70 percent of the kingdom’s domestic water supplies.

But desalination is very energy intensive, accounting for more than half of domestic oil consumption. As oil exports run down, along with state revenues, while domestic consumption increases, the kingdom’s ability to use desalination to meet its water needs will decrease.

End of the road

In Iraq, Syria, Yemen and Egypt, civil unrest and all-out war can be traced back to the devastating impact of declining state power in the context of climate-induced droughts, agricultural decline, and rapid oil depletion.

Yet the Saudi government has decided that rather than learning lessons from the hubris of its neighbours, it won’t wait for war to come home – but will readily export war in the region in a madcap bid to extend its geopolitical hegemony and prolong its petro-dominance.

Unfortunately, these actions are symptomatic of the fundamental delusion that has prevented all these regimes from responding rationally to the Crisis of Civilization that is unravelling the ground from beneath their feet. That delusion consists of an unwavering, fundamentalist faith: that more business-as-usual will solve the problems created by business-as-usual.

Like many of its neighbours, such deep-rooted structural realities mean that Saudi Arabia is indeed on the brink of protracted state failure, a process likely to take-off in the next few years, becoming truly obvious well within a decade.

Sadly, those few members of the royal family who think they can save their kingdom from its inevitable demise by a bit of experimental regime-rotation are no less deluded than those they seek to remove.

* * *

We would only ask if all of the above means that future vists to the US will look dissimilar to this:

- Carl Icahn Says Market "Way Overpriced", Warns "God Knows Where This Is Going"

To be sure, no one ever accused Carl Icahn of being shy and earlier this year he had a very candid sitdown with Larry Fink at whom Icahn leveled quite a bit of sharp (if good natured) criticism related to BlackRock’s role in creating the conditions that could end up conspiring to cause a meltdown in illiquid corporate credit markets. Still, talking one’s book speaking one’s mind is one thing, while making a video that might as well be called “The Sky Is Falling” is another and amusingly that is precisely what Carl Icahn has done.

Over the course of 15 minutes, Icahn lays out his concerns about many of the issues we’ve been warning about for years and while none of what he says will come as a surprise (especially to those who frequent these pages), the video, called “Danger Ahead”, is probably worth your time as it does a fairly good job of summarizing how the various risk factors work to reinforce one another on the way to setting the stage for a meltdown. Here’s a list of Icahn’s concerns:

- Low rates and asset bubbles: Fed policy in the wake of the dot com collapse helped fuel the housing bubble and given what we know about how monetary policy is affecting the financial cycle (i.e. creating larger and larger booms and busts) we might fairly say that the Fed has become the bubble blower extraordinaire. See the price tag attached to Picasso’s Women of Algiers (Version O) for proof of this.

- Herding behavior: The quest for yield is pushing investors into risk in a frantic hunt for yield in an environment where risk free assets yield at best an inflation adjusted zero and at worst have a negative carrying cost.

- Financial engineering: Icahn is supposedly concerned about the myopia displayed by corporate management teams who are of course issuing massive amounts of debt to fund EPS-inflating buybacks as well as M&A. We have of course been warning about debt fueled buybacks all year and make no mistake, there’s something a bit ironic about Carl Icahn criticizing companies for short-term thinking and buybacks as he hasn’t exactly been quiet about his opinion with regard to Apple’s buyback program (he does add that healthy companies with lots of cash should repurchases shares).

- Fake earnings: Companies are being deceptive about their bottom lines.

- Ineffective leadership: Congress has demonstrated a remarkable inability to do what it was elected to do (i.e. legislate). To fix this we need someone in The White House who can help break intractable legislative stalemates.

- Corporate taxes are too high: Inversions are costing the US jobs.

Here’s more from Reuters:

Billionaire investor activist Carl Icahn ramped up criticism of the U.S. Federal Reserve, warning about the unintended consequences of ultra low interest rates on the economy and financial markets.

“They don’t understand the treacherous path they are going down,” Icahn said in an interview with Reuters, in which he also declared his support for Donald Trump as a candidate to be the next U.S. president.

“God knows where this is going. It’s very dangerous and could be disastrous,” said Icahn, who has been a consistent critic of the Fed for keeping its benchmark interest rate close to zero since late 2008.

Icahn said he felt compelled to raise red flags about the state of the financial markets because he believes if more big investors had warned about subprime mortgage market in 2007, the United States might have avoided the crisis that strangled the economy the following year.

In a video entitled “Danger Ahead” and released on Tuesday, Icahn said the Fed’s rate policy had enabled U.S. chief executives – many of whom he describes as “nice but mediocre guys” – to pursue “financial engineering” that he said has exacerbated an already wide gap between rich and poor in America.

Icahn, who slammed money managers who benefit from the so-called “carried interest” loophole under which their earnings are taxed as capital gains rather than ordinary wage income, also endorsed Donald Trump’s presidential bid.

Trump unveiled a tax plan on Monday that he said would eliminate the loophole.

“Those guys who run these companies are borrowing money very cheaply, leveraging up their companies, using it to do two things … They are going in and they are buying back stock or even worse, making stupid takeovers,” said Icahn, adding some recent acquisitions have been done at a too high a price.

Much of this debt is bought via exchange-traded funds, a popular vehicle for trading baskets of bonds and stocks.

Icahn said retail investors had a false sense of security about how easy it would be to sell their holdings of such debt if the market turns.

“It’s like a movie theater and somebody yells fire. There is only one little exit door,” he said. “The exit door is fine when things are OK but when they yell fire, they can’t get through the exit door … and there’s nobody to buy those junk bonds.”

Ultimately what Icahn has done is put the pieces together for anyone who might have been struggling to understand how it all fits together and how the multiple dynamics at play serve to feed off one another to pyramid risk on top of risk. Put differently: one more very “serious” person is now shouting about any and all of the things Zero Hedge readers have been keenly aware of for years.

Full video below.

- The UN Just Unleashed "The Global Goals" – The Elites' Blueprint For A "United World"

Submitted by Michael Snyder via The Economic Collapse blog,

Have you heard of “the global goals”? If you haven’t heard of them by now, rest assured that you will be hearing plenty about them in the days ahead. On September 25th, the United Nations launched a set of 17 ambitious goals that it plans to achieve over the next 15 years. A new website to promote this plan has been established, and you can find it right here. The formal name of this new plan is “the 2030 Agenda“, but those behind it decided that they needed something catchier when promoting these ideas to the general population. The UN has stated that these new “global goals” represent a “new universal Agenda” for humanity. Virtually every nation on the planet has willingly signed on to this new agenda, and you are expected to participate whether you like it or not.

Some of the biggest stars in the entire world have been recruited to promote “the global goals”. Just check out the YouTube video that I have posted below. This is the kind of thing that you would expect from a hardcore religious cult…

If you live in New York City, you are probably aware of the “Global Citizen Festival” that was held in Central Park on Saturday where some of the biggest names in the music industry promoted these new “global goals”. The following is how the New York Daily News described the gathering…

It was a party with a purpose.

A star-studded jamboree and an impassioned plea to end poverty rocked the Great Lawn in Central Park as more than 60,000 fans gathered Saturday for the fourth-annual Global Citizen Festival.

The feel-good event, timed to coincide with the annual gathering of world leaders at the United Nations General Assembly, featured performances by Beyoncé, Pearl Jam, Ed Sheeran and Coldplay.

And it wasn’t just the entertainment industry that was promoting this new UN plan for a united world. Pope Francis traveled to New York to give the address that kicked off the conference where this new agenda was unveiled…

Pope Francis gave his backing to the new development agenda in an address to the U.N. General Assembly before the summit to adopt the 17-point plan opened, calling it “an important sign of hope” at a very troubled time in the Middle East and Africa.

When Danish Prime Minister Lars Rasmussen struck his gavel to approve the development road map, leaders and diplomats from the 193 U.N. member states stood and applauded loudly.

Then, the summit immediately turned to the real business of the three-day meeting — implementation of the goals, which is expected to cost $3.5 trillion to $5 trillion every year until 2030.

Wow.

Okay, so where will the trillions of dollars that are needed to implement these new “global goals” come from?

Let me give you a hint – they are not going to come from the poor nations.

When you read over these “global goals”, many of them sound quite good. After all, who wouldn’t want to “end hunger”? I know that I would like to “end hunger” if I could.

The key is to look behind the language and understand what is really being said. And what is really being said is that the elite want to take their dream of a one world system to the next level.

The following list comes from Truthstream Media, and I think that it does a very good job of translating these new “global goals” into language that we can all understand…

- Goal 1: End poverty in all its forms everywhere

- Translation: Centralized banks, IMF, World Bank, Fed to control all finances, digital one world currency in a cashless society

- Goal 2: End hunger, achieve food security and improved nutrition and promote sustainable agriculture

- Translation: GMO

- Goal 3: Ensure healthy lives and promote well-being for all at all ages

- Translation: Mass vaccination, Codex Alimentarius

- Goal 4: Ensure inclusive and equitable quality education and promote lifelong learning opportunities for all

- Translation: UN propaganda, brainwashing through compulsory education from cradle to grave

- Goal 5: Achieve gender equality and empower all women and girls

- Translation: Population control through forced “Family Planning”

- Goal 6: Ensure availability and sustainable management of water and sanitation for all

- Translation: Privatize all water sources, don’t forget to add fluoride

- Goal 7: Ensure access to affordable, reliable, sustainable and modern energy for all

- Translation: Smart grid with smart meters on everything, peak pricing

- Goal 8: Promote sustained, inclusive and sustainable economic growth, full and productive employment and decent work for all

- Translation: TPP, free trade zones that favor megacorporate interests

- Goal 9: Build resilient infrastructure, promote inclusive and sustainable industrialization and foster innovation

- Translation: Toll roads, push public transit, remove free travel, environmental restrictions

- Goal 10: Reduce inequality within and among countries

- Translation: Even more regional government bureaucracy like a mutant octopus

- Goal 11: Make cities and human settlements inclusive, safe, resilient and sustainable

- Translation: Big brother big data surveillance state

- Goal 12: Ensure sustainable consumption and production patterns

- Translation: Forced austerity

- Goal 13: Take urgent action to combat climate change and its impacts*

- Translation: Cap and Trade, carbon taxes/credits, footprint taxes

- Goal 14: Conserve and sustainably use the oceans, seas and marine resources for sustainable development

- Translation: Environmental restrictions, control all oceans including mineral rights from ocean floors

- Goal 15: Protect, restore and promote sustainable use of terrestrial ecosystems, sustainably manage forests, combat desertification, and halt and reverse land degradation and halt biodiversity loss

- Translation: More environmental restrictions, more controlling resources and mineral rights

- Goal 16: Promote peaceful and inclusive societies for sustainable development, provide access to justice for all and build effective, accountable and inclusive institutions at all levels

- Translation: UN “peacekeeping” missions (ex 1, ex 2), the International Court of (blind) Justice, force people together via fake refugee crises and then mediate with more “UN peacekeeping” when tension breaks out to gain more control over a region, remove 2nd Amendment in USA

- Goal 17: Strengthen the means of implementation and revitalize the global partnership for sustainable development

- Translation: Remove national sovereignty worldwide, promote globalism under the “authority” and bloated, Orwellian bureaucracy of the UN

If you doubt any of this, you can find the official document for this new UN agenda right here. The more you dig into the details, the more you realize just how insidious these “global goals” really are.

The elite want a one world government, a one world economic system and a one world religion. But they are not going to achieve these things by conquest. Rather, they want everyone to sign up for these new systems willingly.

The “global goals” are a template for a united world. To many, the “utopia” that the elite are promising sounds quite promising. But for those that know what time it is, this call for a “united world” is very, very chilling.

- Two Very Disturbing Forecasts By A Former Chinese Central Banker

Earlier today, Yu Yongding – currently a senior fellow at the Chinese Academy of Social Sciences in Beijing but most notably a member of the PBOC’s Monetary Policy Committee from 2004 to 2006 as well as a member of China’s central planning bureau itself, the Advisory Committee of National Planning – gave a speech before the Peterson Institute, together with a slideshow.

Since the topic was China’s debt, economic growth, corporate profitability, and since, inexplicably, it wasn’t pre-cleared by the Chinese department of truth, it was not cheerful. In fact it was downright scary. Among other things, the speech discussed:

- Capital efficiency – low and falling (capital-output ratio rising)

- Corporate profitability – has been falling steadily

- Share of finance via capital market – Very low

- Interest rate on loans – High

- Inflation rate – producer price Index is falling

A key observation was the troubling surge in China’s capital coefficient, first noted here two weeks ago in a presentation by Daiwa which also had a downright apocalyptic outlook on China, and wasn’t ashamed to admit that it expects a China-driven global meltdown, one which “would more than likely send the world economy into a tailspin. Its impact could be the worst the world has ever seen.”

The former central banker also discussed the bursting of China’s market bubble. This, he said was created deliberately for two government purposes:

- To enable debt-ridden corporates to get funds from the equity market

- To boost share prices to stimulate demand via wealth effect

He admits this shortsighted approach failed and “to save the city, we bombed the city” adding that it brings “authorities’ ability of crisis managing into question.”

He also observes that the devaluation that took place on August 11 was the government’s explicit admission that its attempt to reflate an equity bubble has failed, and it was forced to find an alternative method of stimulating the economy. Of the CNY devaluaton Yu says quite clearly that it was simply to boost the economy: “In the first quarter of 2015 China’s capital account deficit is larger that than that of current account surplus” which is due to i) The Unwinding of Carry trade; ii) the diversification of financial assets by households; iii) Outbound foreign investment; and iv) capital flight.

And now that China has officially unleashed devaluation (which Yu believes should be taken to its logical end and the RMB should float) there are very material risks: “the implication of episode can be more serious than the stock market fiasco, with much large international consequences” and that “the failure will have serious consequences on China’s financial stability”

His ominous outlook: “Two bubbles have burst, what next?”

To answer this question we go back to Yongding’s slidedeck, where two particular slides caught our attention: the former central banker’s projections on Chinese debt/GDP and corporate profits. They need no further commentary.

Trajectory of corporate profitability (before interest payments) – slide 12

and Corporate debt-to-GDP simulation (baseline scenario) – slide 15

As a reminder, this is the base-case of a former central banker. One can only imagine how bad it really must be.

* * *

Full presentation (pdf)

- Sep 30 – Fed's Mester: US Can Handle Rate Hike This Year

Follow The Market Madness with Voice and Text on FinancialJuice

EMOTION MOVING MARKETS NOW: 12/100 EXTREME FEAR

PREVIOUS CLOSE: 12/100 EXTREME FEAR

ONE WEEK AGO: 31/100 FEAR

ONE MONTH AGO: 14/100 EXTREME FEAR

ONE YEAR AGO: 15/100 EXTREME FEAR

Put and Call Options: EXTREME FEAR During the last five trading days, volume in put options has lagged volume in call options by 13.19% as investors make bullish bets in their portfolios. However, this is still among the highest levels of put buying seen during the last two years, indicating extreme fear on the part of investors.

Market Volatility: NEUTRAL The CBOE Volatility Index (VIX) is at 26.83. This is a neutral reading and indicates that market risks appear low.

Stock Price Strength: FEAR The number of stocks hitting 52-week lows exceeds the number hitting highs and is at the lower end of its range, indicating fear.

PIVOT POINTS

EURUSD | GBPUSD | USDJPY | USDCAD | AUDUSD | EURJPY | EURCHF | EURGBP| GBPJPY | NZDUSD | USDCHF | EURAUD | AUDJPY

S&P 500 (ES) | NASDAQ 100 (NQ) | DOW 30 (YM) | RUSSELL 2000 (TF) | Euro (6E) |Pound (6B)

EUROSTOXX 50 (FESX) | DAX 30 (FDAX) | BOBL (FGBM) | SCHATZ (FGBS) | BUND (FGBL)

CRUDE OIL (CL) | GOLD (GC) | 10 YR T NOTE | 2 YR T NOTE | 5 YR T NOTE | 30 YR TREASURY BOND| SOYBEANS | CORN

MEME OF THE DAY – BEIJING AFTER VOLKSWAGEN

UNUSUAL ACTIVITY

APPS Director purchase 127K @ 1.57

JOY Director purchase 12,200 A $ 14.77 , 4,346 A $ 14.8 , 2,854 A $ 14.81 , 2,265 A $ 14.82 , 2,435 A $ 14.83

Z NOV 30 Puts @ 4.70 on the offer 1600 contracts

MU Jan 5 Put Activity @ 0.18 on the offer

BDSI NOV 6 Calls on the offer @ 0.80 1800+

HEADLINES

Fed’s Mester: US can handle rate hike this year

Moody’s: Govt shutdown doesn’t directly affect creditworthiness of US

ECB’s Weidmann: Deflation Concerns Have Dissipated

Villeroy Cleared to Become Next Governor of Bank of France

Wells Fargo cuts S&P 500’s year-end target to 2,025-2,125

InBev Said to Line Up BofA, Santander on SABMiller Financing

Glencore says it is ‘operationally and financially robust’

Bank of America to Lay Off Employees in Banking, Markets

Twitter is getting ready to drop its 140-character limit

Ukraine group agrees on plan to pull back tanks and weapons

GOVERNMENTS/CENTRAL BANKS

Fed’s Mester: US can handle rate hike this year – Nikkei

Moody’s: Govt. shutdown doesn’t directly affect creditworthiness of US government – Rtrs

ECB’s Weidmann: Deflation Concerns Have Dissipated – NASDAQ

ECB’s Makuch: Would Be Speculative To Consider Adjustments To QE – ForexLive

ECB’s Nowotny: Risk Overstretching Mandate Without Monetary Union – FXStreet

Villeroy Cleared to Become Next Governor of Bank of France – BBG

Bank of France Nominee Villeroy: Mario Draghi’s current MonPol is the right one – Rtrs

Japanese PM Abe: Japan has successfully shrugged off the ‘deflation mindset’ – BBG

Abe adviser calls for extra stimulus in Japan – FT

RBA under pressure to cut rates – AFR

FIXED INCOME

Treasury yields fall to lowest level in a month – MktWatch

European Yields Reflect Slow Inflation Adding to Pressure on ECB – BBG

Market liquidity warning from IMF – FT

FX

USD: Dollar slips as commodity currencies steady – Rtrs

CAD: Canadian dollar hit fresh 11-year lows before rebounding – CBC

EUR: US Dollar Pares Gains, Euro Off Daily Lows – WBP

ECB: Forex Reserves Rise To EUR 264.7bln, Up EUR 400mln

ENERGY/COMMODITIES

Crude futures jump nearly 2%, ahead of weekly API Supply Report – Investing.com

Gold ends lower for third straight session – MktWatch

Copper Ends Longest Slump in a Month as Demand Concerns Subside – BBG

EQUITIES

Wall Street mixed in choppy trade – Courier Mail

Europe closes lower as Glencore soars 16.9%, oil up 2% – CNBC

FTSE 100 falls, with Wolseley hit by weaker revenue outlook – BBC

Wells Fargo cuts S&P 500’s year-end target to 2,025-2,125 range – MktWatch

M&A: InBev Said to Line Up BofA, Santander on SABMiller Financing – BBG

M&A: Axel Springer to Purchase Majority Stake in Business Insider for $344.1mln – WSJ

MINERS: Glencore says it is ‘operationally and financially robust’ – BBC

AUTOS: VW chief Matthias Mueller pledges fix for emissions faults – FT

AUTOS: Porsche board to name new CEO on Wednesday – source on Rtrs

FINANCIALS: Bank of America to Lay Off Employees in Banking, Markets – WSJ

FINANCIALS: Societe Generale considers closing a fifth of retail branches – FT

FINANCIALS: RBS CEO: Could Buy Back Shares To Speed Up Govt. Exit – Rtrs

FINANCIALS: GE And MS Said To Delay Deadline On Commercial Assets Bid – AFR

TOBACCO: Reynolds American to sell some assets to Japan Tobacco for $5bln – MktWatch

INDUSTRIALS: Boeing to Start Delivering Military Helicopters to India in 2018 – WSJ

TECH: Twitter is getting ready to drop its 140-character limit – Re/Code

TECH: Google unveils two Nexus phones, 5X and 6P – CNBC

EMERGING MARKETS

India’s Central Bank Cuts Key Interest Rate More Than Expected – WSJ

Ukraine group agrees on plan to pull back tanks and weapons – IFX

- BofA Issues Dramatic Junk Bond Meltdown Warning: This "Train Wreck Is Accelerating"

On Tuesday, Carl Icahn reiterated his feelings about the interplay between low interest rates, HY credit, and ETFs. The self-feeding dynamic that Icahn described earlier this year and outlined again today in a new video entitled “Danger Ahead” is something we’ve spent an extraordinary amount of time delineating over the last nine or so months. Icahn sums it up with this image:

The idea of course is that low rates have i) sent investors on a never-ending hunt for yield, and ii) encouraged corporate management teams to take advantage of the market’s insatiable appetite for new issuance on the way to plowing the proceeds from debt sales into EPS-inflating buybacks. The proliferation of ETFs has effectively supercharged this by channeling more and more retail money into corners of the bond market where it might normally have never gone.

Of course this all comes at the expense of corporate balance sheets and because wide open capital markets have helped otherwise insolvent companies (such as US drillers) remain in business where they might normally have failed, what you have is a legion of heavily indebted HY zombie companies, lumbering around on the back of cheap credit, easy money, and naive equity investors who snap up secondaries.

This is a veritable road to hell and it’s not clear that it’s paved with good intentions as Wall Street is no doubt acutely aware of the disaster scenario they’ve set up and indeed, they’re also acutely aware of the fact that when everyone wants out, the door to the proverbial crowded theatre will be far too small because after all, that door is represented by the Street’s own shrinking dealer inventories. Perhaps the best way to visualize all of this is to have a look at the following two charts:

So now that the wake up calls regarding everything described above have gone from whispers among sellsiders to public debates between Wall Street heavyweights to shouts channeled through homemade hedge fund warning videos, everyone is keen to have their say. For their part, BofAML is out with a new note describing HY as a “slow moving trainwreck that seems to be accelerating.” Below are some notable excerpts:

A slow moving train wreck that seems to be accelerating

For five months in a row now more than 50% of the sectors in our high yield index have had negative price returns. That’s the longest such streak since late 2008 (Chart 1). This isn’t to whip up predictions of utter doom and gloom as in that fateful year. But it’s a stark statistic, highlighting our principal refrain for the last several months – this isn’t just about one bad apple anymore. The weakness in high yield credit is to us not just a commodity story; it is about highly indebted borrowers struggling to grow, an investor base that cannot digest more risk, a market that has usually struggled with liquidity and an economy that refuses to rise above mediocrity.

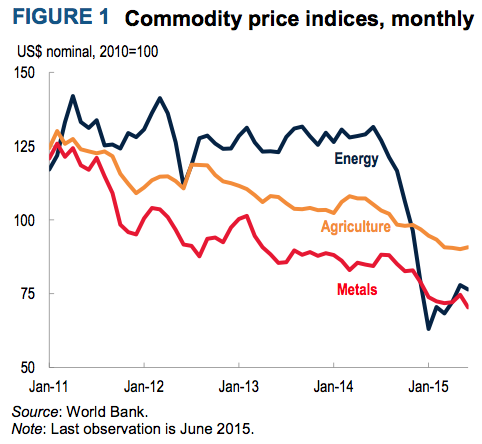

The problems in the coal sector that began to surface two years ago were perhaps the canary in the coal mine in hindsight. It was easy to dismiss a tiny sector with badly managed companies in a product that was facing secular headwinds as a one-off. But then we had the collapse in oil prices, much more difficult to ignore given the sheer size of the Energy sector in high yield. Barely had the market got its head around the scale of the issue when metals and miners started showing tremors. Now it’s the entire commodity complex.

At this juncture, BofAML has a rather disconcerting premonition. Essentially the banks’ strategists suggest that everything is about to become a junk bond, that corporate management teams will be tempted to resort to fraud, and that a dearth of liquidity threatens to bring the entire house of cards tumbling down:

Around this time last year, when our view on HY began turning decidedly less rosy, the biggest pushback we got from clients was that we were too bearish. A couple of months back, as our anticipated low single digit return year looked likely to come to fruition, many clients began to sympathize with our view, but challenged us on our contention that there were issues beyond the commodity sector. Tellingly, we now have an Ex- Energy/Metals/Mining version of almost every high yield metric we track (it started off as just Ex-Energy last year). Point out the troubles in Retail and Semiconductors and pat comes the reply that one’s always been structurally weak and the other’s going through a secular decline. Mention the stirring in Telecom and we’re told that it’s isolated to the Wirelines. When we began writing this piece, Chemicals and Media were fine, and Healthcare was a safer option; not so much anymore. At this pace, we wonder just how long until our Ex-Index gets bigger than our In-Index.

As Chart 2 shows, the malaise is spreading, albeit slowly. Price action has no doubt been violent over the last twelve months, but it has now started ensnaring non-commodity related bonds too. Over a third of the bonds that have experienced more than a 10% price loss this month belong neither to Energy nor Basic Industries.

Admittedly, over the last few weeks several conversations have indicated a slow acceptance that the turn of the credit cycle is upon us. That however is just the beginning. We suspect that this is the start of a long, slow and painful unwind of the excesses of the last five years.

Along with decompression comes a tick up in defaults, and we expect those to increase in 2016 and 2017. Although a company with a poor balance sheet doesn’t necessarily default, all defaulted issuers have poor fundamentals- and we see a lot of companies with lackluster balance sheets and earnings. The difference why in one environment an issuer survives while in another it doesn’t has as much or more to do with risk aversion and the subsequent conscious decision to no longer fund the company than any change in leverage or earnings. And risk aversion, as noted above, is increasing amongst our clientele. As more investors continue to see the forest for the trees, we believe they will see what we have seen: a series of indicators that are consistent with late cycle behavior that we think clearly demonstrates a turn of the credit cycle.

Finally, there is other typical late-stage behavior that is observable but difficult to quantify. We often see that a cycle is approaching its end when the bad apples start visibly separating out from the pack as idiosyncratic risk surfaces. We saw this first with Energy and Retail, then Telcos and Semis, and now creeping into some of the perceived ‘safe havens’ such as Healthcare and Autos. This is also when company balance sheets that have amassed debt during the cycle start to show visible cracks and investors question whether companies have enough earnings capacity to grow into their balance sheet. Terms of issuance become more issuer-unfriendly and non-opportunistic deals go through pushing new issue yields up. This is also a time when problems surface (Volkswagen), and negative surprises have the capability to cause precipitous declines in stocks and bonds (Valeant, Glencore).

Though we don’t and won’t pretend to predict the next corporate scandal or regulatory hurdle, what we do know is that as cycles become long in the tooth, companies could act desperately.

In addition to a world of lackluster earnings, bloated balance sheets, and worrying global economic conditions, we’re hard-pressed to come up with any client conversation we’ve had on HY over the last 12 months that hasn’t included a tirade on appalling bond market liquidity.

We’ve heard from several portfolio managers with many years of investing experience behind them that this is by far the worst they have seen. Anecdotal evidence from our trading desk also seem to support this view.

We certainly think liquidity is a problem in this market. In fact it was the very reason that our concerns about HY became magnified last fall, as the inability to enter and exit trades easily leads to more volatility and contagion into seemingly unaffected sectors (sell not what you want to, but what you can).

Got all of that? If not, here’s a video summary:

And then there is of course UBS, who has been calling for the HY apocalypse for months. Here’s their latest:

Corporate credit markets have been under significant pressure in recent sessions, with idiosyncratic events erupting across the auto (VW), metals/mining (Glencore), TMT (Sprint, Cablevision), healthcare (Valeant) and emerging market (Petrobras) sectors, respectively. US IG and HY spreads widened 5bp and 27bp, respectively, to levels of approximately 180bp and 675bp, at or exceeding previous wides recorded in 2015.

Here’s our short take: US high grade and high yield markets have suffered under the weight of weak commodity prices, heightened issuance (and the forward calendar), the rally in the long bond, rising idiosyncratic risks and illiquidity limiting the recycling of risk. Lower commodity prices are increasingly pressuring metals/mining and energy firms because prices are so low that many business models are essentially broken. Heavy supply, specifically in the high grade market, is a result of releveraging announcements to satiate equity investors and there have been few signs that management teams are retrenching – effectively setting up a standoff between equity and bond investors where ultimately the path to slower issuance is a broader re-pricing in spreads. Falling Treasury yields have chilled the demand from yield bogey buyers as rates have fallen faster than spreads have widened. Rising idiosyncratic risk, although it arguably is thematically symptomatic of late stage antics where firms are under massive pressure to boost profits (e.g., VW, Valeant), has added accelerant to the fire. And lack of liquidity has made the recycling of risk increasingly difficult.