- Stocks, Crude Tumble As Offshore Yuan Sinks To Day Session Lows

From the close of the US day session, offshore Yuan began to weaken and despite the largest liquidity injection in 3 years, has tumbled almost 200 pips from the dead-cat-bounce highs, testing the lows once again. This in turn has weighed on crude and dropped Dow futures 140 points off the after-hours highs…

As Yuan tumbled so Crude and stocks lurched lower…

We have seen this pattern before… this morning…

What happens next?

- The U.S. Is At The Center Of The Global Economic Meltdown

Submitted by Brandon Smith via Alt-Market.com,

While the economic implosion progresses this year, there will be considerable misdirection and disinformation as to the true nature of what is taking place. As I have outlined in the past, the masses were so ill informed by the mainstream media during the Great Depression that most people had no idea they were actually in the midst of an “official” depression until years after it began. The chorus of economic journalists of the day made sure to argue consistently that recovery was “right around the corner.” Our current depression has been no different, but something is about to change.

Unlike the Great Depression, social crisis will eventually eclipse economic crisis in the U.S. That is to say, our society today is so unequipped to deal with a financial collapse that the event will inevitably trigger cultural upheaval and violent internal conflict. In the 1930s, nearly 50% of the American population was rural. Farmers made up 21% of the labor force. Today, only 20% of the population is rural. Less than 2% work in farming and agriculture. That’s a rather dramatic shift from a more independent and knowledgeable land-utilizing society to a far more helpless and hapless consumer-based system.

What’s the bottom line? About 80% of the current population in the U.S. is more than likely inexperienced in any meaningful form of food production and self-reliance.

The rationale for lying to the public is certainly there. Economic and political officials could argue that to reveal the truth of our fiscal situation would result in utter panic and immediate social breakdown. When 80% of the citizenry is completely unprepared for a decline in the mainstream grid, a loss of savings through falling equities and a loss of buying power through currency destruction, their first response to such dangers would be predictably uncivilized.

Of course, the powers-that-be are not really interested in protecting the American people from themselves. They are interested only in positioning their own finances and resources in the most advantageous investments while using our loss and fear to extract more centralization, more control and more consent. Thus, the hiding of economic decline is enacted because the decline itself is useful to the elites.

And just to be clear for those who buy into the propaganda, the U.S. is indeed in a speedy decline.

In 'Lies You Will Hear As The Economic Collapse Progresses', published in summer of last year, I predicted that “Chinese contagion” would be used as the scapegoat for the downturn in order to hide the true source: American wealth destruction. Today, as the Dow and other markets plummet and oil markets tank due to falling demand and glut inventories, all we seem to hear from the mainstream talking heads and the people who parrot them in various forums is that the U.S. is the “only stable economy by comparison” and the rest of the world (mainly China) is a poison to our otherwise exemplary financial health. This is delusional fiction.

The U.S. is the No. 1 consumer market in the world with a 29% overall share and a 21% share in energy usage, despite having only 5 percent of the world’s total population. If there is a global slowdown in consumption, manufacturing, exports and imports, then the first place to look should be America.

Trucking freight in the U.S. is in steep decline, with freight companies pointing to a “glut in inventories” and a fall in demand as the culprit.

Morgan Stanley’s freight transportation update indicates a collapse in freight demand worse than that seen during 2009.

The Baltic Dry Index, a measure of global freight rates and thus a measure of global demand for shipping of raw materials, has collapsed to even more dismal historic lows. Hucksters in the mainstream continue to push the lie that the fall in the BDI is due to an “overabundance of new ships.” However, the CEO of A.P. Moeller-Maersk, the world’s largest shipping line, put that nonsense to rest when he admitted in November that “global growth is slowing down” and “[t]rade is currently significantly weaker than it normally would be under the growth forecasts we see.”

Maersk ties the decline in global shipping to a FALL IN DEMAND, not an increase in shipping fleets.

This point is driven home when one examines the real-time MarineTraffic map, which tracks all cargo ships around the world. For the past few weeks, the map has remained almost completely inactive with the vast majority of the world’s cargo ships sitting idle in port, not traveling across oceans to deliver goods. The reality is, global demand has fallen down a black hole, and the U.S. is at the top of the list in terms of crashing consumer markets.

To drive the point home even further, the U.S. is by far the world’s largest petroleum consumer. Therefore, any sizable collapse in global oil demand would have to be predicated in large part on a fall in American consumption. Oil inventories are now overflowing, indicating an unheard-of crash in energy use and purchasing.

U.S. petroleum consumption was actually lower in 2014 than it was in 1997 and 25% lower than earlier projections predicted. A large part of this reduction in gas use has been attributed to fewer vehicle miles traveled. Though oil markets have seen massive price cuts, the lack of demand continued through 2015.

This collapse in consumption is reflected partially in newly adjusted 4th quarter GDP forecasts by the Federal Reserve, which are now slashed down to 0.7%. And remember, Fed and government calculate GDP stats by counting government spending of taxpayer money as "production" or "commerce". They also count parasitic programs like Obamacare towards GDP as well. If one were to remove government spending of taxpayer funds from the equation, real GDP would be far in the negative. That is to say, if the fake numbers are this bad, then the real numbers must be horrendous.

And finally, let’s talk about Wal-Mart. There is a good reason why mainstream pundits are attempting to marginalize Wal-Mart’s sudden announcement of 269 store closures, 154 of them within the U.S. with at least 10,000 employees being laid off. Admitting weakness in Wal-Mart means admitting weakness in the U.S. economy, and they don’t want to do that.

Wal-Mart is America’s largest retailer and largest employer. In 2014, Wal-Mart announced a sweeping plan to essentially crush neighborhood grocery markets with its Wal-Mart Express stores, building hundreds within months. Today, those Wal-Mart Express stores are being shut down in droves, along with some supercenters. Their top business model lasted around a year before it was abandoned.

Some in the mainstream argue that this is not necessarily a sign of economic decline because Wal-Mart claims it will be building 200 to 240 new stores worldwide by 2017. This is interesting to me because Wal-Mart just suffered its steepest stock drop in 27 years on reports that projected sales will fall by 6% to 12% for the next two years.

It would seem to me highly unlikely that Wal-Mart would close 154 stores in the U.S. (269 stores worldwide) and then open 240 other stores during a projected steep crash in sales that caused the worst stock trend in the company’s history. I think it far more likely that Wal-Mart executives are attempting to appease shareholders with expansion promises they do not plan to keep.

I am going to call it here and now and predict that most of these store sites will never see construction and that Wal-Mart will continue to make cuts, either with store closings, employee layoffs or both.

As the above data indicates, global demand is disintegrating; and the U.S. is a core driver.

The best way to sweep all these negative indicators under the rug is to fabricate some grand idea of outside threats and fiscal dominoes. It is much easier for Americans to believe our country is being battered from without rather than destroyed from within.

Does China have considerable fiscal issues including debt bubble issues? Absolutely. Is this a catalyst for global collapse? No. China’s problems are many but if there is a first “domino” in the chain, then the U.S. economy claims that distinction.

China is the largest exporter in the world, not the largest consumer. If anything, a crash in China’s economy is only a REFLECTION of an underlying collapse in U.S. demand for Chinese goods (among others). That is to say, the mainstream dullards have it backward; a crash in China is a herald of a larger collapse in U.S. markets. A crash in China is a symptom of the greater fiscal disease in America. The U.S. is the primary cause; it is not the victim of Chinese contagion. And the crisis in the U.S. will ultimately be far worse by comparison.

I wrote in 'What Fresh Horror Awaits The Economy After Fed Rate Hike?', published before Christmas:

"Market turmoil is a guarantee given the fact that banks and corporations have been utterly reliant on near-zero interest rates and free overnight lending from the Fed. They have been using these no-cost and low-cost loans primarily for stock buybacks, purchasing back their own stocks and reducing the number of shares on the market, thereby artificially elevating the value of the remaining shares and driving up the market as a whole. Now that near-zero lending is over, these banks and corporations will not be able to afford constant overnight borrowing, and the buybacks will cease. Thus, stock markets will crash in the near term.

This process has already begun with increased volatility leading up to and after the Fed rate hike. Watch for far more erratic stock movements (300 to 500 points or more) up and down taking place more frequently, with the overall trend leading down into the 15,000-point range for the Dow in the first two quarters of 2016. Extraordinary but short lived positive increases in the markets will occur at times (Christmas and New Year’s tend to result in positive rallies), but shock rallies are just as much a sign of volatility and instability as shock crashes."

Markets moved immediately into crash territory after the new year began. This was an easy prediction to make and one that I have been reiterating for months — just as the timing of the Fed rate hike was an easy prediction to make, based on the Fed’s history of deliberately increasing instability through bad policy as the economy moves into deflationary spirals. The Fed did it during the Great Depression and is doing it again today.

It is no coincidence that global markets began to tank after the first Fed rate hike; no-cost overnight lending to banks and corporations was the key to maintaining equities in a relatively static position. As the U.S. loses momentum, the world loses momentum. As the Fed ends outright stimulation and manipulation, the house of cards falls.

I have said it many times and I’ll say it yet again: If you think the Fed’s motivation is to prolong or protect the U.S. economy and currency, then you will never understand why it takes the policy actions it does. If you understand and accept the fact that the Fed is a saboteur working carefully and incrementally toward the destruction of the U.S. to make way for a new globally centralized system, everything falls into place.

To summarize, the U.S. economy as we know it is not slated to survive the next few years. Read my article 'The Economic Endgame Explained' for more in-depth information on why a collapse is being engineered and what the openly admitted goal is, including the referenced 1988 article from The Economist titled “Get Ready A World Currency In 2018,” which outlines the plan for a reduction of the dollar and the U.S. system in order to make way for a global basket reserve currency (Special Drawing Rights).

It is astonishingly foolish to assume that even though the U.S. has held the title of king of global consumption share for decades, that our economy is somehow not a primary faulty part in the sputtering global economic engine. Economies are falling because demand is falling. Demand is falling because Americans are not buying. Americans are not buying because Americans are broke. Americans are broke because central bank policy has created an environment of wealth destruction. This wealth destruction in the U.S. has been ongoing, but only now is it becoming truly visible. The volatility we see in developing nations is paltry compared to the financial chaos we now face. Anyone who attempts to dismiss the dangers of a U.S. breakdown or the threat to the unprepared public is either an idiot, or they are trying to divert and distract you from reality. The coming months will undoubtedly verify this.

- For Emerging Markets, It Is Now Worse Than The Asian Financial Crisis

"It’s Black Wednesday for emerging markets," one strategist warned and Thursday is not looking any better, as SocGen's Berg warns "The rout in emerging markets could continue for some time, especially as the major global central banks have exhausted their ammunition in recent years, making it unlikely that they will rescue global markets this time around." In fact, as Bloomberg reports, this year's EM turmoil is already worse than in the same period in 1998's Asian financial crisis (and EM FX is even worse).

The MSCI Emerging Markets Index dropped 3 percent to 692.76, the lowest close since May 2009.

More than $2 trillion has been wiped out from the value of developing-nation equities this year as the MSCI Emerging Markets Index slid 13 percent, the worst start to a year since data began in 1988. As Bloomberg reports, The drop has exceeded the 7.9 percent decline in the gauge in the same period in 1998 during the Asian financial crisis and the drop in 2009 amid the global financial crisis.

“We are now in the correction territory,” Don Townswick, director of equity products at Conning Inc. Indian stocks are on the cusp of a bear market, potentially joining the three out of every four major emerging stock markets that have fallen 20 percent from peaks.

But it's not just stocks, EM FX markets are collapsing as traders are betting that it’s become too expensive for policy makers to continue defending exchange rates after investors and companies pulled $735 billion out of developing nations last year, according to the Institute of International Finance.

“With some losses already booked this year in their portfolios, investors will avoid risk as much as possible," said Attila Vajda, managing director at Singapore-based advisory firm Project Asia Research & Consulting Pte. “Investors remain more pessimistic with the global outlook."

And finally EM debt is tumbling.

The premium investors demand to hold emerging-market debt over U.S. Treasuries widened nine basis points to 481, according to JPMorgan Chase & Co. indexes.Which is why EM central bankers such as Mexico;s Carstens are begging for moar QE…

Central banks in emerging markets could follow counterparts in the developed world and become “market makers of last resort”, using unconventional monetary policies to try and stimulate their flatlining economies, according to Mexico’s central bank chief.

“Emerging markets need to be ready for a potentially severe shock,” Mr Carstens told the Financial Times. “The adjustment could be violent and policymakers need to be ready for it.”

Policymakers and economists have warned that heavy selling of EM stocks and bonds by international investors since the middle of last year threatens to provoke a credit crunch that would make it hard for EM companies to service their debts.

Many EM companies have filled up on cheap credit over the past decade, after a commodities boom and ultra-loose monetary policies led by the US Federal Reserve resulted in very low borrowing costs. As investors pull out, those costs are set to soar.

Mr Carstens said the required policy response from EM central bankers would stop short of outright “quantitative easing” or QE — the large-scale buying of financial assets undertaken by the Fed and other developed market central banks.

But it would include exchanging high risk, long-dated assets held by investors for less risky, shorter-dated central bank and government liabilities.

So Operation Twist? If it were to happen, maybe this time they will use the break to delever?

- Guest Post: How Hitler Came To Power

Submitted by 'Thinker' via The Burning Platform blog,

Hitler came to power for a number of documented reasons, some of which are rational, others of which are emotional. Either way, the world continues to question how a vicious madman could rise to power in Germany during this time, most of all the German people who, to this day, will do almost anything to prevent another authoritarian movement.

Though I believe that is being used today against them as a bigger authoritarian movement gains hold (migrant fundamentalism), the German people seem to be either blind to a new definition of totalitarianism or are so terrified of it happening again in Germany that they are incapable of resisting it.

Following WWI, the following issues remained from the 1920s or were present at the time:

Long-term bitterness

Deep anger about the First World War and the Treaty of Versailles created an underlying bitterness to which Hitler’s viciousness and expansionism appealed, so they gave him support.

Today, we have deep-seated anger at a number of things: government over-reach, the broken rule of law, inequality, crony capitalism, lack of meaningful representation from elected officials, degenerated race relations… we all know the many things that have created the seething undercurrent in this country.

Ineffective Constitution

Weaknesses in the German Constitution crippled the government. In fact, there were many people in Germany who wanted a return to dictatorship. When the crisis came in 1929–1933 – there was no one who was prepared or able to fight to stop Hitler.

Here in the U.S., we have a growing number of people who promote / want socialism, or expect the government to take a more authoritarian approach. Our Constitution is in shambles after the actions of the past few Presidents, with many questioning whether it really stands for something any more. When the rule of law fails, that’s a sure sign that we are facing a constitutional crisis. We even have a governor (TX) calling for a Constitutional Convention to restore states’ rights… I’d say that fits, as well.

Money

The financial support of wealthy businessmen gave Hitler the money to run his propaganda and election campaigns.

Banks, MIC companies, foreign governments, shadowy billionaires pulling strings, TPTB… always been this way, always will be, with very few exceptions throughout history.

Propaganda

Nazi propaganda persuaded the German masses to believe that the Jews were to blame and that Hitler was their last hope.

Plenty of this to go around on both sides… Muslims are the problem, illegal immigrants, black people / white people, China, you name it. There’s a LOT of finger-pointing and tribalism going on now, and one guy standing up and saying he’s going to fix everything.

Promises to fix everything

Hitler promised everybody something, so they supported him.

No one’s doing that just yet — promising something to everyone — but we’re not far off. Trump is saying things people want to hear, which is the power behind his meteoric rise. He’s claiming he’s going to get blacks voting for him, he’s going to get women voting for him… like most of the politicians we need to worry about the most, he’s broadening his appeal in order to achieve what he wants to do. But is it good for everyone? Will he really do it? Once someone like that is elected, they tend to do whatever they want, no matter what they’ve said in the past. Just look at our current fiasco-in-charge.

Attacks on other parties

The Stormtroopers attacked Jews and people who opposed Hitler. Many opponents kept quiet simply because they were scared of being murdered – and, if they were, the judges simply let the Stormtroopers go free.

We’re not here yet, though one could say the current Administration has this one nailed. The IRS is used to target opposition, the NSA can take down anyone they want to, police forces around the nation already act above the law and get away with it. It wouldn’t take much for a REAL authoritarian to take advantage of the stage that’s been set. Which is why it’s so important to get past the “it’s only against blacks / conservatives / immigrants” mentality. Remember the Hangman.

Personal Qualities

Hitler was a brilliant speaker, and his eyes had a peculiar power over people. He was a good organizer and politician. He was a driven, unstable man, who believed that he had been called by God to become dictator of Germany and rule the world. This kept him going when other people might have given up. His self-belief persuaded people to believe in him.

Driven, organized, belief that only he can fix things, grandiose statements of making the country “great” again… signs that we should tread very, very carefully.

Economic Depression

After the Wall Street Crash of 1929, the US called in its loans to Germany, and the German economy collapsed. The number of unemployed grew; people starved on the streets. In the crisis, people wanted someone to blame, and looked to extreme solutions – Hitler offered them both, and Nazi success in the elections grew.

We don’t have people literally starving, though more are below poverty level than when the War of Poverty started. Instead, we have people “starving” from societal, family and community breakdown. People want someone to blame and they’re looking for extreme solutions — Trump on one hand / Hillary or Sanders on the other. Either way, we lose.

“Those who cannot remember the past are condemned to repeat it.” — Santayana, The Life of Reason, 1905

- Tom DeMark: "Today Is An Interim Low" Followed By A 5-8% Rebound, Then Another Selloff; China To Fall Further

There are not many technicians that Steve Cohen has on speed dial, but Tom DeMark, whose indicators grace the default graphs of many Bloomberg terminals around the globe, is one of them. One reason may be DeMark’s recent track record, having called a “Sell” on November 3 which was close to the all time high in the S&P, shortly after which US indices tumbled leading to the worst start of the year in history hitting DeMark’s targets well ahead of time.

Earlier today, just as global stocks entered a bear market, DeMark spoke with Bloomberg TV, and may have been one of the catalysts for today’s violent surge off the lows just as the Dow Jones was crashing by over 550 points, when he said that “today may have been an interim low” highlighting that the intensity of the decline is comparable to the plunge in November 2008 and August 2011, both of which were followed by reflex rallies of 5-8%, roughly the same as what he expects now:

We think it could be a pretty good rally off that low; We’re going to have a two-step affair: a low today, maybe tomorrow and then we rally and people take a deep breath. After we see that rally, maybe anywhere from a week and a half to three weeks, we decline again and I think that’s coincident with the Shanghai Composite and the Hang Seng Index declining.

Incidentally, he said this just around noon when stocks were at their lows, so he did not have the benefit of hindsight from the market close. However, this good news for US stocks if only in the short-term, will not be shared by their Asian peers: DeMark discussed the Hong Kong and Chinese market, and sees those as continuing their fall:

We are pretty confident the next level on the HSCEI is below 7,500. We think what we’re going to see in the HSCEI is four consecutive, maybe five, lower closes and that should bottom that market. We should get down below 7,500 and the Shanghai Composite we should still get down to objective which is about 2,500-2,600.

DeMark then reveals why at this point a central bank intervention, which gratifying in the very near term, would be the worst possible outcome for a stable, long-term rally in stocks:

Markets bottom when the last seller has sold and markets top when the last buyer has bought. We are looking for a bottom that’s a secondary bottom where you make one bottom, you rally, make a lower low and the internals of the market show that there’s strength and at the same time when we make that low there’s a low of negative news: we don’t want to see positive news from the government; we don’t want to see positive news from central banks. That interferes with the rhythm of the market.

Finally since this was a typical soundbity finTV interview in which the anchors always have to know what, if anything, the interviewee is buying, we found DeMark’s answer to be wonderfully laconic:

If I were a long-term buyer, I’d wait. Today we got -2,500 net declines in the NYSE. We’ll rally, we’ll make a lower low, and maybe we do -1,500 for a few days which would be a divergence and indicates that we are probably at a bottom. We could recover 40% of the decline subsequent then to that but we do have a lot of damage done to the market long-term.

The interview took place just after noon, which may explain why the Steve Cohens of the world bought today’s massive dip and sent some of the most shorted stocks soaring in an epic closing dash for trash.

What happens next? DeMark could well be right, however his call for a rebound has been consensus for the past few days, and ironically the reason for today’s sharp decline may have been that everyone was expecting stocks to jump which may explain why they did precisely the opposite.

In any event, look for the next few days to see if DeMark still has his magic. We, on the other hand, would rather wait for “Gandalf” Kolanovic’ next take.

Full interview below:

- PBOC Injects Massive $60 Billion Liquidity – Most In 3 Years; China Stocks, Yuan Drop

Offshore Yuan is sliding lower after its "US equity market saving" surge during the day session as PBOC fixes Yuan stable for the 10th day in a row. Despite the smoke and mirrors of stability however, they injected a colossal 400 billion Yuan into the financial system – the most in 3 years.

Offshore Yuan is sliding…

PBOC holds Yuan Fix stable for the 10th day with a very small weakening:

- *CHINA SETS YUAN REFERENCE RATE AT 6.5585 AGAINST U.S. DOLLAR

But injected a godzilla-size 400bn Yuan of liquidity

- *PBOC TO INJECT 110B YUAN WITH 7-DAY REVERSE REPOS: TRADER

- *PBOC TO INJECT 290B YUAN WITH 28-DAY REVERSE REPOS: TRADER

This is not normal new year liquidty injection at all…

- *PBOC INJECTS MOST CASH IN THREE YEARS IN OPEN-MARKET OPERATIONS

Something is breaking and PBOC is desperate to fill the hole with centrally planned reverse repo.

And equity markets are not bouncing like the rest opf AsiaPac:

- *CHINA'S CSI 300 INDEX SET TO OPEN DOWN 1.2% TO 3,136.38

- *CHINA SHANGHAI COMPOSITE SET TO OPEN DOWN 1.4% TO 2,934.39

- We Know How This Ends – Part 2

Submitted by Jeffrey Snider via Alhambra Investment Partners,

In March 1969, while Buba was busy in the quicksand of its swaps and forward dollar interventions, Netherlands Bank (the Dutch central bank) had instructed commercial banks in Holland to pull back funds from the eurodollar market in order to bring up their liquidity positions which had dwindled dangerously during this increasing currency chaos. At the start of April that year, the Swiss National Bank (Swiss central bank) was suddenly refusing its own banks dollar swaps in order that they would have to unwind foreign funds positions in the eurodollar market. The Bank of Italy (the Italian central bank) had ordered some Italian banks to repatriate $800 million by the end of the second quarter of 1969. It also raised the premium on forward lire at which it offered dollar swaps to 4% from 2%, discouraging Italian banks from engaging in covered eurodollar placements.

The “rising dollar” of 1969 had somehow become anathema to global banking liquidity even in local terms.

The FOMC, which had perhaps the best vantage point with which to view the unfolding events, documented the whole affair though stubbornly and maddeningly refusing to understand it all in greater context of radical paradigm banking and money alterations. In other words, the FOMC meeting MOD’s for 1968 and 1969 give you an almost exact window into what was occurring as it occurred, but then, during the discussions that followed, degenerating into confusion and mystification as these economists struggled to only frame everything in their own traditional monetary understanding – a religious-like tendency that we can also appreciate very well at this moment.

At the April 1969 FOMC meeting, Charles A. Coombs, Special Manager of the System Open Market Account, reported that the bank liquidity issue then seemingly focused on Germany was indeed replicated in far more countries.

Mr. Coombs reported that the other main recent development in the European exchange markets had been the actions taken by the various continental central banks to defend their domestic liquidity and credit situations from the strains generated by the sharp rise in U.S. bank borrowings from the Euro-dollar market.

European central banks, in particular, were nearly apoplectic about US banks’ sudden and incessant presence as eurodollar borrowers. Prior to 1968, eurodollars were largely a European affair, that Merchant’s bankers market to achieve global trade finance and settlement. Rising consumer inflation starting in 1965 had the effect in domestic money markets of increasing interest rates then under the control of Regulation Q. Ostensibly a systemic protection arrangement put in place in the 1930’s to avoid another Great Depression, Regulation Q limited what banks could pay on deposits. By the middle of 1968, nearly all money market rates had hit their ceilings; eurodollar markets had no ceilings.

Large time deposits particularly of corporate, non-bank accounts started shifting in 1968 and playing a large role in provoking and amplifying the global currency crisis that year. Large banks in New York responded to the loss of primarily CD’s by simply bidding for funds in eurodollars (or exchanging them by bookkeeping alone, as Milton Friedman pointed out contemporarily) and booking those liabilities instead as borrowings from their foreign subsidiaries operating in eurodollar markets. The scale here was also massive; foreign subs booking eurodollar liabilities on behalf of their domestic head offices had added $3 billion during January and February 1969 alone.

The more US banks were “forced” to bid in eurodollars to escape the liability and deposit strangle of Regulation Q, the more illiquidity spread throughout the rest of the exchange markets, particularly eurodollars and eurocurrency. As the FOMC discussion in April 1969 pointed out then, “U.S. banks were willing to pay almost any rate for marginal additions to their resources, but that the actions of U.S. banks at their margins were tending to force upward the general levels of rates in European money markets.” There was a direct link between eurodollars and the domestic money conditions in the countries most exposed or participatory in eurodollars.

And it wasn’t just eurodollars, either. The loss of time deposit liabilities had struck smaller reserve city banks domestically. These banks, unlike the global NYC banks, however, could not bid in eurodollars to re-obtain this funding. Instead, there was a massive increase in “borrowed reserves”, both federal funds and the Discount Window. From the February 1969 FOMC MOD:

These funds were then channeled through the Euro-dollar market to the largest banks, with an actual basic reserve surplus developing in New York City banks last week and a record level of borrowing by country banks. These twin developments had the result of taking some of the pressure off the Federal funds market as the most aggressive bidders had less urgent needs and country banks made greater use of the discount window. This in turn helps explain last week’s anomaly of the highest level of net borrowed reserves in 16 years and a relatively comfortable Federal funds market.

The domestic, as well as international, banking system was becoming fully functional on a wholesale level of action and activity (and, as you can appreciate, it greatly favors the biggest NYC and London banks). But while there might be some domestic redistribution through NYC bank “excess reserves” into federal funds, for foreign liquidity arrangements there was no such recycling pass-through possible. Thus, “tightening” in eurodollars was directly translatable:

He [Mr. Bodner, AVP of FRBNY] noted that rising Euro-dollar rates tend initially to push up the forward exchange rates for other currencies. In recent weeks, however, when the German Federal Bank had been supplying forward marks relatively cheaply there had been large outflows from Germany into Euro-dollars and fairly significant increases in German domestic interest rates. Swiss rates, too, had risen.

And Denmark, Holland, Japan and any number of other eurodollar-connected places. While Mr. Bodner was ascribing these processes to the short-term, “tend initially”, what the events of 1969 would demonstrate conclusively was that the disruption left a lasting, scarring impact upon global finance (and then, as the recession developed, global economy). The “rising dollar” had major influence on what were thought completely separate financial systems – an assumption that persisted even though central banks had been actively participating and entangling their own banking systems (as Bundesbank belatedly admitted) within it all for years by then.

Throughout the whole of 1969, the FOMC remained as if this was all some minor nuisance for foreigners to settle out amongst themselves. Though the Fed had sent representatives to the conference in Bonn in November 1968, there was absolutely no urgency even though central bank after central bank succumbed to the “rising dollar.” From the April 1969 MOD:

In addition to domestic considerations, there is the impact of Euro-dollar takings on foreign money and exchange markets mentioned by Mr. Coombs. He suggests careful watching and contingency planning. This raises serious questions about the need for policy tools that could be used on short notice should there arise an urgent need to reduce the strains in the Euro-dollar market. Fortunately, we don’t have to reach a conclusion today. [emphasis added]

But it wasn’t just quantity issues that were affecting almost everything in the global regime during the dying days of Bretton Woods; in fact, the innovation here in qualitative terms and repurposing was perhaps far more important. It certainly was a contributing factor toward the eventual dissolution of gold exchange, but these transformations in money and banking would rule the next forty-five years and set us up to do this all over again:

The impact of monetary restraint on reserve aggregates and on bank deposits and credit is amply reflected in the written reports. It is also amply reflected in the ingenuity of banks in trying to avoid the constraints of Regulation Q. In addition to a still more intensive use of the Euro-dollar market, there has been increasing evidence of the exploration or use of other devices–such as the introduction of “documented discount notes,” sales of assets to foreign branches, sales of commercial paper by a subsidiary or by a bank holding company, as well as various forms of link financing. While these devices are probably not yet large in volume, they are casting increasing doubt on the validity of the regular bank credit statistics that we follow.

And:

He [FOMC Board Member Charles Scanlon] had no strong feeling regarding the establishment of reserve requirements against Euro-dollars except to question whether that device would be totally effective. He had been impressed by the ingenuity of people engaged in the Euro-dollar market who had already worked out various methods of escaping the constraints of a possible imposition of reserve requirements–including the use of brokers and repurchase agreements on Euro-dollars.

“Escaping constraints” was not a feature of hard money, as that was entirely the point of hard money. Not only were repurchase agreements becoming more common as a domestic workaround of Regulations Q and D, they were also becoming more prevalent upon eurodollars where more swaps and forwards than “covered” participation of global banks existed. In other words, not only would there be, as there increasingly had been, no hard money there wouldn’t even be money. The dollar was becoming the full “dollar” and that meant a systemic shift due to massive imbalance that was unanswerable under the paradigm in operation at that time – not just Bretton Woods but in many ways the economic and monetary theories that then prevailed. Rather than restore a hard money anchor economists instead simply continued the progression because they saw themselves now free and “flexible” to control it all more closely.

It was, obviously, a disaster right from the start as we have been made to live their errors in repetition. By 1980, Keynesianism in general was being totally repudiated but rather than fade into history it just merged with the technocratic principles that had been adopted by central banks thinking they could more easily wield their own influence under this “floating” monstrosity; monetarism and Keynesianism became all one big mess. Thus, the precursor to the degradation of the serial asset bubbles of the 21st century was refashioned as some kind of monetarist, central planning Golden Age – the Great “Moderation.”

But this new floating and intangible eurodollar system was itself inherently unstable once it surpassed some threshold of intrusiveness. That seems to have been in 1995 when eurodollars were shifted from payment system accounting for largely global trade to encompass an entirely parallel offshore banking system. There were continuous indications that this was a terribly inefficient and just plain bad idea (starting almost right away with the Asian flu/LTCM) but it would continue on anyway until August 2007. Since then, just like 1961, the world has been infected with almost continuous instability attaining more and more the properties and desperation that looks to be a symmetrical bookend of 1968-69.

The only difference relevant in this overriding conception is that the eurodollar in 1969 was ready to break free of the shackles of hard money. Its very existence owed to the fact that central banks were repeating the same processes that they had experimented with in the 1920’s and thus felt that they had learned from those mistakes (they didn’t; blaming gold the whole time when economists, deep down, care little for gold so much as power and control). The eurodollar imbalance of 1969, which led to the great interruption of the 1970’s, was a faction, the majority faction, of banking following along the lines of monetary flexibility; in short, economists thought they would be replacing gold with themselves when even in 1969 it should have been readily apparent that banks were replacing gold with their own designs.

One final note, a haunting warning that was echoed in 1979 (itself an echo of 1964) and seemingly destined to be unheeded and thus the source of our great repetition. If we are doomed to repeat history, it is because the self-selected “best and brightest” are more enamored with their own credentials than their abilities as critical thinkers in a truly enlightened, scientific discipline. Mr. Coombs’ words from April 1969 would find application in August 2007, again in August 2011 and in increasing regularity since June 2014 and this renewed “rising dollar.”

European central banks remained apprehensive, however, that a serious crunch in the Euro-dollar market might suddenly develop if intensified U.S. and European competition for Euro-dollars suddenly revealed some vulnerable positions. The situation could be particularly serious because the Euro-dollar market had become an increasingly important source of financing for industrial and commercial enterprises not only in Europe but in the whole world. One bankruptcy could attract a lot of attention, and if it led the European commercial banks that had been supplying funds to the market to reassess the credit risks they faced, the result might be a sudden scramble for liquidity. The chances of such a development were enhanced by the fact that no central bank had formal responsibility for the behavior of the Euro-dollar market; what had been accomplished in that connection had been done through informal central bank cooperation.

As noted through this whole discussion, that “informal central bank cooperation” doesn’t really amount to anything. That lesson could be applied to the Bundesbank “selling dollars” in 1969, the PBOC “selling UST’s” in 2015 or the worthless, useless Federal Reserve RRP in 2016. They really don’t know what they are doing, they never have and it truly doesn’t matter fixed or floating. Adjust accordingly because we know how this ends; we’ve already seen it.

- Canada's "Other" Problem: Record High Household Debt

Earlier today, the Bank of Canada surprised some market participants by failing to cut rates.

True, the loonie was plunging and another rate cut might very well have accelerated the decline, further eroding the purchasing power of Canadians who are already struggling to keep up with the inexorable rise in food prices, but there are other, more pressing concerns.

Like the fact that some analysts say the CAD should shoulder even more of the burden as Canada struggles to adjust to a world of sub-$30 crude. In short, if Stephen Poloz could manage to drive the loonie lower, the CAD-denominated price of WCS might stand a chance of remaining above the marginal cost of production. Barring that, the shut-ins will start and that means even more job losses in Canada’s oil patch, which shed some 100,000 total positions in 2015.

Alas, Poloz elected to stay put, characterizing the current state of monetary policy as “appropriate.”

We’re reasonably sure that assessment won’t hold once the layoffs pick up and as we noted earlier, the longer Poloz waits, the larger the next cut will ultimately have to be, which means that if the BOC waits too long, Poloz may have to rethink his contention that the effective lower bound is -0.50%.

While there are a laundry list of concerns when it comes to assessing the state of the Canadian economy and the impact of either higher rates (the loonie is supported but growth is further choked off) or lower rates (the economy gets a boost but consumer spending is stifled as Canadians watch their purchasing power evaporate), perhaps the most important thing to remember is that Canada is now the most leveraged country in the G7.

According to a new report from the Parliamentary Budget Officer (PBO) the household debt-to-income ratio is now a whopping 171% which means, for anyone who is confused, “that for every $100 in disposable income, households had debt obligations of $171.”

That’s the highest level in a quarter century and it means that when it comes to household leverage, no other advanced economy does it like Canada:

That would be bad enough in a favorable economic environment with a benign outlook for rates, but it’s a veritable nightmare when the economy is sliding headlong into recession and central planners are hell bent on trying to normalize policy some time in the next five or so years.

Put simply, the more debt you have, the higher the cost of servicing your obligations and just about the last thing a grossly overleveraged economy needs is a wave of job losses and a severe economic downturn. Brazil is facing a similar dynamic.

“Since 1991, household debt has increased each quarter, on average, by almost 7 per cent on a year-over-year basis, with the sharpest acceleration occurring over 2002 to 2008,” the PBO says in the report. “In the third quarter of 2015, household debt amounted to $1.9 trillion.”

“On its own, however, the debt-to-income ratio provides a limited measure of the financial vulnerability of households,” the report continues, adding that “what matters more for financial vulnerability is not so much the level of the debt relative to income, but rather the capacity of households to meet their debt service obligations.”

Correct, and on that measure, things have only been worse on one other occasion: during the crisis.

As Canada’s depression worsens, expect overburdened households to simply fold up under the pressure. That’s when the dominos start to fall in earnest as a cascade of foreclosures bursts the nation’s housing bubble once and for all and as the world discovers how exposed Canada’s banks are to the country’s levered up families. “Concerns about financial vulnerability are particularly prominent in the current context given the recent economic weakness and the expectation that interest rates will rise in the coming years from their historically-low levels,” the report concludes.

Of course if rates don’t rise, that’s probably even worse news for Canadian households because it will mean that the country is still mired in recession.

We close with two passages, the first from Finance Canada’s Update of Economic and Fiscal Projections and the second from the Bank of Canada’s Financial System Review.

Canadian household debt levels also remain elevated relative to historical norms. While this is not a risk in and of itself, it does limit the contribution that consumption and residential investment can make to growth. Moreover, if there were a negative external shock to the economy, this could trigger deleveraging among those households holding higher levels of debt, leading to a commensurate impact on consumption and residential investment.

Household vulnerabilities could be exacerbated by a severe recession that is accompanied by a widespread and prolonged rise in unemployment. This could reduce the ability of households to service their debt and cause serious and broad-based declines in house prices.

- War On Cash Escalates: China Readies Digital Currency, IMF Says "Extremely Beneficial"

Remember when Bitcoin and its digital currency cohorts were slammed by authorities and written off by the elite as worthless? Well now, as the war on cash escalates, officials from The IMF to China are seeing the opportunity to control the world's money through virtual (cash-less) currencies. Just as we warned most recently here, state wealth control is the goal and, as Bloomberg reports, The PBOC is targeting an early rollout of China's own digital currency to "boost control of money" and none other than The IMF's Christine Lagarde added that "virtual currencies are extremely beneficial."

By way of background, as we explained previously, What exactly does a “war on cash” mean?

It means governments are limiting the use of cash and a variety of official-mouthpiece economists are calling for the outright abolition of cash. Authorities are both restricting the amount of cash that can be withdrawn from banks, and limiting what can be purchased with cash.

These limits are broadly called “capital controls.”

Why Now?

Why are governments suddenly so keen to ban physical cash?

The answer appears to be that the banks and government authorities are anticipating bail-ins, steeply negative interest rates and hefty fees on cash, and they want to close any opening regular depositors might have to escape these forms of officially sanctioned theft. The escape mechanism from bail-ins and fees on cash deposits is physical cash, and hence the sudden flurry of calls to eliminate cash as a relic of a bygone age — that is, an age when commoners had some way to safeguard their money from bail-ins and bankers’ control.

Forcing Those With Cash To Spend or Gamble Their Cash

Negative interest rates (and fees on cash, which are equivalently punitive to savers) raise another question: why are governments suddenly obsessed with forcing owners of cash to either spend it or gamble it in the financial-market casinos?

The conventional answer voiced by Mr. Buiter is that recession and credit contraction result from households and enterprises hoarding cash instead of spending it. The solution to recession is thus to force all those stingy cash hoarders to spend their money.

* * *

And so now we see China pushing for the early unleashing its own virtual currency, as Bloomberg reports

Issuance of digital currency can help reduce costs, curb crimes and money laundry, facilitate transactions and boost central bank’s control on money supply and circulation, PBOC says in statement on website after concluding a seminar today.

PBOC has asked its research team, which was set up in 2014, to study application scenarios for digital currency and strive for an early rollout.

People's Bank of China digital currency seminar held in Beijing. From the People's Bank, Citibank and Deloitte digital currency expert, respectively, on the overall framework of digital currency currency evolving national digital currency, encryption currency issued by the State and other topics of discussion and exchange. People's Bank of China Governor Zhou Xiaochuan attended the meeting, the People's Bank of China Deputy Governor Chair Fan Yifei. Relevant research institutions, major financial institutions and advisory bodies of experts attended the meeting.

The meeting pointed out that with the development of information technology and mobile Internet, cloud computing Trusted controlled, secure storage terminal evolution, block chain technology worldwide payment undergone tremendous changes, the development of digital currency is central Bank of currency and monetary policy has brought new opportunities and challenges. The People's Bank attaches great importance from 2014 to set up a special research team, and in early 2015 to further enrich the power of digital distribution and business operations monetary framework, the key technology of digital currency, digital currency issued and outstanding environment, digital currency legal issues facing the impact of digital currency on economic and financial system, the relationship between money and private legal digital distribution of digital currency, digital currency issuance of international experience conducted in-depth research, has achieved initial results.

The meeting held that China's current economy under the new norm, explore the central bank issued digital currency has a positive practical significance and far-reaching historical significance. It can reduce the traditional distribution of digital currency note issue, the high cost of circulation, improve convenience and transparency of economic transactions and reduce money laundering, tax evasion and other criminal acts to enhance the central bank's money supply and currency in circulation control, better support economic and social development, the full realization of inclusive finance help. Future, digital currency issuance, circulation system also helps build our new financial infrastructure construction, further improve China's payment system, improve payment and settlement efficiency, promote economic quality and efficiency upgrades.

The meeting urged the People's Bank of digital currency research team to actively absorb the important results and practical experience of digital currency research at home and abroad, continue to advance on the basis of preliminary work to establish a more effective organizational guarantee mechanism, to further clarify the strategic objectives of the central bank issued digital currency and do key technologies, multi-scene digital currency research applications for the early introduction of digital currency issued by the central bank. Design of digital currency should be based on economic, convenience and safety principles, and ensure the application of low-cost digital currency, wide coverage, digital currency payment instruments with other seamlessly, enhance the applicability and vitality of digital currency.

The People's Bank in advancing digital currency research work with relevant international agencies, Internet companies to establish a communication link with the domestic and foreign financial institutions, traditional card-based payment institutions were widely discussed. At home and abroad to participate in discussions of attention to this work, and related research on expert theory, practice and exploration and development path with the people in the banking system conducted in-depth exchanges.

Which was raidly followed by yet another belessing from The IMF:

- *IMF’S LAGARDE SAYS VIRTUAL CURRENCIES ARE EXTREMELY BENEFICIAL

- *VIRTUAL CURRENCIES ALSO COULD BE DESTABILIZING: LAGARDE

The International Monetary Fund extolled the potential benefits of virtual currencies and said they warrant a more nuanced regulatory approach, at a time when the future of bitcoin, the most well-known example, is in doubt.

“Virtual currencies and their underlying technologies can provide faster and cheaper financial services, and can become a powerful tool for deepening financial inclusion in the developing world,” IMF Managing Director Christine Lagarde said in a statement Wednesday to accompany the report.

"The challenge will be how to reap all these benefits and at the same time prevent illegal uses, such as money laundering, terror financing, fraud and even circumvention of capital controls.”

* * *

However, as we detailed previously. there are three enormous flaws in this thinking.

One is that households and businesses have cash to hoard. The reality is the bottom 90 percent of households have less income now than they did fifteen years ago, which means their spending has declined not from hoarding but from declining income.

While corporate America has basked in the glory of sharply rising profits, small business has not prospered in the same fashion. Indeed, by some measures, small business has been in a six-year recession.

The bottom 90 percent has less income and faces higher living expenses, so only the top slice of households has any substantial cash. This top slice may see few safe opportunities to invest their savings, so they choose to keep their savings in cash rather than gamble it in a rigged casino (i.e., the stock market).

The second flaw is that hoarding cash is the only rational, prudent response in an era of financial repression and economic insecurity. What central banks are demanding — that we spend every penny of our earnings rather than save some for investments we control or emergencies — is counter to our best interests.

This leads to the third flaw: capital — which begins its life as savings — is the foundation of capitalism. If you attack savings as a scourge, you are attacking capitalism and upward mobility, for only those who save capital can invest it to build wealth. By attacking cash, the central banks and governments are attacking capital and upward mobility.

Those who already own the majority of productive assets are able to borrow essentially unlimited sums at near-zero interest rates, which they can use to buy more productive assets. Everyone else — the bottom 99.5 percent — is reduced to consumer-serfdom: you are not supposed to accumulate productive capital, you are supposed to spend every penny you earn on interest payments, goods, and services.

This inversion of capitalism dooms an economy to all the ills we are experiencing in abundance: rising income inequality, reduced opportunities for entrepreneurship, rising debt burdens, and a short-term perspective that voids the longer-term planning required to build sustainable productivity and wealth.

Benefits To Banks and the Government of Eliminating Physical Cash

The benefits to banks and governments by eliminating cash are self-evident:

- Every financial transaction can be taxed.

- Every financial transaction can be charged a fee.

- Bank runs are eliminated.

In fractional reserve systems such as ours, banks are only required to hold a fraction of their assets in cash. Thus a bank might only have 1 percent of its assets in cash. If customers fear the bank might be insolvent, they crowd the bank and demand their deposits in physical cash. The bank quickly runs out of physical cash and closes its doors, further fueling a panic.

The federal government began insuring deposits after the Great Depression triggered the collapse of hundreds of banks, and that guarantee limited bank runs, as depositors no longer needed to fear a bank closing would mean their money on deposit was lost.

But since people could conceivably sense a disturbance in the Financial Force and decide to turn digital cash into physical cash as a precaution, eliminating physical cash also eliminates the possibility of bank runs, as there will be no form of cash that isn’t controlled by banks.

So, when the dust has settled who ultimately benefits by this war on cash – government and the central banks, pure and simple.

- David Morgan: We Are On The Precipice

Submitted by Adam Taggart via PeakProsperity.com,

Precious metals guru David Morgan returns to address the great threat to the global financial/monetary system from derivative risk. He sees the world at an unprecedented moment in history where the interconnected nature of the global economy makes all players vulnerable to the mind-boggling volume of outstanding derivatives, which makes the sum of all world equity + debt look tiny in comparison (if you haven't seen it yet, look at this visual from The Money Project):

I want to give a very clear example that comes from gaming theory and I think this is a very concise and easy way for most people to understand our derivative risk exposure .

There are all kinds of gambling programs out there but one of the simplest ones before any computers was: you are at the roulette table (or you could be wherever, but roulette serves as the best analogy), and you bet a dollar on black and you lose. Then the next bet, you bet $2.00 and you lose. And then the next bet, you bet $4 and you lose. And the next bet, you bet $8 and you lose. The idea is that you keep betting on black, and eventually that's going to come up and you're going to win on the roulette table. The problem with that is this. You start to bet 2 4 8 16 32 64 128 256 and on and on, and what you are doing is you are betting $256. For what? To win a dollar. That is what you are doing. And that, Chris, I think is the best example I can give to the listeners about what we are doing in these derivatives.

This is based on simplified "delta hedging" which is fairly easy to understand. But now you've got these mathematicians out there writing these derivatives that make the example I just gave you look like child’s play. That's literally a fact. And these things are so interdependent and there is so much counter-party risk — that is, of course the biggest, issue — If you win the bet in the derivatives market, what happens if the counter party can’t pay you? That's what happened in 2008. People still don’t realize how close we were to the edge at that point because banks were not trusting each other or each other’s paper. So they weren’t trusting their counter-party. What happened was the Fed came in and said: Well, Bank A you don’t trust Bank Bs paper; Bank B you don’t trust Bank As paper — here's what we are going to do: I’ll take your paper. The Fed is taking these worthless mortgages and saying: We'll settle in T-bills. You like those things, don’t you? The answer is: Of course. What is better than a T-bill?

So then they settled out and, of course, this is where this whole expansion of the Fed’s balance sheet has taken place over the past several years. Everybody is happy because you have paper you can trust. But what happens when you don’t trust government paper? And Chris, that is really what is happening now. If you look at the foreign markets ,what has been going on is they basically have been dumping the dollar. The exchange stabilization fund has come in and sopped it up so it's not transparent to the markets unless you really know how to dig deep.

We are, in my view, in a place where the world has never been. We are on the precipice of a situation that is global in scope and — for all practical purposes — is going to effect almost everybody on the planet.

In this podcast, Chris and David also discuss the upcoming Solutions Conference in Las Vegas on February 22, where they will both be featured presenters. Those looking for more information about attending that conference can find it by clicking here.

Click the play button below to listen to Chris' interview with David Morgan (49m:51s)

- Why Oil Under $30 Is A Major Problem

Submitted by Gail Tverberg via Our Finite World blog,

A person often reads that low oil prices–for example, $30 per barrel oil prices–will stimulate the economy, and the economy will soon bounce back. What is wrong with this story? A lot of things, as I see it:

1. Oil producers can’t really produce oil for $30 per barrel.

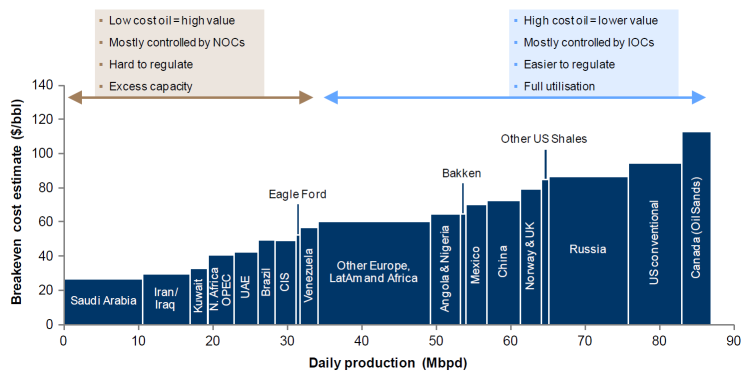

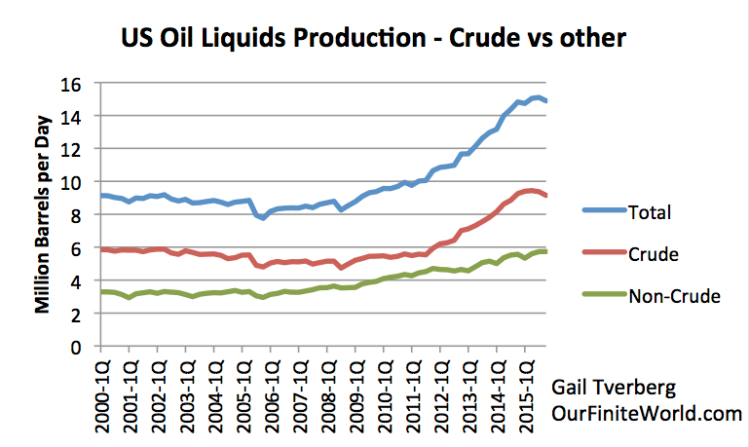

A few countries can get oil out of the ground for $30 per barrel. Figure 1 gives an approximation to technical extraction costs for various countries. Even on this basis, there aren’t many countries extracting oil for under $30 per barrel–only Saudi Arabia, Iran, and Iraq. We wouldn’t have much crude oil if only these countries produced oil.

Figure 1. Global breakeven prices (considering only technical extraction costs) versus production. Source: Alliance Bernstein, October 2014

2. Oil producers really need prices that are higher than the technical extraction costs shown in Figure 1, making the situation even worse.

Oil can only be extracted within a broader system. Companies need to pay taxes. These can be very high. Including these costs has historically brought total costs for many OPEC countries to over $100 per barrel.

Independent oil companies in non-OPEC countries also have costs other than technical extraction costs, including taxes and dividends to stockholders. Also, if companies are to avoid borrowing a huge amount of money, they need to have higher prices than simply the technical extraction costs. If they need to borrow, interest costs need to be considered as well.

3. When oil prices drop very low, producers generally don’t stop producing.

There are built-in delays in the oil production system. It takes several years to put a new oil extraction project in place. If companies have been working on a project, they generally won’t stop just because prices happen to be low. One reason for continuing on a project is the existence of debt that must be repaid with interest, whether or not the project continues.

Also, once an oil well is drilled, it can continue to produce for several years. Ongoing costs after the initial drilling are generally very low. These previously drilled wells will generally be kept operating, regardless of the current selling price for oil. In theory, these wells can be stopped and restarted, but the costs involved tend to deter this action.

Oil exporters will continue to drill new wells because their governments badly need tax revenue from oil sales to fund government programs. These countries tend to have low extraction costs; nearly the entire difference between the market price of oil and the price required to operate the oil company ends up being paid in taxes. Thus, there is an incentive to raise production to help generate additional tax revenue, if prices drop. This is the issue for Saudi Arabia and many other OPEC nations.

Very often, oil companies will purchase derivative contracts that protect themselves from the impact of a drop in market prices for a specified time period (typically a year or two). These companies will tend to ignore price drops for as long as these contracts are in place.

There is also the issue of employee retention. In a sense, a company’s greatest assets are its employees. Once these employees are lost, it will be hard to hire and retrain new employees. So employees are kept on as long as possible.

The US keeps raising its biofuel mandate, regardless of the price of oil. No one stops to realize that in the current over-supplied situation, the mandate adds to low price pressures.

One brake on the system should be the financial pain induced by low oil prices, but this braking effect doesn’t necessarily happen quickly. Oil exporters often have sovereign wealth funds that they can tap to offset low tax revenue. Because of the availability of these funds, some exporters can continue to finance governmental services for two or more years, even with very low oil prices.

Defaults on loans to oil companies should also act as a brake on the system. We know that during the Great Recession, regulators allowed commercial real estate loans to be extended, even when property valuations fell, thus keeping the problem hidden. There is a temptation for regulators to allow similar leniency regarding oil company loans. If this happens, the “braking effect” on the system is reduced, allowing the default problem to grow until it becomes very large and can no longer be hidden.

4. Oil demand doesn’t increase very rapidly after prices drop from a high level.

People often think that going from a low price to a high price is the opposite of going from a high price to a low price, in terms of the effect on the economy. This is not really the case.

4a. When oil prices rise from a low price to a high price, this generally means that production has been inadequate, with only the production that could be obtained at the prior lower price. The price must rise to a higher level in order to encourage additional production.

The reason that the cost of oil production tends to rise is because the cheapest-to-extract oil is removed first. Oil producers must thus keep adding production that is ever-more expensive for one reason or another: harder to reach location, more advanced technology, or needing additional steps that require additional human labor and more physical resources. Growing efficiencies can somewhat offset this trend, but the overall trend in the cost of oil production has been sharply upward since about 1999.

The rising price of oil has an adverse impact on affordability. The usual pattern is that after a rise in the price of oil, economies of oil importing nations go into recession. This happens because workers’ wages do not rise at the same time as oil prices. As a result, workers find that they cannot buy as many discretionary items and must cut back. These cutbacks in purchases create problems for businesses, because businesses generally have high fixed costs including mortgages and other debt payments. If these businesses are to continue to operate, they are forced to cut costs in one way or another. Cost reduction occurs in many ways, including reducing wages for workers, layoffs, automation, and outsourcing of manufacturing to cheaper locations.

For both employers and employees, the impact of these rapid changes often feels like a rug has been pulled out from under foot. It is very unpleasant and disconcerting.

4b. When prices fall, the situation that occurs is not the opposite of 4a. Employers find that thanks to lower oil prices, their costs are a little lower. Very often, they will try to keep some of these savings as higher profits. Governments may choose to raise tax rates on oil products when oil prices fall, because consumers will be less sensitive to such a change than otherwise would be the case. Businesses have no motivation to give up cost-saving techniques they have adopted, such as automation or outsourcing to a cheaper location.

Few businesses will construct new factories with the expectation that low oil prices will be available for a long time, because they realize that low prices are only temporary. They know that if oil prices don’t go back up in a fairly short period of time (months or a few years), the quantity of oil available is likely to drop precipitously. If sufficient oil is to be available in the future, oil prices will need to be high enough to cover the true cost of production. Thus, current low prices are at most a temporary benefit–something like the eye of a hurricane.

Since the impact of low prices is only temporary, businesses will want to adopt only changes that can take place quickly and can be easily reversed. A restaurant or bar might add more waiters and waitresses. A car sales business might add a few more salesmen because car sales might be better. A factory making cars might schedule more shifts of workers, so as to keep the number of cars produced very high. Airlines might add more flights, if they can do so without purchasing additional planes.

Because of these issues, the jobs that are added to the economy are likely to be mostly in the service sector. The shift toward outsourcing to lower-cost countries and automation can be expected to continue. Citizens will get some benefit from the lower oil prices, but not as much as if governments and businesses weren’t first in line to get their share of the savings. The benefit to citizens will be much less than if all of the people who were laid off in the last recession got their jobs back.

5. The sharp drop in oil prices in the last 18 months has little to do with the cost of production.

Instead, recent oil prices represent an attempt by the market to find a balance between supply and demand. Since supply doesn’t come down quickly in response to lower prices, and demand doesn’t rise quickly in response to lower prices, prices can drop very low–far below the cost of production.

As noted in Section 4, high oil prices tend to be recessionary. The primary way of offsetting recessionary forces is by directly or indirectly adding debt at low interest rates. With this increased debt, more homes and factories can be built, and more cars can be purchased. The economy can be forced to act in a more “normal” manner because the low interest rates and the additional debt in some sense counteract the adverse impact of high oil prices.

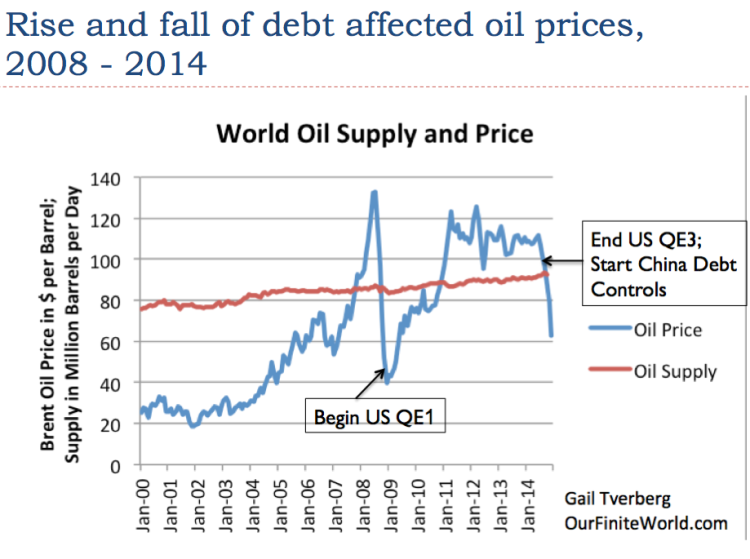

Oil prices dropped very low in 2008, as a result of the recessionary influences that take place when oil prices are high. It was only with the benefit of considerable debt-based stimulation that oil prices were gradually pumped back up to the $100+ per barrel level. This stimulation included US deficit spending, Quantitative Easing (QE) starting in December 2008, and a considerable increase in debt by the Chinese.

Commodity prices tend to be very volatile because we use such large quantities of them and because storage is quite limited. Supply and demand have to balance almost exactly, or prices spike higher or lower. We are now back to an “out of balance” situation, similar to where we were in late 2008. Our options for fixing the situation are more limited this time. Interest rates are already very low, and governments generally feel that they have as much debt as they can safely handle.

6. One contributing factor to today’s low oil prices is a drop-off in the stimulus efforts of 2008.

As noted in Section 4, high oil prices tend to be recessionary. As noted in Section 5, this recessionary impact can, at least to some extent, be offset by stimulus in the form of increased debt and lower interest rates. Unfortunately, this stimulus has tended to have adverse consequences. It encouraged overbuilding of both homes and factories in China. It encouraged a speculative rise in asset prices. It encouraged investments in enterprises of questionable profitability, including many investments in oil from US shale formations.

In response to these problems, the amount of stimulus is being reduced. The US discontinued its QE program and cut back its deficit spending. It even began raising interest rates in December 2015. China is also cutting back on the quantity of new debt it is adding.

Unfortunately, without the high level of past stimulus, it is difficult for the world economy to grow rapidly enough to keep the prices of all commodities, including oil, high. This is a major contributing factor to current low prices.

7. The danger with very low oil prices is that we will lose the energy products upon which our economy depends.

There are a number of different ways that oil production can be lost if low oil prices continue for an extended period.

In oil exporting countries, there can be revolutions and political unrest leading to a loss of oil production.

In almost any country, there can be a sharp reduction in production because oil companies cannot obtain debt financing to pay for more services. In some cases, companies may go bankrupt, and the new owners may choose not to extract oil at low prices.

There can also be systemwide financial problems that indirectly lead to much lower oil production. For example, if banks cannot be depended upon for payroll services, or to guarantee payment for international shipments, such problems would affect all oil companies, not just ones in financial difficulty.

Oil is not unique in its problems. Coal and natural gas are also experiencing low prices. They could experience disruptions indirectly because of continued low prices.

8. The economy cannot get along without an adequate supply of oil and other fossil fuel products.

We often read articles in the press that seem to suggest that the economy could get along without fossil fuels. For example, the impression is given that renewables are “just around the corner,” and their existence will eliminate the need for fossil fuels. Unfortunately, at this point in time, we are nowhere being able to get along without fossil fuels.

Food is grown and transported using oil products. Roads are made and maintained using oil and other energy products. Oil is our single largest energy product.

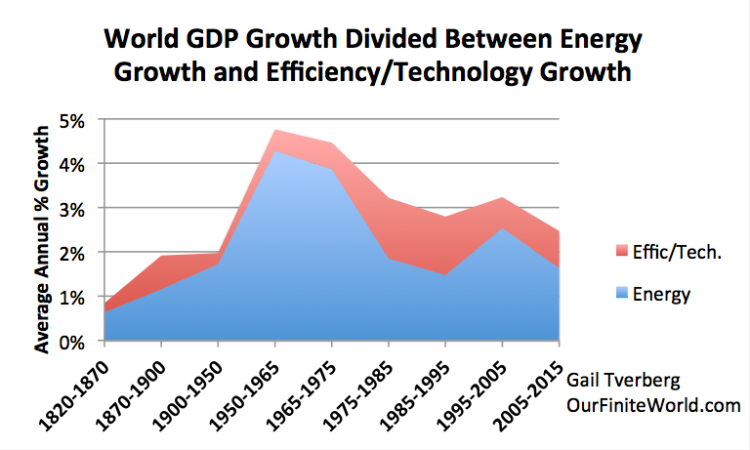

Experience over a very long period shows a close tie between energy use and GDP growth (Figure 3). Nearly all technology is made using fossil fuel products, so even energy growth ascribed to technology improvements could be considered to be available to a significant extent because of fossil fuels.

Figure 3. World GDP growth compared to world energy consumption growth for selected time periods since 1820. World real GDP trends from 1975 to present are based on USDA real GDP data in 2010$ for 1975 and subsequent. (Estimated by the author for 2015.) GDP estimates for prior to 1975 are based on Maddison project updates as of 2013. Growth in the use of energy products is based on a combination of data from Appendix A data from Vaclav Smil’s Energy Transitions: History, Requirements and Prospects together with BP Statistical Review of World Energy 2015 for 1965 and subsequent.

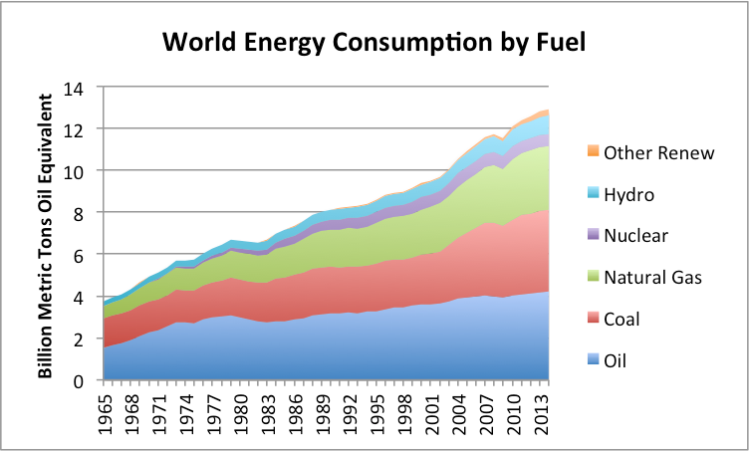

While renewables are being added, they still represent only a tiny share of the world’s energy consumption.

Figure 4. World energy consumption by part of the world, based on BP Statistical Review of World Energy 2015.

Thus, we are nowhere near a point where the world economy could continue to function without an adequate supply of oil, coal and natural gas.

9. Many people believe that oil prices will bounce back up again, and everything will be fine. This seems unlikely.

The growing cost of oil extraction that we have been encountering in the last 15 years represents one form of diminishing returns. Once the cost of making energy products becomes high, an economy is permanently handicapped. Prices higher than those maintained in the 2011-2014 period are really needed if extraction is to continue and grow. Unfortunately, such high prices tend to be recessionary. As a result, high prices tend to push demand down. When demand falls too low, prices tend to fall very low.

There are several ways to improve demand for commodities, and thus raise prices again. These include (a) increasing wages of non-elite workers (b) increasing the proportion of the population with jobs, and (c) increasing the amount of debt. None of these are moving in the “right” direction.

Joseph Tainter in The Collapse of Complex Societies points out that once diminishing returns set in, the response is more “complexity” to solve these problems. Government programs become more important, and taxes are often higher. Education of elite workers becomes more important. Businesses become larger. This increased complexity leads to more of the output of the economy being funneled to sectors of the economy other than the wages of non-elite workers. Because there are so many of these non-elite workers, their lack of buying power adversely affects demand for goods that use commodities, such as homes, cars, and motorcycles.1

Another force tending to hold down demand is a smaller proportion of the population in the labor force. There are many factors contributing to this: Young people are in school longer. The bulge of workers born after World War II is now reaching retirement age. Lagging wages make it increasingly difficult for young parents to afford childcare so that both can work.

As noted in Section 5, debt growth is no longer rising as rapidly as in the past. In fact, we are seeing the beginning of interest rate increases.

When we add to these problems the slowdown in growth in the Chinese economy and the new oil that Iran will be adding to the world oil supply, it is hard to see how the oil imbalance will be fixed in any reasonable time period. Instead, the imbalance seems likely to remain at a high level, or even get worse. With limited storage available, prices will tend to continue to fall.

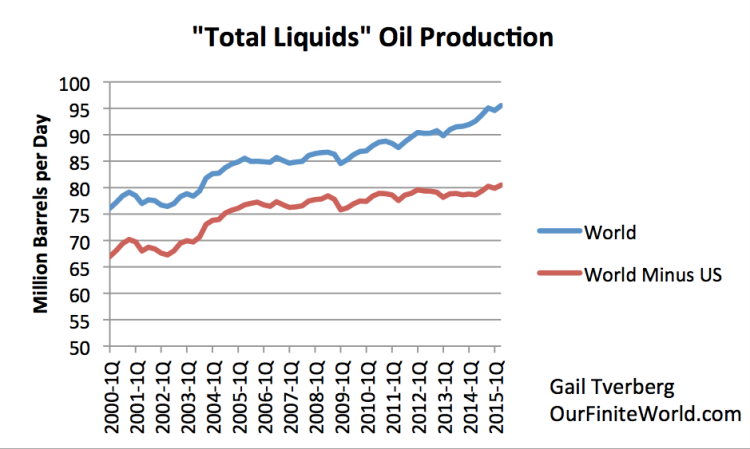

10. The rapid run up in US oil production after 2008 has been a significant contributor to the mismatch between oil supply and demand that has taken place since mid-2014.