- U.S. Rejected Offers by Afghanistan, Iraq, Libya and Syria to Surrender … and Proceeded to Wage War

The Daily Mail reported last year:

A self-selected group of former top military officers, CIA insiders and think-tankers, declared Tuesday in Washington that a seven-month review of the deadly 2012 terrorist attack has determined that [Gaddafi offered to abdicate as leader of Libya.]

‘Gaddafi wasn’t a good guy, but he was being marginalized,’ [Retired Rear Admiral Chuck ] Kubic recalled. ‘Gaddafi actually offered to abdicate’ shortly after the beginning of a 2011 rebellion.

‘But the U.S. ignored his calls for a truce,’ the commission wrote, ultimately backing the horse that would later help kill a U.S. ambassador.

Kubic said that the effort at truce talks fell apart when the White House declined to let the Pentagon pursue it seriously.

‘We had a leader who had won the Nobel Peace Prize,’ Kubic said, ‘but who was unwilling to give peace a chance for 72 hours.’

Similarly, Saddam Hussein allegedly offered to let weapons inspectors in the country and to hold new elections. As the Guardian reported in 2003:

In the few weeks before its fall, Iraq’s Ba’athist regime made a series of increasingly desperate peace offers to Washington, promising to hold elections and even to allow US troops to search for banned weapons. But the advances were all rejected by the Bush administration, according to intermediaries involved in the talks.

Moreover, Saddam allegedly offered to leave Iraq:

“Fearing defeat, Saddam was prepared to go peacefully in return for £500million ($1billion)”.

“The extraordinary offer was revealed yesterday in a transcript of talks in February 2003 between George Bush and the then Spanish Prime Minister Jose Maria Aznar at the President’s Texas ranch.”

“The White House refused to comment on the report last night. But, if verified, it is certain to raise questions in Washington and London over whether the costly four-year war could have been averted.”

According to the tapes, Bush told Aznar that whether Saddam was still in Iraq or not, “We’ll be in Baghdad by the end of March.” See also this and this.

Susan Lindauer (after reading an earlier version of this essay by Washington’s Blog) wrote:

That’s absolutely true about Saddam’s frantic officers to retire to a Villa in Tikrit before the invasion. Except he never demanded $1 BILLION (or $500 MILLION). He only asked for a private brigade of the Iraqi National Guard, which he compared to President Clinton’s Secret Service detail for life throughout retirement. I know that for a fact, because I myself was the back channel to the Iraqi Embassy at the U.N. in New York, who carried the message to Washington AND the United Nations General Assembly and Security Council. Kofi Annan was very much aware of it. So was Spain’s President Asnar. Those historical details were redacted from the history books when George Bush ordered my arrest on the Patriot Act as an “Iraqi Agent”– a political farce with no supporting evidence, except my passionate anti-war activism and urgent warnings that War in Iraq would uncover no WMDs, would fire up a violent and bloody counter-insurgency, and would result in Iran’s rise as a regional power. In 2007, the Senate Intelligence Committee hailed my warnings in Jan. 2003 (as the Chief Human Intelligence covering Iraq at the U.N.) to be one of the only bright spots in Pre-War Intelligence. Nevertheless, in 2005 and again in 2008, I was declared “incompetent to stand trial,” and threatened with “indefinite detention up to 10 years” on Carswell Air Force Base, in order to protect the cover up of Iraqi Pre-War Intelligence.

(The New York Times has covered Lindauer at least 5 times, including here and here.)

On October 14, 2001, the Taliban offered to hand over Osama bin Laden to a neutral country if the US halted bombing if the Taliban were given evidence of Bin Laden’s involvement in 9/11.

Specifically, the Guardian noted in 2001:

Returning to the White House after a weekend at Camp David, the president said the bombing would not stop, unless the ruling Taliban “turn [bin Laden] over, turn his cohorts over, turn any hostages they hold over.” He added, “There’s no need to discuss innocence or guilt. We know he’s guilty” …

Afghanistan’s deputy prime minister, Haji Abdul Kabir, told reporters that the Taliban would require evidence that Bin Laden was behind the September 11 terrorist attacks in the US.

“If the Taliban is given evidence that Osama bin Laden is involved” and the bombing campaign stopped, “we would be ready to hand him over to a third country”, Mr Kabir added.

However, as the Guardian subsequently pointed out:

A senior Taliban minister has offered a last-minute deal to hand over Osama bin Laden during a secret visit to Islamabad, senior sources in Pakistan told the Guardian last night.

For the first time, the Taliban offered to hand over Bin Laden for trial in a country other than the US without asking to see evidence first in return for a halt to the bombing, a source close to Pakistan’s military leadership said.

And the Guardian reports today:

Russia proposed more than three years ago that Syria’s president, Bashar al-Assad, could step down as part of a peace deal, according to a senior negotiator involved in back-channel discussions at the time.

Former Finnish president and Nobel peace prize laureate Martti Ahtisaari said western powers failed to seize on the proposal. Since it was made, in 2012, tens of thousands of people have been killed and millions uprooted, causing the world’s gravest refugee crisis since the second world war.

Ahtisaari held talks with envoys from the five permanent members of the UN security council in February 2012. He said that during those discussions, the Russian ambassador, Vitaly Churkin, laid out a three-point plan, which included a proposal for Assad to cede power at some point after peace talks had started between the regime and the opposition.

But he said that the US, Britain and France were so convinced that the Syrian dictator was about to fall, they ignored the proposal.

***

“There was no question because I went back and asked him a second time,” he said, noting that Churkin had just returned from a trip to Moscow and there seemed little doubt he was raising the proposal on behalf of the Kremlin.

Ahtisaari said he passed on the message to the American, British and French missions at the UN, but he said: “Nothing happened because I think all these, and many others, were convinced that Assad would be thrown out of office in a few weeks so there was no need to do anything.”

Similarly, Bloomberg reported in 2012:

As Syria slides toward civil war, Russia is signaling that it no longer views President Bashar al-Assad’s position as tenable and is working with the U.S. to seek an orderly transition.

***

After meeting with French President Francois Hollande, among the most adamant of Western leaders demanding Assad’s departure, Putin said Russia was not invested in Assad staying.

***

“We aren’t for Assad or for his opponents,” Putin told reporters in Paris on June 1. “We want to achieve a situation in which violence ends and a full-scale civil war is avoided.”

And yet, as with Gaddaffi, Saddam Hussein and Bin Laden, the U.S. turned down the offer and has instead prosecuted war. See this and this.

Postscript: An offer by Russia for Assad to leave is not the same as an offer by Assad himself. However, because the Syrian government would have long ago fallen without Russia’s help, the distinction is not really that meaningful.

- Head Of China's 'Goldman Sachs' Probed For Insider Trading As "Market Purification" Continues

Imagine for a moment the sentiment shock for mainstream Americans if Goldman Sachs' Lloyd Blankfein was probed for insider-trading and publicly scapegoated for causing a nation's equity market (and economy) to collapse. While it may be true, it would never happen in America… But in China, as part of what authorities call "purifying the markets," the president of China’s biggest brokerage has been swept up in a widening campaign to root out financial wrongdoing and assign blame for the nation’s $5 trillion stock rout. As Bloomberg notes, shares are falling further in today's markets as the probe of Citic Securities President Cheng Boming comes after the state-run Xinhua News Agency reported last month that four executives at Citic had admitted to so-called insider trading.

BPlayer(null, {“id”:”LiRrgCDwTjKFzr93fEsM6w”,”htmlChildId”:”bbg-video-player-LiRrgCDwTjKFzr93fEsM6w”,”serverUrl”:”http://www.bloomberg.com/api/embed”,”idType”:”BMMR”,”autoplay”:false,”log_debug”:false,”ui_controls_popout”:false,”wmode”:”opaque”,”share_metadata”:{“canonical_url”:”http://bloom.bg/1OuwRXE”},”use_share_overlay”:true,”video_autoplay_on_page”:false,”use_js_ads”:true,”ad_code_prefix”:””,”ad_tag_gpt_preroll”:true,”ad_tag_gpt_midroll”:true,”ad_tag_sz_preroll”:”1×7″,”ad_tag_sz_midroll”:”1×7″,”ad_tag_sz_overlay”:”1×7″,”ad_network_id_preroll”:”5262″,”ad_network_id_midroll”:”5262″,”ad_network_id_overlay”:”5262″,”ads_vast_timeout”:10000,”ads_playback_timeout”:10000,”use_comscore”:true,”comscore_ns_site”:”bloomberg”,”comscore_page_level_tags”:{“bb_brand”:”bbiz”,”bss_cont_play”:0,”bb_region”:”US”},”use_chartbeat”:true,”chartbeat_uid”:”15087″,”chartbeat_domain”:”bloomberg.com”,”vertical”:”business”,”ad_tag_overlay”:”business/videooverlay”,”use_parsely”:true,”source”:”BBIZweb”,”module_conviva_insights”:”enabled”,”conviva_account”:”c3.Bloomberg”,”zone”:”video”,”ad_tag_cust_params_preroll”:””,”width”:640,”height”:360,”ad_tag”:””,”ad_tag_midroll”:””,”offsite_embed”:true});

Since the market crash, China’s targets have ranged from so-called “malicious” short sellers to a journalist from business magazine Caijing whose report was alleged to have caused market panic. Authorities say they want to “purify” the market.

“There does seem to be a bit of a witch hunt for a scapegoat at the moment, but I think this is mostly signaling by the authorities that they will not tolerate what they perceive as ‘unhelpful’ selling in the market,” Tony Hann, a London-based money manager at Blackfriars Asset Management, which oversees about $350 million, said in an e-mail.

Citic confirmed the police investigation of Cheng in a statement to Shanghai’s stock exchange. A brokerage spokeswoman declined to comment further.

…

“The rumor of this investigation had already been on the streets for some time,” said Castor Pang, the head of research at Core-Pacific Yamaichi Hong Kong, referring to the Cheng probe. “The central government may use this case to accelerate its probe into insider trading and tighten regulation further.”

* * *

Citic shares are hitting fresh 11-month lows…

- How To Solve The Immigration Crisis Fast, Easy, & Cheap!

Submitted by Paul Rosenberg via FreemansPerspective.com,

No, I’m not kidding. I can solve the immigration and refugee crises without more wars, without rounding people up like animals, and while boosting the GDP. It’s not hard. All you have to do is stop thinking inside the same old status quo.

Here’s the plan:

#1: The Fed provides loans to build new cities. Seeing that they were recently spending $85 billion per month buying up mortgage debt and Treasuries, we’ll take that as a cap. We’ll buy up farmland (or forest or desert) and start installing utilities. There’s such an incredible amount of open land that we’ll have thousands of spots to choose from.

#2: The federal and state governments forbear all income taxes from anyone who opens a business in the new cities for as long as they operate those businesses. Think they’ll come?

#3: The federal and state governments forbears all taxes from undocumented immigrants (and their families) who choose to reside in the new cities. They also forebear all enforcement of immigration laws upon them. Wanna bet they’ll show up?

#4: The federal and state governments forbear all taxes, regulations, fines, bases, offices, employees, services, and impositions for 100 years in the new cities. “Outside the status quo,” remember?

#5: The federal and state governments guarantee that entry and exit to/from these cities will be unimpeded.

#6: Federal and state governments agree that they will provide no welfare, disability, or any other handout programs in the new cities for 100 years. We don’t want a dependent class.

Oh, and one more thing:

#7: No person or corporation who has done business with any federal or state government over the past 10 years shall be considered for any such loans; nor shall anyone with more than incidental political involvement. A panel of radical anarcho-capitalists shall decide.

There are a few fine points that could be added, but these seven major points just about do it. The plan falls short of philosophical perfection (witness the Federal Reserve being named in it), but it had to be something that would work tomorrow morning, and this would.

And Then…

And then we’ll have an excellent free-for-all. These cities would become the places to be. Businesses would start looking for facilities the next morning. Hundreds of them, maybe thousands. Immigrants would flock to the cities.

Libertarian and entrepreneurial types, disgusted by the status quo, would load up and drive to the new cities just to get away from regulations. Nonconformists of a dozen descriptions would start buying property, even without tax breaks.

These cities would, within only a few years, become the coolest places on the planet – by far.

But…

That’s right, there won’t be any government-provided policemen or courts. And yes, I know how many people have been trained to freak out about that: “It will be murder, death, and mayhem!”

I’ll be taking bets on that one.

The people who come to these cities would be coming to escape from their chains and to be productive. Those are precisely the kinds of people who clean up a town. And with no taxes to pay for 100 years, they’ll have plenty of extra money to spend on whatever security services (or whatever else) they need.

And the Results…

These would be the results:

-

The plan will cost the various governments nothing at all. (I’m presuming here that the loans would be repaid… which should be almost a cinch.)

-

The skittish citizens who can’t sleep at night because of immigration could all relax; all of the scary people would be in new cities and wouldn’t be terrorizing them anymore.

-

This would definitely juice the GDP.

-

10 cities of a million people each would be easy to build. Just ask the Chinese.

-

Most of the usual troublemakers would separate from the status quo, and stop bothering them.

-

Fun, innovation, and progress.

So, why not?

And this same model might do nicely in Europe. They have plenty of empty land too.

-

- Traders Fear Second China State Entity Default As Aussie Leading Index Plunges, PBOC Devalues Yuan

Chinese equity markets are holding modest 'bounce' gains after two days of carnage.

- *CHINA'S CSI 300 INDEX RISES 0.1% TO 3,156.62 AT BREAK

- *CHINA'S SHANGHAI COMPOSITE RISES 0.1% TO 3,009.57 AT BREAK

After 3 days of stronger fixes PBOC devalued the Yuan but the Ministry of Finance made it clear that "devaluation is not aimed at boosting exports," which makes us wonder, is it aimed at selling Treasuries? No additional direct liquidity injections but anxiety grows as China National Erzhong Group Co. may miss an interest payment later this month after one of its creditors filed a restructuring request, putting it at risk of becoming the second state-owned company to default in the nation’s onshore bond market.

As Bloomberg details, uncertainty over the payment comes as deflation risks, overcapacity and spiraling corporate debt cloud the outlook for China’s economy, forecast to expand at the slowest pace since 1990 this year.

China National Erzhong is a wholly owned subsidiary of state-owned China National Machinery Industry Corp., according to a China International Capital Corp. report in April.

Today’s statement doesn’t say whether China National Erzhong will be able to pay the interest if the court rejects the creditor’s request. The statement also said there is some uncertainty over whether the court will accept the restructuring request, and said China National Erzhong is trying to raise money to pay the interest.

Yields on the 2017 bonds have risen to 28.801 percent from 26.846 percent at the start of the year, ChinaBond prices show.

…

The smelting-equipment maker might not be able to pay a coupon that’s due Sept. 28 on its 1 billion yuan ($157 million) of 5.65 percent 2017 notes if a local court accepts the creditor’s restructuring application before that date, according to a statement posted on Chinamoney.com.cn. China National Erzhong, based in China’s western Sichuan province, issued the five-year securities in 2012 at par and the debentures are currently trading at 67.72 percent of that.

“Because Erzhong is a state-owned company, if it defaults it may arouse investors’ concern about companies’ credit risks,” said Qu Qing, a bond analyst at Huachuang Securities Co. in Beijing.

* * *

China then makes it clear that all this currency war stuff is..

- *YUAN DEVALUATION NOT AIMED AT BOOSTING EXPORTS: MOFCOM'S SHEN

Confident that things are stabilizing, except that…

- *HKMA CHAN URGES PEOPLE TO WATCH FOR RISK AND MARKET VOLATILITY

- *HKMA CHAN SAYS CHANCE OF U.S. RAISING RATES VERY HIGH THIS YR

But send us your money anyway!!!

- *CHINA'S REFORM TO BENEFIT FOREIGN INVESTORS: NDRC'S LIAN

- *CHINA MOFCOM LOOKING INTO FALLING U.S. INVESTMENT IN CHINA:SHEN

- *CHANGES IN CHINA, U.S. MARKETS CAUSED FALL OF INVESTMENT: SHEN

* * *

As we detailed earlier…

Following last night's double-disappointment – the absence of China's 'National Team' and the lack of moar from The BoJ, everything was not awesome when Asian markets closed. However, dismal US data has floated all boats on a sea of bad-news-is-good-news as the world holds its breath ahead of Thursday's Fedsplosion. China's weakness is spreading as Aussie Leading Index plunges most in 3 years. Trading volumes remain de minmus as 1300 hedge funds have liquidated in China in recent weeks (as the $800,000 Tibetan Mastiff bubble bursts). Tonight Japan opens with selling pressure ands China bouncing modestly higher, but it's quiet, too quiet. PBOC devalued Yuan for the first time in 4 days but one local Chinese trader opined confidently ahead of The Fed, "Mother PBOC is so worried there could be a liquidity problem that it will ensure abundant supply."

Last night's Japanese open was an epic meltup in USDJPY and NKY 225 (only to give it all back when The BoJ did not "get back to work"). Tonight it starts with "malicious selling" but that was quickly ramped.

Aussie markets are unhappy as The Westpace leading Index collapsed by the most in 3 years

China opens with an idea...

- *CHINA TO PROMOTE COS.' OVERSEAS DEBT REGISTRATION REFORM

- *CHINA NDRC TO REMOVE QUOTA FOR COS.' OVERSEAS DEBT

- *CHINA TO ENCOURAGE QUALIFIED COS. TO SELL BONDS OVERSEAS

Which will lower the cost of borrowing (great), ensure some USD liquidity (easing PBOC pressures perhaps), but will leave Chinese corporates exposed to a devaluing Yuan (un-great).

And then unleashes some propaganda (it's unpatriotic to move your money overseas…)

Margin debt declines once again as Chinese Stocks push lower amid the asbence of The National Team…

- *SHANGHAI MARGIN DEBT BALANCE DROPS TO LOWEST IN NINE MONTHS

Shenzhen and ChiNext are getting slammed this week…

With a small bounce in the pre-market has now faded:

- *CHINA'S CSI 300 INDEX SET TO OPEN DOWN 0.1% TO 3,149.16

- *CHINA SHANGHAI COMPOSITE SET TO OPEN DOWN 0.2% TO 2,998.04

PBOC stepped back in and devalues Yuan after 3 days of strengthening…

- *CHINA SETS YUAN REFERENCE RATE AT 6.3712 AGAINST U.S. DOLLAR

More bad news for US automakers:

- *FITCH: CHINA AUTO SECTOR MOVES INTO NEW NORMAL OF SLOWER GROWTH

New-car sales in China may decline for the first time in more than a decade this year, as a slowing economy combines with a clampdown on lavish spending, stricter registration limits and stock-market volatility. The slowdown and unprecedented discounts dragged on the eight Chinese car dealers trading in Hong Kong, with combined net income falling by 29 percent in the first six months.

And the death of liquidity in Chinese stock futures markets have rung the bell on the newly minuted Chinese hedge fund industry (as Bloomberg reports)…

It’s about to get even uglier for China’s hedge funds.

The newfangled industry, short on expertise and ways to protect itself from market declines, has seen almost 1,300 funds liquidate amid China’s $5 trillion stocks selloff, and a similar number may be at risk, according to Howbuy Investment Management Co. Now, a government crackdown on short selling and other hedging strategies have made prospering in a bear market difficult.

It’s an inglorious turn for China’s on-again, off-again love affair with stocks, which saw the number of hedge-fund-like vehicles explode in past years as the government made it easier to register funds and introduced new financial instruments. The market rout — and the regulatory response to it — has revealed cracks in the industry that suggest it may need years to recover. In the most devastating blow to domestic hedge funds, China has imposed new restrictions on trading in stock-index futures, a key investment strategy to dampen volatility and avoid big losses.

“It spells the end, at least temporarily, for China domestic hedge funds,” Hao Hong, chief China strategist at BOCOM International Co. in Hong Kong, said in an interview.

But it is another bursting bubble that everyone is talking about… If this does not sum up the farce of China, I do not know what does…

"The Tibetan mastiff market went crazy in 2008 when some investors, instead of dog lovers, hyped the price among rich people," he said. "The price was not reasonable at all."

Many newly rich Chinese such as coal mine owners who became extremely wealthy during the price hike in commodities between 2006 and 2008 started to buy such a dog as a pet.

Different from dog lovers and professional breeders, they did not have the inside knowledge about such dogs, including how to tell a real one from the mixed-blood species and even other similar kinds. As a result, the market was full of so-called Tibetan mastiffs with prices as high as 5 million yuan ($793,650) to 10 million yuan for one such dog.

"Even if they paid a lot, the dogs they got were still not pure-bred Tibetan mastiffs," Peng said.

However, the market still created many millionaires at the time. Some people began to trade so-called Tibetan mastiffs as a business.

It appears The Chinese just cannot help themselves.

But it is next week's big event that is the real deal… (post-FOMC)…

- *CHINA'S XI TO VISIT U.S. SEPT. 22-25

China's President Xi Jinping will visit Washington Sept. 25, the White House confirmed in a statement released late Sept. 15.

The widely anticipated official state visit reciprocates President Barack Obama’s state visit to China in November 2014. The White House said Xi's visit “will present an opportunity to expand U.S.-China cooperation on a range of global, regional, and bilateral issues of mutual interest” and will allow Obama and Xi to “address areas of disagreement constructively.”

Finally, we leave it to one local Chinese trader to sum up the "we have faith" attitude that somewhow still remains… (as MNI reports)

"Mother PBOC is so worried there could be a liquidity problem that it will ensure abundant supply — liquidity is super good now so we can sit back and relax," said said Qin Xinfeng, a trader with Qingdao Rural Commercial Bank.

But the Fed hike will nonetheless push global and Chinese markets into unknown territory.

- Aussie Property Market Collapse Looms As Chinese Flee Amid Capital Controls

Given the recent admission by the Australian Central Bank that property prices "have gone crazy," it appears new Chinese 'regulations' may just kill Australia's golden goose of 'weath creation' as Aussie's largest trade partner sees its economy collapse. While the Aussies themselves proclaimed a "war on cash," it appears, as AFR reports, that Chinese purchases of Australian property have dropped significantly in the past month, according to agents, as buyers struggle to shift money out of the country following Beijing's move to tighten capital controls. With Chinese banks now limiting any overseas transfer to USD50,000 – in an effort to control capital outflows – and with China dominating the Aussie housing market, one agent exclaimed, "it has affected 70 to 80 per cent of current transactions and some have already been suspended."

To date Chinese investment has been overwhelmingly focussed on the most familiar capital city property markets of Melbourne and Sydney, with around 80 per cent of foreign investment hitting Victoria and New South Wales. As PeteWargent shows, China dominated the foreign buyer of Aussie homes…

As Bloomberg notes, Chinese buyers were approved to buy A$12.4 billion ($9.9 billion) of Australian real estate in 2013-14, the Foreign Investment Review Board said in its annual report, without differentiating between commercial and residential property. China's total approved investment in Australia was A$27.7 billion over the period, compared with the U.S.'s A$17.5 billion.

And Q1 2015 showed no signs of a slowdown in that flood of capital to Australia…

But now, as AFR reports, China's capital controls will kill that flow of money into Aussie property…

Chinese purchases of Australian property have dropped significantly in the past month, according to agents, as buyers struggle to shift money out of the country following Beijing's move to tighten capital controls.

One Chinese agent said the latest efforts by the central government to avoid large capital outflows were having a "significant impact" on his business.

"It has affected 70 to 80 per cent of current transactions and some have already been suspended," said the agent who asked not to be named.

The tighter foreign exchange rules are also set to impact the federal government's relaunched Significant Investor Visa (SIV), which provides fast-tracked residency for those investing at least $5 million into Australia.

"I think it will be big, big trouble for the SIV program because the amount of money is just too large," said one Shanghai-based adviser, who sells Australian property and advises wealthy clients on their migration plans.

Only seven SIV applications have been submitted since the new rules were introduced on July 1, which require investors to put their money into riskier assets such as venture capital and emerging companies.

China has previously tolerated significant capital outflows via so called "grey channels", but has tightened up enforcement in recent weeks as the economy slows and fears over capital flight put downward pressure on the currency.

The crackdown from Beijing has seen Chinese banks setting up watch lists for unusual transactions, according to one bank manager, who asked not to be named as he was not authorised to speak about the policy.

He said the operation was aimed at cracking down on a practice whereby family and friends of those wanting to purchase a property overseas all transfer US$50,000 into an overseas account. That's the limit each Chinese individual is allowed to move out of the country each year.

The purchaser then pays back his friends and family in China and uses the money from the overseas account to put down a deposit on the property.

However, banks are now tracking the source of funds for overseas bank accounts that have received more than US$200,000 within 90 days, according to the bank manager, who works in Shanghai for one of the major state-owned banks.

"We have always had this policy but now it has been restated and is being enforced more strictly," he said.

"In the past we could find a way around these rules but now all those ways have been blocked."

"I'm sure this would be having an impact on overseas property purchases," he said.

The tighter rules in China come as Sydney recorded its lowest auction clearance rate for the year this past weekend, while Melbourne has now recorded two weekends below the same time last year, according to Corelogic RP Data.

* * *

Finally, as we have noted previously,

The problem is that Australia, after decades of effort to diversify, is looking ever more like a petrodollar economy of the Middle East, but without the vast horde of foreign currency reserves to fall back on when commodity prices fall.

Instead, Australians must borrow to maintain the standards of living that the country has become accustomed to, which even some Greeks will admit is unsustainable.

- Governments Give Migrants A Disastrous Mix Of Social Welfare & Bureaucracy

- Ron Paul: Congress Is 'Fiddling' While The Economy Burns

Submitted by Ron Paul via The Ron Paul Institute for Peace & Prosperity,

Reports that the official unemployment rate has fallen to 5.1 percent may appear to vindicate the policies of easy money, corporate bailouts, and increased government spending. However, even the mainstream media has acknowledged that the official numbers understate the true unemployment rate. This is because the government’s unemployment figures do not include the 94 million Americans who have given up looking for work or who have settled for part-time employment. John Williams of Shadow Government Statistics estimates the real unemployment rate is between 23 and 24 percent.

Disappointingly, but not surprisingly, few in Washington, DC acknowledge that America’s economic future is endangered by excessive spending, borrowing, taxing, and inflating. Instead, Congress continues to waste taxpayer money on futile attempts to run the economy, run our lives, and run the world.

For example, Congress spent the majority of last week trying to void the Iranian nuclear agreement. This effort was spearheaded by those who think the US should waste trillions of dollars on another no-win Middle East war. Congressional war hawks ignore how America’s hyper-interventionist foreign policy feeds the growing rebellion against the dollar’s world reserve currency status. Of course, the main reason many are seeking an alternative to the dollar is their concern that, unless Congress stops creating — and the Federal Reserve stops monetizing — massive deficits, the US will experience a Greek-like economic crisis.

Despite the clear need to reduce federal spending, many Republicans are trying to cut a deal with the Democrats to increase spending. These alleged conservatives are willing to lift the “sequestration” limits on welfare spending if President Obama and congressional democrats support lifting the “sequestration” limits on warfare spending. Even sequestration's miniscule, and largely phony, cuts are unbearable for the military-industrial complex and the rest of the special interests that control our government.

The only positive step toward addressing our economic crisis that the Senate may take this year is finally holding a roll call vote on the Audit the Fed legislation. Even if the audit legislation lacks sufficient support to overcome an expected presidential veto, just having a Senate vote will be a major step forward.

Passage of the Audit the Fed bill would finally allow the American people to know the full truth about the Fed’s operations, including its deals with foreign central banks and Wall Street firms. Revealing the full truth about the Fed will likely increase the number of Americans demanding that Congress end the Fed's monetary monopoly. This suspicion is confirmed by the hysterical attacks on and outright lies about the audit legislation spread by the Fed and its apologists.

Every day, the American people see evidence that, despite the phony statistics and propaganda emanating from Washington, high unemployment and rising inflation plague the economy. Economic anxiety has led many Americans to support an avowed socialist’s presidential campaign. Perhaps more disturbingly, many other Americans are supporting the campaign of an authoritarian crony capitalist. If there is a major economic collapse, many more Americans — perhaps even a majority — will embrace authoritarianism. An economic crisis could also lead to mob violence and widespread civil unrest, which will be used to justify new police state measures and crackdowns on civil liberties.

Unless the people demand an end to the warfare state, the welfare state, and fiat money, our economy will continue to deteriorate until we are faced with a major crisis. This crisis can only be avoided by rejecting the warfare state, the welfare state, and fiat money. Those of us who know the truth must redouble our efforts to spread the ideas of liberty.

- Comexodus: JPMorgan's Vault Is One Withdrawal Away From Running Out Of Deliverable Gold

One week ago, when we reported the record plunge in registered gold held by the various Comex gold warehouses in general, and JPMorgan in particular, which saw the “gold coverage” ratio, or the number of paper claims through open futures interest for every ounce of deliverable gold, soar to what we then thought was a record, and unsustainable 207x, we thought this situation would be promptly rectified as a few hundred thousand ounces of eligible gold would be “adjusted” back into the “registered” category.

Not only has this not happened, but with every passing day the situation is getting progressively worse.

According to the latest Comex vault data, not only was another 157K ounces withdrawn today, but the conversion of Registered into Eligible continues, and as a result another 10% of total deliverable gold was “adjusted away”, leaving just 163,334 ounces of registered gold: the lowest in Comex history.

As a result, the ratio of Eligible to Registered gold is now a record high 41.2x in the history of the Comex.

Once again the culprit for the decline was JPM which saw not only a 122,124 ounces of Eligible gold be withdrawn, reducing the total by 13% to 750K ounces, but 8.9K ounces of registered gold was pushed into the Eligible category, in the process reducing total JPM registered gold by 45% overnight to a paltry 10,777 ounces: this amounts to only 335 kilograms of gold, or just 27 bricks of “good delivery” gold.

Finally, since aggregate gold open interest continues to remaing consistent at just about 41 million ounces of gold, today’s latest ongoing reduction in deliverable Comex gold means that as of yesterday’s close, there was a record 252 ounces of gold paper claims to every gold physical ounce of currently available and deliverable gold.

To summarize: last week we were confident that JPM would promptly adjust a few hundred thousands ounces of Eligible gold back into Registered status to silence growing concerns about Comex distress. A week later we are not as concerned by the relentless surge in paper gold dilution, as we are that JPM still has not even bothered to do this. Especially since with just 335 kilograms of gold, or less than 27 bricks, JPMorgan is now just one withdrawal request away from running out of deliverable physical gold.

- Putin Accuses World Of "Using Terrorist Groups" To Destabilize Governments

If you’ve followed the incessant back-and-forth between Washington and Moscow over the course of the proxy wars raging in Ukraine and Syria, you know that the Kremlin is without equal when it comes to describing US foreign policy in a way that is both succinct and accurate.

This was on full display earlier this year when Vladimir Putin’s Security Council released a document that carried the subtle title “About The US National Security Strategy.” We’ve also seen it on a number of occasions over the past several weeks in the wake of Russia’s stepped up military role in support of the Assad regime at Latakia. For instance, last week, Russian foreign ministry spokeswoman Maria Zakharova delivered the following hilariously veracious assessment of how Washington has sought to characterize Moscow’s relationship with Damascus:

“First we were accused of providing arms to the so-called ‘bloody regime that was persecuting democratic activists, now it’s a new edition – we are supposedly harming the fight against terrorism. That is complete rubbish.”

Yes, it probably is, but let’s not forget that Russia hasn’t exactly been forthcoming when it comes to acknowledging that, like Washington, Moscow’s interest in Syria is only related to terrorism to the extent that terrorism serves as a Western tool to destabilize the Assad regime which, you’re reminded, must remain in place if Putin intends to protect Gazprom’s iron grip over Europe’s supply of natural gas.

Of course what that suggests is that even as Russia uses ISIS as a smokescreen to justify sending troops to Syria, the Kremlin is by definition being more honest about its motives than The White House. That is, ISIS has destabilized Assad and because Russia has an interest in keeping the regime in power, Moscow actually does have a reason to eradicate Islamic State. The US, on the other hand, facilitated the destabilization of the country in the first place by playing a role in training and arming all manner of Syrian rebels, and to say that some of them might well have gone on to fight for ISIS would be a very generous assessment when it comes to describing the CIA’s involvement (a less generous assessment would be to call ISIS a “strategic CIA asset”). That means that the US will only really care about wiping out ISIS once Assad is gone and it’s time to install a puppet government that’s friendly to both Washington and Riyadh and at that point – assuming there are no other regimes in the area that the Pentagon feels like might need destabilizing – the US military will swiftly “liberate” Syria from the ISIS “scourge.”

To be sure, Russia is well aware of the game being played here and if there’s anything Vladimir Putin is not, it’s shy about calling the US out, which is precisely what he did on Tuesday at a security summit of ex-Soviet countries in Dushanbe, Tajikistan. Bloomberg has more:

Russian President Vladimir Putin said the fight against Islamic State should be the global community’s top priority in Syria, rather than changing the regime of Bashar al-Assad.

“It’s necessary to think about the political transition in that country” and Assad is willing to “involve healthy opposition forces in the administration of the state,” Putin said. “But the focus today is definitely on the need to combine forces in the fight against terrorism.”

Countries need to “put aside geopolitical ambitions” as well as “direct or indirect use of terrorist groups to achieve” goals that include regime change, in order to counter the threat of Islamic State, Putin said. “Elementary common sense responsibility for global and regional security demands the collective effort of the international community.”

The first thing to note there is that Putin has essentially called the US out for using terrorists to destabilize Assad. So for anyone just looking for the punchline, that was it. Everyone else, read on.

At this point what should be obvious is that Vladimir Putin’s intentions in Syria are anything but unclear. Russia is openly supplying the Assad regime with military aid in an effort to prevent terrorists and extremists (some of which were trained by the US and received aid from Qatar) from facilitating the strongman’s ouster. It’s that simple and frankly, the only two things Russia hasn’t made explicitly and publicly clear (because this is international diplomacy after all, which means everyone is always lying about something) are i) the role that natural gas plays in all of this, and ii) that the Kremlin will seek to prevent anyone from overthrowing Assad, so to the extent that there are any real, well-meaning “freedom fighters” in Syria, they’ll find themselves on the wrong end of Russian tank fire just the same as ISIS.

As clear as that is, the US must stick to the absurd notion that the Pentagon just can’t seem to get to the bottom of what Russia is doing and to the still more absurd idea that Russia – who seems to be the only outside party that’s actually interested in fighting ISIS as evidenced by the fact that there are Russian boots on the ground – is somehow hurting the very serious effort by the US and its allies to defeat Islamic radicals in Syria. Here’s Bloomberg again:

Russia’s intentions in Syria are unclear and it’s important for U.S. diplomats to understand them, Martin Dempsey, chairman of the U.S. Joint Chiefs of Staff, told reporters in Tallinn, Estonia, on Tuesday. While Putin’s said it wants to prevent Islamic State’s expansion, “explaining the purpose and seeing how it actually evolves on the ground are two very different things and we will be working on that,” Dempsey said.

Right, “explaining” that your “purpose” is to take your very powerful military and defeat what amounts to a large militia that’s woefully under-armed and under-trained by comparison “and seeing how it actually evolves are two very different things.” If you buy that argument, then you are buying into the patently ridiculous idea that if the US and Russia were to bring their combined military might to bear on ISIS in Syria, that somehow the outcome of that battle would be in doubt.

The Pentagon knows that notion is silly, but what it also knows is that once American troops are on the ground, there’s no not routing the other militants while you’re there, so what would happen in relatively short order, is that the opposition would be all gone and then, well, what do you do with Assad?

The much more straightforward way to go about this (unless of course you have a 9/11 and a story about WMDs buried in the desert as a cover that makes an outright, unilateral invasion possible), is to allow for the entire country to descend into chaos until one or more rebel/extremist groups finally manages to take Damascus, at which point you simply walk in with the Marines and remove them, then install any government you see fit. In the meantime, you just fly over and bomb stuff (hopefully with a coalition that includes Europe) in order to ensure that the situation remains sufficiently unstable. But now this plan won’t work, because unless we see a replay of the Soviet-Afghan war, none of Syria’s rebel groups are going to be able to rout the Russian army which means the US is stuck doing exactly what it’s doing now: trying to explain why it won’t join Russia in a coalition to eradicate ISIS while working to figure out what’s next now that the Russians are officially on the ground.

We’ll close with the following from Alexander Golts, a military analyst and deputy editor of the online newspaper Yezhednevny Zhurnal who spoke to WSJ:

“The idea of this is…to show Russia as part of the alliance of civilized nations that are standing against barbarism. But that idea won’t have much of a chance, because the U.S. and the Saudis and others consider Assad the source of the problem.”

- How The Justice Department Is Actively Preventing Civil Asset Forfeiture Reform

Submitted by Mike Krieger via Liberty Blitzkrieg blog,

Civil asset forfeiture is one of the most unethical and barbaric practices routinely performed by law enforcement in these United States today. Naturally, the Department of Justice is doing everything it can to protect the practice.

When I say that the rule of law is dead in America, I am not exaggerating. In fact, with each passing day it becomes increasingly obvious that the Justice Department not only has no interest in justice, it appears to view its primary role as coddling and protecting lawlessness amongst the so-called “elite” and their minions.

Today’s post proves the point once again. The state of California is in the process of passing a civil asset forfeiture bill, and in response, the DOJ is providing talking points to the California District Attorneys’ Association so that it can more effectively fight the bill. All of this after the DOJ had previously expressed faux support for civil asset forfeiture reform.

TechDirt reports:

At the beginning of this year, Attorney General Eric Holder attempted to close an exploitable loophole in asset forfeiture laws. State and local law enforcement agencies often sought federal “adoption” of seizures in order to route around statutes that dumped assets into general funds or otherwise limited them from directly profiting from these seizures. By partnering with federal agencies, local law enforcement often saw bigger payouts than with strictly local forfeitures.

The loophole closure still had its own loopholes (seizures for “public safety,” various criminal acts), but it did make a small attempt to straighten out some really perverted incentives. But deep down inside, it appears the DOJ isn’t really behind true forfeiture reform. In fact, it seems to be urging local law enforcement to fight these efforts by pointing out just how much money these agencies will “lose” if they can’t buddy up with Uncle Sam.

A cache of documents uncovered by the Institute for Justice today demonstrate that federal law enforcement officials in the Departments of Justice (DOJ) and Treasury are collaborating with local law enforcement organizations in California to undermine efforts to reform the state’s civil forfeiture laws. The California District Attorneys Association is circulating a set of emails from officials with the DOJ and Treasury indicating that the federal government would disqualify the state from receiving funds from the federal Equitable Sharing Program if it passes the pending reforms. The documents also reveal that the DOJ has already disqualified New Mexico from participating in the program, following passage of a sweeping civil forfeiture reform bill this spring.

The DOJ’s insertion into the legislative process begins with talking points delivered in emails that stress the amount of money agencies will be “losing” if they’re no longer allowed to federalize seizures. The documents show members of the Treasury Department affirming that California’s reform will “force” the DOJ to cut state law enforcement agencies out of the loop — supposedly because the Mother Ship can’t secure convictions fast enough.

Citing “resources, desire, or technical capability,” Treasury Executive Office for Asset Forfeiture Legal Counsel Melissa Nasrah wrote in an email to Santa Barbara Senior Deputy District Attorney Lee Carter, “I highly doubt our federal agencies can figure out whether a conviction occurred in any timely manner,” and “it seems the legislation, in effect, takes decision-making authority away from Treasury. Accordingly, I think I would still advise our policy officials here that it would be prudent to not share with CA agencies should this law be passed.”

Sure enough, the “warnings” from the feds are echoed in a letter from the California District Attorneys’ Association in opposition of the bill. The association expresses its abject dismay at the fact that law enforcement agencies might actually have to secure convictions to hold onto seized assets. According to the CDAA, asset forfeiture without accompanying convictions is a must because indictments and jail time alone aren’t punitive enough.

The current version of the bill would essentially deny every law enforcement agency in California direct receipt of any forfeited assets. California’s asset forfeiture law will be changed for the worse, and it will cripple the ability of law enforcement to forfeit assets from drug dealers when arrest and incarceration is an incomplete strategy for combatting drug trafficking.

That the DOJ has decided to pile on — despite its nominal reform efforts — is also less than shocking. After all, it takes a cut from every “adopted” investigation — all the while enabling local entities to bypass statutory safeguards meant to keep the abuse of civil forfeiture to a minimum.

To read the entire letter from the California District Attorneys’ Association, go to the end of the TechDirt article.

In case you still aren’t convinced of the unethical and unconstitutional nature of civil asset forfeiture, i.e., police theft, check out the following:

The DEA Strikes Again – Agents Seize Man’s Life Savings Under Civil Asset Forfeiture Without Charges

Asset Forfeiture – How Cops Continue to Steal Americans’ Hard Earned Cash with Zero Repercussions

Quote of the Day – An Incredible Statement from the City Attorney of Las Cruces, New Mexico

- Explosive Allegation: Citigroup Leaked Central Bank Trading Activity

For years we had been wondering when it would start: by “it” we mean angry ex-bankers, disgruntled due to either the terms of their termination, their compensation, or generally unhappy with their treatment by their former employee, standing up and blowing the whistle on crimes they witnessed while (un)happily employed.

Then, over the past month, the answer has emerged as not one, not two, but at least six individual case have emerged in which former currency traders at Citigroup, HSBC, Lloyds and other banks have seen former employees sue their previous bosses. As Bloomberg reports, “some of the traders say they were unfairly swept up in clear-outs of currency desks at the center of regulatory probes into the manipulation of foreign-exchange markets.”

And now they want revenge.

The reason for the wrath is that as a result of the crackdown on FX manipulation more than 30 traders were fired, suspended or put on leave over the last two years. However, as the Tom Hayes of Libor manipulation “rain man” fame has shown, in many cases those fired were merely the lowest men on the totem pole, and their termination was meant to cover up the crimes of individuals much higher up in the food, and value, chain. Indeed, Bloomberg adds, in the years after the 2008 financial crisis, fired bankers were telling London employment judges they had been made scapegoats for systemic failings.

Since most employment claims in the U.K. must be filed within three months of a dismissal to be allowed to proceed, they tend to come in clusters: and once one former worker shows there is little to lose, others quickly join in.

More importantly, since damages in employment cases are normally capped at about 78,300 pounds ($121,000), unless there is a finding of discrimination or the claimant wins status as a whistle-blower, employees are suddenly incentivized to expose all the crime they have been directly or indirectly witnessed to make sure their last potential parting gift from the financial industry is large enough.

And since few have the desire or eligibility to work in finance, they may as well go out with a bang: currency traders have little to lose by filing employment claims, according to James Davies, a London-based employment lawyer at Lewis Silkin. “If your reputation is already tarnished in the financial services sector then you’re less likely to be concerned by any adverse publicity arising from making a claim,” he said. “You’re also more likely to have the resources to make it possible to litigate.”

Here are some examples of the already filed cases, chronicled by Bloomberg:

Carly McWilliams, Perry Stimpson, David Madaras and Robert Hoodless all filed suits against Citigroup after they were fired amid the bank’s internal rigging investigation. Serge Sarramegna and Paul Carlier are suing HSBC and Lloyds for unfair dismissal and so-called public interest disclosure, or whistle-blowing, in relation to foreign-exchange practices. Only Stimpson’s case has reached trial so far. Carlier’s case could start as soon as Wednesday, the same day as a trial involving another Lloyds employee, Andrew Reed, is scheduled to begin. Including two discrimination complaints, as many as four banker lawsuits could be heard in London employment tribunals tomorrow.

Of all those, the case of Stimpson is by far the most interesting one.

Perry Stimpson Photographer: Luke MacGregor/Bloomberg

Testifying at a London tribunal last week, Stimpson alleged improper conduct was endemic in the bank’s currency-trading and claimed he saw managers deliberately flout the bank’s code of conduct. The former FX trader spored nobody, and named former managers and specific examples of their misbehavior. Rules of client confidentiality could “be bent at the request of senior management,” he said.

“I’m not here to mudsling, I’m here so the truth about foreign exchange at Citigroup is heard once and for all,” Stimpson said at the start of the case. The bank and the managers say his allegations are unfounded.

Maybe they are, but a deeper dive into his allegations reveals something far more troubling: Citigroup may have been sending details of its central bank customers’ trading activity to other clients, Stimpson said in a witness statement to a London court on Thursday.

Here is the kicker according to Reuters:

“Our Investor Desk would comply with a weekly request from (a client) for details of Central Bank activity that Citi had transacted,” Stimpson said in his witness statement to an employment tribunal in London. Stimpson did not specify which central banks he was referring to.

If anyone is confused, this means that not only do central banks trade FX on a day to day basis, something which has become increasingly clear in the past couple of years by merely observing the rigged market, but Citi was actively leaking this data to select clients!

Stimpson adds that Jeff Feig, who was Citi’s global head of trading at the time, called a halt to sending round the “central bank survey”, as Stimpson said it was referred to, in mid-2013 because he decided it was wrong. He did not elaborate.

Jeff Feig quit Citi in a hurry when the FX manipulation scandal was just getting started last September to join Fortress Macro as co-investment chief. He “unexpectedly” quit Fortress in this July, less than a year on the job, for “reasons unknown.” Surprisingly, it may not just be the FX manipulation catching up with him: his biggest position had been a EURCHF bet which blew up in January after the shocking SNB peg-breaker announcement. Guess he didn’t see that one coming.

Other unprecedented and criminal violations was Citigroup’s “common practice on the Investor Desk to cut and paste details of Citibank’s order book on to Bloomberg chats at the request of customers.” Stimpson said in his statement.

While unproven yet, these allegations are nothing short of a bombshell, and explain why Citigroup and its peers have rushed in an epic scramble to settle all FX manipulation allegations as fast as possible, to avoid precisely details such as these from coming out.

They did not , however, anticipate scapegoats such as Perry daring to fight back.

Of course, Citi has neither seen, nor heard, nor said nothing: a Citi spokesman said: “All of the allegations of wrongdoing being made by Mr Stimpson have been investigated and were found to be without merit.”

You mean to say the bank investigated itself and found that it did not engage in grossly criminal behavior such as leaking central bank trades to private clients? Unpossible!

On the other hand, Citi has its scapegoating narrative well laid out: it said Stimpson was dismissed for serious breaches of contract, alleging he shared confidential client information with traders at other banks via electronic chatrooms. Stimpson was dismissed last November in the wake of an industry scandal that resulted in banks paying more than $10 billion in fines for failing to stop traders attempting to manipulate the $5 trillion-a-day forex market.

Because where there is gross currency manipulation, it is always just one or two traders who did it. Nobody else! They never got the idea by watching their bosses and superiors do just that, and greenlight their own manipulation. Duh.

Ironically, Citi’s story falls apart when one digs through the evidence: Stimpson said he was strongly encouraged to gather and share more market information with colleagues and traders at other banks in order to have a broader understanding of market conditions to help the bank in its trading. Maintaining contacts to gather information became one of his annual goals that would help dictate his year-end bonuses.

“Dude, get yourself on a chat,” his then line manager Bob de Groot told him in 2009, according to Stimpson’s statement. “Perry has made a good effort to talk to other participants in the market, he could give a little more effort in sharing information and ideas across the business,” is what de Groot wrote in his 2009 year-end review, Stimpson claimed in his statement.

It gets worse:

In his testimony, Stimpson said Citigroup staff breached confidentiality around some clients and that some senior staff used inside information to trade, in contravention of the bank’s own code of conduct.

In his witness statement, Stimpson said Michael Plavnik, then head of the short-term interest rate trading desk, looked to profit from trading euros around that day’s “fixing”, the daily process of setting what are effectively benchmark exchange rates used by many funds, companies and central banks around the world.

Plavnik had heard Citi’s spot FX desk had a large order to buy euros at the fix. Armed with that knowledge, he bought 200 million euros before the fix to sell them back into the market at the fixing rate, Stimpson claimed in his statement.

And, lo and behold, a Citi spokesman told Reuters that “Plavnik has not been found to have committed any misconduct.” That is to say, who knows how many more senior bankers Plavnik could take down with him if charges were filed against even a mid-level maret rigger.

Instead he was rewarded, more for not getting caught than any other reason: Plavnik has since been promoted to global head of short-term interest rate trading.

That said, Stimpson is not innocent either: “Stimpson, who is representing himself, admitted that he had signed Citi codes of conduct, which covered a wide range of issues from ethics to client confidentiality, but barely paid any attention to their content.”

Neither did anybody else, and until all these market manipulators finally end up in jail, nobody ever will.

In the meantime, however, expect many more such scapegoats to emerge and explain to the world how all such former “conspiracy theories” were really “conspiracy fact” – who knows, maybe one day a former Fed trader will give the full explanation of just how the NY Fed’s market group manipulates the S&P500 on a day to day basis with the generous help of Citadel’s E-mini spoofing algorithms…

- Abenomics Explained (In 1 Chart & 4 Words)

"It Does Not Work"

* * *

Following The BoJ's "no change" decision last night, today's spin is that it guarantees moar Abenomics printagoggery in October… Sure because that has worked so well in the past!!

In fact, like all the rest, there is scarcely a block of the calendar since the “impossible” global panic in 2008 that hasn’t seen any of them doing something to expand their balance sheet or impress the “time-axis.” By my more conservative count, qualified as the BoJ doing something different rather than purely expanding or extending something already in progress, there have been 10 QE’s in Japan but using the numerical standard which has been applied to the Federal Reserve there may have been as many as 22 or more.

What none of those have amounted to is an actual and sustainable economic advance; NONE, no matter how you count them. In very simple fact, the idea that central banks “need” to keep doing them in continuous fashion is quite convincing that at the very least they don’t mean what central bankers think they mean, and perhaps worse that the more they are done and to greater extents the more harm that eventually befalls. It isn’t difficult to suggest and even directly observe that Japan’s economy has shrunk during the QE age, but that fact isn’t applicable to Japan alone (there are sure too many non-adjusted data points that uncomfortably assert the same for even the US). That would seem to at least offer a basis for a “deflationary mindset” no matter the actual economic effects.

So you truly have to wonder these kinds of days, like last week:

Global equity markets rose on Wednesday, led by an 8 percent surge in Japanese stocks, helping lift the dollar as the prospect of more economic stimulus out of Asia soothed investors rattled by recent market turmoil.

The charge into stocks pushed yields on low-risk government bonds higher, and a sale of German 10-year debt attracted bids worth less than the amount on offer. The U.S. Treasury is scheduled to auction $21 billion of 10-year paper later.

This is not so much investing or even finance as it is a cult (calling it a religion or even ideology is unjustifiably too charitable).

h/t @Not_Jim_Cramer

Charts: Bloomberg

- How Our Energy Problems Lead To A Debt Collapse Problem

Submitted by Gail Tverberg via Our Finite World blog,

Usually, we don’t stop to think about how the whole economy works together. A major reason is that we have been lacking data to see long-term relationships. In this post, I show some longer-term time series relating to energy growth, GDP growth, and debt growth–going back to 1820 in some cases–that help us understand our situation better.

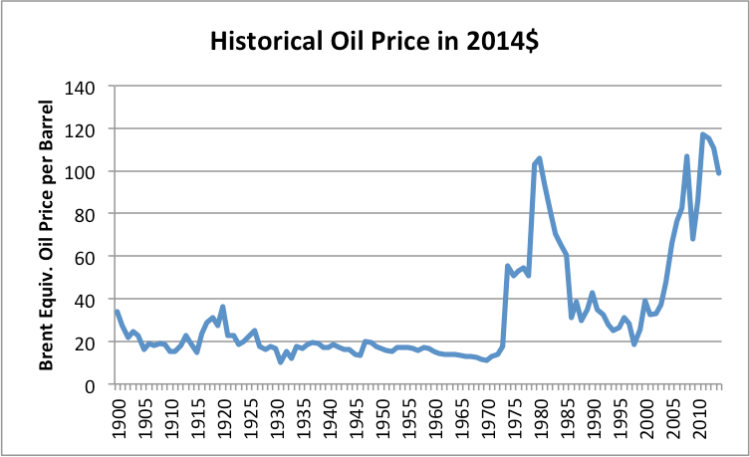

When I look at these long-term time series, I come to the conclusion that what we are doing now is building debt to unsustainably high levels, thanks to today’s high cost of producing energy products. I doubt that this can be turned around. To do so would require immediate production of huge quantities of incredibly cheap energy products–that is oil at less than $20 per barrel in 2014$, and other energy products with comparably cheap cost structures.

Our goal would need to be to get back to the energy cost levels that we had, prior to the run-up in costs in the 1970s. Growth in energy use would probably need to rise back to pre-1975 levels as well. Of course, such a low-price, high-growth scenario isn’t really sustainable in a finite world either. It would have adverse follow-on effects, too, including climate change.

In this post, I explain my thinking that leads to this conclusion. Some back-up information is provided in the Appendix as well.

Insight 1. Economic growth tends to take place when a civilization can make goods and services more cheaply–that is, with less human labor, and often with less resources of other kinds as well.

When an economy learns how to make goods more cheaply, the group of people in that economy can make more goods and services in total because, on average, each worker can make more goods and services in his available work-time. We might say that members of that economy are becoming more productive. This additional productivity can be distributed among workers, supervisors, governments, and businesses, allowing what we think of as economic growth.

Insight 2. The way that increased productivity usually takes place is through leveraging of human labor with supplemental energy from other sources.

The reason why we would expect supplemental energy to be important is because the amount of energy an individual worker can provide is not very great without access to supplemental energy. Analysis shows that human energy amounts to about 100 watts –about equal to the energy of a 100-watt light bulb.

Human energy can be leveraged with other energy in many other forms–the burning of wood (for example, for cooking); the use of animals such as dogs, oxen, and horses to supplement our human labor; the harnessing of water or wind energy; the burning of fossil fuels; and the use of nuclear energy. The addition of increasingly large amounts of energy products tends to lead to greater productivity, and thus, greater economic growth.

As an example of one kind of leveraging, consider the use of oil for delivering goods in trucks. A business might still be able to deliver goods without this use of oil. In this case, the business might hire an employee to walk to the delivery location and carry the goods to be delivered in his hands.

A big change occurs when oil and other modern fuels become available. It is possible to manufacture trucks to deliver goods. (In fact, modern fuels are needed to make the metals used in building the truck.) Modern fuels also make it possible to build the roads on which the truck operates. Finally, oil products are used to operate the truck.

With the use of a truck, the worker can deliver goods more quickly, since he no longer has to walk to his delivery locations. Thus, the worker can deliver far more goods in a normal work-day. This is the way his productivity increases.

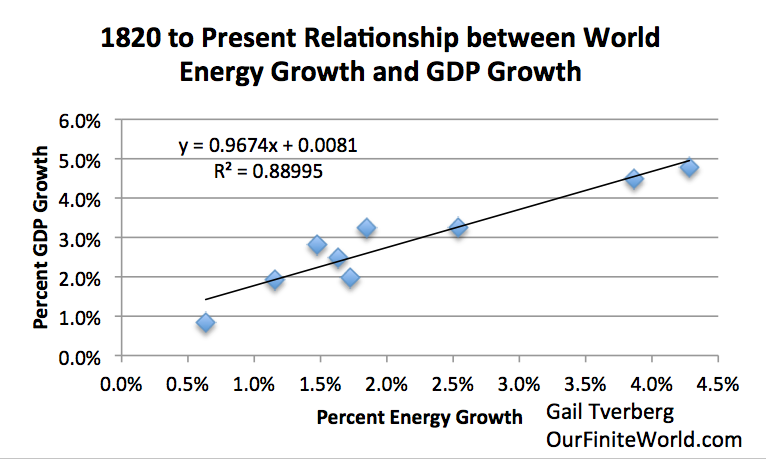

Insight 3. Growth in GDP has generally been less than 1.0% more than the growth in energy consumption. The only periods when this was not true were the periods 1975-1985 and 1985-1995.

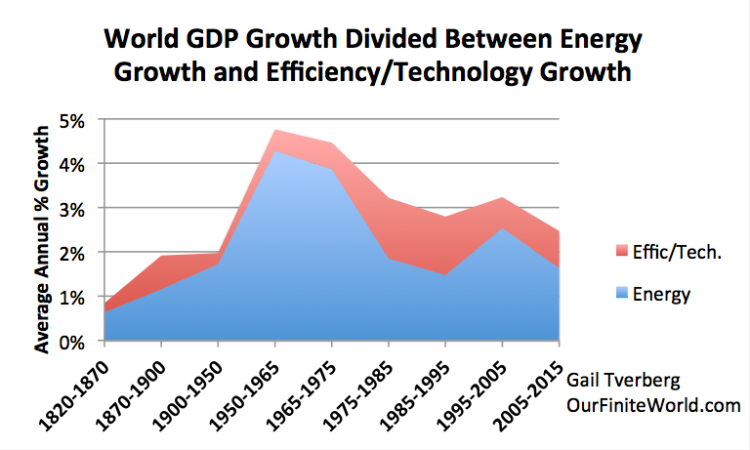

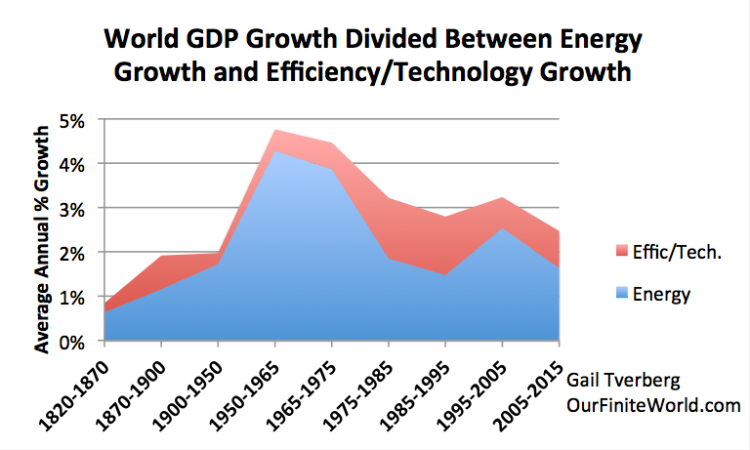

This is an exhibit I prepared using data from the sources listed.

Figure 1. World GDP growth compared to world energy consumption growth for selected time periods since 1820. World real GDP trends for 1975 to present are based on USDA real GDP data in 2010$ for 1975 and subsequent. (Estimated by author for 2015.) GDP estimates for prior to 1975 are based on Maddison project updates as of 2013. Growth in the use of energy products is based on a combination of data from Appendix A data from Vaclav Smil’s Energy Transitions: History, Requirements and Prospects together with BP Statistical Review of World Energy 2015 for 1965 and subsequent.

The difference between energy growth and GDP growth is attributed to Efficiency and Technology. In fact, energy use and technology use work hand in hand. People don’t buy oil just to have oil; they buy oil for the services that devices using oil can provide. Efficiency is important too. If a device is cheaper to use, thanks to efficient use of energy, consumers find it more affordable (if the cost of the device itself is not too expensive). Thus, efficiency can lead to more use of energy.

The period between 1975 and 1985 was the period when the developed economies were making many changes including

- Changes to make automobiles smaller and more fuel efficient

- Replacement of oil-fired electricity generation with nuclear (which needed no fossil fuels for ongoing fuel) and with coal

- Replacement of home heating using oil with more modern heating units, not using oil

Some of this effort continued into the 1985-1995 period, as newer cars gradually replaced older cars, and modern furnaces gradually replaced oil-fired furnaces. Thus, we should not be surprised that the 1975-1985 and 1985-1995 periods were the ones with unusually high growth in Efficiency/Technology.

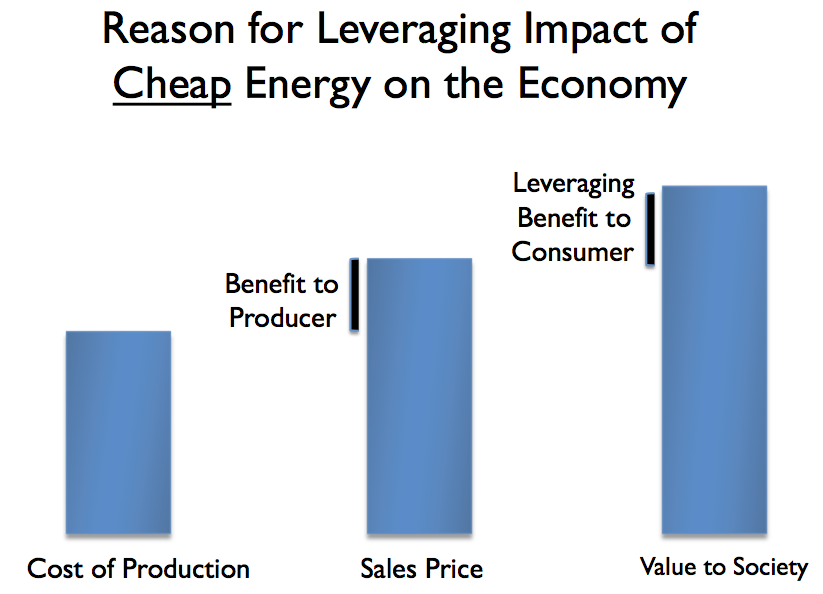

Insight 4. The value of energy to society is not the same as the cost of extracting it, refining it, and shipping it to the desired end location.

The value of energy to society reflects the additional goods and services that we as a society can produce, thanks to the benefits energy adds to the system as a whole. This value can be either higher or lower than the cost of extracting the energy from the ground, processing it, and delivering it so that it will work in our devices.

If the price of oil, or of other energy products, is low, we would expect the cost of production to be lower than its value to society. We can visualize the relationship to be as shown in Figure 2. It is the low price that provides the leveraging benefit of oil.

In the example given in Insight 2 of the worker, driving a truck over a road to deliver goods, there are actually many “players” involved:

- The company extracting the oil

- The government of the company extracting the oil

- The business making the truck

- The government of the country building the road

- The business hiring the worker delivering the goods

- The worker himself

The benefit of the efficiency gain is shared among the different players listed above. How this sharing is done is based on relative price levels and government tax levels. Thus, there are many different types of entities (which I refer to on Figure 2 as “consumers”) all getting a benefit from the leveraging impact of the oil products, at the same time.

The value to society of oil and of other energy products is pretty much fixed, based on the energy content (in Btus or whatever other unit a person desires). The value to society can change a little with energy efficiency, if we learn to pave roads with less use of energy products, and if we learn to manufacture trucks with less use of energy products, and if we can make the trucks that use less diesel per mile.

If the cost of producing oil or other energy product rises (in other words, the left bar in Figure 2 gets taller), then the “gap” between the cost of production and the value to society (right bar) may fall too low. The amount of money to distribute, resulting from the gain that comes from using energy to leverage human labor, falls. None of the entities involved can get an adequate distribution: There is less money to pay interest payments on debt; there is less money to pay dividend payments to stockholders; there is less money to give the workers raises. In fact, it reminds me of the situation described in my post Why We Have an Oversupply of Almost Everything (Oil, labor, capital, etc.)

If there is too little gap between the selling price of oil and its value to society, there gets to be pressure for the price of oil to fall. Partly, this comes from low wage increases (because wages are being squeezed). If workers cannot buy finished products such as homes and cars, the price of commodities such as steel and oil tends to drop. This seems to be the situation today. Partly this pressure come from the fact that society can live for a while with “squeezed margins. Eventually, some of the “pain” needs to go back to the oil producers (difference between left bar and middle bar on Figure 2), instead of only being borne by the oil consumers (difference between middle bar and right bar on Figure 2). This is why we should expect the kind of oil price drop we have experienced in the past year.

Insight 5. We would expect world economic growth to slow as oil prices rise, because of Insights (1) and (2).

According to (1), we need to make goods increasingly cheaply to cause increasing economic growth. Oil is the energy product with the highest use worldwide. If its cost rises, it takes a huge amount of savings elsewhere in the system to allow the combination to still produce goods increasingly cheaply.

According to (2), it is the energy content that needs to rise. With higher prices, consumers can afford less. As a result, they tend to consume less, in energy content. This lower energy consumption lowers the leveraging of human energy, so there tends to be less economic growth.

Figure 3 shows world oil prices. Given Insights (1) and (2), we would expect the rate of economic growth to slow during the 1975-1985 period and during the 2005-2015 period, and indeed they do, in Figure 1.

Insight 6. Increasing debt seems to be a major driver of demand growth, and thus energy consumption.

There are many reasons why we would expect debt to be hugely beneficial to economic growth:

Debt is used to “smooth” many kinds of transactions. For example, the payment of wages to an individual represents a kind of debt, since otherwise, the employer would need to pay the worker daily, using the type of goods produced by the business–something that would be very inconvenient.

Debt is also helpful in enabling big financial transactions, such as the purchase of a house or a factory or a car. With debt, the amount that needs to be saved up in advance is greatly reduced. Most of the cost can be paid in monthly installments over the life of the item purchased. If debt is used to pay for a factory, the output of the factory can be used to repay the debt.

An indirect impact of adding debt is that it helps raise the price of commodities, such as oil, steel, and electricity. This happens because with the use of debt, “demand” for expensive products like homes, factories, and cars is greater, because more people and businesses can afford to buy them, thanks to the availability of debt. These expensive products are made with commodities like steel, wood, oil, and coal. With more debt, the prices of these commodities tend to balance at a higher level than they would otherwise. For example, oil prices may balance at $100 per barrel, instead of $70 per barrel. At these higher price levels, production from higher-cost sources becomes profitable–for example, oil from deeper wells, water from desalination, and coal transported over longer distances.

Because of these benefits of debt use, it is hard for me to imagine that fossil fuel extraction could have occurred without the use of very large amounts of debt. I first discussed this issue in Why Malthus Got His Forecast Wrong.

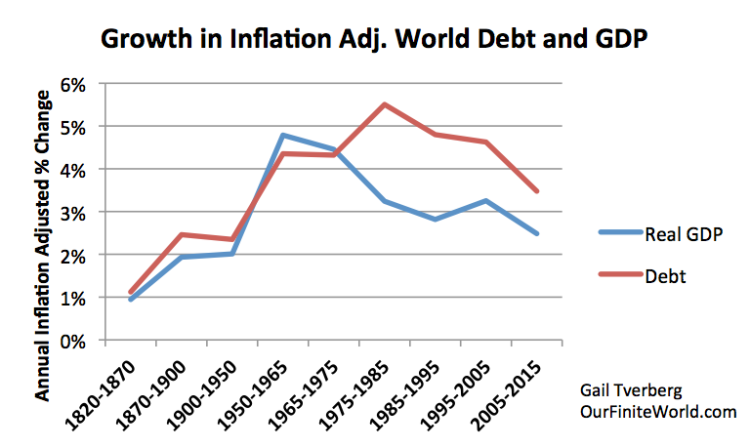

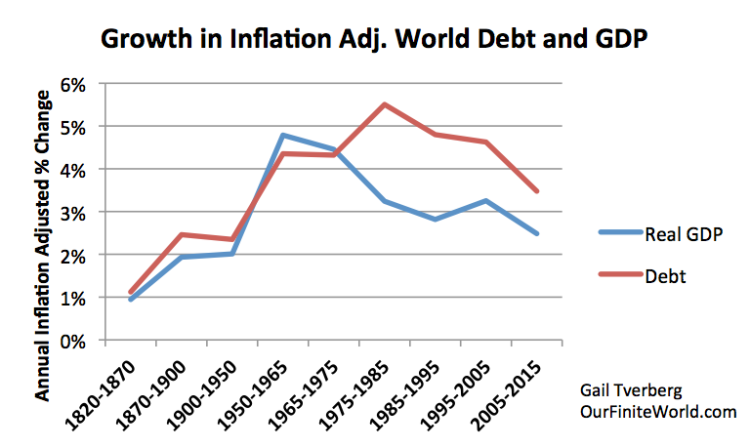

Figure 4 shows an estimate of how world debt has grown, on an annual, inflation-adjusted basis, compared to inflation-adjusted GDP. (See the Appendix for additional information.)

Figure 4. Worldwide average inflation-adjusted annual growth rates in debt and GDP, for selected time periods. See Appendix for information regarding calculation.

Figure 4 indicates that the growth of debt spurted about 1950. One influence may have been John Maynard Keynes’ book, The General Theory of Employment, Interest and Money, written in 1936. This book advocated the use of additional debt to stimulate economies that were growing at below their full potential. We also know that governments with war debts needed to offset the repayment of these war debts with new “peace debts” (debt available to businesses and consumers) if they didn’t want their economies to shrink for lack of debt growth. See my post The United States’ 65-Year Debt Bubble.

Insight 7. Once inflation-adjusted oil prices passed $20 per barrel, a change took place. We started needing much more debt to generate a dollar of GDP.

This problem can be seen on Figure 4–the lines diverge, starting in the 1975-1985 period. Up until about 1975, the rise in debt levels was similar to GDP growth. In fact, if we look at Figure 1, energy growth also tended to grow with debt and GDP in the pre-1975 time period. After 1975, we started needing increasing amounts of debt to generate GDP growth.

We can understand the need for more debt by thinking about how leveraging really works. Leveraging works because of the energy content of the supplemental energy. To get the desired quantity of energy content, a larger dollar amount of investment is needed to produce the same quantity of energy, if the cost of producing the energy product is higher.

Most people look at debt growth as a percentage of GDP growth, but this misses an important dynamic: is our problem occurring because debt growth is high, or because GDP growth in response to the debt growth is low? When I look at Figure 4, my conclusion is that when energy costs were low–basically at pre-1975 levels of $20 a barrel for oil, and similarly cheap levels for nuclear and other fossil fuels–it was possible for debt growth to approximately match GDP growth. Once energy costs started to rise, more debt was needed. Some of this was additional debt related directly to the process of creating energy products; some of this debt related to international trade and to buyers’ need to finance higher-cost end products.

Based on Figure 4, even the drop back to the $30 to $40 per barrel range in the 1985 to 2000 period didn’t fix the rising debt to GDP ratio problem. To truly fix the situation, we need to get the cost of producing fuels to a low enough level that they can profitably be sold at the equivalent of less than $20 per barrel. With diminishing returns, this seems to be impossible.

Insight 8. Adding more energy efficiency may require more debt growth as well.

The biggest spurt of debt came in the 1975-1985 period. If we compare Figure 4 to Figure 1, and consider what was happening at that time, quite a bit of this additional debt may have related to changes associated with increased energy efficiency: new efficient nuclear electricity generation to replace generation of oil with electricity; new more efficient home heating to replace old oil based heating units; and the building of new, more fuel-efficient cars.

Insight 9. The limit we are reaching can be viewed as a debt limit.

If demand really comes from additional debt, then what we need to keep GDP growth high is debt that grows sufficiently rapidly. (An alternative way of keeping demand high would be through rising wages of non-elite workers. Unfortunately, these wages tend to be depressed by diminishing returns–a problem I wasn’t able to cover in this post. See my post, How Economic Growth Fails.)

Many people believe that energy demand can rise endlessly. It seems to me that this belief is very close to the belief that the ratio of debt to GDP can rise endlessly.

Insight 10. Our debt system is very close to a Ponzi Scheme.

A Ponzi Scheme is a fraudulent investment program in which the operator promises a high rate of return to investors. Instead of obtaining these returns from true profits, the operator funds payouts to existing investors using ever-rising amounts of new investment. Eventually the plan fails, from lack of new investment dollars.

Our economic growth situation is not fraudulent, but otherwise it has uncomfortable similarities to a Ponzi Scheme. Instead of adding new investors each year, our economy needs to increase its amount of debt each year, in order to continue to grow GDP. GDP would not grow on its own, without additional investment funded by debt. To make matters worse, the required amount of additional debt rises, as the cost of producing additional energy products rises.