- Syrian Crisis: What Will Happen Next?

Submitted by Brandon Smith via Alt-Market.com,

The Syrian crisis and the confluence of clashing interests there was entirely predictable. In fact, I wrote an article on my former website in 2010 outlining the potential for Syria as a high value catalyst for global conflict titled “Will Globalists Trigger Yet Another World War?”

In it, I summarized the dubious history of wars initiated over the past century, including the nature of false flags and false paradigms created by globalists designed to divide nations and peoples and turn them against each other. This strategy of engineered war (along with engineered economic collapse) has been used time and time again by the elites to artificially generate chaos and then consolidate and centralize power while the masses are blinded by confusion.

Even back then, the problem with Syria seemed obvious:

"…We have a nuclear armed Israel itching to attack Iran. We have Iran engaged in a defense pact with Syria against Israel. We have Syria with Russian navy bases and weapons on its soil, and we have the U.S. rampaging through the Middle East encroaching on the borders of Pakistan and Yemen, essentially pissing off everyone. What we have is a Globalist made recipe for disaster, using the same ingredients they have used for the last several major wars…"

Only a year after I published the piece the civil uprising in Syria began, starting with the “Daraa protest movement”, aided by covert intelligence agencies including the CIA.

In 2012, I decided to reexamine my original theory on Syria as a global catalyst in my article “Syria And Iran Dominoes Lead To World War.”

In that article, I felt it was necessary to summarize trends in the region, where they might lead, and how globalists might exploit each scenario to achieve a false conflict between East and West. I predicted that the entire Syrian insurgency was conjured out of the ether by NATO interests, due to the suspicious nature of the Council On Foreign Relations and their public statements suddenly SUPPORTING Al-Qaida in Syria. U.S. involvement in the funding and training of the organization we now know as ISIS (or al-Qaida 2.0) has been proven.

I predicted that U.S. ground troops would enter Syria. This has happened, though the U.S. government maintains that their role and numbers will be “limited.”

I suggested that once U.S. troops were deployed in any capacity in the region, Iran would join forces with the Syrian government under their already existing mutual defense pact. Today, Iranian troops are entering Syria en masse for combat operations.

I also predicted that U.S. involvement in Syria would eventually elicit a military response from Russia and a financial response from China. Though China has not yet used the conflict as an excuse to accelerate the dumping of U.S. treasuries, Russia is now fully committed to airstrikes and is preparing a ground invasion, possibly exceeding 150,000 troops.

Some developments I suggested in my previous articles have not yet surfaced, though I believe there is more than enough momentum for them to be triggered. For instance, I believe Israel is still the ultimate wild card in the Syrian crisis. A military response from Israel is more than possible, particularly against Iran in retaliation for flooding into the region. Further U.S. involvement, including the greater commitment of major naval assets, is likely. And if the U.S. or Israel escalate, I believe Iran will shut down the Strait of Hormuz, perhaps even with the aid of Russia.

Russian President Vladimir Putin has hinted that Israeli activity in Syrian airspace will be obstructed, and reports of some “near misses” between Russian and Israeli fighters have surfaced.

Currently, U.S. “relations” with Russia are at lows not seen since the Cold War. In the meantime, the globalists have created a perfect storm of conflicting interests that could very well lead to outright world war. That said, there are different brands of warfare. And, as I pointed out five years ago, the elites do not necessarily need the threat of nuclear war to open the door to collapse.

Economic warfare would be just as devastating to many parts of the globe and the U.S. in particular, causing massive population reduction through starvation in the span of a few months while leaving large areas of infrastructure intact. Economic warfare is also a perfect distraction of the public eye away from the crimes of international financiers. Our fiscal structure is already in the middle of an implosion set in motion by deliberately destructive central banking policies. But in the midst of economic warfare, such monetary atrocities can simply be blamed on “the treachery of the East.” The Syrian debacle makes an economic battle scenario between East and West "believable" for many people around the world.

Still, wider regional warfare of the shooting variety is certainly guaranteed in the near future.

Saudi Arabia has denounced Russian and Iranian involvement in Syria and has increased support to “moderate rebels.” Of course, as we have seen repeatedly in the past couple of years, there are in fact NO moderates in Syria as rebel groups continue to obtain Western money and weapons and then join the ranks of ISIS.

The Saudis have made it clear that they will never accept a situation in which the Assad regime continues to hold power in Syria. They have threatened a military response in the event that Assad gains superiority over the insurgency. Keep in mind that the Saudis have already committed forces to Yemen.

Tensions are also increasing between Saudi Arabia and Iran over Syrian involvement, despite recent Saudi support for the U.S./Iran nuclear deal. The European Council On Foreign Relations has warned that there are now no “mediators for deescalation” in the region. Of course, this is exactly the way they prefer it.

Turkey is also now a factor, with Turkish officials claiming airspace violations by Russia, and Turkish forces operating in at least a limited capacity in Syria and Iraq. Syria is a gasoline soaked mess and there are too many potential sparks to keep track of. The globalists have conjured an environment in which a disastrous domino effect is almost guaranteed.

Another rather unexpected consequence of the Syrian crisis is the now active effort by the elites to initiate a Cloward-Piven strategy using so-called Syrian "refugees" to destabilize the EU and perhaps even the U.S. Already, the suggested immigration count for such refugees, many of whom are not even from Syria, has risen from 10,000 bound for the U.S. to 100,000. I believe as the crisis continues to grow this number will be increased to 1 million refugees or more bound for the U.S. Expect many extremist elements to be shipped into our borders along with them.

It is absolutely imperative to remember regardless of what happens next, almost every element of this crisis has been staged. War and economic despair are the ultimate expedient world-changing tools. They wipe the slate nearly clean, as it were, and mold public perception through fear. That which you thought impossible today becomes rather reasonable tomorrow after crisis takes hold; and this includes the final deconstruction of constitutional values, the militarization of our society, the loss of financial prosperity, the extreme degradation of living standards and the ultimate centralization of everything.

It is also important to realize that there are no sides in this conflict. The East/West paradigm is a sham of epic proportions and always has been. False sides are meant to distract and bewilder the public. They are designed to create counterfeit cross-sections of blame. They are an anathema to truth.

For further and deeper analysis on possible future developments on a global scale please read my articles “The Economic End Game Explained” and “Has America Been Set Up As History’s Ultimate Bumbling Villain?”

The question today is merely one of timing. How long before a negative trigger is introduced? How long before Israeli planes come into contact with Russian or Iranian fighters? How long before U.S. troops come into contact with Russian troops? How long before Israel or Saudi Arabia strike Iran? And if the U.S. backs out completely, how long before the entire dynamic of the Middle East is flipped and America loses petro-status for the dollar? With the speed of events forming a fiscal-political riptide, it is hard to imagine we will be waiting very long to find out.

- St. Louis Prepares For "Catastrophic Event" As Underground Fire Nears Nuclear Waste Cache

Beneath the surface of a St. Louis-area landfill lurk two things that should never meet: a slow-burning fire and a cache of Cold War-era nuclear waste, separated by no more than 1,200 feet.

Government officials have quietly adopted an emergency plan in case the smoldering embers ever reach the waste, a potentially “catastrophic event” that could send up a plume of radioactive smoke over a densely populated area near the city’s main airport.

Although the fire at Bridgeton Landfill has been burning since at least 2010, the plan for a worst-case scenario was developed only a year ago and never publicized until this week, when St. Louis radio station KMOX first obtained a copy.

But don't panic, as officials say it is "contained"…

County Executive Steve Stenger cautioned that the plan “is not an indication of any imminent danger.”

“It is county government’s responsibility to protect the health, safety and well-being of all St. Louis County residents,” he said in a statement.

Landfill operator Republic Services downplayed any risk. Interceptor wells — underground structures that capture below-surface gasses — and other safeguards are in place to keep the fire and the nuclear waste separate.

“County officials and emergency managers have an obligation to plan for various scenarios, even very remote ones,” landfill spokesman Russ Knocke said in a statement. The landfill “is safe and intensively monitored.”

The cause of the fire is unknown. For years, the most immediate concern has been an odor created by the smoldering. Republic Services is spending millions of dollars to ease or eliminate the smell by removing concrete pipes that allowed the odor to escape and installing plastic caps over parts of the landfill.

Directly next to Bridgeton Landfill is West Lake Landfill, also owned by Republic Services. The West Lake facility was contaminated with radioactive waste from uranium processing by a St. Louis company known as Mallinckrodt Chemical. The waste was illegally dumped in 1973 and includes material that dates back to the Manhattan Project, which created the first atomic bomb in the 1940s.

The Environmental Protection Agency is still deciding how to clean up the waste. The landfill was designated a Superfund site in 1990.

The proximity of the two environmental hazards is what worries residents and environmentalists. At the closest point, they are 1,000 to 1,200 feet apart.

If the underground fire reaches the waste, “there is a potential for radioactive fallout to be released in the smoke plume and spread throughout the region,” according to the disaster plan.

The plan calls for evacuations and development of emergency shelters, both in St. Louis County and neighboring St. Charles County. Private and volunteer groups, and perhaps the federal government, would be called upon to help, depending on the severity of the emergency.

No reports of illness have been linked to the nuclear waste. But the smell caused by the underground burning is often so foul that Missouri Attorney General Chris Koster sued Republic Services in 2013, alleging negligent management and violation of state environmental laws. The case is scheduled to go to trial in March.

Last month, Koster said he was troubled by new reports about the site. One found radiological contamination in trees outside the landfill’s perimeter. Another showed evidence that the fire has moved past two rows of interceptor wells and closer to the nuclear waste.

Koster said the reports were evidence that Republic Services “does not have this site under control.” Republic Services responded by accusing the state of intentionally exacerbating “public angst and confusion.”

Ed Smith of the Missouri Coalition for the Environment said he would like to see the county become even more involved “to ensure that businesses, schools, hospitals and individuals know how to respond in a possible disaster at the landfill, just like preparing for an earthquake or tornado.”

Underground smoldering is not unheard of, especially in abandoned coal mines. Common causes include lightning strikes, forest fires and illegal burning of waste.

At least 98 underground mine fires in nine states were burning in 2013, according to the Office of Surface Mining Reclamation and Enforcement.

Few underground fires can match one in Centralia, Pennsylvania. In 1962, a huge pile of trash in the town dump, near a coal mine, was set on fire, and it has burned beneath the town for more than half a century.

- Caught On Tape: Russian Warships Launch 26 Cruise Missiles At ISIS Targets

On Monday evening, we detailed the Russian hardware being used in Moscow’s campaign to rout anti-regime forces and restore the government of Bashar al-Assad in Syria.

As we noted in our preface to that feature, “watching Russia effectively humiliate the West by bragging day in and day out is nothing if it’s not amusing, and indeed the leaked diplomatic cable from 2006 which outlines Washington’s intent to effectively start a civil war in Syria leaves one completely uninclined to be at all sympathetic to the ridiculous situation the US and its allies have found themselves in.”

That, along with the fact that Western nations like France are not only unwiling to admit that the West’s participation in Syria has been an outright disaster, but are now set to “correct” a refugee crisis by bombing the very place from which the refugees are fleeing leaves us inclined to highlight the following video (out today from the Russian Defense Ministry) that shows what happens when a military superpower decides that because an existing aerial campaign has become akin to shooting fish in a barrel, it might be time to do some sea-based target practice on a few Nike-wearing, black flag-waving jihadists…

From RT:

Russia’s Defense Ministry has published a video of its warships firing cruise missiles from the Caspian Sea to hit the positions of Islamic State militants in Syria.

“[Last] night the ship strike group of the Russian Navy, consisting of the Dagestan missile ship, the small-sized missile ships Grad Sviyazhsk, Uglich and Veliky Ustyug launched cruise missiles against ISIS infrastructural facilities in Syria from the assigned district of the Caspian Sea,” the ministry said in a comment under the video.

According to the ministry, the Russian military attack was conducted “by high-precision ship missile systems Kalibr NK, the cruise missiles of which engaged all the assigned targets successfully and with high accuracy.”

On September 30, Russia launched its military operation against Islamic State at the request of the Syrian government. Since the start of the operation the Russian military have destroyed at least 112 objects, including commanding pints, ammunition depots and armored vehicles belonging to jihadists.

- Time To End Monetary Central Planning

Submitted by Richard Ebeling via EpicTimes.com,

There is no way to describe current Federal Reserve policy other than as monetary confusion and misdirection. In a nutshell, Janet Yellen and the other members of the Fed’s Board of Governors have no idea what to do. Do they raise certain interest rates over which they have some direct influence? Do they keep them at their current rock bottom levels, as they have for the last six years?

On the one hand, government measured unemployment levels have fallen from their high of over 10 percent at the depth of the recent recession to 5.1 percent in September 2015.

However, there is an alternative measure of unemployment also calculated by the U.S. Bureau of Labor Statistics. It includes not only those currently unemployed and looking for work during the previous four weeks, but also “discourage workers” who have stopped looking for jobs who would be interested in working if they found a suitable employment; and those who are part-time who would prefer to be employed full-time. If these two additional groups are included, the U.S. unemployment rate is 10 percent, double the headline “official” level of unemployment the administration touts as a “positive” sign of the economy’s recovery.

On the other hand, price inflation as measured by the Consumer Price Index seems to be barely rising. According to the Bureau of Labor Statistics, price inflation in August 2015 was .02 percent higher than twelve months earlier.

Again, however, when food and energy prices are subtracted out of the Consumer Price Index to leave what the government statisticians call “core” inflation, prices in August were 1.8 percent higher than a year ago. Certainly not a “galloping” inflation, but not the nearly zero price inflation rate the highline number suggests, particularly since food prices were up 1.6 percent over the year; the “drag” on measured price inflation was all due to a 15 percent decline in energy prices compared to twelve months earlier.

No Trade-Offs Between Employment and Inflation

If we look at that alternative unemployment rate of 10 percent in conjunction with the “core” price inflation rate of 1.8 percent, what we see is a moderate form of what in the 1970s was called “stagflation”: high unemployment with rising price inflation.

The Federal Reserve could try to nudge up the key interest rates it most directly has influence over, especially the Federal Funds rate at which banks lend to each other overnight, but with the risk of threatening the investment and home mortgage borrowing that it has attempted to “stimulate” through near zero interest rates.

Or the Federal Reserve could continue to keep those interest rates low through a continuation of their moderated “quantitative easing” monetary policy, but with the risk that price inflation (however measured) may start to rise faster than it has, creating the danger of price inflation above their declared target level of two percent a year.

(It should be kept in mind that even the Federal Reserve’s “modest” target rate of two percent annual price inflation would still result in a near 50 percent decrease in the value of every the dollar in our pockets in around 20 years.)

Either way, the old Keynesian notion that you can lower unemployment by accepting a higher rate of price inflation, and vice versa, shows itself to be as illusionary as when it was first touted back in the 1960s as the mechanical macroeconomic policy trade-off between unemployment and price inflation known as the Phillips Curve.

The European Central Bank, by the way, is in its own dilemma. European Union-wide official unemployment continues to hover above 10 percent with a modest price deflation as most recently measured, in spite of that central bank’s own version of “quantitative easing” of nearly $70 billion of new paper money-creation per month since the beginning of 2015.

The Fed Causes Booms and Busts

The only result of these years of monetary expansion and interest rate manipulation is economic instability and distortion. The financial market indices significantly gyrate up and down seemingly every day based on attempted nuanced readings of the latest public statements by any of the Federal Reserve Governors concerning interest rate policy changes.

The house of cards constructed on years of artificially low or zero interest rates in terms of investments undertaken with trillions of dollars of cheap money, as well as home mortgages at manipulated interest costs, hang in the balance again as in previous boom-bust cycles.

Every time the booms turn into busts, the central bankers insist that they have had nothing to do with it. It has been due to “irrational exuberance” in financial markets, or huckster bankers who duped people into taking out loans they could not really afford, or international events beyond a national central bank’s control, or just, well, “bad luck” with things happening in unpredictable ways even under the watchful eyes of the central bank “experts.”

The fact is, the boom-bust cycles that have plagued modern industrial societies for well over a century, including the Great Depression of the 1930s and this most recent “Great Recession,” as it has been dubbed, have not “just happened” or been the result of inherent and inescapable weaknesses in a market economy or capitalist financial markets.

The booms and busts of the business cycle are the result of the very central bank system that government policy-makers and central bankers insist they are there to either prevent or mitigate in its amplitude and duration.

As I explain in my new, recently released book, Monetary Central Planning and the State, published by the Future of Freedom Foundation, central banking suffers from the same political and economic shortcomings as all other forms of central planning.

Monetary Printing Press Plunder

First, placing the control of the monetary system in the hands of the government or a government-created agency such as the U.S. Federal Reserve System opens the door to the temptation of political abuse in many forms. On the one hand, the temptation exists to use the monetary printing press to create the money that covers the expenses of a government’s deficit spending and provides the artificially low interest rates to manipulate the costs of funding the government’s accumulated debt.

On the other hand, a central bank can also be used to “stimulate” employment and production in the service of politicians leading up to an election, to make it seem that those in political power have the magic wand to “create jobs” and better standards of living – what is sometimes referred to as the “political business cycle.”

It also enables pandering to special interest groups wanting sources of below-market rates of interest for loans, as well as the banking institutions themselves that have access to the created credit supplied by the central bank with which they earn interest income that otherwise might not have been there.

Government full or near monopoly control of any resource, asset or institution (such as a central bank) historically has always brought in its wake plunder and privilege for some at others’ expense that would not have been possible in a more open, competitive market setting.

Monetary Central Planning and the Business Cycle

However, even if those who oversee and manage central banks were as “pure” and benevolent as angels only wishing to do good for mankind with no ulterior self-interested motives or temptations, the monetary and banking system would still constantly run the risk of suffering from the same boom-bust cycles that we see in our world today.

That is because central banking is a form of central planning, and as such, manifests the same weaknesses and impossibilities as all centrally planned economic systems. Interest rates are market-generated prices that are meant to coordinate the decisions of savers with those of potential investors, by bringing the two sides of the loan market into balance.

Income-earners make a decision to spend a portion of their earned income on desired consumer goods and to save a portion of that income for planned and possible demands and uses in the future. The real resources that saved portion of their money incomes represent in terms of buying power in the market is transferred to interested and able borrowers; they use that saved portion of other people’s money income to enter the market and demand and purchase resources, raw materials, capital goods (machines, tools, equipment) and labor services to undertake future-oriented and time-consuming investment projects of various types and lengths that will bring forth goods to be bought and sold in the future.

Interest rates, in other words, serve as the balancing rod to keep in coordinated order the use of scarce resources in society between the production of consumer goods closer to the present and the investments that will bring forth consumer goods further in the future. It is the balancing of resource uses and goods production across time.

Central Banker Hubris vs. Competitive Markets

There is no way to know what are the “correct” coordinating interest rates for different types of loans with differing periods of investment time in relation to people’s decisions to consume and save parts of their income other than to allow free, competitive financial markets to discover through the interactions of supply and demand what the “equilibrium” or market-balancing interest rates should be.

This is, of course, no different than in the case of any other good or service that can be offered on the market. No central planner can replace the competitive market and its free pricing system for integrating and coordinating all the complex knowledge and circumstances of multitudes of millions of suppliers and demanders in an ever-changing world.

And, likewise, it is shear arrogance and naïve hubris for central planners to believe that they do or ever can have the knowledge, wisdom and ability to correctly determine what the quantity of money should be in the economy, what money’s value or purchase power should be over goods and services in the marketplace, or what interest rates would assure that coordinated balance between savings and investments.

Monetary Freedom and Private Competitive Banking

That is why in is time to rethink and challenge the presumption of a need for and superior outcome from the institution of central banking, whether in the United States or anywhere else in the world.

In the twentieth century a group of economists known as members of or sympathizers with the “Austrian School of Economics” challenged the reasoning and rationale behind central banking. Among these leading Austrian economists were Ludwig von Mises and F. A. Hayek.

Though Austrian economists have differed sometimes in their emphases and arguments about the practical workings of a private, competitive free banking system, there is one underlying premise shared by all of them: a completely market-based monetary and banking system would be far superior to historical and current institutional forms of central banking.

Money is, perhaps, the most central and essential, economic good in the market, since it is the generally used medium of exchange to facilitate all transactions entered into by buyers and sellers. It makes smoother and more effective the exchange of goods and services throughout the economy.

Money and Banking is Too Important to Leave to Central Banks

But precisely because of its central role and significance in a complex and ever-changing market economy the supply and control of money is too important to leave in the hands of politicians or their central bank appointees.

They are either too open to the temptations of short-run political purposes in their control of the monetary printing press; or they suffer from what Hayek called a “pretense of knowledge” in presuming that they can ever know more or better than the cumulative knowledge of all the participants of the competitive market as manifested in the prices and interest rates that emerge through the interaction of supply and demand.

Historically, markets – which means all of us in our roles as consumers and productions – determined which commodities were most useful as media of exchange for different types and sizes of transactions. Money was not and need not be a creation or creature of the state, and has most often been commodities such as gold and silver.

Banking as the institutional procedure and process to facilitate and coordinate the decisions of savers and investors emerged out of the market discovery of profitable opportunities in providing intermediary services to minimize the costs of lenders and borrowers directly searching out trading partners for the exchanging of resources and goods across time.

Money Creation as a Tool of Plunder

Governments and their central bank creations usurped market-based monetary and banking systems to serve the plundering purposes of kings, princes, parliaments, and special interest groups who all wanted to hold the magical hand of the monetary printing press.

Print up money (or its digital substitutes and surrogates in more modern times) and you can have access to all the hard work of others who have invested in manufacturing and bringing to market all the goods and services you desire without having to undertake the reciprocal effort and work to make and trade an actual good or service to earn the money so as to honestly buy what you want from them. Some are so impolite as to refer to such monetary mischief as “fraud” and “theft.”

Added to this more “base” purpose of government monopolization of the monetary printing press, has been, over the last one hundred years, the arrogance and hubris of social engineers, bureaucratic elites of “experts” and “socially-oriented” policy-makers who presume to know how to micro-manage and macro-manage society better than leaving people to manage their own lives through peaceful interaction with others in the competitive marketplace.

Their century-long legacy in the arena of money and banking has been the booms and busts of the business cycle. The monetary social engineers have worn different hats at different times – calling themselves Keynesians, Monetarists, New Classical or Rational Expectations theories, or Post- and New Keynesians – but they remain variations on the same conceptual and ideological theme: monetary central planners imposing their notions of desired market outcomes by co-opting the functioning of a real and functioning market-based competitive system of free banking using market-chosen media of exchange.

The time has come to end the tragic and disruptive reign of monetary central planning.

- China Opens Weaker Than Expected After Goldman Downgrade And "Mirage Of A New Dawn" Warnings

After a "no change" statement from The BoJ, today's dismal Japanese data was terrible enough to be great news in the new normal as August machine orders drop the most in at least a decade and stocks, USDJPY dipped and ripped. However, it was the China open that investors waited for (after China shares rising 10% in US trading, and CNH strengthening on lower than expected reported outflows) as Goldman slashed its 12m target for Chinese stocks, and Bocom's chief strategist (who called the boom and the bust) says "rally is mirage of new dawn, volume is dying, sell the rallies." PBOC fixed the Yuan at its strongest in 2 months and while Chinese stocks opened up notably it was less than US ADRs suggested (CSI +4% vs ASHR +9.5%).

Global stocks are up 7 days in a row (since Chinese markets shut) – the longest win streak since April… the biggest 7-day rip since Dec 2011…

But we start with Japan…. After a "no change" statement from The BoJ, today's dismal Japanese data is terrible enough to be great news as Machine Orders collapse 3.5% YoY (against expectations of a 3.5% rise) dropping for the 3rd month in a row. This is the biggest MoM drop (-5.7%) for August in at least a decade…

In addition Japanese investors sold the most foreign bonds in 4 months and bought a near-record amount of foreign stocks…

- *JAPAN PORTFOLIO INVESTMENTS IN INDONESIA RISE TO RECORD IN AUG.

This – notably – sparked weakness in USDJPY and Nikkei 225… but Kuroda and his merry men quickly stepped in to fix that…

* * *

But global investors were waiting with baited breath for the China open (after being told "don't worry" earlier by The PBOC)…

Before it opened, we noted that Offshore Yuan and US equities had decoupled…

And if last year was anything to go by, it could get ugly…

As China returns from a week-long holiday to the following news:

- Factory PMIs, both official and Caixin, came in slightly above forecast for Sept.

- Govt eased down-payment rules for first-time homebuyers to support housing;

- FX reserves fell less than est., easing fears about extreme selling pressure on yuan

Chinese stocks in U.S. rose almost 10% during the break… but while Chinese Stocks open higher (but less than US ADRs suggested)…

- *FTSE CHINA A50 STOCK-INDEX FUTURES RISE 7.7% AT OPEN

And then weakened more…

- *CHINA'S CSI 300 STOCK-INDEX FUTURES RISE 4% TO 3,251.2

- *CHINA SHANGHAI COMPOSITE SET TO OPEN UP 3.4% TO 3,156.07

- *CHINA'S CSI 300 INDEX SET TO OPEN UP 3.8% TO 3,324.98

- *HANG SENG CHINA ENTERPRISES INDEX EXTENDS DROP TO 1.1%

So The PBOC strengthened the Yuan fix to its highest in 2 months…

And injects more liquidity…

- *PBOC TO INJECT 120B YUAN WITH 7-DAY REVERSE REPOS: TRADER

And this…

#CHINA CENTRAL BANK LAUNCHES #YUAN CROSS-BORDER INTERBANK PAYMENT SYSTEM ON OCT 8

— Amanda Lee (@Lee_AHY) October 8, 2015

- *PBOC SAYS CIPS OFFERS YUAN CLEARING, SETTLEMENT SERVICE

- *PBOC SAYS 19 BANKS PARTICIPANT CIPS

* * *

Goldman has downgraded China…

- *CSI300 INDEX 12-MO. TARGET CUT TO 4,000 VS 5,000 AT GOLDMAN

‘Reform’ and ‘liquidity’ continue to buttress our constructive strategic market view. Our refreshed 12m CSI300 target is 4,000 (from 5,000), 25% upside, comprising 10% EPS accrual and a liquidity-based target P/E of 12.7X (-0.4 s.d.), but a harsher growth backdrop could see another 8% downside from current levels. Implementation of SOE and other structural reforms, and the 13th Five Year Plan (FYP) are the key issues to watch.

But added…

- “Harsher” growth backdrop could see another 8% downside from current level

- Govt may need to buy another 200b to 300b yuan worth of equities to keep SHCOMP at 3,100

However, on the other hand, the man who called China's boom and bust warns to sell rallies…

“I still think it’s better to sell into highs rather than buying dips," Hong, the chief China strategist at Bocom in Hong Kong, said in an e-mail interview. “The government has succeeded in curbing market volatility. But volume is dying, too."

"The government won’t intervene actively as long as the Shanghai Composite is at or above current level, i.e. around 3,000," said So, who has a year-end target of 3,200 for the index. "There is limited room to re-leverage. Demand for margin lending would be low anyway, as it takes time to mend investors’ broken hearts."

"There will be oversold technical reprieves,” Hong said. Such rallies “can give people a mirage of a new dawn — until they give up hopes of bottom fishing.”

* * *

Finally there is this…

- *VIETNAM TO ALLOW SHORT SELLING TO BOOST TRADING OF STOCKS: NEWS

Just do not tell China.

Charts: Bloomberg

- Marc Faber Fears Sudden 1987-Like Crash Or Longer-Term "Sliding Slope Of Hope"

Sometimes less is more (less good data is moar good for stocks) and in the case of Marc Faber's recent appearance on Bloomberg's "What'd You Miss", 66 seconds of honesty was all that the hosts could take.

The Gloom, Boom & Doom report editor notes "we have had a meaningful decline in many stocks already," and warns it is far from over as market face two possibilities of "longer-term unattractiveness": "a 1987-style collapse," or a 1973-74-style slow "sliding slope of hope."

In the full interview, Faber goes into more detail on the world's deflationary pressures amid "colossal financial asset inflation."

- No More "Free Trade" Treaties: It's Time for Genuine Free Trade

Submitted by Ferghane Azihari via The Mises Institute,

It is erroneous to believe that free traders have been historically in favor of free trade agreements between governments. Paradoxically, the opposite is true. Curiously, many laissez-faire advocates fall into the government-made trap by supporting “free-trade” treaties. However, as Vilfredo Pareto stated in the article “Traités de commerce of the Nouveau Dictionnaire d’Economie Politique” (1901):

If we accept free trade, treatises of commerce have no reason to exist as a goal. There is no need to have them since what they are meant to fix does not exist anymore, each nation letting come and go freely any commodity at its borders. This was the doctrine of J.B. Say and of all the French economic school until Michel Chevalier. It is the exact model Léon Say recently adopted. It was also the doctrine of the English economic school until Cobden. Cobden, by taking the responsibility of the 1860 treaty between France and England, moved closer to the revival of the odious policy of the treaties of reciprocity, and came close to forgetting the doctrine of political economy for which he had been, in the first part of his life, the intransigent advocate.

In 1859, the French liberal economist Michel Chevalier went to see Richard Cobden to propose a free trade treaty between France and England. For sure, this treaty, enacted in 1860, was a temporary success for free traders. What is less known however, is that at first, Cobden, in accordance with the free trade doctrine, refused to negotiate or sign any “free trade” treaty. His argument was that free trade should be unilateral, that it consists not in treaties but in complete freedom in international trade, regardless of where products come from.

Chevalier eventually succeeded in obtaining Cobden’s support. But Cobden was puzzled by the complete secrecy surrounding the negotiations and, in a letter to Lord Palmerston, he attributed this secrecy to the “lack of courage” of the French government. Similarly, today, the lack of transparency concerning free-trade negotiations is problematic and it is often hard to know what the content of a treaty will be.

Today, while some of these treaties are currently being negotiated, there are already examples of similar agreements enforced. One could refer to the General Agreement on Tariffs and Trade (GATT), the General Agreement on Trade in Services (GATS), the Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS) or more regional agreements like the North American Free Trade Agreement (NAFTA) or the European Economic Area (EEA).

But why would protectionist governments who spend their time hampering markets by giving monopolies and other kinds of privileges at national level, open markets at the international level? The very fact that governments are negotiating in the name of free trade should be suspicious for any libertarian or true advocate of free trade.

Intergovernmental Agreements Enhance Government Power

Murray Rothbard opposed NAFTA and showed that what the Orwellians were calling a “free trade” agreement was in reality a means to cartelize and increase government control over the economy. Several clues lead us to the conclusion that protectionist policies often hide behind free trade agreements, for as Rothbard said, “genuine free trade doesn’t require a treaty.”

The first clue is the intergovernmental and top down approach. Intergovernmentalism is nothing more than a process governments use to mutualize their respective sovereignties in order to complete tasks they are not able to accomplish alone. Nation-states are entities which rarely give up power. When they finalize agreements, it is to strengthen their power, not to weaken it. On the contrary, free trade requires a decline of governments’ regulatory power.

Also, free trade does not require interstate cooperation. On the contrary, free trade can be and has to be done unilaterally. As freedom of speech does not need international cooperation, freedom to trade with foreigners does not need governments and treaties. Similarly, our government should not rob their population with corporatist and protectionist policies just because others do. Anyone who believes in free trade does not fear unilateralism. The simple fact that bureaucrats and politicians do not conceive of the international economy outside of a legal frame settled by intergovernmental agreements is sufficient to show the mistrust they express toward individual freedom. This reinforces the conviction that these agreements are driven by mercantilist preoccupations rather than genuine free trade goals.

Extending Regulatory Control Beyond Your Own Borders

The second clue concerns the intense conflicts between governments on these agreements characterized by a high degree of technicality. History shows that multilateralism leads toward deadlock. The failure of the Doha Round is the cause of the proliferation of bilateral and regional initiatives. The contentious relations between governments come from the will of some states to dictate their norms to other countries’ producers through an international harmonization process. But this is the exact opposite of free trade. As economic theory shows us, exchange and the division of labor is not based on equality and harmonization but rather on differences and inequality. Furthermore, the technicality and secrecy surrounding free-trade agreements favor mercantilism and protectionism to the extent that technical regulations are used to favor producers who are politically well connected.

The Trans Pacific Partnership (TPP) is a good illustration of this balance of power. It was at first an agreement between four countries (Brunei, New-Zealand, Singapore, and Chile.) which tried to resist some neighbors’ commercial influence, especially China. Then the United States came and convinced more countries (Australia, Malaysia, Peru, Vietnam, Canada, Mexico, and Japan) to join the negotiations. Let’s also notice that most of the countries invited are already bound by regional or bilateral agreements with the United States. China remains excluded from the process. This governmental drive toward regulatory hegemony is obviously the complete opposite of free trade. Indeed, free trade supposes letting consumers peacefully choose what products they want to promote rather than determining what is available through bureaucratic coercion.

Consolidation of Monopolies

The third clue concerns the vigor with which governments have tried over several decades to impose at the international level a more constraining legal framework for so-called “intellectual property.” The first initiatives appear in 1883 and 1886 with the Paris Convention for the Protection of Industrial Property and the Bern Convention for the Protection of Literary and Artistic Works. Amended several times during the twentieth century, the initiatives embrace, respectively, 176 and 168 states. These conventions are placed under the auspices of the World Intellectual Property Organization (WIPO), an international bureaucracy which joined the United Nations system in 1974. A turning point came in 1994 with the signature of the Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS) administrated by the World Trade Organization (WTO). It is now incorporated as an essential part of the administration of international commerce and benefits from the WTO’s sanction mechanisms.

In 2012 we endured a fresh attempt by our governments to reduce our freedom to create and share intellectual works with the Anti-Counterfeiting Trade Agreement (ACTA). And, if we look at the negotiations mandates of these trade agreements, we can see they all include a chapter on the reinforcement of “intellectual property” rights. Intellectual property has become a key concept of the international economy. But this must not hide its illegitimacy.

As Vilfredo Pareto remarked, “From the point of view of the protectionist, treaties of commerce are … what is most important for a country’s economic future.” Each time a new “free trade” treaty is enacted, what is seen is the attenuation of tariff barriers, but what is not seen is the sneaky proliferation and harmonization of non-tariff barriers impeding free enterprise and creating monopolies at an international scale at the expense of the consumer. It’s time for genuine free trade.

- "I Would Say Don't Worry" Says Chinese Central Banker As Indian Central Banker Says "World Economy Is Looking Grim"

Earlier today, the IMF with its usual several year delay, discovered what pretty much everyone else had known for years: that emerging markets have massively overborrowed, according to the IMF to the tune of $3 trillion, most notably in China.

Of course, this is one of the many things we have been cautioning about for the past 6 years, perhaps nowhere more vividly than in this November 2013 infographic showing “How In Five Short Years, China Humiliated The World’s Central Banks.”

So now that the IMF has finally caught up with what our readers knew two years ago, here are some more of its “profound” observations:

This dangerous over-leveraging now threatens to unleash a wave of defaults that will imperil an already weak global economy, said stark findings from the IMF’s twice yearly report.

The Fund warned there was no margin for error for policymakers navigating these hazardous risks.

“Policy missteps and adverse shocks could result in prolonged global market turmoil that would ultimately stall the economic recovery,” said Jose Viñals, financial counsellor at the IMF.

And just when one thinks there is hope yet for the IMF, and it is almost on the same page as the BIS (the same BIS whose board of directors is comprised of all modern central bankers of course), the IMF goes and says what its policy recommendation is: engage in the same policies that have not only failed, but led the world to the brink, but not just one where the market can plunge 20%, 40%, or more percent, but where the entire neo-Keynesian/fiat/fractional reserve system is ultimately left discredited in the garbage heap of history, where it belongs.

The world’s major central banks should ensure policy remains “accommodative” for fear of setting off a new wave of instability that would see bond prices rise and asset prices collapse, said the IMF.

In fact, just do more QE. Best of all, just paradrop money right; after all that $200 trillion in global debt (and a few quadrillion in derivatives) won’t inflate itself away, right?

Whoever wishes to, can waste their team reading the full report here.

One person who didn’t read it, but had no choice but to engage in damage control was China’s deputy PBOC governor Yi Gang, who had the following absolutely comical retort to the IMF:

“I would say, don’t worry,” said Yi Gang, deputy governor of the People’s Bank of China, after the International Monetary Fund warned of risks in China’s economic challenges.

“China will still have pretty much middle-to-high growth in the near future,” said Mr Yi, speaking in Lima, where the IMF-World Bank annual meetings were beginning.

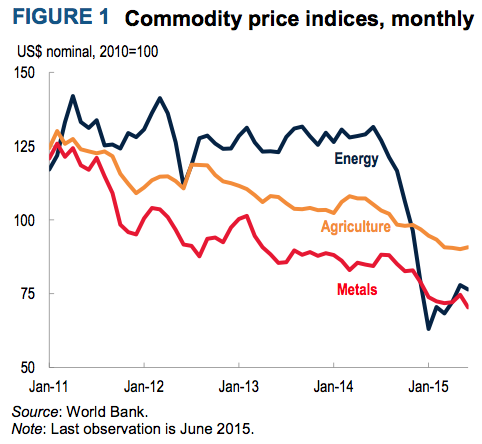

“A lot of people are considering a slowdown of the Chinese economy,” he said, referring to how the downturn has helped send global commodity prices plummeting, hurting the economies of exporters. But he insisted that Chinese imports of raw materials for its industrial economy will grow steadily in the future.

We won’t even dignify this utter gibberish with a comment, but instead will give the word to a far more credible and serious policy maker, former IMF chief economist and current India central bank governor Raghuram Rajan, perhaps the only sane central banker anywhere these days, who realizes it is now too late for “macroprudential policy”, and certainly far too late “not to worry.”

Instead he called for a “global safety net” backed by the IMF to provide support to economies “that might experience liquidity crises in the future, especially given that such problems might be triggered by the reversal of years of highly accommodative, post-crisis monetary policy in advanced economies such as the US.”

Look what he did there, IMF? He did not call for more QE/NIRP/ZIRP or money paradrops: instead he realizes when the game is over, and when it is time to move on to the next, far less pleasant stage in the global lifecycle.

What is this safety net Rajan proposes?

Without such a safety net, governments were reluctant to approach the IMF because of the stigma attached to such a plea and the implication that they were undergoing a full-blown solvency crisis rather than a temporary shortage of liquidity as billions of dollars of capital rushed for the exit.

Mr Rajan said one possibility was a multilateral swap arrangement among central banks — of the sort that already exists between the emerging Brics economies and in the $50bn Japanese credit line for India, for example — guaranteed by the IMF. “I think a lot of emerging markets would like to see something like this,” he said, but admitted there was no appetite for the idea among advanced economies.

Of course there isn’t: it would mean reducing the equity return for the shareholders of DM central banks. And that must be avoided at all costs, even if the currency said shareholder plans to liquidity asset holdings into will not exist for much longer.

Finally, Rajan’s summary of the state of the global economy was far less cheerful and far more credible than that of Yi Gang:

The world economy, he said, was “looking grim.”

So then, worry?

- The World Map Of Debt

What if we were to redraw the world map based on the sustainability of national debt levels?

Original graphic by: HowMuch.net

Countries that are smaller in size, but that have big debt loads, would stand out more. If we used debt-to-GDP as scaling criteria, Japan would become the largest country on our new map. Japan holds 19.99% of all global debt despite only having about 6% of the world’s economic production. The country’s debt-to-GDP ratio is 230%.

Greece and Italy, two medium-sized European countries, would be bigger than North America as a whole. That said, the United States does hold an extreme amount of debt itself, equal to an astounding 29.05% of global debt. It is just masked more because of the country’s significant GDP. We have also looked at the United States another way in the past, and by the measure of debt-to-revenue, the US has the 2nd largest debt burden in the world.

On the opposite side of the question, there are large countries that have less debt – they disappear from the map almost completely. Australia, a giant land mass, is reduced to a tiny island with its load of 29% debt-to-GDP. Nigeria shrinks to a tiny speck on the map with an 11% ratio.

- Edward Snowden: "They've Said They Won't Torture Me…"

Submitted by Simon Black via SovereignMan.com,

Just in case anyone still foolishly believes that there’s a shred of decency left in the ‘justice’ system in the Land of the Free, I would humbly present exhibit A: Edward Snowden.

In a recent interview with the BBC, Edward Snowden disclosed that he has offered numerous times to the US government to return to the United States, face trial, and if necessary, spend time in prison.

[full interview below]

It hasn’t mattered that hundreds of thousands of people have signed petitions asking President Obama to pardon Mr. Snowden.

Those petitions have been totally ignored.

So Snowden is preparing to return and face trial, negotiating terms with Uncle Sam to ensure that he’s treated fairly.

As he told the BBC, “So far they’ve said they won’t torture me. Which is a start, I think. But we haven’t gotten further than that.”

It’s a sad reflection on the values of a country that someone who blows the whistle on the government committing egregious crimes and violating its own constitution has to flee to Russia in order to escape oppression.

It’s even worse that the government in the Land of the Free rescinded his passport.

But it’s utterly shocking that any negotiation about his return has to start by taking TORTURE off the table.

The fact that torture even has to be mentioned is utterly pathetic. And it pretty much tells you everything you need to know about justice in America… and what happens if you dare cross the government.

- Someone In Chicago Is Shot Every 2.8 Hours (Despite Major Gun Control)

Having pointed out the surge in gun sales that has accompanied many of the largest mass shootings in America (and the government's instant knee-jerk reaction to tighten gun control, perhaps ignoring the mental problems many Americans face), and earlier noted that 'mass shootings' are now running at a pace of more than 1 per day in America, we thought DailyCaller.com's Mike Piccione's intriguing report detailing the supposed "gun-free-zone" of Chicago provided some crucial color that few seem willing to listen to…

Someone in Chicago has been shot every 2.84 hours this year for a total of 2,349 shootings during the period of January 1, 2015 to October 6, 2015, according to crime stats published by the Chicago Tribune.

This year, Chicago is expected to eclipse the previous milestone of a shooting every 3.38 hours in 2014 with a total victim count of 2,587.

But – Chicago ranks as one of the most regulated cities in the nation for gun control.

Concealed carry is almost nonexistent. To purchase a gun or ammunition requires a Firearm Owners Identification card in the entire state of Illinois, and additionally, a Chicago Firearm Permit – which is required to possess a firearm in Chicago.

Not only are the people heavily regulated in Chicago, but guns are also heavily regulated. Any long gun with a grip protruding from the stock or a firearm with a telescoping stock is prohibited and classified as an “assault weapon.”

Magazines are limited to a 12-round capacity.

Even a spring-powered pellet gun with a muzzle velocity of 700 feet-per-second is classified as a “firearm,” although it does not use gun powder, the component that puts the “fire” in “firearm.”

A stun-gun — a non-lethal device with no projectile — is considered a deadly weapon and cannot be carried for self-defense.

Chicago, for all intents and purposes, is a “gun-free zone.”

But all the state and city regulations associated with firearms in Chicago have failed to produce a safe city, and these are the policies that President Obama and Secretary Clinton wish to extend to the rest of the country.

While saying that “criminals go out-of-state to places where it is easier to obtain guns” is often used to push gun control, it illustrates that criminals ignore gun laws in every state and that onerous access to Second Amendment rights on law abiding citizens doesn’t stop crime.

Clinton’s campaign platform includes a call for federal legislation mandating background checks on all private firearms transfers and sales. Clinton also wants to repeal the “Protection of Lawful Commerce in Arms Act.” That law protects firearm manufacturers from lawsuits for negligent use of firearms.

President Obama, through is spokesman Josh Earnest, has announced, “The president has frequently pushed his team to consider a range of executive actions that could more effectively keep guns out of the hands of criminals and others who shouldn’t have access to them. That’s something that is ongoing here.”

Per the president’s policy, Chicago has taken every action “that could more effectively keep guns out of the hands of criminals and others who shouldn’t have access to them.”

* * *

Yet the shootings continue to rise…

- Presenting SocGen's "China Syndrome": "The Vicious Cycle Of Lower Demand, Prices And Commodity Currencies"

To be sure, there have been no shortage of narratives that we’ve been keen on presenting, perpetuating, and explaining this year as the series of global ponzi schemes that have been built in the seven years since the crisis continue to unravel.

Of course what’s important to understand here is that contrary to what our mainstream media critics – some of whom are now effectively jobless – will tell you, we aren’t in the business of spinning the narrative.

We’re in the business of helping to explain how things actually work on the Street as well as helping readers get to the bottom of what can sometimes be an impossibly complex geopolitical news cacophony designed to make you believe what the world’s most powerful governments want you to believe. So when we run headlines like this one: “Bloomberg’s Commodity Index Just Hit 21st Century Low”, it’s important to understand that we’re not using hyperbole for the sake of using hyperbole. We’re simply alerting those who frequent these pages to a very serious dynamic that in fact is now one of the driving forces behind global economic outcomes.

In short, the global commodities rout that’s unfolded in the wake of the death of the petrodollar and the demise of the Chinese growth machine has served to wreak havoc on EM commodity currencies and now threatens to plunge the world into crisis and forever delay “liftoff” in the US.

Through it all, one thing that readers and (some) analysts have noted is that even as it becomes clearer and clearer that central banks and the paper they print are on their way to having zero credibility with anyone, commodities (so, the things people actually use and the things that actually have intrinsic value) have literally collapsed when priced in terms of worthless fiat paper.

SocGen calls this the “China Syndrome” and we present the following analysis for readers to consider on the way to determining if the rout in the prices for materials that the world actually needs is justified, or whether perhaps it is just a casualty of another nefarious feedback loop gone awry…

- Is a Ban on Physical Cash Coming Soon?

The Central Banks hate physical cash. So much so they there will likely try to ban it in the near future.

You see, almost all of the “wealth” in the financial system is digital in nature.

1) The total currency (actual cash in the form of bills and coins) in the US financial system is a little over $1.36 trillion.

2) When you include digital money sitting in short-term accounts and long-term accounts then you’re talking about roughly $10 trillion in “money” in the financial system.

3) In contrast, the money in the US stock market (equity shares in publicly traded companies) is over $20 trillion in size.

4) The US bond market (money that has been lent to corporations, municipal Governments, State Governments, and the Federal Government) is almost twice this at $38 trillion.

5) Total Credit Market Instruments (mortgages, collateralized debt obligations, junk bonds, commercial paper and other digitally-based “money” that is based on debt) is even larger $58.7 trillion.

6) Unregulated over the counter derivatives traded between the big banks and corporations is north of $220 trillion.

When looking over these data points, the first thing that jumps out at the viewer is that the vast bulk of “money” in the system is in the form of digital loans or credit (non-physical debt).

Put another way, actual physical money or cash (as in bills or coins you can hold in your hand) comprises less than 1% of the “money” in the financial system.

As far as the Central Banks are concerned, this is a good thing because if investors/depositors were ever to try and convert even a small portion of this “wealth” into actual physical bills, the system would implode (there simply is not enough actual cash).

Remember, the current financial system is based on debt. The benchmark for “risk free” money in this system is not actual cash but US Treasuries.

In this scenario, when the 2008 Crisis hit, one of the biggest problems for the Central Banks was to stop investors from fleeing digital wealth for the comfort of physical cash. Indeed, the actual “thing” that almost caused the financial system to collapse was when depositors attempted to pull $500 billion out of money market funds.

A money market fund takes investors’ cash and plunks it into short-term highly liquid debt and credit securities. These funds are meant to offer investors a return on their cash, while being extremely liquid (meaning investors can pull their money at any time).

This works great in theory… but when $500 billion in money was being pulled (roughly 24% of the entire market) in the span of four weeks, the truth of the financial system was quickly laid bare: that digital money is not in fact safe.

To use a metaphor, when the money market fund and commercial paper markets collapsed, the oil that kept the financial system working dried up. Almost immediately, the gears of the system began to grind to a halt.

When all of this happened, the global Central Banks realized that their worst nightmare could in fact become a reality: that if a significant percentage of investors/ depositors ever tried to convert their “wealth” into cash (particularly physical cash) the whole system would implode.

As a result of this, virtually every monetary action taken by the Fed since this time has been devoted to forcing investors away from cash and into risk assets. The most obvious move was to cut interest rates to 0.25%, rendering the return on cash to almost nothing.

However, in their own ways, the various QE programs and Operation Twist have all had similar aims: to force investors away from cash, particularly physical cash.

After all, if cash returns next to nothing, anyone who doesn’t want to lose their purchasing power is forced to seek higher yields in bonds or stocks.

The Fed’s economic models predicted that by doing this, the US economy would come roaring back. The only problem is that it hasn’t. In fact, by most metrics, the US economy has flat-lined for several years now, despite the Fed having held ZIRP for 5-6 years and engaged in three rounds of QE.

As a result of this… mainstream economists at CitiGroup, the German Council of Economic Experts, and bond managers at M&G have suggested doing away with cash entirely.

If you think this sounds like some kind of conspiracy theory, consider that France just banned any transaction over €1,000 Euros from using physical cash. Spain has already banned transactions over €2,500. Uruguay has banned transactions over $5,000. And on and on.

This is just the beginning. Indeed… we've uncovered a secret document outlining how the US Federal Reserve plans to incinerate savings.

We detail this paper and outline three investment strategies you can implement

right now to protect your capital from the Fed's sinister plan in our Special Report

Survive the Fed's War on Cash.

We are making 1,000 copies available for FREE the general public.

To pick up yours, swing by….

http://www.phoenixcapitalmarketing.com/cash.html

Best Regards

Phoenix Capital Research

- Recovery? Student Homelessness Has Doubled Since Before The Recession

Submitted by Mike Krieger via Liberty Blitzkrieg blog,

How’s that recovery going for you? That’s what I thought.

Here’s the latest data point from the ongoing oligarch crime spree shamelessly marketed to the masses as an “economic recovery.”

From Five-Thirty-Eight:

The number of homeless students in the country’s classrooms has more than doubled since before the recession, according to recently released federal data. That’s an alarming trend, but a new report offers some hope: At least part of the increase, the authors say, is not because more students have become homeless, but because states have gotten better at identifying homeless students.

Here’s a visual representation of America’s Banana Republic neo-feualism for those of you so inclined:

Bull market in serfdom. If this is what a recovery looks like, I don’t want to see a recession.

There were about 1.4 million homeless students nationwide in the 2013-14 school year, according to the Department of Education, twice as many as there were in the 2006-07 school year, when roughly 680,000 students were homeless.

The rankings are based on an array of indicators that range from the concrete, like the number of available rental units that are affordable for extremely low-income families, to the less so, like the number of policies that reduce homeless families’ barriers to accessing child care. Matthew Adams, the institute’s principal policy analyst, said that rather than try to measure the effectiveness of policies in each state, which can be hard to quantify, the goal of the report is to identify and compare the efforts being made by each state.

Don’t forget to send thank you notes to America’s #1 criminal at large. Return address optional:

- "They're Converging To Dire Levels!": SocGen's Edwards Delivers Critical Warning On Inflation Expectations

At a certain point, one has to wonder if there will ever be a time when developed market policy makers throw in the towel.

When both Japan and Europe slid back into deflation lately, it served notice that trillions upon trillions in central bank asset purchases are definitely not working to restore confidence in the global economic recovery and/or reinvigorate inflation expectations.

However, you cannot simply print trillions in paper liabilities in order to purchase your own other paper liabilities (and no, that is not a typo, that’s just simply what’s happening here) without creating distortions across capital markets and that’s exactly what’s happened across the globe as the Fed and its DM brethren have “accidentally” engineered an epic case of capital misallocation that, far from promoting an increase in global demand and trade, has actually contributed to a global deflationary supply glut.

That is actually not nearly as complicated as it sounds. Put simply: if you keep uneconomic businesses in business, you also keep their supply online, which means that at the end of the day, if the fiat money you’re injecting doesn’t end up trickling down and stimulating aggregate demand because the NIM margins of the banks you’re giving it to are so low thanks to ZIRP as to discourage them from sharing the wealth, well then, all you’ve actually done is create a scenario where the idea of inflation expectations is essentially meaningless right up until everyone wakes up to what’s going on, and then it’s Weimar time.

So consider all of that, and then consider the following from SocGen’s Albert Edwards who has some characteristically introspective commentary regarding the interplay between central banks and inflation expectations and generally does a nice job of explaining what we’ve been at pains to point out for months (if not years): namely that central bankers are largely hapless when it comes to achieving their stated goal of rescuing their respective economies from the deflationay doldrums.

* * *

From SocGen

Two things caught my eye this week. The first was more soggy Japanese economic data which suggests that the BoJ may soon hit the QE button even harder. That would trigger a renewed slide in the yen and another round of Asian currency turmoil – plus c?a change! But, secondly and perhaps more important is increasing evidence of a loss of confidence that the Fed is actually in control. Ignore for a moment the stock market’s celebration of weaker than expected payrolls. Instead investors should focus on the rapid decline in US inflation expectations since the Fed meeting – even now converging to dire eurozone levels!

Expectations of the first Fed rate hike were kicked into March next year in the wake of the weaker than expected payroll release. We?ve been here before and it?s becoming tedious. But at least the equity market?s euphoric reaction was entirely predictable.

Far more interesting is the continuing slide in US break-even inflation expectations. The measure for 5y expectations, in 5 years time, has now decisively fallen below the January low (see chart below) and the spread verses the eurozone has now fallen to only 20bp against 60bp last October. Bond investors are signalling to us that they don?t believe the Fed is in control anymore. The Fed by contrast is brushing aside the market?s deflation concerns. It all feels very much like Japan circa 1995 in the wake of the yen?s then surge.

Talking about Japan, we are at a crucial crossroads. Most observers, except perhaps the BoJ and the Abe government, believe the economic data has been disturbingly weak. Most therefore expect the BoJ to crank up QE, or QQE as it is known in Japan ? having added a wishful qualitative to their quantitative easing. You know my view. All this money printing will ultimately end in tears. Despite being a fully paid up member to the school of thought that believes that Japan has no option other than to monetise its public sector deficit because the government is insolvent, that is also the same reason why I remain bullish on the Nikkei. Japan?s massive QQE (many times that of the Fed and ECB) is the steroids that mean Japan should outsprint all other runners in this currency race to the bottom. And when the yen renews its slide, expect round two of Asian emerging currency weakness to begin and US and eurozone inflation expectations to head lower still.

* * *

There are two takeaways here, the first is from Edwards and the second from us.

From SocGen:

The collapse in inflation expectations tells us that the market believes the central banks, despite their monetary profligacy, are failing to prevent the western economies from turning Japanese, and thus at risk of repeating their devastating slide into outright deflation in the 1990s.

And from “The Unwind Of QE Means The “S&P Should Be Trading At Half Of Its Value”, Deutsche Bank Warns“:

In his latest weekly note, DB’s derivatives analyst Alekandar Kocic focuses on the interplay between US inflation expectations and US equities, and points out something curious, and very much spot on:

Policy response to the crisis post-2008 consisted of unprecedented injection of liquidity, transfer of risk from private to public balance sheet, and reduction of volatility from its toxic levels. The net result was near-zero rate levels and collapse of volatility across the board, while different market sectors developed high degrees of coordination. The last effect has been an indirect result of the central banks’ flows and the distortions they introduced in the bond market. In this environment other markets acted as a complement to rates (through which monetary policy was transmitted) and crowding out there pushed investors to articulate their views elsewhere. Their participation was a function of amount of liquidity injection. As a consequence everything was trading off of US inflation expectations as the main expression of the QE effects.

That was the case for the first 5 years of “unconventional policy” until some time in 2013. Then something snapped. Kocic continues:

With deflation as the main risk tackled by monetary policy, its success or failure was gauged by the ability to reflate the economy. Inflation expectations and breakevens were therefore signals for risk-on or risk-off trade. In fact, most market sectors, from FX to EM equities, were trading in high coordination with breakevens. Taper tantrum was the end of these correlations and a beginning of dispersion across different assets. In effect, it was the unwind of the “QE” trade, its first phase. While most other assets, like credit spreads, EM equities or different currencies, do not have a logical connection with US breakevens, US equities do. The dispersion between these assets and breakevens was an expected consequence of policy unwind. However, for US equities this unwind distorted their “natural” correlation with inflation. Persistence of these dislocations is just a manifestation of to what extent QE has been an important driver of post-2008 markets.

Which brings us to the punchline:

Since 2013, stocks rallied while disinflationary pressures were reinforced by a strong USD, low commodity prices and a decline in global demand. If pre-2013 coordination between the two is taken as a reference, then based on current stock prices breakevens should trade about 1.5% wider. This means the Fed should be hiking because inflation is above target. Alternatively, given the current level of inflation, S&P should be trading at half of its value.

Wait, the S&P should be trading at 900… or even less? Yes, according to the following Deutsche Bank chart:

Only one question remains: which breaks first – do inflation expectations surge higher, soaring by some 150 bps to justify equity valuations, or do equities crash?

Is reconciliation likely – and, if so, in which direction? Are we returning to the pre-crisis world, or we are in a completely new regime?

The answer will come from none other than the Fed and by now, even Janet Yellen knows that one word out of place, one signal to the market that the QE-inflation trade will converge with stocks crashing instead of inflation rising (which, unless the Fed launched QE4, NIRP of even helicopter money now appears inevitable), and some $10 trillion in market cap could evaporate overnight.

Is it any wonder that Yellen is exhibiting “health issues” during her speeches: the realization that the fate of the biggest stock market bubble lies on your shoulders would make anyone “dehydrated.”

In retrospect, Ben Bernanke knew exactly what he was doing when he got out of Dodge just as the endgame was set to begin.

- Lawmaker Calls For Study On Links Between Pharmaceuticals And Mass Killers

Submitted by Barry Donegan via TheAntiMedia.org,

Following recent media reports of high-profile mass shootings, a Republican assemblywoman from Nevada is calling for an investigation into whether psychiatric pharmaceuticals commonly taken by mass murderers can cause side effects that may contribute to their mental health decline.

According to KSNV Las Vegas, GOP Assemblywoman Michele Fiore says that, rather than blaming mass shootings on the guns used by the perpetrators, studies should be done on the drugs that many of them have a history of having taken to treat mental health disorders.

“We have to look into what is being prescribed and what is in these meds just like clinical studies. Why don’t we do studies on the medication all of these shooters were taking and take that medication off the market? Obviously, medications can alter your mind just as alcohol can alter the mind,” said Fiore.

Though it is not yet known whether the perpetrator in last week’s tragic shooting at Umpqua Community College in Roseburg, Oregon was on psychiatric medication, early reports from The Oregonian note that he identified himself by the social media screen name “lithium love,” he mentioned anger and depression in a note that was found in connection with the attack, and he had a long history of behavioral problems in school.

He had also been discharged by the U.S. Army midway through basic training in 2008 and graduated from a school that The Oregonian described as “geared for special education students with a range of issues from learning disabilities, health problems and autism or Asperger’s Disorder.”

In August of this year, a CBS46 Atlanta Reality Check report by Ben Swann raised questions about the possibility of a connection between mass murderers and pharmaceutical drugs used to treat mental health disorders, noting that 26 high-profile perpetrators had been taking psychiatric medication.

Watch the Reality Check below.

- As A Shocking $100 Billion In Glencore Debt Emerges, The Next Lehman Has Arrived

One week ago, in a valiant attempt to defend the stock price of struggling commodity trading titan Glencore, one of the company's biggest cheerleaders, Sanford Bernstein's analyst Paul Gait (who has a GLEN price target of 450p) appeared on CNBC in what promptly devolved into a great example of just how confused equity analysts are when it comes to analyzing highly complex debt-laden balance sheets.

In the clip below, starting about 2:30 in, CNBC's Brian Sullivan gets into a heated spat with Gait over precisely how much debt Glencore really has, with one saying $45 billion the other claiming it is a whopping $100 billion.

The reason for Gait's confusion is that he simplistically looked at the net debt reported on Glencore's books… just as Ivan Glasenberg intended.

However, since Glencore – like Lehman – is first and foremost a trading operation, one also has to add in all the stated derivative exposure (something we did ten days ago), in addition to all the unfunded liabilities, off balance sheet debt, bank commitments and so forth, to get a true representation of just how big, or rather massive, Glencore's true risk is to its countless counterparties.

Conveniently for the likes of equity analysts such as Gait and countless others who still have GLEN stock at a "buy" rating, Bank of America has done an extensive analysis breaking down Glencore's true gross exposure. Here is the punchline:

We consider different approaches to Glencore’s debt. Credit agencies, such as S&P, start with “normal” net debt, i.e. gross debt less cash and then deduct some share (80% in the case of S&P of “RMIs” – Readily Marketable Inventories. These are considered to be “cash like” inventories (working capital) in the marketing business. At the last results, RMIs were about US$17.7 bn. Giving full credit for RMIs plus a pro-forma for the equity raise and interim dividend we derive a “Glencore Adjusted Net Debt” of c. US$28 bn.

On the other hand, from discussions with our banks team, we believe the banks industry (and ultimately regulators) may look at the number i.e. gross lines available (even if undrawn) + letters of credit with no credit for inventories held. On this basis, we estimate gross exposure (bonds, revolver, secured lending, letters of credit) at c. $100 bn. With bonds at around $36 bn, this would still leave $64 bn to the banks’ account (assuming they don’t own bonds).

Charted, here is why Sullivan and his $100 billion number was spot on, and why Glencore's banks suddenly realize the company has more gross exposure than its has total assets!

BofA lays out the stunning, if only for equity analysts, details:

Over US$100bn in estimated gross exposures to Glencore