- Lawrence Wilkerson: "The American 'Empire' Is In Deep, Deep Trouble"

Former US army colonel and Chief of Staff for Colin Powell, Lawrence Wilkerson unleashed a most prescient speech on the demise of the United States Empire.

As Naked Capitalism's Yves Smith notes, Wilkerson describes the path of empires in decline and shows how the US is following the classic trajectory. He contends that the US needs to make a transition to being one of many powers and focus more on strategies of international cooperation.

The video is full of rich historical detail and terrific, if sobering, nuggets, such as:

"History tells us we’re probably finished.

The rest of of the world is awakening to the fact that the United States is 1) strategically inept and 2) not the power it used to be. And that the trend is to increase that."

Wilkerson includes in his talk not just the way that the US projects power abroad, but internal symptoms of decline, such as concentration of wealth and power, corruption and the disproportionate role of financial interests.

Wilkerson also says the odds of rapid collapse of the US as an empire is much greater is generally recognized. He also includes the issues of climate change and resource constraints, and points out how perverse it is that the Department of Defense is the agency that is taking climate change most seriously. He says that the worst cases scenario projected by scientists is that the world will have enough arable land to support 400 million people.

Further key excerpts include:

“Empires at the end concentrate on military force as the be all and end all of power… at the end they use more mercenary based forces than citizen based forces”

“Empires at the end…go ethically and morally bankrupt… they end up with bankers and financiers running the empire, sound familiar?”

“So they [empires] will go out for example, when an attack occurs on them by barbarians that kills 3000 of their citizens, mostly because of their negligence, they will go out and kill 300,000 people and spend 3 trillion dollars in order to counter that threat to the status quo. They will then proceed throughout the world to exacerbate that threat by their own actions, sound familiar?…This is what they [empires] do particularly when they are getting ready to collapse”

“This is what empires in decline do, they can’t even in govern themselves”

Quoting a Chinese man who was a democrat, then a communist (under Mao) then, when he became disenchanted, a poet and writer…”You can sit around a table and talk about politics, about social issues, about anything and you can have a reasonable discussion with a reasonable person. But start talking about the mal-distribution of wealth and you better get your gun” ….”that’s where we are, in Europe and the United States”.

- Emerging Market Meltdown May Plunge Global Economy Into Recession

When the Fed effectively telegraphed its new reaction function last month, the FOMC served notice to the world that it was not only acutely aware of what’s going on in emerging markets, but also extremely worried about the possibility that hiking rates could end up triggering something far worse than the “tantrum” that unfolded across EM in 2013.

The dire scenario facing the world’s emerging economies has by now been well documented.

In short, slumping commodity prices, depressed raw materials demand from the Chinese growth engine, a slowdown in global trade, and a loss of competitiveness thanks to the yuan devaluation have conspired with a number of idiosyncratic, country-specific political risk factors to wreak havoc on EM FX and put an immense amount of pressure of the accumulated stash of USD-denominated reserves.

For the Fed, this presents a serious problem. Hiking rates has the potential to accelerate EM capital outflows and yet not hiking rates does too. That is, a soaring dollar will obviously ratchet up the pressure on EM FX but then again, because the uncertainty the FOMC fosters by continuing to delay liftoff contributes to a gradual capital outflow, not hiking rates endangers EM as well.

As we’ve been keen to point out, DM central banks aren’t operating in a vacuum. That is, if a policy “mistake” serves to tip EM over the edge, the crisis will feed back into the world’s advanced economies forcing DM central banks to immediately recant any and all hawkishness. For more evidence of EM fragility and the link between an emerging market meltdown and DM stability, we go to FT:

Emerging economies risk “leading the world economy into a slump”, with lower growth and a rout in financial markets, according to the latest Brookings Institution-Financial Times tracking index.

Released ahead of the annual meetings of the International Monetary Fund and World Bank in Lima, Peru, the index paints a much more pessimistic outlook than the fund is likely to predict later this week.

According to Eswar Prasad of Brookings, weak economic data across most poorer economies has created “a dangerous combination of divergent growth patterns, deficient demand, and deflationary risks”.

The Tiger index — Tracking Indices for the Global Economic Recovery — shows how measures of real activity, financial markets and investor confidence compare with their historical averages in the global economy and within each country.

The extreme weakness in the emerging market component of the Tiger growth index shows that data releases have been significantly weaker than their historic averages.

Divergence is almost as important as a new trend highlighted in the index, however, with India emerging as a bright spot and commodity importers such as Brazil and Russia mired in recession.

Because emerging economies are now much more important in the global economy and growth rates are still higher than their developed counterparts, global growth is still hovering around 3 per cent, close to its long-term average.

The concern, according to Mr Prasad is that the slump in emerging economies’ confidence will infect advanced economist in the months ahead.

Of course the trouble in EM portends a drain in global FX reserves. This is what Deutsche Bank has dubbed the end of the “Great Accumulation” and, all else equal, it’s a drain on global liquidity as exported capital from commodity producers turns negative. Here’s BNP on what the picture looked like in Q2:

The Q2 2015 COFER (Currency Composition of Foreign Exchange Reserves) report from the IMF contained some key changes. For the first time, the IMF reported the list of 92 countries that are providing reserve allocation data. Importantly China started reporting its FX allocations for the first time, although still on a partial basis, with the goal of increasing the reported portfolio to full coverage of FX reserves over the next two to three years. A full inclusion of China would push the share of allocated to total reserves over 80%, making COFER reserve allocation data much more representative and relevant for analysing EM FX reserve management trends.

On a valuation adjusted basis, we estimate that total foreign exchange reserve holdings declined by USD 107bn in Q2. The IMF no longer reports the split between advanced and emerging economies but it’s very likely that much of this decrease was due to EM FX intervention.

In other words, the dynamics that have propped up the global financial system for decades are now unwinding and at a much more fundamental level than what occurred in 2008. Emerging markets are now liquidating their USD cushions and a combination of low commodity prices and hightened political risks threatens to set the world’s most important emerging markets back decades.

Importantly, it’s no longer a matter of whether DM central bankers can correct the problem by adopting policies that will serve to boost global demand, but rather if the world’s most vaunted central planners can keep things from completely unraveling and on that note we close with the following from the above cited Eswar Prasad:

“The impotence of monetary policy in boosting growth and staving off deflationary pressures has become painfully apparent, especially when it is acting in isolation and when a large number of countries are resorting to the same limited playbook.”

- And Scene: Ben Bernanke Says More People Should Have Gone To Jail For Causing The Great Recession

For those who may be unfamiliar – which would mean roughly 90% of the US population who believe the Federal Reserve is a national park – Ben Bernanke was Fed chairman from 2006 until 2014. He is better known as the Fed chairman who never launched a tightening cycle during his tenure. He is best known for not only bailing out Wall Street from the folly of his and his predecessor’s bubble-creating monetary policy and boosting the Fed’s balance sheet to $4.5 trillion, but also for the following selection of quotes:

10/1/00 – Article published in Foreign Policy Magazine

A collapse in U.S. stock prices certainly would cause a lot of white knuckles on Wall Street. But what effect would it have on the broader U.S. economy? If Wall Street crashes, does Main Street follow? Not necessarily.

7/1/05 – Interview on CNBC

INTERVIEWER: Ben, there’s been a lot of talk about a housing bubble, particularly, you know [inaudible] from all sorts of places. Can you give us your view as to whether or not there is a housing bubble out there?

BERNANKE: Well, unquestionably, housing prices are up quite a bit; I think it’s important to note that fundamentals are also very strong. We’ve got a growing economy, jobs, incomes. We’ve got very low mortgage rates. We’ve got demographics supporting housing growth. We’ve got restricted supply in some places. So it’s certainly understandable that prices would go up some. I don’t know whether prices are exactly where they should be, but I think it’s fair to say that much of what’s happened is supported by the strength of the economy.

7/1/05 – Interview on CNBC

INTERVIEWER: Tell me, what is the worst-case scenario? We have so many economists coming on our air saying ‘Oh, this is a bubble, and it’s going to burst, and this is going to be a real issue for the economy.’ Some say it could even cause a recession at some point. What is the worst-case scenario if in fact we were to see prices come down substantially across the country?

BERNANKE: Well, I guess I don’t buy your premise. It’s a pretty unlikely possibility. We’ve never had a decline in house prices on a nationwide basis. So, what I think what is more likely is that house prices will slow, maybe stabilize, might slow consumption spending a bit. I don’t think it’s gonna drive the economy too far from its full employment path, though.

10/20/05 – Testimony before the Joint Economic Committee, Congress

House prices have risen by nearly 25 percent over the past two years. Although speculative activity has increased in some areas, at a national level these price increases largely reflect strong economic fundamentals.

11/15/05 – Confirmation Hearing before Senate Banking Committee

SEN. SARBANES: Warren Buffet has warned us that derivatives are time bombs, both for the parties that deal in them and the economic system. The Financial Times has said so far, there has been no explosion, but the risks of this fast growing market remain real. How do you respond to these concerns?

BERNANKE: I am more sanguine about derivatives than the position you have just suggested. I think, generally speaking, they are very valuable… With respect to their safety, derivatives, for the most part, are traded among very sophisticated financial institutions and individuals who have considerable incentive to understand them and to use them properly. The Federal Reserve’s responsibility is to make sure that the institutions it regulates have good systems and good procedures for ensuring that their derivatives portfolios are well-managed and do not create excessive risk in their institutions.

3/6/07 – At bankers’ conference in Honolulu, Hawaii… as delinquencies in the subprime mortgage sector rise

The credit risks associated with an affordable-housing portfolio need not be any greater than mortgage portfolios generally.

3/28/07 – Testimony before the Joint Economic Committee, Congress

Although the turmoil in the subprime mortgage market has created severe financial problems for many individuals and families, the implications of these developments for the housing market as a whole are less clear…At this juncture, however, the impact on the broader economy and financial markets of the problems in the subprime market seems likely to be contained.

5/17/07 – Remarks before the Federal Reserve Board of Chicago

…we believe the effect of the troubles in the subprime sector on the broader housing market will likely be limited, and we do not expect significant spillovers from the subprime market to the rest of the economy or to the financial system. The vast majority of mortgages, including even subprime mortgages, continue to perform well.

8/31/07 – Remarks at the Fed Economic Symposium in Jackson Hole

It is not the responsibility of the Federal Reserve–nor would it be appropriate–to protect lenders and investors from the consequences of their financial decisions. But developments in financial markets can have broad economic effects felt by many outside the markets, and the Federal Reserve must take those effects into account when determining policy.

1/10/08 – Response to a Question after Speech in Washington, D.C.

The Federal Reserve is not currently forecasting a recession.

2/27/08 – Testimony before the Senate Banking Committee

I expect there will be some failures [among smaller regional banks]… Among the largest banks, the capital ratios remain good and I don’t anticipate any serious problems of that sort among the large, internationally active banks that make up a very substantial part of our banking system.

4/2/08 – New York Times article after the collapse of Bear Stearns

“In separate comments, Mr. Bernanke went further than he had in the past, suggesting that the Fed would remain aggressive and vigilant to prevent a repetition of a collapse like that of Bear Stearns, though he said he saw no such problems on the horizon.”

6/10/08 – Remarks before a bankers’ conference in Chatham, Massachusetts

The risk that the economy has entered a substantial downturn appears to have diminished over the past month or so.

7/16/08 – Testimony before House Financial Services Committee

[Fannie Mae and Freddie Mac are] adequately capitalized. They are in no danger of failing… [However,] the weakness in market confidence is having real effects as their stock prices fall, and it’s difficult for them to raise capital.

I see the financial markets as already quite fragile. The credit markets aren’t working. Corporations aren’t able to finance themselves through commercial paper. Even if the situation stayed as it did today, that would be a significant drag on the economy.

3/16/09 – Interview on CBS’s 60 Minutes

It’s absolutely unfair that taxpayer dollars are going to prop up a company (AIG) that made these terrible bets, that was operating out of the sight of regulators.

5/5/09 – Response to Questioning at Senate Joint Economic Committee Hearing

The forecast we have is for the economy, in terms of growth, to begin to turn up later this year, but initially not to grow at the rate of potential, which means that unemployment and resource slack will continue to rise into 2010. We think that the unemployment rate will probably peak early in 2010 and then come down relatively slowly after that. Um, currently, we don’t think it’s going to get to 10 percent, we’re somewhere in the 9’s, but clearly, that’s way too high.

7/21/09 – Testimony before the House Committee on Financial Services

A perceived loss of monetary policy independence could raise fears about future inflation, leading to higher long-term interest rates and reduced economic and financial stability.

… Or summarized:

And then earlier this year, when we learned that Bernanke’s memoir titled “The Courage To Act” is coming out, he added another quote:

“When the economic well-being of their nation demanded a strong and creative response, my colleagues at the Federal Reserve, policymakers and staff alike, mustered the moral courage to do what was necessary, often in the face of bitter criticism and condemnation. I am grateful to all of them.”

Why do we bring this up?

Two reasons:

First, tomorrow Ben Bernanke will be on CNBC’s Squawk Box to promote his book, the same CNBC which from a credible financial channel has metamorphosed into an outlet whose only purpose is to cheerlead the stock market and get as many people invested in the next and final Ponzi as possible. He will also discuss the disastrous state of the post-post-bubble economy and the latest plunge in payrolls.

Second, today as part of the same book promotion tour (supposedly because nobody wants to pay Bernanke $250,000 to listen to an hour of bullshit now that the Fed no longer has credibility) he had this exchange with the USA Today’s Susan Page:

Q. Should somebody have gone to jail.

Bernanke: Yeah, yeah I think so. I have objected for a long time – the Department of Justice is responsible for that.

A quick tangent here: in March 2013 former US Attorney General Eric Holder told Senator Chuck Grassley that the size of some institutions is so big “that it does become difficult for us to prosecute them when we are hit with indications that if you do prosecute, if you do bring a criminal charge, it will have a negative impact on the national economy, perhaps even the world economy. And I think that is a function of the fact that some of these institutions have become too large.”

Nuf said. Continuing with Bernanke’s answer:

Bernanke: A lot of [the DOJ’s] efforts have been to indict or threaten to indict financial firms. Now financial firm, of course, is a legal fiction. It’s not a person, you can’t put a financial firm in jail. It would have been my preference to have more investigation of individual actions as obviously everything that went wrong, or was illegal, was done by some individual not by an abstract firm.

So something like the Federal reserve being an “abstract firm” versus people like Ben Bernanke who were actual individuals?

The whole thing is 4:20 into the exchange.

We thoroughly agree with Bernanke that more people who were responsible for the biggest economic collapse in history should have gone to jail, starting, of course, with Ben Bernanke himself.

However, as even Bernanke himself now points out, with the entire judicial and legislative system now a supreme farce, explicitly in the pocket of corporations and Wall Street banks, we aren’t holding our breath.

Then again, after the next, and final financial crash – one that wipes out the paper wealth of America – and the one that finally destroys the central-bank/central-planning model, putting an end to Keynesian economics as well as fiat currency, ironically the safest place for people like Bernanke as the revolutionary mob approaches would be, well, jail.

We doubt the irony of this will be appreciated by Ben.

- The Perilous Misperception That Central Bankers Have Mitigated Market Risk

Via Doug Noland's Credit Bubble Bulletin,

This week provided further evidence that the bursting global Bubble has progressed to a critical juncture, afflicting Core markets and economies. Ominously, few seem aware of the profound ramifications – or even the unfolding hostile market backdrop. Even many of the most sophisticated market operators have been caught off guard. There is, as well, scant indication that Federal Reserve officials appreciate what’s unfolding.

I was again this week reminded of an overarching theme from Adam Fergusson’s classic, “When Money Dies: The Nightmare of Deficit Spending, Devaluation, and Hyperinflation in Weimar German”: throughout that period’s catastrophic monetary inflation, German central bank officials believed they were responding to outside forces. Somehow they remained oblivious that the trap of disorderly money printing had become the core problem.

Dr. Williams’ comment, “It's okay to have the party. It’s okay to get the party going…”, would be laughable if it were not so tragic. At this point, let’s hope the true story of this period gets told. I’m trying: monetary policies for almost 30 years now have been disastrous, a harsh reality masked by epic global market Bubbles.

It’s incredible that confidence in central banking has proved so resilient, though this dynamic no doubt revolves around a single – and circular – dynamic: “whatever it takes” central banking has thus far succeeded in sustaining securities market inflation. And it’s astounding that central bankers at this point are professing “It’s ok to get the party going.” The central bankers’ beloved Party is going to get crashed.

My mind this week also drifted back to a CBB written weeks after the tragic 9/11/2001 attacks. Shock had hit the markets, confidence and the real economy. Officials were determined to stimulate. I recall writing something to this effect: “If stimulus is deemed necessary, please rely on some deficit spending rather than monkeying with the financial markets. Market intervention/manipulation is such a slippery slope.” Back then no one had any idea how far experimental monetary policy could slide into the dark caverns of the deep unknown. Economic, financial, terror, geopolitical – or whatever unanticipated risk that might arise – all-powerful central bankers had an answer that would make things right.

I read with keen interest a Q&A with Jim Grant (Grant’s Interest Rate Observer) reproduced at Zero Hedge. Like others, I’m a big fan of Jim’s writing and analysis.

Question: “So what’s next for the global financial markets?”

Grant Answers: “The mispricing of biotech stocks or corn and soybeans is of no great consequence to financial markets at large. Interest rates are another matter. They are universal prices: They discount future cash flows, calibrate risks and define investment hurdle rates. So interest rates are the traffic signals of a market based economy. Ordinarily, some are amber, some are red and some are green. But since 2008 they have mainly been green.”

It’s apropos to expand on Grant’s comments. Overnight lending rates and Treasury yields are the pillar for a broad range of rates and market yields – at home as well as abroad. Had the Fed, as in the past, restricted its operations – and market distortions – to Treasury bills, I would be much less apprehensive. If the Fed limited its rate-setting doctrine to responding to real economy variables the world would today be a less unstable place.

Instead, the Fed over recent decades nurtured securities market inflation and even turned to targeting higher market prices as its prevailing reflationary policy instrument. Importantly, the Fed and central bankers later resorted to the full-fledged manipulation of broad market risk perceptions. This was a game-changer. Essentially no risk was outside the domain of central bankers’ reflationary measures. As such, audacious markets could Party on, gratified that central bankers had relegated hangovers to a thing of the past.

Key aspects of central bank experimentation over time bolstered global risk assets and, in the end, fomented a historic global financial Bubble. First, by slashing rates all the way to zero, the Federal Reserve and others imposed punitive negative real returns on savers. Part and parcel to the Bernanke Doctrine, rate policies incited unprecedented global flows to equities, corporate bonds and EM bonds and equities. Meanwhile, dollar devaluation spurred historic (“Global Reflation Trade”) speculative excess and leveraging, especially destabilizing for susceptible commodities and EM complexes. Literally Trillions flooded into EM markets and economies, spurring Trillions more of further destabilizing domestic “money” and Credit expansion. Fiasco.

Over-liquefied global markets were conspicuously unstable. Repetitious Fed (and global central bank) responses to fledgling “Risk Off” Bubble dynamics along the way solidified the perception that “whatever it takes” central banks were prepared to fully backstop global securities markets. The summer of 2012 demonstrated to what extent concerted global policy measures would go in response to nascent financial crisis in Europe. Faith in the central bank market backstop became complete in 2013; a bout of market “Risk Off” had the Fed delaying “lift-off” and Bernanke reassuring markets that the Fed was prepared to “push back against a tightening of financial conditions.” It had essentially regressed to the point where a high-risk Bubble backdrop had central bankers telegraphing their willingness to invoke the “nuclear option” (open-ended QE/“money” printing) to blunt incipient market risk aversion.

"Moneyness of Risk Assets" has been fundamental to my “global government finance Bubble” thesis. Policy measures transformed risk perceptions throughout the markets, with global financial assets coming to be perceived as highly liquid and safe stores of wealth (money-like). It may have appeared subtle but it was nonetheless revolutionary. Post-mortgage finance Bubble reflationary measures fomented unprecedented global securities markets distortions. Central bank purchases launched Treasury, agency and global sovereign debt prices to the stratosphere. “Money” flooded into global equities funds, pushing stock prices to record highs. The EFT industry exploded to $3.0 TN, matching the bloated hedge fund industry. The global yield chase coupled with over-liquefied markets ensured record corporate debt issuance. The easiest borrowing conditions imaginable stoked stock buybacks, M&A and other financial engineering

The global financial Bubble evolved to be systemic in nature. So long as global financial conditions remained extraordinarily loose and market prices continued inflating, an expanding global economy appeared to underpin booming securities markets.

The bullish consensus has been convinced that central bankers saved the world from crisis (the “100-year flood”) and securely placed the world recovery on a solid trajectory. I’m sure they have instead fomented catastrophe. Empirical research quantifies central bank impact on market yields in the basis points. Such research would surely also claim QE has had minimal impact on equities prices. Equities are not seen as overvalued. No one it seems sees comparable excesses to 1999 or 2007.

I will make an attempt to concisely state my case. Central banks have convinced market participants that they can ensure liquid (and continuous) markets. Markets perceive that the Fed and global central banks have the willingness and capacity to backstop securities markets. While impossible to quantify, these perceptions have become fully embodied in securities markets around the globe. Importantly, central bank assurances and market perceptions of boundless central bank liquidity are today fundamental to booming global derivatives markets.

Following the 2008 crisis, I expected U.S. and global equities to trade at lower than typical multiples to earnings and revenues. After all, risk premiums would be expected to remain elevated based on recent history. I believed mortgage securities would trade at wider spreads to Treasuries. I thought that, after the market collapse and economic crisis, investors would view corporate debt cautiously. Moreover, I expected counter-party concerns to weigh on derivatives markets for years to come.

I did not anticipate that do “whatever it takes” central banking would overpower the world. Zero rates for seven years and a $4.5 TN Fed balance sheet weren’t in my thinking – because they certainly weren’t in the Fed’s (recall the 2011 “exit strategy”). A $30 TN Chinese banking system would have seemed way far-fetched. Besides, there were indications that Washington had at least learned the crucial lesson of “too big to fail” and moral hazard.

In reality, they learned all the wrong lessons. Traditional central banking was turned on its head. Reckless “money” printing was let loose. Foolhardy market manipulation became the norm. The role played by leveraged speculation and derivatives trading in the 2008 market meltdown was disregarded. And somehow “too big to fail” was transposed from goliath financial institutions to gargantuan global securities markets. And it’s now coming home to roost.

There’s a perilous misperception that central bankers have mitigated market risk. They have instead grossly inflated myriad risks – market, financial, economic, social and geopolitical. As for market risk, Trillions were enticed to global risk markets under false premises and pretense – certainly including specious central bank assurances. And there is the multi-hundreds of Trillions global derivative marketplace that operates under the presumption of liquid and continuous markets. Importantly, central bank manipulation – of market prices and perceptions – fomented the type of excesses that virtually ensures a crisis of confidence.

Individuals can hedge market risk. The broader marketplace, however, cannot effectively hedge market risk. There is simply no one with the wherewithal to shoulder the market attempting to offload risk. Yet central bankers have convinced the marketplace that do “whatever it takes” includes a promise of market liquidity. And this perception of boundless liquidity has ensured a booming derivatives “insurance” marketplace.

There’s a crisis scenario that’s not far-fetched at this point. Fear that global policymakers are losing control spurs risk aversion. The sophisticated leveraged players panic as markets turn illiquid. The Trillions-dollar trend-following and performance-chasing Crowd sees things turning south. Worse still, illiquidity hits confidence in the ability of derivative markets to operate orderly. In short order securities liquidations and derivative-related selling completely overwhelm the market.

It comes back to a momentous flaw in contemporary finance: Markets do not have the capacity to hedge market risk. Indeed, the perception that risks can easily be offloaded through derivative “insurance” has been instrumental in promoting risk-taking. Never have markets carried so much risk. And never have markets been as vulnerable to an abrupt change in perceptions with regard to central banker competence, effectiveness and capabilities.

A Friday morning Bloomberg (Tracy Alloway) article was appropriately headlined “It’s been a Terrible Week for the Credit Market,” included a series of notable paragraph subtitles: “It started in high yield…”, “Glencore made it worse…”; “Then the quarter ended on a down note…”; “And attention turned to investment grade…”; “The pain intensified…”; “What happens next.” A Friday afternoon Bloomberg (Sridhar Natarajan and Michelle Davis) headline read “Credit Investors Bolt Party as Economy Fears Trump Low Rates.” According to Bloomberg, the average junk bond yield this week surged 40 bps to 8.30%, with Q3 junk bond losses the second-worst quarter going back to 2009. This week also saw investment-grade CDS jump to a more than two-year high.

It’s worth noting that the markets were (again) at the brink of disorderly in early-Friday trading. “Risk Off” saw stocks under significant pressure. The dollar/yen traded to 118.68, near August panic lows, before rallying back above 120 late in the day. Treasuries were in melt-up mode. And despite bouncing 4.1% off of Friday morning trading lows, bank stocks ended the week down 1.5%. Underperforming ominously, the 3.8% rally from Friday’s lows still left the Securities Broker/Dealers down 3.1% for the week. Earlier in the week, Glencore worries spurred the first serious “counter-party” concerns in awhile.

October 2 – Reuters (Christopher Condon Craig Torres): “Federal Reserve Vice Chairman Stanley Fischer said he doesn’t see immediate risks of financial bubbles in the U.S., while raising concerns that the central bank’s policy tool kit is limited and untested. ‘Banks are well capitalized and have sizable liquidity buffers, the housing market is not overheated and borrowing by households and businesses has only begun to pick up after years of decline or very slow growth,’ Fischer said… Still, he warned that ‘potential shifts of activity away from more regulated to less regulated institutions could lead to new risks.’ Created a century ago in response to recurring banking crises, the Fed has taken a renewed interest in identifying potential systemic financial threats since the global meltdown of 2008-09…”

Today’s paramount systemic financial threat is not new. Risk is now high for a disorderly – Party Crashing – “run” on financial markets. At the minimum, global markets will function poorly as faith in central banking begins to wane.

- The American 'Recovery' In 1 Chart

- There Will Be Blood – Part II

By Chris at www.CapitalistExploits.at

Following right along from “Letters from a Hedge Fund Manager – Part I”, today we have “part deux” as a follow up for you…

——————————

Date: 10 December 2014

Subject: There Will Be Blood – Part II

Let me be clear: I am no expert on shale wells. I’m not even an “almost” expert in the shale sector. If you called me an idiot when it comes to shale drilling, I wouldn’t argue with you. With that caveat out of the way, I’m going to generalize about the shale sector (anyway).

In oil and gas, most of the money is spent up front in acquiring the drilling rights and putting the well into production. You then have revenue and hopefully some profit in the period afterwards, as the well produces for you. Unfortunately, shale wells are very different from conventional wells. Shale wells see the vast majority of their total production in the first two years after they are drilled. This means that you have to keep drilling more wells just to stay at a constant level of production. In many ways this is akin to a hamster wheel – except you can never get off – or your production collapses. If you want to grow production, you need to drill even more wells – all of which see significant declines after two years.

Let me show this by using some data from WPX Energy (WPX: USA):

Basically, in order to keep production roughly constant, they borrowed a bunch of money, spent a bunch of money and lost globs of money in the process – yet production remained constant. Amazingly, this is a $2.5 billion dollar company. Don’t feel bad for WPX. Their numbers aren’t all that different from plenty of other shale companies.

In essence, since shale wells have a short lifespan of intensive production and they are highly leveraged to the prevailing energy price over this peak production period – particularly since the land acquisition and drilling expenses are already sunk costs. What if you drill a well based on $100 oil and it’s at $60 today? Hope you hedged your production. What about all the money you borrowed to buy future drilling sites that are no longer economic to produce?

Here’s the thing – I have this hunch that, excluding a handful of the best “plays”, much of the shale being drilled was never all that profitable, even when oil was at $100. Given the high initial costs of acquiring land and drilling a well, much of the profitability accounting for a well depends on the shape of the decline curve. Given how young the shale industry is and how imprecise the data can be, I suspect that many of these companies have been aggressive in their assumptions – especially if they need the capital markets to fund their dreams.

If your well production declines by 70% in the first 24 months, adding 10 weeks to that duration doesn’t sound like much, but it lowers the depletion, depreciation and amortization cost per barrel by almost 10%. More importantly, it dramatically increases the IRR and NPV of each well – which are important benchmarks for lenders. Unfortunately, as an equity investor, good luck trying to determine the actual economics of each well, when you have: misleading data, changing production across the whole company and all sorts of one-time costs lumped in with operating expenses.

Instead, a whole bunch of investors seem to have taken comfort in the high single digit yields offered on short dated bonds issued by these shale companies – along with an ingrained belief that oil prices would remain constant or rise. Now with oil prices declining, all sorts of lenders are having a “whoops moment.” In fact, I wonder if the financial system on the verge of having another “WHOOPS! moment”?

In Part III, we will look at just how much debt is tied to this sector – for starters, it’s not just the high yield debt that is suddenly flashing danger.

When subprime first got wobbly in 2007, there was a small panic followed by the “all clear” from Wall Street analysts. You literally had a year to prepare for the fallout, before prices followed. Despite a bunch of media coverage on this topic, I don’t think that most people appreciate the true magnitude of what may happen if oil stays at these prices.

Remember, all of this is very long-term bullish for energy prices. This shakeout will set the stage for the next boom, but first, there will be all sorts of pain experienced in sectors that do not even appear linked to the energy sector. I suspect that this pain, will be the major theme for 2015.

——————————

The collapse in oil prices, leading to massively uneconomic projects being mothballed and those that are economic being “value adjusted”, actually opens up some very interesting opportunities once this all unravels itself like the ball of yarn that it is.

– Chris

PS: If you don’t want to miss the next “There Will Be Blood” writeup then leave your email address here to receive the next letter straight in your inbox.

“The bubble is bursting. And if oil stays where it is, the worst is yet to come.” – Spencer Cutter, Bloomberg Intelligence

- Russia Claims ISIS Now On The Ropes As Fighters Desert After 60 Airstrikes In 72 Hours

One question that’s been asked repeatedly over the past thirteen months is why Washington has been unable to achieve the Pentagon’s stated goal of “degrading and defeating” ISIS despite the fact that the “battle” pits the most advanced air force on the planet against what amounts to a ragtag band of militants running around the desert in basketball shoes.

Those of a skeptical persuasion have been inclined to suggest that perhaps the US isn’t fully committed to the fight. Explanations for that suggestion range from the mainstream (the White House is loathe to get the US into another Mid-East war) to the “conspiratorial” (the CIA created ISIS and thus doesn’t want to destroy the group due to its value as a strategic asset).

The implication in all of this is that a modern army that was truly determined to destroy the group could likely do so in a matter of months if not weeks and so once Russia began flying sorties from Latakia, the world was anxious to see just how long the various rebel groups operating in Syria could hold up under bombardment by the Russian air force.

The answer, apparently, is “less than a week.”

On Saturday, the Russian Ministry of Defense said it has conducted 60 bombing runs in 72 hours, hitting more than 50 ISIS targets.

According to the ministry (Facebook page is here), Islamic State fighters are in a state of “panic” and more than 600 have deserted.

Here’s what happens when the Russians locate a terrorist “command center”:

According to The Kremlin, the structure shown in the video is (or, more appropriately, “was”) “an ISIS hardened command centre near Raqqah.” Su-34s hit it with concrete-piercing BETAB-500s setting off a series of explosions and fires that “completely destroyed the object.”

Here’s RT:

Surgical airstrikes by Russian fighter jets have knocked out a number of Islamic State installations in Syria, including the battle headquarters of a jihadist group near Raqqa, according to the Russian Defense Ministry.

“Over the past 24 hours, Sukhoi Su-34 and Su-24M fighter jets have performed 20 sorties and hit nine Islamic State installations,” Igor Konashenkov, Russia’s Defense Ministry spokesman, reported.

Konashenkov added that yesterday evening Russian aircraft went on six sorties, inflicting strikes on three terrorist installations.

“A bunker-busting BETAB-500 air bomb dropped from a Sukhoi Su-34 bomber near Raqqa has eliminated the command post of one of the terror groups, together with an underground storage facility for explosives and munitions,” the spokesman said.

Commenting on the video filmed by a Russian UAV monitoring the assault near Raqqa, Konashenkov noted, “a powerful explosion inside the bunker indicates it was also used for storing a large quantity of munitions.

“As you can see, a direct hit on the installation resulted in the detonation of explosives and multiple fires. It was completely demolished,” the spokesman said.

And here’s the Russian Defense Ministry taking a page out of the US Postal Service’s “neither rain, sleet, snow, nor hail” book on the way to serving notice that nothing is going to stop the Russian air force from exterminating Assad’s enemies in Syria:

Twenty-four hours a day #UAV’s are monitoring the situation in the ISIS activity areas. All the detected targets are effectively engaged day and night in any weather conditions.

Now obviously one must consider the source here, but Kremlin spin tactics aside, one cannot help but be amazed with the pace at which this is apparently unfolding. If any of the above is even close to accurate, it means that Russia is on schedule to declare victory over ISIS (and everyone else it looks like) in a matter of weeks, which would not only be extremely embarrassing for Washington, but would also effectively prove that the US has never truly embarked on an honest effort to rid Syria of the extremist groups the Western media claims are the scourge of humanity.

Summed up in 10 priceless seconds…

- China's President Confirms Practice Of Moving Official Reserve Assets To Other Entities In China

By Louis Cammarosano of Smaulgld

- Shanghai Gold Exchange withdrawals were 65.681 tonnes of gold during the week ended September 25, 2015.

- Total gold withdrawals on the Shanghai Gold Exchange year to date are 1,958 tonnes.

- Withdrawals on the Shanghai Gold Exchange are running 37.2% higher than last year and 17.88% higher than 2013’s record withdrawals.

- Hong Kong gold kilobar withdrawals pass 565 tonnes in 2015.

- Chinese President Xi Jinping admits “some assets in foreign exchanges were transferred from the central bank to domestic banks, enterprises and individuals”

Shanghai Gold Exchange

The Shanghai Gold Exchange (SGE) delivered 65.681 tonnes of gold during the week ended September 25,2015. During prior trading week ended September 18 2015, the SGE withdrawals were 63.22 tonnes of gold.

The two week total of withdrawals is 128.90 tonnes of gold and the year to date total is 1,958 tonnes, for an annualized run rate of approximately 2,650 tonnes.

Shanghai Gold Exchange vs. Global Mining Production

Total global gold mining production in 2014 was 2,608* tonnes. The volume of gold withdrawn on the Shanghai Gold Exchange this year is pacing to be about 2,650 tonnes or roughly equivalent to the total global mining production of last year. This leaves little or no mining supply to satisfy global gold demand in India (expected 2015 gold demand of about 1,000 tonnes) and the rest of the world.

Shanghai Gold Exchange and HongKong Kilo Bar Withdrawls vs. Global Mining Production

Through September 25 2015, Shanghai Gold Exchange withdrawals are 1958 tonnes and through September 30, 2015 Hong Kong Kilo bar withdrawals (see below) are 565 tons.

Combined year to date the withdrawals on both exchanges are 2,523 tonnes through the first nine months of 2015. Modest projections could take the combined gold withdrawals from Hong Kong Kilo bars and the Shanghai Gold Exchange to 2,900 tonnes in 2015.

Shanghai Gold Exchange Withdrawals vs. Comex Deliveries

In “Silver and Gold Short and Long Positions on Comex” we noted:

Comex is a place where banks trade gold and silver they don’t have to banks who buy gold and silver they don’t want.

These following two charts illustrate the point:

Two Week Withdrawals on the Shanghai Gold Exchange in September 2015 vs. Comex 2014

Withdrawals on the Shanghai Gold Exchange were 137 tonnes during the two week period ended September 18, 2015, compared to just 85 tonnes delivered in all of 2014 on Comex.

Shangahai Gold Exchange Withdrawals vs Comex Deliveries of Gold 2008-2015

The chart illustrates that paper market vs. physical market natures of the Comex and Shanghai Gold Exchanges.

China is becoming the center of the Asian gold world. A $16 billion China Gold Fund was announced in May and the Shanghai Gold Exchange continues to establish itself as viable competitor to the gold trading centers in London and Chicago. China’s gold imports, trading and mining production are one of the cornerstones of China’s de-dollarization/Yuan strengthening initiatives that focuses no so much on selling U.S. Treasuries but creating alternative financial systems like the Asian Infrastrucure Investment Bank.

China is widely believed to be making a play for inclusion in the International Monetary Fund’s (IMF) Special Drawing Rights (SDRs) Program later this year. If China fails to gain inclusion in the SDR, its recent initiatives to strengthen its currency and gain greater acceptance of the Yuan may provide a strong alternative to the IMF regime.

China Updates its Gold Holdings

China recently announced their first update to their official gold holdings since 2009. The People’s Bank of China announced that their gold holdings had climbed from 1054 tons to 1658 tons, making China the fifth largest gold holding nation in the world.

China chose to incude six years worth of gold accumulation (over 600 tons) all in the month of June.Last month China reported that they added 19.3 tons (610,000 ounces) of gold to their reserves in July bringing their total to 1,677 tons (53.93 million ounces). Earlier this month the PBOC updated their August gold reserves, indicating that they had added 16 tonnes of gold to their reserves, bringing their total to over 1693 tonnes.

Chinese gold reserves grew by 16 tonnes in August.

China’s recent update to its gold holdings put it in fifth place among gold holding nations.

Many suspect that China has far more gold than they have reported. Click here for an explanation on where China’s gold might be.

Chinese President Xi Jinping recently confirmed the practice of moving the People’s Bank of China’s reserve assets to other entities in China: “some assets in foreign exchanges were transferred from the central bank to domestic banks, enterprises and individuals” This might explain where some of China’s gold hoard, that many suspect they posses but have not reported as reserves, may be located.

* * *

How does all that gold get to China?

The Bank of China also recently joined the auction process at the London Bullion Market Association where the price of gold is determined.

In addition, the Chicago Mercantile Exchange futures contract for Hong Kong Kilobars has experienced withdrawls of an average of more than five tons of gold a day since it began in mid March earlier this year. As of September 30, 2015, over 535 tonnes of gold have been withdrawn pursuant to this program since March 2015 for an annualized run rate over 1,200 tonnes of gold a year.

COMEX Hong Kong Gold Kilobar Withdrawals Through September 30, 2015

Comex Hong Kong gold kilo bar withdrawals have passed 565 tonnes since March 2015 and passed 18 tonnes on three trading days in September.

The Bank of China also recently joined the auction process at the London Bullion Market Association where the price of gold is determined.

China is the world’s largest gold producer:

China is the world’s largest gold producer with mining production over 2,000 tons the past five years. China has mined 228.7 tons of gold during the first six month of 2015.

Volume of Gold Withdrawals on the Shanghai Gold Exchange

Shanghai Gold Exchange Withdrawals for the week ended September 25, 2015, were over 65 tonnes.

The volume of withdrawals of gold on the Shanghai Gold Exchange as of September 25, 2015, is running 37.2% higher than 2014 during the same period and 17.9% higher than 2013’s record pace.

Withdrawals of gold as of September 25, 2015, on the Shanghai Gold Exchange are running 37% higher than last year and 18% higher than the record pace set in 2013.

In addition to the vibrant Shanghai Gold Exchange and increasing world leading gold mining production, China is also the world’s largest gold importer. Here is a chart showing the volumes of gold traded on the Shanghai Gold Exchange vs. gold imported through Hong Kong as of July 2015.

China also imports unreported amounts of gold through Shanghai.

* * *

All charts, other than those labeled “Smaulgld”, courtesy of Nick Laird.

*Gold Mining Production Source:2014 Gold Year Book published by CPM Group. There are various estimates of global gold mining production ranging from 2,600 tons to 3100 metric tons.

Shanghai Gold Exchange Data source GoldMinerPulse - Ron Paul Trounces Trump, Exclaims Election Is Entertainment "Orchestrated By Major Media"

Former congressman and presidential candidate Ron Paul has unleashed a harsh (but entirely fair) criticism of the current presidential campaign. Talking to RT's Ameera Davis this week, Paul lambasted the media's control of the U.S. electoral process, Donald Trump’s candidacy, and the stock market…

"So I think some of this stuff in the presidential campaigns is orchestrated by the major media. It is entertainment. They have competitions going on and on. So I don't put a lot of stock [in the presdential process], this is still pretty early. …

Donald Trump is an authoritarian and he brags about it. "I'm the boss and I tell people what to do."

Well government happens to be a little different than that.

An authoritarian is the opposite of a libertarian. A libertarian wants to release the individuals, get government out of our lives, out of the economy, and out of all these places around the world…"

- It's The Entrepreneur That Saves An Economy – Not The Fed

Once again via a stunningly dismal monthly “jobs” report we were shown just how inept the Federal Reserve is in its ability to deliver a qualitative as well as quantitative resolution to one of its core mandates. Only if you use the “math” now prevalent (as well as rampant) within economics can one look at any part of it and say “the economy is creating jobs” without bursting out in laughter, or, busting out in tears.

Yet, just when one thinks it couldn’t get any worse, all one needs to hear is an explanation from one of its members as to try to explain such a pitiful report. The reason for so many without jobs? (I’m paraphrasing) “They just don’t want one.” I wish I were making that up, but sadly, that’s their assessment.

The participation rate hit a low not seen since the late 1970’s with a now whopping 94.6 million out of work. However, if one were to listen to the next in rotation tenured economics professor from _____________ (fill in your Ivy League of choice) you would think the jobs market was strong. After all, “We’re at 5.1% unemployment!” As if this was a number one could use in earnest.

This number itself has been so adulterated with adjustments even the Fed scuttled it’s policy weighting when they originally implied years back somewhere in the 6’s would make certain for a more hawkish monetary policies. Yet, the 6’s came – and went – and QE came, and stayed well past its “sell by date.”

The problem that’s taking place right now within the economy is exactly what you get when you take a free market economy and try to impose a command and control blanket over it: you smother it.

The Ivory Tower academics have no real understanding of what “free” actually entails when it’s expressed through the economy as a whole. The ability to build a better mouse trap, or, solve a previously unsolvable riddle all while charging a price two parties can both bear, profit by, and have satisfaction in the transaction does not, nor ever will take place within a command and control base. Ever.

Free markets allow for competition to find equilibrium as to provide and deliver a service or good someone will pay a fair price for. And yes, even for such an item such as a stock price.

Command and control fosters either the “State” to be the only provider, or, a fostered crony capitalism styled arrangement which is nothing more than another iteration of some communist system in prettier buildings wearing better suits. Harsh? Yes. Off point? Hardly. And that’s the problem.

The great capital formation experiment and enterprise known as Wall Street and its Exchanges, once the envy of the world, has now been transformed into nothing more than a rigged casino where Fed fueled “hot money” front runs orders in ways so egregious to the principal of fair play; walking into “a den of thieves” would be considered a step up.

Today the entrepreneur is being stifled. Yes, some will point to Silicon Valley and shout “But, but!” however, there too these issues of perversion against the entrepreneur are also made manifest. Unicorns are just that – fictional manifestations claiming to be real to anyone who’ll stay at arm’s length. (i.e., don’t get too close to the books or else!)

Here again, the reality of a market no longer primed and pumped via QE for their long-awaited IPO will find out the hard way their time for “cashing out” has come and went; further crushing many budding entrepreneurs hopes let alone the employees that took “stock options” in lieu of salary.

The funds or individual investors that were sold these fictional based realities (i.e., the can’t tun a net profit via GAAP yet via Non-GAAP they’re killing it!) who bought into the fictional hype will abandon and be far more than hesitant to invest in any future IPO’s let alone stocks in general.

If you think I’m exaggerating just look at Twitter™ or Alibaba™ for clues. For if you missed their original IPO not all that long ago, not too worry. You can buy in now for even less. And it’s just the beginning.

The real issue here is that some other good ideas that would, or could, help the economy foster business formation, encourage hiring and more will be left to dangle and rot on many a branch for discontent doesn’t take place in a vacuum – it happens throughout all sectors when confusion, disillusionment, as well as apathy sets in via mixed messaging from “central command.”

You can’t run or start a business when you can’t rely on what the rules or overarching policies going forward will be. (i.e., The cost of money will be whatever we decide today for tomorrow we might change it back) It wreaks havoc throughout the acutely connected fibers of business.

Businesses don’t stand alone – they depend on each other in differing sectors for supplies, transportation logistics, and so much more. Change a policy haphazardly, or signal a coming change only to not follow through sends ripples and shock-waves down a supply line with unintended as well as unforeseen consequences which can throw some businesses into free fall, and some into out right bankruptcy.

Business people know and understand this intuitively. Ivory Tower academics, intellectuals, and economists are not only clueless, it’s their wanton indignation of these facts that move their policies beyond destructive right into outright dangerous territory for any free market based economy.

The only one’s that can benefit from such a business environment are those that gorge and reward themselves via the availability current Fed. policy fosters. And the name for it is: crony capitalism.

Whether the Fed. wants to admit or not, that’s what their current policy and communication fosters and bolsters which is the antithesis of what the Fed. itself states as its primary objective; for there is no wage growth, no true job creation, no sustainable capital formations, and not stable markets.

The Fed. is killing the economy – not helping it. And as de facto proof I point to their own measurements of achievement. The markets, the labor participation rate, small business formation, wage growth, and on, and on. It’s all pathetic.

The Fed’s QE program has adulterated valuations so much it will be a wonder if we ever get back to a more normalized set of business values let alone their valuations and away from this calamity.

There are entrepreneurs along with CEO’s of companies who are quite literally chomping at the bit to try new or improved innovations – yet don’t dare for either their competitors are being kept alive via cheap money afforded them under current ZIRP policy, or worse, don’t dare hire or spend for who knows if the Fed. will raise out of the blue or announce some new program that runs anathema to basic sound monetary policies.

You don’t invest in cap-ex or hiring for the long-term if you don’t know what the rules might be tomorrow never-mind next year. Period.

If you want to see how and why the U.S. economy was the envy of the world along with the how and why everyone on the planet wanted the opportunity to come here and try for themselves. It can easily be done using this simple yet forgotten example or exercise:

Want an example of crony-capitalism, or, “State” run centrally commanded and controlled? Look no further than any communist or dictatorial country on the planet. What you’ll notice and can’t avoid is this: There are very few if not one sole business or supplier for any given service. The reason? You can’t compete with their favored access to either capital or permitting.

Want an example of a free market? Although they’re almost a relic, pick up any telephone book and look in the back where the businesses are located or, the Yellow Pages™. Look at how many differing as well as different options are available for any given service. Want your septic tank cleaned? There’s usually 10 or more options with names like “Steve’s” or “Dave’s” or Bill’s” and so forth. Need windows for your house? There’s probably 20 or more of those with assorted names. Many I’ll garner are also closer in proximity (as to your neighborhood) than you ever paid attention to previously. It goes on and on.

The issue today happens when “Steve, Dan, or Bill” can’t stay in business because “Conglomerate Septic Enterprises” is allowed to not only provide cheaper pricing afforded to it via relying on its stock narrative (i.e., we make Non-GAAP profits sparkle) rather than having to compete using fundamental business practices. (i.e., making a net profit via 1+1=2 math) “Steve, Dan, and Bill” find themselves either forced out or forced into liquidation only to be sucked up at bargain prices by the “conglomerate” which will finance the acquisition with “free money” available only to it and entities like it. And if it all hits the fan and begins rolling down the hill “Conglomerate” will either be “bailed out” or better yet, “bailed out and government-owned.”

This is just one example of why the economy is mired in quicksand. Entrepreneurs, as well as others are being stymied in what seems a relentless battle against academic theory rather than true business acumen. And the theory that an economy so large, so complex, so diverse as that of the U.S. can be fine tuned, manipulated, and more by some appointed committee that for all intents and purposes never held a position in that economy except for some academic based position is not just maddening – it’s lunacy!

The Fed needs to stop its meddling. Stop trying to add one more extension to their already over extended Rube Goldberg inspired monetary policies and get the hell out-of-the-way.

If the Fed is going to do something – do it. If you’re going to say something for clarity – say it – then stop talking. If you’re going to set and announce publicly an objective (such as hitting a specific target value like 6.1 unemployment et al) once it gets hit – do what you stated. Other than that, all the mumbo-jumbo clarifying classifiers for clarity regurgitated one Fed. speaker after another will do nothing more than increase the tension on the economies “parking brake.” Not release it.

Entrepreneurs can and will find ways as to navigate conditions and produce the much wanted as well as needed business formations that bolster a growing environment for business. However, what they won’t do is put their livelihoods on the line where bankruptcy and more can be around every business day when not only do rules change near daily – but goal posts get pulled up and moved at whim.

Adherence to timelines and narratives of an imperfect policy are sometimes far more important than tinkering and dabbling daily in some ill-fated quest for policy perfection.

The Fed keeps approaching the economy from the viewpoint of a “tinkerer.” Maybe a little more of this, or a little less of that here, or there. Maybe just an adjustment here, or there, and sooner or later it will run like a finely tuned machine. It won’t. That’s the job for the entrepreneur – not the Fed. And the more they “tinker” after every misstep or miscalculation; the more their policy and approach would make even Rube Goldberg blush for the complexity to such a straight forward task.

As I’ve stated many times it’s an open question where both sides have a legitimate argument for the Fed’s original insertion into the markets during the 2008 crisis. However, what is not an open question is their resolve to continue and pump trillions of dollars to incentivize Wall Street’s predator class to find ways of adulterating the capital formation process while forcing savers, retirees, and more to question why every-time they take out their wallet a bulls-eye or laser dot suddenly appears on it from the shadows.

The markets are beginning to show just how tall and flimsy this house of cards built on QE quicksand has grown. And the coming shifting sands have only just begun with onerous consequences for everyone involved. And this all could have been avoided in my opinion if the Fed. had relinquished its insertion into the markets back years ago and had let the markets rise and fall on their own to find its equilibrium.

Entrepreneurs and ideas thrive in that type of environment. Exactly what we so desperately need. Yet, instead, all we have is this crony styled, unicorn imagined monstrosity of all that’s unholy to true business principles.

I’ll finish with one last thought which I’ve been pounding the desk (as well as keyboard) for years to anyone that would listen. However, now I don’t think it needs to be said – it’s coming to fruition in vivid detail I’m afraid sooner as opposed to later which no one will be able to avoid.

“Markets right themselves with pain… That’s Capitalism.

Back room manipulation to avoid that pain only increases the severity of it down the road.”

If one cares to see just how much pain might be in the near future, all one needs to do is look at a chart of one’s favorite major index. For it’s not a pretty picture of health by any stretch of the imagination even if viewed through rose-colored glasses.

The Fed has created a playing field where now even Unicorns are going to come up lame to only limp past greener pastures on their way to IPO heaven and quite possibly – straight to the glue factory.

- Deutsche Bank Boosts German GDP Forecast Due To "Surge In Immigration"

Even as the Syrian proxy war is on the verge of breaking out in a full-blown regional war, one involving not only the Saudis but the mastermind behind the entire conflict, Qatar, which is willing to sacrifice millions of innocent civilians just so its gas can finally be sold in Europe, the refugee crisis resulting from the constant instability in the mid-east, fanned by both the US and Russia, is approaching unprecedented proportions for one country: Germany.

It is Germany which is now expecting up to one and a half million (and likely many more) asylum seekers to arrive in 2015 according to Reuters, up from the 800,000- 1 million expected previously, with the result increasing social unrest not only as a result of the influx of foreigners, but due to the domestic reaction. As reported last weekend, Germany’s domestic intelligence chief warned on Sunday of a radicalisation of Right-wing groups amid a record influx of migrants, as xenophobic rallies and clashes shook several towns at the weekend. President Joachim Gauck meanwhile warned of Germany’s “finite capacity” to absorb refugees, cautioning against more “tensions between newcomers and established residents”.

Furthermore, the domestic spy chief Maassen said that “what we’re seeing in connection with the refugee crisis is a mobilisation on the street of Right-wing extremists, but also of some Left-wing extremists” who oppose them.” He added, speaking on Deutschlandfunk public radio, that for the past few years his service had witnessed a “radicalisation” and “a greater willingness to use violence” by all extremist groups, including the far right, the anti-fascist far-left and Islamists.

This explains the dramatic exchange this past weekend when Facebook CEO Mark Zuckerberg and German Chancellor Angela Merkel were caught on a hot mic at the United Nations discussing the removing of certain posts from the prolific site. As Western Journalism chronicled, Merkel brought up the subject of anti-immigrant posts appearing on the German version of Facebook, as the country grapples with how to handle the largest refugee crisis since World War II.

“We need to do some work.” Zuckerberg says. The German chancellor presses him. “Are you working on this?” she asks in English. “Yeah,” the Facebook CEO responds before the introductory remarks of the lunch meeting cuts off their conversation.

Reuters reported earlier this month that Facebook intends to cooperate with the German government in eliminating “hate postings” regarding the refugees. Specifically, the social media site will partner with the German Internet watchdog Voluntary Self-Monitoring of Multimedia Service Providers to identify offending posts.

After the hot mic fiasco, Facebook promptly issued the following statement:

“We are committed to working closely with the German government on this important issue,” Facebook spokeswoman Debbie Frost said via e-mail to BloombergBusiness. “We think the best solutions to dealing with people who make racist and xenophobic comments can be found when service providers, government and civil society all work together to address this common challenge.”

So as the German refugee crisis has now dragged down not only Merkel, whose popularity rating just tumbled to a four year low “reflecting growing concern over the influx of hundreds of thousands of refugees into Germany, a poll showed on Thursday”, but has exposed “free speech” advocate Facebook as merely another government propaganda pawn, Germany has been scrambling to find some silver lining on this scandal.

It did just that on Friday, when the bank with the greatest amount of notional derivatives in Europe and the world, Deutsche Bank, raised its German 2016 GDP forecast “because the heavy influx of migrants would increase consumption as much as half a percentage point.”

In other words, the more the immigrants, the greater the GDP boost according to the world’s riskiest bank.

According to Reuters, German gross domestic product is now forecast to come in at 1.9 percent in 2016 compared with 1.7 percent in previous forecasts, the bank said in a research note published on Friday.

“Although the external and the financial environment have deteriorated we have lifted our 2016 GDP call,” Deutsche Bank said.

“Drivers are stronger real consumption growth due to lower oil prices/stronger EUR and the surge in immigration,” analysts wrote, adding they expected the boost in consumption to be evenly split between private and public.

As a reminder this analysis was written when “only” 800,000 refugees were expected to enter Germany. Now that the number is nearly double, does that mean that German GDP is set to surpass 3%, or perhaps even 4%? Maybe Germany just found the answer to economic collapse domestically: just start a war abroad and accept the destroyed nation’s population.

But before unleashing another round of Keynesian mocking and ridicule, perhaps this was the goal all along: “At the time of arrival, the average age of the immigrants is 23.3 years old – much younger than the domestic population, which averages 44.5 years, the bank said. Germany has long struggled to deal with its aging population, with government and industry saying immigration was needed to counter the looming demographic squeeze.”

Well, what better way to provide a demographic boost to an aging population than to accept millions of refuges as a result of a conflict that ultimately benefits nobody more than Europe (if and when the Qatar gas pipeline is finally completed). Now if only Japan were to accept a few million Syrian refugees too, suddenly the demographic implosion of the entire developed world would become a thing of the past.

- Here Come The Money Helicopters!

Submitted by Bill Bonner of Bonner & Partners (anntated by Acting-Man.com's Pater Tenebrarum),

$10 Trillion Goes to Money Heaven

We interrupt our series on what to do if you have no money to bring you an update on those who are losing it. (You can catch up on Parts I and II of that series here and here.)

What was the best place for your money so far in 2015? Cash! Compared to cash, almost everything is down. We are headed for the worst quarter for stocks since 2011, says the lead story in today’s Financial Times.

Global stock markets have lost $10 trillion of their value over the last three months. What? Where did all that paper wealth go? The old-timers say it went to “money heaven.”

One fine morning in money heaven….will it ever rain down again? Of course, no money has actually disappeared. Only make-believe values have.

We’re not so sure. But we stop. We stare. We look at it as we would at a corpse. What happened to its life force? Where did it go? Why is it no longer there? We have no answer. But looking at a stock market sell-off is like standing over an open coffin: We are in awe at the power of the gods to take as well as to give.

They ask no one’s permission. They follow their own playbook (which they never reveal to mortals). And they are as much a law unto themselves as the NSA. But what’s $10 trillion that never actually existed anyway? Easy come, easy go, right?

Well… yes… and no. It’s usually a pleasure to welcome a baby, but a funeral can be painful. And every one of those dollars – now headed for heaven or hell – will be missed by someone.

On Wednesday, the Dow rose 154 points to 16,049. That left the stock market overvalued by about 8,000 points. At least, that is the assessment of billionaire investor and Wall Street legend Carl Icahn. The current price-earnings ratio for the Dow is 15, he says, and “half of that is bulls**t.”

The ½ bulls**t index, daily – click to enlarge.

“Money talks and bulls**t walks,” is the old expression. And sometimes the bulls**t walks out the door… taking the money with it. That is what has been happening in this quarter. And not only in the U.S. The biggest losses have been suffered abroad. Japan, for example, deserves special notice.

Our Trade of the Decade Sours

As you might remember, our “Trade of the Decade” was to sell Japanese government bonds (JGBs) and buy Japanese stocks. After a quarter-century of a bear market, we figured Japanese investors were sure to catch a break. And Japanese bonds had been so overbought for so long, the market in JGBs was bound to run into trouble.

This trade looked pretty good a few weeks ago. Japanese stocks were up almost 20% this year alone in dollar terms. That was largely thanks to Prime Minister Shinz? Abe’s plan to devalue the yen… one of his so-called Three Arrows. But like all macroeconomic engineering by public officials, the plan soon revealed itself as just more bulls**t.

Tripping over a lack of third arrows – the Nikkei Index – click to enlarge.

Instead of stimulating the economy, Abe’s first two arrows – monetary and fiscal easing – struck vital organs, draining away what little life was left. Japan is now on the verge of a technical recession. Its economy shrank in the second quarter. And it’s on the verge of repeating the trick in the quarter just ending.

In fact, so disappointing were the results that Abe forgot his third arrow – structural reform – and instead picked up a new quiver with the usual assortment of crooked and twisted policy claptrap.

But the bulls**t walked out the door anyway, with Japanese stocks giving up all this year’s gains. Japan’s economy is shrinking. And deflation came back to life the day after Abe proclaimed it dead.

Abe’s economics textbook – it’s not working, so maybe they should do more of it?

Cartoon by Li Feng

And now cometh Etsuro Honda, a special advisor to Mr. Abe and often described as an “architect” of Abenomics. Mr. Honda says it may be premature to say Japan is in recession. Instead, he describes the economy as “static.”

In yesterday’s interview with the Financial Times, Honda took no blame for the slowdown, even though he, as much as any living human being, is clearly responsible for it. Instead, he proposes to go “full retard,” with even more imbecilic policies.

Japan has a nigh endless supply of insane Keynesians doing the same thing over and over and over again – here is one more, Etsuro Honda. His proposal? Let’s go full retard. Doesn’t he know that no matter what you do, you should never go full retard?

QE for the People

This, we fear, is not just a freaky sideshow. It is more like the coming attractions. Japan has led the world for the last three decades – first with an unsustainable bubble economy in the 1980s… then with a meltdown… followed by a long on-again-off-again recession.

The Japanese feds tried every trick in the book to revive the economy – except for the one that would have worked. The government borrowed and spent (as a percentage of the economy) more than any nation had ever done. And it invented ZIRP and QE as policy tools.

But now it’s become “urgent,” says Honda, to do more. Hasn’t he done enough already? you may ask. But no… He now proposes more QQE (for “qualitative and quantitative easing”). What grotesquerie lies ahead?

Our mouth hangs open. What is this strange beast slouching towards the Eccles Building (the headquarters of the U.S. Fed)…waiting to be born? The idea behind Japan’s quantitative easing was to INCREASE the quantity of money in the system so as to DECREASE the quality of each unit.

It was expressly meant to devalue the yen so that consumers would want to get rid of their currency faster. QQE makes no sense… even in the perverse terms of modern central bank meddling.

Here is how the money will come back from its hideout in money heaven – via helicopter! Look how happy the peasants are!

Illustration via adamsmith.org

But wait. There’s more. Honda says it will be accompanied by a “supplementary budget, focusing on the real income shortage of mid- and low-income households.”

Right now, this proposed extra spending is being funded out of taxes. But support is growing around the world for such spending to be funded by “People’s QE.” The idea behind “People’s QE” is that central banks would directly fund government spending… and even inject money directly into household bank accounts, if need be. And the idea is catching on.

Already the European Central Bank is buying bonds of the European Investment Bank, an E.U. institution that finances infrastructure projects. And the new leader of Britain’s Labor Party, Jeremy Corbyn, is backing a British version of this scheme.

Ah-ha! That’s the monster coming to towns and villages near you! Call it “overt monetary financing.” Call it “money from helicopters.” Call in “insane.” But it won’t be unpopular. Who will protest when the feds begin handing our money to “mid- and low-income households”?

We wait. We watch. We wonder how the Japanese will attempt to bring back to life the economy they have worked so hard to kill. And now, all over the world, central planners, bankers, and politicians are watching too. “Where goest the Bank of Japan, there too I shall go,” they tell themselves.

Stay tuned…

Somewhere in a dungeon in Tokyo, a crack team of Abe’s economic advisors is working around the clock on a secret project that will save us all!

Somewhere in a dungeon in Tokyo, a crack team of Abe’s economic advisors is working around the clock on a secret project that will save us all! - Hanging By A Thread

The poker game continues as markets finished the week right back in range. Bulls got a magic save on Friday following bad news as both NFP and factory orders came in far below expectations. None of these misses were predicted by either economists or the Fed. Confidence inspiring? Not so much. Yet is bad news good news again? QE4 coming? The fact is bears couldn’t keep price below 1900 $SPX (a key level we had discussed in Technical Charts) and once the level held again it was panic buying on strong volume.

So we’re back in range and both bulls and bears still have to prove their cases. Traders love this environment as it provides plenty of opportunity for outsized gains, but the risks to charts are mounting and frankly markets are hanging by a thread and need a major technical rescue soon.

Let’s walk through some key charts:

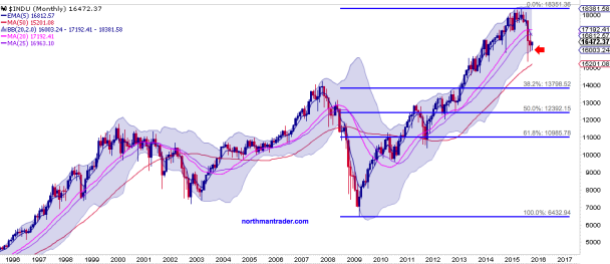

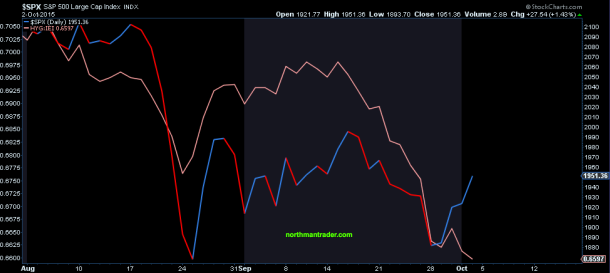

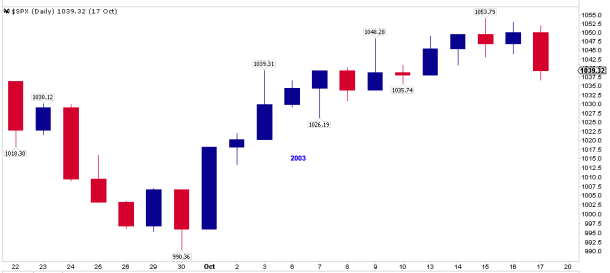

Daily $SPX: Back in range, potential for a double bottom, MACD cross, but declining MAs with major resistance ahead: