- Retailer Bankruptcies Are Hailing Down on the US Economy

Wolf Richter www.wolfstreet.com

Another retailer is heading for bankruptcy. This time Aeropostale, with 800 teen-clothing stores, after three years in a row of losses. It’s “preparing to reorganize under a Chapter 11 bankruptcy, and could file as soon as this month, according to people familiar with the matter,” Bloomberg reported today.

Upon Bloomberg’s propitious report, Aeropostale shares plunged 28% to 15 cents. It has been a penny stock since last September. The New York Stock Exchange, which had threatened the company with delisting, removed the stock before 2 p.m. today, and trading of the shares has been suspended.

Bloomberg:

Aeropostale is trying to work out a loan to finance its operations during the bankruptcy process, according to the people. A deal to avert a filing or find a buyer also could still emerge, they said.

Which is what just about all collapsing retailers are valiantly trying to do. And often to no avail.

In March, Aeropostale had already announced that it would “evaluate strategic alternatives.” It hired Stifel Financial Corp. to work on a sale or restructuring. According to Bloomberg, it’s also working with law firm Weil Gotshal & Manges LLP and FTI Consulting, “people familiar with the matter said last week.”

As in so many cases, there is a private equity angle. PE firm Sycamore Partners owns a large state in Aeropostale and is its main lender. But they have been embroiled in a feud. Sycamore also owns Aeropostale’s key clothing supplier, MGF.

In 2013, when Sycamore acquired its stake in Aeropostale and lent if $150 million, it obtained two seats on the board and set up the supply deal with MGF. Bloomberg:

At the time, Sycamore was seen as possible savior for the troubled chain. Some investors expected the investment firm to eventually acquire the rest of Aeropostale, helping redeem a stock that has been declining since 2010.

But that didn’t work out. These hopeful investors lost their shirts. Sycamore’s two directors left Aeropostale’s board. In March, Aeropostale said that MGF has stopped delivering merchandise in violation of the terms of its agreement, leaving the retailer short on merchandise. MGF, as Bloomberg put it, said “it was merely seeking protection from Aeropostale.”

There are numerous other 1990s and 2000s brands that didn’t quite make the transition in the relentlessly tough US retail environment of squeezed consumers, fickle and picky teens, smart women, shoppo-phobic men, inscrutable millennials, and a brutal shift to online sales.

And now their bankruptcies are hailing down on the US economy with increasing intensity. Here are a few standouts in 2016 and 2015. Note the PE firms behind many of them:

April 16, 2016: Vestis Retail Group, the operator of sporting goods retailers Eastern Mountain Sports (camping, hiking, skiing, adventure sports), Bob’s Stores (family clothing and shoes), and Sport Chalet (general sporting goods), filed for Chapter 11 bankruptcy. It will close all 56 stores and stop online sales.

In the filing, it blamed the going-out-of-business sales at “certain Sports Authority locations,” plus the weather, which had been too warm, and trouble with switching to a new software platform. It’s owned by private equity firm Versa Capital Management LLC.

April 7, 2016: Pacific Sunwear of California, clothing retailer with nearly 600 stores and derailed ambitions of skate-and-surf cool, filed for Chapter 11 bankruptcy. PE firm Golden Gate Capital, a lender to the company, agreed to convert over 65% of its loan into equity of the reorganized company and add another $20 million in financing. Wells Fargo agreed to provide $100 million of debtor-in-possession financing.

March 2, 2016: Sports Authority filed for Chapter 11 bankruptcy. It said it would close 140 of its 450 stores, including all stores in Texas. In 2006, it had been taken over in a leveraged buyout by a group of PE firms led by Leonard Green & Partners [Another Private-Equity LBO Queen Bites the Dust].

February 2, 2016: Hancock Fabrics filed for Chapter 11 bankruptcy, for the second time. It closed 70 of its retail sewing and crafting stores. Its inventories are being liquidated with going-out-of-business sales at the remaining 185 stores.

January 16, 2015: Wet Seal, teen fashion retailer, filed for Chapter 11 bankruptcy.

October 2015: American Apparel filed for Chapter 11 bankruptcy, after years of all sorts of sordid turmoil – and losses since 2009.

In 2014, hedge fund Standard General entered into a deal with the company’s “controversial” founder and former CEO Dov Charney. The deal raised his stake to 43% but gave the hedge fund a big block of the shares as collateral. The hedge fund and some other investors also own a big part of American Apparel bonds and thus control the bankruptcy negotiations. The hedge fund expects to emerge owning about a quarter of the restructured company’s debt and about 5% of its new equity.

September, 2015: Quiksilver, surfwear retailer, filed for Chapter 11 bankruptcy. In January, 2016, it emerged from bankruptcy and is now controlled by PE firm Oaktree Capital.

June, 2015: Anna’s Linens filed for Chapter 11 bankruptcy.

April 2015: Frederick’s of Hollywood filed for Chapter 11 bankruptcy

February 2015: RadioShack filed for Chapter 11 bankruptcy. In May 2015, Standard General took control of it in a bankruptcy auction.

February 2015: Cache Inc., women’s dress and formal-wear retailer, filed for Chapter 11 bankruptcy.

January 2015: Body Central Corp, women’s clothing retailer, after announcing it was exploring a Chapter 11 bankruptcy, ended up not filing, but closed its 265 stores under a Florida process called “an assignment for the benefit of creditors.”

These are the ugly skid marks of the “end of the credit cycle,” as it’s called, an era when defaults and bankruptcies suddenly re-materialize, and when investors get to eat big losses in what they thought were conservative investments.

In March, total commercial bankruptcy filings by corporations of all sizes and other business entities jumped 25% from a year ago to a total of 3,351, with the two biggest culprits being energy and, well, retail. Read… US Commercial Bankruptcies Suddenly Soar

- Is Hillary Clinton The Democrats' Richard Nixon?

Authored by Eric Zuesse,

Richard Nixon’s similarities to Hillary Clinton are remarkable:

1: Both were highly successful politicians who had exceptionally negative net-approval ratings from the U.S. public, but were viewed highly favorably by the voters within their own Party.

2: Both were unsuccessful in their first run for the Presidency, but managed to come back and ran considerably more successful campaigns the second time around.

3: Both were highly distrusted, except by the voters within their own Party.

4: Both went into their Presidential campaign years (especially the second time around) as being “the candidate with experience.”

5: Both were war-hawks and proponents of a big military, but were also liberals on social policies and regulatory policies (for example, Nixon signed into law the National Environmental Policy Act, several environmental initiatives including the Clean Air and Clean Water Acts, the Mammal Marine Protection Act, and the creation of the Environmental Protection Agency; and, he started the Earned-Income Tax Credit, which "now lifts more children out of poverty than any other government program”).

6: Whereas Nixon, running during the Cold War against the sitting Vice President Hubert Humphrey in 1968, lied that he had ‘a secret plan to end the Vietnam war' (he actually had — and applied — a secret plan to extend the Vietnam war), and he won the Presidency on the basis of that lie; Hillary Clinton, running against the anti-restoration-of-the-Cold-War progressive Bernie Sanders in 2016, lies by saying that she has a plan to end the war in Russia-allied Syria. Sanders says: “Of course Assad is a terrible dictator. But I think we have got to get our foreign policies and priorities right. The immediate — it is not Assad who is attacking the United States. It is ISIS. And ISIS is attacking France and attacking Russian airliners. The major priority, right now, in terms of our foreign and military policy should be the destruction of ISIS.” Clinton says an emphatic no to that: "Assad has killed, by last count, about 250,000 Syrians. The reason we are in the mess we're in, that ISIS has the territory it has, is because of Assad.” So, she is promising regime-change in Syria and saying that it’s the prerequisite to defeating ISIS — which is an absurd lie, since ISIS, and Al Qaeda, and all the other jihadist groups who have flocked into Syria to overthrow and replace Assad, are certainly not the way to defeat ISIS, nor to defeat the other jihadist groups there, all of which are anti-Assad, as is Clinton herself. Clearly, then, her ‘plan’ to win the war in Syria is, essentially, to replace Assad with jihadists — to whom the U.S. is sending thousands of tons of weapons. Her Big Lie there is merely stupider than Nixon’s (it’s transparently stupid, because both she and ISIS aim, above all, to overthrow Assad), but it’s just as much a lie about war-and-peace as was Nixon’s ’secret plan to end the Vietnam war’; and, in that sense, it is remarkably similar and (like Nixon’s lie was) can be believed only by liar-trusting fools, including virtually all members of the candidate’s own Party, plus a large percentage of political independents.

7: Both Richard Nixon and Hillary Clinton were/are famous for being secretive, and for distrusting everyone except his/her proven-loyal personal entourage — loyalty is a higher value to them than is any other. They are paranoid — very us-versus-‘them’ — and all-too-willing to use unethical means of defeating ‘them’ (not really the American people’s foreign ‘enemy’, but, above all, their own domestic “enemies-list”).

8: Both Nixon and Clinton famously use curse-words profusely in private, and treat their subordinates like trash, and rule them by fear.

9: Both of them had/have established records backing coups abroad, in order to impose the will of America’s President, no matter how bloody (such as the coups that overthrew Mossadegh in Iran in 1953 and Allende in Chile in 1973, and the coups that overthrew Zelaya in Honduras in 2009, and Yanukovych in Ukraine in 2014).

* * *

Investigative historian Eric Zuesse is the author, most recently, of They’re Not Even Close: The Democratic vs. Republican Economic Records, 1910-2010, and of CHRIST’S VENTRILOQUISTS: The Event that Created Christianity.

- Denver Schools To Arm Guards With Military-Style Rifles

Submitted by Mac Slavo via SHTFPlan.com,

Are children safe in public schools?

If the answer seems pretty obvious, it is confirmation that society has definitely gone to extremes that would not have been recognizable in past decades of American history.

Now Denver-area schools are becoming the first to guard their student populations with military-style semiautomatic rifles, and things certainly appear to be escalating.

via NBC News/AP:

A suburban Denver school district is arming its security staff with military-style semiautomatic rifles in case of a school shooting or other violent attack, a move that appears unprecedented even as more schools arm employees in response to mass violence elsewhere.

The guards, who are not law enforcement officers, already carry handguns.

[…]

The move raised new questions about how far school officials should go in arming employees, a practice that has become standard in the aftermath of the 2012 Sandy Hook Elementary School shootings.

One can only hope that these weapons would stop a shooter before they could hurt anyone, but there isn’t any guarantee.

Active shooters, mass killings and militarized police and security now haunt the halls where education and learning is supposed to be taking place. More children than ever before are on pharmaceutical medications, despite the known links to suicide and homicide. Between Common Core and politically-correct policies, these institutions are teaching that up-is-down, and down-is-up like never before.

One school in Florida even punished a 16-year old student for wrestling a gunman threatening other students to the ground and preventing a shooting. Active shooter and martial law drills have become commonplace, and many of them have been unannounced, causing terror and panic in students and teachers.

While most schools remain “gun-free zones” and have been reluctant to allow teachers to be armed in the case of the worst incidents, many have readily invested in armed security, surveillance technology and counter-terrorism approaches to “safety” in schools.

The result has been a heightened atmosphere that is increasingly paranoid, and ready to treat anyone and everyone as potential suspects – including children:

Ken Trump, a school safety consultant in Cleveland, said the Douglas County case may mark the first time a district has equipped its in-house security officers with semiautomatic rifles.

“Taking this step certainly ratchets up a notch the whole idea, the question of what’s reasonable, what’s necessary in terms of arming officers,” Trump said.

But are they being protected from potential violence, or indoctrinated in a police state society where even children are under sharp suspicion, and misbehavior is criminalized? Can we see down the road as to whether this is likely to tend towards more freedom, or less? More armed citizens is positive, but more guns only in the hands of police, but private and public, may prove not be.

Regardless, it is a precedent for the growing police state society that expects individuals to conform to the masses, and obey authorities at all costs. Michael Snyder argued that public schools are purposely preparing students to live in such a society:

Our children are the future of America, and our public schools are systematically training them to become accustomed to living in a “Big Brother” police state. All across the United States today, public schools have essentially become “prison grids” that are run by control freaks that are absolutely obsessed with micromanaging the lives of their students down to the smallest detail. As you will read about below, students all over the country are now being monitored by RFID microchips, their lunches are being inspected on a daily basis by school administrators, and the social media accounts of students are being constantly monitored even when they are at home.

[…] One thing that was unheard of back when I was in high school was “active shooter drills”. They are being held in school districts all over the nation today, and they often involve the firing of blanks and the use of fake blood.

In typical fashion, Snyder goes on to make a long list of bizarre school practices that will make your head spin, and are, frankly, teaching the future members of society how to become helpless slaves.

Everyone can see that there is a problem, but nobody seems to know the way to fix it.

There is a fine line somewhere in there…

- Hundreds Of Chinese Children Mysteriously Fall Ill Suffering From Nose Bleeds, Rashes, Coughing

Hundreds of school children in East China’s Jiangsu Province have fallen mysteriously ill, suffering from nose bleeds, itching, rashes, coughing, and other complicated symptoms, whose cause has not been determined.

CRI reports that some of the parents alleged that they noticed irritant smells at the school. They suspect that the smell comes from chemical factories near the school, which they believe are the main causes of their children’s symptoms.

This is the second week in a row where students were found to be suffering from the same symptoms in the same province.

As a result, local authorities have mandated that five chemical factories near the school suspend operations. Meanwhile, the school insists on continuing all school activities as usual.

Mckinsey estimated in a 2013 study that China would drive roughly 60% of global chemical market demand growth from 2011 to 2020. As firms scramble to get chemical plants up and running in China, it appears that “safety” was conveniently brushed aside and is now leading to dramatic consequences for all those in the vicinity .

- Commodity Trader: "What Is Happening Has Absolutely No "Reasonable" Explanation"

One commodity trader writes in with some very unique observations. From trader "Peter"

* * *

The insanity has now fully spilled into the commodity markets – a market which I professionally made a transition to after the 2008 crisis from the financial markets, simply because I believed it was a market that would still function according to true fundamentals…

I guess that only lasted so long…

The commodity markets have been prone to excessive speculation for years, but at the end, the thought of specializing in something “tangible” that EVENTUALLY would have to revert back to true supply and demand fundamentals made all the sense in the world. Specially with the true circus that the financial markets have become since 2008…

* * *

From: XXXXXXXXXX

To: "Peter"

Sent: Wednesday, April 20, 2016 1:35 PM

Subject: volume totals today774K of soybeans traded today and that would be a record by nearly 160K contracts as yesterday set the record at 615K.

Over 88K Jly/Nov traded today and 97K May/Jly traded. Unheard of non-roll numbers.

Meal volume was 270K and we have to think that was a record as well but not 100% on that one.

Lots of ideas around to try and explain the move: from commercial short hedgers blowing out, Chinese pricing, product switching from Argentina to the US.

Not really sure if all or any of this is true but it was quite a wild session

* * *

From: "Peter"

Sent: Wednesday, April 20, 2016 2:41 PM

To: XXXXXXXXXX

Subject: RE: Some staggering volume totals todayMan… I would be VERY surprised if this was due to any of the reasons people are mentioning…

Chinese pricing – I am very positive it does have something to do with it, but for the overnight session – not the daytime.

Commercial hedgers blowing out – very possibly adding to the mess – but no way commercial volume takes us to these levels of ridiculousness in total volume…

Product switching from ARG – yep, because we REALLY need to ration our 400+ mb bean stocks… LOLThis is way past insane, ridiculous, etc…

The “fundamental” reasons people are trying to ping to this are simply a nice “window dressing”…

There is nothing else that can explain this other than you know what?

Here comes my Very-REAL Conspiracy Theory: the stupid FED and other Central Bankers around the world acting in unison to artificially raise inflation so that they can hopefully get out of the F’ing mess they got themselves into with this low/negative rate BS. Call me crazy, and I am not a “conspiracy theorist” – but what is happening has absolutely no “reasonable” explanation. So I have to think outside the box…

The FED and other Central Banks have already destroyed the equity and other macro-financial markets… it is now turn for the commodities markets…

I am serious … I really am… I wish I was just being sarcastic… but pause for a moment and think about what is written above…

What explains the move in Crude? Ok, I could try and put some sort of “rationality” on the initial move from $26 – $40 (as crazy as it was), but the action in the oil market since Sunday’s “about face” in Doha? No way anything other than pure, simple and outright manipulation can explain these last 3 days of action in the crude oil market… nothing…

How about the fact that the main drag on the inflation figures has been what? What? FOOD & ENERGY…

So is it so crazy to think that Central Bankers all got together in early 2016 and came up with the following equation???

ARTIFICIALLY RAISE COMMODITY VALUATIONS = HIGHER ARTIFICIAL INFLATION = CLAMORING FOR RATES TO BE RAISED = CENTRAL BANKS HAVING A “SUCCESSFUL” END TO THE CLUSTERFCK THEY GOT THEMSELVES AND THE REST OF ALL OF US INTO WITH THEIR “ZIRP” AND “NIRP” EXPERIMENTS…

Who or what has the power to produce such volume in such short amount of time?????? Not the powerful Chinese, not the commercials, not even the “regular” hedge fund crowd… This is much bigger than that Chris… much bigger…

When you pause and think about what I just wrote – it will not sound that crazy after all…

I truly wish I was joking…

I also wish I could let go of my natural makeup of focusing on “fundamentals” and just go long everything… but I don’t believe I can… and I am frankly and idiot for it…

Don’t write this off as some crazy conspiracy… Think about it… it is almost scary how much sense it makes…

At the end of the day… it is what it is…Peter

- Is Bitcoin About To Soar?

Back on September 2, 2015 when bitcoin was trading at $230, we laid out the simplest and most fundamental reason why, irrelevant of one’s ideological persuasion with “alternative” or digital currency – bitcoin would soar.

it was earlier this summer when the digital currency, which can bypass capital controls and national borders with the click of a button, surged on Grexit concerns and fears a Drachma return would crush the savings of an entire nation. Since then, BTC has dropped (in no small part as a result of the previously documented “forking” with Bitcoin XT), however if a few hundred million Chinese decide that the time has come to use bitcoin as the capital controls bypassing currency of choice, and decide to invest even a tiny fraction of the $22 trillion in Chinese deposits in bitcoin (whose total market cap at last check was just over $3 billion), sit back and watch as we witness the second coming of the bitcoin bubble, one which could make the previous all time highs in the digital currency, seems like a low print.

For now only a small fraction of the eligible potential Chinese bitcoin users have emerged. Even so, bitcoin is now double the price where it was when we wrote the above forecast.

But what if just like every other market, fundamentals only matter to a certain extent, and what is far more important is the algos scanning for patterns and creating self-fulfilling chartist prophecies.

In other words, what if the Bitcoin technicals are far more important? Then we may be about to see a major breakout to the upside. As Dan Eskola writes, “a large move in bitcoin” is imminent.

He explains why:

A “Bullish Pennant” is a buy indicator. It exists here since the price action in October 2015 was bullish. Since then the prices have stabilized somewhat but have not sold off or broke out higher. Bitcoin prices are searching for direction.

The long term chart also shows some common characteristics.

Fundamental analysis is great, technical analysis is easy. The following fundamental bullish factors indicate that the prices for Bitcoin are headed higher.

- A finite number of Bitcoin will be mined.

- Central bankers are convinced inflation targeting is the correct policy action to promote price stability.

- Capital controls in struggling economies are creating new users of Bitcoin.

- Easier to transfer than Gold, the traditional inflation hedge.

- ETF $COIN seeking regulatory approval will expand market awareness and offer another vehicle for investors.

I believe the market participants that price Bitcoin use technical analysis because it is easy and fundamental analysis is difficult. I believe that Bitcoin prices will move higher for the rest of 2016.

- 47% Of Americans Can't Even Come Up With $400 To Cover An Emergency Room Visit

Submitted by Michael Snyder via The Economic Collapse blog,

If you had to make a sudden visit to the emergency room, would you have enough money to pay for it without selling something or borrowing the funds from somewhere?

Most Americans may not realize this, but this is something that the Federal Reserve has actually been tracking for several years now. And according to the Fed, an astounding 47 percent of all Americans could not come up with $400 to pay for an emergency room visit without borrowing it or selling something.

Various surveys that I have talked about in the past have found that more than 60 percent of all Americans are living to paycheck to paycheck, but I didn’t realize that things were quite this bad for about half the country. If you can’t even come up with $400 for an unexpected emergency room visit, then you are just surviving from month to month by the skin of your teeth. Unfortunately, about half of us are currently in that situation.

Earlier today someone pointed me toward an excellent article in The Atlantic that discussed this, and I have to admit that The Atlantic is one of the last remaining bastions of old school excellence in journalism that you will find in the mainstream media. Of course I don’t see eye to eye with them on a lot of things philosophically, but there are some really hard working journalists over there.

The article where I found the 47 percent figure comes from The Atlantic, and it is entitled “The Secret Shame of Middle-Class Americans“. It was authored by Neal Gabler, and he says that he can identify with the 47 percent of Americans that don’t have $400 for an unexpected emergency room visit because he is one of them…

I know what it is like to have to juggle creditors to make it through a week. I know what it is like to have to swallow my pride and constantly dun people to pay me so that I can pay others. I know what it is like to have liens slapped on me and to have my bank account levied by creditors. I know what it is like to be down to my last $5—literally—while I wait for a paycheck to arrive, and I know what it is like to subsist for days on a diet of eggs. I know what it is like to dread going to the mailbox, because there will always be new bills to pay but seldom a check with which to pay them. I know what it is like to have to tell my daughter that I didn’t know if I would be able to pay for her wedding; it all depended on whether something good happened. And I know what it is like to have to borrow money from my adult daughters because my wife and I ran out of heating oil.

To me, this is yet more evidence that the middle class in America is dying.

Last year, it was reported that middle class Americans make up a minority of the population for the very first time in our history.

But back in 1971, 61 percent of all Americans lived in middle class households.

So what happened?

Well, the big corporations started shipping millions of good paying manufacturing jobs overseas. Millions of other good paying jobs were replaced by technology, and the competition for the good jobs that remained became extremely intense.

During the good times, the U.S. economy still created new jobs, but most of those jobs were low paying service jobs.

At this point, a majority of American workers have jobs that would be considered low paying. In fact, 51 percent of all American workers make less than $30,000 a year according to the Social Security Administration.

And once you account for inflation, the truth is that our incomes have been going down for years. According to a study that was released by Pew Charitable Trusts, median household income in the United States decreased by 13 percent between 2004 and 2014.

That isn’t “progress” any way that you slice it.

If you go all the way back to 1970, the middle class took home approximately 62 percent of all income in the United States.

Today, that number has fallen to just 43 percent.

So the fact that 47 percent of Americans can’t even pay for an unexpected emergency room visit is not exactly a surprise. To be honest, a whole host of other surveys have come up with similar numbers. Here is more from Neal Gabler…

A 2014 Bankrate survey, echoing the Fed’s data, found that only 38 percent of Americans would cover a $1,000 emergency-room visit or $500 car repair with money they’d saved. Two reports published last year by the Pew Charitable Trusts found, respectively, that 55 percent of households didn’t have enough liquid savings to replace a month’s worth of lost income, and that of the 56 percent of people who said they’d worried about their finances in the previous year, 71 percent were concerned about having enough money to cover everyday expenses.

What all of these numbers tell us is that the middle class is disappearing. I tend to compare it to a game of really bizarre musical chairs. With each passing month more chairs are being pulled out of the circle, and those members of the middle class that haven’t fallen into poverty yet are just hoping that a chair will still be there for them when the music stops.

Even during the “Obama recovery”, we have seen poverty in America absolutely explode. In fact, some brand new numbers just came out that are quite startling. The following comes from another author for The Atlantic named Gillian B. White…

Recently, the Brookings Institution published a report looking at the same idea but giving it a different name. The paper, builds on research from the British economist William Beveridge, who in 1942 proposed five types of poverty: squalor, ignorance, want, idleness, and disease. In modern terms, these could be defined as poverty related to housing, education, income, employment, and healthcare, respectively. Analyzing the 2014 American Community Survey, the paper’s co-authors, Richard Reeves, Edward Rodrigue, and Elizabeth Kneebone, found that half of Americans experience at least one of these types of poverty, and around 25 percent suffer from at least two.

To underscore this point, let me just run five quick facts about the growth of poverty in this country by you…

–The number of Americans that are living in concentrated areas of high poverty has doubled since the year 2000.

–In 2007, about one out of every eight children in America was on food stamps. Today, that number is one out of every five.

–46 million Americans use food banks each year, and lines start forming at some U.S. food banks as early as 6:30 in the morning because people want to get something before the food supplies run out.

–The number of homeless children in the U.S. has increased by 60 percent over the past six years.

–According to Poverty USA, 1.6 million American children slept in a homeless shelter or some other form of emergency housing last year.

That last number really gets me every time.

How can “the wealthiest and most powerful nation on the planet” have more than a million homeless children?

This is one of the reasons why I hammer on our ongoing economic collapse over and over and over. It is affecting real families with real children that have real hopes and real dreams.

This is not the way our country is supposed to work.

It is supposed to be “the land of opportunity”.

It is supposed to be a place where anyone can live “the American Dream”.

But instead it has become an economic wasteland where the largest and most prosperous middle class in the history of the world is being systematically eviscerated.

So no, the U.S. economy is not doing “just fine” – anyone that tries to tell you that lie is simply peddling fiction.

- Pimco Economist Has A Stunning Proposal To Save The Economy: The Fed Should Buy Gold

Back in December 2014, just before the ECB officially launched its initial phase of QE in which it would monetize government bonds, Mario Draghi was asked a very direct question: what types of assets could the ECB buy as part of its quantitative easing program. He responded, “we discussed all assets but gold.”

The reason for his tongue in cheek response was because over the prior few weeks speculation had arisen that gold could be part of the central bank’s asset purchases after Yves Mersch, a member of the ECB executive board and former Governor of the Central Bank of Luxembourg, said on November 17 that “theoretically the ECB could purchase other assets such as gold, shares, ETFs to fulfill its promise of adopting further unconventional measures to counter a longer period of low inflation.“

Mario Draghi promptly shot down that idea.

But according to a provocative paper released by none other than Pimco’s strategist Harley Bassman, Yves Mersch’s inadvertent peek into what central bankers are thinking, may have been on to something.

In “Rumpelstiltskin at the Fed“, Bassman goes down the well-trodden path of proposing Fed asset purchases as the last ditch panacea for the US economy, however instead of buying bonds, or stocks, or crude oil, Bassman has a truly original idea: “the Fed should unleash a massive Fed gold purchase program that could echo a Depression-era effort that effectively boosted the U.S. economy.“

He is of course, referring to FDR’s 1933 Executive Order 6102, which made it illegal for a citizen to own gold bullion or coins. Americans promptly sold their gold to the government at the official price of $20.67, with the resulting hoard of gold was then placed in Fort Knox.

The Gold Reserve Act of 1934 raised the official price of gold to $35.00, a near 70% increase. It also resulted in an implicit devaluation of the US dollar. As Bassman points out, over the three years from January 1934 to December 1936, GDP increased by 48%, the Dow Jones stock index rose by nearly 80%, and most salient to our topic, inflation averaged a positive 2% annually, despite a national unemployment rate hovering around 18%.

In short, a brief economic nirvana which was unleashed by the devaluation of the dollar confiscation of gold. In fact, we have frequently hinted in the past that another Executive Order 6102 is inevitable for precisely these reasons. However this is the first time when we see a “respected economist” openly recommend this idea as a matter of monetary policy.

Bassman says that the Fed should “emulate a past success by making a public offer to purchase a significantly large quantity of gold bullion at a substantially greater price than today’s free-market level, perhaps $5,000 an ounce? It would be operationally simple as holders could transact directly at regional Federal offices or via authorized precious metal assayers.”

What would the outcome of such as “QE for the goldbugs” look like? His summary assessment:

A massive Fed gold purchase program would differ from past efforts at monetary expansion. Via QE, the transmission mechanism was wholly contained within the financial system; fiat currency was used to buy fiat assets which then settled on bank balance sheets. Since QE is arcane to most people outside of Wall Street, and NIRP seems just bizarre to most non-academics, these policies have had little impact on inflationary expectations. Global consumers are more familiar with gold than the banking system, thus this avenue of monetary expansion might finally lift the anchor on inflationary expectations and their associated spending habits.

The USD may initially weaken versus fiat currencies, but other central banks could soon buy gold as well, similar to the paths of QE and NIRP. The impactful twist of a gold purchase program is that it increases the price of a widely recognized “store of value,” a view little diminished despite the fact the U.S. relinquished the gold standard in 1971. This is a vivid contrast to the relatively invisible inflation of financial assets with its perverse side effect of widening the income gap.

And before Krugman accuses Bassman of secretly being on our payroll, this is how Pimco’s economist defends his unorthodox idea:

Admittedly, this suggestion is almost too outrageous to post under the PIMCO logo, but NIRP surely would have elicited a similar reaction a decade ago. But upon reflection, it could be an elegant solution since it flips the boxes on a foreign currency “prisoner’s dilemma” (more on this below). Most critically, a massive gold purchase has the potential to significantly boost inflationary expectations, both domestic and foreign.

* * *

Many people will rightfully dismiss the gold idea as absurd, as just another fanciful strategy to print money; why not just buy oil, houses or some other hard asset? In fact, why fool around with gold; why not just execute helicopter money as originally advertised? I would answer the former by noting that only gold qualifies as money; and as for the latter, fiscal compromise on that order seems like a daydream in Washington today – don’t expect a helicopter liftoff anytime soon.

Let’s be honest; most people thought NIRP was just as nonsensical a few years ago, yet it has now been implemented by six central banks with little evidence it is effective. And while a gold purchase program should qualify as a fairy tale, what is unique here is that it actually occurred with a confirmed positive effect on the U.S. economy.

We agree, if for no other reason than everything central banks have done and tried in history has been a disastrous mistake, leading to either huge asset bubbles or massive busts, which in turn have needed even more spectacular bubbles to be reflated and so on. As such, the one thing that central banks should do is that which they are “genetically” against – purchasing the one asset class which is their inherent nemesis, the one Ben Bernanke said had value only because of “tradition”: Gold.

Of course, all of the above assumes Americans would be willing to sell their gold to the Fed at any prices, but as Bassman finally lays it out, it is worth finding out. Janet, are you listening?

* * *

Rumpelstiltskin at the Fed

Though it seems incredibly farfetched, a massive Fed gold purchase program could echo a Depression-era effort that effectively boosted the U.S. economy.

As our title alludes, I am about to spin a monetary policy fairy tale, a fantasy that could certainly never occur … except for the small detail that it’s happened before.

First I must remind you there are only two avenues out of a debt crisis – default or inflate – and inflation is just a slow-motion default. Thus in the darker days of the global financial crisis, the U.S. Federal Reserve set sail on a monetary experiment tangentially suggested by late Nobel laureate Milton Friedman, the original coiner of the phrase “helicopter money.” (Ben Bernanke borrowed this clever construct in his famous November 2002 speech, “Deflation: Making Sure ‘It’ Doesn’t Happen Here.”)

The notion was simple: Increase monetary velocity via financial repression to create inflation, depreciate nominal debt and deleverage both the public and private economies of the U.S. The toolkit of financial repression would include, but not be limited to, near-zero overnight interbank borrowing rates, massive asset purchase programs (also known as quantitative easing or QE), term surface restructuring (known as Operation Twist) and good old-fashioned jawboning, in this case taking the form of distant forward guidance.

Notwithstanding various political exhortations, there can be little doubt the Fed’s aggressive monetary policies after the collapse of Lehman Brothers were quite effective in cushioning the macro economy from the financial turmoil. Would the economy have cured itself without the Fed? We can’t prove a negative, but up until China allowed the devaluation of the yuan last August and Japan implemented negative interest rates in January, the Fed’s “Plan A” was working reasonably well.

But we do not operate in a vacuum, and various monetary machinations from the eurozone, Japan and China are now working in concert to export deflation to the U.S. This is quite worrisome as it may well hinder the U.S. economy from reaching the Fed’s target inflation level (2%) and escape-velocity economic growth.

Thus did Fed Chair Janet Yellen, in her most recent visit to Congress, tentatively start to explore a “Plan B” (which looks like Plan A on steroids) that includes, if only in theory, the barest remote possibility of a negative interest rate policy (NIRP).

There are a host of reasons PIMCO believes NIRP would be not only ineffective, but also possibly harmful to the U.S. economy, and these have been detailed by CIOs Scott Mather and Mihir Worah. But this does raise the question as to whether the Fed has indeed reached the bottom of its toolkit. Many things are possible, at least in theory, including the famous helicopter drop. Another option is to resurrect a plan that was actually implemented (with great success) 83 years ago.

The real fairy tale

From shortly after the October 1929 stock market crash to just before Franklin Delano Roosevelt became president in 1933, U.S. gross domestic product (GDP) declined by nearly 43%; during a similar timeframe, consumer prices declined by nearly 24%.

Employing what can only be described as force majeure politics, in April 1933 the U.S. government issued Executive Order 6102, which made it illegal for a citizen to own gold bullion or coins. Lest they risk a five-year vacation in prison, citizens sold their gold to the government at the official price of $20.67. This hoard of gold was then placed in a specially built storage facility – Fort Knox.

The Gold Reserve Act of 1934 raised the official price of gold to $35.00, a near 70% increase; positive results were almost immediate. Over the three years from January 1934 to December 1936, GDP increased by 48%, the Dow Jones stock index rose by nearly 80%, and most salient to our topic, inflation averaged a positive 2% annually, despite a national unemployment rate hovering around 18%.

Such a pity that these halcyon days were soon sullied as the government tightened financial conditions (both fiscal and monetary) from late 1936 to early 1937, which many point to as the precipitant of the Dow’s 33% decline. Additionally, the 1938 calendar reported a 6.3% decline in GDP and a 2.8% deflation in consumer prices. (Many suspect it is the fear of a 1937 redux that motivates the Fed to contemplate additional extraordinary actions, including NIRP.)

So in the context of today’s paralyzed political-fiscal landscape and a hyperventilated election process, how silly is it to suggest the Fed emulate a past success by making a public offer to purchase a significantly large quantity of gold bullion at a substantially greater price than today’s free-market level, perhaps $5,000 an ounce? It would be operationally simple as holders could transact directly at regional Federal offices or via authorized precious metal assayers.

Admittedly, this suggestion is almost too outrageous to post under the PIMCO logo, but NIRP surely would have elicited a similar reaction a decade ago. But upon reflection, it could be an elegant solution since it flips the boxes on a foreign currency “prisoner’s dilemma” (more on this below). Most critically, a massive gold purchase has the potential to significantly boost inflationary expectations, both domestic and foreign.

Asset or currency?

While never an officially stated policy, there has been a slow-moving, low-intensity currency war taking place over the past decade. The U.S. was the first mover, implementing QE in 2009, which had the effect of depreciating the trade-weighted U.S. dollar (USD) by 16%. Japan was next, implementing “Abenomics” in 2012; this helped depreciate the yen (JPY) versus the USD by over 30% in eight months. Europe went last when Mario Draghi followed through on “whatever it takes” in 2014; the euro devalued versus the USD from peak to trough by 24%. China had pegged the yuan to the USD to help maintain a stable trading environment, however, the increasing value of their currency against their other trading partners was hindering growth, and thus the motivation for a slight realignment last August.

The problem the world’s major economies now face is that any attempt to depreciate their currencies to improve the terms of trade must effectively come out of the pockets of their partners; this creates a classic prisoner’s dilemma. Thus the interesting twist of a Fed gold purchase program.

Warren Buffett famously railed against the shiny yellow metal in 2012 when he noted all the gold in the world could be swapped for the totality of U.S. cropland and seven ExxonMobils with $1 trillion left over for “walking-around money.” His point was that these assets can generate significant returns while owning gold produces no discernable cash flow.

While this observation is certainly true, the rub is that this is not a fair comparison since gold is not an asset; rather, it should be considered an alternate currency. Pundits often describe the five factors that define “money”:

- Its supply is controlled or limited,

- It is fungible/uniform – this is why diamonds cannot qualify,

- It is portable – this is why land cannot qualify,

- It is divisible – thus art cannot be money, and

- It is liquid – this means people will readily accept it in exchange.

By this definition, gold is certainly a form of money, and to Mr. Buffett’s point, one also earns no cash flow on paper dollars, euros, yen or yuan.

Raising expectations

A massive Fed gold purchase program would differ from past efforts at monetary expansion. Via QE, the transmission mechanism was wholly contained within the financial system; fiat currency was used to buy fiat assets which then settled on bank balance sheets. Since QE is arcane to most people outside of Wall Street, and NIRP seems just bizarre to most non-academics, these policies have had little impact on inflationary expectations. Global consumers are more familiar with gold than the banking system, thus this avenue of monetary expansion might finally lift the anchor on inflationary expectations and their associated spending habits.

The USD may initially weaken versus fiat currencies, but other central banks could soon buy gold as well, similar to the paths of QE and NIRP. The impactful twist of a gold purchase program is that it increases the price of a widely recognized “store of value,” a view little diminished despite the fact the U.S. relinquished the gold standard in 1971. This is a vivid contrast to the relatively invisible inflation of financial assets with its perverse side effect of widening the income gap.

In coda I would respond to the argument that a central bank cannot willfully create inflation – I disagree; it just depends upon how hard one tries. There are plenty of examples ranging from Weimar Germany to Zimbabwe where central banks have unleashed uncontrolled hyperinflations.

The more interesting question is not whether the Fed can create a 15% to 20% price spiral, but rather can they implement policies that will result in a somewhat gentle and controlled 2% to 3% inflation rate that will slowly deleverage the U.S. debt load while simultaneously increasing middle class nominal wages.

Many people will rightfully dismiss the gold idea as absurd, as just another fanciful strategy to print money; why not just buy oil, houses or some other hard asset? In fact, why fool around with gold; why not just execute helicopter money as originally advertised? I would answer the former by noting that only gold qualifies as money; and as for the latter, fiscal compromise on that order seems like a daydream in Washington today – don’t expect a helicopter liftoff anytime soon.

Let’s be honest; most people thought NIRP was just as nonsensical a few years ago, yet it has now been implemented by six central banks with little evidence it is effective. And while a gold purchase program should qualify as a fairy tale, what is unique here is that it actually occurred with a confirmed positive effect on the U.S. economy.

So when the next seat for a Fed governor becomes available, I would nominate Rumpelstiltskin … just a thought.

- Soros Warns China Credit Cycle Has Gone "Parabolic" Just To Keep Zombies Alive

After warning last year of a "practically unavoidable" hard-landing to come in China, George Soros unleashed his central-planner-crushing self last night on the great red ponzi. As we noted last night, Soros warned the "parabolic" rise in credit is very worrisome, and "eerily reminiscent of US in 2007-8," specifically adding that "most of the money that banks are supplying is needed to keep bad debts and loss-making enterprises alive." Soros' full discussion can be found below…

“Most of the damage occurred in later years," he said according to Bloomberg, referring to the spurt in US growth before the crash.

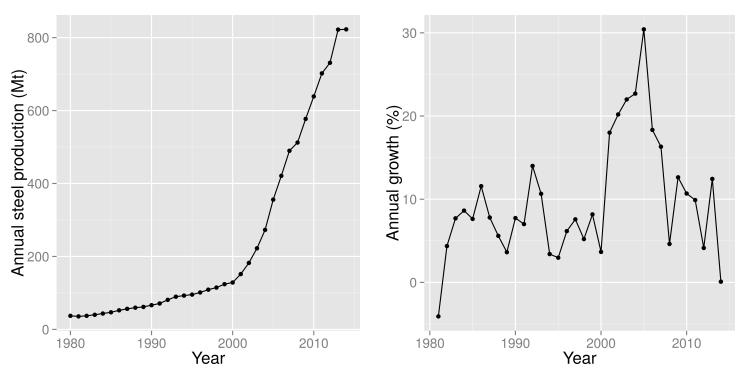

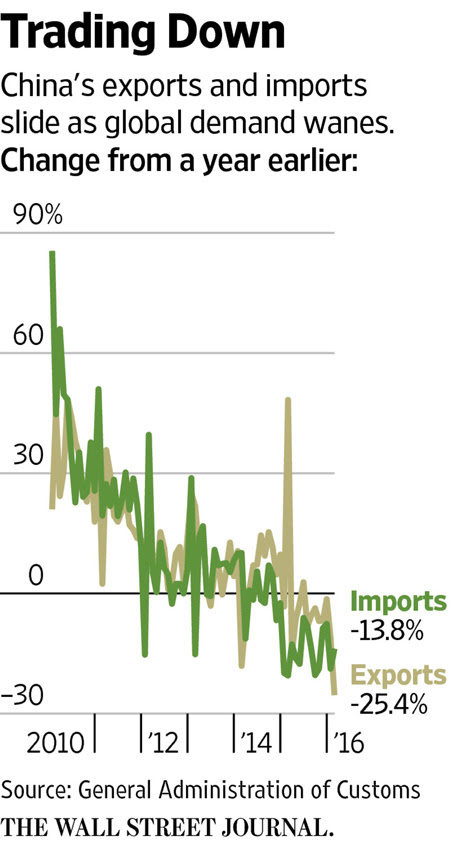

Simply put – as we highlighted with the shenanigans in the steel industry – China is attempting reflate its economy once again by reviving zombies who have now died twice. This can only end badly, and Soros was not alone in his opinions…

"Whether we call it stabilization or not, I am not sure,” Andrew Colquhoun, the head of Asia Pacific sovereigns at Fitch Ratings said in an interview in New York. “From a credit perspective, we’d be more comfortable with China slowing more than it is. We are getting less confident in the government’s commitment to structural reforms."

The stabilizing trend isn’t giving investors “enough confidence,” as China seems to have relied more on government investment in state-owned enterprises to boost the economy, said Gao Xiqing, former vice chairman of the China Securities Regulatory Commission, in an interview in New York this week.

George Soros' full discusssion can be viewed below (he begins at around 27:00 mark)…

asiasociety on livestream.com. Broadcast Live Free

Digest powered by RSS Digest

the minister picked about six kids at random, had them walk up to the stage, and he gave each of them a McDonald’s bag with a meal inside of it. They joyfully ate their meal, while all the rest of us watched on with true envy. It was the first time I knew what it was like to be jealous of someone who had something to eat when I was hungry. That is a memory that has stuck with me my entire life.

the minister picked about six kids at random, had them walk up to the stage, and he gave each of them a McDonald’s bag with a meal inside of it. They joyfully ate their meal, while all the rest of us watched on with true envy. It was the first time I knew what it was like to be jealous of someone who had something to eat when I was hungry. That is a memory that has stuck with me my entire life. having sold off former state assets to businesspeople who were required to line the pockets of those in a position of power to hand over those assets in the first place. In my opinion, anyone rich from Russia or China has almost certainly garnered their fortune through corrupt means, and one glance at the air or water of Beijing will tell you just how much the businessmen care about the environment or the people who have to wallow around in it.

having sold off former state assets to businesspeople who were required to line the pockets of those in a position of power to hand over those assets in the first place. In my opinion, anyone rich from Russia or China has almost certainly garnered their fortune through corrupt means, and one glance at the air or water of Beijing will tell you just how much the businessmen care about the environment or the people who have to wallow around in it.

Saving...

Saving...