- Rich Flee "Crime Infested Hell Hole" Chicago Amid Racial Strife, Civil Unrest

Those who pull the strings are apt to push racial division and general chaos, as the economic avalanche falls in on the population at large.

As SHTFPlan.com's Mac Slavo notes, uncertain about why finances and money become so difficult, most will fall into the trap of faction-vs-faction on the streets, as the elite helicopter away on profits derived from our general demise.

Taxpayer bailouts, harsher regulations, and more and more policing of every aspect of life would soon follow. If Chicago goes the way of Detroit, it will be not only because of crime and racial tension, but because the jobs, the opportunity and the future have all been shipped overseas and sold off to the highest bidder.

As The Daily Sheeple's Joshua Krause details, Millionaires fearing civil unrest are fleeing Chicago by the thousands…

As time goes on the city of Chicago is rapidly turning into a crime infested hell hole, rife with poverty, debt, and racial tension.

According to CNN, 141 people were murdered in Chicago during the first three months of the year, which is 71.9% higher than the 82 people who were killed in the same time frame last year. Even more astonishing for a city that prides itself on tackling guns, is the fact that shootings during the first three months of the year have gone up 88.5%, from 359 in 2015, to 677 in 2016. In other words, gun violence has nearly doubled over the past year.

CNN interviewed several residents in Chicago about the explosion in violence, and they all seemed to blame it on the economy. “If you really want to stop this epidemic of violence, the best way to stop a bullet is with a job” explained one resident.

While there is certainly merit to that, the economy isn’t the sole contributing factor to violence. In fact, all crime rates declined in the United States following the crash of 2008. Maybe it’s time for the city to admit that making it easier to own and carry a weapon would also alleviate their horrendous crime rates.

The city is well on its way to joining the likes of Detroit, and there may be no escaping that eventuality. That’s why many of the city’s wealthy elites are getting the hell out of there.

The Chicago Tribune reports that roughly 3,000 millionaires have left the city over the past year alone, which amounts to about 2 percent of their wealthy population.

This is the largest exodus of wealthy people in the United States, and one of the largest in the world. Paris and Rome are the only cities that lost more millionaires than Chicago in the same time period.

According to research, many of these elites are relocating to other cities in the United States such as Seattle and San Francisco, which saw a net inflow of millionaires over the past year.

When asked about why they were leaving Chicago, most of these millionaires cited racial tension and rising crime rates.

If you happen to live in Chicago, take a hint from the people with insider knowledge and connections, and get out while you still can.

- It Begins: Obama Forgives Student Debt Of 400,000 Americans

Joining the ranks of "broke lawyers" who can cancel their student debt, "Americans with disabilities have a right to student loan relief,” now according to Ted Mitchell, the undersecretary of education, said in a statement. Almost 400,000 student loan borrowers will now have an easier path to a debt bailout as Obama primes the populist voting pump just in time for the elections.

On top of "the student loan bubble’s dirty little secret," here is another round of student debt relief…as MarketWatch reports,

The Department of Education will send letters to 387,000 people they’ve identified as being eligible for a total and permanent disability discharge, a designation that allows federal student loan borrowers who can’t work because of a disability to have their loans forgiven. The borrowers identified by the Department won’t have to go through the typical application process for receiving a disability discharge, which requires sending in documented proof of their disability. Instead, the borrower will simply have to sign and return the completed application enclosed in the letter.

If every borrower identified by the Department decides to have his or her debt forgiven, the government will end up discharging more than $7.7 billion in debt, according to the Department.

“Americans with disabilities have a right to student loan relief,” Ted Mitchell, the undersecretary of education, said in a statement. “And we need to make it easier, not harder, for them to receive the benefits they are due.”

About 179,000 of the borrowers identified by the Department are in default on their student loans, and of that group more than 100,000 are at risk of having their tax refunds or Social Security checks garnished to pay off the debt. Often borrowers losing out on these benefits aren’t even aware that they’re eligible for a disability discharge, said Persis Yu, the director of the Student Loan Borrower Assistance Project at the National Consumer Law Center.

“Borrowers just frankly don’t know about this program,” she said. “In the past it’s been incredibly complicated to apply and that process has been getting better over time, but some people just assume that it’s not going to work.” The letters will help make more borrowers aware of their rights, Yu said.

* * *

So it's a start – "broke lawyers" , "the poor" and "disabled Americans" get student debt relief. What about models that suddenly become too ugly to work? Or Petroleum Engineers no longer able to work because of The Fed's over-indulgent easy money creating a glut in oil prices? Don't they have a right to relief from their student debt? Seems like not granting students debt relief would violate all of their "safe spaces" – so cancel it all! Student Debt Jubilee here we come.

As we detailed previously, however, this is a drop in the bucket…

Borrowers hold $1.2 trillion in federal student loans, the second-biggest category of consumer debt, after mortgages. Of that, more than $200 billion is in plans with an income-based repayment option, according to the Department of Education and Moody’s Investors Service. For taxpayers the loans are "a slow-ticking time bomb," says Stephen Stanley, a former Federal Reserve economist who’s now chief economist at Amherst Pierpont Securities in Stamford, Conn.

The Congressional Budget Office estimates that, for loans originated in 2015 or after, the programs will cost the government an additional $39 billion over the next decade.

So that's a $39 billion taxpayer loss just on loans originated this year or later, and that could very well rise as schools begin to figure out that they can effectively charge whatever they want for tuition now that the government is set to pick up the tab for any balances borrowers can't pay (which incidentally is precisely what we said in March).

Consider that, then consider how much of the existing $200 billion pile of IBR debt will have to be written off and add in another $10 billion or so to account for for-profit closures and it's not at all unreasonable to suspect that taxpayers will ultimately get stuck with a bill on the order of $100 billion by the time it's all said and done and that's if they're lucky – if the "cancel all student debt" crowd gets its way, the bill will run into the trillions.

* * *

And finally, as a reminder, if things don't change, Student Debt could be $17 trillion by 2030…

Student Loan Debt is a cancer for our society. This misconception that getting a college education equals a steady career has been dashed by the recession. For-profit colleges pray on undereducated and low-income individuals. Text book prices have risen exponentially while the cost of a quality education has as well.

This industry of education is going backwards, and will one day burst.

- "My Daddy’s Rich And My Lamborghini’s Good-Looking": Meet The Rich Chinese Kids Of Vancouver

By now, the only people in the world who are not aware that Vancouver has been overrun by Chinese “hot money-parking” oligarchs, who rush to buy any and every available real estate leading to such grotesque charts as the following showing the ridiculous surge in Vancouver real estate prices…

… are officials from the prvincial government conveniently turning a blind eye to what is a very clear real estate bubble. Which perhaps is understandable – for now prices are only going up, giving the impression that all is well even if it means locking out local buyers from being able to purchase any local housing. It will be a different story on the way down.

But instead of focusing on the culprit of this regional housing bubble, this time we’d like to present the “rich kids” of the Vancouver’s new invading billionaire class, who according to the NYT are also filthy rich.

Meet Andy Guo, an 18-year-old Chinese immigrant, who loves driving his red Lamborghini Huracán. He does not love having to share the car with his twin brother, Anky. “There’s a lot of conflict,” Mr. Guo said, as a crowd of admirers gazed at the vehicle and its vanity license plate, “CTGRY 5,” short for the most catastrophic type of hurricane.

The 360,000-Canadian-dollar car was a gift last year from the twins’ father, who travels back and forth between Vancouver and China’s northern Shanxi Province and made his fortune in coal, said Mr. Guo, an economics major at the University of British Columbia.

The car is more fashion than function. “I have a backpack, textbooks and laundry, but I can’t fit everything inside,” he lamented. And that is not the worst of it. “A cop once pulled me over just to look at the car,” he said.

The story behind the story is well-known. As the NYT summarizes, “China’s rapid economic rise has turned peasants into billionaires. Many wealthy Chinese are increasingly eager to stow their families, and their riches, in the West, where rule of law, clean air and good schools offer peace of mind, especially for those looking to escape scrutiny from the Communist Party and an anti-corruption campaign that has sent hundreds of the rich and powerful to jail.”

Their target of choice: Vancouver.

With its weak currency and welcoming immigration policies, Canada has become a top destination for China’s 1 percenters. According to government figures, from 2005 to 2012, at least 37,000 Chinese millionaires took advantage of a now-defunct immigrant investor program to become permanent residents of British Columbia, the province that includes Vancouver. This metropolitan area of 2.3 million is increasingly home to Chinese immigrants, who made up more than 18 percent of the population in 2011, up from less than 7 percent in 1981.

The stats are also known:

Many residents say the flood of Chinese capital has caused an affordable housing crisis. Vancouver is the most expensive city in Canada to buy a home, according to a 2016 survey by the consulting firm Demographia. The average price of a detached house in greater Vancouver more than doubled from 2005 to 2015, to around 1.6 million Canadian dollars ($1.2 million), according to the Real Estate Board of Greater Vancouver.

And according to Knight Frank, in the last year alone Vancouver home prices soared by 25%, the most in the entire world “due to lack of supply, foreign demand and weaker Canadian dollar.” Understandably, residents angry about the rise of rich foreign real estate buyers and absentee owners, particularly from China, have begun protests on social media, including a #DontHave1Million Twitter campaign. The provincial government agreed this year to begin tracking foreign ownership of real estate in response to demands from local politicians.

But neither the soaring prices, not the groundswell in anger has had any impact on the new class of uberwealthy Chinese. Indeed, as the NYT adds, “the anger has had little effect on the gilded lives of Vancouver’s wealthy Chinese. Indeed, to the newcomers for whom money is no object, the next purchase after a house is usually a car, and then a few more.”

One group of people is particularly happy: local car dealers.

Many luxury car dealerships here employ Chinese staff, a testament to the spending power of the city’s newest residents. In 2015, there were 2,500 cars worth more than $150,000 registered in metropolitan Vancouver, up from 1,300 in 2009, according to the Insurance Corporation of British Columbia.

Many of Vancouver’s young supercar owners are known as fuerdai, a Mandarin expression, akin to trust-fund kids, that means “rich second generation.” In China, where the superrich are widely criticized as being corrupt and materialistic, the term provokes a mix of scorn and envy. The fuerdai have brought their passion for extravagance to Vancouver. White Lamborghinis are popular among young Chinese women; the men often turn in their leased supercars after a few months in order to play with a newer, cooler status symbol.

You will know them by their Lamborghinis: hundreds of young Chinese immigrants, along with a handful of Canadian-born Chinese, have started supercar clubs whose members come together to drive, modify and photograph their flashy vehicles, providing alluring eye candy for their followers on social media.

From left, Loretta Lai, Chelsea Jiang and Diana Wang attended a reception

at a Lamborghini dealership last month in Vancouver, British ColumbiaCall it the rich Chinese kids of Instagram… in Vancouver.

The Vancouver Dynamic Auto Club has 440 members, 90 percent of whom are from China, said the group’s 27-year-old founder, David Dai. To join, a member must have a car that costs over 100,000 Canadian dollars, or about $77,000. “They don’t work,” Mr. Dai said of Vancouver’s fuerdai. “They just spend their parents’ money.”

Because they are rich, they are confident they own the town: “occasionally, the need for speed hits a roadblock. In 2011, the police impounded a squadron of 13 Lamborghinis, Maseratis and other luxury cars, worth $2 million, for racing on a metropolitan Vancouver highway at 125 miles per hour. The drivers were members of a Chinese supercar club, and none were older than 21, according to news reports at the time.”

And when a mere Lamborhini is not enough, there is always a Rolls-Royce:

On a recent evening, an overwhelmingly Chinese crowd of young adults had gathered at an invitation-only Rolls-Royce event to see a new black-and-red Dawn convertible, base price $402,000. It is the only such car in North America.

For some, such as Jin Qiao, 20, the price is no object: a baby-faced art student he moved to Vancouver from Beijing six years ago with his mother. During the week, Mr. Jin drives one of two Mercedes-Benz S.U.V.s, which he said were better suited for the rigors of daily life.

Ms. Jiang at the Lamborghini dealership. Credit

His most prized possession is a $600,000 Lamborghini Aventador Roadster Galaxy, its exterior custom wrapped to resemble outer space. A lanky design major who favors Fendi clothing and gold sneakers, Mr. Jin extolled the virtues of exotic cars and was quick to dismiss those who criticized supercar aficionados as ostentatious. “There are so many rich people in Vancouver, so what’s the point of showing off?” he said.

Where does the money come from for these “toys” which most people will live all their lives and never be able to afford? His parents of course. Asked what his parents did for work, Mr. Jin said his father was a successful businessman back in China but declined to provide details. “I can’t say,” he stammered with evident discomfort.

The corruption behind the nouveau China riche is well known, but as long as its flows those on the receiving end of the fund flows, are happy. “In Vancouver, there are lots of kids of corrupt Chinese officials,” said Shi Yi, 27, the owner of Luxury Motor, a car dealership that caters to affluent Chinese. “Here, they can flaunt their money.”

Not every has a penchant for supercars. Take Diana Wang, 23, who thinks a supercar is a poor investment, because its value decreases over time. “Better to spend half a million dollars on two expensive watches or some diamonds,” said a University of British Columbia graduate student who said she owned more than 30 Chanel bags and a $200,000 diamond-encrusted Richard Mille watch.

Ms. Wang, right, at the Lamborghini reception. Left, Paul Oei

photographed his wife, Ms. Lai, with a new carNow those are some good investments. Her business accumen has helped her land a starring role on the online reality show “Ultra Rich Asian Girls of Vancouver,” and normally drives her parents’ Ferrari or Mercedes-Maybach when she visits them in Shanghai.

But, get this, in Canada, her parents gave her a strict car budget of 150,000 Canadian dollars ($115,000), so she drives the less-flashy Audi RS5.

“I could be in danger if people saw me in a supercar,” she said, her Breguet watch, worth more than a BMW, glinting in the sunlight as she drove the Audi through town.

But don’t call Ms. Wang spoiled: four years ago, to learn the value of money after her friends criticized her spending habits, Ms. Wang spent three days on the streets of Vancouver, playing homeless. She said she had left her mansion with no phone, identification or wallet, wearing Victoria’s Secret pajamas and $1,000 Chanel shoes.

While in voluntary poverty, she lined up for donated food and felt the sting of humiliation after she was kicked out of a Tim Horton’s fast-food restaurant for falling asleep at a table. The experiment, she said, gave her a new appreciation for her parents’ financial support.

“Before that experience, I never looked at a price tag,” she said. “Now I do.”

- 2012 Redux – They Really Don't Know What They Are Doing

Submitted by Jeffrey Snider via Alhambra Investment Partners,

The old adage is that strong and sustained economic growth cures many ills, if not all of them, so it is unsurprising that so many central banks would be so determined to create it. They are, surprisingly, limited in that endeavor as they always stop one step short of recognizing the shortfall. In other words, they will do everything (as they are now forcing themselves to prove) in the orthodox toolkit to achieve that goal but absolutely refuse any other means outside of it – including actual free markets.

The big news over the weekend came from Italy, and it was more rumor and innuendo than anything. Some very ugly patterns have resurfaced in events everyone assumed had been put to rest in 2011. Bank stocks, European in particular, have had a difficult time since the middle of last year, so the actual condition of European banks is undoubtedly a primary topic of policy discussions – both fiscal and monetary. Nowhere is that more pressing than Italy, where Italian banks stocks are off 35% (in the FTSE Italy Bank Index) vs. “just” 25% for European banks within the Stoxx Europe 600.

Representatives of Italy’s leading (I’m not sure what qualifies a bank for that description since it is a pretty dubious distinction in this specific case) banks met with government officials to discuss yet another bailout scheme. The banks want the government to fund and established a financial vehicle in order to offload the still “somehow” rising epic of non-performing loans. They argued the same all through 2012 until Mario Draghi made his dramatic “promise” that sent sovereign and bank yields plummeting as “markets” assumed that would be the end of the matter.

It’s yet more evidence of the main flaw in orthodox theory. It was presumed that the Great Recession was a temporary interruption in the prior economic trend (which wasn’t itself all that robust); a very serious deviation brought about largely by the financial “shock” of the global banking panic. Recovery theory proceeded on that assumption, whereby central banks’ primary task was to restore banking function. From there, with a clear financial path, the economy could fully recover and that growth would over time alleviate these major imbalances left over from both the pre-crisis and the policy efforts in the aftermath.

It never happened that way, especially in Europe and especially with the events of 2011. Once more the ECB made “normal financial function” its priority first with OMT’s and then the massive LTRO’s. All of that seemed to have worked and December 2011 was the last of major public near-panics. With bond yields and spreads very, very low and no further disruption to banking there should have been recovery; but there hasn’t been.

Proving monetary policy irresistible almost exclusively within its own track (and to nothing else), Italian banks went on a sovereign bond binge of epic proportions. Since the LTRO’s began, Italian banks have increased their holdings of European sovereign securities by 79%, adding more than €312 billion while the ECB through its various programs provided price “cover.” While that was supposed to signal further restoration, it did nothing to shift the trajectory of the cumulative Italian loan portfolio.

Italian bank holdings of non-performing loans have risen a quite similar 83% since the start of 2012. At just shy of €200 billion, NPL’s suggest why Italian banks are rejecting the monetary transmission invitation.

Instead, the banking system in Italy has used various ECB “largesse” (starting with the LTRO’s) to first shrink and then practice the banking equivalent of liquidity preferences. As Keynes once suggested of real economic agents, there is a similar wholesale banking dynamic at work that central banks intentionally make no account. There has to be a reason to lend not just because rates are low and that is assumed to be “stimulative” of loan demand. Absent total profit opportunity, banks instead maximize whatever small return that prioritizes safety and especially liquidity (a factor that the ECB or any central bank further distorts by whatever it is actually doing in the “market”).

Italian banks took Draghi’s promise about “doing whatever it takes” not as a signal to resurrect risk and robust financialism but rather to shrink their loan portfolios. Again, the rationale isn’t difficult to discern since there has been no recovery; and thus no recovery in NPL’s that are now almost 11% of all loans in Italy. And it’s not just loan portfolios that have been cut, total bank assets have, too, in a trend that is immediately recognizable all across the world.

All of this is supposed to be capitalism at its finest. Central banks continue to undertake greater effort to restart a recovery that will not because banks will not and really cannot. That begins to answer why bank stocks have been under so much pressure as with global liquidity; there is a gaining realization that monetarism doesn’t work because financialism is not capitalism and thus requires an active monetary agent to be carried out. Monetarists claim that they are searching for and stimulating the “animal spirits” of capitalism but that isn’t true at all, with Italian banks providing all the necessary evidence. It is the “printing press” that they seek and it is not a central bank function even though many assume, still, that it is.

Without the willing and heavy participation of the banking system, specifically balance sheet capacity in all its forms, including lending and money dealing, monetary policy is just empty promises and really derivative pleading. The recovery of a financialized economy has to be determined by banking whereas in recovery banking is secondary; loan growth is not the predicate for capitalism but its byproduct. For one day, however, it all worked again as Italian bank stocks surged on the premise that the Italian government might bail out its banks that were supposed to be several years past needing one. Like the expansion of QE, it is more proof that none of it ever actually worked and they really don’t know what they are doing. The insolvent remain insolvent, the money still not money, and the recovery something else entirely. Central banks possess no recovery magic; they can’t even deliver their own version of one.

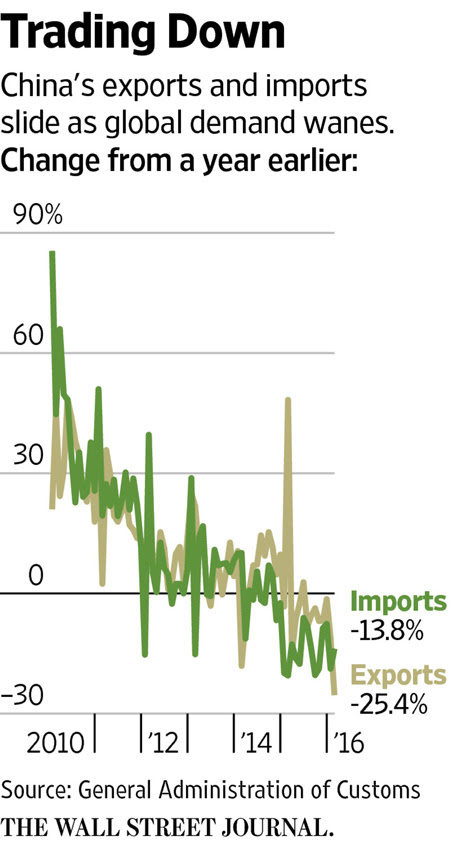

- Chinese Stocks, Yuan Rally After Exports Rebound From February Bloodbath, Imports Fall For 17th Month In A Row

After February’s bloodbath in Chinese trade data, expectations were for a scorching hot rebound in March. With PBOC’s Yuan ‘basket’ devaluation accelerating throughout this period it should not be surprising that Yuan-based China exports soared and imports beat expectations (but fell 1.7% – extending the losing streak to 17 months in a row). For now, oil and stock (US and China) prices are rising in reaction to this “good” news. Offshore Yuan is drifting stronger against the dollar.

Yuan has been plunging against China’s largest trading partners…

And so maybe Jack Lew has a point when he complains about competitive advantage…

- *CHINA’S MARCH TRADE SURPLUS 194.6 BILLION YUAN

- *CHINA’S MARCH EXPORTS RISE 18.7% Y/Y IN YUAN TERMS

- *CHINA’S MARCH IMPORTS FALL 1.7% Y/Y IN YUAN TERMS

USD-based data looks similar…

All driven by what China’s customs spokesman said was a “low base” as Bloomberg’s Tom Orlik notes, China’s March export bounce reflected more base effect than increased demand.

And under the covers…

- *CHINA JAN-MAR COPPER IMPORTS RISE 30.1% Y/Y

- *CHINA JAN.-MAR. CRUDE OIL IMPORTS UP 13.4%

What will Mr.Trump think of all this?

- Bill Gross Unleashes Tweetstorm On Five "Investor Delusions" Soon To Be Exposed

In what has so far been a strange day, in which one headline by an “anonymous diplomatic source” and unconfirmed by the Russian energy ministry has pushed stocks from red on the day back to highs for the year, the latest surprise came from Bill Gross who moments ago broke into a “tweetstorm” to lay out what he see as the latest set of investor delusions.

Gross: (1 of 5) Investor delusions that one day will be exposed to fresh air: #1) China is growing at 6% / yr;

— Janus Capital (@JanusCapital) April 12, 2016

Gross: (2 of 5) #2) Central bank historical models are reliable, Negative yields will work;

— Janus Capital (@JanusCapital) April 12, 2016

Gross: (3 or 5) #3) Corporate EPS growth is internal as opposed to “buy-back” generated;

— Janus Capital (@JanusCapital) April 12, 2016

Gross: (4 of 5) #4) Future corporate tax revisions will increase productivity instead of corporate profits;

— Janus Capital (@JanusCapital) April 12, 2016

Gross: (5 of 5) #5) Demographics don’t matter because they move too slowly.

— Janus Capital (@JanusCapital) April 12, 2016

The market’s response: clinging on to day’s highs as the “delusions” are happy to persist.

- Used-Car Inventories Surge To Record Highs As Goldman Fears "Spillovers From Demand Plateau"

Just 24 hours ago we explained the beginning of the end of the US automaker "house of cards," detailing how the tumble in used-car-prices sets up a vicious circle as Goldman warns "demand has plateaued." This is most evident in the surge in pre-owned vehicle inventories to record highs, forcing, as WSJ reports, dealers to lower prices, further denting new-car pricing. The effect of any sales slowdown, as Goldman ominously concludes, is considerable as spillovers from auto manufacturing can be significant given its highest "multiplier" of any sector in the economy.

As we noted previously used-car-prices are plunging at a similar pace to 2008…

With only sports cars and pickups rising in price in the last 15 months…

and with inventories so extremely high… In New Cars…

And Used Cars… (via WSJ)

Inventories of used cars in good condition are soaring in the U.S., and finance companies and dealers are scrambling to offer leases as a way to make payments affordable for people who don’t qualify for cheap deals on new cars or those looking to save cash.

Wholesale pricing fell during each of those months verus 2015, Manheim Consulting data shows. Manheim estimates used-vehicle supply will hit records in during a three-year period starting in 2016.

Lower used-car prices will eventually dent new-car pricing power, analysts said.

Production slowdowns are inevitable… And as Goldman explains, weakness in auto sales and production could be an unwelcome headache for the manufacturing sector.

We interpret the recent pullback in auto sales as a sign that demand has finally plateaued. Business spending on vehicles has been robust, but pent-up demand from the recession now looks exhausted. Consumer spending on cars and trucks has been flat for two years, despite favorable income trends and access to credit. Auto sales are currently above our estimate of trend demand, and we see the risks to sales as skewed to the downside.

Sales of light vehicles declined to a seasonally adjusted annualized rate (saar) of 16.5 million units last month, in contrast to consensus expectations for a roughly steady result of 17.5m. The downside surprise of one million units was the largest since 2008, and raises questions about whether the robust trend in vehicle sales is finally cooling off. Seasonal factors may have played a role: using an alternative (but standard) seasonal adjustment technique makes the recent decline look less dramatic, and we find some evidence that an early Easter can depress sales activity in March (Exhibit 1). But beyond these technicalities, we would read the latest data as suggesting that auto demand has now plateaued.

In earlier analysis, we argued that US vehicle sales would likely normalize at 14-15m units per year, based on demographic changes and other secular trends (see shaded area in Exhibit 1). However, sales can run above this level for some time—as they have in recent years—as consumers and firms exhaust pent-up demand from the recession. We think this process is now running its course, and the medium-term risks to auto sales are therefore skewed to the downside.

Household spending on new motor vehicles has already flattened out, despite solid fundamentals…

Weakness in auto sales and production could be an unwelcome headache for the manufacturing sector. Growth in auto output has accounted for 40% of the increase in manufacturing production since January 2012, not including spillovers to related sectors (Exhibit 4).

The total effect is likely bigger, as spillovers from auto manufacturing can be significant:

- producing $1 of motor vehicle output requires $1.8 dollars of output from all other industries – the highest “multiplier” of any sector in the economy (according to the BEA’s input-output accounts).

Although prospects for the manufacturing sector have started to look brighter, a pullback in motor vehicle activity could limit the extent of any rebound.

- Visualizing The Energy & Mineral Riches Of The Arctic

The Arctic has been the fascination of many people for centuries.

Hundreds of years ago, the Europeans saw the Arctic’s frigid waters as a potential gateway to the Pacific. The region has also been home to many unique native cultures such as the Inuits and Chukchi. Lastly, it goes without saying that the Arctic is unsurpassed in many aspects of its natural beauty, and lovers of the environment are struck by the region’s millions of acres of untouched land and natural habitats.

However, as VisualCapitalist.com's Jeff Desjardins notes, the Arctic is also one of the last frontiers of natural resource discovery, and underneath the tundra and ice are vast amounts of undiscovered oil, natural gas, and minerals. That’s why there is a high-stakes race for Arctic domination between countries such as the United States, Norway, Russia, Denmark, and Canada.

Today’s infographic highlights the size of some of these resources in relation to global reserves to help create context around the potential significance of this untapped wealth.

Courtesy of: Visual CapitalistIn terms of oil, it’s estimated that the Arctic has 90 billion barrels of oil that is yet to be discovered. That’s equal to 5.9% of the world’s known oil reserves – about 110% of Russia’s current oil reserves, or 339% of U.S. reserves.

For natural gas, the potential is even higher: the Arctic has an estimated 1,669 trillion cubic feet of gas, equal to 24.3% of the world’s current known reserves. That’s equal to 500% of U.S. reserves, 99% of Russia’s reserves, or 2,736% of Canada’s natural gas reserves.

Most of these hydrocarbon resources, about 84%, are expected to lay offshore.

There are also troves of metals and minerals, including gold, diamonds, copper, iron, zinc, and uranium. However, these are not easy to get at. Starting a mine in the Arctic can be an iceberg of costs: short shipping seasons, melting permafrost, summer swamps, polar bears, and -50 degree temperatures make the Arctic tough to be economic.

Original graphic by: 911 Metallurgist

- Dear Dallas Fed, Any Comment?

Several months ago, just as the market was tumbling on the back of crashing oil prices and not only energy companies but banks exposed to them via secured loans seemed in peril, we wrote a post titled “Dallas Fed Quietly Suspends Energy Mark-To-Market On Default Contagion Fears” in which we made the following observations:

… earlier this week, before the start of bank earnings season, before BOK’s startling announcement, we reported we had heard of a rumor that Dallas Fed members had met with banks in Houston and explicitly “told them not to force energy bankruptcies” and to demand asset sales instead.

Rumor Houston office of Dallas Fed met with banks, told them not to force energy bankruptcies; demand asset sales instead

— zerohedge (@zerohedge) January 11, 2016

We can now make it official, because moments ago we got confirmation from a second source who reports that according to an energy analyst who had recently met Houston funds to give his 1H16e update, one of his clients indicated that his firm was invited to a lunch attended by the Dallas Fed, which had previously instructed lenders to open up their entire loan books for Fed oversight; the Fed was shocked by with it had found in the non-public facing records. The lunch was also confirmed by employees at a reputable Swiss investment bank operating in Houston.

This is what took place: the Dallas Fed met with the banks and effectively suspended mark-to-market on energy debts and as a result no impairments are being written down. Furthermore, as we reported earlier this week, the Fed indicated “under the table” that banks were to work with the energy companies on delivering without a markdown on worry that a backstop, or bail-in, was needed after reviewing loan losses which would exceed the current tier 1 capital tranches.

In other words, the Fed has advised banks to cover up major energy-related losses.

Why the reason for such unprecedented measures by the Dallas Fed? Our source notes that having run the numbers, it looks like at least 18% of some banks commercial loan book are impaired, and that’s based on just applying the 3Q marks for public debt to their syndicate sums.

In other words, the ridiculously low increase in loss provisions by the likes of Wells and JPM suggest two things: i) the real losses are vastly higher, and ii) it is the Fed’s involvement that is pressuring banks to not disclose the true state of their energy “books.”

Before we posted the article we naturally gave the Dallas Fed a chance to comment, which it did not take advantage of. To our surprise, however, the Dallas Fed’s Twitter account did respond two days later as follows:

No truth to this @zerohedge story. The Dallas Fed does not issue such guidance to banks. https://t.co/rmE3Zul3PM

— Dallas Fed (@DallasFed) January 18, 2016

We in turn escalated by submitted a FOIA request demanding the Fed provide any and all documents and materials related to such meetings which according to the Fed did not happen. After all, there was “no truth” to the story.

The Dallas Fed’s subsequent response to the FOIA was trivial: “the Board does not maintain or possess calendars of Federal Reserve Bank staff.”

* * *

We bring all of this up several months later for the following reason: in an article published earlier today on Bloomberg titled “Wells Fargo Misjudged the Risks of Energy Financing” in which the author Asjylyn Loder writes the following:

… In September, regulators from the OCC, the Federal Reserve and the Federal Deposit Insurance Corp. met with dozens of energy bankers at Wells Fargo’s office in Houston.

The disagreement centered on how to rate the risk of reserves-based loans. Banks insisted that, in a worst-case scenario, they’d be made whole by liquidating the properties. Regulators pushed lenders to focus instead on a borrower’s ability to make enough money to repay the loan, according to the person familiar with the discussions. The agency reinforced its position with new guidelines published last month that instructed banks to consider a company’s total debt and its ability to pay it back when gauging a loan’s risk. Bill Grassano, an OCC spokesman, declined to comment.

Which, incidentally dovetails with the following article from the WSJ reporting of the same meeting:

The issue came to a head this month when a dozen regulators from the Office of the Comptroller of the Currency, Federal Reserve and Federal Deposit Insurance Corp. flew to Houston to meet with about 40 energy bankers from J.P. Morgan Chase & Co., Wells Fargo & Co., Bank of America Corp., Citigroup Inc. and Royal Bank of Canada. In the spring and fall, regulators conduct a review of large corporate loans shared by multiple banks.

Several industry officials said the meeting, held at Wells Fargo’s offices in downtown Houston, was the first of its kind. The bankers and regulators sat around tables in a large room with a screen displaying the OCC’s agenda that largely focused on examining and rating the loans, people familiar with the meeting said.

Which is odd, because when we read the Bloomberg story, we focus on this particular line: regulators – among which the Fed – “pushed lenders to focus instead on a borrower’s ability to make enough money to repay the loan, according to the person familiar with the discussions.“

Which sounds awfully close like “giving guidance to banks.”

Which, incidentally, is what the Dallas Fed tweet said it does not do when it accused us of lying.

So, dear Dallas Fed, in light of today’s Bloomberg article, would you like to take this chance to revise your statement which is still on the public record at the following link, and according to which you called this website liars?

Or perhaps there is “no truth” to the Bloomberg story either?

- SocGen: "Now We Know Why The Fed Desperately Wants To Avoid A Drop In Equity Markets"

With the ECB now unabashedly unleashing a bond bubble in Europe of which it has promised to be a buyer of last resort with the stronly implied hint that European IG companies should issue bonds and buy back shares, and promptly leading to the biggest junk bond issue in history courtesy of Numericable, it will come as no surprise that the world once again has a debt problem.

For the best description of just how bad said problem is we go to SocGen’s Andrew Lapthorne, one of last few sane analyzers of actual data, a person who first reveaked the stunning fact that every dollar in incremental debt in the 21st century has gone to fund stock buybacks, and who in a note today asks whether “central bank policies going to bankrupt corporate America?”

His answer is, unless something changes, a resounding yes.

Here are the key excerpts:

Sensationalist headlines such as the one above are there to grab the reader’s attention, but the question is nonetheless a serious one. Aggressive monetary policy in the form of QE and zero or negative interest rates is all about encouraging (forcing?) borrowers to take on more and more debt in an attempt to boost economic activity, effectively mortgaging future growth to compensate for the lack of demand today. These central bank policies are having some serious unintended consequences, particular on mid cap and smaller cap stocks.

Aggressive central bank monetary policies have created artificial demand for corporate debt which we think companies are exploiting by issuing debt they do not actually need. The proceeds of this debt raising are then largely reinvested back into the equity market via M&A or share buybacks in an attempt to boost share prices in the absence of actual demand. The effect on US non-financial balance sheets is now starting to look devastating. We’re not the only ones to be worried. The Office of Financial Research (OFR), a body whose function is to assess financial stability for the US Treasury, highlights corporate debt issuance as their primary threat to financial stability going forward.

In our assessment, credit risk in the U.S. nonfinancial business sector is elevated and rising, and by more than depicted in the Financial Stability Monitor. The evidence is broad. Credit growth to the sector has been rapid for years, pushing the ratio of nonfinancial business debt to GDP to a historically high level. Firm leverage is also at elevated levels. Creditor protections remain weak in debt contracts below investment grade. These factors are consistent with the late stage of the credit cycle, which typically precedes a rise in default rates.

The reality is US corporates appear to be spending way too much (over 35% more than their gross operating cash flow, the biggest deficit in over 20 years of data) and are using debt issuance to make up the difference. US corporates will have to borrow over 2.5% of their market capitalisation (over $400bn each year) to, somewhat ironically, buy back their own stock.

This cash flow deficit then needs to be financed, hence the continuing need to raise more and more debt. Current spending implies US non-financials will have to raise another $400bn of debt, a large proportion of which would then be reinvested back into the equity market via share repurchases. Some consider this to be shareholder return, while others (ourselves included) see it as simply remortgaging shareholder equity in an attempt to boost short-term share price performance. This in our view is short-term irrationality.

No matter where you look or how you measure it, leverage is elevated and continues to rise to unusually high levels given where we are in the cycle, with the most worrying rise in small cap stocks’ debt levels. Looking at interest cover is not particularly reassuring either, with the weighted interest coverage ratio approaching the recent low of 2009 when EBIT was depressed and not that far off the 1998/2003 levels when corporate bond yields were significantly higher.

The catalyst for a balance sheet crisis is rarely the affordability of interest rates, so a 25bp rise in Fed rates is neither here nor there. Credit market risk is about assessing the likelihood of getting your money back. As such asset prices (i.e. equity markets) and asset price risk (i.e. equity volatility) are far bigger concerns. So all you need for a balance sheet crisis is declining equity markets, a phenomenon the Fed appears desperate to avoid. Now we know why (see chart below).

Well that, and another reason: as of this moment one can measure the daily credibility of central banks by whether stocks closed higher or lower; too low and everyone starts talking about how CBs no longer have credibility and how they would rather Yellen et al would stop micromanaging everything… and then everyone quiets down when stocks surge back to all time highs. Alas, this means that the markets have not only stopped being a discounting mechanism (or rather they only discount what central banks will do in the immediate future), but have also stopped reflecting the underlying economy a long time ago, something will remains lost on all of the “smartest people in the room.”

- Fed vs. Fed: New York Fed To Issue Its Own GDP Nowcast; Atlanta Fed Too Pessimistic?

Submitted by Mike “Mish” Shedlock

Fed vs. Fed: New York Fed To Issue Its Own GDP Nowcast; Atlanta Fed Too Pessimistic?

It’s Fed vs. Fed in the Nowcasting business. The New York Fed has decided to issue a FRBNY Nowcast, clearly in competition with the Atlanta Fed GDPNow forecast.

The Atlanta Fed has the name GDPNow trademarked.

The Atlanta Fed provides its updates following major economic reports. In contrast, the New York Fed will deliver its version every Friday starting April 15.

We have a sneak peek of this Friday’s Fed vs. Fed battle already.

FRBNY Nowcast

GDPNow History

The above from Sufficient Momentum (For a Recession).

Current Scorecard

- Atlanta: 0.1

- New York: 1.1

I commend the New York Fed for providing much needed entertainment value. Any other regions want to get in on the act?

- Gold Options Traders Extend Longest Bullish Streak Since 2009

Amid gold's best start to a year since 1974, options traders continue to bet on more gains.

Despite the near 17% gains in 2016, put options (bearish bets) have been cheaper than bullish bets (calls) since January 14th.. and options holders own more bullishly biased options overall…

As Bloomberg notes this is the longest streak of bullish "skew" since June 2009, after which gold took off from $900 to $1900.

And most notably, the "excess" skew has been wrung out, just as it did in mid-2009, providing considerably less "short-squeeze" ammo for any speculative downswing attack.

Charts: Bloomberg

- The New Middle Kingdom Of Concrete And The Red Depression Ahead

Submitted by David Stockman via Contra Corner blog,

No wonder the Red Ponzi consumed more cement during three years (2011-2013) than did the US during the entire twentieth century. Enabled by an endless $30 trillion flow of credit from its state controlled banking apparatus and its shadow banking affiliates, China went berserk building factories, warehouses, ports, office towers, malls, apartments, roads, airports, train stations, high speed railways, stadiums, monumental public buildings and much more.

If you want an analogy, 6.6 gigatons of cement is 14.5 trillion pounds. The Hoover dam used about 1.8 billion pounds of cement. So in 3 years China consumed enough cement to build the Hoover dam 8,000 times over—-160 of them for every state in the union!

Having spent the last ten days in China, I can well and truly say that the Middle Kingdom is back. But its leitmotif is the very opposite to the splendor of the Forbidden City.

The Middle Kingdom has been reborn in towers of preformed concrete. They rise in their tens of thousands in every direction on the horizon. They are connected with ribbons of highways which are scalloped and molded to wind through the endless forest of concrete verticals. Some of them are occupied. Alot, not.

The “before” and “after” contrast of Shanghai’s famous Pudong waterfront is illustrative of the illusion.

The first picture below is from about 1990 at a time before Mr. Deng discovered the printing press in the basement of the People’s Bank of China and proclaimed that it is glorious to be rich; and that if you were 18 and still in full possession of your digital dexterity and visual acuity it was even more glorious to work 12 hours per day 6 days per week in an export factory for 35 cents per hour.

I don’t know if the first picture is accurate as to its exact vintage. But by all accounts the glitzy skyscrapers of today’s Pudong waterfront did ascend during the last 25 years from a rundown, dimly lit area of muddy streets on the east side of Huangpu River. The pictured area was apparently shunned by all except the most destitute of Mao’s proletariat.

But the second picture I can vouch for. It’s from my window at the Peninsula Hotel on the Bund which lies directly accross on the west side of the Huangpu River and was taken as I typed this post.

Today’s Pudong district does look spectacular—–presumably a 21st century rendition of the glory of the Qing, the Ming, the Soong, the Tang and the Han.

But to conclude that would be to be deceived.The apparent prosperity is not that of a sustainable economic miracle; its the front street of the greatest Potemkin Village in world history.

The heart of the matter is that output measured by Keynesian GDP accounting—-especially China’s blatantly massaged variety— isn’t sustainable wealth if it is not rooted in real savings, efficient capital allocation and future productivity growth. Nor does construction and investment which does not earn back its cost of capital over time contribute to the accumulation of real wealth.

Needless to say, China’s construction and “investment” binge manifestly does not meet these criteria in the slightest. It was funded with credit manufactured by state controlled banks and their shadow affiliates, not real savings. It was driven by state initiated growth plans and GDP targets. These were cascaded from the top down to the province, county and local government levels—–an economic process which is the opposite of entrepreneurial at-risk assessments of future market based demand and profits.

China’s own GDP statistics are the smoking gun. During the last 15 years fixed asset investment—–in private business, state companies, households and the “public sector” combined—–has averaged 50% of GDP. That’s per se crazy.

Even in the heyday of its 1960s and 1970s boom, Japan’s fixed asset investment never reached more than 30% of GDP. Moreover, even that was not sustained year in and year out (they had three recessions), and Japan had at least a semblance of market pricing and capital allocation—unlike China’s virtual command and control economy.

The reason that Wall Street analysts and fellow-traveling Keynesian economists miss the latter point entirely is because China’s state-driven economy works through credit allocation rather than by tonnage toting commissars. The gosplan is implemented by the banking system and, increasingly, through China’s mushrooming and metastasizing shadow banking sector. The latter amounts to trillions of credit potted in entities which have sprung up to evade the belated growth controls that the regulators have imposed on the formal banking system.

For example, Beijing tried to cool down the residential real estate boom by requiring 30% down payments on first mortgages and by virtually eliminating mortgage finance on second homes and investment properties. So between 2013 and the present more than 2,500 on-line peer-to-peer lending outfits (P2P) materialized—-mostly funded or sponsored by the banking system—– and these entities have advanced more than $2 trillion of new credit.

The overwhelming share went into meeting “downpayments” and other real estate speculations. On the one hand, that reignited the real estate bubble——especially in the Tier I cities were prices have risen by 20% to 60% during the last year. At the same time, this P2P eruption in the shadow banking system has encouraged the construction of even more excess housing stock in an economy that already has upwards of 70 million empty units.

In short, China has become a credit-driven economic madhouse. The 50% of GDP attributable to fixed asset investment actually constitutes the most spectacular spree of malinvestment and waste in recorded history. It is the footprint of a future depression, not evidence of sustainable growth and prosperity.

Consider a boundary case analogy. With enough fiat credit during the last three years, the US could have built 160 Hoover dams on dry land in each state. That would have elicited one hellacious boom in the jobs market, gravel pits, cement truck assembly plants, pipe and tube mills, architectural and engineering offices etc. The profits and wages from that dam building boom, in turn, would have generated a secondary cascade of even more phony “growth”.

But at some point, the credit expansion would stop. The demand for construction materials, labor, machinery and support services would dry-up; the negative multiplier on incomes, spending and investment would kick-in; and the depression phase of a crack-up boom would exact its drastic revenge.

The fact is, China has been in a crack-up boom for the last two decades, and one which transcends anything that the classic liberal economists ever imagined. Since 1995, credit outstanding has grown from $500 billion to upwards of $30 trillion, and that’s only counting what’s visible. But the very idea of a 60X expansion of credit in hardly two decades in the context of top-down allocation system suffused with phony data and endless bureaucratic corruption defies economic rationality and common sense.

Stated differently, China is not simply a little over-done, and it’s not in some Keynesian transition from exports and investment to domestic services and consumption. Instead, China’s fantastically over-built industry and public infrastructure embodies monumental economic waste equivalent to the construction of pyramids with shovels and spoons and giant dams on dry land.

Accordingly, when the credit pyramid finally collapses or simply stops growing, the pace of construction will decline dramatically, leaving the Red Ponzi riddled with economic air pockets and negative spending multipliers.

Take the simple case of the abandoned cement mixer plant pictured below. The high wages paid in that abandoned plant are now gone; the owners have undoubtedly fled and their high living extravagance is no more. Nor is this factory’s demand still extant for steel sheets and plates, freight services, electric power, waste hauling, equipment replacement parts and on down the food chain.

And, no, a wise autocracy in Beijing will not be able to off-set the giant deflationary forces now assailing the construction and industrial heartland of China’s hothouse economy with massive amounts of new credit to jump start green industries and neighborhood recreation facilities. That’s because China has already shot is its credit wad, meaning that every new surge in its banking system will trigger even more capital outflow and expectations of FX depreciation.

Moreover, any increase in fiscal spending not funded by credit expansion will only rearrange the deck chairs on the titanic. Indeed, whatever borrowing headroom Beijing has left will be needed to fund the bailouts of its banking and credit system. Without massive outlays for the purpose of propping-up and stabilizing China’s vast credit Ponzi, there will be economic and social chaos as the tide of defaults and abandonments swells.

Empty factories like the above—–and China is crawling with them—–are a screaming marker of an economic doomsday machine. They bespeak an inherently unsustainable and unstable simulacrum of capitalism where the purpose of credit has been to fund state mandated GDP quota’s, not finance efficient investments with calculable risks and returns.

The relentless growth of China’s aluminum production is just one more example. When China’s construction and investment binge finally stops, there will be a huge decline in industry wages, profits and supply chain activity.

But the mother of all malinvestments sprang up in China’s steel industry. From about 70 million tons of production in the early 1990s, it exploded to 825 million tons in 2014. Beyond that, it is the capacity build-out behind the chart below which tells the full story.

To wit, Beijing’s tsunami of cheap credit enabled China’s state-owned steel companies to build new capacity at an even more fevered pace than the breakneck growth of annual production. Consequently, annual crude steel capacity now stands at nearly 1.4 billion tons, and nearly all of that capacity—-about 70% of the world total—— was built in the last ten years.

Needless to say, it’s a sheer impossibility to expand efficiently the heaviest of heavy industries by 17X in a quarter century.

What happened is that China’s aberrationally massive steel industry expansion created a significant one-time increment of demand for its own products. That is, plate, structural and other steel shapes that go into blast furnaces, BOF works, rolling mills, fabrication plants, iron ore loading and storage facilities, as well as into plate and other steel products for shipyards where new bulk carriers were built and into the massive equipment and infrastructure used at the iron ore mines and ports.

That is to say, the Chinese steel industry has been chasing its own tail, but the merry-go-round has now stopped. For the first time in three decades, steel production in 2015 was down 2-3% from 2014’s peak of 825 million tons and is projected to drop to 750 million tons next year, even by the lights of the China miracle believers.

And that’s where the pyramid building nature of China’s insane steel industry investment comes in. The industry is not remotely capable of “rationalization” in the DM economy historical sense. Even Beijing’s much ballyhooed 100-150 million ton plant closure target is a drop in the bucket—-and its not scheduled to be completed until 2020 anyway.

To wit, China will be lucky to have 400 million tons of true sell-through demand—-that is, on-going domestic demand for sheet steel to go into cars and appliances and for rebar and structural steel to be used in replacement construction once the current one-time building binge finally expires.

For instance, China’s construction and shipbuilding industries consumed about 500 million tons per year at the crest of the building boom. But shipyards are already going radio silent and the end of China’s manic eruption of concrete, rebar and I-beams is not far behind. Use of steel for these purposes could easily drop to 200 million tons on a steady state basis.

Bu contrast, China’s vaunted auto industry uses only 45 million tons of steel per year, and consumer appliances consume less than 12 million tons. In most developed economies autos and white goods demand accounts for about 20% of total steel use.

Likewise, much of the current 200 million tons of steel which goes into machinery and equipment including massive production of mining and construction machines, rails cars etc. is of a one-time nature and could easily drop to 100 million tons on a steady state replacement basis. So its difficult to see how China will ever have recurring demand for even 400 million tons annually, yet that’s just 30% of its massive capacity investment.

In short, we are talking about wholesale abandonment of a half billion tons of steel capacity or more. That is, the destruction of steel industry capacity greater than that of Japan, the EC and the US combined.

Needless to say, that thunderous liquidation will generate a massive loss of labor income and profits and devastating contraction of the steel industry’s massive and lengthy supply chain. And that’s to say nothing of the labor market disorder and social dislocation when China is hit by the equivalent of dozens of burned-out Youngstowns and Pittsburgs.

And it is also evident that it will not be in a position to dump its massive surplus on the rest of the world. Already trade barriers against last year’s 110 million tons of exports are being thrown up in Europe, North America, Japan and nearly everywhere else.

This not only means that China has upwards of a half-billion tons of excess capacity that will crush prices and profits, but, more importantly, that the one-time steel demand for steel industry CapEx is over and done. And that means shipyards and mining equipment, too.

That is already evident in the vanishing order book for China’s giant shipbuilding industry. The latter is focussed almost exclusively on dry bulk carriers——-the very capital item that delivered into China’s vast industrial maw the massive tonnages of iron ore, coking coal and other raw materials. But within in a year or two most of China’s shipyards will be closed as its backlog rapidly vanishes under a crushing surplus of dry bulk capacity that has no precedent, and which has driven the Baltic shipping rate index to historic lows.

Still, we now have the absurdity of China’s state shipping company (Cosco) ordering 11 massive containerships that it can’t possibly need (China’s year-to-date exports are down 20%) in order to keep its vastly overbuilt shipyards in new orders. And those wasteful new orders, in turn will take plate from China’s white elephant steel mills:

This and other state-owned shipyards are being kept busy by China Ocean Shipping Group, better known as Cosco, the country’s largest shipper by carrying capacity, which ordered 11 huge container ships last year. Caixin, the financial magazine, reported that the three ships ordered from Waigaoqiao would be able to carry 20,000 20ft containers, making them the world’s largest.

The weakening yuan and China’s waning appetite for raw materials have come around to bite the country’s shipbuilders, raising the odds that more shipyards will soon be shuttered.

About 140 yards in the world’s second-biggest shipbuilding nation have gone out of business since 2010, and more are expected to close in the next two years after only 69 won orders for vessels last year, JPMorgan Chase & Co. analysts Sokje Lee and Minsung Lee wrote in a Jan. 6 report. That compares with 126 shipyards that fielded orders in 2014 and 147 in 2013.

Total orders at Chinese shipyards tumbled 59 percent in the first 11 months of 2015, according to data released Dec. 15 by the China Association of the National Shipbuilding Industry. Builders have sought government support as excess vessel capacity drives down shipping rates and prompts customers to cancel contracts. Zhoushan Wuzhou Ship Repairing & Building Co. last month became the first state-owned shipbuilder to go bankrupt in a decade.

It is not surprising that China’s massive shipbuilding industry is in distress and that it is attempting to export its troubles to the rest of the world. Yet subsidizing new builds will eventually add more downward pressure to global shipping rates—-rates which are already at all time lows. And as the world’s shipping companies are driven into insolvency, they will take the European banks which have financed them down the drink, as well.

Still, the fact that China is exporting yet another downward deflationary spiral to the world economy is not at all surprising. After all, China’s shipbuilding output rose by 11X in 10 years!

The worst thing is that just as the Red Ponzi is beginning to crack, China’s leader is rolling out the paddy wagons and reestablishing a cult of the leader that more and more resembles nothing so much as a Maoist revival. As Xi said while making the rounds of the state media recently, its job is to:

“……reflect the will of the Party, mirror the views of the Party, preserve the authority of the Party, preserve the unity of the Party and achieve love of the Party, protection of the Party and acting for the Party.”

The above proclamation needs no amplification. China will increasingly plunge into a regime of harsh, capricious dictatorship as the Red Depression unfolds. And that will only fuel the downward spiral which is already gathering momentum.

During the first two months of 2016, for example, China export machine has buckled badly. Exports fell 25.4% in February year over year, following an 11.2% decline in January.

Likewise, local economies in its growing rust belt, such as parts of Heilongjiang, in far northeast China have dropped by 20% in the last two years and are still in free fall. Coal prices in those areas have plunged by 65% since 2011 and hundreds of mines have been closed or abandoned.

The picture below is epigrammatic of what lies behind the great Potemkin Village which is the Red Ponzi.

While pictures can often tell a thousand words, as in the above, sooner or later then numbers are no less revealing. The fact is, no economy can undergo the fantastic eruption of credit that has occurred in China during the last two decades without eventually coming face to face with a day of reckoning. And a Bloomberg analysis of the shocking deterioration of credit metrics in the non-financial sector of China suggests that day is coming fast.

To wit, overall interest expense coverage by operating income has plunged dramatically, and virtually every major industrial sector of the Red Ponzi is underwater with a coverage ratio of less than 1.0X.

Stated differently, during the first two months of this year China’s total social financing or credit outstanding surged at an incredible $6 trillion annual rate. That means the Red Ponzi is on track to bury itself in a further debt load equal to 55% of GDP by year end.

But that’s not the half of it. What is evident from the Bloomberg data below is that the overwhelming share of these new borrowings are being allocated to pay interest on existing debt because it is not being covered by current operating profits.

Firms generated just enough operating profit to cover the interest expenses on their debt twice, down from almost six times in 2010, according to data compiled by Bloomberg going back to 1992 from non-financial companies traded in Shanghai and Shenzhen. Oil and gas corporates were the weakest at 0.24 times, followed by the metals and mining sector at 0.52.

The People’s Bank of China has lowered benchmark interest rates six times since 2014, driving a record rally in the bond market and underpinning a jump in debt to 247 percent of gross domestic product. Yet economic growth has slumped to the slowest in a quarter century and profits for the listed companies grew only 3 percent in 2015, down from 11 percent in 2014. The mounting debt burden has caused at least seven firms to miss local bond payments this year, already reaching the tally for the whole of last year.

“We will likely see a wave of bankruptcies and restructurings when the interest coverage ratio drops further,” said Xia Le, chief economist for Asia at Banco Bilbao Vizcaya Argentaria SA in Hong Kong. “Return on assets for Chinese companies has been declining due to rising debt. Profitability is also slowing due to overcapacity in many sectors, which has weakened the ability of companies to repay their debts.”

Massive borrowing to pay the interest is everywhere and always a sign that the the end is near. The crack-up phase of China’s insane borrowing and building boom is surely at hand.

- Swiss Bank Whistleblower Claims Panama Papers Was A CIA Operation

Submitted by Mike Krieger via Liberty Blitzkrieg blog,

Bradley Birkenfeld is the most significant financial whistleblower of all time, so you might think he’d be cheering on the disclosures in the new Panama Papers leaks. But today, Birkenfeld is raising questions about the source of the information that is shaking political regimes around the world.

“The CIA I’m sure is behind this, in my opinion,” Birkenfeld said.

– From the CNBC article: Swiss Banker Whistleblower: CIA Behind Panama Papers

Last Friday, I published a post titled, Was the Panama Papers “Leak” a Russian Intelligence Operation? Here’s some of what I wrote:

Initially, this seemed to be a theory worth exploring, but in the following days I’ve come to a far different conclusion. The primary divergence between what I currently believe and what Mr. Murray proposed is that I do not think the leaker was a genuine whistleblower motived by the public interest. I think the leaker was working on behalf of a sophisticated intelligence agency.

The fact that we seem to know nothing about “John Doe” concerns me. Say what you will about Edward Snowden, but he came out publicly shortly after his whistleblowing and offered himself up for the world to judge. His life, career and personality have been put on full display, and each and every one of us has had the opportunity to decide for ourselves whether his motivations were noble and pure or not.

With the Panama Papers’ “John Doe” we are given no such opportunity, and in fact, the whole thing reads very much like a script concocted by some big budget intelligence agency. Once I started coming around to this conclusion, the obvious choice was U.S. intelligence; given the lack of implications to powerful Americans, the clownishly desperate attempts to smear Putin, and the appearance of Soros, USAID, Ford Foundation, etc, linked organizations to the reporting.

So for someone who already thinks the whole Panama Papers story stinks to high heaven, a CIA link to the release seems obvious; but is it too obvious? Perhaps.

At this point, I want to make something perfectly clear. I do not profess to know the “real story” behind the Panama Papers. The truth is, nobody knows, except for John Doe and the people he was working for (or with). The only thing I feel fairly confident about is that the story we are being fed is not the real story. The more I read and reflect upon the very minor consequences of the leak thus far, the more I become convinced this was a geopolitical play by a powerful intelligence agency. At first, I assumed it was U.S. intelligence, but Mr. Gaddy puts forth a compelling theory. If this was the work of the CIA, it was an extremely sloppy and obvious hit job. On the other hand, if this was the work of Putin for the purposes of blackmail, it’s one of the most ingenious chess moves I’ve ever seen played on the global stage.

The main point I was trying to hammer home with that post was the fact that I did not believe the Panama Papers was an altruistic act of heroic whistleblowing, but that it was an intelligence operation. I went on to say that I thought the notion it was a Russian job was plausible merely because if it was indeed a CIA operation (as I initially suspected), we would have to accept that the agency is mind-bogglingly sloppy and clownish. Nevertheless, according to notorious swiss bank whistleblower, Bradley Birkenfeld, this is the work of the CIA.

CNBC reports:

Bradley Birkenfeld is the most significant financial whistleblower of all time, so you might think he’d be cheering on the disclosures in the new Panama Papers leaks. But today, Birkenfeld is raising questions about the source of the information that is shaking political regimes around the world.

Birkenfeld, an American citizen, was a banker working at UBS in Switzerland when he approached the U.S. government with information on massive amounts of tax evasion by Americans with secret accounts in Switzerland. By the end of his whistleblowing career, Birkenfeld had served more than two years in a U.S. federal prison, been awarded $104 million by the IRS for his information and shattered the foundations of more than a century of Swiss banking secrecy.

In an exclusive interview Tuesday from Munich, Birkenfeld said he doesn’t think the source of the 11 million documents stolen from a Panamanian law firm should automatically be considered a whistleblower like himself. Instead, he said, the hacking of the Panama City-based firm, called Mossack Fonseca, could have been done by a U.S. intelligence agency.

“The CIA I’m sure is behind this, in my opinion,” Birkenfeld said.

Birkenfeld pointed to the fact that the political uproar created by the disclosures have mainly impacted countries with tense relationships with the United States. “The very fact that we see all these names surface that are the direct quote-unquote enemies of the United States, Russia, China, Pakistan, Argentina and we don’t see one U.S. name. Why is that?” Birkenfeld said. “Quite frankly, my feeling is that this is certainly an intelligence agency operation.”

Asked why the U.S. would leak information that has also been damaging to U.K. Prime Minister David Cameron, a major American ally, Birkenfeld said the British leader was likely collateral damage in a larger intelligence operation.

“If you’ve got NSA and CIA spying on foreign governments they can certainly get into a law firm like this,” Birkenfeld said. “But they selectively bring the information to the public domain that doesn’t hurt the U.S. in any shape or form. That’s wrong. And there’s something seriously sinister here behind this.”

This just further confirms my belief that this whole “leak” isn’t what we are being told. This is the work of an intelligence agency working on behalf of a particular government, not on behalf of the public. Don’t be duped.

- Goldman and Wells Fargo FINALLY Admit They Committed Fraud

Goldman Sachs has finally admitted to committing fraud. Specifically, Goldman Sachs reached a settlement yesterday with the Department of Justice, in which it admitted fraud:

The settlement includes a statement of facts to which Goldman has agreed. That statement of facts describes how Goldman made false and misleading representations to prospective investors about the characteristics of the loans it securitized and the ways in which Goldman would protect investors in its RMBS from harm (the quotes in the following paragraphs are from that agreed-upon statement of facts, unless otherwise noted):

- Goldman told investors in offering documents that “[l]oans in the securitized pools were originated generally in accordance with the loan originator’s underwriting guidelines,” other than possible situations where “when the originator identified ‘compensating factors’ at the time of origination.” But Goldman has today acknowledged that, “Goldman received information indicating that, for certain loan pools, significant percentages of the loans reviewed did not conform to the representations made to investors about the pools of loans to be securitized.”

- Specifically, Goldman has now acknowledged that, even when the results of its due diligence on samples of loans from those pools “indicated that the unsampled portions of the pools likely contained additional loans with credit exceptions, Goldman typically did not . . . identify and eliminate any additional loans with credit exceptions.” Goldman has acknowledged that it “failed to do this even when the samples included significant numbers of loans with credit exceptions.”

- Goldman’s Mortgage Capital Committee, which included senior mortgage department personnel and employees from Goldman’s credit and legal departments, was required to approve every RMBS issued by Goldman. Goldman has now acknowledged that “[t]he Mortgage Capital Committee typically received . . . summaries of Goldman’s due diligence results for certain of the loan pools backing the securitization,” but that “[d]espite the high numbers of loans that Goldman had dropped from the loan pools, the Mortgage Capital Committee approved every RMBS that was presented to it between December 2005 and 2007.” As one example, in early 2007, Goldman approved and issued a subprime RMBS backed by loans originated by New Century Mortgage Corporation, after Goldman’s due diligence process found that one of the loan pools to be securitized included loans originated with “[e]xtremely aggressive underwriting,” and where Goldman dropped 25 percent of the loans from the due diligence sample on that pool without reviewing the unsampled 70 percent of the pool to determine whether those loans had similar problems.

- Goldman has acknowledged that, for one August 2006 RMBS, the due diligence results for some of the loan pools resulted in an “unusually high” percentage of loans with credit and compliance defects. The Mortgage Capital Committee was presented with a summary of these results and asked “How do we know that we caught everything?” One transaction manager responded “we don’t.” Another transaction manager responded, “Depends on what you mean by everything? Because of the limited sampling . . . we don’t catch everything . . .” Goldman has now acknowledged that the Mortgage Capital Committee approved this RMBS for securitization without requiring any further due diligence.

- Goldman made detailed representations to investors about its “counterparty qualification process” for vetting loan originators, and told investors and one rating agency that Goldman would engage in ongoing monitoring of loan sellers. Goldman has now acknowledged, however, that it “received certain negative information regarding the originators’ business practices” and that much of this information was not disclosed to investors.

- For example, Goldman has now acknowledged that in late 2006 it conducted an internal analysis of the underwriting guidelines of Fremont Investment & Loan (an originator), which found many of Fremont’s guidelines to be “off market” or “at the aggressive end of market standards.” Instead of disclosing its view of Fremont’s underwriting, Goldman has acknowledged that it “[u]ndertook a significant marketing effort” to tell investors about what Goldman called Fremont’s “commitment to loan quality over volume” and “significant enhancements to Fremont underwriting guidelines.” Fremont was shut down by federal regulators within several months of these statements.

- In another example, Goldman was aware in early-mid 2006 of certain issues with Countrywide Financial Corporation’s origination process, including a pattern of non-responsiveness and inability to provide sufficient staff to handle the numerous loan pools Countrywide was selling. In April 2006, while Goldman was preparing an RMBS backed by Countrywide loans for securitization, a Goldman mortgage department manager circulated a “very bullish” equity research report that recommended the purchase of Countrywide stock. Goldman’s head of due diligence, who had just overseen the due diligence on six Countrywide pools, responded “If they only knew . . . .”

Similarly, Wells Fargo settled with the Department of Justice last week and – as part of the settlement – admitted fraud:

Wells Fargo & Co admitted to deceiving the U.S. government into insuring thousands of risky mortgages, as it formally reached a … settlement of a U.S. Department of Justice lawsuit.

***

According to the settlement, Wells Fargo “admits, acknowledges, and accepts responsibility” for having from 2001 to 2008 falsely certified that many of its home loans qualified for Federal Housing Administration insurance.

The San Francisco-based lender also admitted to having from 2002 to 2010 failed to file timely reports on several thousand loans that had material defects or were badly underwritten ….

Why should we care?

Because Wells Fargo received a $25 billion dollar bailout and Goldman received $10 billion in one bailout and $13 billion in another.