- U.S. Dollar Index – Is Rising Inflation The Fed`s Nightmare Scenario (Video)

By EconMatters

Is a rising inflation problem going to force the Fed`s hand into raising interest rates faster than the financial markets currently have priced in with many asset classes from bonds, the U.S. Dollar, and equities.

© EconMatters All Rights Reserved | Facebook | Twitter | YouTube | Email Digest | Kindle

- "Free Trade Agreements" Used to Help American Workers … Now They Hurt Them

Trump and Sanders have whipped up a lot of popular support by opposing “free trade” agreements.

But it’s not just politics and populism … mainstream experts are starting to reconsider their blind adherence to the dogma that more globalization and bigger free trade agreement are always good.

UC Berkeley Economics professor Robert Reich – Bill Clinton’s Secretary of Labor – wrote last month:

Suppose that by enacting a particular law we’d increase the U.S. Gross Domestic Product. But almost all that growth would go to the richest 1 percent.

The rest of us could buy some products cheaper than before. But those gains would be offset by losses of jobs and wages.

This is pretty much what “free trade” has brought us over the last two decades.

I used to believe in trade agreements. That was before the wages of most Americans stagnated and a relative few at the top captured just about all the economic gains.

Recent trade agreements have been wins for big corporations and Wall Street, along with their executives and major shareholders.

***

But those deals haven’t been wins for most Americans.

The fact is, trade agreements are no longer really about trade.

Indeed, while it’s falsely called a “trade agreement”, only 5 out of 29 of the Trans Pacific Partnership’s chapters have anything to do with trade. And conservatives point out that even the 5 chapters on trade do not promote free trade.

Reich continues:

Worldwide tariffs are already low. Big American corporations no longer make many products in the United States for export abroad.

***

Google, Apple, Uber, Facebook, Walmart, McDonalds, Microsoft, and Pfizer, for example, are making huge profits all over the world.

But those profits don’t depend on American labor – apart from a tiny group of managers, designers, and researchers in the U.S.

To the extent big American-based corporations any longer make stuff for export, they make most of it abroad and then export it from there, for sale all over the world – including for sale back here in the United States.

The Apple iPhone is assembled in China from components made in Japan, Singapore, and a half-dozen other locales. The only things coming from the U.S. are designs and instructions from a handful of engineers and managers in California.

Apple even stows most of its profits outside the U.S. so it doesn’t have to pay American taxes on them. [Background.]

This is why big American companies are less interested than they once were in opening other countries to goods exported from the United States and made by American workers.

They’re more interested in making sure other countries don’t run off with their patented designs and trademarks. Or restrict where they can put and shift their profits.

In fact, today’s “trade agreements” should really be called “global corporate agreements” because they’re mostly about protecting the assets and profits of these global corporations rather than increasing American jobs and wages. The deals don’t even guard against currency manipulation by other nations.

According to Economic Policy Institute, the North American Free Trade Act cost U.S. workers almost 700,000 jobs, thereby pushing down American wages.

Since the passage of the Korea–U.S. Free Trade Agreement, America’s trade deficit with Korea has grown more than 80 percent, equivalent to a loss of more than 70,000 additional U.S. jobs.

The U.S. goods trade deficit with China increased $23.9 billion last year, to $342.6 billion. Again, the ultimate result has been to keep U.S. wages down.

The old-style trade agreements of the 1960s and 1970s increased worldwide demand for products made by American workers, and thereby helped push up American wages.

The new-style global corporate agreements mainly enhance corporate and financial profits, and push down wages.

***

Global deals like the Trans Pacific Partnership will boost the profits of Wall Street and big corporations, and make the richest 1 percent even richer.

But they’ll bust the rest of America.

Similarly, the New York Times reports:

Were the experts wrong about the benefits of trade for the American economy?

***

Voters’ anger and frustration, driven in part by relentless globalization and technological change … is already having a big impact on America’s future, shaking a once-solid consensus that freer trade is, necessarily, a good thing.

***

The angry working class — dismissed so often as myopic, unable to understand the economic trade-offs presented by trade — appears to have understood what the experts are only belatedly finding to be true: The benefits from trade to the American economy may not always justify its costs.

***

In a recent study, three economists — David Autor at the Massachusetts Institute of Technology, David Dorn at the University of Zurich and Gordon Hanson at the University of California, San Diego — raised a profound challenge to all of us brought up to believe that economies quickly recover from trade shocks. In theory, a developed industrial country like the United States adjusts to import competition by moving workers into more advanced industries that can successfully compete in global markets.

They examined the experience of American workers after China erupted onto world markets some two decades ago. The presumed adjustment, they concluded, never happened. Or at least hasn’t happened yet. Wages remain low and unemployment high in the most affected local job markets. Nationally, there is no sign of offsetting job gains elsewhere in the economy. What’s more, they found that sagging wages in local labor markets exposed to Chinese competition reduced earnings by $213 per adult per year.

In another study they wrote with Daron Acemoglu and Brendan Price from M.I.T., they estimated that rising Chinese imports from 1999 to 2011 cost up to 2.4 million American jobs.

“These results should cause us to rethink the short- and medium-run gains from trade,” they argued. “Having failed to anticipate how significant the dislocations from trade might be, it is incumbent on the literature to more convincingly estimate the gains from trade, such that the case for free trade is not based on the sway of theory alone, but on a foundation of evidence that illuminates who gains, who loses, by how much, and under what conditions.”

***

The case for globalization based on the fact that it helps expand the economic pie by 3 percent becomes much weaker when it also changes the distribution of the slices by 50 percent, Mr. Autor argued.

***

The new evidence from trade suggests American policy makers cannot continue to impose all the pain on the nation’s blue-collar workers if they are not going to provide a stronger safety net.

That might have been justified if the distributional costs of trade were indeed small and short-lived. But now that we know they are big and persistent, it looks unconscionable.

- Putin & The Failure Of Washington's Propagandist Predictions

Authored by Paul Craig Roberts,

American presstitutes, such as the New York Times and the Wall Street Journal, expressed surprise at Russia’s support for the Syrian ceasefire, which Russia has been seeking, by Putin’s halt to attacks on the Islamic State and a partial withdrawal of Russian forces. The American presstitutes are captives of their own propaganda and are now surprised at the failure of their propagandistic predictions.

Having stripped the Islamic State of offensive capability and liberated Syria from the Washington-supported terrorists, Putin has now shifted to diplomacy. If peace fails in Syria, the failure cannot be blamed on Russia.

It is a big risk for Putin to trust the neocon-infested US government, but if ISIS renews the conflict with support from Washington, Putin’s retention of air and naval bases in Syria will allow Russia to resume military operations. Astute observers such as Professor Michel Chossudovsky at Global Research, Stephen Cohen, and The Saker have noted that the Russian withdrawal is really a time-out during which Putin’s diplomacy takes the place of Russian military capability.

With ISIS beat down, there is less danger of Washington using a peace-seeking ceasefire to resurrect the Islamic State’s military capability. Therefore, the risk Putin is taking by trusting Washington is worth the payoff if the result is to enhance Russian diplomacy and elevate it above Washington’s reliance on threats, coercion, and violence.

What Putin is really aiming for is to make Europeans realize that by serving as Washington’s vassals European governments are supporting violence over peace and may themselves be swept by the neoconservatives into a deadly conflict with Russia that would ensure Europe’s destruction.

Putin has also demonstrated that, unlike Washington, Russia is able to achieve decisive military results in a short time without Russian casualties and to withdraw without becoming a permanent occupying force. This very impressive performance is causing the world to rethink which country is really the superpower.

The appearance of American decline is reinforced by the absence of capable leaders among the candidates for the Republican and Democratic party nominations for president. America is no longer capable of producing political leadership as successive presidents become progressively worse.

The rest of the world must be puzzled how a country unable to produce a fit candidate for president can be a superpower.

- Silver Soars Post-Fed As Gold Ratio Tumbles Most In 5 Months

Two weeks ago we hinted at the flashing red warning coming from 'a 4,000 year old' financial indicator. The Gold/Silver ratio had reached extremely high levels, which at the time we explained…

This isn’t normal.

In modern history, the gold/silver ratio has only been this high three other times, all periods of extreme turmoil—the 2008 crisis, Gulf War, and World War II.

This suggests that something is seriously wrong. Or at least that people perceive something is seriously wrong.

And as we concluded at the time…

Good times never last forever, especially with governments and central banks engineering artificial prosperity by going into debt and printing money.

These tactics destroy a financial system. And the cracks are visibly expanding.

So while the gold/silver ratio isn’t any kind of smoking gun, it is an obvious symptom alongside many, many others.

Now, the ratio may certainly go even higher in the event of a major banking or financial crisis. We may see it touch 100 again.

But it is reasonable to expect that someday the gold/silver ratio will eventually fall to more ‘normal’ levels.

In other words, today you can trade 1 ounce of gold for 80 ounces of silver.

But perhaps, say, over the next two years the gold/silver ratio returns to a more historic norm of 55. (Remember, it was as low as 30 in 2011)

This means that in the future you’ll be able to trade the 80 ounces of silver you acquired today for 1.45 ounces of gold.

The final result is that, in gold terms, you earn a 45% “profit”. Essentially you end up with 45% more gold than you started with today.

So bottom line, if you’re a speculator in precious metals, now may be a good time to consider trading in some gold for silver.

And, that appears to have happened…

As Silver has soared post-Fed…

Crushing the Gold/Silver ratio back to one-month lows (withthe biggest 2-day drop since October 5th 2015)…

But do not forget – even at 79x – this is an extreme level of fear – nothing has been 'fixed' as governments escalate their repression of financial freedom.

- A First-Hand Account Of What's Really Happening In Subprime Auto

“Originate-to-sell practices are not and have never been prevalent.”

That’s a quote from Citi’s Mary Kane who, in a note out in late January, sought to dispel the notion that subprime auto was the next “Big Short.”

While it may be true that ABS as a percentage of total auto loan origination has been range-bound between 15% and 30% for more than a decade, there’s almost no question that the ability to securitize certain loans is helping to fuel subprime auto.

Just have a look at Skopos Financial and Santander Consumer for instance. No lender in their right mind would make some of the loans that show up in the collateral pools behind their ABS deals if they had to hold them on their own books. For example, 14% of the loans backing a $154 million Skopos deal last year were made to borrowers with no credit score at all. If you need a visual, take a look at this winner from Skopos:

Of course, the real test will come when, amid jitters about the economy, demand for auto ABS (as well as marketplace ABS and any other paper that isn’t backed by something rock solid) dries up. If subprime lending dries up at the same, well, correlation doesn’t necessarily equal causation but…

In any event, you don’t have to believe us, just ask someone who works in the industry. Below, find a first-hand account from a reader who says that when you’re in the subprime auto business and the securitization window slams shut, it’s all downhill from there.

* * *

I wanted to give some insight into what is currently happening in subprime auto finance.

I work for a smaller but fast growing auto finance company. We grew from opening the doors in 2013 to having a $250 million portfolio as of today. Things for the last 3 years have been booming and it seemed like there would be no end to our growth. We were rated an A by S&P in January and were ready to start securitizing our portfolio.

Since January we have grown at our fastest pace on record and things couldn’t be better.

We were hiring at a ridiculous rate and planned on doubling our staff in six months. One of my assistants was actually part of the hiring blitz and told me they needed to hire 13 people that week so he was moving his office down to the floor HR was on.

Later that day he came to my desk and told me that our director had told him to go back upstairs, because he wasn’t needed down there anymore.

He soon became worried and said he thought that he might have done something wrong. Being a ZeroHedger I told him it was probably because we haven’t securitized yet.

On March 1st I came into the office to find out that they had started layoffs. These people were fairly new and were in departments that the executive staff has now deemed unnecessary.

I had a meeting with my boss who told me my job is safe but due to us not being able to securitize we were freezing hiring going forward but we were hopefully done with layoffs.

We are a very solid company with a low default rate and higher standards than somewhere like Skopos. I worked in subprime auto during the Financial Crisis and it feels much worse right now than it did there in 2007 or 2008.

A lot of customer’s who are subprime work in the energy industry and although they are living off of severance and savings right now you can see the wave that will be landing in a few months.

* * *

Yes, yes we certainly can…

- "Is This Who We Want" – Hillary Strikes Back With Attack Ad Mocking Trump

When yesterday we showed Donald Trump’s first long overdue Hillary Clinton attack ad (which starred Jihadi John, a laughing Putin, and a barking Hillary) which had a simple message “we don’t need to be a punchline”, we predicted that it would “resonate.” It did, and within hours had accumulated several hundreds thousands views.

Many wondered how long until Hillary’s response. They didn’t habe long to wait – earlier today, Priorities USA, a pro-Clinton SuperPAC, on Thursday came out with its own attack ad mocking Trump.

Hillary’s attack ad is shown below:

The oddly unimaginative, almost carbon-copy clip uses the same footage and wording as Trump’s, until cutting to a Trump interview with MSNBC from earlier this week.

“I’m speaking with myself, number one, because I have a very good brain, and I’ve said a lot of things,” Trump says in the clip, which ends with the same punchline as that released by Trump a day earlier: “we don’t need to be a punchline”

The ad follows with a shot of Clinton laughing. It is unclear precisely why the footage was taken from the 11-hour Benghazi hearings in October: perhaps it symbolizes Hillary laughing at her devastating foreign policy which led her to defend herself in Congress against accusations her actions led to the death of Americans in Libya.

What is clear is that the as Trump and Hillary increasingly duke it out against each other, this will be the most entertaining election in recent history.

As a reminder, this is the original Trump attack ad released yesterday.

We’ll let readers decide which attack ad is more memorable, and respond to the rhetorical “is this who we want.” As for the U.S. “not wanting to be a punchline,” sadly it’s too late for that, which incidentally explains Trump’s meteoric rise in the polls, one which even JPMorgan has noticed…

- The Gloves Are Off: Trump Accuses Hillary Of Being "Involved In Corruption For Most Of Her Professional Life"

It’s popcorn time.

Barely 24 hours after Trump launched his first Hillary attack ad in which he showed a laughing Putin respond to a barking Hillary, and shortly after Hillary’s SuperPAC responded in kind with an ad of its own in which it used a Trump quote to mock him, the gloves are officially off, and now that both presidential candidates – both convinced they will face off against each other – are beyond the foreplay stage, the gloves have come off and the direct attacks are escalating rapidly.

So rapidly, in fact, that one may say Trump is risking a potential lawsuit with the following accusation (which, however, should not be too difficult to prove should one of Hillary’s SuperPACs sue him for libel).

This is what Trump tweeted moments ago.

Hillary Clinton has been involved in corruption for most of her professional life!

— Donald J. Trump (@realDonaldTrump) March 18, 2016

This is more than your typical political ad hominem – this is a material allegation with legal implications that goes to the core of Hillary’s biggest weakness, her trustworthiness or complete lack thereof, and Trump’s charges will only escalate from here on out, hopefully with actual examples. We look forward to Hillary’s response.

One thing is certain: for the next six months, America will be entertained.

- Central Bankers' Embarrassment Of Stitches

Authored by Danielle DiMartino Booth,

Leonor Jean-Christine Soulas d’Allainval was no Shakespeare. His first play, “L’Embarras des richesses,” was a three-act comedy that premiered in 1726 and was performed only four times in the hopeful playwright’s lifetime. At age 53 he died embarrassingly franc-less at the Hotel de Paris. That’s not to say Soulas did not leave his linguistic mark, however unintentionally. The title of his play directly translates to ‘the burden of wealth.’ But that meaning seems to have been lost in transit across the English Channel courtesy of a Brit.

That Englishman, John Ozell, an accountant and translator died wealthy thanks to his numerical acumen. It was however not his talent for accounting but rather his 1735 translation of Soulas’ play that would prove to be his more lasting legacy, perhaps intentionally. Today, ‘an embarrassment of riches,’ as it’s come to be universally known among idioms, simply means too much of a good thing.

In the here and now, a recent New York Times article chronicled the sun-setting on the current era of excess that has known no equal, including the Roaring Twenties. “For the ultrawealthy, 2015 was an embarrassment of riches,” the Times’ James Stewart wrote March 11th. He referenced such extravagances as $100 million penthouses, $179 million Picassos, $48 million blue diamonds and $13 million vintage Jaguars.

But something happened towards the middle of last year in this land of excess; embarrassment has given way to anxiety. In an apparent refutation of ‘show don’t tell,’ prospective buyers along Billionaires Row, Manhattan’s 57th Street between Columbus Circle and Park Avenue, have begun to blanch at the idea of movin’ on up. Evidently, the $6,000-plus per square foot price tag was easier to envision when the half dozen rising new towers were just so many deep holes in the ground.

Now that the fabulous-five, 1000-foot tall “supertall” towers are actually scraping the skyline, sales have plunged from their towering great heights. A meagre 189 Manhattan apartments sold last year for $10 million or more, a 12 percent decline from 2014. Similar tales of woe emanate from art and ‘priceless’ car auctions at which the wares on offer appear to indeed have no price, at least for which they’ve sold.

What’s a consignor to do? For starters, pray. Perhaps in Mandarin? A recent report found that despite the country’s well telecast economic slowdown, China now boasts 568 billionaires, topping the United States’ 535. Even on a city-to-city level, Beijing’s 100 billionaires now best New York’s 95.

The good news for Manhattanites with selling on the mind is that the Chinese are game to pay a tasty whim sum just to get their yuan out of the country. If you harbor any doubts as to their intent, just ask a few of the Big Apple’s resident billionaires who run a quaint private equity firm known as the Blackstone Group. These fine gentlemen make up part of the one-in-four American billionaires who work in finance and investments. Bless them.

Blackstone boasts the title of the world’s largest real-estate private equity fund manager by assets. Though the firm is known for holding its properties in portfolio for years, a resent, as in three months, acquisition of a luxury hotel portfolio is presently selling faster than a bell hop looking for a tip. And even for Blackstone, the resulting $450 million profit is nothing to sneeze at. Especially in light of the above mentioned shrinkage in apartment prices.

Plus, word is the buyer, China’s Anbang Insurance Group, is the party that did the approaching. It did seem as though the Waldorf Astoria, which the insurer with close ties to the Chinese government, acquired last year, along with a few Ritz Carltons, Four Seasons, a Hotel del Coronado and the Essex House thrown in for good measure would just about do the trick and appease the firm’s appetite for trophy U.S. hotels.

That is, until the news hit the wires days later that this once obscure Chinese insurer had bid $12.8 billion for Starwood Hotels, which boasts the Sheraton and Westin brands under their banner. It must be buy one, get one at double the price week for those with deep enough pockets, which is saying something about the depth of those pockets considering Anbang has been around for all of 12 years.

If this tale induces a sensation of déjà vu a la Rockefeller Center and Japanese buyers circa 1989, don’t let it. Don’t ask yourself whether the enthusiastic buyers are flush or flushing their yuan down the drain. Be comforted by what the cavalcade of bullish real estate strategist assure. The Chinese are not marking a top; they’re making rationale choices based on models that guarantee price appreciation based on recent trends. Hmmm.

The acquiescent acceptance of acquisition valuations makes the Chinese government’s latest stimulus measures that much starker in contrast. While there is unquestionably dry powder with which to sustain the overseas buying spree, there is also festering rot that needs to be cleansed from their domestic banking system.

And so we hear the latest, that the Chinese government will launch its answer to the U.S. TARP program, wherein Chinese commercial banks swap out bad debts to the government in exchange for equity in said bank. Reported non-performing Chinese bank loans rose to $614 billion in 2015, a decade high, even as their economic growth slumped to a 25-year low. Of course, the aim of the package is identical to that of all stimulus measures launched since 2008 — to spur yet more lending to lift economic growth. More and more yet of the same.

Which brings us to the European Central Bank (ECB) which added non-financial corporate bonds to the menu of fixed income instruments it can buy to achieve its goal of flooding the markets with 80 billion in euros every month so as to…drum roll, please…incentive, more lending. It seems that there were simply not enough sovereign bonds and asset-backed securities to get the job done, and that’s before the ECB expanded its quantitative easing (QE) program from 60 billion euros a month before last Thursday’s meeting

No doubt, with 900 billion euros outstanding, the ECB has an appreciably large pool of assets at which to aim its buyer-not-beware bazooka. A gut check, though, should prompt the question as to why European policymakers are so keen to increase their own QE program when the effort has produced so few results everywhere else it’s been attempted.

A fine point: at roughly $50 billion in outstanding bonds, life insurers top the list of eligible targets for ECB purchases. Just so we understand each other, ECB President Mario Draghi envisions buying non-financial corporate bonds in the sector most damaged by the policies he’s deployed since vowing to do whatever it takes to reignite inflation via record low interest rates. Recall that low interest rates are the bane of insurance companies that depend on reasonably high interest rates to make good on the long-term promises they’ve made to those who pay stiff premiums in exchange for those promises.

All of this is not to say that QE the world round has not had some redeeming qualities, especially for the uber wealthy who need never deign to Uber anywhere. Tally up China, the United States, India and the rest of the world and you find that worldwide billionaires now number 2,188, up 99 from 2014. Their collective net worth grew nine percent to $7.3 trillion last year alone, a figure that eclipses the GDPs of Germany and the U.K. combined. Jolly right, Herr.

So why is it the world’s central bankers are tripping over each other in an embarrassment of stitches to patch the splitting seams of the world economy with ineffectual sewing tools they’ve determined give new meaning to the other embarrassment, that of riches?

One thing is for certain. All of this quantitative pleasing has done little to lift the spirits of the world’s worker bees. Take the latest report on retail sales here in the U.S., which the Lindsey Group’s Peter Boockvar characterized as “mediocre” at best due to the current level of growth over the last year coming in at 2.9 percent. Not only is it punk compared to the five-year average of 3.5 percent; it’s downright depressed looking further back. In the boom-boom days of the dotcom bubble, spending was running at a 5.4-percent rate. Meanwhile, spending averaged 5.0 percent in the mid-2000s “goosed by mortgage equity withdrawals.”

Clearly, central bankers’ efforts are suffering from the law of diminishing returns, the phenomenon of benefits gained declining as a factor of the amount of money and energy invested. For now, at least, the other major player, the Bank of Japan, is standing down, perhaps because of the huge backlash to negative interest rates in that country. It remains to be seen, though, how long policymakers there will withstand a strengthening yen before succumbing to another stab at stimulus measures.

As for the Federal Reserve, the dichotomous signals the labor market and retail sales data have recently imparted are bound to have made the enunciating of “on the other hand” in today’s FOMC statement that much more challenging and maybe even a little embarrassing. The risk is always acute that the message gets lost in translation from Fedspeak to plain English as translators from days long since gone could easily attest. Perhaps, had central bankers simply taken to heart that well known idiom that cautions ‘a stitch in time saves nine’ early on, they would not now be so franticly stitching such a gaping gash in the world economy.

- Hacker Group "Anonymous" Releases Trump's Social Security, Phone Numbers

Earlier this month, infamous hacker collective Anonymous declared “war” on Donald Trump who they accuse of being a fascist and seeking to institute a dictatorship in America.

We’re not sure how many people took them seriously and we’re almost positive Trump himself got a good, hearty laugh at the threat (after all, the group also declared “war” on Bakr al-Baghdadi) but on Thursday, the group claims it has released Trump’s phone number and social security number.

Here’s the clip:

“Do with it as you will,” the group’s trademark mask says, “but just be aware that you are responsible for your own actions.”

- Why The Fed Is Paralyzed – Its Economic Model Is Junk

Submitted by Jeffrey Snider via Alhambra Investment Partners,

If there is any doubt as to the confusion inside the FOMC, one needs only to examine its models. The latest updated projections make a full mockery of both monetary policy and the theory that guides it. Ferbus and the rest don’t buy the labor market story, either, which is why the Fed can only be hesitant at best about “normalization.” Coming from the (neo or not) Keynesian persuasion, what is showing up should never happen.

The theoretical notion of recovery is very straightforward in orthodox economics. In recession, the economy starts with high unemployment and therefore low inflation. Using the Phillips Curve as a short-term guide, orthodox models assume that as levels of unemployment begin to normalize, output (GDP) will rise. That will occur first without any uptick in inflation as the “slack” produced by the recession keeps price pressures to a minimum.

In Stage 1 everything is easy, so long as you can gain forward momentum in unemployment or output (which is what the QE’s were supposed to accomplish with regard to theoretical notions of hysteresis). Stage 2 gets slightly more complicated as the economy nears or reaches “full employment.” At that point, inflation should start to rise which will moderate output growth. If it progresses too far, that means the economy has reached “overheating” whereby inflation gets out of control and actively suppresses output, even reversing employment gains.

By the simple act of communicating a rate hike in December (though not actually carrying it out in meaningful fashion), the FOMC proclaimed closeness to overheating. But there is a huge problem with not just observed conditions but also projected economic conditions for the immediate future. If the economy and recovery has progressed sufficiently through Stage 2 to demand policy action before overheating, we should see a concurrent rise in inflation as well as output. The FOMC estimates show no such thing; worse, they estimate the opposite for especially inflation, as modeled GDP projections continue to muddle. That was true for not just CY 2015 as it was completed in full disappointment, but now encompassing CY 2016 as well.

Both years start out in the earliest projections as they should according to theory, or close enough to be plausible; GDP should accelerate to at least something significantly better than the deficient output expansion of the recent past. Instead, as time rolls forward, that acceleration never materializes as GDP has stagnated around 2% year after year. The March 2016 projections show yet again another year absent acceleration in output (losing track of how many years in a row that would make).

In terms of inflation, the trends are even worse. When oil prices first crashed in late 2014/early 2015 that was demanded to be “transitory” uniformly across both models and orthodox interpretations (redundant, I know). A year later, not only did inflation never materialize for the rest of 2015, it is now modeled to be increasingly absent in 2016, as well.

That’s a huge problem because the unemployment rate only gets better and better at each forecast. Back in late 2013 as the sounds of taper grew louder, the FOMC’s staff models projected the unemployment rate in 2016 would only be 5.4% to 5.9% (central tendency). That was forecast as a relatively slow improvement because output growth had been so lacking to that point, and even though it was expected to accelerate it was never thought to attain true recovery mechanics (something more like 4-5% rather than 3-3.5%). Instead, as noted above, GDP growth never accelerated at all – but the unemployment rate fell far faster than orthodox theory predicted anyway. In fact, so fast it asserts a major problem somewhere because Okun’s Law suggests GDP should have been, given the unemployment rate improvement, not just higher than 2.1% to 2.3% but higher than even the 3.3% once thought the upper bound back in 2013.

In other words, in late 2013 the models suggested relatively modest GDP of 2.5% to 3.3% in 2016 which would bring unemployment down also modestly to 5.4% and perhaps as high as 5.9%. That progress was supposed to be closing in on full employment enough to propel inflation very close to the 2% target for the PCE deflator. Instead, as of the March 2016 projections, the unemployment rate is expected to be enormously lower at just 4.6% to 4.8%, but GDP still stuck (and being downgraded each quarter) at 2.1% to 2.3% while inflation at the lower bound of the central tendency is 1%? One of these factors really doesn’t add up even in this orthodox context.

It isn’t difficult to determine which one, as persistently low calculated “inflation” is fully consistent with insufficient economic growth (or worse) for the nth year in a row. It is the huge and unexpected improvement in the unemployment rate blowing right on past “full employment” almost two years faster than predicted that is completely out of line; this “best jobs market in decades” that doesn’t project beyond really questionable BLS statistics.

As if to emphasize this statistical struggle against orthodox theory, the models are “forced” by the inequity between reported unemployment and the continuing disagreement via output and inflation to reduce to the long run growth rate estimate in order to make 2.2% growth seem like it could possibly belong in Stage 2 as if it were acceleration.

That means the unemployment rate is so far out of whack that the FOMC, a committee dedicated to believing in it above all else, really cannot base monetary policy on the most basic Keynesian, Phillips Curve assumptions. In fact, by count of even orthodox theory, the unemployment rate cannot be real. It doesn’t take much survey outside of these three variables to confirm the suspicion. As much as policymakers want it to be meaningful and representative, the fact that their own models not only fail to confirm it but openly refute it (with emphasis) is why Janet Yellen is slow on the rate hikes even though she talks about the jobs market at every opportunity (as if the unemployment rate as merely a number were, rational expectations, itself a stimulant that QE never was or could be).

It was the best jobs market in decades that once again finds nobody actually in it; not even the economists.

- What Happened Yesterday: Either Something Spooked The Fed Or There Is A "Central Bank Accord"

From Guy Haselmann of Scotiabank

BURP

Yesterday’s FOMC meeting and press conference generated widespread unease. My personal uncomfortable feeling was reminiscent of a time many decades ago when a date stood me up and provided an excuse that made little sense. Simply put, the combination of the FOMC’s forecasts, economic assessment, and guidance on the future path of interest rates were incongruous and disconnected to their ‘data dependency’ message.

This week was a curious time to recalibrate to a far more dovish stance since it has followed clear improvement in labor markets, inflation indicators, and inflationary expectations. Even with the modest downward adjustments to their economic projects, the Fed’s goals and mandates have not only (basically) been achieved but they seemingly have economic momentum behind them as well.

Core year-over-year inflation measures have been rising. Core CPI rose to 2.3% earlier this week. The PCE deflator has risen to 1.7% which already stands above the Fed’s year-end estimate. The Fed once again lowered the level it believes to be its longer-run estimate of the natural rate to 4.8%.

Regardless, with the unemployment rate currently at 4.9%, the Fed is implying by its belief in the Philips Curve that wages will soon accelerate. Despite modest changes in the Fed’s economic projections, the Fed is forecasting growth above its estimate of potential growth. So how is it possible that a ‘data dependent’ Fed turned dovish?

Reporters tried to address these questions during the press conference. Yellen was uncharacteristically opaque. She deflected questions. It had the appearance of a coach who had a specific game plan, but the familiar playbook was replaced on the day of the game. The market place is abuzz with two possibilities for such a shift.

The first possibility is that something spooked the board. The market is only learning now from Bernanke’s book that QE2 and QE3 were initiated because of fears of the European crisis, not due to a shortfall in economic targets as claimed. Most people believe that the Fed deferred a hike in September due to “international developments”.

The first possibility may have been the catalyst for the second. The second possibility being discussed is that some type of central bank accord was reached at the G20 meeting in Shanghai February 25-26. Maybe they noticed that diverging central bank policies were leading to extreme market volatility and accusations of currency wars. It is not difficult to envision an agreement where central banks agreed to provide more stimuli, if the Fed agreed to pause in order to not offset the effects of such moves.

This would mean that the Fed would have to ignore economic data. Since markets have become more correlated, a pause would allow the dollar to weaken, and in turn, take pressure off of China to devalue the yuan. This would also help commodities to rise and emerging markets to soar. As global financial conditions begin to improve, the Fed would then have better cover under which to hike interest rates.

These theories are certainly possible. Great global challenges and uncertainties exist and so there are many areas that could be concerning to Fed officials, but which cannot be explicitly identified as the cause of the Fed’s policy shift. What is clear is that subsequent to the G-20 meeting, there have been policy stimulus actions from the following: ECB, BoJ, PBoC, RBNZ, and the Central Bank of Sweden (to name a few).

Central bank stimulus today is very different than stimulus during the past several years. Chasing risk assets is an increasingly dangerous game of chicken. Central bank stimulus has not had the desired economic effects, so financial valuations have diverged from economic fundamentals. Helpful regulatory and fiscal measures are nowhere to be found. At some point, policy makers have to treat root causes, rather than the symptoms with monetary painkillers.

Negative interest rates or QE that is too aggressive can scare consumers (e.g., the BoJ reaction). I have written in the past that zero rates and QE does long-term harm, but now I believe that negative rates and QE are harmful and counter-productive in the short-term as well. A retrenching consumer during an earnings recession is not good news.

The FOMC used to say that a hike would be “good news” because it represented great confidence that economic conditions were so good. Now the Fed wants us to believe that their dovish stance is good news as well, because it means greater levels of accommodations. It is a stretch to believe that both can be true.

Financial intermediation between savers and investors has hints of trouble due to negative rates. A news story yesterday said that Munich Re is experimenting with storing cash and gold. The time has come to end NIRP and ZIRP, and other forms of aggressive central bank experimentation and the dangerous consequences that come with them. It time they take a giant collective BURP, I mean BIRP (Basic Interest Rate Policy).

“I bought some batteries, but they weren’t included.” Steven Wright

- Feudalism – Then & Now

The American public has two clear choices: Fight back, or accept serfdom.

As Gaius Publicis recently expressed…

If you think of the country as in decline, as most people do, and you think the cause is the predatory behavior of the big-money elites, as most people do, then you must know you have only two choices — acceptance and resistance.

Why do neo-liberal Democrats, like the Clinton campaign, not want you to have big ideas, like single-payer health care? Because having big ideas is resistance to the bipartisan consensus that runs the country, and they want to stave off that resistance.

But that’s a negative goal, and there’s more. They not only have to stave off your resistance. They have to manage your acceptance of their managed decline in the nation’s wealth and good fortune.

Again: The goal of the neo-liberal consensus is to manage the decline, and manage your acceptance of it.

Corey Robin says when Clinton tells the truth, believe her:

“Amid all the accusations that Hillary Clinton is not an honest or authentic politician, that she’s an endless shape-shifter who says whatever works to get her to the next primary, it’s important not to lose sight of the one truth she’s been telling, and will continue to tell, the voters: things will not get better. Ever. At first, I thought this was just an electoral ploy against Sanders: don’t listen to the guy promising the moon. No such thing as a free lunch and all that. But it goes deeper. The American ruling class has been trying to figure out for years, if not decades, how to manage decline, how to get Americans to get used to diminished expectations, how to adapt to the notion that life for the next generation will be worse than for the previous generation, and now, how to accept (as Alex Gourevitch reminded me tonight) low to zero growth rates as the new economic normal. Clinton’s campaign message isn’t just for Bernie voters; it’s for everyone. Expect little, deserve less, ask for nothing. When the leading candidate of the more left of the two parties is saying that – and getting the majority of its voters to embrace that message – the work of the American ruling class is done.”

In Germany after WWI, austerity imposed by outsiders created the conditions for fascism to grow. We knew this. We were even taught this in school. And we certainly know just how good that is for women and minorities.

But in America (and Britain), that austerity is being imposed by our own leaders, and most effectively by leaders of the Democratic Party (and Labour Party) — the supposed “left” party, the party that was understood to support working people.

Clinton, like all of the DLC, talks like this “new economy” of decline is something that just happened, like it’s a natural force. They do not admit that it was a political decision to break the power of ordinary working people and put it back into the hands of the aristocracy. They pat us on the head and tell us they will try not to make it as bad as the Republicans will, but it will happen and there is nothing to be done about it.

And they actively divide us by making personal and tribal differences into the main show of the public political arena (only 7% of Americans claim never to have used birth control, so how is it a “Democrat” thing?) while behaving like the really big decisions that are wrecking our lives are none of our business. (Bank bailouts that were opposed 200-1 in calls to the White House from the public! Stopping the prosecutions of fraudulent banksters! HAMP instead of real home-owner relief! Secret TPP talks, for godssakes!)

As a woman and person of funny-color, I know who is being callous and insensitive toward me, and it isn’t Bernie Sanders.

Perfectly put.

- Our Economic Growth System Is Reaching Its Limits In A Strange Way

Submitted by Gail Tverberg via Our Finite World blog,

Economic growth never seems to be as high as those making forecasts would like it to be. This is a record of recent forecasts by the International Monetary Fund:

Figure 2 shows world economic growth on a different basis–a basis that appears to me to be very close to total world GDP, as measured in US dollars, without adjustment for inflation. On this basis, world GDP (or Gross Planetary Product as the author calls it) does very poorly in 2015, nearly as bad as in 2009.

Figure 2. Gross Planet Product at current prices (trillions of dollars) by Peter A. G. van Bergeijk in Voxeu, based on IMF World Economic Outlook Database, October 2015.

The poor 2015 performance in Figure 2 reflects a combination of falling inflation rates, as a result of falling commodity prices, and a rising relativity of the US dollar to other currencies.

Clearly something is wrong, but virtually no one has figured out the problem.

The World Energy System Is Reaching Limits in a Strange Double Way

We are experiencing a world economy that seems to be reaching limits, but the symptoms are not what peak oil groups warned about. Instead of high prices and lack of supply, we are facing indirect problems brought on by our high consumption of energy products. In my view, we have a double pump problem.

Figure 3. Double gasoline pump from Torrence Collection of Auto Memorabilia.

We don’t just extract fossil fuels. Instead, whether we intend to or not, we get a lot of other things as well: rising debt, rising pollution, and a more complex economy.

The system acts as if whenever one pump dispenses the energy products we want, another pump disperses other products we don’t want. Let’s look at three of the big unwanted “co-products.”

1. Rising debt is an issue because fossil fuels give us things that would never have been possible, in the absence of fossil fuels. For example, thanks to fossil fuels, farmers can have such things as metal plows instead of wooden ones and barbed wire to separate their property from the property of others. Fossil fuels provide many more advanced capabilities as well, including tractors, fertilizer, pesticides, GPS systems to guide tractors, trucks to take food to market, modern roads, and refrigeration.

The benefits of fossil fuels are immense, but can only be experienced once fossil fuels are in use. Because of this, we have adapted our debt system to be a much greater part of the economy than it ever needed to be, prior to the use of fossil fuels. As the cost of fossil fuel extraction rises, ever more debt is required to place these fossil fuels in use. The Bank for International Settlements tells us that worldwide, between 2006 and 2014, the amount of oil and gas company bonds outstanding increased by an average of 15% per year, while syndicated bank loans to oil and gas companies increased by an average of 13% per year. Taken together, about $3 trillion of these types of loans to the oil and gas companies were outstanding at the end of 2014.

As the cost of fossil fuels rises, the cost of everything made using fossil fuels tends to rise as well. Cars, trucks, and homes become more expensive to build, especially if they are intended to be energy efficient. The cost of capital goods purchased by businesses rises as well, since these too are made with fossil fuels. Needless to say, the amount of debt to purchase all of these goods rises as well. Part of the reason for the increased debt is simply because it becomes more difficult for businesses and individuals to purchase needed goods out of cash flow.

As long as fossil fuel prices are rising (not just the cost of extraction), this rising debt doesn’t look like a huge problem. The rising fossil fuel prices push the general inflation rate higher. But once prices stop rising, and in fact start falling, the amount of debt outstanding suddenly seems much more onerous.

2. Rising pollution from fossil fuels is another issue as we use an increasing amount of fossil fuels. If only a tiny amount of fossil fuels is used, pollution tends not to be much of an issue. Air can remain safe for breathing and water can remain safe for drinking. Increasing CO2 pollution is not a significant issue.

Once we start using increasing amounts, pollution becomes a greater issue. Partly this is the case because natural sinks reach their saturation point. Another is the changing nature of technology as we move to more advanced techniques. Techniques such as deep sea drilling, hydraulic fracturing, and arctic drilling have pollution risks that less advanced techniques did not have.

3. A more complex economy is a less obvious co-product of the increasing use of fossil fuels. In a very simple economy, there is little need for big government and big business. If there are businesses, they can be run by a small number of individuals, with little investment in capital goods. A king, together with a handful of appointees, can operate the government if it does not provide much in the way of services such as paved roads, armies, and schools. International trade is not a huge necessity because workers can provide nearly all necessary goods and services with local materials.

The use of increasing amounts of fossil fuels changes the situation materially. Fossil fuels are what allow us to have metals in quantity–without fossil fuels, we need to cut down forests, use the trees to make charcoal, and use the charcoal to make small quantities of metals.

Once fossil fuels are available in quantity, they allow the economy to make modern capital goods, such as machines, oil drilling equipment, hydraulic dump trucks, farming equipment, and airplanes. Businesses need to be much larger to produce and own such equipment. International trade becomes much more important, because a much broader array of materials is needed to make and operate these devices. Education becomes ever more important, as devices become increasingly complex. Governments become larger, to deal with the additional services they now need to provide.

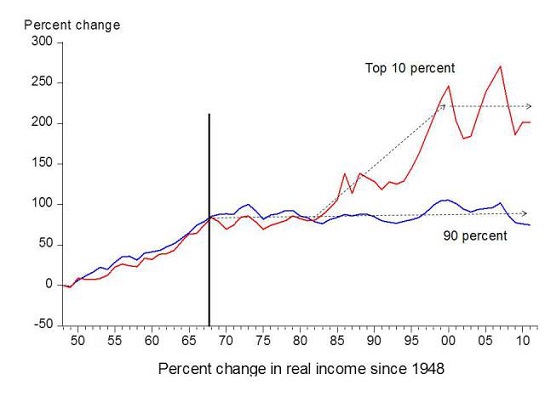

Increasing complexity has a downside. If an increasing share of the output of the economy is funneled into management pay, expenditures for capital goods, and other expenditures associated with an increasingly complex economy (including higher taxes, and more dividend and interest payments), less of the output of the economy is available for “ordinary” laborers–including those without advanced training or supervisory responsibilities.

As a result, pay for these workers is likely to fall relative to the rising cost of living. Some would-be workers may drop out of the labor force, because the benefits of working are too low compared to other costs, such as childcare and transportation costs. Ultimately, the low wages of these workers can be expected to start causing problems for the economic system as a whole, because these workers can no longer afford the output of the system. These workers reduce their purchases of houses and cars, both of which are produced using fossil fuels and other commodities.

Ultimately, the prices of commodities fall below their cost of production. This happens because there are so many of these ordinary laborers, and the lack of good wages for these workers tends to slow the “demand” side of the economic growth loop. This is the problem that we are now experiencing. Figure 4 below shows how the system would work, if increasing complexity were not interfering with economic growth.

Also see my post, How Economic Growth Fails.

The Two Pumps are Really Energy and Entropy

Unlike the markings on the pump (gasoline and ethanol), the two pumps of our system are energy consumption and entropy. When we think we are getting energy consumption, we really get various forms of entropy as well.

The first pump, rising energy consumption, seems to be what makes the world economy grow.

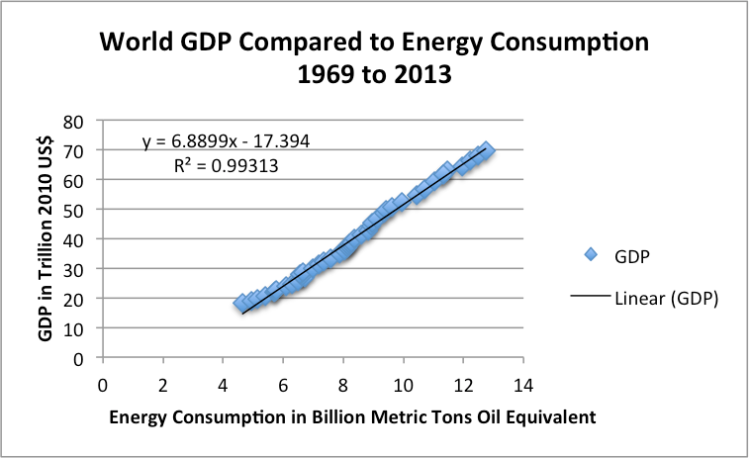

Figure 5. World GDP in 2010$ compared (from USDA) compared to World Consumption of Energy (from BP Statistical Review of World Energy 2014).

This happens because the use of energy products allows businesses to leverage human labor, so that human labor can be more productive. A farmer with a stick as his only implement cannot produce much food, but a farmer with a tractor, gasoline, modern implements, hybrid seeds, irrigation, and access to modern roads can be very productive. This productivity would not be available without fossil fuels. Figure 4, shown earlier, describes how this increased productivity usually gets back into the system.

The second pump in Figure 3 is Entropy Production. Entropy is a measure of the disorder associated with the extraction and consumption of fossil fuels and other energy products. Entropy can be thought of as a loss of information. Once energy products are burned, we have a portion of GDP in the place of the energy products that have been consumed. This is why there is a high correlation between energy consumption and GDP. As energy products are burned, we also have an increasing pile of debt, increasing pollution (that our sinks become less and less able to handle), and increasing wealth disparity.

Figure 6. Difference in US income growth patterns of the top 10% versus the bottom 90%. Chart by economist Emmanuel Saez based on an analysis IRS data, published in Forbes.

Beyond the three types of entropy I have mentioned, there are other related problems. For example, the current immigration problem is at least partly a problem associated with increased complexity and thus increased wealth disparity. Also, low oil prices are a sign of a loss of “information,” and thus also a sign of growing entropy.

Our Energy/Entropy System Operates on an Energy Flow Basis

I think of two different kinds of accounting systems:

- Accounting on a cash flow basis

- Accounting on an accrual basis, such as GAAP

With respect to energy, we burn fossil fuels in a given year, and we obtain output of renewable energy devices in a given year. We eat food that has generally been grown in the year we eat it. There is virtually no accrual aspect to the way the system works. This is very different from the accrual-basis financial statements prepared by most large companies that allow credit for investments before the benefit is actually in place.

When it comes to promises such as Social Security benefits, we are, in effect, promising retirees a share of energy production in future years. The promise is only worth something if the system continues to work well–in other words, if the financial system has not collapsed, pollution is not too great a problem, and marginalized workers are not revolting.

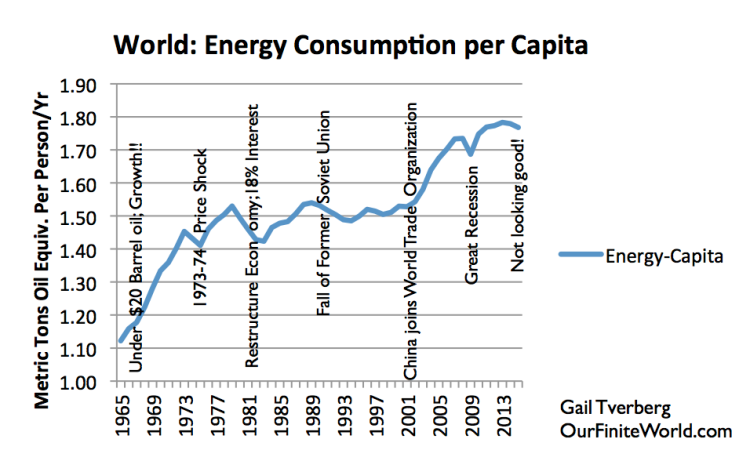

Governments can print money, but they can’t print resources. It is the resources, particularly energy resources, that we need to run the economy. In fact, we need per capita resources to be at least flat, or perhaps increasing.

Figure 7. World energy consumption per capita, based on BP Statistical Review of World Energy 2105 data. Year 2015 estimate and notes by G. Tverberg.

Printing money is an attempt to get a larger share of the world’s resources for the population of a given country. Printing money usually doesn’t work very well, because if a country prints a lot of money, the currency of that country is likely to fall relative to currencies of other countries.

What Causes the System to Fail? Too Little Energy, or Too Much Entropy?

In an interconnected system, it is sometimes hard to understand what causes the system to fail. Is it too little production of energy products, or too much entropy associated with these energy products? Astrophysicist Francois Roddier tells me that he thinks it is too much entropy that causes the system to fail, and I tend to agree with him. The rising amount of debt, pollution, and income inequality tend to bring the system down, long before “running out” of energy products becomes a problem. In fact, the low commodity prices we are now experiencing appear to be part of the entropy problem as well.

Can Renewable Energy Be a Solution?

As far as I can see, renewable energy, unless it is very cheap (like hydroelectric dams were many years ago), absolutely does not work as a solution to our energy problems. The basic issue is that the energy system works on an energy flow year basis. To match energy-in versus energy-out, we need to analyze at each calendar year separately. For example, we need to match energy going into making offshore wind turbines against energy coming out of offshore wind turbines, for each calendar year (say 2016). To keep the net energy flow positive, there needs to be an extremely slow ramp-up of high-cost renewable energy.

In a way, high-cost renewable energy is very close to entropy-only energy. Because of the energy flow year nature of the system, renewable energy generates very little energy, net of energy going into its production. (In some instances, renewable energy may actually be an energy sink.) Instead, renewable energy generates lots of entropy-related products, including increased debt and increased taxes to pay for subsidies. It also adds to the complexity to the system, because of the variable nature of its output. Perhaps renewable energy is less bad at generating pollution, or maybe the pollution is simply of a different type. Ultimately, it is a problem, just as any other type of supplemental energy is.

One problem with so-called renewable energy is that it can’t be expected to outlast the system as a whole, unless it is part of some off-grid system with backup batteries and an inverter. Even then, the lifetime of the whole system is limited to the lifetime of the shortest-lived necessary component: solar panels, battery backup, inverter, and the device the user is trying to run with the system, such as a water pump.

There are currently many stresses on our economic system. We can’t be certain that the system will last very long. When the system starts collapsing, it is likely to take grid-connected electricity systems with it.

What Is the Connection to Energy Returned on Energy Invested (EROEI)?

If a person believes that energy is a one pump system (the left pump in Figure 3), then a person’s big concern is “running out.” If a person wants to maximize the benefit of energy resources, he will choose energy resources with as high an EROEI as possible. In other words, he will try to get as much energy out per unit of energy in as possible. For example, one estimate gives EROEI of 100 to 1 for hydroelectric, 80 to 1 for coal, and much lower ratios for other fuels. Thus, a mix that is heavy in hydroelectric and coal will stretch energy supplies as far as possible.

Another place where EROEI is important is in determining “net” energy, that is, energy net of the energy going into making it.

As I mentioned above, energy per capita needs to be at least level to keep the economy from collapsing. In fact, net energy per capita probably needs to be slightly increasing to keep the economy growing sufficiently, if “net” energy is adjusted for all of the effects that simultaneously impact the energy needs of the economy, apart from energy used in producing “normal” goods and services. (Most people are not aware of the economy’s growing need for energy supplies. For an explanation regarding why this is true, see my recent post, The Physics of Energy and the Economy.)

In theory, EROEI analyses might be helpful in determining how much gross energy is necessary to produce the desired amount of net energy. In practice, there are many pieces that go into determining the total quantity of net energy required to keep the economy expanding, making the calculation difficult to perform. These include:

- The extent to which population is rising.

- The extent to which globalization is taking place, and with it, access to other, higher EROEI, energy supplies.

- The extent to which the economy is getting more efficient in its use of energy.

- The extent to which EROEI is falling for various fuels (on a calendar year basis).

- The extent to which average EROEI is falling, because the mix of fuel is changing to become less polluting.

- The extent to which it is taking more energy to extract other resources, such as fresh water and metals.

- The extent to which it is taking more energy to make pollution control devices, and work arounds for problems with energy.

Looking at Figure 5, it is not obvious that there is a need for a big adjustment, one way or another, to produce net energy from gross energy. Of course, this may be an artifact of the way GDP is measured. High-priced metals and water are treated as part of GDP, as is the cost of pollution control devices. People’s general standard of living may not be rising, but now they are paying for clean air and water, something they didn’t need to pay for before. It looks like GDP is increasing, but there is little true benefit from the higher GDP.

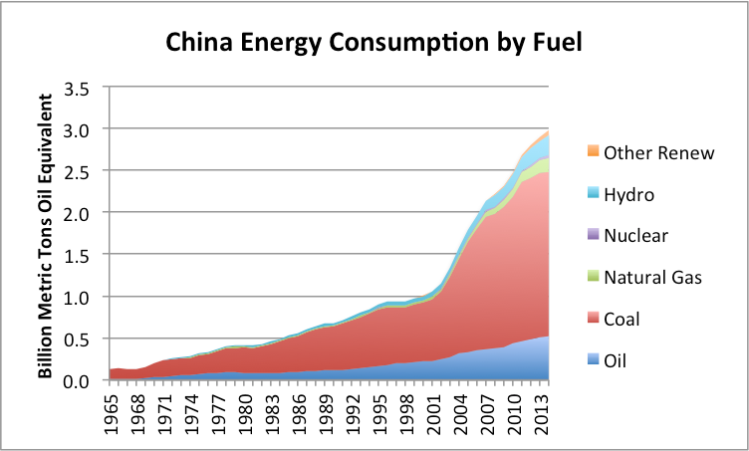

The one big take-away I have from Figure 7 is simply that if our goal is to get net energy to rise sufficiently, the best way to do this is to make certain that gross energy production rises sufficiently. World leaders were successful in doing this since 2001, through their globalization efforts. Of course, the new energy we got was mostly coal–bad from the points of view of pollution and workers’ wages in developed countries, but good from some other perspectives: low direct debt requirement, low complexity requirement, and high EROEI.

Figure 8. China’s energy consumption by fuel, based on data of BP Statistical Review of World Energy 2015.

One issue with EROEI calculations is that they disregard timing, and thus are not on an energy flow-year basis. Ignoring timing also means the calculations give little information regarding the likely debt build-up associated with an energy product.

Conclusion

If a person doesn’t understand what the problem is, it is easy to come to the wrong conclusion. Part of our problem is that we need a growing amount of net energy, per capita, to keep the economy from collapsing. Part of our problem is that entropy problems such as rising debt, increased pollution, and increasing complexity tend to bring the system down, even when we seem to have plenty of energy supplies. These are the two big problems we are facing that few people recognize.

Another part of our problem is that it is necessary for common laborers to have good paying jobs, and in fact rising pay, if the economy is to continue to grow. As much as we would like everyone to have advanced training (and training that changes with each new innovation), the productivity of workers does not rise sufficiently to justify the high cost of giving advanced education to a large share of the population. Instead, we must deal with the fact that the world’s economy needs large numbers of workers with relatively little training. In fact, we need rising pay for these workers, because there are so many of them, and they are the ones who keep the “demand” part of the commodity price cycle high enough.

Robots may be very efficient at producing goods and services, but they cannot recycle the earnings of the system. In theory, businesses could pay very high taxes on the output of automated systems, so that governments could create make-work projects to hire all of the unemployed workers. In practice, the idea is impractical–the businesses would simply move to an area with lower taxes.

Growth now is slowing because of all of the entropy issues involved. People in China cannot stand any more pollution. Too many laborers in developed countries are being marginalized by globalization and by competition with ever more intelligent machines that can replace much of the function of humans. None of this would be a problem, except that we have a huge amount of debt that needs to be repaid with interest, and we need commodity prices to rise high enough to encourage production. If these problems are not fixed, the whole system will collapse, even though there seems to be a surplus of energy products.

- Meet The People Behind The Death Of Canada's Oil Patch

Analyzing provincial statistics in Canada is an exercise in spotting the odd one out.

Alberta, the heart of Canada’s dying oil patch, is a cautionary tale about boom and bust cycles and just how dramatic the difference can be between the good times and the bad.

To be sure, we’ve spilled quite a bit of digital ink documenting the plight of the provincial economy and we’ve also outlined some of the more shocking statistics that touch on the human toll exerted by plunging crude prices. Food bank usage in the province, for instance, rose 23% Y/Y from Q1 2014 through Q1 2015 and suicide rates had risen by a third through the summer of last year.

As far as the economy, the latest data out earlier this month show Alberta was the only province in which real GDP contracted in 2015. “Alberta is facing another recession this year as cuts in energy investment and job losses hit the economy hard,” Conference Board of Canada said, adding that “until imbalances in global oil markets improve, prospects for a recovery are bleak.”

Meanwhile, a report out Wednesday showed that while manufacturing sales across Canada rose 2.3% in January, Y/Y sales plunged 13.2% in Alberta. That’s the sixth decline in seven months and a sure sign that the oil slump has spilled over into the rest of the economy. Provincial manufacturing sales dropped 16% last year.

But at the end of the day, these are all just numbers. In order to get a true sense of the malaise, we bring you the following video and commentary from CBC, who shows you the people behind the statistics.

From CBC

Warren Sonnenberg, 35

Sonnenberg worked for five years on a drilling rig in the oil patch. He started at the bottom as a leasehand and worked his way up to derrickhand. Before he was laid off in January he was making $40 an hour. He never thought the good times would end.

“You’re feeling this stuff for the first time, and you’re feeling this worry and this fear and you’re looking around and you don’t see any relief,” he says. “You want to speak to other people but they’re embarrassed by their own situations.

Gert Raynar

“We are the canary in the coal mine,” Raynar says about the food bank in Leduc where she is the manager. Raynar has never been busier, and she says it’s the same situation all across the province.

Demand on the food bank in Medicine Hat, she says, is up an unbelievable 500 per cent over this time last year.

Clarence Shields

Clarence Shields owns the sprawling Blackjacks roadhouse in Leduc. It’s a kind of unofficial union hall for oil workers.

He says, “you’re seeing a rehash of the ’80s. You’re seeing a generation that has never experienced as quick and as decisive a downturn as we got right now.

“They don’t know where to turn. All we have heard from our government so far is ‘It’ll be OK’. Well it’s not OK. We need help. We really need help.”

- "Fear" Indicator Surges To Record High

As CS' Josh Lukeman notes, the degree of hedging we’re seeing as we go higher illustrated in the CS Fear index (now at all-time highs) suggests institutional investors are not believers in the equity rally

CSFB's "Fear" Indicator has never been higher…

For a succinct explanation of what this far less popular indicator captures we use a handy definition by SentimentTrader:

EXPLANATION:

The CSFB is an indicator specifically designed to measure investor sentiment, and the number represented by the index prices zero-premium collars that expire in three months.

The collar is implemented by the selling of a three-month, 10 percent out-of-the-money SPX call option and using the proceeds to buy a three-month out-of-the-money SPX put option. The premium on both sides will be equal, resulting in a term commonly known as a zero cost collar.

The CSFB level represents how far out-of-the-money that SPX put option is, or in insurance terms it represents the deductible one would have to pay before the put kicks in.

So, for example, if the CSFB is at 20, then that means an investor would have to go 20% out of the money to be able to buy a put with the proceeds from selling a call that's only 10% out of the money. That means there is more demand for put protection – a sign of fear in the marketplace.

The index would rise when there is excess investor demand for portfolio insurance or lack of demand for call options.

It differs from the Chicago Board Options Exchange Volatility Index or VIX. The VIX, calculated from S&P 500 option prices, measures the market's expectation of future volatility over the next 30-day period and often moves inversely to the S&P benchmark.

The VIX is a fear gauge by interpretation, not by definition. It was designed to quantify the expectations for market volatility — a property that is associated with, but not always correlated to fear.

GUIDELINES:

The Fear Barometer doesn't work as most of us expect it to. It doesn't necessarily rise as the market drops, or fall as the market rises. In fact, often it's the exact opposite.

The reason is because traders in S&P 500 index options are mostly institutional, so the options activity is often a hedge against underlying portfolios. So when stocks rise, we often see more demand for put protection, not less.

It turns out that these traders can be pretty savvy short-term market timers. So when we see a sharp upward spike in the Fear Barometer, it means that traders are quickly bidding up put options, and the S&P 500 often sees a short-term decline soon afterward.

Conversely, when we see a sharp contraction in the Barometer (and the Rate Of Change drops to -10% or more), then we often see the S&P rebound shortly thereafter.

In brief, as we have opined previously: when it comes to the "here and now", which in the Fed's centrally-planned market is driven almost excusively by momentum ignition algos, complacency indeed rules. But even the merest glimpse into the near future, or rather how the present environment may disconnect with what may happen tomorrow, or next week, or, as the case may be, in three months, institutional investors are more concerned than ever before. But is this a confirmation that the US stock market is about to have a new "Deutsche Bank" moment?

The answer is unclear. Recall that it is the same "institutional" smart money that has over the past 5 years been hedged by shorting a hedge fund hotel of most hated stocks: the same stocks which as we have shown time and again consistently outperform the market, due to one after another furious short squeeze. Perhaps hedge funds have gotten tired of "hedging" (and generating losses, with hedge fund alpha virtually zero since the Lehman collapse) using cash products, and are now simply rolling over collared protection with every passing month as the stock market rises to recorder highs, well above levels that in 2007 precipitated a crash that nearly wiped out the financial system?

As for whether they are right, well: the best person to ask is Janet Yellen of course. Because with the Fed now permanently broken the business cycle (as any prolonged downturn in the economy will merely bring the Fed back out of hiding and bidding up risk assets), virtually nobody knows just how to trade this centrally-planned construct that the Fed has unleashed on the world.

As for the retail investors, not only do they not know, but as it is quite clear by now, they don't care either…

But as VIX plumbs new depths (fooling the greater masses at its complacency) we note that the last 3 times that "FEAR" spiked to record highs as VIX hit local lows, things did not end well…

- "It's All F**ked": Brazil Descends Into Chaos As Rousseff, Lula Wiretaps Trigger Mass Protests

Just yesterday, we said the following about Brazil: It seems as though this country can’t get through a single day without some piece of political news or economic data creating confusion and turmoil.

We said that on the way to noting that central bank chief Alexandre Tombini looked set to resign for fear that former President Lula’s new cabinet position and attendant promise to “turn the economy around” would lead invariably to government interference in monetary and FX policy.

As regular readers and Brazil watchers alike are no doubt aware, the BRL has been on a veritable rollercoaster ride of late and it’s all thanks, one way or another, to Lula. The currency rallied on his arrest, sold off when he was offered a position in Rousseff’s cabinet, and now, is headed sharply higher after a court injunction blocked his nomination as chief of staff.

The injunction appears to stem from some 50 audio recordings released to the media on Wednesday by Judge Sergio Moro, the lead prosecutor in the car wash probe. At least one of the recordings seems to suggest that Rousseff did indeed offer Lula the ministry post in order to shield him from prosecution.

The most damning call was recorded on Wednesday afternoon, when Rousseff can be heard telling Lula that she is sending him his ministerial papers “in case of necessity.” Obviously, that sounds a lot like an attempt to make sure Lula has proof of his new position in case authorities come to arrest him before he’s sworn in. In Brazil, ministers can only be tried in the Supreme Court which, as you might imagine, could take virtually forever compared to lower courts.

Lula was questioned earlier this month in connection with the possibility that he received luxury properties in exchange for favors tied to the Petrobras scandal.

On other calls recorded Wednesday Lula can be heard cursing the court, telling Rousseff the following: “…we have a totally cowardly supreme court, a totally cowardly high court, a totally cowardly parliament … a speaker of the house who is fucked, a president of the senate who is fucked, I don’t know how many legislators under threat, and everyone thinking that some kind of miracle is going to happen.”

Well, he’s got one thing right: everyone is “fucked,” and Moro doesn’t care. “Democracy in a free society requires that the governed know what their governors are doing, even when they try to act in the dark,” he said.

“Moro also said he believes Lula had advance warning of the raid on 4 March and may have known his phone was tapped,” The Guardian notes, adding that “by midnight on Wednesday there were reports of demonstrations against the government in at least 17 of Brazil’s 26 states. In the southern city of Curitiba, where Moro is based, hundreds gathered in front of the court to show support for the judge and his investigation.”

(protests on Wednesday night in Sao Paulo)

(demonstrations in Brasilia)

Rousseff says the court and the media’s interpretation is incorrect. She claims that she was trying to tell Lula that she was sending him his papers early in case he was unable to attend the swearing-in ceremony.

Put simply: no one was buying that excuse.

“Military police fired tear gas at demonstrators outside government buildings in Brasília, while groups set fire to a doll resembling the ex-president and waved banners calling for his imprisonment,” FT recounts, “[While] thousands of protesters filled São Paulo’s main avenue, Rio de Janeiro’s Copacabana beach and cities in at least 15 other states.”

Rousseff now intends to take legal action against Moro for “breaking the constitution. Here’s a summary of Rousseff’s comments, some of which are outright hilarious in light of the circumstances:

- Says justice system should be focused on proof

- There’s no justification for selective leaks in probes

- There’s no justice when constitutional guarantees are violated

- We want to know who authorized phone taps between her and Lula

- This is a serious act

- Says she has always defended the search for truth

- Convulsing society based on lies is serious, coups can start that way

- Says she won’t retreat from what happened yesterday

- Brazil fights corruption, respects individual rights

- Brazil counts on my work and determination

- Says she counts on Lula’s experience, his ability to understand the people

- Whoever bet on my separation from Lula was wrong

- Brazil confronting economic, political difficulties

- At this moment, we have to be together for Brazil

- We have to leave political paralysis behind us

- We want to reduce inflation, are acting to recover employment

- We extend an open hand to all who want best for Brazil

- People wanting coup won’t pull us off our path, won’t bring people to their knees

A lawyer for Lula called Moro’s release of the tapes “arbitrary.”

Right. “Arbitrary.” In fact, there was nothing “arbitrary” about it. Moro was due to decide on whether to arrest Lula this week and effectively, he and Rousseff were about to circumvent the entire investigation by using ministerial immunity to keep the car wash probe from reaching any higher up in the government than it already has. In other words, it was now or never for Moro and as you might have noticed, he isn’t one to let things go.

The release of the tapes led to a raucous session in Congress where some lawmakers chanted for Rousseff’s head, figuratively speaking… we think. Here are some clips from the protests that swept the country on Wednesday:

This, ladies and gentlemen, is what’s called chaos. Just ask Delcídio do Amaral, the senator whose testimony has only added to Rousseff’s troubles. “I am a prophet of chaos,” he told reporters after the court accepted his plea deal.

According to Eurasia, the leaked phone calls put Rousseff on the brink of impeachment, with odds of her ouster now rising to 75%. A vote, Eurasia says, could come as early as May.