- Utter Desperation: Chinese Police Vow To Arrest "Malicious Short Sellers"

In what can only be described as total and utter desperation, China's Public Security Ministry and China Securities Regulatory Commission are discussing a plan to take action against "hostile short sellers"… (via Google Translate)

[ Ministry of Public Security in conjunction with the recent Commission investigation of malicious short stock and stock index clues ] correspondent was informed on the 9th morning , Vice Minister of Public Security Meng Qingfeng led to the Commission , in conjunction with the recent Commission investigation of malicious short stock and stock index clues show regulatory authorities to the operation of heavy combat illegal activities .

Which in English means…

Special workforce to be led by Vice Public Security Minister who vows to soon nail down those who manipulate Chinese stocks, index futures

— George Chen (@george_chen) July 9, 2015

However, it appears thety are going to need to do more…

* * *

Just one question: Will the police also arrest the brokers who allowed their clients to lever up to extremes with no awareness of risk, encouraged by the government, buying the stocks of companies that make plastic umbrellas at x-thousand P/E multiples?

* * *

I didn't sell. I swear I didn't!!!! pic.twitter.com/jEi0hYrUkm

— Fed Porn (@FedPorn) July 9, 2015

"I shorted" pic.twitter.com/Q3FzGh7gVC

— zerohedge (@zerohedge) July 9, 2015

As we detailed earlier, China is a $hitshow again…

With more than half of Chinese stocks halted or suspended, traders are scrambling to hedge the potential vacuum under prices when (or if) they ever open again. With options limited to non-existent in China, ETFs around the world are under pressure (with significant discounts to NAV everywhere). The cost of protecting against significant downside is now at its highest on record and the skew (difference between optimists and pessimists) has never been higher… This 'protection' has seemingly relieved some of the vicious cycle selling as yet another round of financing to backfill liquidity holes in broker balance sheets, but Chinese stock futures are trading 2-3% lower in the pre-open (less than might be expected as much driven by margin hike forced unwinds as much as sentiment).

- *CHINA'S CSI 300 STOCK-INDEX FUTURES FALL 2.9% TO 3,363

- *CHINA'S SHANGHAI COMPOSITE INDEX SET TO OPEN 2.1% LOWER

Pushing CSI-300 Index into the red for 2015…

BREAKING: China's stock market opens over 2% lower, with over 400 stocks immediately down 10% … and about 1400 stocks still in suspension

— George Chen (@george_chen) July 9, 2015

* * *

But have no fear…

Another day, another round of liquidity poured into the leverage black hole…

- *CHINA SEC. FINANCE AIMS TO OFFER LIQUIDITY TO FUND COS.: CSRC

- *PBOC TO INJECT 35B YUAN WITH 7-DAY REVERSE REPOS: TRADER

And the politburo is getting serious!!

- *CHINA CBRC SUPPORTS BANKS TO COOPERATION WITH CHINA SEC FIN

- *CBRC ENCOURAGES BANKS TO COOPERATE WITH CHINA SEC. FINANCE

- *CBRC ENCOURAGES BANKS TO OFFER FINANCING TO CHINA SEC. FINANCE

- *CHINA CBRC TO SUPPORT STABLE STOCK MARKET DEVELOPMENT

- *CBRC ENCOURAGES BANKS TO ADJUST LOANS TERMS WITH STK COLLATERAL

- *CHINA CBRC ENCOURAGES BANKS TO HELP FINANCE STK REPURCHASES

Next come the orders on pain of death!!??

And then there's this…

- *HAITONG SECURITIES SLUMPS 16.6% IN H.K. AFTER SHR BUYBACK PLAN

That's not what is supposed to happen!!!

But traders have been extremely active in their hedging…

Crash risk has never been more expensive…

While At-the-Money Vol has spiked to 4-year highs…

Overnight saw Flash Crash come to China…

Selling pressure is heavy on the ETFs with all major China ETFs trading well below their NAV (ASHR 4.6% below!!)

And if you thought it was time to BTFD… consider this…

Chinese stocks are still extremely rich relative to the rest of the world.

* * *

We have one simple question.

How do say "unleash the Bullard" in Chinese?

Charts: Bloomberg

- Preparedness Critics Are History's Cannon Fodder

Submitted by Brandon Smith via Alt-Market.com,

The world is entering a kind of no man’s land, in between the realms of insane denial and utterly obvious crisis. Europe is now destabilizing amid the Greek soap opera (an event that I predicted in January would occur in 2015); China’s stock market bubble is bursting; and the U.S. dollar’s world reserve status is about to be decimated by the global shift toward the International Monetary Fund’s basket currency reserve system. I’m afraid I’m going to have to say this because I don’t know if anyone else will admit it: Alternative economic analysts were right, and the mainstream choir was either terribly wrong or disgustingly dishonest. However, as most of us in the liberty movement are well aware, being right is not necessarily a solution to disaster.

At the forefront of alternative economics and constitutional vigilance are the people doing the real work in the movement: the preppers. These are the activists taking concrete action in the tangible world (as opposed to the ethereal laziness of the intellectual world) first to make themselves as independent as possible from the mainstream grid, thereby removing themselves as a potential refugee or looter in the event of national crisis. Second, they are the people mastering valuable and necessary skills that will allow them to rebuild any collapsed social and financial system. Third, they are the people most capable of defending our inherent freedoms and the principles of our founding culture, and they are the only people organizing locally for mutual aid and security. The fact of the matter is preppers are free, and almost everyone else is a slave — a slave to dependency, a slave to doubt, a slave to ignorance, a slave to fear and, thus, a slave to petty establishment authority.

During the Great Depression, the vast majority of American citizens were rural, farm-oriented people with survival skills far beyond the modern American. “Prepping” in those days was ingrained in our society, rather than marginalized and labeled “fringe.” Today, the numbers are reversed, with a dwindling number of farm-experienced Americans and a vast wasteland of urban and suburban citizens — many with few, if any, legitimate skill sets. During the Great Depression, millions of people died of starvation and general poverty, despite the incredible number of people with rural survival knowledge. What do you think would happen to our effeminate; metrosexual; iPhone-addicted; lisping; limp-wristed; self-obsessed; Twitter-, texting-, video game-addled; La-Z-Boy-riding; overgrown-child culture in the event that another economic crisis even remotely similar were to occur? Yes, most of them would die, probably in a horrible fashion.

Think about it for a moment. An incredible subsection of Americans do not know how to feed themselves; they do not know how to hunt; they do not know how to grow crops; they do not know how to repair any necessary items used for subsistence; they do not know how to build anything useful; they do not know how to shoot; they do not know how to defend themselves; they don’t even know how to cook a pot of rice properly. Their only skills involve parroting snarky remarks from their favorite lowest-common-denominator television and Web shows, building ample karma points on Reddit, and avoiding any stance contrary to what they perceive to be the majority opinion (which they also derive from mainstream media and websites).

It is decidedly ironic given the uselessness of such people that it is often the worst subsections of the blind, deaf and dumb that choose to “critique” the prepper lifestyle as “disturbed” or “dangerous.”

In my view, they are absolutely damned pathetic and should be looked down upon with utter contempt as the most concentrated example of slithering human misery ever to smear across the pages of history.

But, hey, that doesn’t mean I wish them harm.

People who are unaware and unprepared are not necessarily our enemies. At one time or another, we all were unaware of the underlying truths to our system and our future, until we woke up one day. On the other hand, there are some people who have truly evolved from the sickly and bitter bile scraped from the lower intestine of the grotesquely ignorant. These people are the anti-preppers.

Anti-preppers are well aware of the philosophies and fact-based arguments of prepper activism; but rather than ignoring or dismissing us outright and moving on with their vapid lives, they instead seek to destroy preppers and the prepping ideal. Why? To understand that, you have to understand the nature of statists and collectivists because that it where these people root themselves and their twisted worldview.

I recently read an article by Joshua Krause over at The Daily Sheeple in which he countered a mainstream hit piece article against preppers titled “Be prepared For preppers.” The article is itself an immensely disturbed display, first using typical and unimaginative ad hominem arguments to marginalize preppers, then mutating into a treatise on why preppers should all be exterminated.

Krause did a fine job of dismantling the substandard and journalistically challenged propaganda essay, but I would like to go beyond the typical arguments of anti-preppers and into the mindset that drives them. I recommend you read “Be prepared for preppers” for good measure, being that it is a perfect example of the psychopathic nature of the common statist. Then, I would like to perform a little brain surgery here and peel away some layers of psyche so that you can understand why these people hate us so much.

The Prepper Stereotype

The sad reality is most anti-preppers I’ve dealt with in person have never even talked to a prepper face to face until they had met me. They tend to enter into an immediate debate posture with multiple assumptions in terms of what a prepper believes and how a prepper lives. This posture begins with an incredulous and sarcastic demeanor. And as they begin to realize that the prepper they are dealing with is smarter than they are, their attitude devolves into conditioned talking points and generally indignant frothing.

Anti-preppers do not know or associate with real preppers. Rather, they derive their opinions of us from popular media, which is in most cases openly biased; episodes of “Doomsday Preppers” and other shows designed to make us look ridiculous; and Southern Poverty Law Center-influenced news articles loaded with carefully crafted slander. They rarely, if ever, confront a prepper or preppers on neutral ground and address facts or figures honestly.

The bulk of what makes up the prepper stereotype is utter nonsense. But it reinforces the anti-prepper’s hateful inclinations, so they eat it up without question.

They Hate Us Because Of Our Freedom

Are anti-preppers “terrorists?” Yes, they are. It might sound harsh, but consider the attitude of the anti-prepper for a moment. He hates you because you have chosen a lifestyle that is independent from the system and ideology of which he chooses to remain a part. He hates you because you have a measure of freedom he does not have, but could have if only he had the guts to do something about it. He hates you because you do not want to participate in the meaningless game of collectivism he has spent his whole life attempting to master. He hates you because you are walking away from his system and doing your own thing. How dare you do your own thing!

Many of us who appreciate libertarian-oriented ideals are proponents of the “non-aggression principle,” which, to summarize, states that respect for individual freedom is the paramount value of any society that seeks to sustain itself peacefully and indefinitely. Human society is not a nexus; it is not a hive. Society, if it is anything at all, is a collection of individual minds and souls acting voluntarily for the advancement the community, but never at the cost of personal liberty. Contrary to popular mainstream belief, the individual does NOT owe society a thing.

Non-aggression requires that society will not violate personal liberty for arbitrary collective gain and that individuals will not use violence or coercion to forcefully mandate the participation of others. That is to say, you leave me to my dream and I leave you to yours. But if you try to deliberately trample my dream in order to enrich your own, I am then within my rights to bring a mighty friggin' hammer down on your skull until you leave me alone. Anti-preppers have no capacity to grasp this concept. To them, each human being is property of the larger group and defiance of the state is blasphemy.

Such collectivists are also predictably devout followers of the religion of resource management, and often argue that preppers are in fact "horders" of resources. Under this ideology, resources do not belong to the people who actually worked to earn them. Rather, resources somehow belong to EVERYONE no matter how lazy they are, and must be constantly redistributed so that all people (common people, not elites) have the same exact amount. They can never seem to define what exactly a "fair share" actually is, and I believe this is because as long as a "fair share" remains ambiguously up to them, they retain the ultimate power to take what they want whenever they want always under the rationale that yesterday you and I had enough, but today we again have too much. The anti-prepper argument that "hording" is harmful to the collective and that all resources, even your food storage, should be managed by the group (the state), is THE propaganda model of the future. Do not forget this because you will be seeing this propaganda take center stage very soon.

Anti-preppers are often the kinds of social justice circus clowns that preach unerring tolerance and claim disdain for any form of discrimination, yet they are at the same time violently discriminatory against anyone who will not preach their particular collectivist gospel. The social collectivist model is by every definition a form of cultism, and in most cases the god of this cult is the state. It treats the state as an infallible omnipotent presence: mother and father, caretaker and disciplinarian.

To refuse participation is to deny the collectivist god, and the kinds of horrors we read about of the religious zealotry of medieval Christian inquisitions pale in comparison to the death and destruction dealt by modern collectivists.

Their worship of the state is energized by their love of its collective power – the state is the ultimate weapon to those who think they can successfully wield it. The state has the ability to "legally" imprison and/or kill, and it has the ability to threaten such consequences against anyone who refuses to conform to the ideological whims of the people who exploit it. Unless, that is, the victims of the state become revolutionaries. This is the great fear of collectivists in terms of the prepper movement; they see us as potential revolutionaries that could conceivably extinguish their mechanism of control, and they don't like that one bit.

The Psychotic Zealotry Of Anti-Preppers

Many anti-preppers are not content only to attack the character of the prepper movement — at least, not anymore. You see, despite the rabid attempts to undermine the validity of prepping and dissuade the growth of the movement, preppers are now legion, with millions of active participants and effective alternative media experts who are dominating Web traffic and crushing traditional media into archaic bone meal. We have made the mainstream media a mainstream joke, and this does not sit well in the minds of statist adherents who once had the power to bottleneck all discussion. If we are so desperately fringe, there would be no need to write unprovoked hit pieces against us to begin with. Who are they trying to convince?

Since they now know they cannot win the war of information, they increasingly foster fantasies of genocide. This quote (in reference to methods for solving the “prepper problem”) from the article linked above truly says it all:

"Furthermore, consumed with the heady lust of their own unexpected survival (see any episode of The Walking Dead), and with only expired condoms at their disposal (not even Doom and Bloom stocks birth-control pills) these mouth-breathers will doubtless multiply rapidly, and, ergo, must be stopped before such an advent. That can mean only one thing: key preparation in any disaster for the rest of us (other than a map to all of Wal-Mart’s distribution warehouses) is this: be prepared to neuter preppers by any means available.

… Not only will such noblesse oblige ensure a stronger gene pool going forward, but hey — those bastards have all the gear and food and fish antibiotics you’ll ever need."

And there you have it: the comic book delusion of the anti-prepper, so desperate to stop us from stockpiling food and essentials, so disturbed by our local organization and ability to defend ourselves, that they would prefer to see us all “neutered,” i.e., killed. Note also the obsession with the sterilization of the gene pool as socialists in their psychotic fury often harken back to their fascist and communist forefathers.

It is perhaps not coincidental that the people most in love with the state are often the first ones to be annihilated by it. Avid lower echelon and middlemen agents of tyranny are in many cases exterminated by the very system they helped to dominance. If they do not meet their demise at the hands of the establishment, then they invariably meet their demise at the hands of those fighting against the establishment.

The problem for anti-preppers is that most of them are weaklings and cowards who are incapable of carrying out their vision of a final program. They have always needed a warrior class mandated by the state to implement the killing they desire. Hilariously, this particular anti-prepper spends 80% of his article shoveling poorly written character assassinations like so much manure as if our concerns of crisis are inconsequential, then goes on to describe his idea of wiping out all preppers and stealing our supplies in the event that the system does collapse. If we are all such “kooks” and paranoid hillbillies, then why even entertain the notion of having us snuffed out so that our stores can be redistributed? Surely, such a collapse will never occur in the midst of our invincible American economy; and, thus, preppers are nothing more than harmless eccentrics wasting our money on boxes of food we won’t touch for another 20 years. Right?

History does not support the assumptions of anti-preppers. And throughout history, anti-preparedness people tend to be the first to meet an early demise in the wake of fiscal and social collapse because they have no utility and because, frankly, no one really likes them. They also aren’t the brightest bulbs around (the guy actually thinks he’s going to find food at a Wal-Mart distribution center after a breakdown in civil order).

Anti-preppers today are promoting violent action against preparedness culture because in the far reaches of their sickly subconscious, they know we are right and that we will not be controlled when the system breaks. These people accuse us of lusting after collapse, when it is in fact they who salivate over mass die-off scenarios in which they fantasize that they will somehow be the survivors despite the fact that they are born victims. They imagine a time when, after the “gene pool has been cleansed,” they will rebuild society as a perfect socialist utopia in which every ideology contrary to their own has been erased from all memory, leaving their ultimate prize: a blank slate world to do with as they wish.

The goal behind the prepper movement is simple, not sinister; we seek to defuse crisis before it occurs by providing our own necessities without the need for a mainstream grid that could easily malfunction and a government that is corrupt beyond repair. If your neighbor is a prepper, be thankful, for you have one less person on your street to worry about as a potential looter during an emergency. If your neighbor is an anti-prepper, beware, for this person sees you as a potential source of supply and thinks you owe him merely because you have something he does not. The bottom line is if the world were full of preppers, there would be no such thing as crisis because there would be no lack of necessity or individual ingenuity. In the land of preppers, disaster vanishes. When was the last time an anti-prepper did anything to improve anything for anyone other than himself? Ask yourself which you would rather be in the end: ready for anything or ready for nothing?

- The "Historic NYSE Halt" Post-Mortem: The Shock And Awe When It All Went Down

What began as a glitch in pre-market trading turned into the NYSE’s longest trading halt since Hurrican Sandy battered the East Coast. The ever-increasing complexity of US equity markets combined with an ever-decreasing pool of greater fools leaves windows open on down days (for it appears these ‘glitches’ only ever occur on down days) for markets to break. While NYSE traders defended the very market structure they have abhorred in the past as evidence that today was “not a failure,” we can’t help but find CNBC’s Scott Wapner’s amusing remark that “if retail investors want low cost liquid trading they are going to have learn to live with it” the perfect post-mortem for a rigged system brimming with confident insiders ever excited to take mom-and-pop’s money.

As Bloomberg reported, “What began Wednesday morning with a seemingly workaday software glitch soon escalated into one of the most startling computer outages in Wall Street history — and, for the Big Board, a race against the clock.”

At the 9:30 a.m. opening bell, traders’ orders for some stocks weren’t reaching the proper destinations for processing. Techies were frantic to fix the problem. At about 9:32 a.m., they succeeded.

Two hours later, boom.

One floor trader started shouting, “My handheld’s down! My handheld’s not working!” He and other traders hurried over to a ramp on the trading floor where NYSE executives usually meet with them to explain any problems. Not today. Three hours later, still nothing. Everyone was just standing around.

“The order flow wasn’t being entered into the display books on the trading floor,” said Pete Costa, president of Empire Executions Inc. who’s worked at the exchange in downtown Manhattan for 34 years. “As soon as that happened, the exchange shut down to understand what was going on.”

Every computer screen “went this pukey, canary yellow color,” Costa said. “That means the stock has stopped trading.”

NYSE BREAK #1 Occurred shortly before the market open as the SNB-driven rebound from overnight weakness was beginning to fade…

Stocks rallied into the open while the NYSE was broken.

The issues were resolved shortly after the market opened… and stocks then plunged:

The tumbling stock market meant there was only one option:

NYSE BREAK #2 Occurred shortly before the European close…

And once again… stocks ripped higher and the world rejoiced that Greece and China didn’t matter after all.

But then, once that problem was resolved, stocks plunged again, which left only one option for the PPT which learned its lesson from China where if there is selling, just halt the stocks being sold.

NYSE BREAK #3 – The Big One started shortly after the European close with stocks near the lows of the day…

CNBC went into full “turmoil” mode:

And this happened:

The NYSE CEO told CNBC that he “didn’t know” if the early halts and glitches were related to the catastrophe that halted the entire exchange for almost 4 hours. Well as a help for him, here is a simple chart from Nanex that shows the last group of trades before the NYSE Blackout were in the same stocks they reported an issue with earlier in the day…

Simply put – they were related.

Why does the market break? Here’s why: an ever increasing level of complexity in the market structure (as machines game each other to death)…

… Meets an ever-decreasing pool of greater fools:

But why 4 hours?

RUHLE: Why not roll over to your fail system, your backup?

FARLEY: We chose the least disruptive option for customers. So if we had moved to our Disaster Recovery Center, which was an option, customers would have had to do a good deal of work to be able connect to that new Disaster Recovery Center.

Contrast that with what we chose to do, which was root out the problem, put a plan in place to fix it, fix it, reopen the New York Stock Exchange, and there was no work for the customers to do to connect to the New York Stock Exchange.

So, to summarize, the NYSE has a disaster recovery center which… they choose not to use because it is an inconvenience to clients who would rather be unable to trade!

Maybe there was a different angle altogether: with China crashing and halting 70% of the market, the US had just one response:

China: We’ll halt 70% of our stocks

US: Oh yeah, we’ll halt the world’s largest stock exchange— zerohedge (@zerohedge) July 8, 2015

Here is the “official” reason according to the NYSE CEO:

RUHLE: And do you attribute this to a system upgrade?

FARLEY: I’m not 100 percent certain, because as I said, most of the day I spent with customers and staff. There was a configuration problem in our system. It likely had to do with an upgrade, but that is premature, and it’s something that will come about as part of a full analysis of the situation.

Of course it’s not the first time NYSE has been halted (as MotherJones reports)

It’s not the first time a random event has interrupted the 223-year-old stock exchange. Most memorably, the NYSE closed following V-J Day, when troops returned at the end of World War II, and for three full days after the terrorist attacks of September 11, 2001. But the NYSE has closed for everything from the funerals of major world figures—such as Queen Victoria of England (1901), Rev. Martin Luther King, Jr. (1968), and Richard Nixon (1994)—to extreme heat (August 4, 1917).

Here is a brief history of events that halted trading at the New York Stock Exchange.

September 1873: The collapse of the Jay Cooke & Company, a major financial institution, caused the New York Stock Exchange’s first closure, for 10 days, due to market calamity.

July 1914: The start of World War I in Europe shuttered the exchange for four months, the longest closure on record.

May 25, 1946: The NYSE shut down due to a railroad strike, part of one of the largest waves of strikes in US history.

1967 – 1996: Over this span of 29 years, eight ferocious blizzards either delayed the opening bell or closed the exchange early.

February 10, 1969: A snowstorm dubbed the “Lindsay Storm” shuttered the stock exchange for a day and a half amid 15.3 inches of snow.

July 21, 1969: This closure was planned, to celebrate the Apollo 11 moon landing.

July 14, 1977: The NYSE closed due to a major blackout across New York City.

October 27, 1997: A failsafe instantaneously stopped all trading for 30 minutes after the Dow Jones Industrial Average plunged 350 points.

May 6, 2010: The same circuit breaker that closed the NYSE in 1997 halted trading after a “flash crash” caused by automated high-frequency trading.

September 11, 2001: Terrorist attacks closed the exchange through September 14. The exchange also closed exactly a year later to mark the anniversary of the attacks.

October 29 – 30, 2012: The NYSE shut down while Hurricane Sandy battered the Eastern Seaboard. It was the first time a weather event closed the market for two full days in 124 years, after a snowstorm that dumped more than 40 feet of snow closed the exchange in 1888.

And won’t be the last: as we wrote last year, the entire market is now like the infamous “social-network” stock CYNK that never existed: it too was pumped up to ridiculous valuations on no volume, not to mention no revenues, no profit and no employees … and then when the selling began it was quietly halted.

Permanently.

- Japanese Investors Lose Faith In Draghi – Dump The Most Foreign Bonds In History

Did the narrative just change? With the world’s investors having entirely lost faith in China’s ability to control its markets, it appears the omnipotence of global central banks is under scrutiny. First the so-called “contained” risks from Greek contagion are non-existent as despite the best efforts of The SNB (and ECB), European stocks and peripheral bonds have tumbled; and now Japanese investors have dumped over JPY 4 trillion foreign bonds in June – the most ever.

One can’t help but wonder why, if Draghi’s QE was successful, why are foreigners not piling into risk assets en masse… but instead selling the most ever as apparently Greece matters after all.

Charts: Bloomberg

- Why Grexit Is The Most Likely Outcome

Submitted by Pieter Cleppe, initially published on the European Leadership Network

Why Grexit is the most likely outcome

Ahead of Greece’s referendum on a bailout plan in early July, EU decision makers, including Eurogroup Chairman Jeroen Dijsselbloem, warned a “no” vote might lead to Greece’s exit from the Euro. After Greece’s overwhelming “no”, and Eurozone leaders’ latest ultimatums, there are a number of factors that indicate that “Grexit” may indeed be the most likely outcome.

1. Greece is already in default to the IMF

Last week, Greece defaulted on its obligations to the IMF, even if we technically would need to say it was put in “arrears”. Greece is the first developed country to do so. Currently, the Greek banking system is dependent on the ECB allowing the Greek Central Bank to issue loans to Greek banks through a scheme called Emergency Liquidity Assistance (ELA). As the name suggests, this funding can only be provided to deal with liquidity problems, so it cannot prop up insolvent banks. Greek banks are intimately linked with the insolvent Greek state, meaning they are insolvent themselves, meaning in turn that the ECB would need to cut off funding.

The necessary two thirds majority needed within the ECB Governing Council to block the Greek Central Bank from creating euros to lend to Greek banks under ELA hasn’t been reached so far. As a result, the ECB has had to come up with all kinds of excuses, the latest being that it will only cut off ELA funding for Greek banks in case there is “no prospect of a deal”. The ECB’s excuses are likely to run out soon, especially if the Greek government defaults on payments to the ECB on 20 July. This week, the ECB restrained ELA a little more, but it’s expected to provide ELA funding at least until Sunday. Political cover would be needed for any further actions though.

Greek pensioners are meanwhile standing at the gates. A logical outcome would be for the Greek government to pay them in “IOUs” or in a parallel currency, which could be used to pay for government services, for example health care, something which the outgoing Greek Finance Minister already suggested.

Another problem is that Greek banks will be running out of actual physical bank notes, possibly by the end of this week. Closing banks is bad enough, but closing ATMs is a recipe for chaos. It would force the Greek government to print Drachmas, while uncertainty would reign during the transition period.

2. Greece and the rest of the Eurozone are further apart than ever

Given that Greece’s finance gap will only have grown bigger as a result of the economic damage inflicted by capital controls, Greek politicians likely will need to accept even more “austerity” than was on offer before the talks with creditors broke down. German Chancellor Merkel stressed earlier this week that Greek measures will have to “go beyond” what was demanded by the creditors before the referendum. How likely is this to happen in the face of the massive “no” vote? Costas Lapavitsas, the leader of the radical wing of Syriza, already warned that “the referendum has its own dynamic. People will revolt if [Tsipras] comes back from Brussels with a shoddy compromise.” Some Greek analysts think Tsipras doesn’t actually want a deal.

It must be said that the so-called “austerity” was always more a synonym for monstrous tax hikes than for actual spending cuts. One of the recent Greek government’s proposals, for example, was to unleash 2.69 billion euro in tax hikes on the Greek private sector this year – perhaps hoping the money wouldn’t be raised anyway – while only cutting spending on “pensions” (which more than often seems to mean the pension administration, not actual pension payouts)– by 60 million euro.

There is still a chance that Greece will back down completely in the next few days, giving up its demand for debt restructuring, which Merkel has called “out of the question”. The result of this would be that Greece would enter a new European Stability Mechanism (ESM) programme. So far however, it looks like the Greek government hasn’t come up with detailed proposals, apart from a general request for ESM support.

It’s therefore more likely that the EU Summit this Sunday decides to exclude the country from the Eurozone and provide funds to make the transition to Drachma through the so-called “Balance of Payments” facility for non-euro states which has been used for Romania, Hungary and Latvia. The invitation of all EU member states to this Summit is already a sign that Grexit is likely, given that they would be needed to sign off on this scenario. In any case, whatever happens next, the fact that EU Commission President Juncker declared that “We have a Grexit scenario, prepared in detail” proves for the first time that the euro adoption is not irreversible.

3. Capital controls are notoriously hard to unwind

According to official Greek data , there was still almost 130 million euro deposited in Greek banks before capital controls were announced. If Greek banks were to reopen, few might trust they wouldn’t close again soon, potentially causing a run. As the ECB is unlikely to provide enough ELA funding for banks to open without a deal, and a deal itself still seemingly unlikely, the government in Athens will have to seriously consider printing its own currency should it ever want to open its banks again.

4. The “no” vote protects the Eurozone’s politicians from looking like they pushed Greece out

In the event of a Grexit, prepare for more blame games between Greece and the rest of the Eurozone. Now that the Greek people have sent a powerful signal that they desire a full-blown “transfer-union”, which is not on offer, it will be much harder to blame Eurozone politicians for refusing more transfers than the ones already conducted, through the ECB and bailout loans with low interest rates.

How might Grexit playout?

Eurozone countries could fly in periodical shipments of euro bank notes until the end of summer, in order to avoid a risk of social breakdown. This special “transition bailout” – possibly financed by future cuts to EU subsidies for Greece – could be decided, as a means of raising hopes for an orderly transition to the Drachma. There is also an alternative scenario in which Greece – after having defaulted and restructured its banks – uses the euro but doesn’t enjoy the cheap money from the ECB, like Montenegro.

This would give Greece an incentive to stay in the EU – and NATO – and to play along when it is legally relegated to the “euro derogation” (the status of Bulgaria, Sweden and Poland) i.e. obliged to join the eurozone in the future. The fact that German Finance Minister Schäuble mentioned ahead of the referendum that a Greek “no” may lead to a “temporary” Grexit may refer to this potential scenario. The IMF and European Parliament President Schulz have been making noises about “IMF assistance” and “humanitarian aid”.

It looks like this is finally it.

- BRICS Bank Officially Launches As Sun Sets On US Hegemony

Before the Asian Infrastructure Investment Bank and, to a lesser extent, the Silk Road Fund became international symbols for the end of Western economic hegemony, there was the BRICS Bank.

Or at least there was the idea of the BRICS bank.

The supranational lender imagined by Russia, China, Brazil, India, and South Africa is, like the AIIB, largely a response to the failure of US-dominated multilateral institutions to meet the needs of modernity and offer representation that’s commensurate with the economic clout of their members. As Bloomberg points out, the countries’ combined economic output is now roughly equal to that of the US. “Back in 2007, the U.S. economy was double the BRICS,” Bloomberg notes.

As a refresher, here’s how the Washington Post described the bank’s structure and purpose on the heels of last summer’s BRICS summit in Fortaleza:

The NDB has been given $50 billion in initial capital. As with similar initiatives in other regions, the BRICS bank appears to work on an equal-share voting basis, with each of the five signatories contributing $10 billion. The capital base is to be used to finance infrastructure and “sustainable development” projects in the BRICS countries initially, but other low- and middle-income countries will be able buy in and apply for funding. BRICS countries have also created a $100 billion Contingency Reserve Arrangement (CRA), meant to provide additional liquidity protection to member countries during balance of payments problems. The CRA—unlike the pool of contributed capital to the BRICS bank, which is equally shared—is being funded 41 percent by China, 18 percent from Brazil, India, and Russia, and 5 percent from South Africa.

On Tuesday, ahead of this year’s summit in Ulfa, the BRICS countries officially launched the new bank along with the reserve currency pool. Here’s WSJ:

The group of five major emerging economies known as Brics launched a development bank on Tuesday ahead of a summit in the Russian industrial city of Ufa, where Russia seeks to demonstrate it hasn’t been isolated by Western sanctions.

The long-planned development bank, aimed at financing projects mainly in member countries Brazil, Russia, India, China and South Africa, will select its first projects to finance by the end of the year, Russian Finance Minister Anton Siluanov said on Tuesday. The countries’ national banks also signed a deal Tuesday to create a $100 billion reserve fund by the end of July that can be tapped in financial emergencies.

The Bank of Russia said it signed an “operational agreement” with Brics counterparts to create a $100 billion pool of mutual reserves. The group agreed to create the fund in 2013 as an alternative to the International Monetary Fund, after seeing investors pull money away from emerging economies, causing their currencies to weaken.

The currency pool would be drawn on by the central banks of Brics states whenever they suffered a shortage of dollar liquidity, helping them maintain financial stability, Russia’s central bank said.

China will contribute $41 billion to the currency pool. Brazil, India and Russia will each provide $18 billion, while the remaining $5 billion will come from South Africa.

The BRICS nations will also look to begin settling more trade in national currencies, a shift we highlighted recently in “The PetroYuan Is Born: Gazprom Now Settling All Crude Sales To China In Renminbi”, “PetroYuan Proliferation: Russia, China To Settle “Holy Grail” Pipeline Sales In Renminbi,” and “De-Dollarization Du Jour: Russia Backs BRICS Alternative To SWIFT.” This comes at a convenient time for Russia, which is attempting to diversify away from the dollar amid Western economic sanctions (recently extended into next year) imposed on Moscow in retaliation for the Kremlin’s perceived involvement in Ukraine. RT has more:

BRICS countries will definitely start using their local currencies for mutual settlements quite soon, the head of Russia’s VTB bank Andrey Kostin told RT Wednesday at the BRICS summit in Ufa.

“We definitely see a growing interest from the countries to make settlements in local currencies,” the CEO of Russia’s second biggest bank said. 40-50 percent of all the mutual settlements among the BRICS countries can be performed in domestic currencies, Kostin estimated, RIA reported.

The Chinese yuan as the leading currency can be used in settlements among BRICS member states, Kostin said, adding that the Russian ruble can be used for that as well.

He says there will be a growing interest from leading Russian exporters to the process of switching to national currencies.

And of course no story about the BRICS bank (or the AIIB for that matter) would be complete these days without some mention of Greece and the possibility that Athens may be forced to look elsewhere for help in the event it’s driven out of the euro and Jean Claude-Juncker’s “humanitarian” plan B proves inadequate to keep the country out of the Third World after Berlin digitally bombs its citizens back to barter status. For today’s Russian/Chinese pivot allusion, we go to IBTimes:

Greece could get financing from the New Development Bank operated by Brazil, Russia, India, China and South Africa (BRICS) if it buys a few shares of the institution to become a member. The bank, which is set to begin operations next April, is seen an alternative to Western financing.

Deputy Russian Finance Minister Sergey Storchak said becoming a part of the bank would require Greek officials to make a political decision.

“We do not have any co-relation between a contribution and an amount of funding,” Russian news agency Tass quoted Storchak as saying. “There is general agreement that the system of the countries’ assets will be balanced.”

Russian Finance Minister Anton Siluanov said Tuesday it is necessary for the new bank to “carve out a niche” since competition among international banks is intense.

Yes, the bank must “carve out a niche”, and preferably one which takes every opportunity to undercut the influence of the US-dominated multilateral institutions that have defined the post-war world and served to underwrite six decades of dollar dominance.

So we suppose it’s not all bad news for China these days. Beijing may have a decelerating economy and a stock market collapse on its hands, but at the end of the day, the country now controls not one (AIIB), not two (Silk Road Fund), but three (BRICS bank) development banks, which gives Xi Jinping quite a few options when it comes to embedding the yuan in global investment and trade which, in the long-run, is far more important than where the SHCOMP closes on Thursday.

- Hong Kong Hammered As China Crash Contagion Continues

Submitted by Pater Tenebrarum via Acting-Man.com,

Efforts of Potent Directors Ignored

When we first commented on the emerging problems with China’s market bubble, we warned that although a bounce from oversold levels was the most likely outcome, it wasn’t set in stone. It appeared to us that Chinese investors were especially prone to falling for the “potent directors fallacy” (a term coined by Robert Prechter of EWI many years ago) – the belief that powerful decision makers, in this case the central bank and the government – would be willing and able support the market no matter what. Willing they have been – able, less so.

Chinese retail investors are shell-shocked

Photo credit: EPA

For a long time it has been the general impression that due to its tight control over the banking system and other sectors in the economy, China’s leadership could just “order the markets around”. Investors who were aware of China’s enormous debt problems and its insanely overvalued real estate markets were regularly baffled by the fact that China’s mandarins were apparently capable of arresting any decline in prices or any emerging credit blow-ups with the flick of a finger. Faith in their abilities is currently being shaken to its core. This is highly relevant to the asset bubbles currently underway in other countries, even though what happens in China has little direct effect due to the country’s closed capital account.

China’s stock market crash just keeps going – the index has now reached an important lateral support level. It will probably bounce from there, but for a variety of reasons this is actually somewhat less certain than it would otherwise be – click to enlarge.

The latest gambit of China’s central planners has been to replace the increasingly wobbly looking real estate bubble with a stock market bubble. The plan, as far as we can tell, was to enable state-owned companies to raise a lot of equity at favorable prices, so as to lessen the relative importance of their debt load, resp. enable them to deleverage by putting the proceeds of stock offerings toward paying down debt. However, the stock market bubble rested on an extremely shaky foundation: inexperienced retail investors and just as inexperienced fund managers were the main buyers, and they used plenty of margin to do so. Now they are in an unmitigated panic.

How to Shoot Oneself in the Foot

In their desperate effort to halt the decline in stock prices, China’s authorities have tried every trick in the book and then some. The latest gambit was initiated by listed companies, and may well have been the equivalent of shooting oneself in the foot: In order to stop stocks from declining further, many were simply suspended from trading. Some of those are suspended because they keep trading “limit down”, but in many cases the trading halts were requested by the companies themselves (the exchange must give its placet to such trading halt requests).

As a result, some 27% of listed companies are currently no longer trading, representing approx. $1.4 trillion in market cap. This is reminiscent of the futile attempts to halt stock market declines in the US and Europe by banning short sales in 2008 (as well as on other occasions, e.g. in early 1932, a short selling ban that was followed by a 69% plunge in stock prices).

“Chinese companies have found a guaranteed way to prevent investors from selling their shares: suspend trading.

Almost 200 stocks halted trading after the close on Monday, bringing the total number of suspensions to 745, or 26 percent of listed firms on mainland exchanges, according to data compiled by Bloomberg. Most of the halts are by companies listed in Shenzhen, which is dominated by smaller businesses.

The suspensions have locked up $1.4 trillion of shares, or 21 percent of China’s market capitalization, and are becoming increasingly popular as equity prices tumble. If not for the halts, a 28 percent plunge in the Shanghai Composite Index from its June 12 peak would probably be even deeper.

“Their main objective is to prevent share prices from slumping further amid a selling stampede,” said Chen Jiahe, a strategist at Cinda Securities Co.”

Later, the number of halts requested increased to more than 1,200, the 21st Century Business Herald said, citing exchange data. The Shenzhen Stock Exchange will reject unjustifiable applications for suspensions, QQ.com reported, citing an unidentified person familiar with the matter.

As an aside, the assertion that the stock market rout has “erased at least $3.2 trillion in value” as most financial media are reporting is a rather unfortunate way of putting it. What has changed are merely stock prices. In a way, the previous “values” were largely fictional. They reflected the fact that many in China felt they had discovered a get-rich-quick scheme and were piling in. The “wealth” this has created was phantom wealth – nothing has changed about the underlying businesses just because their stock prices have soared, nor has any money been destroyed because they plunged – it has merely changed hands.

Why are trading halts counterproductive? For one thing, as most of the suspensions concern small caps, investors are now trying to rescue themselves by selling big caps. For another thing, it deters new buying, because investors must fear that they will be locked out again from trading their shares at some point in the future – this has lowered the potential for a significant bounce. Also, while the decline has superficially slowed due to trading halts, the potential for an even bigger decline is now hanging over the market, as those holding suspended shares are likely to sell as soon as it is possible again.

Another effect was that the spillover to the Hong Kong Stock Exchange has worsened considerably. The HSI has crashed by almost 2,100 points or 8.37% overnight:

The HSI in Hong Kong begins to crash as well – click to enlarge.

Why Are the Authorities Helpless?

There is actually a good reason why China’s authorities have been unable to stop the crash so far, in spite of their otherwise well-known ability to influence markets and the economy. China is beginning to feel the lagged effect of the massive slowdown in money supply growth over recent years. This increasingly unmasks capital malinvestment in China and makes it more difficult to keep asset bubbles supported.

The year-on-year growth rates of the monetary aggregates M1 and M2 in China have collapsed to the lowest level in more than 15 years – click to enlarge.

China’s authorities are now finding out that one cannot have everything at once. If a credit bubble is to be deflated, asset prices cannot grow to the sky at the same time. Rising stock and real estate prices require “fuel” in the form of money supply inflation, and a slowdown in credit extension automatically brings about a slowdown in money supply growth in the modern-day fractionally reserved fiat money system.

As a result, even if the market should begin to bounce from here, it will very likely remain a “sell” until money supply growth has accelerated again for a while. This is however unlikely to happen anytime soon, as China’s banks are increasingly reluctant to add to their burgeoning credit problems (these don’t exist officially, but everybody knows they are simply masked by accounting tricks).

Prime minister Li Keqiang wants to reform China’s economy and is also unlikely to order banks to massively increase their lending again. He may of course eventually well be outvoted by others in the politburo, but at the moment, he remains in charge of economic policy. Note in this context that stock prices fell again on Monday after Li Keqiang failed to mention the stock market crisis in an official statement on the economy.

Conclusion

No bubble can remain aloft without a heavy dose of monetary inflation. The fact that China’s authorities, including its central bank, have been unable to stem the decline stands as a stark warning to the many Western investors who seemingly believe that central banks are nigh omnipotent entities run by magicians. This is not the case. Once an asset bubble begins to burst, there there is nothing central bankers can do to stop it – and we have plenty of bubbles awaiting their turn in the barrel.

China’s premier Li Keqiang: Apparently not sympathetic toward stock market speculators.

- China Makes Selling For Big Investors Illegal

With another bloody session in the books for China’s bursting equity bubble, it’s now abundantly clear that Beijing and the PBoC have lost control not only of the market but of the narrative as well, despite dozens of attempts to steer both in the “right direction.”

Having corralled selling by the National Social Security fund earlier this week and after discouraging local reporters from mentioning selling in the press, China has now made it illegal for big investors to dump shares over the next six months. Here are the details via Bloomberg:

China’s securities regulator banned major shareholders, corporate executives and directors from selling any of their stakes for six months, the latest effort to stop a $3.5 trillion rout in the nation’s equity market.

Controlling shareholders and investors holding more than a 5 percent stake in a company will be prevented from cutting their holdings over that time period, the China Securities Regulatory Commission said in a statement.

And here’s the official word from the CSCR (Google translated):

Recently, the stock market fell irrational, for the maintenance of the capital market, and earnestly safeguard the legitimate rights and interests of investors, is now on the relevant matters are announced as follows: First, from now on within six months, the controlling shareholders of listed companies and shareholders holding more than 5% (hereinafter, saying large shareholders) and its directors, supervisors and senior management personnel shall not reduce shares held by the secondary market. Second, the major shareholders of listed companies and the directors, supervisors and senior management personnel who fails to reduce shareholdings in the Company, the China Securities Regulatory Commission will be given serious treatment. Third, the major shareholders of listed companies and the directors, supervisors and senior management personnel in the six months after the reduction of shares from shareholders with specific measures, separately.

Yes, the stock market “fell irrational” lately. And by “irrational” the CSCR apparently means that temperament that tends to fall over people once they realize they’ve helped to faciliate a completely “irrational”, debt-fueled mania that’s sent valuations on many listings into the stratosphere and lured in millions of farmers and hairdressers who are now collectively leveraged to gills.

In any event, this, like every other move in China’s rapidly expanding plunge protection playbook, will fail miserably, meaning Beijing with ultimately be left with no choice but to “halt” whatever shares are still trading by the end of the week.

We can now add one more desperation measure to the annotated history of Chinese market intervention:

- Two Things the US Government Got Right

By Chris at www.CapitalistExploits.at

In a shocking and uncharacteristic display of common sense, the US government has recently managed to pass two laws which are an absolutely fabulous idea.

The legalization of marijuana in the US is the first one.

I say this not because I’m a closet pot smoker; I don’t even reside in the US, but because Government’s involvement in deciding and having control over what we do and don’t put in our bodies is the height of absurdity.

The leading cause of death in the Western world is not giggling stoners stumbling into oncoming traffic, it’s actually heart disease. We may as well ban deep fried food and TV…

The second law they passed was the JOBS act, which, in a nutshell, allows everyday people to invest in private business while at the same time allowing private business to solicit capital from everyday people.

Combining the two would certainly produce some interesting investment choices, especially if marijuana precedes the investment choice. Then again, this would be akin to drinking alcohol and gambling, which is about as American as apple pie. Let’s face it, without alcohol and gambling Vegas would consist of a single motel and gas station run by a guy with a lazy eye named Chuck.

I bring this up since I recently received an email from a friend where he discussed both crowdfunding and marijuana.

He had been debating whether the marijuana crowdfunding platforms are an “industry to watch.” Legislature changes often provide accelerant to glowing embers and the legalization of marijuana is no different.

We all remember how crazy pot stocks got a few months back. In fact, we detailed this in a January edition of a private alert we put out on select trades we’re placing our personal capital into.

At the time we determined that due to the asymmetry available we just HAD to short one which stood out. Specifically, a useless pump and dump candidate one of our editors of the alert service brought to our attention. The company in question was General Cannabis Corp (CANN).

Easy pickings – find a company with little substance that is being run up on a deadly combination of BS and stupidity and you have yourself a candidate. What could possibly go wrong?

What indeed?

Investors who went long CANN as we went short in mid-January lost their shirts but no matter, they may have kept their underwear as it hasn’t completely disappeared. Rest assured, however, that we’ll get another series of amusing debacles before we all go in a box.

Equity crowdfunding, like the now legalized marijuana industry, is relatively new so the question as to whether marijuana crowdfunding platforms are a sector to watch really isn’t a silly one.

We’ve been very close followers of equity crowdfunding since its emergence, and are very well connected into the ecosystem so I thought I’d offer some insight into the industry as I see it.

Before I proceed a caveat is in order. Seraph, the company Mark and I founded, are, together with our members, investors in a company that keeps a pulse on the equity crowdfunding marketplace and we’re vetting a number of candidates continuously in this space. We do therefore have a bias towards the industry as we have placed capital and are looking to do so again.

It seems obvious to me that the vast majority of the crowdfunding platforms out there, while being run by well intentioned entrepreneurs, will absolutely never make any profits. And when the venture capital that is currently keeping them alive dries up they will simply disappear like a fading sunset over the horizon.

Now, I’ve been accused of being too harsh on many of the platforms who are looking to raise money so I’m going to choose my words carefully. Here goes: most are crap and will die!

Don’t get me wrong. I’m incredibly excited about crowdfunding in general and believe that the growth will continue. In part, because the financial architecture that has been built ensconcing Wall Street, brokers, various other “intermediaries” and political interests provide little value in our world today. People are fed up with them and increasingly distrusting of the financial institutions which we are told are “safe”.

Quarter over quarter, investment via equity crowdfunding is experiencing tremendous growth, and as more laws and regulations are relaxed and people become aware of investment opportunities, we certainly hope – and expect – this growth to continue. There is a movement of capital globally from public to private and crowdfunding is but one conduit for these capital flows.

Equity crowdfunding is a great experiment in the sense that for the first time since the Great Depression, non-accredited retail investors have access to privately listed investment opportunities.

The United States and the United Kingdom acted nearly simultaneously in 2012, allowing equity-based crowdfunding in the US via the JOBS Act and in the UK through new regulations put in place through their Financial Conduct Authority (FCA).

While American accredited investors have been able to crowdfund for several years now, the American government finally implemented rules legalizing equity crowdfunding for non-accredited investors a few weeks ago. Government efficiency at its finest…

The reason why, for the first time in almost 100 years, non-accredited retail investors suddenly became allowed to become angel investors is better answered by the guys who were instrumental in drafting the legislation and bringing about the concept itself. We discussed this some time ago with our colleagues Jason Best and Woodie Neiss and you can listen to their story here and here.

Since 2012, the UK, US, and other markets have seen literally hundreds of equity crowdfunding platforms listing thousands of investment opportunities – with varying models.

In a very general sense, four models of equity crowdfunding platforms have emerged:

1) Platforms for Everyone

Take any trip on the London tube today and – unless you’re blindfolded – you’ll not miss the advertisements from Crowdcube, which boasts nearly £90,000,000 in investments and nearly 190,000 people registered on their site. They continue to be a leading platform in this space. Crowdfunder and Seedrs are two other well-known platforms.

These platforms accept investment in increments as little as £10, though the average investment is actually well over £1,500. They focus on the retail investor who I imagine would often be mom and pop investors. While there are tech and other startup-type businesses listed, investments can also be made into more established consumer goods and retail-type businesses.

2) Platforms Geared Towards Sophisticated Investors

Sites focused on accredited investors require much higher thresholds for investment. Jerusalem-based OurCrowd, has been very successful through a focus on Israel’s hi-tech scene. It has also been expanding listings outside of Israel as well. In the United States, CircleUp is another that comes to mind.

3) Real Estate Crowdfunding

People are claiming that the future of commercial real estate is in crowdfunding. Washington, DC-based Fundrise is the first and among the most notable.

4) Niche markets

There are also a host of specialty crowdfunding platforms. Some focus on agriculture and yes, others focus on growing other products… like marijuana.

Buyer Beware

At the end of the day, equity crowdfunding – like all forms of angel investing – is inherently very risky. You have to accept that you will lose more times than you’ll win but hope that your wins are many times bigger than your losses.

Over the last 30 years early stage venture capital has outperformed stocks and bonds by a large margin, returning an average of 21.29%. This while, as I mentioned last week, up to 3/4 of early stage deals will fail.

Investing in private early stage deals is extremely time consuming and difficult. It takes skill and lots of experience. I learn something new every day and I’m almost completely surrounded by veterans and due diligence from the moment I wake till late at night when I typically pen these articles to you. It’s not a part time thing! There are a few key ingredients that I think are worth pointing out to those interested in getting their feet wet.

Do the Obvious

I am no longer surprised by people losing money in private deals. Occasionally someone will bring me a deal saying it looks really good. I’ll hit them with some simple questions which any investor should have considered before wasting their or my time on.

- Have you done a background search on the people involved?

- Due diligence: have you asked for their financials, and if it’s a start-up with none to show, have they been in business before? If so, ask for the financials of that business. What competition do they have? This question the founders need to have done extensive work on. Have you called the company, bought their product, tested their service? You can learn a lot from finding out how they’re servicing clients right now.

- What terms are being offered? In early stage deals terms are way more important than valuation!

Still interested in crowdfunding?

We for sure are! Crowdfunding is a phenomenon that is changing the way that capital is being allocated. It is fundamentally better for individuals to make their own choices with their capital than it is for Governments or incestuous corporates tied to the government to do this for us.

What I do think, however, is likely to happen is that there will be an entire host of investors getting burned, just like they do at Vegas or Macau. Many will believe that they’ll see the next Uber or Apple get listed on a crowdfunding site, and at the same time will be able to identify the deal.

Furthermore, even if they identify the deal they will have no idea about the structure of the terms and can easily be wiped out by VCs funding the company in a Series B or C round where investor protections were never put in place.

While it’s possible I’ve yet to see the early stage deals from close networks that cross our desks being posted onto any platforms, certainly in the early stages. I don’t see this changing.

Small networks of industry professionals will continue to share deals with those closest to them before taking in capital from any outside sources. Human nature isn’t about to change and humans are social creatures.

When Seraph gets a great deal we share it with those closest to us. Why would we do anything else? That’s human nature….

Furthermore, founders are typically in search of smart capital that can help them build their business. This means connected money with skills and knowledge is always going to be at a premium. If you’re an entrepreneur raising capital and looking to grow your business obtaining that from a crowdfunding platform is much more difficult.

The most promising investment opportunities will continue to be shared in tight, close-knit circles. They will, however, find their way onto crowdfunding platforms when they reach later stage financing rounds. When a company has in place the smart money and is just looking for expansion capital then I think the crowfunding sites are a sweet spot.

Lastly, back to the original question that my friend was discussing – marijuana crowdfunded deals. I don’t see them as any different from a backed beans crowdfunded deal. Crowdfunding is merely a conduit.

– Chris

“An investment in knowledge pays the best interest.” – Benjamin Franklin

- Caught On Tape: The Other Crisis Happening In Greece

With all eyes firmly focused on pensioners at the gate and ATM lines, there is another – just as cruel and unusual – crisis occurring in Greece. Europe's immigration 'problem' is front-and-center on the island of Lesvos, as KeepTalkingGreece reports, unbelievable scenes as refugees try to raid a food truck. No, this is not Somalia…

The incident took place when nearly 2,500 migrants hosted in the camp of Lesvos (Mytilene) municipality in Kara Tepe saw the catering truck approaching. They started to run for a plate with food.

Reason fro the panic to be left hungry without food was a rumor claiming that catering service for refugees had stopped on the island of Samos due to debts.

With hundreds of refugees and undocumented migrants arrive daily to Greece from Turkey, the situation has gone out of control.

On Tuesday, another boat carrying people to Greece sank, more than 10 people went missing.

Next to the Greek humanitarian and economic crisis and the country on the brink of collapse, there is also the Refugees Crisis. Europe is keeping eyes and ears closed, while Eurocrats like European Commission President Jean-Claude Juncker are making ‘nice promises’ for aid and relocation to other EU countries.

On the islands in Eastern Greece where the refugees arrive per boat and in other cities, many citizens have been set volunteers’ initiatives to help refugees. The initiatives are been supported by local business that do whatever they can amid the worst financial crisis since 2010.

- There's No Hope For A Deal "Priced In" Greek Bank Bonds

With equity markets jumping vertically on every possible ‘hope’ of a deal – no matter what the consequence – we look to the asset class that is a) not driven by headline-reading algos and HFT, and b) is by far the most sensitive to reality – Greek Bank Bonds… and they are carnaging!!

This is the asset to watch to judge ‘hope’ in Greece… not the S&P 500!!

Charts: Bloomberg

- What Greece, Cyprus, And Puerto Rico Have In Common

Submitted by Gail Tverberg via Our Finite World blog,

We all know one thing that Greece, Cyprus, and Puerto Rico have in common – severe financial problems. There is something else that they have in common – a high proportion of their energy use is from oil. Figure 1 shows the ratio of oil use to energy use for selected European countries in 2006.

Figure 1. Oil as a percentage of total energy consumption in 2006, based on June 2015 Energy Information data.

Greece and Cyprus are at the bottom of this chart. The other “PIIGS” countries (Ireland, Spain, Italy, and Portugal) are immediately above Greece. Puerto Rico is not European so is not on Figure 1, but it if were shown on this chart, it would between Greece and Cyprus–its oil as a percentage of its energy consumption was 98.4% in 2006. The year 2006 was chosen because it was before the big crash of 2008. The percentages are bit lower now, but the relationship is very similar now.

Why would high oil consumption as a percentage of total energy be a problem for countries? The issue, as I see it, is competitiveness (or lack thereof) in the world marketplace. Years ago, say back in the early 1900s, when countries built up their infrastructure, oil price was much lower than today–less than $20 a barrel (even in inflation-adjusted dollars). Between 1985 and 2000 there was another period when prices were below $40 barrel. Back then, the price of oil was not too different from the price of other types of energy, so an energy mix slanted toward oil was not a problem.

Oil prices are now in the $60 barrel range. This is still high by historical standards. Furthermore, much of the financial difficulty countries have gotten into has occurred in the recent past, when oil prices were in the $100 per barrel range.

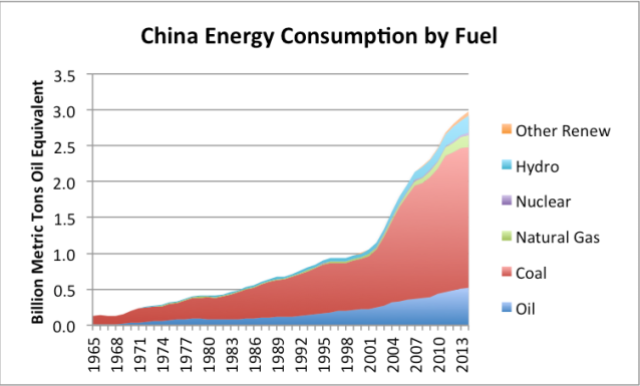

While countries with a large share of oil in their energy mix tend to fare poorly, at least some countries with a preponderance of cheap energy fuels in their energy mix have tended to do very well. For example, China’s economy has grown rapidly in recent years. In 2006, its share of oil in its energy mix was only 23.0%, putting it below Norway but above Poland, if it were included in Figure 1.

Let’s look a little at what it takes for an economy to produce economic growth, and what goes wrong in countries with high energy costs. I should mention that high energy costs can occur for any number of reasons, not just because a country’s energy mix includes a large proportion of oil. Other causes might include a high percentage of high-priced renewables or high-priced liquefied natural gas (LNG) in a country’s energy mix. The reason doesn’t really matter–high price is a problem, whatever its cause.

What Is Needed for an Economy to Grow

The following reflects my view regarding what is needed for an economy to grow:

1. A growing supply of energy products, either internally produced or purchased on the world market, is needed for an economy to grow.

The reason why a growing supply of these energy products is needed is because it takes energy (human energy plus supplemental energy) to make goods and services.

The availability of today’s jobs is also tied to the use of supplemental energy. High-paying jobs such as operating a bull-dozer, producing large quantities of food on a farm using modern equipment, or operating a computer, require supplemental energy in addition to human energy. While jobs can be created that use little supplemental energy to leverage human energy (for example, manual accounting without electricity or computers, growing food without modern equipment, or digging ditches with shovels), these jobs tend to pay very poorly because output per hour worked tends to be low.

To obtain growth in the number of jobs available to workers, a growing supply of energy products to leverage human energy is needed. Looking at the world economy, we can see that historically, growth in energy consumption is highly correlated with economic growth.

Figure 3. World GDP in 2010$ compared (from USDA) compared to World Consumption of Energy (from BP Statistical Review of World Energy 2014).

In fact, we tend to need an increasing percentage growth in energy supply to produce a given percentage growth of GDP because the y intercept of the fitted line is -17.394, rather than 0.000. Back in 1969, 1.0% growth in the consumption of energy products produced 2.2% GDP growth. The fitted line implies that recently, the amount of GDP growth associated with one percentage growth in energy consumption is only 1.2% of GDP. This poor result is taking place, despite all of our efforts toward increased efficiency. Thus, as time goes on, we need more and more energy growth to produce the same level of GDP growth. This is a rather unfortunate situation that world leaders don’t mention. They tend to focus instead on the fact that the growth in GDP tends to be at least a little higher than the growth in energy use.

2. This growing energy supply must be inexpensive, in order to be able to create goods that are competitive in the world market.

Human energy is by its nature expensive energy. Humans require food, water, clothing, and housing to support their biological needs–we are not adapted to eating entirely uncooked food, or to living in climates that get very cold in winter, unless we have protection from the elements. Thus, wages must be high enough to cover these costs.

Cheap supplemental energy provides a great deal more leveraging power than expensive supplemental energy. If we can leverage human energy with cheap energy such as wood or fossil fuels, it is easy to bring down the average cost of energy. (This calculation is made on a Calorie or Btu basis, for the sum of the energy provided by human labor plus that provided by supplemental energy.) If we are dealing with supplemental energy that is by itself high-cost, it is very difficult to bring down this weighted average cost. This is why high-cost oil, or for that matter high-cost supplemental energy of any kind, is a problem.

If human energy can be leveraged with increasing amounts of cheap energy, it can produce an increasing amount of goods and services, ever more cheaply. In fact, this seems to be where economic growth comes from. These goods and services can be shared with many parts of the economy, including government funding, wages for elite workers, wages for non-elite workers, payback of loans with interest, and dividends to stockholders. If there are enough goods and services produced thanks to this increased leverage, all of the various parts of the economy can get a reasonable share, and all can adequately prosper.

If there is not enough to go around, then there are likely be shortfalls in many parts of the economy at once. It is likely to be hard to find good paying jobs, for ordinary “non-elite” workers. Governments are likely to find it difficult to collect enough taxes. Governments may lower interest rates, or may take other steps to make it easier for businesses to continue their operations. Even with lower interest rates, debt defaults may become a problem. See my post, Why We Have an Oversupply of Almost Everything. The entire economy tends to do poorly.

Ayres and Warr provide an illustration of how an increasingly inexpensive supply of energy can lead to greater consumption of that energy–in this case electricity–in their paper Accounting for Growth: The Role of Physical Role of Physical Work.

Figure 4. Ayres and Warr Electricity Prices and Electricity Demand, from “Accounting for growth: the role of physical work.”

There is a logical reason why falling energy prices would lead to rising use of an energy product. If a person can afford to buy, say, $100 worth of energy and the cost is $1 per unit, the person can afford to buy 100 units. If the cost is $5 per unit, the person can afford to buy 20 units of energy. If it is the energy itself that aids growth in economic output (by moving a truck farther, or operating a machine longer), then lower energy prices lead to more energy consumed. This higher amount of energy consumed in turn leads to more economic output. This greater economic output is frequently shared with workers in the form of higher wages because of the workers’ “higher productivity” (thanks to the leveraging of cheap supplemental energy).

When it comes to the cost of energy production, there are “tugs” in two different directions. In one direction, there is the savings in costs that technology can provide. In the other, there is the trend toward higher extraction costs because companies tend to extract the cheapest resource of a given type first. As the inexpensive-to-extract resources are exhausted, the cost of resource extraction tends to rise. We can see from Figure 2 that oil prices first began to spike in the 1970s. After some temporary “fixes” (shifting much electrical production away from oil to cheaper fuels, shifting home heating from oil to other fuels, and starting new extraction in Alaska, Mexico, and the North Sea), the problem was more or less solved for a while. The problem came back in the early 2000s, and hasn’t really been solved. Thus, most of the tug now is in the direction of higher costs of production.1

Once oil prices rose, Greece and other countries that continued to use a high percentage of oil in their energy mix were handicapped because their products tended to become too high-priced for customers. Wages of customers did not rise correspondingly. Potential tourists could not afford the high cost of airline tickets and cruise ship tickets, because these prices depended on the price of oil. Even when oil prices dropped recently, airline companies have not reduced airline ticket prices to reflect their savings.

Because of the high-cost energy structure, manufacturing costs have tended to be high as well. With fewer tourism jobs and few possibilities for making goods for exports, the number of good-paying jobs has tended to shrink. Without enough good-paying jobs, Greek demand for fuel products of all kinds dropped rapidly. (Demand reflects the amount of goods a person wants and can afford. Young people without jobs live with their parents, and thus do not buy new homes or cars, lowering consumption.)

Figure 5. Greece’s energy consumption by fuel, based on BP Statistical Review of World Energy, 2015 data.

Other countries that were positioned to add huge amounts of inexpensive energy were able to continue to continue to grow. The country that did this best was China. It was able to cheaply and rapidly ramp up its coal supply, once it entered the World Trade Organization in 2001. If Greece now adds production of goods, it needs to be able to compete in price with China and other goods-producers.

Figure 6. China’s energy consumption by fuel, based on data of BP Statistical Review of World Energy 2015.