- Internal War Is Now On The Horizon For America

Submitted by Brandon Smith via Alt-Market.com,

If internationalists were to get their way fully with the world and future historians write their analysis from a globalist perspective of the defunct American nation, they will probably say simply that our collapse was brought about by our own incompetence – that we were our own worst enemy. Yes, they would treat America as a cliché. They will of course leave out the destructive influences and engineered disasters of elitists, that would just complicate the narrative.

My hope is that we do not prove these future historians correct, and that they won’t have an opportunity to exist. My work has always been designed to help ensure that resistance thrives, but also that it is pursued in the most intelligent manner possible.

As I write this, China’s stock market has crashed 7% and was shut down by Chinese authorities who are once again initiating outright intervention to stem the tide. U.S. markets are quickly tracking lower. Oil is plummeting.

Relations between Saudi Arabia and Iran have turned ugly, with Iranian protesters overtaking the Saudi embassy and both sides vowing vengeance. Many Americans won’t care much about this because they think it has nothing to do with them. They don’t realize that Saudi Arabia has already publicly suggested a depeg from the U.S. dollar, effectively ending the decades-long relationship between the greenback and oil. The Iranian event and U.S. ties to both nations only make the fall of the dollar’s petro-status more likely in the near term. With the U.S. in the middle, "taking a side" will be a demand. I believe the U.S. government will NOT take a side, and this will elicit a furious response from Saudi Arabia (a currency depeg).

The Obama Administration has just made introductory announcements on new gun control measures through executive order. These announcements were rather light on details and heavy on crocodile tears. Their vagueness is clearly deliberate. Psychological evaluations, redefining who is a lawful firearms dealer, "expanding" background checks; all of these measures could be interpreted broadly to mean almost anything. We will probably know more in the coming weeks.

And in Oregon over the weekend, Ammon Bundy and friends lured hundreds of protesters under false pretenses using the Hammond family tragedy as a vehicle to then initiate a takeover of federal buildings that have no strategic or symbolic value, boxing themselves into a static position and proclaiming themselves to be the “tip of the spear” in the fight against corrupt government. In the meantime, anyone who questions the validity of this idea or the logic behind the “plan” is immediately labeled a coward and “keyboard warrior” by their supporters. Emotionally manipulative arguments abound because there are no tactically rational arguments to be made, which tells me that the plan was doomed before it was implemented.

As I wrote in my article “Oregon standoff a terrible plan that we might be stuck with,” some people (not many but some) in the liberty movement are desperately clamoring for a fight; and they don’t care if the circumstances are intelligently executed or idiotically executed. They only care if it kicks off.

I openly supported and aided the efforts at Bundy Ranch because the ranchers were defending their home from clear federal aggression. The Feds were direct invaders in that scenario. In Oregon, protesters are being perceived as the invaders, not the defenders — and all launched in the name of the Hammond family, who asked them NOT to artificially create a standoff. The two scenarios are polar opposites, and Oregon will end in a very different fashion.

I would just like to note that the Founding Fathers were smart enough to avoid deliberately trapping themselves in static positions on land that had no strategic or symbolic importance while inviting the British to "come and get them". Again, there are right ways and wrong ways to fight tyranny. Simply being willing to fight is not enough.

Now, if Americans are going to create standoff situations that could result in civil war they should do it over draconian gun control measures such as the use of classified government watch lists as grounds for denial of 2nd Amendment rights, rather than using a family who did not want armed support to begin with as a means to an end.

Keep in mind that watch lists are entirely arbitrary. There is no due process involved whatsoever, meaning you or I could walk into a gun store one day only to have our 4473 form denied because some bureaucrat in an office in D.C. decided we said something he doesn’t like and belong on a naughty list. The changing of gun dealer laws could be used to erase gun shows and private sales of firearms as well.

A standoff scenario based on these issues would be a much more practical concept than what is taking place in Oregon.

As our situation in this country becomes more precarious, there are going to be far more flashpoints than anyone will be able to keep track of. It is inevitable that a fight between corrupt elements of the U.S. government and regular people will erupt. I and other analysts have been warning people about this for years. I have been educating people on their preparedness options and tactical resources. I have been promoting community preparedness teams in my work with Oath Keepers and helping to organize such teams in my own part of the country. I even designed the first working thermal evasion suit available to civilians to give people half a chance against advanced weaponry. I have no illusions that a peaceful solution exists. I know that there is no such solution at this point in the game. But when the fighting starts, I also know that those who navigate the storm intelligently rather than allowing their emotions to get the best of them are more likely to survive and succeed.

I cannot say how quickly a crisis will develop. But, I can outline some of the many pitfalls you are going to come across as this storm rises.

False Leadership And Irrational Leadership

You are going to stumble across numerous gung ho activists and even politicians who will claim they have the one and only solution, that they are the real “tip of the spear.” First, if you feel compelled to seek out leaders on the mere basis that they have offered to lead you, then you need to do some soul searching. Become your own leader first. And then, if you meet someone with an excellent plan and a principled motive, give him the time of day, but don’t jump blindly into any situation.

If his plan seems poorly thought out, don’t follow him. If his agenda revolves around his own ego and a desire for personal glory, don’t follow him. If he focuses completely on the Obama administration and ignores the complicity of Republican leadership, don’t follow him. If all he talks about are the evils of the federal government but he ignores the puppet strings that lead to international banks and globalist organizations, don’t follow him. If he refuses to allow his initiatives to be questioned or discussed in a reasonable way, do not follow him. If he acts as if his ideas are sacrosanct and questions your “patriotism” when you do not immediately jump on the bandwagon, do not follow him. Remember, it is the job of this leadership to CONVINCE YOU of the legitimacy of their plan if they are seeking your support. The burden of evidence is on them. It is not your job to support them blindly just because you want to avoid being called a "sunshine patriot".

To summarize, if you are going to follow someone, know him well first, and make sure his planning is solid.

Hotheads And Imbeciles

I’ve found that there are two very frustrating extremes within the liberty movement: the people who embrace pacifism and who refuse to even consider the possibility of a violent conflict and self-defense, and the people who have delusions of being the next George Washington and are ready to dive headlong into any violent confrontation without thinking because they want to cement their own legacy. Neither of these groups seems to be able to treat each event as unique: some events requiring a diplomatic approach and some of them requiring the violence of action.

The pacifists are annoying, but they mostly hurt themselves in their lack of preparedness and a warrior’s mindset. The hotheads are the real problem. If you are only looking for a fight, then one will certainly find you; but any moron can trigger a standoff with the Feds. The point is to be able to make a move that matters in the long run. Hotheads cannot think beyond themselves and their immediate needs. They are like mosquitoes mindlessly hunting for blood. Strategic planning is impossible for them and they will destroy allies in the process of their pursuits.

I hate to say it, but there is a distinct possibility that our current generation of freedom advocates and freedom fighters may not live to see the future we are working toward. That better world built on liberty, individualism and voluntary community is something our children will thrive in, not us. If you are not fighting with a long term strategy in mind, then you have missed the entire point.

Factions And Tribes

Humans in crisis events tend to become more tribal in their associations in order to survive, and this is not necessarily a bad thing. I would rather live in a tribal world than under centralized corrupt government or global government any day. That said, if a “tribe” or faction does not respect the rights of the individual or uses unprovoked violence to achieve its goals, then it is no better than any other tyranny. Never trade safety for tyranny, regardless of the difficulties ahead.

The upside is tyrants of small tribes are easier to deal with than tyrants of large nations. They are no more bulletproof than anyone else, and they don’t have the resources to prevent reprisal if they hurt the wrong people.

Expect that families, neighborhoods, towns, churches, gangs and activist groups will rally around each other as a way to provide security. If you do not already have friends and family on board with your way of thinking, you will be isolated, making survival far more difficult if a breakdown does occur.

Governments Will Not Disappear

I can think of very few scenarios in history in which a crisis or collapse immediately facilitated the fall of the government in power. Rather, the government usually morphs into something else, something more dangerous. In fact, crisis is often the prime excuse used by corrupt officials to rationalize greater controls on the population. This in turn acts as a catalyst for more rebellion, which in turn acts as a vindication of the government’s tyranny.

Does this mean people should not rebel against tyranny? No, it means that we have to fight smart and retain the moral high ground at all times. We must act in a way that exposes the true nature of corrupt government, rather than giving them more ammunition to shoot us down with in the public eye. Above all, if we fight we must fight TO WIN. This means not deliberately searching for an Alamo. Martyrs are ultimately useless in this kind of war because if we lose, no one will remember them anyway. Glory seekers and self-proclaimed prophets will only lead people to disaster.

Develop a tactical mindset because the future will require tactical minds. Maintain your principles no matter the threats ahead. Retain your humanity. But also, when the fight begins, fight with the intention of victory. Choose your ground wisely.

- Martin Shkreli Secures Bail With $45 Million E*Trade Account, Demands Respect From Wu-Tang Clan

“I bought the most expensive album in the history of mankind and fucking RZA is talking shit behind my back and online in plain sight. If I hand you $2 million, fucking show me some respect.”

That’s a quote from the incomparable Martin Shkreli who is upset with the Wu-Tang Clan from whom he purchased a one-of-a-kind double disc for $2 million last year.

RZA, the group’s frontman if not its most famous member, found himself in a bit of an awkward scenario when news of the sale hit the wires.

When the deal was done, Shkreli had not yet become a household name. In other words, it wasn’t apparent to RZA that the soon-to-be proud owner of the one and only copy of “Once Upon A Time In Shaolin” would soon become public enemy number one in America on the way to being arrested for fraud.

“I met him, we had a brief lunch, and he did mention his love of hip-hop,” RZA said in the interview with Bloomberg. “I didn’t get a chance to read him.”

In the wake of the Daraprim fiasco which saw Shkreli raise the price of a drug he acquired from $13.50 to $750 a pill, Wu-Tang decided to donate “a significant portion” of the proceeds to charity.

Even as RZA isn’t particularly enamored with Shkreli’s drug pricing practices, the producer says he doesn’t regret doing the deal. “He bought it, he can do what he wants,” RZA told Bloomberg TV’s John Heilemann.”The beautiful thing about art, from my standpoint, is that it has no discrimination. What we’ve done is historical, and you can’t remove that.”

No, you can’t, and neither can you “remove” the bad taste Shkreli’s Daraprim price hike left in America’s mouth which is why when it came time to set bail, no one was in a forgiving mood. The price of (temporary) freedom for America’s “most hated man”: $5 million.

Unfortunately, the bail bondsman didn’t accept Wu-Tang albums as collateral and so, Shkreli put up his E*Trade account instead. The account’s value is said to be $45 million.

“Martin Shkreli put up his $45 million E*Trade account to secure $5 million bail after federal authorities arrested him on fraud charges last month,” Bloomberg reports. “Shkreli was ordered to disclose how that bond is secured and prosecutors filed papers Thursday stating Shkreli has a brokerage account worth eight figures,” NY Daily News adds. “E*Trade has been ordered to notify prosecutors if the balance of the brokerage account dips below $5 million — which would jeopardize the bail bond and Shkreli’s freedom.”

We wonder if Martin, like the E*Trade-ing Joe Campbell whose short position in KBIO blew up when Shkreli acquired more than half of the float back in November, will start a GoFundMe page in the event his collapsing holdings leave him a few million short on the bail bond.

* * *

RZA talks Shkreli and Trump with Bloomberg Business

- 2016: Oil Limits & The End Of The Debt Supercycle

Submitted by Gail Tverberg via Our Finite World blog,

What is ahead for 2016? Most people don’t realize how tightly the following are linked:

- Growth in debt

- Growth in the economy

- Growth in cheap-to-extract energy supplies

- Inflation in the cost of producing commodities

- Growth in asset prices, such as the price of shares of stock and of farmland

- Growth in wages of non-elite workers

- Population growth

It looks to me as though this linkage is about to cause a very substantial disruption to the economy, as oil limits, as well as other energy limits, cause a rapid shift from the benevolent version of the economic supercycle to the portion of the economic supercycle reflecting contraction. Many people have talked about Peak Oil, the Limits to Growth, and the Debt Supercycle without realizing that the underlying problem is really the same–the fact the we are reaching the limits of a finite world.

There are actually a number of different kinds of limits to a finite world, all leading toward the rising cost of commodity production. I will discuss these in more detail later. In the past, the contraction phase of the supercycle seems to have been caused primarily by too high population relative to resources. This time, depleting fossil fuels–particularly oil–plays a major role. Other limits contributing to the end of the current debt supercycle include rising pollution and depletion of resources other than fossil fuels.

The problem of reaching limits in a finite world manifests itself in an unexpected way: slowing wage growth for non-elite workers. Lower wages mean that these workers become less able to afford the output of the system. These problems first lead to commodity oversupply and very low commodity prices. Eventually these problems lead to falling asset prices and widespread debt defaults. These problems are the opposite of what many expect, namely oil shortages and high prices. This strange situation exists because the economy is a networked system. Feedback loops in a networked system don’t necessarily work in the way people expect.

I expect that the particular problem we are likely to reach in 2016 is limits to oil storage. This may happen at different times for crude oil and the various types of refined products. As storage fills, prices can be expected to drop to a very low level–less than $10 per barrel for crude oil, and correspondingly low prices for the various types of oil products, such as gasoline, diesel, and asphalt. We can then expect to face a problem with debt defaults, failing banks, and failing governments (especially of oil exporters).

The idea of a bounce back to new higher oil prices seems exceedingly unlikely, in part because of the huge overhang of supply in storage, which owners will want to sell, keeping supply high for a long time. Furthermore, the underlying cause of the problem is the failure of wages of non-elite workers to rise rapidly enough to keep up with the rising cost of commodity production, particularly oil production. Because of falling inflation-adjusted wages, non-elite workers are becoming increasingly unable to afford the output of the economic system. As non-elite workers cut back on their purchases of goods, the economy tends to contract rather than expand. Efficiencies of scale are lost, and debt becomes increasingly difficult to repay with interest. The whole system tends to collapse.

How the Economic Growth Supercycle Works, in an Ideal Situation

In an ideal situation, growth in debt tends to stimulate the economy. The availability of debt makes the purchase of high-priced goods such as factories, homes, cars, and trucks more affordable. All of these high-priced goods require the use of commodities, including energy products and metals. Thus, growing debt tends to add to the demand for commodities, and helps keep their prices higher than the cost of production, making it profitable to produce these commodities. The availability of profits encourages the extraction of an ever-greater quantity of energy supplies and other commodities.

The growing quantity of energy supplies made possible by this profitability can be used to leverage human labor to an ever-greater extent, so that workers become increasingly productive. For example, energy supplies help build roads, trucks, and machines used in factories, making workers more productive. As a result, wages tend to rise, reflecting the greater productivity of workers in the context of these new investments. Businesses find that demand for their goods and services grows because of the growing wages of workers, and governments find that they can collect increasing tax revenue. The arrangement of repaying debt with interest tends to work well in this situation. GDP grows sufficiently rapidly that the ratio of debt to GDP stays relatively flat.

Over time, the cost of commodity production tends to rise for several reasons:

- Population tends to grow over time, so the quantity of agricultural land available per person tends to fall. Higher-priced techniques (such as irrigation, better seeds, fertilizer, pesticides, herbicides) are required to increase production per acre. Similarly, rising population gives rise to a need to produce fresh water using increasingly high-priced techniques, such as desalination.

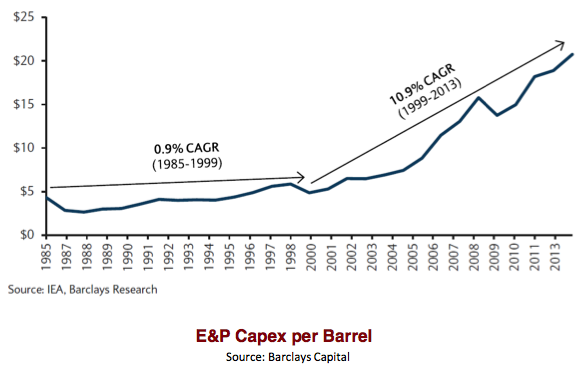

- Businesses tend to extract the least expensive fuels such as oil, coal, natural gas, and uranium first. They later move on to more expensive to extract fuels, when the less-expensive fuels are depleted. For example, Figure 1 shows the sharp increase in the cost of oil extraction that took place about 1999.

- Pollution tends to become an increasing problem because the least polluting commodity sources are used first. When mitigations such as substituting renewables for fossil fuels are used, they tend to be more expensive than the products they are replacing. The leads to the higher cost of final products.

- Overuse of resources other than fuels becomes a problem, leading to problems such as the higher cost of producing metals, deforestation, depleted fish stocks, and eroded topsoil. Some workarounds are available, but these tend to add costs as well.

As long as the cost of commodity production is rising only slowly, its increasing cost is benevolent. This increase in cost adds to inflation in the price of goods and helps inflate away prior debt, so that debt is easier to pay. It also leads to asset inflation, making the use of debt seem to be a worthwhile approach to finance future economic growth, including the growth of energy supplies. The whole system seems to work as an economic growth pump, with the rising wages of non-elite workers pushing the growth pump along.

The Big “Oops” Comes when the Price of Commodities Starts Rising Faster than Wages of Non-Elite Workers

Clearly the wages of non-elite workers need to be rising faster than commodity prices in order to push the economic growth pump along. The economic pump effect is lost when the wages of non-elite workers start falling, relative to the price of commodities. This tends to happen when the cost of commodity production begins rising rapidly, as it did for oil after 1999 (Figure 1).

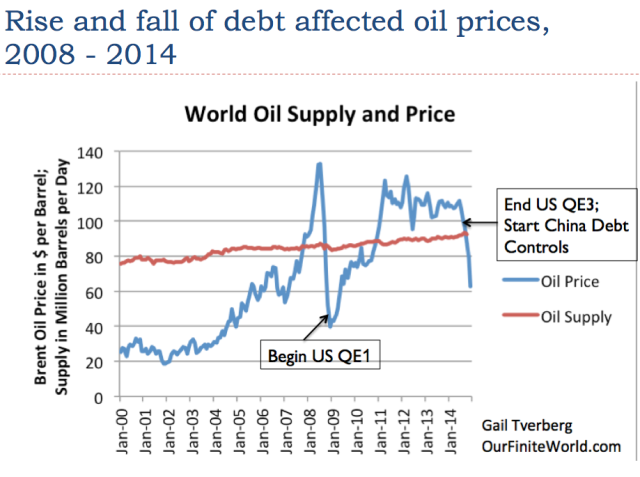

The loss of the economic pump effect occurs because the rising cost of oil (or electricity, or food, or other energy products) forces workers to cut back on discretionary expenditures. This is what happened in the 2003 to 2008 period as oil prices spiked and other energy prices rose sharply. (See my article Oil Supply Limits and the Continuing Financial Crisis.) Non-elite workers found it increasingly difficult to afford expensive products such as homes, cars, and washing machines. Housing prices dropped. Debt growth slowed, leading to a sharp drop in oil prices and other commodity prices.

It was somewhat possible to “fix” low oil prices through the use of Quantitative Easing (QE) and the growth of debt at very low interest rates, after 2008. In fact, these very low interest rates are what encouraged the very rapid growth in the production of US crude oil, natural gas liquids, and biofuels.

Now, debt is reaching limits. Both the US and China have (in a sense) “taken their foot off the economic debt accelerator.” It doesn’t seem to make sense to encourage more use of debt, because recent very low interest rates have encouraged unwise investments. In China, more factories and homes have been built than the market can absorb. In the US, oil “liquids” production rose faster than it could be absorbed by the world market when prices were over $100 per barrel. This led to the big price drop. If it were possible to produce the additional oil for a very low price, say $20 per barrel, the world economy could probably absorb it. Such a low selling price doesn’t really “work” because of the high cost of production.

Debt is important because it can help an economy grow, as long as the total amount of debt does not become unmanageable. Thus, for a time, growing debt can offset the adverse impact of the rising cost of energy products. We know that oil prices began to rise sharply in the 1970s, and in fact other energy prices rose as well.

Looking at debt growth, we find that it rose rapidly, starting about the time oil prices started spiking. Former Director of the Office of Management and Budget, David Stockman, talks about “The Distastrous 40-Year Debt Supercycle,” which he believes is now ending.

Figure 4. Worldwide average inflation-adjusted annual growth rates in debt and GDP, for selected time periods. See post on debt for explanation of methodology.

In recent years, we have been reaching a situation where commodity prices have been rising faster than the wages of non-elite workers. Jobs that are available tend to be low-paid service jobs. Young people find it necessary to stay in school longer. They also find it necessary to delay marriage and postpone buying a car and home. All of these issues contribute to the falling wages of non-elite workers. Some of these individuals are, in fact, getting zero wages, because they are in school longer. Individuals who retire or voluntarily leave the work force further add to the problem of wages no longer rising sufficiently to afford the output of the system.

The US government has recently decided to raise interest rates. This further reduces the buying power of non-elite workers. We have a situation where the “economic growth pump,” created through the use of a rising quantity of cheap energy products plus rising debt, is disappearing. While homes, cars, and vacation travel are available, an increasing share of the population cannot afford them. This tends to lead to a situation where commodity prices fall below the cost of production for a wide range of types of commodities, making the production of commodities unprofitable. In such a situation, a person expects companies to cut back on production. Many defaults may occur.

China has acted as a major growth pump for the world for the last 15 years, since it joined the World Trade Organization in 2001. China’s growth is now slowing, and can be expected to slow further. Its growth was financed by a huge increase in debt. Paying back this debt is likely to be a problem.

Thus, we seem to be coming to the contraction portion of the debt supercycle. This is frightening, because if debt is contracting, asset prices (such as stock prices and the price of land) are likely to fall. Banks are likely to fail, unless they can transfer their problems to others–owners of the bank or even those with bank deposits. Governments will be affected as well, because it will become more expensive to borrow money, and because it becomes more difficult to obtain revenue through taxation. Many governments may fail as well for that reason.

The U. S. Oil Storage Problem

Oil prices began falling in the middle of 2014, so we might expect oil storage problems to start about that time, but this is not exactly the case. Supplies of US crude oil in storage didn’t start rising until about the end of 2014.

Once crude oil supplies started rising rapidly, they increased by about 90 million barrels between December 2014 and April 2015. After April 2015, supplies dipped again, suggesting that there is some seasonality to the growing crude oil supply. The most “dangerous” time for rapidly rising amounts added to storage would seem to be between December 31 and April 30. According to the EIA, maximum crude oil storage is 551 million barrels of crude oil (considering all storage facilities). Adding another 90 million barrels of oil (similar to the run-up between Dec. 2014 and April 2015) would put the total over the 551 million barrel crude oil capacity.

Cushing, Oklahoma, is the largest storage area for crude oil. According to the EIA, maximum working storage for the facility is 73 million barrels. Oil storage at Cushing since oil prices started declining is shown in Figure 7.

Figure 7. Quantity of crude oil stored at Cushing between June 27, 2014, and June 1, 2016, based on EIA data.

Clearly the same kind of run up in oil storage that occurred between December and April one year ago cannot all be stored at Cushing, if maximum working capacity is only 73 million barrels, and the amount currently in storage is 64 million barrels.

Another way of storing oil is as finished products. Here, the run-up in storage began earlier (starting in mid-2014) and stabilized at about 65 million barrels per day above the prior year, by January 2015. Clearly, if companies can do some pre-planning, they would prefer not to refine products for which there is little market. They would rather store unneeded oil as crude, rather than as refined products.

EIA indicates that the total capacity for oil products is 1,549 million barrels. Thus, in theory, the amount of oil products stored can be increased by as much as 700 million barrels, assuming that the products needing to be stored and the locations where storage are available match up exactly. In practice, the amount of additional storage available is probably quite a bit less than 700 million barrels because of mismatch problems.

In theory, if companies can be persuaded to refine more products than they can sell, the amount of products that can be stored can rise significantly. Even in this case, the amount of storage is not unlimited. Even if the full 700 million barrels of storage for crude oil products is available, this corresponds to less than one million barrels a day for two years, or two million barrels a day for one year. Thus, products storage could easily be filled as well, if demand remains low.

At this point, we don’t have the mismatch between oil production and consumption fixed. In fact, both Iraq and Iran would like to increase their production, adding to the production/consumption mismatch. China’s economy seems to be stalling, keeping its oil consumption from rising as quickly as in the past, and further adding to the supply/demand mismatch problem. Figure 9 shows an approximation to our mismatch problem. As far as I can tell, the problem is still getting worse, not better.

There has been a lot of talk about the United States reducing its production, but the impact so far has been small, based on data from EIA’s International Energy Statistics and its December 2015 Monthly Energy Review.

Figure 10. US quarterly oil liquids production data, based on EIA’s International Energy Statistics and Monthly Energy Review.

Based on information through November from EIA’s Monthly Energy Review, total liquids production for the US for the year 2015 will be over 800,000 barrels per day higher than it was for 2014. This increase is likely greater than the increase in production by either Saudi Arabia or Iraq. Perhaps in 2016, oil production of the US will start decreasing, but so far, increases in biofuels and natural gas liquids are partly offsetting recent reductions in crude oil production. Also, even when companies are forced into bankruptcy, oil production does not necessarily stop because of the potential value of the oil to new owners.

Figure 11 shows that very high stocks of oil were a problem, way back in the 1920s. There were other similarities to today’s problems as well, including a deflating debt bubble and low commodity prices. Thus, we should not be too surprised by high oil stocks now, when oil prices are low.

Many people overlook the problems today because the US economy tends to be doing better than that of the rest of the world. The oil storage problem is really a world problem, however, reflecting a combination of low demand growth (caused by low wage growth and lack of debt growth, as the world economy hits limits) continuing supply growth (related to very low interest rates making all kinds of investment appear profitable and new production from Iraq and, in the near future, Iran). Storage on ships is increasingly being filled up and storage in Western Europe is 97% filled. Thus, the US is quite likely to see a growing need for oil storage in the year ahead, partly because there are few other places to put the oil, and partly because the gap between supply and demand has not yet been fixed.

What is Ahead for 2016?

- Problems with a slowing world economy are likely to become more pronounced, as China’s growth problems continue, and as other commodity-producing countries such as Brazil, South Africa, and Australia experience recession. There may be rapid shifts in currencies, as countries attempt to devalue their currencies, to try to gain an advantage in world markets. Saudi Arabia may decide to devalue its currency, to get more benefit from the oil it sells.

- Oil storage seems likely to become a problem sometime in 2016. In fact, if the run-up in oil supply is heavily front-ended to the December to April period, similar to what happened a year ago, lack of crude oil storage space could become a problem within the next three months. Oil prices could fall to $10 or below. We know that for natural gas and electricity, prices often fall below zero when the ability of the system to absorb more supply disappears. It is not clear the oil prices can fall below zero, but they can certainly fall very low. Even if we can somehow manage to escape the problem of running out of crude oil storage capacity in 2016, we could encounter storage problems of some type in 2017 or 2018.

- Falling oil prices are likely to cause numerous problems. One is debt defaults, both for oil companies and for companies making products used by the oil industry. Another is layoffs in the oil industry. Another problem is negative inflation rates, making debt harder to repay. Still another issue is falling asset prices, such as stock prices and prices of land used to produce commodities. Part of the reason for the fall in price has to do with the falling price of the commodities produced. Also, sovereign wealth funds will need to sell securities, to have money to keep their economies going. The sale of these securities will put downward pressure on stock and bond prices.

- Debt defaults are likely to cause major problems in 2016. As noted in the introduction, we seem to be approaching the unwinding of a debt supercycle. We can expect one company after another to fail because of low commodity prices. The problems of these failing companies can be expected to spread to the economy as a whole. Failing companies will lay off workers, reducing the quantity of wages available to buy goods made with commodities. Debt will not be fully repaid, causing problems for banks, insurance companies, and pension funds. Even electricity companies may be affected, if their suppliers go bankrupt and their customers become less able to pay their bills.

- Governments of some oil exporters may collapse or be overthrown, if prices fall to a low level. The resulting disruption of oil exports may be welcomed, if storage is becoming an increased problem.

- It is not clear that the complete unwind will take place in 2016, but a major piece of this unwind could take place in 2016, especially if crude oil storage fills up, pushing oil prices to less than $10 per barrel.

- Whether or not oil storage fills up, oil prices are likely to remain very low, as the result of rising supply, barely rising demand, and no one willing to take steps to try to fix the problem. Everyone seems to think that someone else (Saudi Arabia?) can or should fix the problem. In fact, the problem is too large for Saudi Arabia to fix. The United States could in theory fix the current oil supply problem by taxing its own oil production at a confiscatory tax rate, but this seems exceedingly unlikely. Closing existing oil production before it is forced to close would guarantee future dependency on oil imports. A more likely approach would be to tax imported oil, to keep the amount imported down to a manageable level. This approach would likely cause the ire of oil exporters.

- The many problems of 2016 (including rapid moves in currencies, falling commodity prices, and loan defaults) are likely to cause large payouts of derivatives, potentially leading to the bankruptcies of financial institutions, as they did in 2008. To prevent such bankruptcies, most governments plan to move as much of the losses related to derivatives and debt defaults to private parties as possible. It is possible that this approach will lead to depositors losing what appear to be insured bank deposits. At first, any such losses will likely be limited to amounts in excess of FDIC insurance limits. As the crisis spreads, losses could spread to other deposits. Deposits of employers may be affected as well, leading to difficulty in paying employees.

- All in all, 2016 looks likely to be a much worse year than 2008 from a financial perspective. The problems will look similar to those that might have happened in 2008, but didn’t thanks to government intervention. This time, governments appear to be mostly out of approaches to fix the problems.

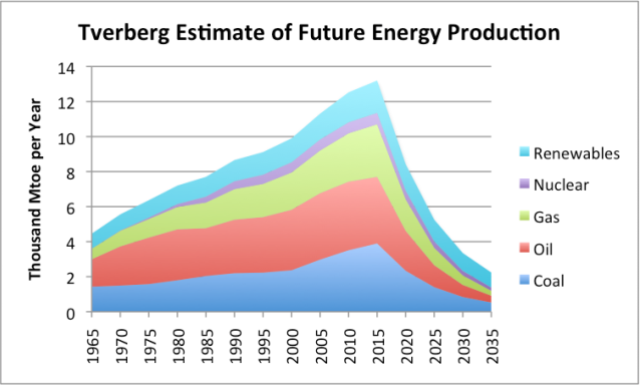

- Two years ago, I put together the chart shown as Figure 12. It shows the production of all energy products declining rapidly after 2015. I see no reason why this forecast should be changed. Once the debt supercycle starts its contraction phase, we can expect a major reduction in both the demand and supply of all kinds of energy products.

Figure 12. Estimate of future energy production by author. Historical data based on BP adjusted to IEA groupings.

Conclusion

We are certainly entering a worrying period. We have not really understood how the economy works, so we have tended to assume we could fix one or another part of the problem. The underlying problem seems to be a problem of physics. The economy is a dissipative structure, a type of self-organizing system that forms in thermodynamically open systems. As such, it requires energy to grow. Ultimately, diminishing returns with respect to human labor–what some of us would call falling inflation-adjusted wages of non-elite workers–tends to bring economies down. Thus all economies have finite lifetimes, just as humans, animals, plants, and hurricanes do. We are in the unfortunate position of observing the end of our economy’s lifetime.

Most energy research to date has focused on the Second Law of Thermodynamics. While this is a contributing problem, this is really not the proximate cause of the impending collapse. The Second Law of Thermodynamics operates in thermodynamically closed systems, which is not precisely the issue here.

We know that historically collapses have tended to take many years. This collapse may take place more rapidly because today’s economy is dependent on international supply chains, electricity, and liquid fuels–things that previous economies were not dependent on.

- "The Jihadists Will Attack Europe": Leaked Phone Call Shows Gaddafi Warned Tony Blair Of Terror Attacks

On Wednesday, we took a close look at the battle for Libya’s oil.

Libya, much like Syria, is a case study in why the West would be better off not intervening in the affairs of sovereign states on the way to bringing about regime change. “Toppling dictators” sounds good in principle, but at the end of the day, it’s nearly impossible to predict what will emerge from the power vacuums the US creates when Washington destabilizes governments.

Post-Baathist Iraq is rife with sectarian discord, a post-Assad Syria would likely be an even bloodier free-for-all than it already is, and post-Gaddafi Libya is a failed state with two governments each claiming legitimacy. These types of environments are exploitable by extremists eager to capitalize on the chaos by seizing resources and, ultimately, power.

Just today for instance, nearly 50 people were killed in Libya when a truck bomb hit a police training center where recruits were holding a morning meeting. “Mayor Miftah Hamadi said the truck bomb detonated as around 400 recruits were gathering in the early morning at the police center in Zliten, a coastal town between the capital Tripoli and the port of Misrata,” Reuters reports, adding that “the Zliten blast was the worst since an attack in February last year when three car bombs hit the eastern city of Qubbah, killing 40 people in what officials described as a revenge attack for Egyptian air strikes on Islamist militant targets.”

“It was horrific, the explosion was so loud it was heard from miles away,” Hamadi told Reuters by phone. “All the victims were young, and all about to start their lives.”

The blast was the deadliest since Gaddafi’s ouster and comes as militants loyal to Ibrahim Jadhran battle ISIS for control of key oil fields and ports. Islamic State’s presence in Libya has grown and the group may be looking to supplement oil income lost to Russian airstrikes in Syria with sales of Libyan crude.

Who could have seen all of this – including the Paris attacks – coming, you ask? Well, Muammar Gaddafi for one.

According to The Telegraph, Gaddafi warned Tony Blair that jihadists would one day attack Europe in the event his government fell. “Gaddafi’s dire prediction was made in two desperate telephone calls with Mr Blair on February 25, 2011 – as civil war was engulfing Libya,” The Telegraph writes. “In the first call at 11:15am, Gaddafi said: “They [jihadists] want to control the Mediterranean and then they will attack Europe.” Here’s more:

In a second call made a little over four hours later, Gaddafi told Mr Blair: “I will have to arm the people and get ready for a fight. Libyan people will die, damage will be on the Med, Europe and the whole world. These armed groups are using the situation [in Libya] as a justification – and we shall fight them.”

Mr Blair had made two calls to Gaddafi to try to negotiate the dictator’s departure from Tripoli as civil war engulfed the nation. Three weeks later, a Nato-led coaltion that included Britain, began bombing raids that led to the overthrow of Gaddafi. The dictator was finally deposed in August and murdered by a mob in October.

This is what Gaddafi got for his trouble:

So much for this:

You’ll recall that Bashar al-Assad also warned Europe that destabilizing governments was a recipe for disaster. “We said, don’t take what is happening in Syria lightly,” Assad said, in the wake of the Paris attacks.

“Unfortunately, European officials did not listen,” he added.

- Russell Napier Explains How The Decline Of The Yuan Destroys Belief In Central Banking

From Russell Napier of ERI-C

It’s Not a Pet, It’s a Falcon: How the decline of the RMB destroys belief in central banking and a successful reflation

Turning and turning in the widening gyre

The falcon cannot hear the falconer;

Things fall apart; the centre cannot hold;– The Second Coming- W.B. Yeats

First catch your falcon, as the formidable Mrs Beeton might have said if she was in need of a method of catching her main course (see Mrs Beeton’s Book of Household Management 1861- ‘Recipe for Jugged Hare’).

Having caught your wild falcon, you can now begin the training process. You are attempting to impose your will upon a creature that, in its wild state, catches, kills and devours other birds. This is creative destruction in its rawest form as those acts of savagery provide the fuel to keep our falcon flying. Taming such wild forces is not easy, whether they be birds of prey or the desires, wishes, greed and fear of millions of people determining prices through their supply and also their demand.

Let’s get some advice from the field of falconry for our central bankers, and the other handmaidens of state control, as they seek to impose their wishes on the will and acts of millions-

‘Falconry is a great sport, but there is a lot of time involved. You will want to have enough time to train your bird. If you don’t have the time, or the willingness, then you might as well not do it at all. If you are one of those people who is not patient, falconry may not be for you. You should not take up falconry if you want the falcon as a pet, or something to show off. Falcons can’t just be put in the closet when you are done with them. It takes time and commitment, but the reward in the end is worth it.’

(Source: WikiHow- How to Train Your Falcon)

A ‘great sport’ indeed, given the alternative sports open to government officials! Well, they have demonstrated that they have the time and they seem to have been born with the willingness, or at least picked it up pretty early in life. Patience just comes with the territory when you work for the government— there really isn’t much of an alternative. However, they do seem to have a problem when it comes to realizing that there is not much point in turning this wild thing, that exists to efficiently convert its kill into energy and life, into a pet ‘in the closet’.

The attempt to train the wild forces of supply and demand by the authorities has really ramped up since 2009. Just four trading days into 2016 the widening of the gyre makes it very obvious that they have failed to create a pet to do their bidding. The wild forces of supply and demand have sought to deliver deflation, at least since 2008, but the falconer has demanded the lift-off of inflation. In the first four trading days of January 2016 it has become even clearer that gravity wins and this bird will not fly.

Throughout 2015, in four quarterly reports for subscribers, this analyst explained that, no matter where you and might stand, this lever of nominal interest rates is simply insufficient to pivot the world into inflation. Those reports focused on what you should buy given that failure. The rest of this Fortnightly looks at the investment consequences of this failure and what investors should do when ‘the centre cannot hold’.

The key failure of control is in China because that failure will overwhelm other seeming successes. In 2012 this analyst labelled one chart “the most important chart in the world”. It was a chart of China’s foreign exchange reserves. It showed how they were declining and The Solid Ground postulated that this would produce a decline in real economic activity in China and higher real interest rates in the developed world. The result of these two forces would be deflation, despite the amount of wind puffed below the wings of the global economy in the form of QE.

Of course, no sooner had this report been issued than China’s grand falconer got to work by borrowing hundreds of billions of USD through its so-called commercial banking system! The alchemical process through which this mandated capital inflow supported the exchange rate while permitting money creation in China stabilized the global economy- for a while.

However, by 2014 it was ever more difficult to borrow more money than the people of China were desperate to export and the market began to win. Since then foreign reserves have been falling and the grand falconer has tried to support the exchange rate while simultaneously easing monetary policy to boost economic growth. I’m no falconer but isn’t this akin to trying to get a bird to fly while tying back its wings?

Some investors, well paid to believe six impossible things before breakfast, did not question the ability of the grand Chinese falconer to fly a falcon with tethered wings.

They changed their minds briefly as the bird plummeted earthwards in August 2015 but still the belief in the ability to reflate the economy and simultaneously support an overvalued exchange rate continued. In January 2016 this particular falcon, let’s call it the people’s falcon, was more ‘falling with attitude’ than flying.

This bird does not fly and if this bird does not fly the centre does not hold. A major devaluation of the RMB is just beginning and the faith in all the falconers will wane as deflation comes to the world almost seven years after the falconers first fanned the winds of QE supposed to levitate everything.

The failure to inflate is the failure to destroy debts to the benefit of equity. Investors should be underweight equity. Of course, the decline in corporate cash-flows, associated with deflation, is bad for interest cover and the price of corporate bonds. Some emerging markets (subscribers see Why Deflation Means Default 1Q 2015) will fail to repay their heavy foreign currency debt burdens. This is dreadful news for those running open-ended funds crammed full of illiquid credit instruments- some have closed and more will follow. The Solid Ground pointed out in 4Q last year that the US$34trn open-ended fund business is simply unfit for purpose in a world of waning liquidity. While this dreadful combination leads to a credit crunch that starts in the bond market it must inevitably also impact negatively upon banking systems. Banks, already de facto utilities for the financing of government, are very vulnerable to attack from thousands of bright kids in the fintech industry. Add to their structural demise the risk of credit quality issues and the growing fear of bail-ins by their bond holders (as subscribers know BRRD will be a huge Eurozone story in 2016) and this could get very messy.

If doctors swear each year to ‘first do no harm’, investors should begin 2016 by reciting ‘first own no banks’.

Investors who buy the bonds of governments that ultimately control the money-creation process should have an almost zero risk of not receiving their payments of principal and interest. These certain and fixed payments will grow in purchasing power during a deflation and thus their price will be bid up. This analyst remains sceptical as to whether this description of a fiat currency system applies to all those countries currently in the Eurozone.

‘Whatever it takes’ may ultimately be constitutionally impossible and the ECB may not be prepared to print sufficient Euros to ensure that every government of the Eurozone makes all payment of principal and interest. If that reality dawns then yield spreads widen in the Eurozone and ultimately your interest and principal may not be repaid in Euros.

For those investors who have to be in equities, North Asia is the only game in town. They, in the form of China, Japan and probably also South Korea, will win the currency wars. Their success in winning this game triggers the scale of deflation that generates the global credit crunch that is virtually inevitable as deflation takes hold. These jurisdictions may be somewhat alien to sound capital allocation, but they keep that capital humming at high rates of capacity, via devaluations, while more market-orientated systems see their assets under-utilized. This analyst prefers Japan (subscribers see Caught in a Trap 2Q 2015) where some shift to more efficient capital allocation is under way, but even the structurally anaemic corporate capital of China is likely to be bid up as the RMB declines in response to further and further economic stimulus- increasingly possible as the exchange rate is allowed to find its own level. This analyst has never invested in a Chinese equity as he is not sure that Chinese management know what equity is but bright stockpickers can find management in China that does. Hedging all North Asian currency exposure is essential.

If you had not noticed, 2016 has begun with gold and the USD rising simultaneously. This is different and important. This is very positive for gold and very bad for the world.

The rise of both together may signal that we have just entered that period when this inert non-yielding substance is preferred to those assets that promise a yield but where the scale of future payments is subject to considerable doubt. Also positive for gold, the advent of deflation, following the failure of the easy reflationary solutions promised by non-elected central bankers, will enfranchise aggressive acts of reflation by our elected representatives. When the tough get going then the going will really get tough- at least if you’re an owner of capital.

Any political fiat, when monetary fiat fails, will be tantamount, in some way or other, to an attempt to directly control the allocation of capital/savings. History shows that this commences a giant game of hide-and-seek, and while gold may shine brightly it is also moved freely in briefcases and is easily hidden. Paper assets are easily tracked, discovered, conscripted and ultimately denuded in value. For gold to rise while the USD also rises signals that investors are beginning to see through the terrible burden on the price of the shiny stuff from ever-rising real rates of interest extant since 2011. Real rates have further to rise but a few more days of a strong USD and a strong gold price means gold has probably entered a bull market that should last for decades rather than years; its value boosted initially by its ability to avoid conscription, but underpinned by the authorities’ mass mobilization of resources to ultimately generate inflation.

From 2009-2015 investors were well paid, at least in the developed world, to believe the most impossible of the six things before breakfast: that central bankers can subvert the desires, wishes, greed and fear of millions of people who set prices every day through their actions.

You now have two choices: keep believing the most impossible thing, or accept that the wild force that establishes market prices has not been tamed. It’s not a pet, it’s a falcon and ‘The falcon cannot hear the falconer’. The ‘people’s falcon’ may be the first to enter ‘a widening gyre’ but it won’t be the only wild force that refuses to be tamed in 2016.

- Here We Go Again: Chinese Stocks Plunge, Give Up Early Gains Despite Yuan Fix Unchanged

Update: *SHANGHAI COMPOSITE INDEX FALLS 2.04%(AFTER BEING UP 3.2%)

And CSI Futures are tumbling…

Not a pretty week…

Shifting notavkly from the opening color that we detailed earlier..

With all eyes on Chinese FX and equity markets, following the worst start to a year for US (and Chinese) stocks in history, PBOC decided (after 7 straight days of devaluation and 7% devaluation since August) to halt the run and increase Yuan fix by a paltry 0.01% to 6.5636 (notably below yesterday's 6.5939 CNY close). Offshore Yuan is strengthening and US equity markets are jumping. Chinese equity markets (now theoretically unhampered by their circuit-breaker panic switch) are far less impressed.

PBOC fixes the Yuan a tiny bit stronger…

Offshore Yuan roller-coastered through the US session as Reuters headlines sparked selling pressure after some Treasury-selling/Yuan-tervention…but is rallying on the not bad news…

Onshore-Offshore spread has tumbled to 900pips from over 1500…

Asian stocks are set for their worst week since 2011 with some notable names in big trouble:

- *NOBLE GROUP TUMBLES 10%, EXTENDING LOSS, AFTER S&P DOWNGRADE

While China ETFs trading in US markets signal notable weakness to come for an-"limited" Chinese stock market…

Chinese stocks look set for a positive open:

- *CHINA SHANGHAI COMPOSITE SET TO OPEN UP 2.2% TO 3,194.63

- *CHINA'S CSI 300 INDEX SET TO OPEN UP 2.4% TO 3,371.87

- *FTSE CHINA A50 INDEX RISES 2.17%

And Dow Futures love it… for now…

Some context:

So no news is good news for now…

Charts: Bloomberg

- Natural Gas Prices Signaling Oil Bottom for Investors

By EconMatters

Natural Gas Prices BottomedEveryone is trying to figure when the oil markets will bottom. Well lost in all the crazy action in markets globally is the nice resurgence off the bottom for natural gas prices. Natural Gas prices have essentially gone from $1.68 per MMBtu to $2.40 per MMBtu rather rapidly in the midst of a mild winter so far. The reason is that all those rig reductions are starting to affect the production of the commodity, less natural gas is coming to market relative to expectations.The Lag EffectThe lag effect in all those rig declines is starting to show up in the natural gas production numbers, and although the cut in oil rigs hasn`t shown up yet in oil production in a meaningful way, it is just around the corner over the next three months by my calculation. We should start to experience some meaningful U.S. Oil Production cuts by late March and early April which will solidify the fact that the oil market had long sense bottomed in January of this year.RigsFri, January 01, 2016Change fromlast weeklast yearOil rigs536-0.37%-63.83%Natural gas rigs1620.00%-50.61%Miscellaneous00.00%-100.00%Rig numbers by typeFri, January 01, 2016Change fromlast weeklast yearVertical893.49%-70.33%Horizontal549-0.90%-58.91%Directional600.00%-65.71%Source: Baker Hughes Inc.Working gas in underground storageStocks

billion cubic feet (bcf)Region2016-01-012015-12-25changeEast857876-19Midwest9831,025-42Mountain185195-10Pacific381382-1South Central1,3471,3407Total3,6433,756-113Source: U.S. Energy Information AdministrationMarket InvestmentBy the time everyone realizes that the oil market has bottomed it is too late to make the real good, easy money off the bottom, just like in natural gas prices. You have to be willing to step in and take the risk that prices haven`t bottomed. You basically are getting paid to buy when everyone else is selling the market, in essence, blood in the streets is the market analogy. We accurately called the bottom in natural gas prices, we will see how close we are in the oil markets. But we know that any investment right now in the oil market where one can stay in the trade, and not be liquidated for any reason, i.e., bankruptcy risk in insolvent company – is going to make money over a two year time frame. Moreover, the reward will far and above exceed the risk involved, and the performance of said trade will greatly outperform the overall market returns of most other asset alternatives.© EconMatters All Rights Reserved | Facebook | Twitter | Free Email | Kindle

- It's Official: Bitcoin Was The Top Performing Currency Of 2015

For most investors, the major story of 2015 was the expectation and eventual fulfillment of a rate hike, signalling the start of tightening monetary policy in the United States. This policy is divergent to those of other major central banks, and this has translated into considerable strength and momentum for the U.S. dollar.

Using the benchmark of the U.S. Dollar Index, a comparison against a basket of major currencies, the dollar gained 8.3% throughout the year.

Despite this strength, the best performing currency in 2015 was not the dollar. In fact, the top currency of 2015 is likely to be considered the furthest thing from the greenback.

Bitcoin, a digital and decentralized cryptocurrency, staged a late comeback in 2015 to overtake the dollar by a whopping 35% by the end of the year.

Courtesy of: The Money ProjectBitcoin is no stranger to extremes. During the year it came into the mainstream in 2013, Bitcoin gained 5,429% to easily surpass all other currencies in gains. However, the following year it would become a dog, losing -56% of its value to become the world’s worst performing currency in 2014.

The second best performing major currency, relative to the USD, was the Israeli shekel. It gained 0.3% throughout the year, and the Japanese yen (0%) and Swiss franc (0%) were close behind, finishing on par with how they started the year.

The world’s worst performing currencies are from countries that were battered by commodities or geopolitical strife.

Ukraine’s hryvnia fell -33.8% in the aftermath of Crimea. Brazil’s real (-30.5%), the Canadian dollar (-15.9%), Russian ruble (-20.8%), and South African rand (-26.7%) all lost significant value in the purging of global commodities. Gold finished the year down -10%, and silver at -11%.

And as China devaluation accelerates, Bitcoin has been surging since the start of the year…

- What China Has To Look Forward To When It Opens In A Few Hours

It’s all up to China tonight, and if early ETF indications are correct, today’s US equity bloodbath is about to spill over right back into Chinese markets again, only this time without the benefit of circuit breakers making it an early close for local traders if they manage to push the market down 7% in 29 minutes.

Moments ago, on Bloomberg TV, Bill Gross said China’s stock markets are likely to drop 5-6% on Friday: “Based upon the ETF in the United States, China is predicted to be down 5 percent or 6 percent…but China is an artificial market. All global markets are artificially based and to the extent that we have a catharsis, I think, depends upon central banks basically giving up in terms of what they do. I don’t think that’s going to happen.”

Gross is referring to the following ETF:

Indeed, it appears that the US is far more bearish on what will happen in China tonight relative to the local futures market:

Incidentally, when asked whether the market turmoil will cause Chair Yellen to say the rate hike is done, Gross said: “I don’t think she’ll say that. They’ve been on this track of raising interest rates for so long that she’s not going to come out with one or done. She may come out there — someone may come out – Fischer perhaps – will come out and acknowledge the fact that global markets and that global financial conditions are an important consideration in terms of future policy. But I don’t think they’re going to divulge that they are not raising interest rates for times as Stan Fischer said a few days ago.”

In other words, central banks to the rescue. Meanwhile…

Angry clients besiege Chinese brokerages

Back in China, which has had non-functioning markets on two of the past four days, should the market rout persist, the already angry local “traders”, most of whom are undereducated and margined to the hilt, will likely snap.

According to Bloomberg, after yesterday’s farce, angry clients besieged a brokerage as China’s market crashed and was halted.

“We cannot go home. We are dealing with a flood of angry phone calls from clients complaining about the market plunge and the circuit-breaker system,” says Wei Wei, an analyst at Huaxi Securities Co. in Shanghai. Wei added that “we are also feeling at a loss and confused today as we didn’t quite figure out what was going on.”

Wei also says that Huaxi management “has asked us to placate clients and guide them to cut holdings rationally if they do margin trading.”

Sorry, but when clients have not only lost a year’s worth of income in minutes but on top of that can’t liquidate the remainder, no amount of placating will work.

Wei then explained what even the Chinese regulator realized after the first few days of experimenting with the new circuit breaker: “the circuit-breaker mechanism actually fuels declines and that goes against the regulator’s goal of stabilizing the market.” It remains to be seen if removing the circuit breaker, a device by definition meant to stabilize markets, will lead to calmer markets. Maybe for the first few minutes, but then all bets are off.

“The new rule on major shareholders’ stock sales isn’t going to work to prevent the market from falling. It’s restricting sales and the CSRC cannot do things like banning them from selling forever. It’ll be a tough day again tomorrow.“

The circuit breaker has been removed, but we feel it will be just as tough tomorrow, or rather, when China opens in a few hours.

In the US, traders are “too old for this”

It’s not just Chinese traders. According to another Bloomberg report, US traders “can’t afford to sleep” during what is becoming a nightly rout, starting just around 8:30pm Eastern.

With China’s stock market in disarray, American investors are finding out just how long their day can last — before they even get to work.

“This morning when I rolled over in my bed at 4 a.m. to check the markets and saw what happened in China and in U.S. futures I thought, ‘Oh, here we go,’” said Howard Ward, who oversees $42.7 billion as the chief investment officer of growth equities at Gamco Investors Inc. “I’m getting too old for this.”

It’s a cowboy market

“If it’s somebody who really doesn’t know a lot about China, this is kind of scary. They say, ‘Oh my god, their market can drop 7 percent,’” said Nick Sargen, who helps manage $46.2 billion as chief economist and senior investment adviser for Fort Washington Investment Advisors Inc. “The reason I can be more calm about it is that I follow that market, I can say, listen it’s a cowboy market.”

Bloomberg concludes by saying that “night owls have been rewarded for at least a year as China’s influence moved action in U.S. stocks to hours when exchanges were closed. In 2015, shares in the S&P 500 swung more during off hours than their small-cap brethren for the first time in at least 15 years.”

So far this year, the only privilege night owls have had is to watch as China loses control of its market on half the trading days so far.

* * *

So what happens tonight? Keep an eye on the Yuan fixing around 8 pm: if the USDCNY sees another substantial jump (i.e., Yuan decline) from last night’s 5 year low rate of 6.5646, this could suggest further turbulence and as all self-fulfilling prophecies go, unleash another pukefest which not even the circuit breaker adjustment will fix. It will also mean that unless the Chinese plunge protection team aka the “National Team” throws everything it has at the stock market, the Shanghai Composite could fall first 5%, then 7%, and then not stop but simply keep falling until someone finally does step in.

In short: it will all be about a central bank rescue again.

But for now either go load up on coffee, or take a nap. It will be a long night.

- "We Came, We Saw, He Died" – Revisiting The Incredible Disaster That Is Libya

Submitted by Mike Krieger via Liberty Blitzkrieg blog,

In retrospect, Obama’s intervention in Libya was an abject failure, judged even by its own standards. Libya has not only failed to evolve into a democracy; it has devolved into a failed state. Violent deaths and other human rights abuses have increased severalfold. Rather than helping the United States combat terrorism, as Qaddafi did during his last decade in power, Libya now serves as a safe haven for militias affiliated with both al Qaeda and the Islamic State of Iraq and al-Sham (ISIS). The Libya intervention has harmed other U.S. interests as well: undermining nuclear nonproliferation, chilling Russian cooperation at the UN, and fueling Syria’s civil war.?

As bad as Libya’s human rights situation was under Qaddafi, it has gotten worse since NATO ousted him. Immediately after taking power, the rebels perpetrated scores of reprisal killings, in addition to torturing, beating, and arbitrarily detaining thousands of suspected Qaddafi supporters. The rebels also expelled 30,000 mostly black residents from the town of Tawergha and burned or looted their homes and shops, on the grounds that some of them supposedly had been mercenaries. Six months after the war, Human Rights Watch declared that the abuses “appear to be so widespread and systematic that they may amount to crimes against humanity.”?

As a consequence of such pervasive violence, the UN estimates that roughly 400,000 Libyans have fled their homes, a quarter of whom have left the country altogether. ?

– From the post: The Forgotten War – Understanding the Incredible Debacle Left Behind by NATO in Libya

Shortly after the NATO-led war which ousted Libyan leader Muammar el-Qaddafi, then Secretary of State Hillary Clinton ebulliently boasted with a characteristic sociopathic giddiness, the following on network television:

Indeed, from Iraq to Libya, and indeed across the entire planet, the U.S. government has an uncanny ability to take an already bad geopolitical situation and turn it into a complete and total chaotic humanitarian disaster. It’d be one thing if the woman in the above video clip had been disgraced and forced into exile in Chappaqua, but the disturbing reality is she will most likely be promoted to the next President of these United States.

In order to fully appreciate what a clueless homicidal maniac she is, let’s reexamine the unmitigated nightmare that is Libya. A nightmare that Clinton and her interviewer laughed uncontrollably about creating.

From Reuters:

At least 47 people were killed on Thursday when Libya’s worst bomb attack since the fall of Muammar Gaddafi hit a police training center as hundreds of recruits gathered for a morning meeting.

No group immediately claimed the attack in the town of Zliten, but suicide blasts and car bombings have increased in Libya as Islamist militants have taken advantage of the North African country’s chaos to expand their presence.

Since a NATO-backed revolt ousted Gaddafi, Libya has slipped deeper into turmoil with two rival governments and a range of armed factions locked in a struggle for control of the OPEC state and its oil wealth.

In the chaos, Islamic State militants have grown in strength, taking over the city of Sirte and launching attacks on oilfields. Islamic State fighters this week attacked two major oil export terminals.

Western powers are pushing Libya’s factions to back a U.N.-brokered national unity government to join forces against Islamic State militants, but the agreement faces major resistance from several factions on the ground.

For more than a year, an armed faction called Libya Dawn has controlled Tripoli, setting up its own self-declared government, reinstating the former parliament and forcing the recognized government to operate in the east of the country.

Western officials say forming a united government would be the first step in Libya seeking international help to fight against Islamic State, including training for a new army and possible air strikes against militant targets.

But hey…

Finally, if you want to understand just how long the war against Syria has been in the works (before ISIS became a huge problem), let’s revisit the following 2011 tweet by “Crazy” John McCain:

Qaddafi on his way out, Bashar al Assad is next.

— John McCain (@SenJohnMcCain) August 21, 2011

And you wonder why the world is in the state it’s in…

For related articles, see:

The Forgotten War – Understanding the Incredible Debacle Left Behind by NATO in Libya

Tunisian Terror Attack Suspects Trained in U.S. “Liberated” Libya

Incredible Tweets from John McCain on Libya and Syria from 2009 and 2011

- Bloodbath

You know it's bad when…

THERE IT IS 7pm ET pic.twitter.com/ufjczF1cYY

— Ivan the K™ ? (@IvanTheK) January 7, 2016

But, but, but… Fed… FANGs… Decoupled… Services… Netflix… Unicorns… Cramer…

The day started badly (as China devaluation stress crushed carry trades and sucked liquidity out of the world, slamming USDJPY, US stocks, bond yields, credit, crude, and copper lower)…no late-day rally today!

*CANADA STOCKS ENTER BEAR MARKET AFTER 20% DROP FROM SEPT. 2014

All that hope as China lifted its circuit-breaker rule and crude briefly rallied… but stocks carnaged back to overnight lows late in the day… Another bounce into the European close then SELL MORTIMER SELL into NYMEX close

Since the start of December, it's ugly…

The NASDAQ is rapidly losing its post-QE3-End gains…

"Policy Error" Much?

"No Brainer" is down 28% from its highs…*APPLE CLOSES AT $96.45; FIRST CLOSE BELOW $100 SINCE OCT. 2014

FANTAsy stocks tumbled deep into the red for the year (yes even NFLX!!) Facebook, Amazon, Netflix, Tesla, and Alphabet… all red…

Financials caught down to credit…But just keep talking up NIM and their "no brainer"-ness

VIX pushed above 25…

VIX term structure inverted…

Credit suggests more to come..

Stocks are "getting there"…

Catching down to breadth…

Away from the excitement of stocks…

Treasury yields tumbled further (some selling pressure as CNH defense suggested China selling)…

The USD Index tumbled back into the red for the week as JPY strength continued…

USDJPY closes at 11 month lows…

Commodities split between growth and safety as PMs rallied and crude, copper crumbled…

as Gold and Silver Surged…

Charts: Bloomberg

Bonus Chart: What did you think would happen?

@federalreserve what did yoiu think would happen? pic.twitter.com/psI62Uszcr

— Not Jim Cramer (@Not_Jim_Cramer) January 7, 2016

- Slovak PM Closes The Door To Refugees: "We Don't Want What Happened In Germany To Happen Here"

Earlier today, Slovak Prime Minister Robert Fico formally stood up to the Brussels supergovernment juggernaut and said his government will not allow Muslims to create “a compact community,” adding that integrating refugees is impossible.

Slovakia has a tiny Muslim community of several thousand.

Fico’s government filed a legal challenge last month to a mandatory plan by the European Union to distribute migrants among members of the bloc.

Fico said Thursday his government sees what he calls a “clear link” between the waves of refugees and the Paris attacks and the sexual assaults and robberies during the New Year’s Eve festivities in Germany.

He says: “We don’t want what happened in Germany to happen here.”

Fico says “the idea of multicultural Europe has failed” and that “the migrants cannot be integrated, it’s simply impossible.”

* * *

After the past week’s events in Cologne, we wonder if there is anyone left in Germany who disagrees.

- Why The U.S. Can't Be Called A "Swing Producer"

Submitted by Arthur Berman via OilPrice.com,

Daniel Yergin and other experts say that U.S. tight oil is the swing oil producer of the world.

They are wrong. It is preposterous to say that the world’s largest oil importer is also its swing producer.

There are two types of oil producers in the world: those who have the will and the means to affect market prices, and those who react to them. In other words, the swing producer and everyone else.

A swing producer must meet the following criteria:

- A swing producer must be a net exporter of oil.

- A swing producer must have enough daily production, spare capacity and reserves to influence market prices by balancing supply and demand through increasing or decreasing output.

- A swing producer must be able to act authoritatively and quickly to increase or decrease output.

- In the real world, a swing producer is a euphemism for a cartel. No single producer has enough oil leverage to balance the market and influence prices by itself. That includes Saudi Arabia, Russia, and the United States, the top 3 producers in the world. Obviously, it also includes U.S. tight oil.

- A swing producer must have low production costs and have the financial reserves to withstand reduced cash flow when restricting or increasing supply is necessary to balance the market.

So, let’s go down the list for OPEC and U.S. tight oil.

OPEC’s net exports for 2014 were 23 million barrels per day (mmbpd) (Figure 1). U.S. net exports were -7 mmbpd. In other words, the U.S. is a net importer of crude oil. A net importer of oil cannot be a swing producer.

Figure 1. OPEC and U.S. 2014 net crude oil exports.

Source: OPEC & Labyrinth Consulting Services, Inc.(Click image to enlarge)

This will not be substantially changed by the repeal of the crude oil export ban because U.S. consumption of crude oil (16.3mmbpd) exceeds domestic production (9.2 mmbpd) by 7.1 mmbpd. If exports of tight oil increase, imports will have to increase by an equal amount to meet demand.

That should be enough to end the discussion about whether U.S. tight oil is a swing producer but I will finish going through the list.

OPEC exists because none of its members alone meet the criteria needed to balance the market and affect prices. OPEC produces 31.4 mmbpd of the crude oil + condensate (47 percent of world production). It has approximately 1.5 million barrels per day (mmbpd) of spare capacity, and it has 72 percent (1220 billion barrels of oil) of the world’s proven reserves (Figure 2). The members of the cartel represent countries whose leaders have the authority to cut or increase oil production at will. Saudi Arabia alone has about $660 billion in cash reserves. Its production costs are less than $10 per barrel.

Figure 2. Comparison of OPEC and U.S. tight oil production, spare capacity and reserves.

Source: EIA, Drilling Info & Labyrinth Consulting Services, Inc.

(Click image to enlarge)

U.S. tight oil accounts for less than 5 percent of the world’s production of crude oil + condensate (3.7 mmbpd). It has approximately 0.23 mmbpd of spare capacity and less than 1 percent of the world’s proven reserves (13 billion barrels of oil). U.S. tight oil producers do not and cannot act together. Tight oil producers spend twice as much money as they make, and have up to 5 times more debt than annual revenue. Its production costs are $65-$70 per barrel.

U.S. tight oil is on life-support at $35 per barrel oil prices.

OPEC is a swing producer. U.S. tight oil is not.

Truth vs. Confirmation Bias

In April 2015, Yergin told CNBC, “What does it mean when you say the U.S. is the new swing producer? It’s much easier to swing down than swing up.”

What he meant was that over-production of U.S. tight oil helped cause the global price of oil to collapse in 2014, to swing down. It had nothing to do with really being the swing producer.

That was a few days before CERA Week, the pricey annual love-fest that Yergin’s company IHS throws in Houston for the oil and gas industry to feel good about itself. It was a clever-sounding trailer to publicize the $7,000-per-ticket event.

Later, in June 2015, Yergin told the Wall Street Journal that “now the U.S. is a swing producer, albeit an inadvertent swing producer as it didn’t set out to take that role.”

A swing producer cannot be inadvertent. A swing producer deliberately increases or decreases its production to balance the market, whether for short-term price advantage, or for demand stimulation and long-term price advantage and market-share.

Either Yergin doesn’t understand what a swing producer is or his swing-producer comments were manipulative and meant to support some agenda.

Many Americans want to believe that the U.S. is nearly energy independent and a major geopolitical force in the world because of oil and gas production from shale. They would like to stick America’s thumb in OPEC’s eye.

Yergin said the U.S. was the new swing producer. What was heard was that America had made OPEC impotent. It was repeated enough by the press and other supposed experts that its truth was confirmed because people want to believe it–even though it is untrue.

Confirmation bias is the tendency to find support for our preconceptions. It may make us feel good but it is a poor basis for decisions. Investors beware.

- For Commodities, This Is The Next Great Depression

While the “sell in 1973, and go away” plan had worked out for some in the commodity space, the destruction of the last decade has only one historical comparison… the middle of The Great Depression.