- Central Banks Are About To Leave Fiat Addicted Stock Markets In Agony

Submitted by Brandon Smith via Alt-Market.com,

Many investors today are not very familiar with market history and tend to live only in the day-to-day mainstream narrative while watching little red and green graphs move up and down. This is not so much an issue in a relatively stable economic environment. The problem is, today we live in the most unstable economic conditions possible.

These investors and analysts are simply not aware that some of the most exciting stock rallies occur during the most volatile crises, and so they interpret every rally of a few days to a few weeks as a signal for recovery. However, in this kind of fiscal environment, all the gains made in a few weeks can be lost in moments.

After the Great Depression began to take hold in U.S. markets, massive rallies unfolded over the span of weeks and sometimes months, only to end in a collapse to even lower depths. For example, in 1930 the Dow Jones enjoyed historic rallies twice, gaining 48% only to lose it all, then gaining more than 16% and crashing down to a 50% loss for the year. Each consecutive year there were multiple rallies of more than 25% and each time they disintegrated. By 1932 stocks were only worth approximately 20% of what they were worth in 1929. Bear market rallies continued to give false hope to investors and the public throughout the crisis, and mainstream banks and economists continued to exploit such rallies to capitalize on those false hopes.

I mention this to put our markets today in perspective. Mainstream analysts and some banking moguls are already declaring a reversion of the instability that was launched at the beginning of this year due to the spike in stocks over the past three weeks. I explained the reason behind this comparatively short term rally in my article “Markets Ignore Fundamentals And Chase Headlines Because They Are Dying.” In desperation, the investment world has placed all its hopes on renewed stimulus measures this March by China and the European Central Bank. They have also made bets that the Fed will not raise rates again until the end of this year, if they raise rates again at all.

I believe the next two weeks will be very telling in terms of how the rest of the year in markets will progress. If mainstream analysts and investors are placing faith in further central bank intervention, they may be greatly disappointed.

Every action of the central bankers this year has indicated a shift away from open intervention. The taper of quantitative easing (QE) has run its course and no new QE has been announced since. The rate hikes were launched in December despite all traditional logic to the contrary and now, Fed officials appear to be staying on track for more hikes in the near term. Kansas City Fed President Esther George told Bloomberg that a fed rate hike in March should “absolutely remain on the table.”

San Francisco Fed President John Williams said there has been “no substantial change” in his view of the economy or the rate hikes and that said rate hikes will likely continue as planned.

Goldman Sachs argues that there will only be “three” more rate hikes this year, rather than four, although, this is three more rate hikes than the investment world was asking for.

Fed statements have given little clue as to the timing of the rate hikes, but all fed statements have so far presented an attitude that they plan to “stay the course.” For now, stock markets do not want to accept this reality.

I believe that the Fed will be raising rates again in the near term. I believe there is a possibility for the fed to surprise with a rate hike at their meeting this March 15th and 16th. If this does not occur, the Fed will likely hint of a hike in June in their press statements. Another hike so soon (or even the threat of an assured hike) will absolutely strangle any market gains made in the past few weeks.

Another date to watch out for will be tomorrow's meeting of the European Central Bank. All eyes are on renewed ECB stimulus; not only renewed stimulus, but stimulus measures vastly beyond what the ECB has initiated in the past. I am not sure why investors’ expectations are so high for the ECB to save the day. The last time this kind of exuberance hit stock markets over a European stimulus package was in December of last year, and the ECB dashed all those hopes into the dirt with a mediocre response. This aided directly in the stock market volatility that came in January and February.

So, the markets are praying for the ECB to “do it right this time.” I highly doubt the ECB's eventual decision will satisfy the unrealistic expectations of the investment community. In fact, I believe the central bank will offer little or nothing, and stocks will come crashing down just as they did after the December meeting.

It wasn’t long ago that the entire financial universe was focused on whether China would intervene in their own markets, either with more stimulus or by arresting more investors that were betting against their stocks. The days of outright Chinese stimulus appear to be over as reports come in that the National People’s Congress concluded without any mention of large scale action to artificially support the Chinese economy. This should not be a surprise to anyone who was paying attention; China’s president warned in January that more economic stimulus is “not the answer to the nation’s challenges.”

So, what does this mean?

Well, first and foremost, it shows that the attitude of central bankers is moving away from intervention. As I have stated many times in the past, actions like the Fed taper of QE3 and the rate hikes only make sense if central banks are planning to ALLOW the markets to decline. The rate hike meetings, stimulus meetings, and the fact that they allow investor conjecture on stimulus to continue without much official contradiction, helps international financiers to control the speed at which this crash occurs. But the fact remains that they are not acting to stop the crash, nor will they act.

There are no fundamental economic indicators that are positive enough to support a market recovery or an economic recovery. All moves in stocks are based on nothing but the delusions of fiat addicted stock players waiting for more printing to feed their habit of “buying the dip” without having to think strategically and educate themselves on sound investments. That is to say, investors have become addicted to central bank manipulation of markets, but now the central banks are cutting off their supply of smack.

Where is this all going?

I have mentioned in past articles the tendency of elitists to warn the public of coming economic collapse, but these warnings are always far too late for anyone to do much to prepare. They do this because they KNOW that a crisis is coming. They know a crisis is coming because THEY created the circumstances which are causing it. The money elites inject warnings into the media not to help the public, or to encourage positive solutions. Rather, they offer these warnings so that after the crash they can present themselves to the public as “good Samaritans,” or fortune tellers who “tried to save us.” They are, of course, neither of these things.

The Bank for International Settlements, the central bank of central banks, has released yet another dire warning into the mainstream, stating that “official” global debt is now 200 percent of GDP and that this debt is unsustainable. They have also warned of a “gathering storm” and the “loss of faith in central banks” as 2016 moves forward.

On top of this, none other than Lord Jacob Rothschild has released his own cautionary letter on the global economy, stating that we are now “in the eye of the storm.”

Why are central banks allowing a controlled demolition of our economy to take place instead of propping up and manipulating markets as they have for the past few years? You can read my many articles on the globalist endgame for a detailed explanation, but to summarize – problem, reaction, solution.

International financiers want a completely centralized global economic structure, including a single currency system, the eventual removal of physical currency to be replaced with more easily controlled digital currency, and ultimately a central authority for global economic governance. In the pursuit of a “New World Order,” they must destroy the structure of the “old world.” Covertly engineer an economic problem, get the masses to beg you to save them from that problem, then offer them the solution you always intended to give them.

Our current crisis, what the International Monetary Fund calls the “global economic reset,” has only just begun. Though sometimes we must read between the lines or connect a few dots, in most cases the banking elites tell us exactly what they are going to do before they do it. It’s time we start listening, stop buying into the day-to-day hype and hopes of false recovery, and prepare accordingly.

- This Is Jeff Gundlach's Favorite (& Scariest) Chart

According to DoubleLine’s Jeff Gundlach, this is his favorite chart – backing his persepctive that equity markets have “2% upside and 20% downside) from here.

In his words: “These lines will converge…”

Chart: Bloomberg

It should be pretty clear what drove the divergence, and unless (and maybe if) The Fed unleashes another round of money-printing (or worse), one can’t help but agree with Gundlach’s ominous call.

- China's Gamblers Ditch The Burst Stock Bubble, Return To Macau's Casinos

China’s plunge protection team may be scrambling to prop up the Shanghai Composite for the duration of the People’s Congress, but the moment the NPC is over, the stock “market” goes with it, and the people know it. But now that China has its favorite bubble back – housing – few care: after all the stock bubble was meant purely as a placeholder until houseflipping mania returns.

However, the bursting of the stock bubble is hardly bad news, and certainly not for Macau, because now that China’s habitual gamblers no longer have a market where to bet it all, they can finally go back to their original stomping grounds.

Here is Bloomberg’s take with “Macau Casinos Bounce Back as Gamblers Ditch China Stocks“

The wheel of fortune is favoring Macau casino operators over brokerages as gambling revenue stabilizes and turbulence in the equity market weighs on turnover. Shares of Galaxy Entertainment Group Ltd. and Sands China Ltd. are among the biggest gainers in Hong Kong in 2016, after being the two worst performers over the previous two years, while Citic Securities Co. and Haitong Securities Co. are down more than 10 percent. The two-year slump in gambling revenue that was sparked by an anti-corruption campaign coincided with China’s biggest-ever bull market in equities.

As the SHCOMP slides lower, expect the green line to resume its trend higher, which ironically may mean that China casino stocks may be one of the better buys in the local market for the foreseeable future.

- Missing Clinton E-Mail Claims Saudis Financed Benghazi Attacks

Submitted by William Reynolds via Medium.com,

Something that has gone unnoticed in all the talk about the investigation into Hillary Clinton’s e-mails is the content of the original leak that started the entire investigation to begin with. In March of 2013, a Romanian hacker calling himself Guccifer hacked into the AOL account of Sidney Blumenthal and leaked to Russia Today four e-mails containing intelligence on Libya that Blumenthal sent to Hillary Clinton.

For those who haven’t been following this story, Sidney Blumenthal is a long time friend and adviser of the Clinton family who in an unofficial capacity sent many “intelligence memos” to Hillary Clinton during her tenure as Secretary of State. Originally displayed on RT.com in Comic Sans font on a pink background with the letter “G” clumsily drawn as a watermark, no one took these leaked e-mails particularly seriously when they came out in 2013. Now, however, we can cross reference this leak with the e-mails the State Department released to the public.

The first three e-mails in the Russia Today leak from Blumenthal to Clinton all appear word for word in the State Department release. The first e-mail Clinton asks to have printed and she also forwards it to her deputy chief of staff, Jake Sullivan. The second e-mail Clinton describes as “useful insight” and forwards it to Jake Sullivan asking him to circulate it. The third e-mail is also forwarded to Jake Sullivan. The fourth e-mail is missing from the State Department record completely.

This missing e-mail from February 16, 2013 only exists in the original leak and states that French and Libyan intelligence agencies had evidence that the In Amenas and Benghazi attacks were funded by “Sunni Islamists in Saudi Arabia.” This seems like a rather outlandish claim on the surface, and as such was only reported by conspiracy types and fringe media outlets. Now, however, we have proof that the other three e-mails in the leak were real correspondence from Blumenthal to Clinton that she not only read, but thought highly enough of to send around to others in the State Department. Guccifer speaks English as a second language and most of his writing consists of rambling conspiracies, it’s unlikely he would be able to craft such a convincing fake intelligence briefing. This means we have an e-mail from a trusted Clinton adviser that claims the Saudis funded the Benghazi attack, and not only was this not followed up on, but there is not any record of this e-mail ever existing except for the Russia Today leak.

Why is this e-mail missing? At first I assumed it must be due to some sort of cover up, but it’s much simpler than that. The e-mail in question was sent after February 1st, 2013, when John Kerry took over as Secretary of State, so it was not part of the time period being investigated. No one is trying to find a copy of this e-mail. Since Clinton wasn’t Secretary of State on February 16th, it wasn’t her job to follow up on it.

So let’s forget for a minute about the larger legal implications of the e-mail investigation. How can it be that such a revelation about Saudi Arabia was made public in a leak that turned out to be real and no one looked into it? Clearly Sidney Blumenthal was someone that Hillary Clinton trusted. Two months earlier, Secretary Clinton found his insights valuable enough to share with the entire State Department. But two weeks after her job as Secretary of State ends, she receives an e-mail from him claiming Saudi Arabia financed the assassination of an American ambassador and apparently did nothing with this information. Even if she didn’t have to turn over this e-mail to the commission investigating the Benghazi attacks, wouldn’t it be relevant? Shouldn’t this be information she volunteers? And why didn’t the Republicans who were supposedly so concerned about the Benghazi attacks ask any questions about Saudi involvement?

Did Secretary Clinton not tell anyone what she knew about alleged Saudi involvement in the attacks because she didn’t want to endanger the millions of dollars of Saudi donations coming in to the Clinton Foundation? These are exactly the kind of conflicts that ethical standards are designed to prevent.

Another E-Mail Turns Up Missing

Guccifer uncovered something else in his hack that could not be verified until the last of the e-mails were released by the State Department last week. In addition to the four full e-mails he released, he also leaked a screenshot of Sidney Blumenthal’s AOL inbox. If we cross reference this screenshot with the Blumenthal e-mails in the State Department release, we can see that the e-mail with the subject “H: Libya security latest. Sid” is missing from the State Department e-mails.

This missing e-mail is certainly something that would have been requested as part of the investigation as it was sent before February 1st and clearly relates to Libya. The fact that it is missing suggests one of two possibilities:

- The State Department does have a copy of this e-mail but deemed it top secret and too sensitive to release, even in redacted form. This would indicate that Sidney Blumenthal was sending highly classified information from his AOL account to Secretary Clinton’s private e-mail server despite the fact that he never even had a security clearance to deal with such sensitive information in the first place. If this scenario explains why the e-mail is missing, classified materials were mishandled.

- The State Department does not have a copy, and this e-mail was deleted by both Clinton and Blumenthal before turning over their subpoenaed e-mails to investigators, which would be considered destruction of evidence and lying to federal officials. This also speaks to the reason why the private clintonemail.com server may have been established in the first place. If Blumenthal were to regularly send highly sensitive yet technically “unclassified” information from his AOL account to Clinton’s official government e-mail account, it could have been revealed with a FOIA request. It has already been established that Hillary Clinton deleted 15 of Sidney Blumenthal’s e-mails to her, this discrepancy was discovered when Blumenthal’s e-mails were subpoenaed, although a State Department official claims that none of these 15 e-mails have any information about the Benghazi attack. It would seem from the subject line that this e-mail does. And it is missing from the public record.

In either of these scenarios, Clinton and her close associates are in violation of federal law. In the most generous interpretation where this e-mail is simply a collection of rumors that Blumenthal heard and forwarded unsolicited to Clinton, it would make no sense for it to be missing. It would not be classified if it was a bunch of hot air, and it certainly wouldn’t be deleted by both Blumenthal and Clinton at the risk of committing a felony. In the least generous interpretation of these facts, Sidney Blumenthal and Hillary Clinton conspired to cover up an ally of the United States funding the assassination of one of our diplomats in Libya.

Why A Grand Jury Is Likely Already Convened

After the final e-mails were released by the State Department on February 29th, it has been reported in the last week that:

- Clinton’s IT staff member who managed the e-mail server, Bryan Pagliano, has been given immunity by a federal judge which suggests that he will be giving testimony to a grand jury about evidence that relates to this investigation and implicates himself in a crime. Until now, Pagliano has been pleading the fifth and refusing to cooperate with the investigation.

- The hacker Guccifer (Marcel Lazar Lehel) just had an 18-month temporary extradition order to the United States granted by a Romanian court, despite being indicted by the US back in 2014. Is Guccifer being extradited now in order to testify to the grand jury that the screengrab with the missing e-mail is real?

- Attorney General Loretta Lynch was interviewed by Bret Baier and she would not answer whether or not a grand jury has been convened in this case. If there was no grand jury she could have said so, but if a grand jury is meeting to discuss evidence she would not legally be allowed to comment on it.

This scandal has the potential to completely derail the Clinton campaign in the general election. If Hillary Clinton really cares about the future of this country and the Democratic party, she will step down now while there is still time to nominate another candidate. This is not a right wing conspiracy, it is a failure by one of our highest government officials to uphold the laws that preserve government transparency and national security. It’s time for us to ask Secretary Clinton to tell us the truth and do the right thing. If the United States government is really preparing a case against Hillary Clinton, we can’t wait until it’s too late.

- How To Trade Tomorrow's ECB Meeting

The European Central Bank promised in January to "review and reconsider" its monetary stance this week. The question, as BloombergBriefs notes, is not if policy makers will ease but how. Haruhiko Kuroda's humbling in FX markets shows what Mario Draghi is up against tomorrow: namely, that even the most forceful policy decisions can be overwhelmed by events, positioning, or sentiment. Draghi has a number of options (some more and some less priced in) but most crucially there two large gaps to be filled in European Stock indices – the question is which is filled first?

As BloombergBriefs adds, ECB members have been relatively shy about communicating their intentions for this meeting. That’s because — as the minutes of the last one revealed — they decided that "it had to be avoided, by means of appropriate communication, that markets developed undue or excessive expectations about future policy action, bearing in mind the market volatility experienced around the December 2015 monetary policy meeting." In other words, this time they have been cautious not to set the rhetorical bar too high to avoid another market disappointment.

So, as The Wall Street Journal explains, Draghi has a few options:

The ECB could move interest rates.

They are the ECB’s primary, and least controversial, stimulus tool. Analysts expect the ECB to cut its deposit rate — charged to banks for storing their funds with the central bank — by at least a 0.1 percentage point, to minus 0.4%.

A cut steeper than this would likely weaken the euro against other major currencies, and reduce short term lending rates, both things that are positive from the ECB’s perspective. On the other hand, rate cuts have also squeezed income streams for banks, cutting the amount they can make by lending.

[Though we note the market is already pricing in far more rate cuts…]

To offset some of the pain for banks, the ECB might impose the most punitive rate on only a portion of banks’ reserves. Japan, Switzerland and Sweden already have such multi-tier systems. Another way to ease the pressure on banks could be to cut the ECB’s main interest rate to zero from 0.05%.

They could also expand quantitative easing.

The ECB is currently buying about €60 billion a month of mainly eurozone government bonds, as well as asset-backed securities and covered bonds. Economists expect the ECB to accelerate its purchases by at least €10 billion per month, to €70 billion, and perhaps extend their duration by six months, to September 2017.

Taken together, those two measures would boost the program by €540 billion to €2 trillion, or around 20% of eurozone gross domestic product, said Ken Wattret, an economist at BNP Paribas in London.

When the ECB first announced its bond buying program, European stocks rallied, and bond yields tumbled. A bigger than expected expansion could have this effect again, as the purchases raise the price of bonds and shift investors into other markets.

Part of any expansion could be a loosening the restrictions on QE.

There are five major constraints right now.

- Bonds are purchased in proportion to a country’s capital key, a measure of the size of each economy and population.

- The ECB won’t buy more than 33% of any individual bond issue.

- It won’t buy more than 33% from any individual issuer.

- The bonds purchased must mature in no less than two years, and no more than 30 years.

- And it won’t buy bonds that yield less than its deposit rate.

Dropping the latter requirement would be the least contentious tweak, economists say, and would greatly expand the pool of eligible assets, particularly of German bonds.

Cutting the deposit rate as expected would, of course, make more bonds with negative yields eligible for the bond buying program. However, yields are likely to fall in reaction to any rate cut too, making some bonds ineligible again.

The ECB could also buy other stuff.

The ECB could buy corporate or senior bank bonds. That would be a “highly effective signal” with powerful effects, but would likely encounter serious resistance from some council members, said Holger Schmieding, chief economist at Berenberg Bank in London. More radically, the ECB could start buying stocks or even real estate, as Japan’s central bank has done.

And BofA's Stephen Suttmeier details what to look for in the charts:

EUR/USD – weakness into resistance leans bearish

The last few major technical observations show EUR/USD's trend leans lower. Price made lower highs over the past year, two trend exhaustion signals suggested an end to the rally in February, and now price is failing to break above a short-term trend line that was once support. Price action failed at the 200d moving average and resulted in two doji candlesthis week, showing that neither bulls nor bears took control.

EUR/GBP: Watch for a short-term head-and-shoulders top

A close below the neckline of .77100 would form a short-term head-and-shoulders top that targets a move down to about .75000. Downside levels to know include the 50d average at .76586, .75440 and .74530. A close above yesterday's high, at .77928, and this top pattern is canceled.

Bund and Gilt 10yr yield lean higher after 'exhaustion'

Bund yields have confirmed the exhaustion suggested by the TD Sequential indicator on the daily and weekly charts by breaking above a short-term resistance line.

Yield is also confirming the rising momentum divergence on the daily chart. A break above the less steep daily trend line creates additional upside targets to .298%, .36% and .42%.

Brent may start to outpace WTI

Front-month continuous Brent oil prices are breaking above a resistance line, although WTI is lagging behind and has yet to break a similar line. This may be an early sign that the WTI-Brent spread begins to decline toward support provided by a five-year trend line that is aligned with the 200wk moving average.

Tactical bottoms in equities a vote of confidence in ECB

The developing tactical bottoms on the EURO STOXX 50 (SX5E), STOXX Europe 600 (SXXP) and EURO STOXX Banks (SX7E) are a technical guide to how confident Europe's equity market is regarding the ECB and monetary policy. Near-term bottom breakouts would provide a vote of confidence in the ECB, unless indices fail to breakout. Either way,we view bounces as bear-market rallies.

EuroStoxx bounce reminiscent of bear-market behaviour

The tactical bottom or base may not be big enough to usher in a stronger rally for these indices. A decisive breakout above 3055.38-3056.22 on the SX5E would project to 3430, but the falling 200-day MA and downtrend line from last April provide resistance near 3282-3385. In addition, the SX5E was not able to meet its late October tactical bottom breakout target of 3660. This is bear-market bounce behavior and the risk remains for a limited tactical rebound. Important first supports come in at 2932 to 3855-3800.

EuroStoxx Banks (SX7E)

The SX7E did not breakout with the SX5E and SXXP in late October. Banks make up 14% of the SX5E and 10% of the SXXP, so it is important for the SX7E to confirm any upside breakouts in the SX5E and SXXP. A positive sign for the SX7E would be a decisive move above 109.59-110.68 (with additional confirmation from a move above the daily Ichimoku cloud), which would project to 132. However, the larger downtrend from July remains intact and prior support, at 122-126, could limit upside. Support at 103-100. This is bear-market bounce behavior and the risk remains for a limited tactical rebound. Important first supports come in at 332 to 320-318.

Perhaps even more prescient are the two huge gaps that will inevitably be filled (via Geneve Swisss Bank)

And finally, don't forget that THIS is not fixed yet…

* * *

In summary – Bunds are pricing in a 30bps rate cut, economist expect 10bps… Draghi will disappoint; and if he raises QE, markets will instanly front-run it forcing yields lower and making even more of them ineligible… Good Luck Mario!

- China Food Inflation Explodes To 4 Year Highs As Producer Prices Slump For 47th Straight Month

For the 47th month in a row, China's Producer Prices have fallen year-over-year – a record deflationary streak. CPI rose 2.3% YoY – the fastest pace since May 2014 (against expectations of a 1.8% rise in consumer prices, and at the upper end of the +1.5% to +2.4% range). PPI printed as expected with a 4.9% YoY plunge in producer prices (-4.5% to -5.5% range). However, what is most disturbing – from both a social unrest and economic-stimulus-hope basis, is that Food prices exploded 7.3% YoY – the most in 4 years.

CPI accelerating and PPI slumping..

"The uptick in consumer prices is certainly striking," Bloomberg Intelligence economists Tom Orlik and Fielding Chen wrote in a report. "But with virtually the entirety of the increase coming from food prices, it’s not an increase that’s likely to be sustained for long. Food prices are subject to supply shocks and seasonal blips."

But, it looks like Food-flation is here to stay… China Pork prices were up 18.8% YoY in January (we can't wait to see the Feb data now)

As Bloomberg noted recently,

"It’s really a problem of lack of domestic growth and domestic demand," John Zhu, an economist at HSBC Holdings Plc in Hong Kong, said in a Bloomberg Television interview. "The longer you get negative PPI, the more the risk that inflation expectations get dragged lower."

Factory-gate deflation will probably moderate to about 5 percent in the first quarter, according to Niu Li, an economist at the State Information Center, a research arm of the National Development and Reform Commission, the nation’s chief planning agency.

"The producer-price index is still much lower than what we thought, indicating severe difficulties in the industrial sector," Niu said in an interview. "The PBOC is unlikely to impose any major change in its monetary policies because of the reading."

And so with PPI tumbling and CPI surging – expectations for some yuuge stimulus package are wishful thinking.

Yuan is tumbling on the data…

And if anyone needed a lesson in market "efficiency", Dow Futures spiked 70 points on this decidedly bearish (i.e. no stimulus) data – note that the momentum started early and then snapped it higher on the data… only to fade back…

Charts: Bloomberg

- Why This Sucker Is Going Down – The Case Of Japan's Busted Bond Market

Submitted by David Stockman via Contra Corner blog,

The world financial system is booby-trapped with unprecedented anomalies, deformations and contradictions. It’s not remotely stable or safe at any speed, and most certainly not at the rate at which today’s robo-machines and fast money traders pivot, whirl, reverse and retrace.

Indeed, every day there are new ructions in the casino that warn investors to get out of harm’s way with all deliberate speed. And last night’s eruption in the Japanese bond market was a doozy.

The government of what can only be described as an old age colony sinking into certain bankruptcy sold 30-year bonds at an all-time low of 47 basis points. Let me clear here that we are talking about a record low not just for Japan but for the history of mankind.

To be sure, loaning any government 30-year money at 47 basis points is inherently a foolhardy proposition, but its just plain bonkers when it comes to Japan.

Here is its 30-year fiscal record in nutshell. Not withstanding years of chronic red ink and its recent 2014 consumption tax increase from 5% to 8%, Japan is still heading straight for fiscal oblivion. Last year (2015) it spent just under 100 trillion yen, but took in hardly 50 trillion yen of revenue, stacking the difference on its already debilitating mountain of public debt, which has now reached 240% of GDP.

That’s right. A government which is borrowing nearly 50 cents on every dollar of outlays should be paying a huge risk premium to even access the bond market. But a government with a 240% debt-to-GDP ratio peering into a demographic sinkhole would be hard pressed to borrow at any price at all on an honest free market.

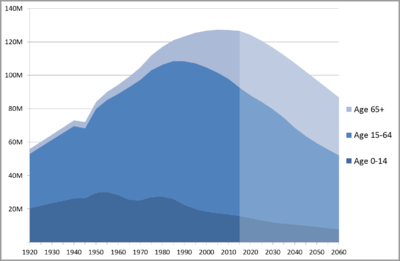

The graphs below show what lies 30 years down its demographic sinkhole. To wit, Japan’s population will have declined by 30% to 90 million, while its working age population will have plummeted from 78 million to about 52 million or by 33%. Moreover, its labor force participation rate has been declining for years, but even if it were to stabilize at the current 60% level, it would still mean just 31 million workers.

The trouble is, Japan already has 31 million retirees, and that number is projected to hit 36 million by 2060. In short, at the maturity date of the bonds the Japanese government sold last night, Japan will have more retirees than workers; it will be at a fiscal and demographic dead end.

So how did Japan sell billions of 30-year bonds given these catastrophic fiscal and demographic trends? The short answer is that it didn’t sell anything to investors. Instead, it rented what amounts to a put option to fast money traders. The latter operate from the assumption that they can cop a capital gain in the next while and then sell the paper back to the BOJ.

And why wouldn’t they make that bet. The lunatics who run the BOJ have essentially guaranteed that they are the buyer of first and only resort for any Japanese government debt that remains outside of their vaults.

Indeed, central bank announcements of negative yield are a form of code in the canyons of Wall Street and other financial markets. It means moar central bank bond-buying ahead, and therefore rising prices on the trading bait infused with the financial Viagra of NIRP.

This is another way of saying that the BOJ has essentially destroyed the government bond market. Indeed, during Q4 2015 monthly volume in the JGB market fell to the lowest level since 2004. As one bond market observer explained,

“Yields will continue to fall and the curve will continue to flatten under pressure from negative rates and quantitative easing,” said Shuichi Ohsaki, the chief rates strategist at Bank of America Merrill Lynch in Tokyo. “Trading volumes will become even thinner. A typical bond investor probably wouldn’t want to touch this market.”

As of last night’s auction, the entire JGB yield curve is now negative out to 13 years. That means that $5 trillion of bonds issued by the most fiscally impaired major government on the planet have been pushed into the netherworld of subzero returns.

Needless to say, the government of Japan and the BOJ are not in the midst of some exotic experiment that is off the grid relative to the rest of the global financial system. To the contrary, they are implementing Keynesian central banking and fiscal policies on a state of the art basis. They are doing what Bernanke, Krugman, the IMF and heavyweight (on all counts) Keynesian blowhards like Adam Posen have recommended for years.

Indeed, rather than blow the whistle on the obvious lunacy being practiced in Tokyo, the recent G-20 meeting gave Japan a pass on its currency trashing efforts and implied that its

“stimulus” policies were just what the economic doctors and policy apparatchiks assembled in Shanghai ordered.Tomorrow, in fact, Draghi will make another plunge in the same direction. Already, more than $2 trillion of European government bonds are trading at negative yields, and for the same reason.

To wit, the central bankers of the world have created a front-runners paradise. Yet so doing they have stood the very concept of a government bond in its head. Whereas the legendary British consol traded for nearly 200 years (outside of war interruptions) at par and to a rock solid 3% yield, today’s sovereign debt is being turned into a gambling vehicle where financial gunslingers and hedge funds play for short-run capital gains on 95:1 repo leverage.

In a word, the central banks have nearly destroyed the government bond markets. In the process, they have flushed trillions of capital into corporate debt and equity in search of yield and momentary trading gains with scant regard for the incremental risks involved.

So, yes, the casino is implanted with FEDs (financial explosive devices) everywhere, including upwards of $60 trillion of sovereign debt that is radically mispriced; and which must eventually implode when the gamblers finally stampede out of the casino.

Perhaps last night’s Japanese bond auction was an omen, after all. The JGB 30Y yield is now below the UST 2Y for the first time since, well, the Lehman event of September 2008.

Shortly thereafter, of course, our befuddled President at the time, George W. Bush explained the macroeconomic situation in a way that even the Congressional leadership assembled at the White House could understand.

“This sucker is going down”, he told them. He got that right. It was just a matter of time.

- Deutsche Bank Goes "Searching For Liquidity;" Can't Find Any

Liquidity worries are so 2015.

In the new year, there are much more pressing concerns.

Like a possibly imminent, overnight yuan float, which would quite simply torpedo every risk asset on the planet even as it would probably be just the thing Beijing’s economy needs to secure long-term stability.

And then there’s crude prices which, when you strip out the volatility and near daily OPEC headline hockey, are poised to remain suppressed in perpetuity (don’t get lost in the daily melee, this is a story about fundamentals, and from a fundamental perspective, the outlook is bearish – just look at storage overflow and Iranian supply). That means the global deflationary impulse is likely to persist and that, in turn, translates to more central bank meddling and less liquidity.

The funny thing is, although the punditry has apparently forgotten about liquidity, the issue now looms larger than ever because the junk bond liquidation is upon us, and that’s just the start of what’s ultimately going to be a bursting of the entire financial asset bubble central banks have inflated since 2009. HY is just ground zero for liquidity issues, and make no mistake, you’re going to see this take center stage in the months ahead.

Apparently, all of the above isn’t lost on Deutsche Bank’s research team (bless their hearts, because they’ll all be fired in the space of 12 months as their employer crashes and burns in what will end up being the largest banking disaster in Europe’s history) who are out with a rather insightful presentation on market liquidity.

We present, below, several slides which help to underscore the fact that “liquidity” is a lot like health insurance. You don’t need it until you do. But if you get sick and don’t have it… well… you may well end up sleeping in a cardboard box.

And to carry that analogy further, markets are headed for Skid Row.

- Guest Post: A Message To The Voting Cattle

Via The Burning Platform blog,

The following video explains as well as we’ve ever heard, why we should all vote for Candidate Nobody.

Here is the video:

Of course, not 1 in 20 will listen to a twenty-minute video, even here. So, I transcribed it. And, added some pictures for your viewing pleasure. You should be able to read it in under ten minutes…

* * *

You cannot begin to imagine in how many ways the world is the opposite of what you have been taught to believe.

You see the guy who sells drugs to willing customers so he can feed his family as the scum of the earth, while you see the hypocrite who gives away stolen money in the name of government, as a saint.

You see the guy who tries to avoid been robbed by the federal thugs as a crook and a tax cheat, but see as virtuous the politician who gives away the same stolen loot to people whom it does not belong.

You see the cop as a good guy when he drags a man away from his friends and family and throws him in prison for ten years for smoking a leaf [every 51 seconds in Amerika]. And you see anyone who defends himself from such barbaric fascism as the lowest form of life … a cop-killer. In reality, most drug dealers are more virtuous than any government social worker, and prostitutes have far less to be ashamed of than political whores, because they trade only with what’s rightfully theirs, and only with those who want to trade with them.

The upstanding church-going law-abiding tax-paying citizen who votes democrat or republican, is far more despicable, and a bigger threat to humanity, than the most promiscuous lazy drug snorting hippie. Why? Because the hippie is willing to let others be free, and the voter is NOT. The damage done to society by bad habits and loose morality is nothing compared to the damage done to society by the self-righteous violence committed in the name of the State.

You imagine yourselves to be charitable and tolerant when you are nothing of the sort. Even the Nazis’ had table manners and proper etiquette when they weren’t killing people. You think you’re good people because you say ‘please’ and ‘thank you’? You think sitting in that big building on Sunday makes you noble and righteous?

The difference between you and a common thief is that the thief has the honesty to commit the crime himself …. while you whine for government to do you’re stealing for you. The difference between you and the street thug is that the thug is open about the violence he commits, while you let others forcibly control your neighbors on your behalf. You advocate theft, harassment, assault and even murder, but accept no responsibility for doing so.

You old folks want the government to steal from your kids so you get your monthly check. You parents want all your neighbors to be robbed, to pay for your kids schooling. You all vote for which ever crook promises to steal money from other people to pay for what you want.

You demand that those people who engage in behaviors you don’t approve of, be dragged off and locked up but feel no guilt for the countless lives your whims have destroyed. You even call the government thugs ‘your representatives’ and yet you never take responsibility for the evil they commit.

You proudly support the troops as they kill whomever the liars in DC tell them to kill and you feel GOOD about it.

You call yourselves Christians or Jews or some other religion but the truth is, what you call your religion is empty window dressing. What you truly worship, the God you truly bow to, what you really believe in, is the State.

Thou shall not steal, though shall not murder, unless you can do it by way of government then it’s just fine isn’t it? If you call it ‘taxation’ and ‘war’ it stops being a sin right? After all, it was only your God that said you shouldn’t steal and murder, but the State said it was OK. It’s pretty obvious which outranks the other in your minds. Despite all the church’s, synagogues’ and mosques we see around us, this nation has one God and only one God and that God is called Government.

Jesus taught non-violence and told you to love your neighbor but the State encourages you to vote for people who will use the violence of government to butt into every aspect of everyone else’s life. Which do you believe?? To those about to stone a woman who had committed adultery, Jesus said ‘let him who is without sin cast the first stone’ but the State says it’s perfectly fine to lock someone up if they do something which you find distasteful, such as prostitution. Which do you believe?

The Christian God says ‘Thou shall not covet’ …. but coveting is the life-blood of the beast that is the State. You were taught to resent, despise, and hate anyone who has what you don’t have, you clamor for the State to tear other people down, steal their property and give it to you, and you call that fairness, the Bible calls it coveting and stealing.

You are not Christians. You are not Jews. You are not Muslims. And you certainly aren’t Atheists. You all have the same God and its name is … Government. You’re all members of the most evil insane destructive cult in history; if there ever was a devil the State is it, and you worship it with all your heart and soul. You pray to it to solve every problem, to satisfy all your needs, to smite your enemies and to shower its blessings upon you. You worship what Nietzsche called ‘the coldest of all cold monsters’ and you hate those of us who don’t. To you the greatest sin is disobeying your God, ‘breaking the law’ you call it. As if anyone could possibly have any moral obligation to obey the arbitrary commands and demands of the corrupt lying delusional megalomaniacs who infest this despicable town.

Even your Ministers, Priests and Rabbi’s, most often than not, are traitors to their own religions, teaching that the commands of human authority should supersede adherents to the laws of the Gods they say they believe in.

Several years ago I heard one pompous evangelical jack-ass in particular, pontificating on the radio that anyone who disobeys the civil authority be it a King or any other government, is ‘engaging in rebellion against God’. Those were the exact words he used. What if the government is doing something wrong? Well this salesman for Satan opined ‘that is the business of those in government and you are still obligated to obey’.

Everywhere you turn be it the State or the church, the media or the schools, you are taught one thing above all else, the virtue of subjugating yourselves to mortals who claim to have the right to rule you. It is sickening the reverence in which you speak of the liars and thieves whose feet are so firmly planted on your necks. You call the congressmen and the judges ‘Honorable’ and you swoon at the magnificence of the grandiose halls they inhabit, the temples they built to celebrate the domination of mankind.

You feel pride at being able to say you once shook a Senators hand, or saw the President in person. Ah, yes! The grand deity himself, his royal highness … the President of the United States of America! You speak the title as if you’re referring to God Almighty. The vocabulary has changed a bit but your mindset is no different from that of the groveling peasants of old, who bowed low faces in the dirt with a feeling of unworthiness and humility when in the presence of whatever narcissist had declared himself to be their rightful lord and master.

The truth of the matter back then and today, is that these parasites who call themselves leaders are not superior beings. They’re not great men and women. They’re not honorable. They’re not even average.

The people who earn an honest living — from sophisticated millionaire entrepreneurs to illiterate day laborers doing the most menial tasks you can imagine — those people deserve your respect. Those are people you should treat with courtesy and civility. But, the frauds who claim the right to rule you and demand your subservience and obedience, they deserve only your scorn and contempt.

Those who seek so-called high office are the lowest of the low. They may dress better have larger vocabularies and do a better job of planning out and executing their schemes, but they are no better than pickpockets, muggers and car-jackers. In fact they are worse, because they don’t want to rob of just your possessions, they want to rob you of your very humanity, deprive you of your free will by slowly leeching away your ability to think, to judge, to act, reducing you to slaves in both body and mind. And still you persist in calling them leaders. Leaders?? Where is it that you think you are going exactly that would require you to have a leader?

If you just live your own life and mind your own damn business, exercising your own talents, pursuing your own dreams striving to be what you believe you should be, what possible use would you have for a leader? Do you ever actually think about the words that you hear, the words that you repeat? You parrot oxymoronic terms such as ‘leader of the free world’.

Even pretending for a moment that there’s some huge journey or some giant battle, that everyone in the entire nation is undertaking together that would require a leader … why would you ever think even for a moment, that the crooks that infest this town are the sort of people you should listen to or emulate or follow anywhere? Somewhere within your mostly dormant brains you know full well that politicians are all corrupt liars and thieves, opportunistic con-men, exploiters and fear-mongers. You know all this, and yet you still speak as though you are the ones who are the stupid vicious animals, while the politicians are the great wise role models, teachers and leaders, without whom civilization could not exist.

You think these crooks are the ones that make civilization possible? What belief could be more absurd, yet when they do their pseudo-religion rituals, deciding how to control you this week, you still call it law, and continue to treat their arbitrary demands as if they were moral decrees from the Gods, that no decent person would ever consider disobeying. You have become so thoroughly indoctrinated into the cult of State worship that you are truly shocked when the occasional sane person states the bleeding obvious.

The mere fact that the political crooks wrote something down and declared their threats to be law, does not mean that any human being anywhere has the slightest moral obligation to obey. Every moment of every day in every location and every situation, you have a moral obligation to do what YOU deem to be right, not what some delusional bloated windbag says is legal … and that requires you to first determine right and wrong for yourself, a responsibility you spend much time and effort trying to dodge.

You proclaim how proud you are to be law-abiding citizens and express your utter contempt for anyone who considers themselves ‘above’ your so-called ‘laws’ … laws that are nothing more than the selfish whims of tyrants and thieves.

The word crime once meant ‘an act harmful to another person’, now it means ‘disobedience to anyone of the myriad of arbitrary commands coming from a parasitical criminal class’. To you the word ‘crime’ is merely synonymous with the word ‘sin’; implying that the ones whose commands are being disobeyed must be something akin to Gods, when in truth they are more akin to leeches.

The very phrase ‘taking the law into your hands’ perfectly expresses what a sacrilege it is in your eyes for a mere human being to take upon himself the responsibility to judge right from wrong and to act accordingly, instead of doing what you do, unthinkingly obeying whatever capricious commands this cesspool of maggots spews forth.

You glorify this criminal class as law-makers, and believe that no one is lower than a law-breaker, someone who would dare disobey the politicians, likewise you speak with pious reverence of law-enforcers, those who forcibly impose the politicians every whim on the rest of us. When the State uses violence you imagine it to be inherently righteous and just, and if anyone resists, they are in your eyes, contemptible low lives, lawless terrorist criminals.

Like the lawless terrorist criminals who helped slaves escape the plantation. Like the lawless terrorist criminals who helped Jews escape the killing machine of the Third Reich. Like the lawless terrorist criminals who were crushed to death under the tanks of the Red Chinese government in Tienanmen Square. Like all the lawless terrorist criminals in history who had the courage to disobey the never ending stream of tyrants and oppressors who have called their violence ‘authority’ and ‘law’.

Everything you think you know is backwards, upside down and inside out, but what takes the cake, the height of your insanity, is that fact that you view as violent terrorists, the only people on the planet who oppose the initiation of violence against their fellow man, Anarchists, Voluntaryists and Libertarians. We use violence only to defend ourselves against someone who initiates violence against us. We use it for nothing else.

Meanwhile your belief system is completely schizophrenic and self-contradictory. One the one hand you teach the young slaves that violence is never the answer, yet out of the other side of your mouths you advocate that everyone and everything everywhere and at all times be controlled, monitored, taxed and regulated through the force of government. In short, you are teaching your children that the masters may use violence whenever they please, but the slaves should never resist. You indoctrinate your children into a life of unthinking helpless subservience. You are putting the chains around their little necks and fastening the lock tight, and worst of all, you feel good about it.

Out of one side of your mouths you condemn the evils of fascism and socialism, and lament the injustices of the regimes of Hitler, Stalin and Mao, while out of the other side of your mouths you preach exactly what they did —- the worship of the collective, the subjugation of every individual to that evil insanity that wears the deceptive label ‘the common good’.

You babble on and on about diversity and open-mindedness then beg your masters to regulate and control every aspect of everyone’s lives, creating a giant herd of unthinking conformist drones. You wear different clothes and have different hairstyles and you think that makes you different, yet all your minds are enslaved to the same club of masters and controllers. You think what they tell you to think and you do what they tell you to do while imagining yourselves to be progressive, thinking and enlightened.

From your position of relative comfort and safety you now condemn the evils of other lands and other times, while turning a blind eye to the injustices happening right in front of you. You tell yourself that had you lived in those other places, in those other times, you would have been among those who stood up against oppression and defended the down-trodden. But, that is a lie. You would have been right there with the rest of the flock of well-trained sheep, loudly demanding that the slaves be beaten, that the witches be burned, that the non-conformists and rebels be destroyed.

How do I know this? Because that is exactly what you are doing today, today’s injustices and oppressions are fashionable and popular, and those who resist them, you tell yourselves, are just malcontents and freaks, people whose rights don’t matter, people who deserve to be crushed under the boot of authority, isn’t that right? You bunch of spineless unthinking hypocrites! Look in the mirror!

Take a look at what you imagine to be righteous and kind – you are the devil’s plaything.The crowds of thousands wildly applauding the speeches of Adolf Hitler – that was YOU. The mob demanding that Jesus Christ be nailed to the cross – that was YOU. The white invaders who celebrated the whole-sale slaughter of those ‘Godless Redskins’ – that was YOU. The throngs filling the Coliseum applauding as Christians were fed to the lions – that was YOU.

Throughout history the perpetual suffering and injustice occurring on an incomprehensible scale, it was all because of people JUST LIKE YOU – the well-trained thoroughly indoctrinated conformists, the people who do as they’re told, who proudly bow to their masters, who follow the crowd believing what everyone else believes and thinking whatever authority tells them to think, that is YOU.

And your ignorance is not because the truth is not available to you, there’s been radicals preaching it for thousands of years. No, you are ignorant because you shun the truth with all your heart and soul. You close your eyes and run away when a hint of reality lands in front of you. You condemn as extremists and fringe cooks those who try to show you the chains you wear, because you don’t want to be free, you don’t even want to be human.

Responsibility and reality scare the hell out of you so you cling tightly to your own enslavement and lash out at any who seeks to free you from it, when someone opens the door to your cage you cower back in the corner and yell “Close it! Close it!!”.

Well some of us are finished with trying to save you, we’ve wasted enough effort trying to convince you that you should be free, all you ever do is spout back what your masters have taught you, that being free only leads to chaos and destruction, while being obedient and subservient leads to peace and prosperity.

There are none so blind as those who will not see, and you, you nation of sheep, would rather die than see the truth.

- Presenting The Interactive Map Of European Refugee Assaults

Everyone assumed it would be the threat (or the reality) of international terrorism that would ultimately break Europe’s resolve when it came to goodwill towards Mid-East refugees.

Indeed, we remember vividly when the first reports of a “Kalashnikov assault” on cafes in the French capital hit social media on that fateful Friday in November.

“That’s it,” we assumed, for Europe’s experiment with an open-door migrant policy.

In spite of the violence and in spite of the chaos that ensued (manhunts across France, lockdowns in Molenbeek, a shootout in Saint-Deni) Europe largely kept its arms open to refugees from Syria, Afghanistan, and Iraq. The Paris attacks, Europeans seemed to reason, were more indicative of why people were fleeing to Europe, than they were a precursor of what refugees would ultimately import to the bloc.

But sentiment soured in January.

A wave of sexual assaults allegedly perpetrated by men of “Arab and North African origin” caused Europe to cast aspersions. No longer were these “victims” fleeing the type of carnage that tragically befell Paris in November, they were suddenly transplants from a barbarous culture whose attitude towards women was outdated by hundreds of years.

Is that reputation justified?

Who knows.

Frankly that would require an academic study of rapes and sexual assaults across the bloc before and after the mass migration, and control variables would need to be introduced for the nationality (or at least the likely suspected race) of the attackers. We’re reasonably sure someone is working on just that type of analysis at this very moment, but until robust, objective, quantitative results are available, the following interactive map will have to do. Explore it for yourself using Google’s legend and tools.

h/t Garrett

- Keith Olbermann Unleashes On Donald Trump: "I Am Moving Out Of Your Building"

We had a hard time deciding if the following rant written by the twice disgraced Keith Olbermann about, of all things, punishing Donald Trump by moving out of a Trump building (he is “getting out because of the degree to which the very name “Trump” has degraded the public discourse and the nation itself. I can’t hear, or see, or say that name any longer without spitting”) after dutifully making Trump richer for 9 years by paying his rent on time every month, was the product of some grotesqsue ghost writing by a 5-year-old, or a legitimate grievance, but ultimately we realized it was the latter.

Then we started laughing. We are confident everyne else will too after reading the following.

By Keith Olbermann, originally posted in the WaPo.

“I can’t stand to live in a Trump building anymore”

Okay, Donnie, you win.

I’m moving out.

Not moving out of the country — not yet anyway. I’m merely moving out of one of New York’s many buildings slathered in equal portions with gratuitous gold and the name “Trump.” Nine largely happy years with an excellent staff and an excellent reputation (until recently, anyway) — but I’m out of here.

I’m getting out because of the degree to which the very name “Trump” has degraded the public discourse and the nation itself. I can’t hear, or see, or say that name any longer without spitting. Frankly, I’m running out of Trump spit.

And, yes, I’m fully aware that I’m blaming a guy with the historically unique fashion combination of a cheap baseball cap and Oompa Loompa makeup for coarsening politics even though, out of the two of us, I’m the one who has promulgated a “Worst Persons in the World” list for most of the past decade. That’s how vulgar this has all become. It’s worse even than Worst Persons.

This is the campaign of a PG-rated cartoon character running for president, interrupting a string of insults the rest of us abandoned in the seventh grade only long enough to resume a concurrent string of half-crazed boasts: We’re gonna start winning again! We’re gonna build an eleventy-billion-foot-high wall! We’re not gonna pay a lot for this muffler!

All this coarseness is largely masking the truth that the Trump campaign is entirely about coarseness. Take away the unmappable comb-over and the unstoppable mouth and the Freudian-rich debates about genitalia, and there is no Trump campaign. Donald Trump’s few forays into actual issues suggest he is startlingly unaware of how the presidency or even ordinary governance works.

Of course that doesn’t preclude his election. A December study carried out with the University of Massachusetts at Amherst showed that Trump’s strongest support comes from Republicans with “authoritarian inclinations.” They don’t want policy, nuance or speeches. They want a folding metal chair smashed over the bad guy’s head, like in the kind of televised wrestling show in which Trump used to appear.

And it isn’t as though the American electorate hasn’t always had a soft spot for exactly the worst possible person for the presidency. Two months before the 1864 vote, some Republicans were so thoroughly convinced that Abraham Lincoln would lose in a landslide that they proposed to hold a second Republican convention and nominate somebody to run in his place. The Democrat they feared, George B. McClellan, was not only probably the worst general in the history of the country, but also his campaign platform was predicated on stopping the Civil War, giving the South whatever it wanted, running the greatest president in history out of town and repudiating the Emancipation Proclamation. Even after the North’s victory at Atlanta turned the tide of the war and thus the election, McClellan — anti-Union, anti-Lincoln, anti-victory and pro-slavery — still got 45 percent of the all-Northern vote.

There could still be enough idiots to elect Trump this November. Hell, I was stupid enough to move into one of his buildings. But here in those buildings, even as I pack, is the silver lining hidden amid the golden Donald trumpery.

One day Trump appeared in person and, with what I only later realized was the same kind of sincere concern and respect that Eddie Haskell used to pay “Beaver” Cleaver’s mother, asked me how I liked the place and to let him know personally if anything ever went wrong. About 15 months ago, when the elevators failed and many of the heating-unit motors died and the water shut off, I wrote him. He sent an adjutant over to bluster mightily about the urgency of improvements and who was to blame for the elevators and how there would be consequences, and within weeks Trump’s minions were obediently and diligently installing — a new revolving door at the back of the lobby.

That three-week project stretched past three months, smothered the lobby in stench and grime, required the repeated removal and reinstallation of a couple of railings, and for a time created a window frosting problem even when it wasn’t cold out.

So at least there’s this comfort. If there is a President Trump and he decides to build this ludicrous wall to prevent the immigration from Mexico that isn’t happening, and he uses that same contractor, it’ll take them about a thousand years to finish it.

- The "Terrifying Prospect" Of A Triumph Of Politics Over Economics

Authored by Paul Brodsky of Macro-Allocation.com,

The Triumph of Politics

All of life’s odds aren’t 3:2, but that’s how you’re supposed to bet, or so they say. They are not saying that so much anymore, or saying that history rhymes, or that nothing’s new under the sun. More and more theys seem to be figuring out that past economic and market experiences can’t be extrapolated forward – a terrifying prospect for the social and political order.

Consider today’s realities:

Global economies have grown to their current scale thanks to a glorious secular expansion of worldwide credit – credit unreserved with bank assets and deposits; credit extended to brand new capitalists; credit that can never be extinguished without significant debt deflation or hyper monetary inflation

Economies no longer form sufficient capital to sustain their scales or to justify broad asset values in real terms

Markets cannot price assets fairly in real terms without risking significant declines in collateral values supporting them and their underlying economies

Politicians that used to anguish (rhetorically) over the right mix of potential fiscal policies, ostensibly to get things back on track (as if somehow finding the right path would have actually been legislated into existence), have come to realize the limits of their power to have a meaningful impact

Monetary authorities have become the only game in town, assassinating all economic logic so they may juggle public expectations in the hope – so far successfully executed – that neither man nor nature will be the wiser.

The good news for policy makers is that man remains collectively unaware and vacuous; the bad news is that nature abhors a vacuum. The massive scale of economies relative to necessary production (not to mention already embedded systemic leverage) suggests this time is truly different.

The net result of these realities is that assets are generally rich over the long term in both stock and flow terms. They are rich in stock terms because there is not enough money and transferable credit to settle accounts at current prices were all assets to be sold. (Although assets would never be sold en masse at once, the dearth of money and transferable credit relative to asset values implies lower future real valuations in societies with aging populations.)

Stocks, bonds and real estate are rich in flow terms because current revenues and earnings have been pulled forward from the far future and are insufficient to provide investors with positive returns when adjusted for debt service and/or necessary currency devaluation.

Unlike the credit crisis in 2008, the provenance of today’s spreading economic miasma is not grass roots greed and lather. Institutional idiocy (or corruption) in the form of poor policy responses to the crisis is to blame. Extraordinarily easy monetary policies, that continue today, have reduced economic sustainability and worsened future economic prospects. Like Catholicism without hell, capitalism without failure can’t work.

It has been a triumph of politics over economics, and still they persist. Taking the old cigarette ad as a guideline, monetary policy makers “would rather fight than switch” to a more laissez faire posture that would let price levels of goods, services and assets find natural clearing prices.

A Tenuous Thread

So into the breach we go with negative interest rates. Quickly slowing global output growth and trade, fully-priced equity markets and naturally occurring non-sovereign debt deflation are pushing sovereign debt yields ever lower. Investors are meeting asset allocation requirements and valuing return-of-capital over return-on-capital (at least in nominal terms)

Meanwhile, gold strength is discounting the eventual policy response to global debt deflation – central bank administered de-leveraging through monetary inflation. (Increasing the total money stock effectively de-leverages balance sheets by decreasing the burden of debt repayment, rather than decreasing the stock of debt, which also reduces nominal output.) To be sure, negative sovereign market yields across the world and gold strength reflect rational economics.

Central bank policy rates are following market yields through zero percent, not the other way around. Central bankers seem desperate to appear as though the global economy remains in a cyclical growth phase, and that negative market yields are a product of their contrivance, borne from their wisdom and unique cleverness that such a scheme will be economically stimulative. Their institutional stiff upper lips are politically expedient yet alarmingly negligent. It would be better to step aside, let valuations fall where they may, and then, if they must, help pick up the pieces.

A soothing narrative that ignores real asset values and unsustainably high real economic growth rates is being held together by beta investors structured during the economic scaling phase to allocate capital as though it would persist forever, and by policy makers willing to assume formerly model-able Keynesian economics.

Banks

Commercial banks are generally unconcerned with inflation-adjusted returns – theirs or their constituents. Their revenues and earnings can only be increased over time by increasing the nominal scale of their loan books.

Borrowing short-term and lending long-term requires only a positively sloped yield curve. Absolute rate levels do not matter. It makes little difference to commercial banks whether they borrow at 3% and lend at 5% or borrow at negative 3% and lend at negative 1%. This implies that commercial banks can survive in a negative interest rate environment.

Commercial bank funding rates are ultimately determined by deposit rates and/or central bank lending rates. Diminished returns elsewhere – like the capital markets – allow commercial banks to borrow from depositors or their central banks at reduced, even negative costs.

Investment banks are not really banks. Rather than using a spread model like depository institutions, they survive and prosper mostly on a transaction model, which requires healthy and active capital markets. Those that operate alongside commercial banks (e.g., JP Morgan Securities), tend to have trouble when investors withdraw from capital market participation.

Both investment and commercial banks suffer from declining capital market participation – investment banks due to declining transactional and asset management fees; commercial banks due to declining market liquidity, which leads to declining nominal values of their loan books.

The primary responsibility of central banks is the health and viability of their commercial banking systems. The secondary responsibility is the health of the economies their constituent banks serve. Importantly, central banks do not directly oversee the viability of non-bank creditors. This is a critical policy identity to understand in times of significant market dislocation and decreasing market liquidity.

Shadow Banking

We know a bit about shadow banking, having spent 1986 through 1996 as a mortgage-backed securities trader and 1996 through 2006 as an MBS hedge fund manager. Shadow banking ultimately reduces to non-bank investors that extend credit. It includes a broad swath of investors, including large and small bond buyers, and even private lenders like your uncle Henry.

There is a fundamental difference between bank loans and shadow bank loans. Banks make loans without having 100% of the capital they lend. Alternatively, shadow bank loans are fully-funded. JP Morgan creates a loan (at once an asset and a liability) from thin air while BlackRock or Uncle Henry must have $1,000 to lend $1,000.When we overlay this fundamental identity with the primary responsibility of central banks (to maintain a healthy and viable commercial banking system), we cannot help but conclude that bonds and other loans made outside the banking system are not ultimately protected by central banks’ ability to create bank reserves.

This suggests extraordinary power lies in the subjective policies of central banks. In a contracting economy in which debt service is stressed, to what degree might monetary authorities decide to let shadow bank loans suffer? Is it possible central banks and other economic policy makers would pick favorites within the non-bank credit markets? Might central banks prefer to protect debt in the public credit markets that is also held as assets by its constituent banks? Was the 2009 experience, in which non-bank lenders and borrowers like General Motors and AIG were bailed out, be repeated? How political might this process be?

Rational Policy Applications

There is a lot to consider when it comes to negative interest rates and central bank monetary and credit policies. Negative interest rates means creditors pay to lend to governments, which further means that central banks, acting as monetary agents for sovereign governments, can turn government expenses into revenues. And they can do this while not necessarily impacting the viability of their primary constituent banks.

If we assume that high and rising global leverage (as measured by debt-to-GDP or debt-to-base money) will eventually crowd-out global consumption and demand growth, then we can also assume that the purveyors of money and credit will be able to selectively apply austerity within their economies.

Today, for example, sovereign debt and bank balance sheets in Japan and Europe are benefitting greatly from their central banks’ negative interest rate policies. The German government can sell five-year debt and receive forty basis points while Deutsche Bank can buy back its debt at levels that improve its sick balance sheet. Meanwhile European savers must find a place to store their wealth where it is not effectively taxed by negative yields.

We continue to argue the Fed will hike Fed Funds more this year in an effort to strengthen the Dollar and attract global capital to American banks and capital markets. The US Treasury curve would continue to flatten in response, pushing mortgages rates lower – an effective easing. Such a scenario would help fund the Treasury at lower yields and increase US bank deposits, which would be able to offer global depositors higher rates (even at 0%) than European and Japanese banks.

As Saudi Arabia is making a play for global market share in crude through its superior position as the low cost producer, so will the US make a play for global capital (and foreign assets) through its dominant reserve currency, asset markets and control over shipping lanes. This would be a perfectly rational response to current economic and market conditions.

Rational Investment Posture

Negative sovereign yields and policy rates (NIRP) might be ringing the proverbial bell. After seven years of major exogenous monetary stimulus concluding in negative rates around the world, investors today would be irrational to expect an economic expansion in the coming years or even a mild recession followed by a garden variety expansion, in our view.

- "You Want A Bloodbath?!" New Video Surfaces Of Police Shooting Oregon Protester In Back

On January 2, Ammon Bundy had an idea.

He would use the (re)incarceration of Dwight Hammond and his son Steven as a pretext for the takeover of a remote wildlife refuge. Then, once the facility was “secured,” the occupants would refuse to leave until the Hammonds were released and until Washington made concessions on state’s rights and land usage.

It would be a grand rekindling of the “Sagebrush Rebellion” and Ammon would make his father Cliven (who became a kind of folk hero after staging a jailbreak for his cows who had been imprisoned by the federal government for bovine trespassing) proud.

Of course we all know how Ammon’s “coup” turned out.

He and his compatriots camped out in a snowy shack for a month and Robert “LaVoy” Finicum ended up getting shot by police on the side of the road. Meanwhile America either didn’t understand the cause or else simply didn’t care because when asked to send “supplies” to the aggrieved occupiers the nation sent sex toys and penis-shaped gummy candies. That’s not an editorial comment on the merits of the cause – it’s just a straightforward account of what happened.

Anyway, there was still some controversy surrounding the death of “LaVoy” despite the fact that authorities released footage which pretty clearly shows Finicum reaching into his pocket, not once, but twice as police closed in. Officials would later say that in that pocket was this loaded 9 mm:

On Tuesday, county prosecutors ruled the shooting “justified and necessary” despite the fact that Finicum was shot three times in the back.

Here’s the autopsy report showing the three shots in Finicum #OregonStandoff pic.twitter.com/CQn7COKzkL

— Simone Del Rosario (@SimoneReports) March 8, 2016

Here is footage from inside Finicum’s truck synced with footage from police. We will leave it to readers to determine whether the shooting was indeed “justified and necessary.”

Finally, here are excerpts from The Oregonian’s account of the dramatic events that led to Finicum’s death:

As Robert “Lavoy” Finicum powered his Dodge pickup over Devine Summit on the state highway north of Burns, he spotted the police van idling on a U.S. Forest Service road.

Finicum glanced over at the state trooper in the driver’s seat as he went past.

He pointed a finger at him, as if to say “I see you” and kept going.

That likely was the moment Finicum realized he and his group wouldn’t make the community meeting planned that evening in John Day.

Less than 30 minutes later, Finicum was dead and four other leaders of the Malheur National Wildlife Refuge takeover were in handcuffs.

Police knew the leaders planned to travel to John Day in Grant County to the north on the only direct highway there – U.S. 395.

They devised a traffic stop by state troopers to allow FBI agents to arrest the group on federal conspiracy charges. By midday, some members of the arresting team positioned themselves on Forest Service Road 2820, which branches east off the state highway toward a snow park near the summit of

Devine Ridge. Another team set up roughly two miles north on the highway, prepared to act as a roadblock.

“The sheriff is waiting for us,” Finicum yelled out the driver’s window to the officers and agents staged behind his truck.

He puts his hands out the window and invited police to shoot.

“Back down or you kill me now,” he said.

He repeated twice more that he was going to meet the sheriff.

Ryan Bundy, 43, of Mesquite, Nevada, seated behind Finicum with a .38-caliber pistol and two rifles within reach, yelled out the window: “Who are you?”

Finicum echoed him.

“Yeah, who are you?”