- The Tools Collectivists Use To Gain Power

Submitted by Brandon Smith via Alt-Market.com,

While many divisions within our society are arbitrary or engineered, there is one division that represents perhaps the most pervasive and important conflict of our time; the division between collectivists and individualists.

Now, people who do not understand the nature of collectivism will often argue that individualism and collectivism are not mutually exclusive because individuals require groups in order to survive and thrive. However, a “group” is not necessarily a collective.

For some reason the core fundamental of collectivism – the use of psychological coercion or physical force to compel participation – goes right over the heads of many skeptics. A group does not have to be collectivist. Any group can and should be voluntary. Collectivism is NOT voluntary. Therefore, collectivism and individualism are indeed mutually exclusive. Collectivists and individualists cannot exist in the same space at the same time without eventually coming into conflict. There is simply no way around it.

From the position of the liberty minded (or the average Libertarian), collectivism is by far the inferior of the two philosophies. Collectivists often boast of the social and economic “harmonization” collectivism creates, as well as the mobilization of labor to “streamline progress.” The reality is that artificially rigged harmony is no harmony at all. If people are forced to homogenize and get along through fear, then peace has not truly been accomplished.

Human beings must come to their own conclusions on cooperation and tolerance in their own time. They cannot be manipulated and shoehorned into a “utopian” framework. Problems will result, like genocide, which tends to erupt during almost every attempt at collectivist utopianism.

Economic harmonization is even less practical, with government force inevitably used to confiscate resources from one group to give to another group, essentially punishing success or frugality. This creates an environment in which achievement becomes less desirable. When people do not have individual incentive to pursue achievement, they see personal effort as wasted. Innovation and entrepreneurship fall by the wayside, and society as a whole begins to diminish in prosperity. Without individual accomplishments and ingenuity, the group is nothing but a hollow mindless ant hill.

Another argument which usually arises is that individualism leads to “selfishness” and the dominance of wealth devouring machines like corporations. I would remind collectivists that corporations exist only through the legal framework and protections of corporate personhood created by governments, and without government protections and favor, corporations could not exist. It is by collectivism, not individualism, that corporatocracy thrives.

At the same time, collectivists consistently blame individualist "free markets" for the numerous ailments of nations. Yet another misrepresentation considering America has not had true free markets in well over a century, and most other nations have never had true free markets in their history. Feudalism and its child Socialism have always been present to plague mankind.

There are no merits to collectivism that are not accomplished with greater success by individualism and voluntary community. In fact, collectivism only serves to enrich and empower a select few elites while destroying the future potential of all other individuals.

Given the disturbing nature of collectivism, one would think that attempts at collectivist societies would be a rarity, shunned by most people as akin to inviting cancer into the body. Unfortunately, cultures based on individualism are the minority in history.

The average collectivist is not usually much of a beneficiary of collectivism. We call these people “useful idiots” or “sheeple” who unknowingly serve the darker machinations of elitists while under the delusion that they are changing society for the better. The reason useful idiots participate in collectivism are many, but I have found that across the spectrum these people tend to be weak willed, weak minded, and by extension, possess a rabid desire for control over others.

It is perhaps no coincidence that “intellectuals” (self proclaimed) tend to end up at the forefront of modern efforts for collectivism. While the poor and destitute are often exploited by collectivism as a mob to be wielded like a battering ram, it is the soft noodle-bodied and fearful academia that acts as middle management in the collectivist franchise. It is they that desire the power to impose their “superior” ideologies on others, and since they are too weak to accomplish anything on their own, they require the cover and momentum of collectivist movements to give them the totalitarian fix they so crave. In other words, they believe in humanitarianism by totalitarianism.

Individualism is under constant and imminent threat as the collectivist obsession with control grows. The ultimate end game of collectivists is to derive submission from individuals, to corner people into handing over their individualism willingly. It is not enough for them to merely apply force, the greatest power is in the power of consent. Here are the most common tools used by collectivists to obtain power and manufacture consent from the masses.

The Illusion Of Consensus

Collectivists rely greatly on the force of a well-aimed mob to convince the general public they have the consensus position; that they are in the majority. Appearing to be in the majority is the single most important goal of a collectivist movement, even if they are in reality a small minority. The anonymity of web activism gives the force of the mob a new potency. No more than a dozen collectivists working in tandem can wreak havoc in multiple web forums or harass numerous individualist publications while giving casual readers the impression that their ideology is “everywhere.”

The key here is that collectivists understand that the average person does not want to be seen as too contrary to the majority. They understand that the majority view matters to the public, even if the majority view is utterly wrong. If collectivists can convince enough people that their ideology is the majority view, they know that many people will blindly adopt that ideology as their own in order to fit in. The lie of consensus then becomes a self perpetuating prophecy. This problem will remain forever a danger as long as people continue to care at all about the majority view.

The Destruction Of Core Institutions

Those institutions people consider “core institutions” are sometimes vital, and sometimes not. That said, it is the openly admitted objective of collectivists through socialist-style movements to destroy core institutions so that there is no competition to their new system. A collectivist society cannot allow citizens to have any loyalties beyond their loyalty to the group or the state.

So, individual liberties must be degraded or removed, as per the constant reinterpretation of the Constitution as a “living document.” Religious institutions must be painted as shameful affairs for stupid barbaric cave-people. And, the family unit must be broken apart. This is done through economic depravity so pronounced that families never see each other, through state influence over children through public schooling, and through identity politics and propaganda which create sexual and racial conflicts out of thin air.

Dominating Discussion

This coincides with the idea of artificial consensus, but it goes beyond the use of the mob. In our daily lives we are now bombarded with collectivist messages — in mainstream news, in television shows, in movies, through web media and print media. The money behind these outlets belongs to a very small and select group of people, but through them the collectivist worldview is injected into every corner of our society. I would call this propaganda by attrition; an indirect but steady insertion of collectivism creating an atmosphere in which the ideology becomes commonplace even though it is being promoted by a limited number of people.

Exploiting The Youth

When we are young, most of us spend a great deal of time and energy working to be taken seriously. The question is, should we be taken seriously?

In my view and the view of the liberty minded, it really depends on the person’s actions, experience, efforts and accomplishments. Most younger people have little to no experience in life and haven’t had the time to accomplish much. They are still learning how to function in the world, and what kind of goals they want to pursue (if they ever pursue any goals). Because of this, it is hard for those of us who have gone through considerable struggles in life and reached a certain level of achievement to take them seriously when they decide to stroll into a room and pontificate on their moral and philosophical superiority. It makes me want to ask; what the hell have you ever accomplished?

This is not to say that there are not ingenious young people out there, or ignorant and lazy older folks. There are. But collectivist movements seek to exploit younger generations exactly because of their general lack of experience and naivety, as well as their feelings of entitlement when it comes to respect.

Collectivism almost always utilizes a theory called “futurism” in order to appeal to the young. The theory, which was a leading philosophy behind the rise of fascism, proclaims that all new ideas are superior in their social usefulness and all old ideas and beliefs should be abandoned like so much dead skin. According to futurism, those who cling to old ideas and principles are an obstacle to the progress of society as a whole.

The funny thing is, the ideas usually expounded by collectivists are as old as time — elitism, feudalism, totalitarianism, etc. None of these methodologies are “new” by any stretch of the imagination, but collectivists repackage them as if they are some grand new secret to Shangri-La. Younger adherents of collectivism latch onto futurism almost immediately. For, if all new ideas are superior, and all old ideas are barbaric, and younger people are the purveyors and consumers of everything new, then this means that it is the youngest generations that are the wisest, and the village elders that are naïve. By default, the young become the village elders without them ever having to struggle, make sacrifices, learn hard lessons, suffer loss, rise to challenges, or accomplish anything.

The enticing nature of this sudden groundswell of cultural respect is simply far too much for the average person college age or younger to ignore. Collectivism gives the young what they think they want, then uses them as tools for greater conquests.

Forcing Society To Accept The Lowest Common Denominator

Collectivism requires the homogenization of society, to the point that individualism is frowned upon and success is treated as negligible. Whether it is public schools lowering standards to the point that students with little or no reading comprehension graduate, or businesses being forced to lower standards in the name of “diversity” while rejecting employees with superior skill sets because they do not belong to a designated victim group, or government institutions like the military lowering physical standards to accommodate far weaker candidates in the name of “gender parity” while putting every soldier’s life at risk in the process, we are constantly being asked to accommodate the lowest common denominator instead of reaching for the highest level of excellence.

This makes the concept of success a bit of a joke. For “success” within such a system is easy as long as one follows the rules; excelling as an individual is not a factor. And by success I mean being allowed to survive, because that is the best you are going to get in a collectivist structure. The only way to fail is to not follow the rules, rules which may be arbitrary or idiotic at their core. Individualists are immediately punished for thinking or acting outside the box, when this is exactly the kind of behavior that should be encouraged. A society built on the lowest common denominator is a society destined for collapse. Individuals are systematically weeded out in the name of homogenization and all of their potential achievements and innovations disappear with them.

The nightmare of collectivism is the defining battle of our age. It is in this era that we will decide whether or not individual liberty and freedom of thought are more important than the illusory security and “harmony” of the collective.

I, for one, long to see a future in which individual enterprise is allowed to thrive and voluntary participation is the root principle on which our culture functions; a future in which state power is reduced to zero, or near zero, and government force is no longer an acceptable means by which one group can seek to control another group. I may not see this world in my lifetime, but the liberty-minded can make it possible for newer generations by avidly defending ourselves against collectivism today. As pointed out in the beginning, collectivism and individualism cannot coexist; confrontation is inevitable. Recognizing this, and preparing for it, is our duty as free human beings.

- Visualizing Where The Money's Made Is In America

The U.S. Department of Commerce and its Bureau of Economic Analysis (BEA) recently released its statistics on gross domestic product (GDP) by metropolitan area for 2014. The BEA determines the statistics for each metropolitan area as the sum of the GDP originating in all industries in the area. The data is the sub-state counterpart of the nationwide GDP. It is the most comprehensive measure of economic activity.

HowMuch.net built a map to provide a 3D visualization of the GDP by metropolitan area, seen below. The higher the cone rising out of the map, the greater the GDP in that area. In analyzing the data, we found that the top 20 metropolitan areas represent over 52% of the total GDP in the United States. GDP grew 2.3% for all metropolitan areas in 2014, after increasing 1.9% in 2013.

As shown by the map, the New York metropolitan area, which includes Newark and Jersey City,lead the country with $1.5 trillion in GDP. The area had GDP growth of 2.4% in 2014. The New York metropolitan area provided almost 10% of the total GDP for the entire country.

The Greater Los Angeles area was second with $866 billion in GDP, with an increase of 2.3% over 2013. This was followed by the Chicago metropolitan area with $610 billion and growth of 1.8%. In fourth was the Houston metro area with $525 billion. Dallas, another Texas metro area, had $504 billion in GDP.

GDP By State

We also broke down the GDP by state. We calculated that the top 5 states contributed 40% of the overall GDP for the United States as follows:

-

California: $2.11 trillion, 13% of overall GDP

-

Texas: $1.46 trillion, 9.5% of overall GDP

-

New York: $1.28 trillion, 8.4% of overall GDP

-

Florida: $769 billion, 4.8% of overall GDP.

-

Illinois: $680 billion, 4.3% of overall GDP.

Effect of Population

One important factor for GDP appears to be the population for both the state and the metropolitan areas. New York, Los Angeles, Chicago, Dallas and Houston are the five most densely populated metropolitan areas in that order. Further, California, Texas and New York have the highest populations by state in that order. There appears to be a relationship between GDP output and the population for a geographical area.

The Final Analysis

The largest metropolitan areas contributed the greatest amount of GDP for the country. According to our analysis, the top 20 metropolitan areas contributed over half of the United State’s GDP. The New York metropolitan area contributed nearly 10% to the GDP by itself. In terms of a breakdown by state, the top 5 states contributed around 40% of the entire country’s GDP. California alone contributed over 13% of the total GDP for the country.

-

- A "Zero Tolerance" Police State

Submitted by Nick Giambruno via InternationalMan.com,

I’ve almost become numb to horrendous videos like these…

It seems like a new shocking police abuse video sweeps the nation almost every week. These viral videos help bring a small dose of accountability to government employees. And they don’t like it one bit.

The unjustified violence isn’t what really upsets them. They’re upset because they can’t operate with near total impunity anymore. The Internet and proliferation of smartphones have made it much harder for the government and mainstream media to sweep inconvenient incidents under the rug.

This is why some states, most notoriously Florida, are abusing outdated eavesdropping laws to harass people who attempt to film the police.

It’s all part of a long trend. The government will always try to shield itself from the fallout from its behavior. Another favorite tactic is to simply declare troublesome information “classified” or to withhold it because of “national security,” a vague and misused term.

It’s an upside down situation. The government can monitor almost any aspect of the average citizen’s life whenever it wants. But it’s difficult to impossible for the average citizen to monitor the government. In a free society, the opposite would be true.

The Camera Is the New Gun

Trying to prohibit people from recording cops is a desperate move. And I don’t think it’s practical.

Nearly everyone has a phone that can record a decent quality video, and it only takes seconds to upload a video onto the Internet. Once it’s there, it’s hard for anyone to make it disappear.

Even a police incident in a small town no one has ever heard of can become a national news phenomenon. This has made it harder for the government and mainstream media to shape the narrative.

It’s also why Judge Andrew Napolitano calls the camera the new gun.

This scenario played out recently at Spring Valley High School in South Carolina. A teenage girl refused to put her cell phone away. The teacher asked her to leave the classroom. She didn’t. So the school called in its resource officer.

“Resource officer” strikes me as a strange term. As far as I can tell, it’s just a police officer stationed at a school. Why not call it what it is?

Some bureaucrat likely invented the term to sanitize a situation that reasonable people find disturbing. It’s unnerving to think about heavily armed government employees interacting with your children every day they go to school (which looks more and more like a prison). “Resource officer” certainly makes the whole thing sound friendlier.

But back to the incident in South Carolina…

The resource officer showed up and asked the student to leave. When she refused, he wrapped his arm around her neck in a headlock. The struggle tipped over the girl’s desk and she fell to the ground. Then the officer dragged the girl and threw her across the classroom.

It’s a barbaric and unjustifiable way to treat a young girl. But it’s hardly unique or surprising.

In my experience, U.S. police are much more aggressive than police in the rest of the world. I noticed it when I started traveling many years ago. I’ve also noticed that the average citizen is more likely to run into the police in the U.S. Both of these trends are accelerating.

This is especially true for young people in public schools. No other country comes close to having the same level of police presence in schools. And no other country criminalizes as many everyday activities.

According to the LA Times there are now over 14,000 resource officers in schools across the U.S.

The explosion in the number of cops embedded in schools started in the 1990s. That’s when “zero tolerance” madness really started to sweep the country. It was a side effect of the ludicrous War on Some Drugs.

At first, these school cops only got involved with things like illegal drugs, gangs, and serious violence. Over time, there’s been a predictable mission creep. Schools were tempted to use the officers in more and more situations. At this point, they’re effectively enforcing school rules. Horseplay and disobeying the teacher now lead to arrests and criminal records rather than in-school discipline, like detention.

South Carolina has a “disturbing school” law, which makes it a crime "to interfere with or to disturb in any way or in any place the students or teachers of any school or college in this state.” The government can fine up to $1,000 or jail for 90 days anyone who breaks the law.

The law’s vague and subjective wording effectively allows the police to harass students whenever the school administration asks…or whenever they want to. This is the law that gave the high school in South Carolina the pretext to call its resource officer to deal (violently, if needed) with the girl who wouldn’t put away her cell phone.

Seven other states already have similar laws. I’d bet the ongoing “zero tolerance” psychosis helps push many more through.

A Harbinger of Things to Come

Unfortunately, most people don’t even question whether there should be a resource officer in each and every school in the first place. Most passively accept it as an undisputed necessity. If they want change, they usually want a more aggressive police presence in schools.

I doubt the attitudes and mindsets that have fostered this situation will change for the better anytime soon. I expect the police state trend will only accelerate in the U.S.

How will the government pay for all this police activity? I’d bet civil asset forfeitures will continue to play a big role.

Dozens of government agencies now have the power to lock up all your U.S. bank accounts, your U.S. brokerage accounts, and even your home. They only need the flimsiest hint that something might be wrong.

It doesn’t matter if the underlying allegation is about taxes, drugs, food safety, the environment, or something else. It doesn’t even take a real allegation to make it happen. A single government employee’s suspicion or ill will is enough to push the bureaucratic launch button and start your nightmare.

They act without warning, and they can strip away all of your assets without waiting for a hearing, a trial, or any other token of due process.

If it’s in the U.S., it’s theirs, whenever they say it is.

Yes, after they strike, you can go to court to get your property back. But how will you hire a lawyer if they’ve frozen your bank account? And how will you pay your bills while the legal process grinds on?

Forget what you learned in civics class. Sometimes a government agency just wants your property.

As the Institute for Justice has stated, “Under modern civil forfeiture laws…filling law enforcement’s coffers is often the primary purpose of the seizure.”

The government can easily pick up any assets you keep in the U.S.

The Ultimate Protection from an Out of Control Government

If you’re alarmed by the growing threat from your own government to your personal freedom and financial health, I don’t blame you.

You’ve seen the crowded parade of new laws, taxes, and regulations. Many more are in the works.

In fact, as financial resources shrink and government deficits rise, I’m afraid the grab for money will become more desperate. Governments will go beyond taxation and reach into checking, savings, and even Grandma’s retirement account for help.

Events around the world show cash strapped governments are more than willing to use capital controls, income tax hikes (to rates as high as 75% in France), debt monetization, nationalization of private pensions, bail-ins and bank deposit confiscations, and other ways to grab your money.

No matter how safe your government says your money is, how comfortable can you really be if it’s all in one country?

Most people understand that it’s foolish to keep all their eggs in one basket. But they don’t apply the principle all that well. Portfolio diversification isn’t just about investing in multiple stocks or in multiple asset classes. Real diversification – the kind that keeps you safe – means holding assets in multiple countries so you’re not overexposed to economic and political risks in any one of them.

- Mission Accomplished? Chinese Stocks Re-Enter "Bull Market" – Up 24% From August Lows

For the 3rd time since the crash in June, Chinese stocks have staged a magnificent recovery. Amid the selling bans, arrests, deaths, manipulation, massive direct government buying, and general happy-talk propoganda, Chinese stocks are now up 24% from the August lows… Of course, we are sure every one of the grandmas and farmers – fully levered – clung on through the dips.. and are now still 32% down from the June highs…

Where next?

Charts: Bloomberg

- Desperate-To-Hike Fed Admits "Inflation Is Not As Low As You Think"

Following this morning's basic admission by Janet Yellen that "no matter what" The Fed is raising rates in December (which was then solemnly supported by an obedient Bill Dudley who "100% agrees with Yellen"), Fed Vice-Chair Stan Fischer, speaking tonight, reaffirmed this belief by, as we detailed previously, telling investors to ignore weak inflation. After San Fran Fed's Williams admission that "there's something going on here we don't understand," Fischer tonight admitted "US inflation is not as low as you think," at once contradicting Yellen's earlier comments and the various market-based measures, while confirming our previous detailed solving of the mystery of the hidden inflation.

Inflation Breakevens are collapsing…(longer-dated near record lows)

Inflation expectations are at a record low… and worse…

- *CURTIN SAYS `DISINFLATIONARY MINDSET' IS TAKING HOLD

But all of that is wrong.. As Stan Fischer admitted tonight:

- *FISCHER SAYS NOT MUCH EVIDENCE INFLATION MEASURE IS TOO LOW

- *FED'S FISCHER SAYS HE BELIEVES WAGE GROWTH WILL COME BACK

- *FISCHER SAYS U.S. INFLATION IS `NOT AS LOW AS YOU THINK'

- *FISCHER SAYS FED IS NOT THAT FAR FROM 2% INFLATION TARGET

Wait, what!!??

Having now admitted that all of the above market-based (and survey-based) expectations (and current measures) of inflation are wrong, as we noted previously, depending on the importance of the credit channel, the Federal Reserve, by pegging the short term rate at zero, have essentially removed one recessionary market mechanism that used to efficiently clear excesses within the financial system.

While stability obsessed Keynesians on a quest to the permanent boom regard this as a positive development, the rest of us obviously understand that false stability breeds instability.

It is clear to us that the FOMC in its quest to maintain stability is breeding instability and that previous attempts at the same failed miserably with dire consequences for society. We are sure it is only a matter for time before it happens again.

And further seemingly confirmed that the real "hidden" inflation mystery – as we solved here – is in fact in the very heart of The Fed's wealth creation process: the U.S. transformation from a homeownership society, to one of renters.

From the latest, just released joint white paper by Harvard's Center for Housing Studies in conjunction with the Enterprise Resource Center, in which we read that the US rental crisis is about to get far worse. In fact, in an optimistic scenario in which rental inflation rises by 3% annually (it is currently far higher at 3.6%), while annual income growth is rising at a speed 2.0% (it is currently far lower in real terms) the number of severely cost burdened households – those who spend over half of their income on rent – will rise by over 25% over the next decade, from 11.8 million to a record 14.8 million households!

Which means that is using at least somewhat realistic assumptions, the real number of households who spend more than half of their income on rent will likely be in the upper teens if not 20s of millions by 2025.

From the report:

if current trends where rent gains outpace incomes continue, we find that for each 0.25 percentage point gain in rents relative to incomes, the number of severely cost-burdened renters will increase by about 400,000. Under the worst-case scenario of real rent gains of 1 percentage point higher than real income gains per year over the decade, the number of severely cost-burdened renters would reach 14.8 million by 2025, an increase of 25 percent above today’s levels.

More depressing details about the state of the US housing rental market:

At the time of the decennial census in 2000, one in five renters were severely cost burdened, paying more than half of their gross income for rent and utilities (Figure 2). Meanwhile, another 18 percent faced moderate cost burdens, spending between 30 and 50 percent of their income on housing costs, exceeding the widely accepted standard that housing should not command more than 30 percent of a household budget.3 This represented a slight improvement over the shares burdened in 1990 as income gains outpaced growth in rents.

And here is the punchline: "in the years following 2000, gains in typical monthly rental costs exceeded the overall inflation rate, while median income among renters fell further and further behind (Figure 3). As a result, the share of renter households facing severe cost burdens grew dramatically, reaching a new record high of 28 percent in 2011 before edging down to 26.5 percent in 2013. Adding in those with moderate burdens, just under half of all renters were cost burdened in 2013. These rates are substantially higher than a decade ago and roughly twice what they were in 1960."

And far from confirming the "bullish thesis" that Millennials will eventually move out of their parents basement and buy (or rent) their own housing while starting new households, just the opposite is taking place:

In 2015, 15.1 percent of 25 to 34 year olds were living with their parents, a fourth straight annual increase, according to an analysis of new Census Bureau data by the Population Reference Bureau in Washington. The proportion is the highest since at least 1960, according to demographer Mark Mather, associate vice president with PRB. "The phenomenon of young adults, facing their own financial challenges, forced to squeeze in the homes of their parents. And new data show the trend is getting worse, not better."

In conclusion, nowhere is the mystery of the "missing" inflation more obvious than in the following interactive map showing that in virtually all major seaboard metro areas, including the major cities in California, New York, and Florida, the number of households with a cost burden is 50% or higher.

As we concluded when addressing this mystery,

All of this could have been avoided if only the Fed has observed the "missing" and soaring rental inflation that was right in front of its nose all the time, and which it did everything in its power to ignore just so the 1% can keep their ZIRP (and soon NIRP)and QE, and become even wealthier on the back of the middle class and the 80 million of 25-34 year old Americans who have found out the hard way that not only is the American Dream of owning a home officially dead, it has been replaced with the American nightmare of completely unffordable renting.

* * *

And thus, The Fed is forced to entirely trounce its "data-dependent" bullshit in order that it can do whatever it wants… in this case, raise rates in order to perhaps slow the speculative bubble in housing (driving rental inflation) just enough (goldilocks-style) to turn the multi-year trend in homeownership around…the lowest in 48 years!

Or, perhaps more likely, show it can and to have the merest of ammunition when the current bubble bursts before resorting to QE-moar… because as Peter Schiff recently concluded,

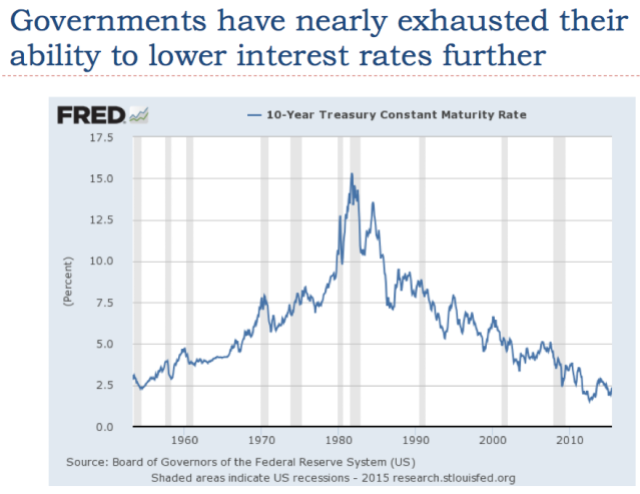

If the Fed is unable to raise rates from zero, it will also be have no ability to cut them to fight the next recession. So the next time an economic downturn occurs (one may already be underway), the Fed will have to immediately launch the next round of QE. When QE4 proves just as ineffective as the last three rounds to create real economic growth, the Fed may have to consider the radical ideas now being contemplated by the Bank of Japan.So this is the endgame of QE: Exploding debt, financial distortion, prolonged stagnation, recurring recession, and the eventual government takeover of industry and the economy. This appears to be the preferred alternative of politicians and bankers who simply refuse to let the free markets function the way they are supposed to.If interest rates were never manipulated by central banks and QE had never been invented, the markets could have purged themselves years ago of the speculative bubbles and mal-investments. Sure we could have had a deeper recession, but it also could have been much shorter, and it could have been followed by a far more robust and sustainable recovery.Instead Washington has joined Tokyo on the road to Leningrad. - US Officials: ISIS "Likely" Had Bomb On Russian Plane

On Wednesday, IS Sinai released a statement reiterating the contention that the Russian passenger jet which fell out of the sky over the Sinai Peninsula last weekend was “downed” by an act of terrorism. The ISIS “home office” (so to speak) in Raqqa aired a video congratulating their Egyptian “brothers” on the “achievement.”

In the immediate aftermath of the crash, officials attempted to discredit the ISIS video which purported to show the plane exploding in mid-air. While we were quick to note that it’s virtually impossible to verify the video’s authenticity, we also pointed out that if the footage was indeed genuine, someone on the ground knew exactly when to start filming which would certainly seem to suggest that whatever happened to the Russian jet was premeditated.

Whatever one chooses to believe, evidence continues to pile up to support the contention that the plane broke apart in the sky – i.e. that the plane exploded.

For instance, an Egyptian forensics expert noted that the scattering of body parts over an eight kilometer radius seems to prove that there was an explosion of board. Meanwhile the UK on Wednesday suspended flights from Sharm el-Sheikh in Egypt after saying that the Russian jet “may well” have been destroyed by an “explosive device.”

That seemed to indicate that Western governments were set to “confirm” ISIS’ contention that a bomb is to blame for the crash.

Now, Western media are reporting that according to US “intelligence”, an ISIS bomb was indeed the cause of the catastrophe that claimed the lives of 224 people last Saturday. Here’s Reuters:

Evidence now suggests that a bomb planted by the Islamic State militant group is the likely cause of last weekend’s crash of a Russian airliner over Egypt’s Sinai peninsula, U.S. and European security sources said on Wednesday.

Islamic State, which controls swathes of Iraq and Syria and is battling the Egyptian army in the Sinai Peninsula, said again on Wednesday it brought down the airplane, adding it would eventually tell the world how it carried out the attack.

The Airbus A321M crashed on Saturday in the Sinai Peninsula shortly after taking off from the resort of Sharm el-Sheikh on its way to the Russian city of St Petersburg, killing all 224 people on board.

The U.S. and European security sources stressed they had reached no final conclusions about the crash.

And here’s more from NBC:

There’s significant evidence that a bomb brought down Russia’s Metrojet Flight 9268 over the Sinai Peninsula last weekend, U.S. officials told NBC News on Wednesday, saying U.S. investigators are focusing on ISIS operatives or sympathizers as the likely bombers.

Questions have swirled over whether foul play or terrorism may have downed the Metrojet-operated Airbus A321 since it crashed in Egypt on Saturday, killing all 224 people aboard. ISIS’s media office in Sinai released an audio message Wednesday reiterating its claim of responsibility. Neither Wednesday’s claim nor an earlier one immediately after the crash said how ISIS is supposed to have brought down the plane.

U.S. officials stressed that while they believe it’s “likely” that a bomb was on the plane, it’s still too early to conclude that for certain. They told NBC News that mechanical failure remains a possibility.

A U.S. official said investigators are looking at the possibility that an explosive device was planted aboard the plane by ground crews, baggage handlers or other ground staff at the Sharm el-Sheikh airport before takeoff. Passengers and the flight crew weren’t significantly suspected after intelligence scrub of the passenger manifest and the crew showed no one with suspected ties to any terrorist group, officials said.

Three top officials at the airport, including the head of security, were fired Wednesday after investigators uncovered numerous lax security procedures, officials told NBC News.

So apparently, US officials have more evidence about what happened to this plane than either the Russians or the Egyptians do and Washington is now confident enough to say that ISIS is “likely” responsible.

Needless to say, there are any number of questions that should be asked here, but at least NBC gets one thing right:

A U.S. official told NBC News he expects Russia to retaliate “heavily and militarily” if the theory is borne out.

- October Gun Sales Hit Record High For Six Consecutive Months

Two things happened after the most recent widely publicized US mass shootings: i) Obama once again made a concerted effort to pass anti-gun legislation, and ii) gun sales soared most likely in response to i). As we reported a month ago citing the FT, “gun sales this year could surpass the record set in 2013, when gun purchases surged after the December 2012 Sandy Hook murders.”

… the calls for tighter gun laws lead to an increase in weapons sales. “Once the public hears the president on the news say we need more gun controls, it tends to drive sales,” said Mr Hyatt, who owns one of the largest gun retailers in the US. “People think, if I don’t get a gun now, it might be difficult to get one in the future. The store is crowded.”

“We don’t want our business to be based on tragedy but we have to deal with what we have no control over,” Mr Hyatt said. “And after these shootings and then the calls for tougher gun laws, we see a buying rush.”

This is not surprising: as Wired noted back in 2013, sharp spikes in gun sales usually following mass shootings for several reasons.

The desire to protect one’s self In many cases, gun shootings followed by 24/7 media coverage prompt citizens to arm themselves, according to testimonies. In Aurora, for instance, Jake Meyers of Rocky Mountain Guns and Ammo told The Post shoppers cited self-protection when checking out new weapons. “A lot of it is people saying, ‘I didn’t think I needed a gun, but now I do,’ ” Meyers said. “When it happens in your backyard, people start reassessing — ‘Hey, I go to the movies.'”

The fear of stricter gun laws Another logical factor is that gun owners’ or soon-to-be-gun owners’ sense a tide of gun control regulations following a massacre and seek to purchase guns ahead of fast-moving laws. Paul Helmke, president of the Brady Campaign to Prevent Gun Violence, spoke to this following a 60 percent uptick in gun sales in the aftermath of the Tucson shootings in 2011. “Some Americans fear tougher gun control laws in the aftermath of Saturday’s attack so they want to stock up now,” he told Politico. “What it shows is maybe gun owners in Arizona and these other states feel that there’s going to be some change in the law, which is what I hope our elected officials” trying to enact. Obviously, that fear has been unfounded. Since coming into office, Obama has been virtually silent on the issue of gun control, despite the protestations of liberals.

The feeling of uncertainty It’s important to remember, spikes in guns sales don’t just coincide with shooting sprees. They also coincide with violent events of any kind, as Fredrick Kunkle at The Washington Post reported. “People also rushed to buy guns after the 1992 riots in Los Angeles and the breakdown of order in New Orleans after Hurricane Katrina.” That has led some industry experts and law enforcement officials to point to a general feeling of uncertainty as a driver of gun buying habits. “People often buy firearms during periods of uncertainty,” Gary Kleck, a researcher at Florida State University’s College of Criminology and Criminal Justice, told the paper.

Which brings us to today when in the latest FBI background check data – a proxy for total gun sales in the United States as most gun purchases require a background check – we find that, as expected, Obama’s latest threat to implement stricter gun controls backfried once more, and the month of October saw a record number of background checks.

As the Free Beacon adds it wasn’t just October: the same was true for September, August, and so on: in fact, October was the sixth consecutive month to see a record number of checks. “So far in 2015 the FBI has performed 17,584,346 firearms related checks. Currently, 2015 is on pace to beat 2013’s record 21,09,273 checks.”

The full breakdown:

More from the Free Beacon:

Gun rights activists have pointed to Democrats’ calls for new gun control measures as one reason why gun sales have increased. Democratic frontrunner Hillary Clinton has said that the Supreme Court is wrong on the Second Amendment, that Australian style mandatory gun buybacks should be considered in the United States, and that she would implement new gun control through executive action.

“Barrack Obama and Hillary Clinton are the best gun salespeople on the planet. The more they scream for new gun control laws the more guns walk off the shelves at gun stores,” said Alan Gottlieb, the head of the Second Amendment Foundation. “To quote the lyrics of Peter, Paul and Mary, ‘When will they ever learn, when will they ever learn.’”

The biggest irony, however as we reported on Sunday, is that “homicide rates have been cut in half over past 20 years as new gun ownership soared.”

So thanks Obama: courtesy of your inept approach to resolving every social issue not to mention your naive, recurring attempts to uproot the Second Amendment, you are making the US safer one teleprompted, faux-emotional speech at a time. Granted, everyone knows that was not your intention, but the public will take whatever it can.

- War, Big Government, & Lost Freedom

Submitted by Dr. Richard Ebeling via The Cobden Centre,

We are currently marking the hundredth anniversary of the fighting of the First World War. For four years between the summer of 1914 and November 11, 1918, the major world powers were in mortal combat with each other. The conflict radically changed the world. It overthrew the pre-1914 era of relatively limited government and free market economics, and ushered in a new epoch of big government, planned economies, and massive inflations, the full effects from which the world has still not recovered.

All the leading countries of Europe were drawn into the war. It began when the archduke of Austria- Hungary, Franz Ferdinand, and his wife, Sophia, were assassinated in Bosnia in June 1914. The Austro-Hungarian government claimed that the Bosnian-Serb assassin had the clandestine support of the Serbian government, which the government in Belgrade denied.

How a Terrible War Began and Played Out

Ultimatums and counter-ultimatums soon set in motion a series of European military alliances among the Great Powers. In late July and early August, the now-warring parties issued formal declarations of war. Imperial Germany, the Turkish Empire, and Bulgaria supported Austria-Hungary. Imperial Russia supported Serbia, which soon brought in France and Great Britain because these countries were aligned with the czarist government in St. Petersburg. Italy entered the war in 1915 on the side of the British and the French.

The United States joined the conflict in April 1917, a month after the abdication of the Russian czar and the establishment of a democratic government in Russia. But this first attempt at Russian democracy was overthrown in November 1917, when Vladimir Lenin led a communist coup d’état; Lenin’s revolutionary government then signed a separate peace with Imperial Germany and Austria-Hungary in March 1918, taking Russia out of the war.

The arrival of large numbers of American soldiers in France in the summer of 1918, however, turned the balance of forces against Germany on the Western Front. After having been driven out of the French territory they had occupied since the first year of the war, the Germans agreed to the armistice on November 11, 1918 that ended what was already called the Great War – the “War to End All Wars” as it was falsely believed.

The Human and Material Costs of War

The human and material cost of the First World War was immense. During the conflict more than 60 million men were called up to fight. At least 20 million soldiers and civilians lost their lives, with an equal number wounded.

The participating governments combined spent more than $145.9 billion in fighting each other. In 2015 dollars, this represents a monetary expenditure of more than $3.8 trillion. (As a point of comparison, what the belligerent powers spent, in total, fighting each other in the four years of World War I, the U.S government almost spent, alone, in fiscal year 2015 – $3.6 trillion!)

These numbers, of course, do not capture the human suffering from the four years of war. On the Western Front, which ran through northern France from the English Channel to the Swiss border, millions of soldiers lived endless months – years – in frontline trench warfare. They fought in the heat of the summer and the cold of winter, often with the decomposing bodies of their fallen comrades next to them for days on end.

They fought in battles such as the one for the French town of Verdun in which hundreds of thousands of men were killed during human wave attacks in attempts to capture enemy positions. Soldiers were mowed down by machine guns or crushed under the treads of that new machine of war, the tank.

The airplane entered modern warfare for the first time, raining down bombs on both military and civilian targets. And both sides introduced the use of poison mustard gas that blinded the eyes, blistered the lungs, and brought agonizing death.

War and the End of Limited Government Liberalism

The First World War also brought about the end of the (classical) liberal epoch in modern Western civilization. For most of the 100 years before 1914, the Western world had moved in the direction of greater individual freedom and wider economic liberty.

All-powerful kings were replaced with representative democratic government or constitutionally limited monarchy. Expanding civil liberty brought about a more impartial equality before the law and the end of human slavery.

The older eighteenth century mercantilist system of economic planning and control by government was ended. In its place, arose domestic free enterprise and widening global freedom of trade. The standard of living of tens of millions in the West began to dramatically rise above subsistence and starvation for the first time in human history, while at the same time population sizes grew exponentially.

War may not have been abolished in the nineteenth century, but new international “rules of war” meant that they were less frequent, of shorter duration, and when among the Great Powers, at least, often involved fewer deaths and greater respect for civilian life and property.

(The American Civil War in the 1860s was the one major exception with more than 650,000 deaths and massive destruction in the Southern states.)

Wars and armament races, many argued at the time, had become too costly and destructive among “civilized” nations. A universal epoch of international peace was hoped for when the new century dawned in 1900.

But in 1914, the First World War shattered the long liberal peace that had more or less prevailed in Europe since the last world war that ended with the defeat of Napoleon’s France in 1815. But even before 1914, there were emerging anti-liberal forces that were moving the world toward greater government control and a renewal of international conflict. (See my article, “Before Modern Collectivism: The Rise and Fall of Classical Liberalism.”)

The Rise of Nationalism and Socialism

Early in the nineteenth century, the ideology of nationalism became a new rallying cry for peoples throughout Europe and increasingly around the world. If liberalism had espoused peaceful market exchange and the freedom of individuals under the rule of law, nationalism called for the forced unification under one government of all peoples speaking the same language or sharing the same culture or ethnicity. National collectivism was considered a higher ideal than respect for the liberty of the individuals comprising communities and nations.

In the middle of the nineteeth century, another form of collectivism started to gain popularity and support: socialism. Karl Marx and other socialists argued that capitalism was the root of all social evil, causing poverty and resulting in exploitation of the masses for the benefit of those who privately owned the means of production. Socialists called for the nationalization of the means of production, central planning of all economic activity, and the curtailing of individual freedom for the sake of the collective good.

War and the Planned Society

Imperialist designs by the Great Powers in conjunction with the new ideological forces of rising nationalism and socialism all came together in the caldron of conflict that enveloped so much of the world after 1914.

Immediately with the outbreak of hostilities, the liberal system of individual liberty, private property, free enterprise, free trade, limited government, low taxes, and sound money was thrown to the wind.

The epoch of political and economic collectivism had begun. Civil liberties were rapidly curtailed in all the belligerent nations, with laws restricting freedom of speech and the press. Opponents of war were silenced with long prison sentences for “anti-patriotic” behavior. Industry and agriculture were soon placed under increasingly strict price and wage controls.

Governments imposed wartime planning boards that directed the economic activities of all. They raised taxes to heights never experienced even under the most plundering hands of absolute monarchs of the past. Governments also ended international free trade, and introduced rigid regulations over all imports and exports.

The nineteenth century freedom of movement under which people in the West could travel from one nation to another without passport or visa was abolished; a new era of immigration and emigration barriers began. The individual was now completely under the control and command of the state.

With this came a new governmental responsibility: direct caring for the economic welfare of the citizenry. German free-market economist Gustav Stolper explained:

“Just as the [First World] War for the first time in history established the principle of universal military service, so for the first time in history it brought economic national life in all its branches and activities to the support and service of state politics – made it effectively subordinate to the state. . . . Not supply and demand, but the dictatorial fiat of the state determined economic relationships – production, consumption, wages, and cost of living . . .

“At the same time, and for the first time, the state made itself responsible for the physical welfare of its citizens; it guaranteed food and clothing, not only to the army in the field but to the civilian population as well . . .

“Here is a fact pregnant with meaning: the state became for a time the absolute ruler of our economic life, and while subordinating the entire economic organization to its military purposes, also made itself responsible for the welfare of the humblest of its citizens, guaranteeing him a minimum of food, clothing, heating, and housing.”

Gold as Money in the Prewar Liberal World

Along with these losses of personal civil and economic freedom came yet another abridgement of the liberal system of government: the abolition of the gold standard. During the 25 years of war between France and Great Britain following the French Revolution of 1789, both governments had resorted to the money printing press to finance their war expenditures. As a result, inflation had eaten away at the wealth and security of the British and French citizenry.

When those wars ended in 1815, the lesson learned was that governments could not be trusted with direct control over the creation of money. The liberal monetary goal was the reestablishment of the gold standard, so the amount of money in society was independent of political manipulation.

Better to rely upon the market forces of supply and demand and the profitability of gold mining, the classical liberals argued, than the caprice of politicians and special interest groups desiring to print the paper money they wanted to use to plunder the peaceful production of the mass of humanity.

Through the decades of the nineteenth century, first Great Britain and then the rest of the Western nations legally established the gold standard as the basis of their monetary systems. The gold standard was mostly managed by national central banks, and thus not truly free market monetary systems.

But central banks were expected to, and for the most part did, abide by the monetary “rules of the game” of limiting increases (or decreases) in the domestic currency to additions to (or reductions in) the nation’s supply of gold. Sound money for the nineteenth century liberals was gold money.

Paper Money and Inflation Finances the War

But with the firing of the first shots in the summer of 1914, the belligerent governments all ended legal redemption of their currencies for fixed amounts of gold. The citizens in these warring counties were pressured or compelled to hand over to their respective governments the gold in their private hands, in exchange for paper money.

Almost immediately, the monetary printing presses were set to work creating the vast financial means needed to fight an increasingly expensive war.

In 1913, the British money supply amounted to 28.7 billion pounds sterling. But soon, as British economist, Edwin Cannan, expressed it, the country was suffering from a “diarrhea of pounds.” When the war ended in 1918, Great Britain’s money supply had almost doubled to 54.8 billion pounds, and continued to increase for three more years of peacetime until it reached 127.3 billion pounds in 1921, a fivefold increase from its level eight years earlier.

The French money supply had been 5.7 billion francs in 1913. By war’s end in 1918, it had increased to 27.5 billion francs. In this case, a fivefold increase in a mere five years. By 1920, the French money supply stood at 38.2 billion francs. The Italian money supply had been 1.6 billion lire in 1913 and increased to 7.7 billion lire, for a more than fourfold increase, and stood at 14.2 billion lire in 1921.

In addition, these countries took on huge amounts of debt to finance their war efforts. Great Britain had a national debt of 717 million pounds in 1913. At the end of the war that debt had increased to 5.9 billion pounds, and rose to 7.8 billion pounds by 1920.

French national debt increased from 32.9 billion francs before the war to 124 billion francs in 1918 and 240 billion francs in 1920. Italy was no better, with a national debt of 15.1 billion lire in 1913 that rose to 60.2 billion lire in 1918 and climbed to 92.8 billion in 1921.

Though the United States had only participated in the last year and a half of the war, it too created a large increase in its money supply to fund government expenditures that rose from $1.3 billion in 1916 to $15.6 billion in 1918. The U.S. money supply grew 70 percent during this period from $20.7 billion in 1916 to 35.1 billion in 1918.

Twenty-two percent of America’s war costs were covered by taxation, about 25 percent from printing money, and the remainder of 53 percent by borrowing.

The German Ideology of Power for War

The most severe inflations during World War I occurred in Central and Eastern Europe. Among the worst of these were the one in Germany during and then after the war, with the near total collapse of the German currency in 1922 and 1923.

For decades before the start of the war, German nationalist and imperialist ambitions were directed to military and territorial expansion. A large number of German social scientists known as members of the Historical School had been preaching the heroism of war and the superiority of the German people who deserved to rule over other nationalities in Europe.

Hans Kohn, one of the twentieth century’s leading scholars on the history and meaning of nationalism, explained the thinking of leading figures of the Historical School, who were also known as “the socialists of the chair” in reference to their prominent positions at leading German universities. He wrote:

“The ‘socialists of the chair’ desired a benevolent paternal socialism to strengthen Germany’s national unity. Their leaders, Adolf Wagner and Gustav von Schmoller, [who were Heinrich von] Treitschke’s colleagues at the University of Berlin and equally influential in molding public opinion, shared Treitschke’s faith in the German power state and its foundations. They regarded the struggle against English and French political and economic liberalism as the German mission, and wished to substitute the superior and more ethical German way for the individualistic economics of the West . . . In view of the apparent decay of the Western world through liberalism and individualism, only the German mind with its deeper insight and its higher morality could regenerate the world.”

These German advocates of war and conquest also believed that Germany’s monetary system had to be subservient to the wider national interests of the state and its imperial ambitions. Austrian economist Ludwig von Mises met frequently with members of the Historical School at German academic gatherings in the years before World War I. He recalled:

“The monetary system, they said, is not an end in itself. Its purpose is to serve the state and the people. Financial preparations for war must continue to be the ultimate and highest goal of monetary policy, as of all policy. How could the state conduct war, after all, if every self- interested citizen retained the right to demand redemption of banknotes in gold? It would be blindness not to recognize that only full preparedness for war [could further the higher ends of the state].”

Germany’s Great Inflation began with the government’s turning to the printing press to finance its war expenditures. Almost immediately after the start of World War I, on July 29, 1914, the German government suspended all gold redemption for the mark. Less than a week later, on August 4, the German Parliament passed a series of laws establishing the government’s ability to issue a variety of war bonds that the Reichsbank – the German central bank – would be obliged to finance by printing new money.

The government created a new set of Loan Banks to fund private sector borrowing, as well as state and municipal government borrowing, with the money for the loans simply being created by the Reichsbank.

During the four years of war, from 1914 to 1918, the total quantity of paper money created for government and private spending went from 2.37 billion to 33.11 billion marks. By an index of wholesale prices (with 1913 equal to 100), prices had increased more than 245 percent (prices failed to increase far more because of wartime price and wage controls). In 1914, 4.21 marks traded for $1 on the foreign exchange market. By the end of 1918, the mark had fallen to 8.28 to the dollar.

Germany’s Hyperinflation and the Destruction of the Mark

But the worst was to come in the five years following the end of the war. Between 1919 and the end of 1922, the supply of paper money in Germany increased from 50.15 billion to 1,310.69 billion marks. Then in 1923 alone, the money supply increased to a total of 518,538,326,350 billion marks.

By the end of 1922, the wholesale price index had increased to 10,100 (still using 1913 as a base of 100). When the inflation ended in November 1923, this index had increased to 750,000,000,000,000. The foreign exchange rate of the mark decreased to 191.93 to the dollar at the end of 1919, to 7,589.27 to the dollar in 1922, and then finally on November 15, 1923, to 4,200,000,000,000 marks for the dollar.

During the last months of the Great Inflation, according to Gustav Stolper, “more than 30 paper mills worked at top speed and capacity to deliver notepaper to the Reichsbank, and 150 printing firms had 2,000 presses running day and night to print the Reichsbank notes.” In the last year of the hyperinflation, the government was printing money so fast and in such frequently larger and larger denominations that to save time, money, and ink, the bank notes were being produced with printing on only one side.

Finally, facing a total economic collapse and mounting social disorder, the German government in Berlin appointed the prominent German banker, Halmar Schacht, as head of the Reichsbank. He publicly declared in November 1923 that the inflation would be brought to an end and a new non-inflationary currency backed by gold would be issued. The printing presses were brought to a halt, and the hyperinflation was stopped just as the country stood at the monetary and social precipice of total disaster.

The Legacies of Tyranny, Paternalism and Lost Freedom

But the deaths, destruction, and disruptions of the First World War and its immediate aftermath were never fully recovered from. In 1922, Mussolini and his Fascist Party came to power in Italy. In 1933, Hitler’s Nazi movement took power in Germany in the midst of the Great Depression.

In the United States, also in 1933, Franklin D. Roosevelt’s New Deal ushered in the arrival of America’s version, at first, of a fascist-type planned economy, with a growing concentration of political control and economic paternalism in the form of the modern interventionist-welfare state in the postwar period that followed a worse and far more destructive and mass murdering Second World War. (See my article, “When the Supreme Court Stopped Economic Fascism in America.”)

Out of this second “war to end all wars,” came America’s role as global policeman and international social engineer during the Cold War with the Soviet Union. But even the post-Cold War era after the end of the Soviet Union in 1991 has seen part of the legacy of World War I in international affairs.

The wars and “ethnic cleansings” experienced in the former Yugoslavia in the 1990s, and at least part of the causes behind the current conflicts in the Middle East are outgrowths of the post-World War I peace settlements imposed by the victorious Allied powers.

But most importantly, I would suggest, is the lasting legacy out of the First World War that has been the rationales and implementations of paternalist Big Government in the Western world, with its diminished recognition and respect for individual liberty, free association, freedom of competitive trade and exchange, reduced civil liberties and weakened impartial rule of law.

From this has followed the regulating and redistributing State, which includes political control and manipulation of the monetary and banking systems to serve those in governmental power and others who feed at the trough of governmental largess.

It is a legacy that will likely take another century to completely overcome and reverse, if we are able to devise a strategy for restoring the idea and ideal of a society of liberty.

- In New Audio, Video ISIS Says "We Downed" Russian Plane, Threatens Putin With Bowie Knife From Front Yard

The thing about the ongoing “war” on terror is that it seems to get more surreal by the day and indeed, the videos, pictures, and claims that emanate from ISIS’ media arm are at times so outlandish, violent, and outright bizarre that quite a few observers have questioned how they can possibly be authentic.

There was the clip purporting to show members building flying landmines out of condoms for instance and let’s not forget the nearly hour long video (that at times appeared as though it walked right out of a high school social studies class) explaining why ISIS intended to wean the world off of fiat money and transition back to the gold dinar.

And of course no critique of ISIS propaganda would be complete without mentioning their uncanny ability to produce Hollywood-esque murder montages violent enough to make Quentin Tarantino blush (a few installments back, ISIS filmed the drowning of a handful of “spies” and judging from the video, high quality underwater video cameras are something you regularly come across in the Syrian countryside).

Finally, in what has to be considered the silliest terror-related story of the year, al-Qaeda was out this week calling ISIS leader Bakr al-Baghdadi a “feeble, failure person.” ISIS responded by calling al-Qaeda a bunch of “donkeys.” If you want to understand just how surreal the whole thing is, look no further than the following picture (note that everyone looks to be wearing white, high top Nikes):

Well, the story took a further turn for the ridiculous on Wednesday after IS Sinai, apparently aggravated by claims that their video of an exploding plane doesn’t actually depict the destruction of the Russian passenger jet that crashed in the Sinai Peninsula last Saturday, released an audio message to confirm that they did indeed “down” the plane and that they’ll prove it when they’re good and ready and not a minute prior.

Some highlights:

- “We downed Russia plane, so die in your rage.”

- “Bring your black box, and do your analysis...prove we didn’t down it...we will reveal the way at the time we wish.”

- “We are the ones who downed it thank to God and we are not forced to reveal how we downed it.”

The group says that for now, the proof is that the attack coincided with the one-year anniversary of IS Sinai’s pledge of allegiance to Baghdadi (Ayman al-Zawahiri’s “feeble, failure person”) but the dates appear to be questionable.

Whatever the case, it doesn’t seem to have occurred to IS Sinai that they are asking the world to prove a negative.

Meanwhile, the home office in Raqqa is out praising the supposed “downing.” In a new video, five ISIS members praise the actions of their “Sinai brothers” and then go the extra mile by directly threatening Vladimir Putin. The video:

Here’s a screenshot for your amusement:

And yes, that is an actual still shot from the video.

Five guys sitting in the front yard waving a bowie knife at The Kremlin.

There you go Moscow. Your move.

- There Are Now 293 Ounces Of Paper Gold For Every Ounce Of Physical As Comex Registered Gold Hits New Low

Unlike Bitcoin, which has doubled in the past few weeks (as the predicted Chinese buying onslaught indeed materialized), it hasn’t been a good week for spot gold prices which have tumbled from $1,180 to just over $1,100. While the reason for the selling is unknown, with recurring speculation that an imminent Fed rate hike will make holding gold even more unwelcome in real terms (if not in India where gold now pays interest on par with inflation), what we do know is that as of yesterday the total registered gold at the Comex had dropped to a fresh record low following another transfer of “registered” gold into “eligible.”

This reduced overnight the total amount of eligible gold by a third to just over 151,000 ounces, or under 5 tons as the zoomed in chart below shows.

And since the gold open interest continues to rise modestly…

… this means that as of today, the gold “coverage” ratio, or the amount of paper claims for every ounce of physical, has just hit a new all time high of 293 ounces of paper per ounce of registered physical.

Curiously, the last time we observed a comparable surge in the Comex dilution ratio took place just two months ago when a comparable “adjustment” reduced JPM’s “Registered” inventory by 122,124 ounces. Back then many said the adjustment would be promptly reversed.

Two months later not only has that not happened, but JPM is now down to just 10,777 ounces of Registered while many other vaults continue to see either outright withdrawals or comparable adjustments.

How much longer can this exponential surge in the dilution ratio continue? We don’t know, although with less than 5 tons of registered gold left in the Comex vault system, we hope that the mystery of what is really going on at the Comex will finally be unveiled.

- David Stockman Explains How To Fix The World (In 7 Words)

While we are used to David Stockman's detailed and lengthy "nailing" of the real state of the world, the following brief clip of an interview with Fox Business, in which David explains how to 'fix' so many of our problems, can be summarized perfectly in just seven short words: "Replace The Fed with the free market."

Enjoy 4 minutes of refeshing honesty… as the Fox anchor just cannot fathom who or what would "control" rates if there was no Fed…

Watch the latest video at video.foxbusiness.com

- Yellen Says Negative Rates On The Table "If Outlook Worsened"

As the market now diligently calculates the suddenly surging odds of a December rate hike, here’s Yellen with a preview of what will happen once the rate hike cycle is aborted…

- YELLEN SAYS IF OUTLOOK WORSENED FED MIGHT WEIGH NEGATIVE RATES

- YELLEN SAYS NEGATIVE RATES COULD HELP ENCOURAGE BANKS TO LEND

… just as it was aborted in Japan in August of 2000 when the BOJ also decided to send a signal how much stronger the economy is by hiking 25 bps, only to cut 7 months later and to proceed to monetize not only all net Japanese debt issuance a decade later, but to hold half of all equity ETFs.

The good news:

- YELLEN SAYS SHE DOESN’T SEE NEED FOR NEGATIVE RATES NOW

- YELLEN SAYS FED SEES ECONOMY ON STEADY PATH OF IMPROVEMENT

Because when have the Fed’s forecasts before ever been wrong.

- Why America’s Land of the Free Title Was Just Revoked

Submitted by Claire Bernish via TheAntiMedia.org,

The Land of the Free — America has just been stripped of its favorite longstanding self-designation — the official title of ‘Land of the Free’ now belongs to its neighbor to the north, Canada.

In fact, the Legatum Institute’s 2015 Prosperity Index found Canadians experience the greatest personal freedom and general social tolerance of all 142 nations in the report — while the U.S. trailed behind in ninth place. But that’s only part of the story.

Regarding the feeling of safety and security, America fell two spots from last year’s embarrassing rank to 33rd on the list — landing literally just ahead of the United Arab Emirates and Kuwait.

According to Foreign Policy’s Siobhán O’Grady:

“Americans fear more for their safety each day than people living in Egypt, Bangladesh, and Sudan — countries that suffer from regular terrorist attacks, civil unrest, and war.

“Just what exactly Americans have to be so scared about isn’t exactly clear [… ] And while 17 percent had property stolen in 2014, that was still below the global average of 17.5 percent.”

O’Grady’s tongue-in-cheek query sharply derides Americans’ unfortunate, gullible tendencies to believe whatever subject or object the government deems must be the target for fear. In many ways, the Legatum report proves fear-mongering works.

If all of this weren’t sufficient to prove the freedom in which Americans ostensibly bask remains little more than illusion, the U.S. stood alone among Western nations with high levels of State-sponsored violence — right in line with Saudi Arabia and the Ukraine.

Legatum suggested recent uprisings in Ferguson and Baltimore were the reason for this startling comparison, though the general rise in police violence coupled with an astonishing lack of accountability shouldn’t be ignored.

Canada’s actual tolerance and freedom could be a lesson for U.S. politicians who insist on touting the tired Land of the Free moniker — especially now that it no longer applies.

- US Spec Ops Already On The Ground In Syria Sources Say, As Russian Troop Presence Grows To 4,000

On Tuesday evening, we noted that the US is set to send F-15C Eagle twin-engine fighters to Incirlik. This suggests that the Pentagon is preparing for air-to-air combat with the Russians.

As hyperbolic as that might sound, there’s really no alternative explanation for why Washington would send the fighters to Syria unless of course ISIS and/or the mishmash of rebels and militants fighting for control of the country have air forces no one has ever heard about.

Indeed, Russia made a similar move by sending Sukhoi Su-30s to Latakia and according to several sources, those planes had a run-in with Israeli jets over Lebanon last month.

The interesting thing, from our perspective anyway, is that Lebanese sources were out on Wednesday claiming that US spec ops are already on the ground – and they’re operating in the west. Here’s Sputnik:

US military advisors are alleged to have started training so-called moderate rebels near the city of Salma in the Latakia province in what amounts to breaking a pledge not to put US boots on the ground in Syria, Lebanon’s satellite television channel al-Mayadeen reported, citing an unnamed military source.

And here’s Salma:

Now bear in mind, this is Russian media citing an unnamed Lebanese source, so that would be a bit like American media citing an unnamed Saudi correspondent, but still, even the suggestion that Washington has placed “advisers” in Salma is alarming. That is, the going assumption was that these spec ops forces would be placed with the YPG or somewhere near Raqqa to avoid even the appearance that The Pentagon is set to place troops with soldiers that are in direct contact with Iranian ground forces and as such could potentially get hit with Russian airstrikes.

Of course we won’t get much in the way of clarity from Washington. US Assistant Secretary for Near Eastern Affairs Anne Patterson told the House Foreign Affairs Committee on Wednesday that the “the activities and location of the special forces are classified.” Patterson also said that “Russia’s military intervention has dangerously exacerbated an already complex environment,” on the way to claiming that “the opposition puts up a very strong fight.”

Obviously, it’s difficult to know where even to start in terms of analyzing that bit of nonsense. First, the situation is indeed “already complex” thanks to Washington, Riyadh, Ankara, and Doha who collectiively decided that “start civil war via the funding of terrorists” was the proper “strategy” for bringing about regime change in Damascus. Second, it’s not clear that the “opposition” is putting up a “very strong fight,” and even if it were, that’s at least partly attributable to the Pentagon handing rebels things like anti-tank weapons. If Patterson thinks that’s constructive, well, maybe she needs to find a new occupation.

Meanwhile, Western media reports indicate that there are as many as 4,000 Russian troops in Syria (so, i) just “slightly” more than the 50 Obama is sending, ii) far less than the number of militants the US and its regional allies have trained, and iii) far less than the Iranian contingent, which, between Shiite militas from Iraq, Hezbollah, and the Quds, probably number more than 10 or 15,000). Here’s Reuters:

Moscow’s military force in Syria has grown to about 4,000 personnel, but this and more than a month of Russian air strikes have not led to pro-government forces making significant territorial gains, U.S. security officials and independent experts said.

Moscow, which has maintained a military presence in Syria for decades as an ally of the ruling Assad family, had an estimated 2,000 personnel in the country when it began air strikes on Sept. 30. The Russian force has since roughly doubled and the number of bases it is using has grown, U.S. security officials said.

The Russians have suffered combat casualties, including deaths, said three U.S. security officials familiar with U.S. intelligence reporting, adding that they did not know the exact numbers.

Russia’s foreign ministry declined to comment on the size of the Russian contingent in Syria or any casualties it has suffered. It referred questions to the Russian Defense Ministry, which did not respond to written questions submitted by Reuters.

The Kremlin has said there are no Russian troops in combat roles in Syria, though it has said there are trainers and advisers working alongside the Syrian military and also forces guarding Russia’s bases in western Syria.

A U.S. defense official said Russian aircraft are now operating out of four bases, but multiple rocket launcher crews and long-range artillery batteries are deployed outside the facilities.

“They have a lot of people outside the wire,” he said.

The main Russian base is at the Bassel al-Assad International Airport near the port city of Latakia. All of Moscow’s fixed wing aircraft are flying from there in support of ground offensives by the Syrian army and foreign Shiite militias, the defense official said.

Three other bases – Hama, Sharyat and Tiyas – are being used for helicopter gunships, he said. The Russians began operating from Tiyas only this week, the official said.

Russia’s air fleet in Syria comprises 34 fixed-wing aircraft and 16 helicopters, the U.S. officials said.

In a testament to what we said above, Reuters goes on to note that the rebels’ ability to fight off pro-regime forces stems largely from the delivery of U.S.-made TOW anti-tank missiles. Saudi Arabia is supplying them to forces battling Iran near Aleppo: